OQtima offers leverage options of 1:1000 across 7 asset classes, including Forex and Crypto, for a minimum deposit of $100. The broker features two account types, ECN+ and ONE, with 8 base currencies and MT4/5 access.

OQtima; Company Information and Regulation

OQtima is a global brokerage company founded in 2023 in Limassol, Cyprus. The broker, formerly known as Nordskov Capital, has a team with 30+ years of experience in the industry.

With a product catalog of over 1,000 instruments, it serves clients via the widely adopted MetaTrader 4 and MetaTrader 5 platforms.

The broker differentiates itself with fast execution, tight crypto spreads, notably a BTCUSD spread of just $13, and access to advanced research tools powered by Trading Central.

Multiple authorities, including CySEC and FSA, regulate the company in various jurisdictions. It operates through two legal entities, including:

- OQTIMA INT LTD (for International clients): Registered in Seychelles and regulated by the Financial Services Authority (FSA) with License Number SD109

- OQtima EU Ltd (for EU clients): Registered in Cyprus and regulated by the Securities & Exchange Commission (CySEC) with License No. 406/21

EU clients are served through OQtima EU Ltd, licensed by the Cyprus Securities and Exchange Commission (CySEC), offering Tier-1 protection with coverage under the Investor Compensation Fund (ICF) up to €20,000.

Global clients are onboarded via OQTIMA INT. LTD, regulated by the Seychelles FSA (Tier-3), which provides fund segregation but lacks a formal compensation scheme.

Leverage option is capped at 1:30 under CySEC and reaches 1:1000 under FSA. This OQtima review will explore the International entity’s offerings and features.

Thanks to features like free VPS for high-volume clients and support for automated trading via Expert Advisors, OQtima has positioned itself as a compelling option for crypto traders, scalpers, and algorithmic traders.

| Entity Parameters/Branches | OQtima EU Ltd | OQTIMA INT LTD |

Regulation | CySEC | FSA |

Regulation Tier | 1 | 3 |

Country | Cyprus | Seychelles |

Investor Protection Fund/Compensation Scheme | ICF up to €20,000 | No |

Segregated Funds | Yes | Yes |

Negative Balance Protection | Yes | Yes |

Maximum Leverage | 1:30 | 1:1000 |

Client Eligibility | Europe | Global |

OQtima CEO

Based in Sydney, NSW, Angelo d'Alessio is an experienced executive with a strong background in marketing, leadership, and the aviation industry.

- Current Role (2022–Present): Chief Executive Officer at OQtima

- Previous Roles: Chief Marketing Officer at TMGM (2020–2022) and IC Markets (2016–2020)

- Education: School of Advanced Studies Isufi (2014–2015) – Business Administration & Management

