QNB Invest offers Forex and CFD trading with leverage options of up to 1:10 for a minimum deposit requirement of TRY 50,000 or $1,000.

The broker also provides access to available Futures and Options contracts in Borsa Istanbul. TheCommission for trades under $12,500 is $25, and there is a 0.5% fee for each transaction.

QNB Invest (An Introduction to the Broker and Its Regulatory Status)

QNB Invest, also known as QNB Finansinvest, positions itself as a Forex and CFD broker with ties to the Turkish financial market.

QNB Finansinvest (also known as QNB Invest) operates as the investment arm of Finansbank and is fully owned by Qatar National Bank (QNB Group).

The broker is regulated by the Capital Markets Board of Turkey (CMB) and holds full membership in the Istanbul Stock Exchange (BIST), including its Futures and Options Market (VIOP).

The company was founded on December 27, 1996, and later joined QNB Group, the most valuable banking brand in the MEA region. Key features of QNB Invest:

- Regulated by the Capital Markets Board of Turkey (CMB)

- Available across 30 countries and 3 continents

- An affiliate of QNB Group with $150B+ in assets as of 2017

- Paid-in Capital of up to TRY 50M as of 2017

QNB Invest follows STP (Straight Through Processing) execution, ensuring client orders are routed directly to liquidity providers without dealer intervention. This structure enhances execution speed and price transparency.

As part of its regulatory compliance, QNB Invest implements advanced fund protection measures, including encrypted data transmission, segregated client accounts, and two-factor authentication, to ensure the safety and integrity of client capital.

Here is the regulatory information of QNB Invest:

Entity Parameter / Branch | QNB Finansinvest |

Regulation | Capital Markets Board of Turkey (CMB) |

Regulation Tier | N/A |

Country | Turkey |

Investor Protection Fund / Compensation Scheme | Covered by the Investor Compensation Center (Yatırımcı Tazmin Merkezi) under CMB regulation |

Segregated Funds | Yes |

Negative Balance Protection | N/A |

Maximum Leverage | 1:10 |

Client Eligibility | Available to individual and corporate, local and international clients |

QNB Invest Table of Specifications

The Forex broker was registered in Istanbul as a trading service provider with registry No. 358657. Let’s see what QNB Invest has to offer.

Broker | QNB Invest |

Account Types | Demo, Real |

Regulating Authorities | CMB |

Based Currencies | USD, TRY |

Minimum Deposit | TRY 50,000 or $1000 |

Deposit Methods | Bank Transfer |

Withdrawal Methods | Bank Transfer |

Minimum Order | N/A |

Maximum Leverage | 1:10 |

Investment Options | Wealth management services, Investment advisory, Securities |

Trading Platforms & Apps | MT5, QNB ProTrader, QNB Mobile Application |

Markets | Forex, Metals, Energies, Stocks, Indices, Options, Futures, ETFs |

Spread | N/A |

Commission | $2 for trades above $12,500 $25 for trades below 12,500 |

Orders Execution | Market |

Margin Call / Stop Out | N/A |

Trading Features | Demo account, Mobile trading, Derivative instruments |

Affiliate Program | No |

Bonus & Promotions | N/A |

Islamic Account | N/A |

PAMM Account | No |

Customer Support Ways | Email, Tel, Chatbot, Fax |

Customer Support Hours | Weekdays from 09:00 to 18:00 (GMT +3) |

Trading Accounts

The broker offers 2 main account types, including Real and Demo. Unfortunately, we can’t provide detailed features of the trading accounts in this QNB invest review because the company’s website lacks the related information.

- Minimum deposit: TRY 50,000 or $1,000

- Maximum leverage: Up to 1:10

Important Note: Traders must first use the demo account and complete 50 trades before qualifying for a real account.

QNB Invest Broker Pros and Cons

The company is associated with one of the biggest banking industry players in MEA.

