Pacific Financial Derivatives (PFD) is a New Zealander broker since 1999. It offers 1:300 maximum leverage, NDD trading model, and no restrictions on trading strategies such as news trading.

This broker is regulated by the reputable Financial Markets Authority of New Zealand and also operates another branch internationally under an SVG license.

Pacific Financial Derivatives was launched in 1999 and owned by a Japanese investor who is unknown

Pacific Financial Derivatives was launched in 1999 and owned by a Japanese investor who is unknown

Pacific Financial Derivatives Company Information & Regulation

Pacific Financial Derivatives Ltd (PFD) has been a stalwart in the forex and CFD brokerage industry since its inception in 1999. Here's what you need to know about the company's background and regulatory status:

- Ownership: PFD is100% owned by a Japanese investor with extensive experience in the derivatives industry, bringing a wealth of knowledge to the table;

- Regulation: The broker is fully regulated by the Financial Markets Authority (FMA) of New Zealand, a top-tier regulatory body that ensures strict oversight and investor protection;

- Client Fund Security: As per regulatory requirements, PFD segregates client funds, adding an extra layer of security for traders;

- Membership: PFD is a proud member of the Financial Service Provider Register (FSP 28944) and the Financial Dispute Resolution (FDR) scheme in New Zealand;

- Global Reach: While headquartered in Auckland, PFD caters to retail and institutional traders worldwide, with a notable exception being the United States.

This regulatory backing ensures that PFD adheres to fair dealing principles, anti-money laundering protocols, and capital market standards in New Zealand.

The following table summarizes key regulatory and operational details of Pacific Financial Derivatives.

Entity Parameters / Branches | PFD-NZ (Pacific Financial Derivatives Ltd) | PFD-LLC (Pacific Financial Derivatives LLC) |

Regulation | FMA | Unregulated (SVG) |

Regulation Tier | 1 | N/A |

Country | New Zealand | St. Vincent & the Grenadines |

Investor Protection Fund / Compensation Scheme | No | No |

Segregated Funds | Yes | No |

Negative Balance Protection | No | No |

Maximum Leverage | 1:300 | 1:300 |

Client Eligibility | Global (except USA & restricted jurisdictions) | Global (excl. USA & UN/OFAC sanctioned) |

Summary of Specifications

Let's break down the key specifics of Pacific Financial Derivatives to give you a clear picture of what this Forex broker offers:

Broker | Pacific Financial Derivatives |

Account Types | PFD Trader, PFDPro, PFDProPlus |

Regulating Authorities | FMA |

Based Currencies | EUR, USD, NZD, AUD, GBP, JPY |

Minimum Deposit | $0 |

Deposit/Withdrawal Methods | VISA, MasterCard, PayPal, POLi, Bank Wire Transfer |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:300 |

Investment Options | Copy Trading, MAM Account |

Trading Platforms & Apps | PFD Trader (Implement of MT4) |

Markets | Forex, Indices, Commodities |

Spread | From 0.06 Pips in PFDTrader, From 0.2 Pips in PFDPro, From 0.1 Pips in PFDPlus |

Commission | $0 in PFDTrader, $1 in PFDPro / PFDPlus |

Orders Execution | Market |

Margin Call/Stop Out | 150%/100% |

Trading Features | 1:300 Maximum Leverage, Islamic Account, Fast Execution, Copy Trading, MAM Account, $0 Commission |

Affiliate Program | No |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Indoor Meeting, Email, Phone Call, Skype, Live Chat |

Customer Support Hours | 24/5 |

PFD stands out with its low spreads and fast execution speeds, making it an attractive option for high-frequency traders and those employing scalping strategies.

The broker's use of the popular MetaTrader 4 platform, coupled with Expert Advisor (EA) functionality and FIX API support, caters well to both manual and automated trading styles.