OQtima Specific Features

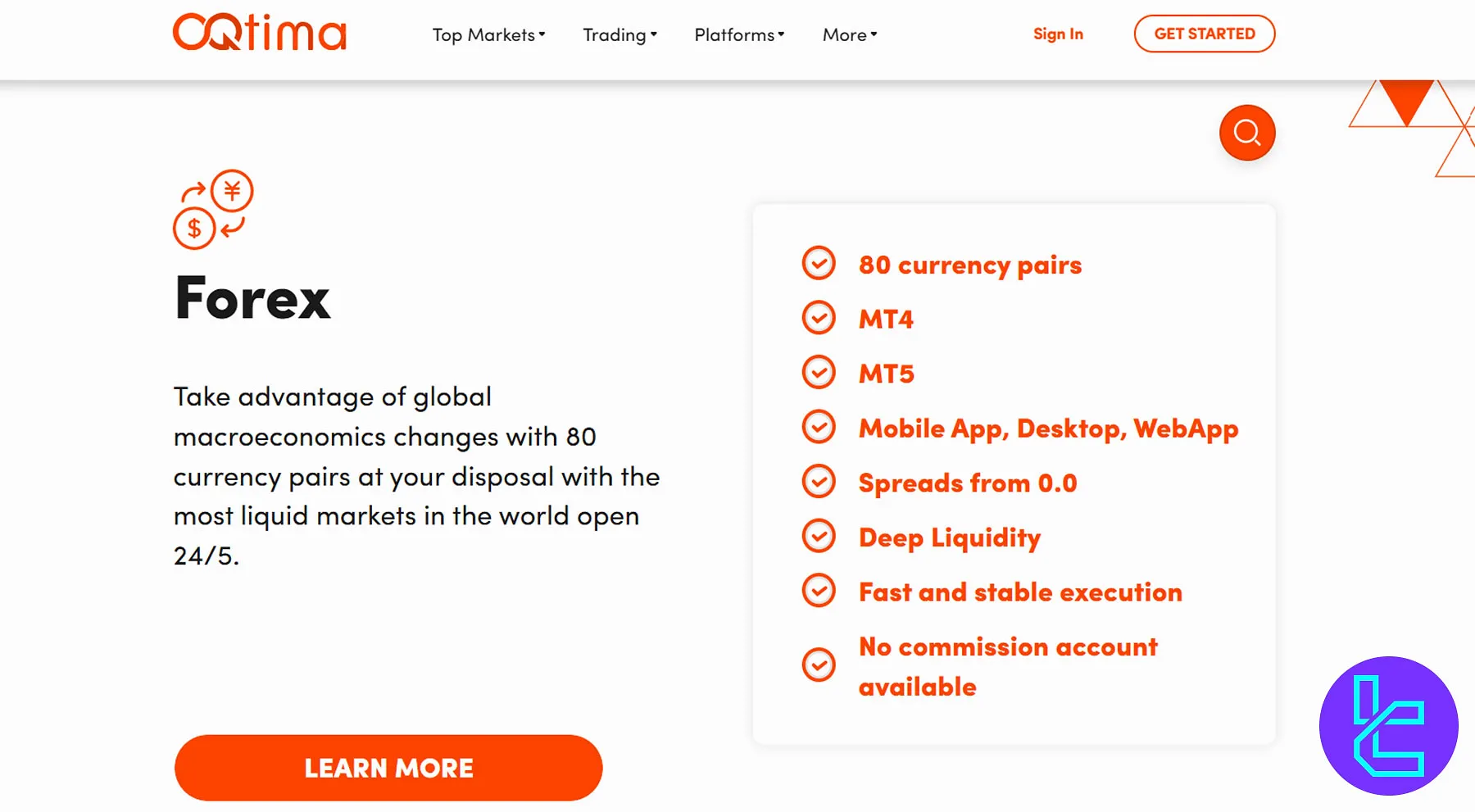

The Forex broker offers 1,000+ assets with spreads from 0.0 pips. Let’s explore other OQtima offerings.

Broker | OQtima |

Account Types | ECN+, ONE |

Regulating Authorities | FSA, CySEC |

Based Currencies | USD, EUR, JPY, GBP, CAD, CHF, SGD, ZAR |

Minimum Deposit | $100 |

Deposit Methods | Credit/Debit Cards, Crypto, International Bank Wire, UK Bank Wire, Local Banking, STICPAY, PIX, E-Wallets |

Withdrawal Methods | Credit/Debit Cards, Crypto, International Bank Wire, UK Bank Wire, Local Banking, STICPAY, PIX, E-Wallets |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:1000 |

Investment Options | None |

Trading Platforms & Apps | MT4, MT5 |

Markets | Forex, Indices, Shares, Metals, Energies, Crypto, ETFs |

Spread | Variable based on the account type |

Commission | Variable based on the account type |

Orders Execution | Market |

Margin Call / Stop Out | 80% / 20% |

Trading Features | Commission-free Trading, Private VPS, Islamic Account, Trading Tools (e.g., Market Buzz, Alpha Generation, and Trading Calendar) |

Affiliate Program | Yes |

Bonus & Promotions | 100% Match Bonus |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Tel, Ticket, Live Chat, WhatsApp, Line |

Customer Support Hours | 24/5 |

OQtima Broker Account Types

The company keeps things simple with two main trading accounts, each designed to cater to different trading styles and needs.

- The ONE Account offers commission-free trading with spreads starting at 1.0 pip, ideal for casual traders;

- The ECN+ Account is designed for active traders, offering raw spreads from 0.0 pips and a $6 commission per round-turn.

Both accounts supportscalping, hedging, and Expert Advisors (EAs), and share a minimum deposit of $100.

Islamic (swap-free) accounts are available on request. All accounts use a uniform risk management structure with an 80% margin call and 20% stop-out threshold.

OQtima Account Types Comparison Table

Features | ECN+ | ONE |

Min Deposit | $100 | $100 |

Max Leverage | 1:1000 | 1:1000 |

Base Currencies | USD, EUR, JPY, GBP, CAD, CHF, SGD, ZAR | |

Margin Call | 80% | 80% |

Stop Out | 20% | 20% |

Spreads from | 0.0 pips | 1.0 pips |

Commissions | $3.0 per side | $0 |

OQtima Upsides and Downsides

The broker claims that Gianluigi Buffon uses OQtima’s trading services. It offers client fund segregation, negative balance protection, and best execution policies

Let’s explore the pros and cons to understand the legendary goalkeeper’s decision better.