Qatar National Bank's credibility adds to QNB Invest's legitimacy. However, the broker sure has some flaws, too

Pros | Cons |

CMB regulated | Lack of transparency regarding trading fees |

A wide range of trading instruments | A 0.5% commission for transactions |

Advanced platforms (MT5 and QNB ProTrader) | Limited leverage options (up to 1:10) |

Long track record with 28+ years of experience | High entry barrier for Forex ($1,000) |

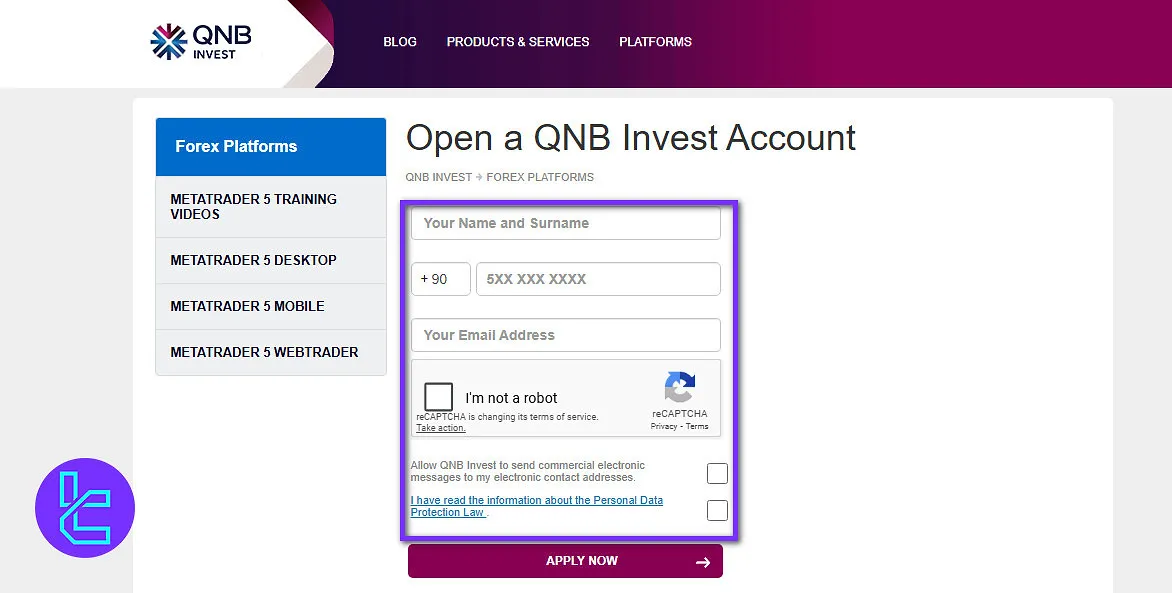

Sign up and Verification

To access QNB Invest’s live trading services, users must first register with QNB Bank. Account creation involves a call-back procedure initiated through the broker’s official platform.

#1 Visit the Official QNB Invest Website

Go to the official site and click “HESAP AÇ” (Open Account) to start the process.

#2 Submit Call-Back Request

To request a follow-up from the support team, provide your personal information, including:

- Full name

- Phone number

#3 Wait for Account Confirmation

A QNB representative will contact you by phone to guide you through completing your account setup, linked to your QNB Bank registration.

Opening a demo account is also possible using only your name, email, and phone number no bank integration required.

QNB Finansinvest Apps and Platforms

QNB Invest offers a versatile platform suite, including MetaTrader 5, WebTrader, QNB ProTrader, and even integration with TradingView. These platforms are accessible via desktop, mobile, and web interfaces, enabling flexible trading across devices.

Features include support for pending and limit orders, access to real-time market data, and economic calendars. QNB also offers free market analysis and newsletter subscriptions for its clients.

While QNB Pro Trader is only available for Windows, here are the download links for other platforms' mobile applications:

TradingFinder has developed a wide range of TradingViewand MT5 indicators that you can access for free.

QNB Invest Trading Costs

The broker lacks transparency regarding trading and non-trading costs. While its website does not provide specific spread data, we’ve confirmed the following fees with QNB support.