Account Types: Full Comparison

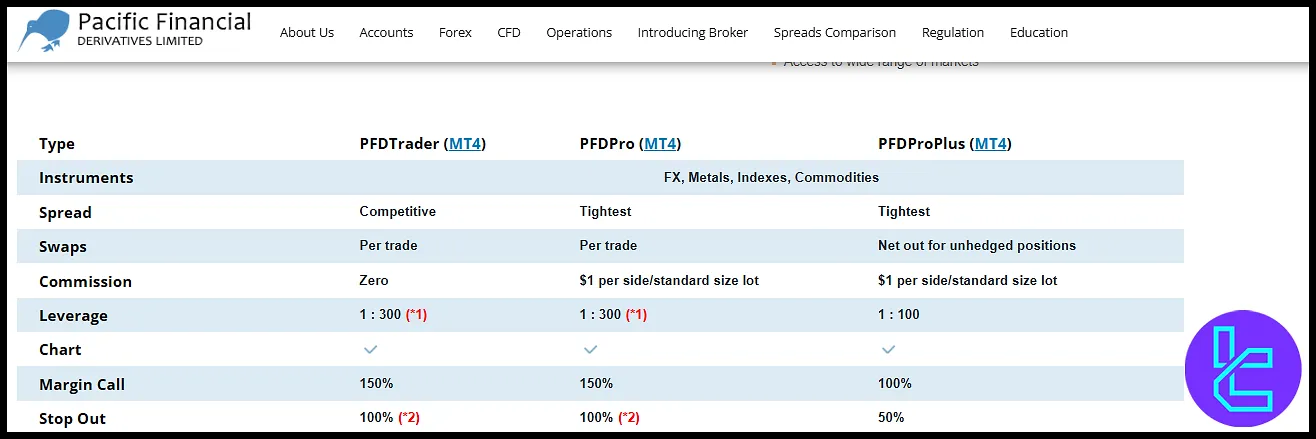

Pacific Financial Derivatives offers three distinct account types, each tailored to different trading styles and experience levels.

There are 3 accounts available to trade in PFD

There are 3 accounts available to trade in PFD

All three account types operate on the robust MetaTrader 4 (MT4) platform, ensuring a familiar and feature-rich trading environment. Besides these accounts, PFD offers an Islamic swap-free account, which is designed for Muslim traders.

PFD Broker Account Comparison

Specifics | PFDTrader | PFDPro | PFDProPlus |

Spread | From 0.6 Pips | From 0.2 Pips | From 0.1 Pips |

Swaps | Per trade | Per trade | Tightest |

Commission | $0 | $1 Per Trade | $1 Per Trade |

Maximum Leverage | 1:300 | 1:300 | 1:100 |

Margin Call | 150% | 150% | 100% |

Stop Out | 100% | 100% | 50% |

EA | Allowed | Allowed | Allowed |

Signal | Available | Available | Available |

Minimum Position Size | 0.01 Lot | 0.01 Lot | 0.01 Lot |

Minimum Deposit | 0 | 0 | $1000 |

Execution Type | Market | Market | Market |

Advantages and Disadvantages

Like any broker, Pacific Financial Derivatives comes with its own set of pros and cons. Let's weigh them up:

Advantages | Disadvantages |

Regulated by New Zealand's FMA, ensuring a high level of oversight and investor protection | Some user reviews report issues with account access and fund withdrawal, hinting at potential customer service challenges |

Offers multiple account types, including Islamic accounts for Shariah-compliant trading | The range of trading instruments is somewhat limited compared to more extensive brokers |

Uses the popular and versatile MetaTrader 4 platform | Educational resources and market analysis tools are minimal, potentially challenging for novice traders |

No minimum deposit requirement, lowering the entry barrier for new traders | Very few trading platforms |

Multiple deposit and withdrawal options available for convenient fund management | - |

Sign Up & Verification Guide on Pacific Financial Derivatives: Complete Manual

Pacific Financial Derivatives (PFD) offers access to Forex and CFD trading via three professional account types. The registration process ensures compliance with FMA (New Zealand) regulations and includes secure ID verification.

#1 Sign Up on the PFD Website

Visit theofficial PFD site and click “Open a Live Account”. Enter your information, including:

- Username

- Account password

You’ll receive an activation link and account ID via email.

#2 Choose Account Type & Verify Identity

Select from PFD Trader, PFD Pro, or PFDPro Plus accounts. Upload supporting documents, including:

- Proof of Identity: Passport or Driving license

- Proof of Address: Utility bill or Bank statement

#3 Finalize Setup & Fund Account

Once verified, log in to your client portal, complete any remaining details, and deposit funds via bank transfer, credit/debit card, or e-wallets. You’re now ready to trade.