Pros | Cons |

Ultra-low spreads from 0.0 pips | Limited history as a new broker (founded in 2023) |

Commission-free account | No copy trading services |

8 base currencies | Limited range of account types compared to some competitors |

No fees on deposits or withdrawals | Lack of transparency about the founders |

Registration and KYC

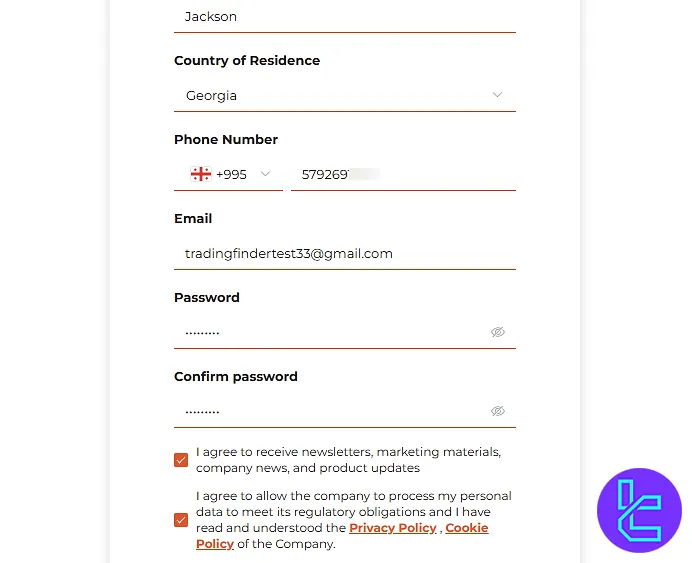

Getting started with OQtima takes under 3 minutes, ideal for traders seeking quick entry into the markets.

The OQtima registration process requires only essential personal information; users can immediately activate their accounts and begin exploring the broker's services.

#1 Access the Sign-Up Page

Visit the official OQtima website and click the “Get Started” button on the homepage. You’ll be directed to the registration form instantly.

#2 Complete the Registration Form

Fill in the application form with the following details:

- First and last name

- Country of residence

- Mobile number

- Account password

Agree to the platform’s terms and click “Continue” to finalize the setup. Your account becomes active immediately, and you're ready to log in and explore OQtima’s trading platform.

However, to fully activate your account features, you must complete the KYC procedure.

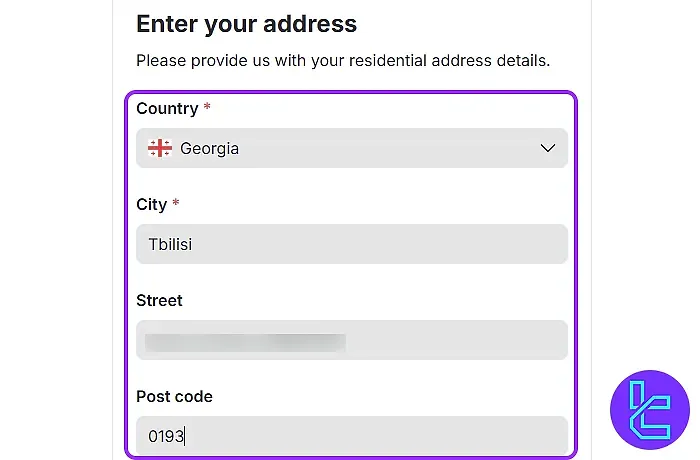

#3 Proceed with the KYC Procedure

Log in to the client portal and click "Upload Documents" to initiate the OQtima verification process. Provide address details and supporting documents, including:

- Proof of Identity: Passport, Driving license, Resident permit, or ID card

- Proof of Address: Utility bill or Bank statement

OQtima Trading Platforms

OQtima offers both MetaTrader 4 and MetaTrader 5 platforms on desktop, web, and mobile. Although modern alternatives like cTrader are missing, OQtima’s MT5 offering is robust for both manual and automated trading strategies.

The broker enhances the MetaTrader experience with the Guardian Angel plugin, which integrates Trading Central tools, including Market Buzz, Featured Ideas, and Alpha Generator. Advanced trading tools include:

- Free VPS hosting

- 38 indicators and 24 drawing tools

- 21 timeframes for multi-layered analysis

- Strategy tester for EAs

- One-click execution, depth-of-market, and alarm triggers

OQtima MetaTrader 4 (MT4)

OQtima MetaTrader 5 (MT5)

TradingFinder has designed a wide range of MT4 indicators and MT5 indicators that you can access for free.

Fees Explained

OQtima’s fee structure is competitive across key instruments. The ECN+ account features raw spreads from 0.0 pips with a $6 round-turn commission, while the ONE account is commission-free with spreads from 1.0 pips.