- A $2 commission for trades above $12,500

- A $25 commission for trades below $12,500

- A 0.5% fee for transactions

Some sources claim that EURUSD and GBPUSD spreads are as follows:

- EURUSD: 1.8 - 2.6 pips

- GBPUSD: 2.1 - 2.9 pips

QNB Invest Swap Fees

QNB Invest does not provide any publicly available information regarding swap or overnight financing fees on its official website.

Traders seeking information on swap fees must contact QNB Invest directly, as such data is not disclosed through the broker’s online resources.

QNB Non-Trading Fees

QNB Invest does not disclose detailed information about non-trading fees on its official website. The broker does not specify whether it charges an inactivity fee for dormant or inactive accounts, leaving this aspect unclear.

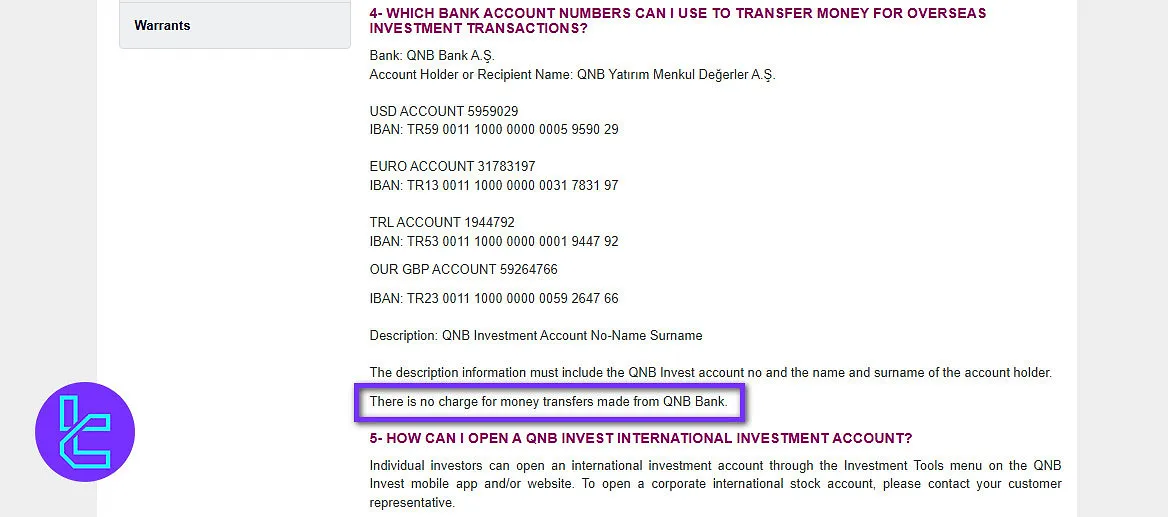

However, according to the information available on its official pages, QNB Invest does not charge any fees for deposits.

Transfers made through QNB Bank accounts are processed free of charge, ensuring that clients can fund and access their accounts without additional costs.

Payment Methods

In this QNB Invest review, we must mention that the broker hasn’t disclosed the available payment options on its website. However, it’s safe to assume that they support bank transfers.

While this limits payment flexibility, all transactions are free from deposit and withdrawal fees.