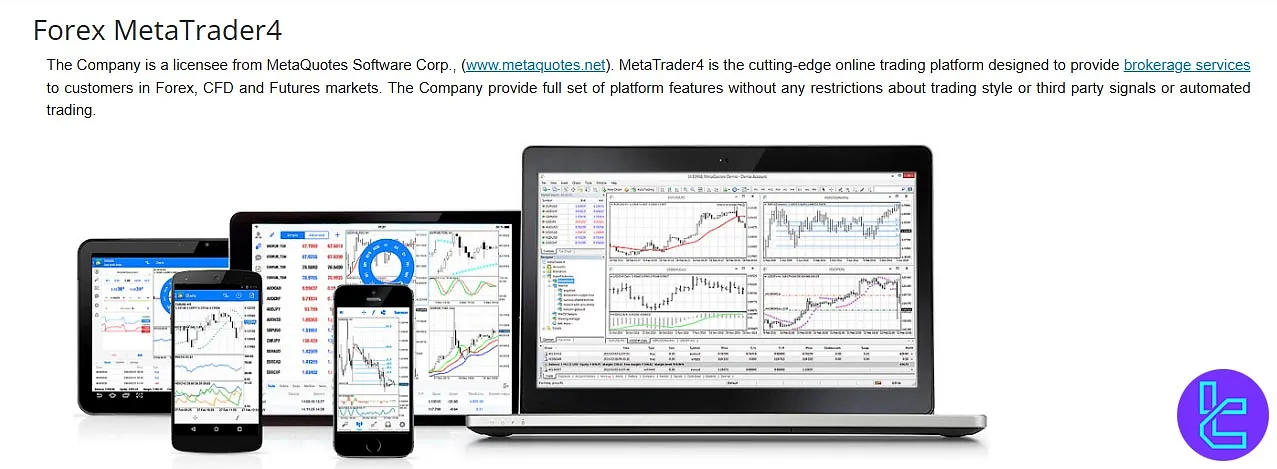

PFD Trading Platforms

Pacific Financial Derivatives offers a robust trading environment through its implementation of the industry-standard MetaTrader 4 (MT4) platform called PFD Trader.

PFD Trader (MT4) features:

- User-friendly interface suitable for both beginners and experienced traders

- Real-time charting with a wide range of technical indicators and drawing tools

- Customizable workspace to suit individual trading preferences and various trading strategies

- Advanced order types, including stop-loss, take-profit, and trailing stops

- Automated trading capabilities through Expert Advisors (EAs)

By leveraging the power and flexibility of MetaTrader 4, PFD ensures that traders have access to a comprehensive suite of tools and features to execute their trading strategies effectively.

Additional features include MetaTrader Market integration, trading signal services, and MultiTerminal for account managers. MetaTrader 5 and proprietary platforms are not supported at this time.

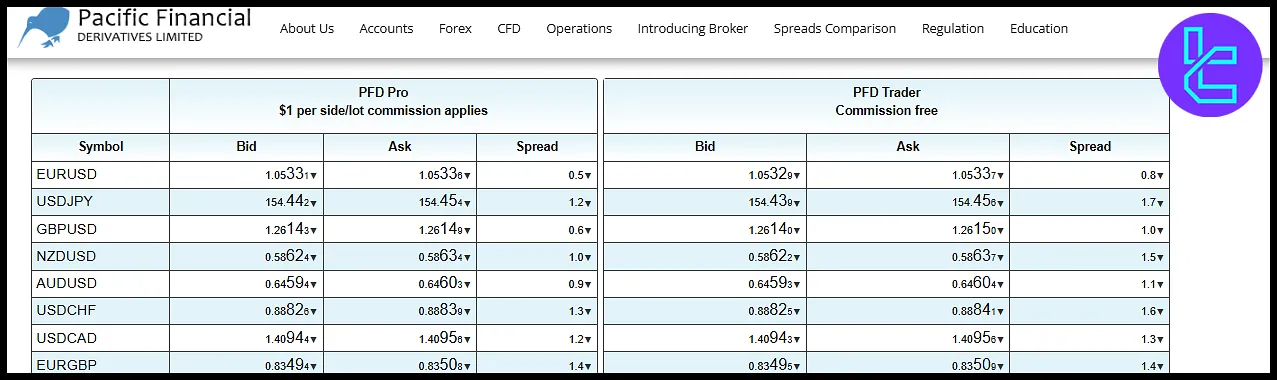

How Much Are the Commissions and Spreads on Pacific Financial Derivatives?