Account Type | Commission | Spreads from (pips) |

ECN+ | $3 per side traded | 0.0 |

ONE | $0 | 1.0 |

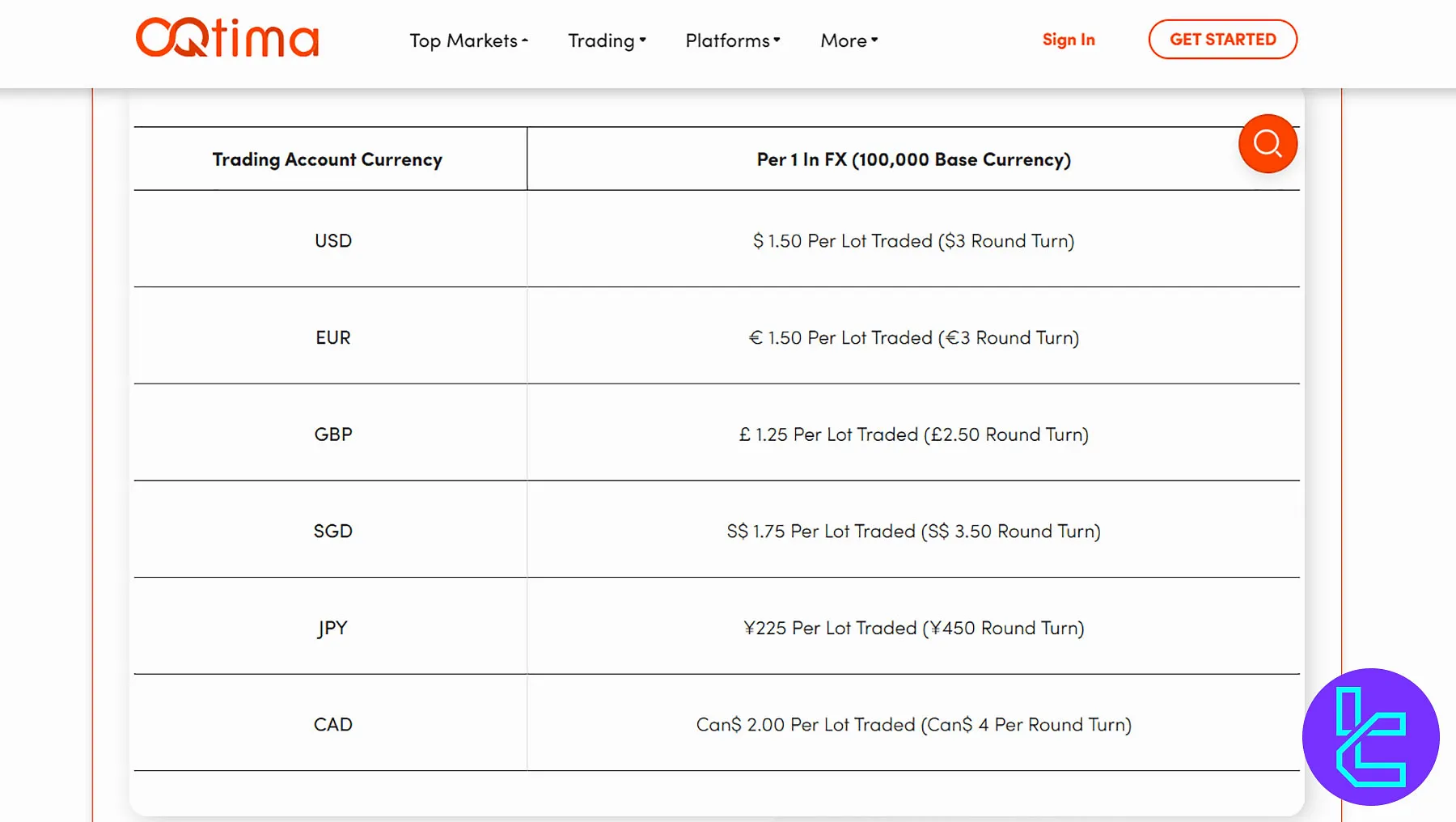

Note that commissions differ based on the account's base currency, as stated in the following picture:

The table below gathers average spread information of the most popular Forex pairs across OQtima accounts.

Instrument | ECN+ Spreads | ONE Spreads |

AUDUSD | 0.14 | 1.14 |

EURUSD | 0.12 | 1.12 |

GBPJPY | 1.61 | 2.61 |

GBPUSD | 0.36 | 1.36 |

USDCHF | 0.60 | 1.60 |

EURJPY | 0.80 | 1.80 |

GBPCAD | 2.09 | 3.09 |

OQtima Swap Fees

A swap rate, also called a rollover fee, is a financing charge applied to any position held overnight or, in the case of shares, beyond the market’s daily closing time for that stock.

The rate is shown in your trading platform as an annual percentage and is calculated using the formula:

Market Price (EOD) × Trade Size in Lots × Swap Rate ÷ 100 ÷ 360 = Swap Charge per Night (USD)

OQtima Non-Trading Costs

The broker does not impose deposit or withdrawal fees but applies a $20 monthly inactivity fee after six months of dormancy.