QNB Invest Deposit

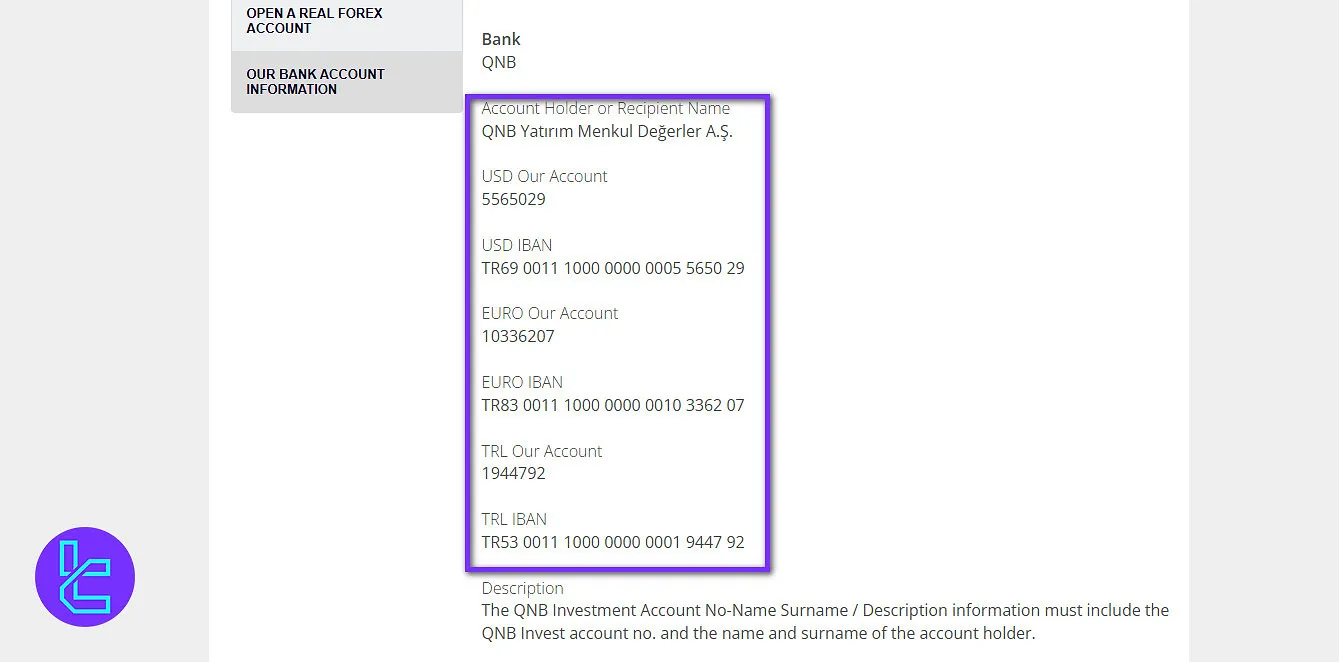

Clients of QNB Invest (QNB Finans Yatırım Menkul Değerler A.Ş.) can fund their trading or investment accounts via direct bank transfers to the company’s designated accounts at QNB Bank.

The broker provides separate IBANs for USD, EUR, and TRY transactions to facilitate both domestic and international transfers. Here are the details:

Currency | Bank | Account Holder | Account Number | IBAN |

USD | QNB | QNB Yatırım Menkul Değerler A.Ş. | 5565029 | TR69 0011 1000 0000 0005 5650 29 |

EUR | QNB | QNB Yatırım Menkul Değerler A.Ş. | 10336207 | TR83 0011 1000 0000 0010 3362 07 |

TRY | QNB | QNB Yatırım Menkul Değerler A.Ş. | 1944792 | TR53 0011 1000 0000 0001 9447 92 |

When initiating a transfer, clients must clearly state their QNB Invest account number along with their full name in the transaction description to ensure proper allocation of funds.

Deposits can be made in Turkish Lira, U.S. dollars, or euros, and the platform allows for currency conversion between TRY and USD directly through the client portal.

QNB Invest Withdrawal

Withdrawals can be requested online through qnbinvest.com.tr or by contacting a customer representative.

The process supports seamless transfers between investment accounts and linked bank accounts, allowing users to withdraw or exchange their balances efficiently without additional service charges.