Understanding the cost structure is crucial when choosing a forex broker. Here's a breakdown of Pacific Financial Derivatives' spreads and commissions across their account types:

Fees | Trader | Pro | ProPlus |

Spread | From 0.6 Pips | From 0.2 Pips | From 0.1 Pips |

Commission | $0 | $1 Per Trade | $1 Per Trade |

PFD's spreads are generally lower than industry averages, making it an attractive option for traders focused on minimizing costs. The broker's fast execution speeds (averaging under 50ms) further enhance the appeal for scalpers and day traders.

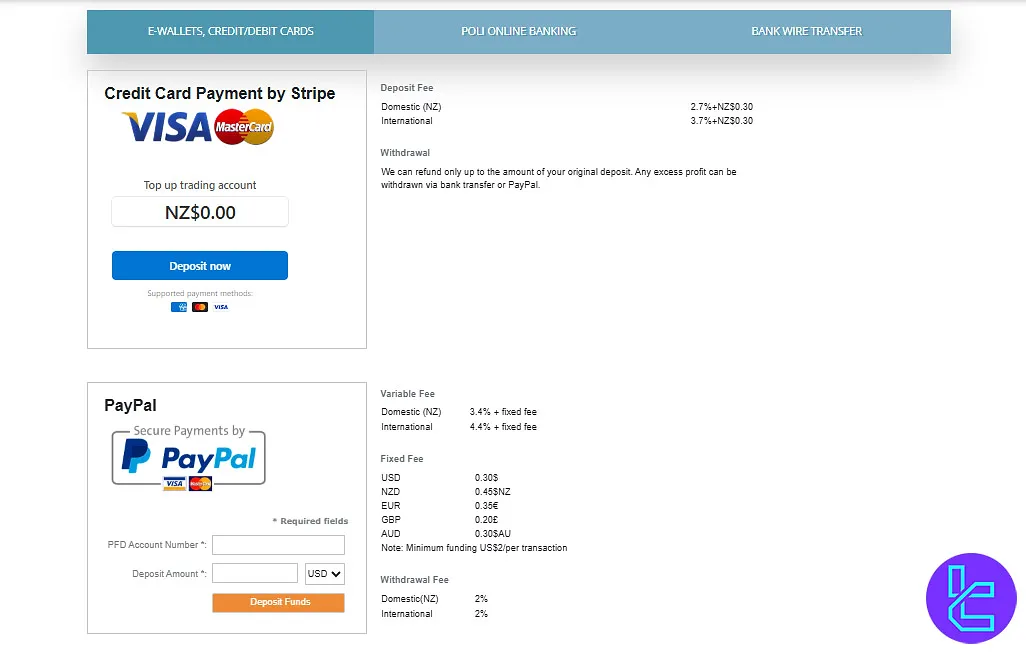

Other non-trading costs of Pacific Financial Derivatives:

- Deposit Fees: 2.7% + NZ$0.30 (domestic), 3.7% + NZ$0.30 (international)

- Inactivity Fee: $25

- Swap/Rollover: May apply overnight (e.g., ~1% for short positions)

- Withdrawal Fees: 1.5%–2.9% depending on method (free via Neteller)

Swap Fee at PFD Broker

Overnight positions at Pacific Financial Derivatives are subject to swap or rollover charges based on the interest rate differential between the two currencies and the broker’s liquidity provider costs.

The swap rate is displayed in MT4 as “points” where 1.0 point equals 0.1 pip. For Islamic accounts, no interest is charged on overnight positions, though an administrative fee applies after three days.

Non-Trading Fees at PFD Broker

Over and above the direct trading costs, this broker charges distinct non-trading fees such as deposit method charges and wallet transfer levies, with explicit percentages for domestic and international transactions.

These fees apply regardless of trading activity and should be factored into your cost-base.