OQtima Deposit and Withdrawal

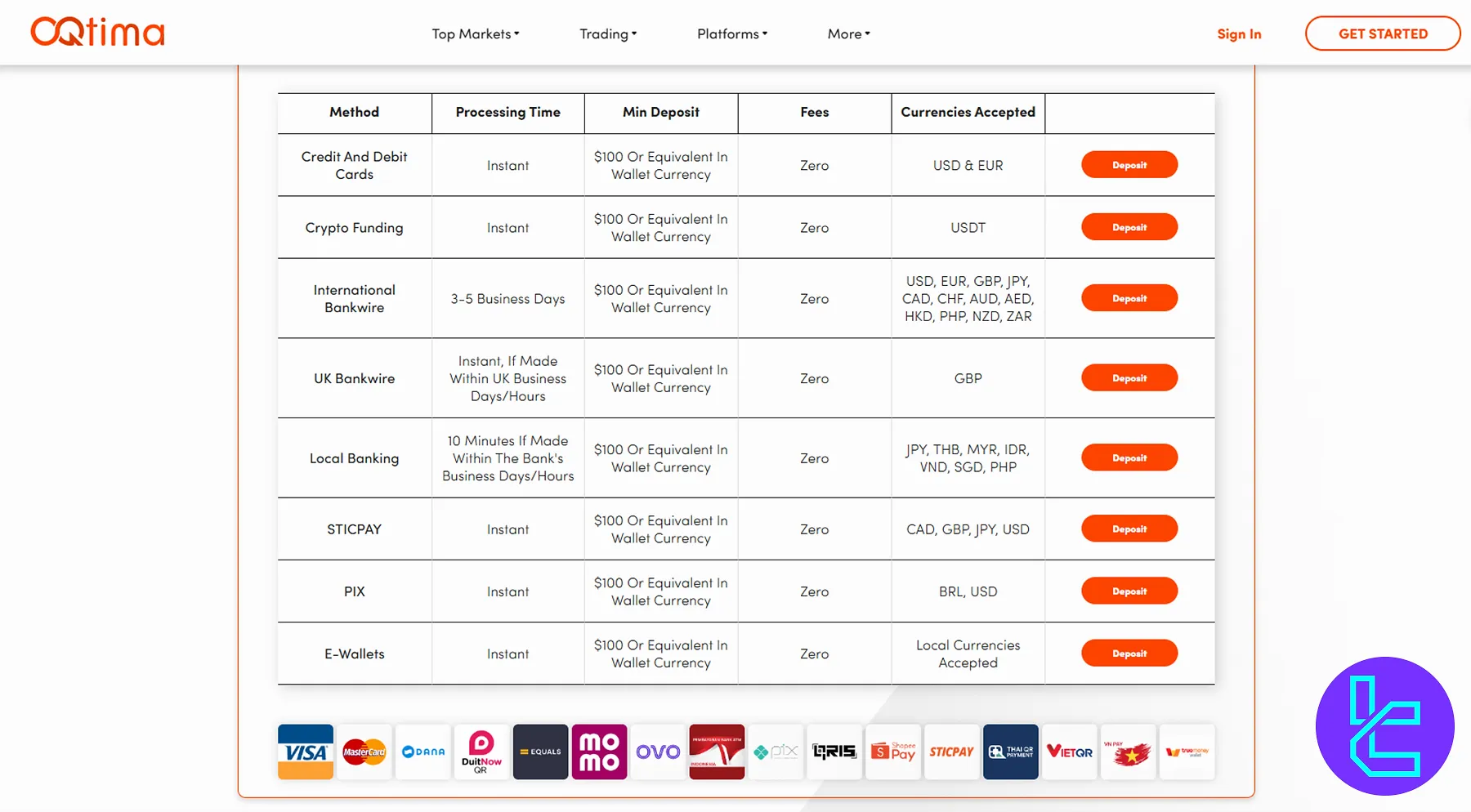

The broker offers a variety of payment options to cater to traders worldwide. OQtima deposit and withdrawal methods:

- Credit/Debit Card

- Cryptocurrency

- International Bank Wire

- UK Bank Wire

- Local Banking

- SticPay

- PIX

- E-Wallets

OQtima accepts Shopee Pay and EQUALS payments

OQtima accepts Shopee Pay and EQUALS payments

OQtima Deposits

OQtima offers 8 flexible funding options ranging from bank transfers to crypto payments, all with zero deposit fees.

Minimum deposits start at $100, and most transactions process instantly, ensuring traders can fund accounts without delays.