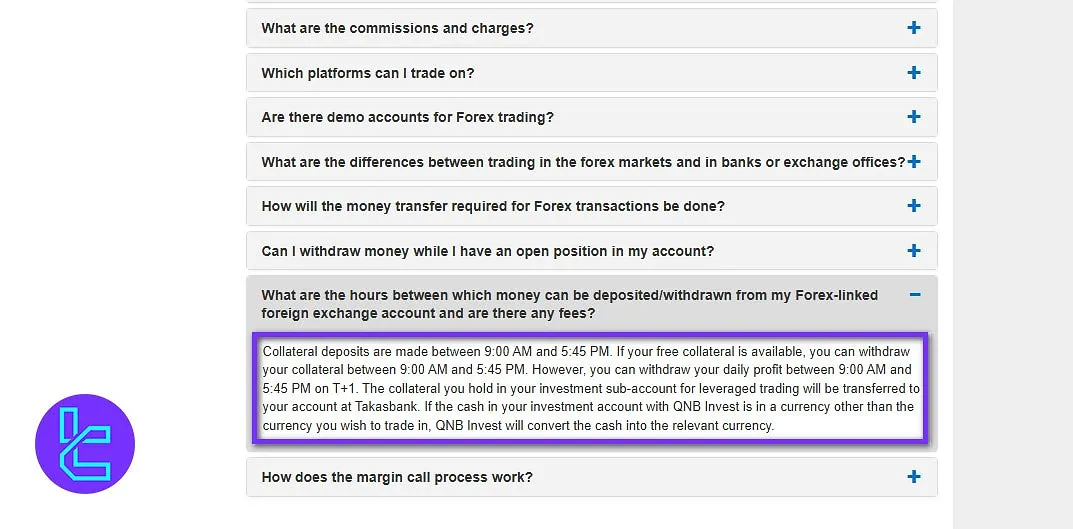

Withdrawals and collateral operations follow specific time windows. Collateral deposits are accepted between 09:00 and 17:45, while eligible collateral or daily profit withdrawals can be processed during the same hours on a T+1 settlement basis.

For leveraged positions, collateral funds are held with Takasbank, ensuring compliance with Turkish market regulations.

If an investor’s account balance is denominated in a different currency than the intended trade, QNB Invest automatically performs the necessary currency conversion before execution.

Here are details for withdrawal methods:

Method | Availability | Processing Hours | Processing Time | Fees |

Bank Transfer (via qnbinvest.com.tr) | Available to linked bank accounts | 09:00 – 17:45 | Same day or T+1 for profits | No withdrawal fees |

Customer Representative Request | Available during working hours | 09:00 – 17:45 | Same day | No withdrawal fees |

QNB Invest Broker Investment Plans

The company has not taken a modern approach to growth plans and doesn’t offer copy trading or social trading services.

Instead, it offers a wide range of wealth management and investment counseling services in addition to a list of fixed-income products, such as:

- Bonds and ETFs

- Treasury bills

QNB Invest Trading Assets

The broker has provided a wide range of tradable instruments for its Turkish and international clients, including:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | Standard, Micro, Ultra Low accounts | 50+ currency pairs | 50–70 currency pairs | Up to 1:10 |

Stocks | CFDs on shares (via MT5 platform) | Over 1000 global stocks, including Borsa Istanbul | 800–1200 | N/A |

Commodities | CFDs on metals, energies, and commodities | N/A | 10–20 instruments | N/A |

ETFs | Exchange-Traded Funds | Varies by market | Around 10 | N/A |

Options & Futures | VIOP (Turkish Futures and Options Market) | Multiple contracts on equities, indices, commodities | 10+ | Varies by contract |

While QNB focuses heavily on traditional markets, it doesn’t currently offer cryptocurrency trading.

Promotional Offerings

The broker’s website does not mention traditional bonuses like welcome gifts or extra deposits, and it is not clear whether the company offers an affiliate program.

However, it provides market analysis reports through the Investment Consultancy contract.