That said, here are the key non-trading-fee details you should know:

- Domestic deposit fee: 2.7% + NZ$0.30 when funding from New Zealand payment services;

- International deposit fee: 3.7% + NZ$0.30 for non-NZ payment methods;

- Withdrawal fee via certain methods: 1.5% + fixed amount (example: e-wallets) for the SVG branch;

- No inactivity fee is stated or charged according to official PFD disclosures.

What Deposit & Withdrawal Options Are Available at PFD?

In the Pacific Financial Derivatives review, we discovered that they offer a variety of deposit and withdrawal options to cater to their global client base. PFD Funding Methods:

- Credit/Debit Cards: VISA, MasterCard

- E-wallets: PayPal

- Local Payment Solutions: POLi (for Australia and New Zealand)

- Bank Wire Transfer: Available in multiple currencies (USD, NZD, GBP, AUD, EUR, JPY)

Remember, as a regulated broker, PFD adheres to strict anti-money laundering (AML) policies. Always use accounts in your own name, matching the details on your trading account.

For large withdrawals or any issues, don't hesitate to contact PFD's customer support team for assistance.

Deposit Methods at Pacific Financial Derivatives

Pacific Financial Derivatives offers clients multiple secure and efficient ways to fund their trading accounts. Options include credit/debit cards, e-wallets such as PayPal, POLi online banking, and traditional bank wire transfers.

Each method is designed to provide convenience, transparency, and fast processing times while ensuring all transactions are made from accounts in the client’s own name.

Below is a detailed overview of the main deposit methods and their related conditions:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Credit/Debit Card (via Stripe) | USD, EUR, NZD, GBP, AUD | From USD 2 | Domestic: 2.7% + NZ$0.30 | Instant |

E‑Wallets (via PayPal) | USD, EUR, NZD, GBP, AUD | From USD 2 | Domestic: 3.4% + fixed fee | Instant |

POLi Online Banking | NZD | Varies | 1% per transaction (capped at NZ$3 + GST) | Instant / Same day |

Bank Wire Transfer | USD, NZD, AUD, GBP, EUR, JPY | Varies by currency | Standard bank transfer fees apply | 1‑5 business days |

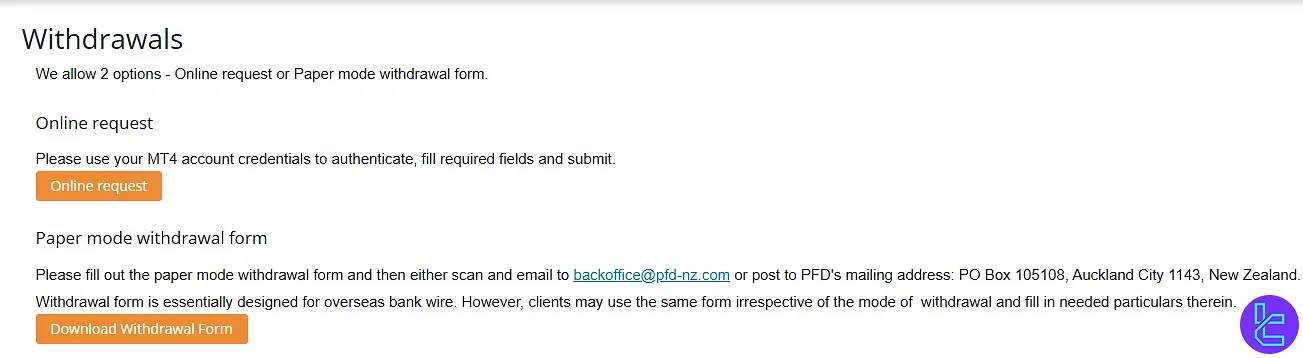

Withdrawal Methods at Pacific Financial Derivatives

You can submit your withdrawal by logging into your MT4 account and completing the online form, or by using the paper-mode withdrawal form (which must be scanned and emailed or mailed).

Below are the withdrawal methods and some of their typical parameters as provided by the broker for your reference:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Credit/Debit Card (via Stripe) | USD, EUR, NZD, GBP, AUD | N/A | N/A | N/A |

E‑Wallets (via PayPal) | USD, EUR, NZD, GBP, AUD | N/A | Domestic: 2% International: 2% | N/A |

Copy Trading & Investment Options

Pacific Financial Derivatives offers a range of investment options, including copy trading and MAM (Multi-Account Manager) accounts.