Deposit Method | Processing Time | Supported Currencies | Min Deposit |

Credit/Debit Cards | Instant | USD, EUR | $100 |

Crypto Funding | Instant | AVAX, BNB, BTC, BCH, ADA, DASH, DOGE, ETH, LTC, MATIC, XRP, SHB, SOL, USDC, ESDT | $100 |

International Bankwire | 3–5 Business Days | USD, EUR, GBP, JPY, CAD, CHF, AUD, AED, HKD, PHP, NZD, ZAR | $100 |

UK Bankwire | Instant (UK business hours) | GBP | $100 |

Local Banking | ~10 Minutes (business hours) | JPY, THB, MYR, IDR, VND, SGD, PHP | $100 |

STICPAY | Instant | CAD, GBP, JPY, USD | $100 |

PIX | Instant | BRL, USD | $100 |

E-Wallets | Instant | Local currencies accepted | $100 |

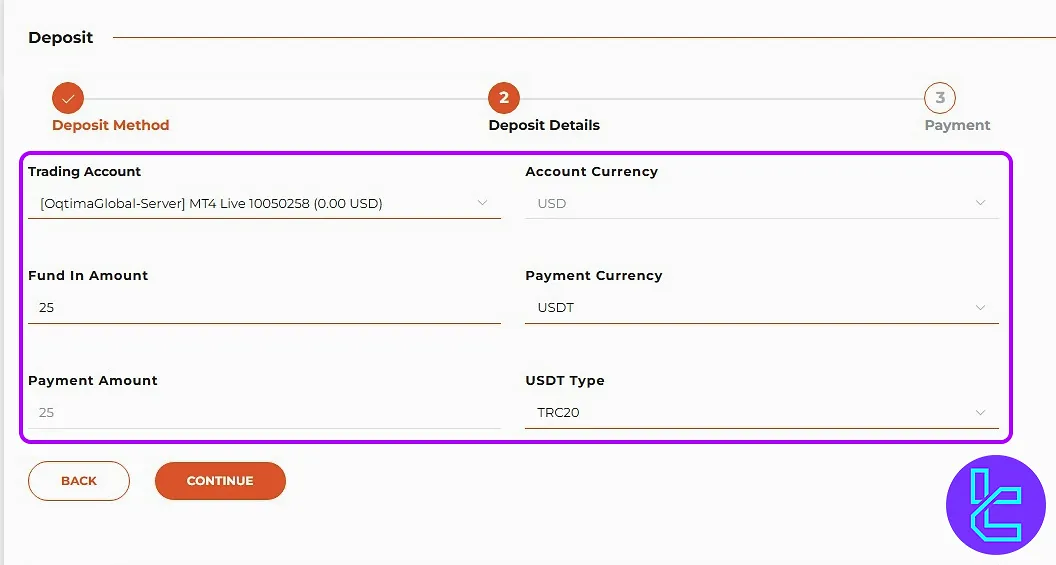

OQtima TRC20 Deposit Guide

Depositing USDT via the TRC20 network to your OQtima account is a fast, secure, and fee-free process, typically completed in under 1 hour with a minimum deposit of $20. Key points about OQtima TRC20 deposits:

- 5-step process: Deposit → select account → enter details → receive wallet address → confirm in transaction history

- Payment method: Tether (USDT) on the Tron TRC20 network

- Minimum deposit: $20; blockchain network fee applies only to blockchain transfer

- Wallet address provided with QR code for quick scanning

- Status and history available in the Reports section

OQtima Withdrawals

OQtima supports the same 8 methods for payouts as for deposits. All requests are processed within 1 business day, except international bank wires, which can take 3–5 business days.

Withdrawals are fee-free unless over 5 per month or with no trading activity, which incurs a 3% fee.

Withdrawal Method | Processing Time | Supported Currencies |

Credit/Debit Cards | 1 Business Day | USD, EUR |

Crypto Funding | 1 Business Day | AVAX, BNB, BTC, BCH, ADA, DASH, DOGE, ETH, LTC, MATIC, XRP, SHB, SOL, USDC, ESDT (ERC20/TRON) |

International Bankwire | 3–5 Business Days (Mon–Fri, 9–3) | USD, EUR, GBP, JPY, CAD, CHF, AUD, AED, HKD, PHP, NZD, ZAR |

UK Bankwire | 1 Business Day | GBP |

Local Banking | 1 Business Day | JPY, THB, MYR, IDR, VND, SGD, PHP |

STICPAY | 1 Business Day | CAD, GBP, JPY, USD |

PIX | 1 Business Day | BRL, USD |

E-Wallets | 1 Business Day | Local currencies accepted |

This structure ensures fast and cost-effective fund management for global clients.