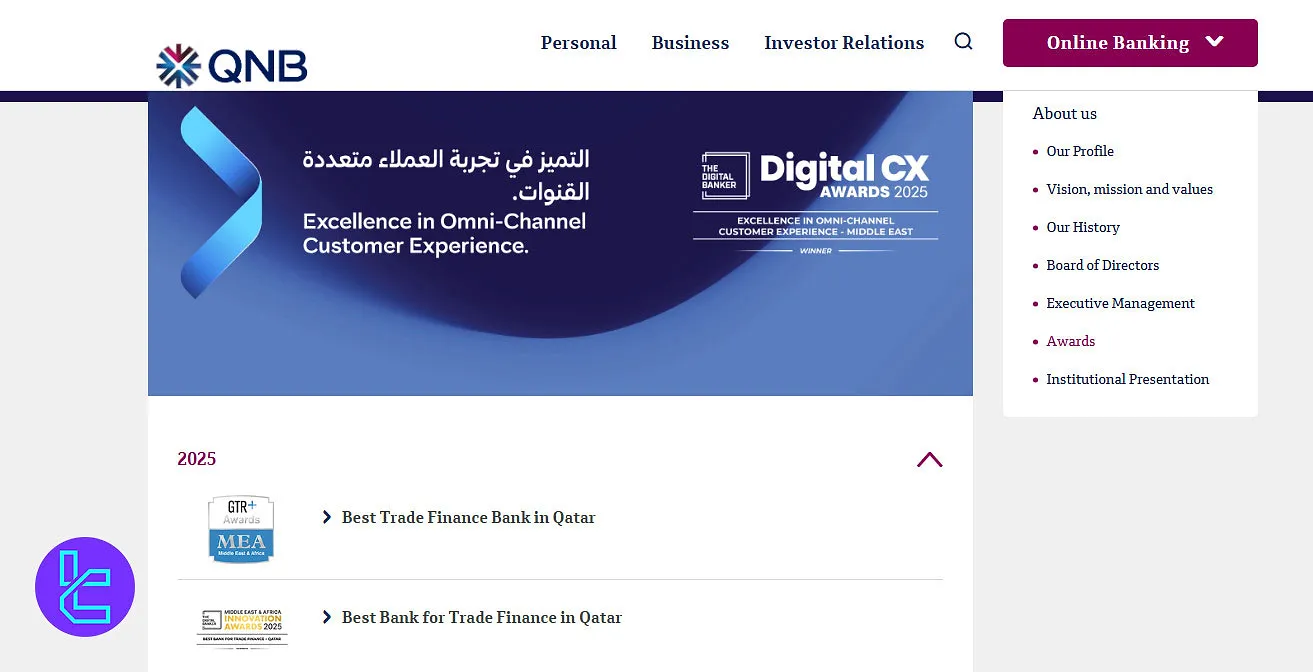

QNB Invest Awards

QNB Invest does not provide information about awards or recognitions on its official website, so there is no publicly documented record of the broker receiving industry accolades.

However, its parent company, QNB Group, has been recognized with several prestigious awards in the banking and financial sector, including:

- Best Trade Finance Bank in Qatar

- Best Bank for Trade Finance in Qatar

- Best Bank for Cash Management in Qatar

- Best Bank for Payments in the Middle East

- Best Bank for Cash Management

These QNB awards highlight the parent company’s industry credibility and operational excellence. While QNB Invest does not list awards independently, it operates under a parent organization with established recognition and a strong reputation in financial services.