Copy Trading

- Automatically replicating trades of experienced traders

- Ideal for beginners or those with limited time for market analysis

- A diverse pool of strategy providers to choose from

- Real-time copying of trades with adjustable risk settings

MAM Accounts

- Designed for professional money managers and institutional clients

- Management of multiple client accounts simultaneously

- Flexible allocation methods (percentage, lot, equity)

- Detailed reporting and performance tracking

Pacific Financial Derivatives offers MAM account to money managers

Pacific Financial Derivatives offers MAM account to money managers

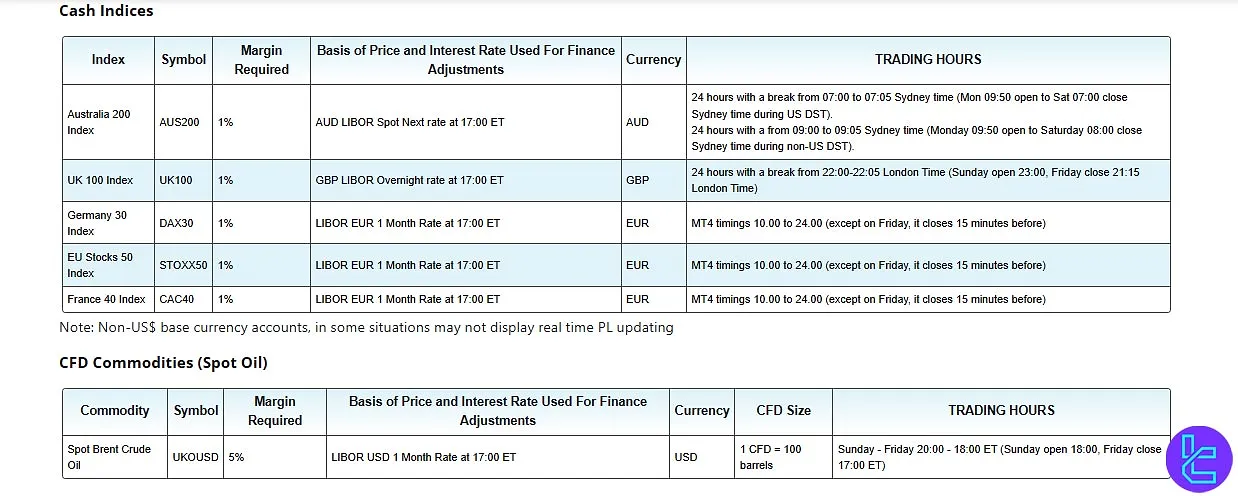

Tradable Markets & Symbols Overview

Pacific Financial Derivatives offers over 70 symbols across three asset classes, including the Forex market, indices, and commodities.

Below is a table summarizing the key categories:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex (FX) | Currency pairs (majors, minors, exotics) | 50 | 30–60 | 1:300 |

Commodities | Gold, Silver, Oil | 5 | 10–20 | N/A |

Indices | Indices, Non-expiring Futures | 5+ | 10–20 | N/A |

While PFD's range of 70+ tradable instruments might be more limited compared to some larger brokers, it covers the most popular and liquid markets.

Does Pacific Financial Derivatives Offer Any Bonuses?

As of our latest Pacific Financial Derivatives review, it does not offer any trading bonuses or promotions. This approach aligns with many regulated brokers who have moved away from bonus schemes due to regulatory constraints and a focus on transparent, fair-trading conditions.

Pacific Financial Awards

Pacific Financial Derivatives awards are for its excellence, transparency, and reliability in global financial markets.

The broker’s strong performance and service quality have earned it multiple industry awards across various categories.