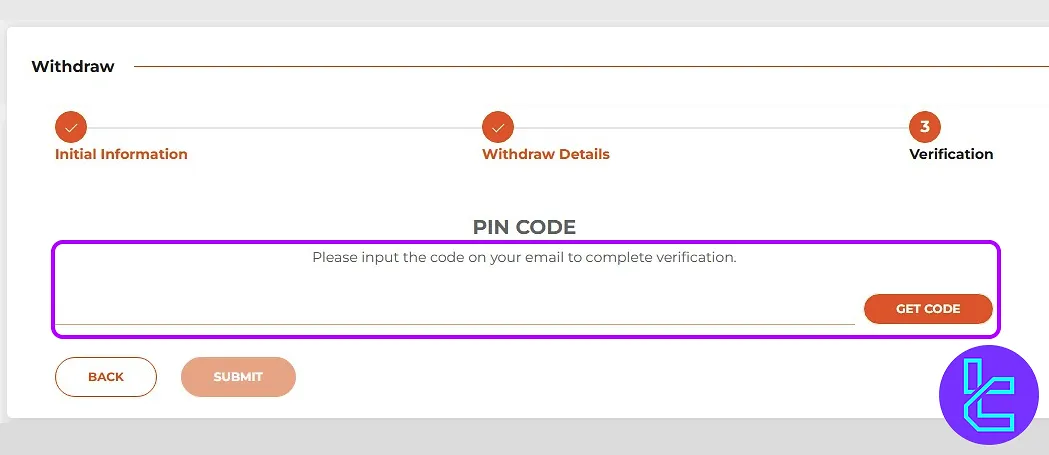

OQtima TRC20 Withdrawal

USDT cash out is a secure process, requiring a minimum payout of $50 and typically taking up to 3 business days for approval.Key points about OQtima TRC20 withdrawal:

- 5-step process: Withdraw Funds → choose USDT → enter wallet & amount → email code confirmation → track in Reports

- Network: Tether (USDT) on the Tron TRC20 network

- Minimum withdrawal: $50.

- 6% fee applies if no trades are made after depositing

- Approval time: up to 3 business days; status viewable in Transaction Report

- New wallet addresses require verification via a screenshot upload in the Documents section

Copy Trading and Growth Plans

The company doesn’t provide dedicated copy trading or social trading services on its platform.

However, interested traders can use the built-in copy trade feature on MT4 and MT5 platforms.

OQtima Broker Markets

While the company boasts over 1,000 trading instruments, its “Trading Accounts” page indicates 300+ available markets on OQtima.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max Leverage |

Forex | CFDs | 80 | 50 - 70 currency pairs | 1:1000 |

Indices | CFDs | 20 | 10 - 20 instruments | 1:500 |

Stocks | CFDs | 91 | 800 - 1200 | 1:20 |

ETFs | CFDs | 100+ | 20 - 30 | N/A |

Metals | CFDs | Gold and Silver | 3 - 5 | 1:1000 |

Energies | CFDs | WTI, BRENT, and NGAS | 3 - 5 instruments | 1:500 |

Cryptocurrencies | CFDs | 45 instruments | 20 - 30 instruments | 1:20 |

All instruments are offered as CFDs with no access to spot trading or direct stock ownership. This wide coverage supports both short-term speculation and portfolio diversification.

Bonus and Promotion

OQtima offers a comprehensive Introducing Broker program in addition to a traditional welcome gift with the following features:

- Deposit Bonus: A100% Match bonus of up to $500, available in certain regions

- IB: A monthly income of $800 for referring 10 new clients with daily payouts

OQtima Customer Support

The broker boasts 24/5 support through multiple channels, including a live chat feature and hotlines.

support@oqtima.com | |

Phone 1 | +44 330 828 5704 |

Phone 2 | +248 4632034 |

Line | |

Live Chat | Available on the official website |

Ticket | Through the “Contact Us” page |

OQtima Restricted Countries

While the broker aims to serve a global clientele, there are restrictions on who can open an account. The following countries are currently restricted on OQtima platform:

- United States

- North Korea

- Iran

This list may change, so it's always best to check directly with OQtima or consult their terms and conditions for the most up-to-date information.