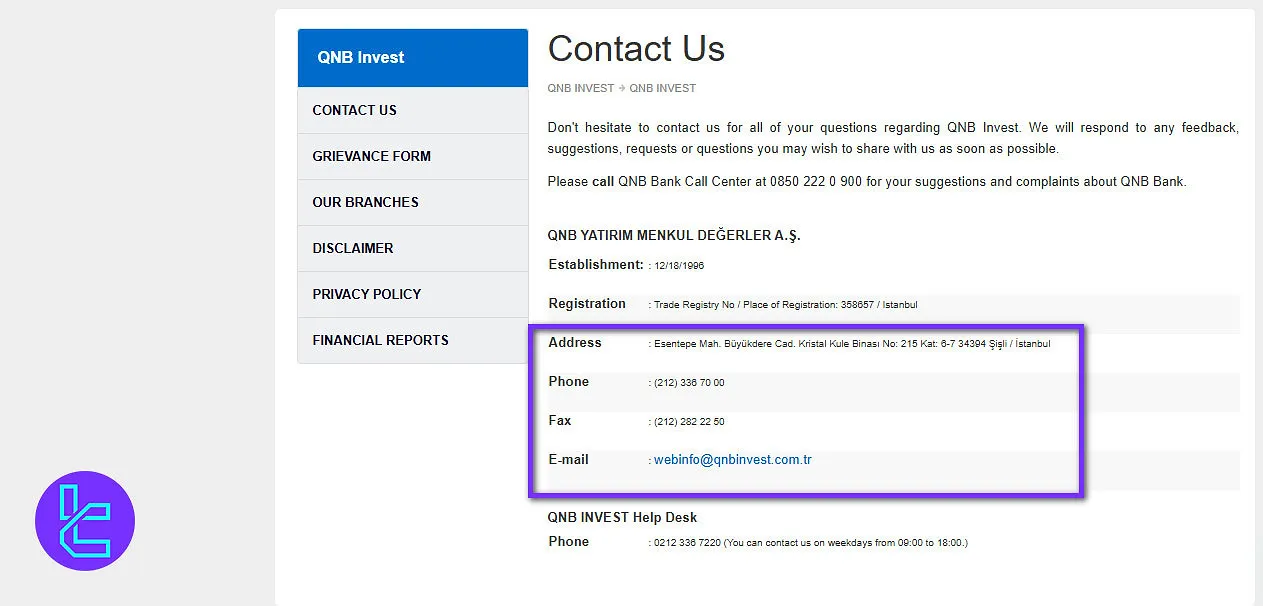

QNB Invest Support Channels

While the customer hotline's working hours are weekdays from 09:00 to 18:00 (GMT +3), the broker provides 24/7 support through a chatbot that only understands Turkish and doesn’t respond to English.

webinfo@qnbinvest.com.tr | |

Tel | 0212 336 7220 |

Chatbot | Available on the official website |

Fax | 0212 282 2250 |

While there’s no live chat with a human agent, the multilingual team responds promptly during office hours.