Here are some of the key PFD Awards:

- Best Forex Customer Service Brand - 2018

- Best MT4 Broker in New Zealand - 2024

- Best Forex Broker in New Zealand - 2024

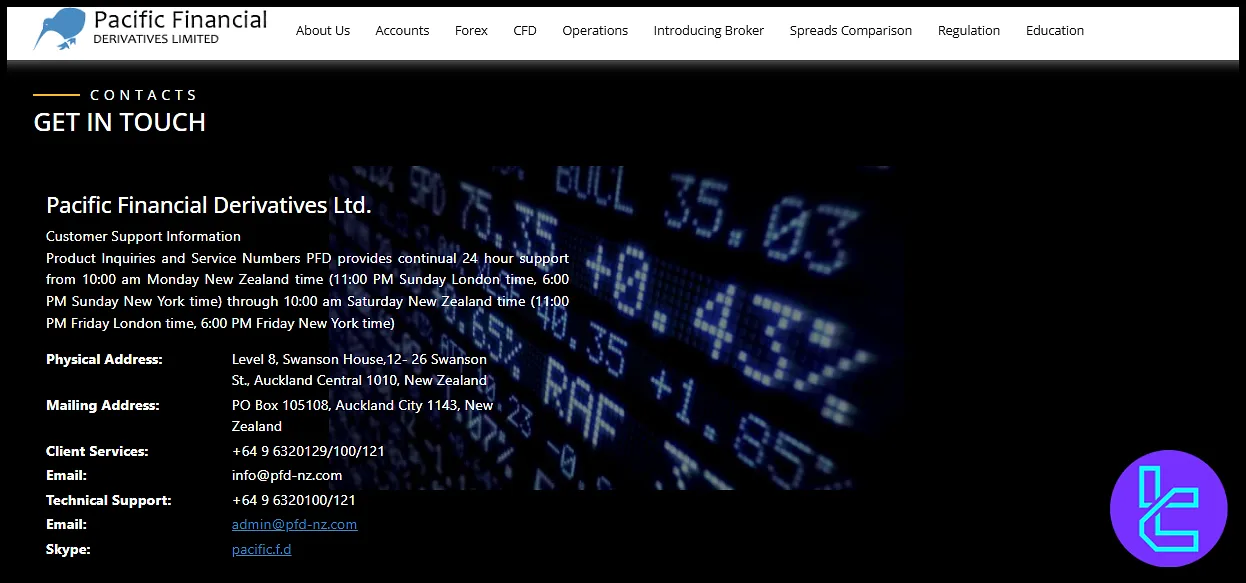

Customer Support

Pacific Financial Derivatives LLC (PFD) is a well-established financial derivatives broker that prides itself on providing round-the-clock (Monday to Friday) customer support through various channels. Support:

- Email: info@pfd-fx.com

- Skype: pacific.f.d

- Live Chat: Available 24/5

- Indoor Meeting: Euro House, Richmond Hill Road, P.O. Box 2897, Kingstown, St. Vincent and the Grenadines

PFD support team is not available 24/7

PFD support team is not available 24/7

The support team offers assistance with technical issues, account setup, and trading guidance.

What Countries Are Banned from Using PFD Services?

While PFD is a globally accessible broker, it's important to note that they may have restrictions on clients from certain countries due to regulatory requirements.

Pacific Financial Derivatives Restricted Countries:

- Afghanistan

- Congo Republic

- Cote d’Ivoire

- Eritrea

- Guinea Bissau

- Iran

- North Korea

- Lebanon

- Liberia

- Libya

- Myanmar

- Somalia

- Sudan

- Syria

- Tajikistan

- Yemen

- USA

- Zimbabwe

Trust Scores & Reviews

Trust and reputation are crucial factors when choosing a forex broker. The Pacific Financial Derivatives ForexPeaceArmy profile has received mixed reviews from traders, with a current rating of 3.1/5 (15+ reviews).

The broker doesn't have a Trustpilot profile. Its regulation by New Zealand's FMA adds a layer of credibility and security for traders.

However, the broker's offerings are somewhat limited compared to some competitors, particularly in terms of tradable instruments [only 70+ assets available to trade] and educational resources.

As of our latest “Pacific Financial Derivatives review”, PFD seems best suited forexperienced forex traders and those engaged in high-frequency trading who prioritize execution speed and low costs.