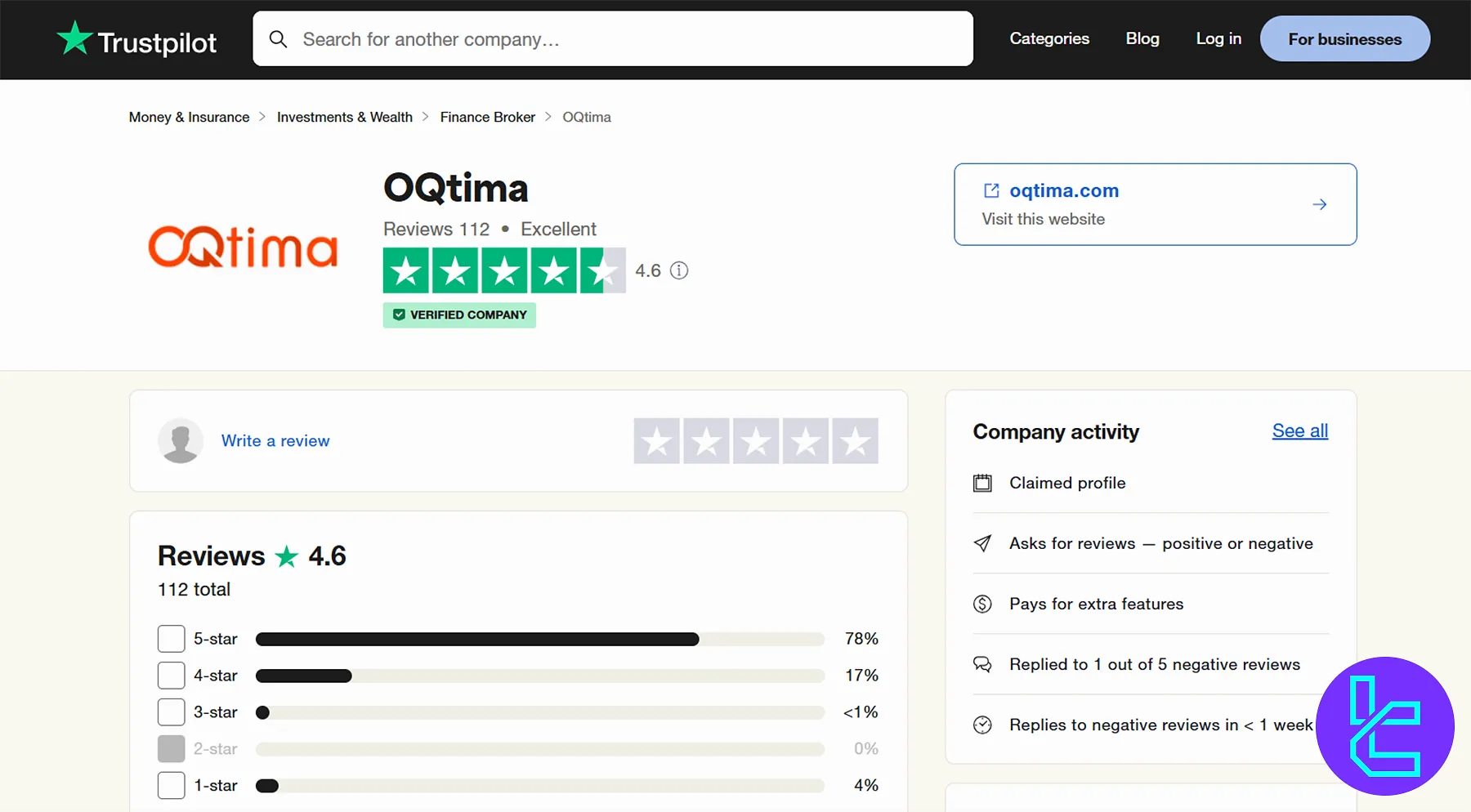

Trust Score and User Experience

While the broker is relatively new, it has already garnered positive feedback from traders.

There are 112 reviews on the OQtima TrustPilot profile, resulting in an excellent score of 4.6 out of 5.

Educational Resources

OQtima doesn’t focus on trader education since its website provides no learning sections. However, it does offer various trading tools to help traders make informed decisions, including:

- Free Private VPS: A minimum deposit of $3000 and a minimum trading volume of 5 lots requirements

- Trading Calendar: Powered by Trading Central

- Featured Ideas: Live bullish or bearish investment ideas

- Market Buzz: 100K+ news and social sources

- Alpha Generation: Actionable insights for the MetaTrader platform

These tools support experienced traders but offer little guidance for beginners, limiting the broker’s appeal to novice users.

You can check TradingFinder's Forex education section for additional resources.

OQtima vs Other Brokers

Let's check OQtima's standing in the trading world in comparison with popular brokers:

Parameter | OQtima Broker | Exness Broker | HFM Broker | FxPro Broker |

Regulation | FSA, CySEC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB |

Minimum Spread | From 0.0 pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $0.0 | From $0.2 to USD 3.5 | From $0 | From $0 |

Minimum Deposit | $100 | $10 | From $0 | $100 |

Maximum Leverage | 1:1000 | Unlimited | 1:2000 | 1:500 |

Trading Platforms | MT4, MT5 | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App |

Account Types | ECN+, ONE | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 1,000+ | 200+ | 1,000+ | 2100+ |

Trade Execution | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending |

Conclusion and Final Words

OQtima provides access to 1,000+ trading instruments with spreads from 0.0 pips. The company supports Crypto, SticPay, and PIX payments without transaction fees. OQtima broker has a TrustPilot score of 4.6 out of 5.