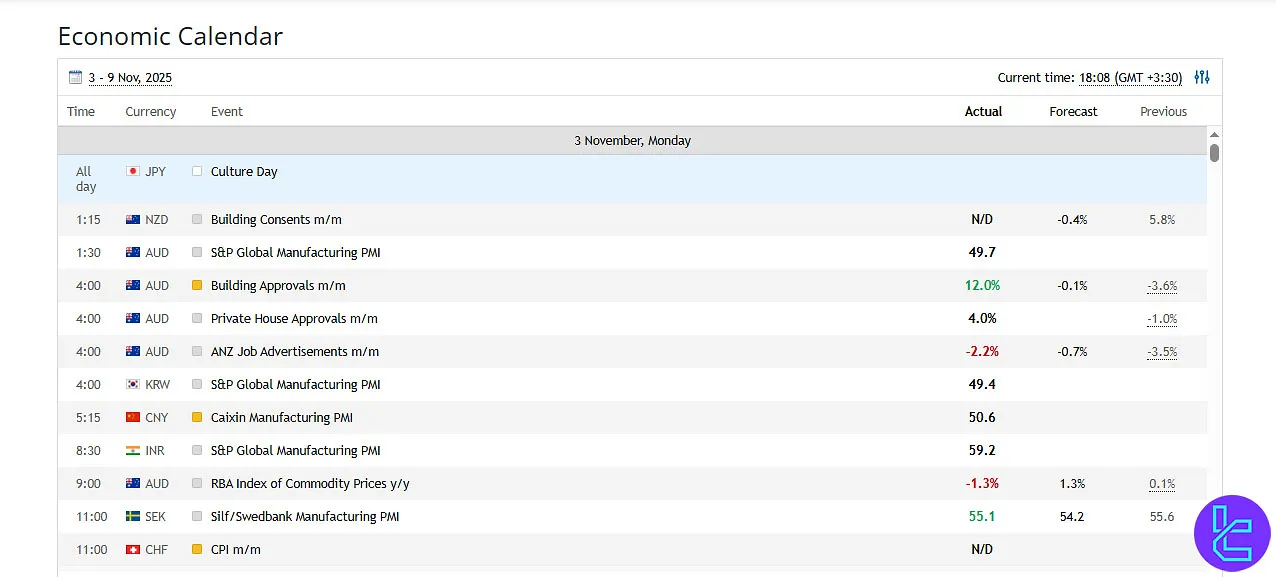

Educational Resources Offered by Pacific Financial Derivatives

Despite the criticism of limited educational resources, PFD does offer some basic tools to help traders get started:

- Forex Introduction: Covers the basics of forex trading, including market fundamentals and trading strategies;

- Forex Glossary: Explains common terms like bid/ask, bear/bull market, currency pairs, leverage, and pips;

- Economic Calendar: Provides information on key economic data releases that can impact currency markets.

While these resources can be helpful for beginners, more experienced traders might find them lacking in depth and may need to seek additional educational materials elsewhere.

You can check TradingFinder's Forex education for additional resources.

Pacific Financial Derivatives Comparison Table

The table below provides a comprehensive comparison between PFD and other forex brokers:

Parameter | Pacific Financial Derivatives Broker | TMGM Broker | AvaTrade Broker | Tickmill Broker |

Regulation | FMA | ASIC, VFSC, FSC, FMA | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA | FSA, FCA, CySEC, LFSA, FSCA |

Minimum Spread | From 0.06 Pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $0.0 | From $0.0 | $0 | From $0.0 |

Minimum Deposit | $0 | $100 | $100 | $100 |

Maximum Leverage | 1:300 | 1:1000 | 1:400 | 1:1000 |

Trading Platforms | MT4 | MT4, MT5, IRESS, TMGM Mobile App | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader | Metatrader 4, Metatrader 5, Metatrader Web, Mobile App |

Account Types | PFD Trader, PFDPro, PFDProPlus | EDGE, CLASSIC | Standard, Demo, Professional | Classic, Raw |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 70+ | 12000+ | 1250+ | 620+ |

Trade Execution | Market | Market, Instant | Instant | Market |

TradingFinder Expert Conclusion and final words

Pacific Financial Derivatives (PFD) offers spot and futures trading for over 70 assets. Beside these, you are able to use copy trading and MAM account with spreads start from 0.1 pips. But, it has only one trading platform [PDF Trader as an implement of MT4.]