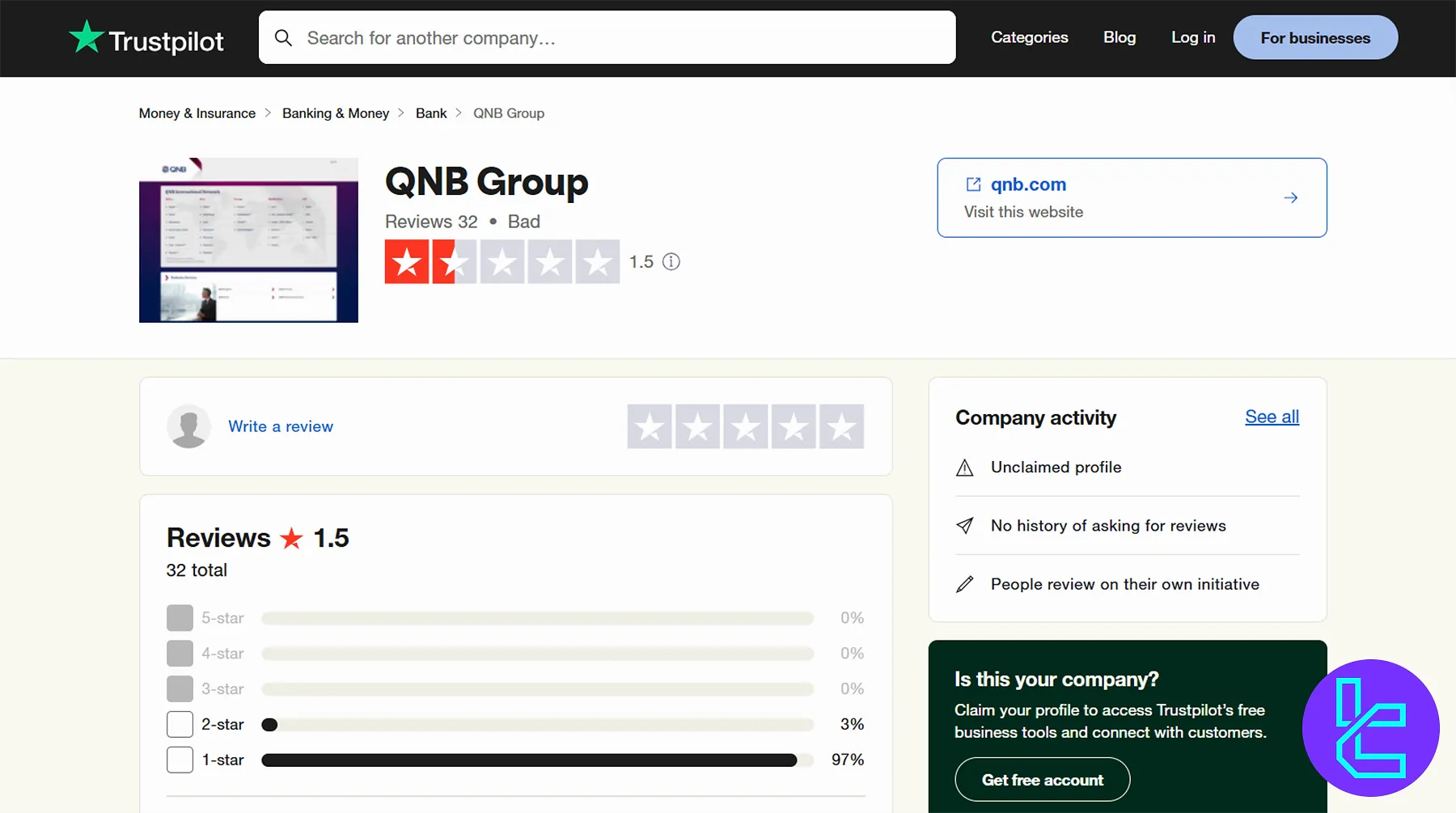

User Satisfaction

When evaluating the broker’s user satisfaction, it's important to approach online QNB Invest reviews.

While the brokerage itself doesn’t have a profile on reputable sources like TrustPilot and Forex Peace Army, its mother company does. The QNB Group Trustpilot profile has a bad rating of 1.5 out of 5 based on32 reviews.

Restricted Countries

The broker has an international network across three continents and 30 countries, including Asia (e.g., China, Hong Kong, and Singapore), Europe (e.g., France, Switzerland, and the United Kingdom), and Africa (e.g., Egypt, Sudan, and Tunisia). The broker’s website doesn’t provide a specific list of restricted countries.

QNB Invest Educational Resources

The company focuses on providing Forex, CFD, and fixed-income securities trading services to Turkish and International investors.

While it offers tutorials on platform usage and trading basics (e.g., Technical analysis, Glossary, Fundamental analysis, etc.), the educational materials are limited compared to competitors.

You can check TradingFinder's Forex education section for additional learning materials.

QNB Invest Compared to Other Brokers

Let's check QNB Invest's standing in the Forex trading world in comparison with popular brokerage companies:

Parameter | QNB Invest Broker | LiteForex Broker | FxPro Broker | FXGlory Broker |

Regulation | CMB | CySEC | FCA, FSCA, CySEC, SCB | No |

Minimum Spread | N/A | From 0.0 Pips | From 0.0 Pips | From 0.1 Pips |

Commission | From $2.0 | From $0.0 | From $0 | $0 |

Minimum Deposit | TRY 50,000 or $1000 | $50 | $100 | $1 |

Maximum Leverage | 1:10 | 1:30 | 1:500 | 1:3000 |

Trading Platforms | MT5, QNB ProTrader, QNB Mobile Application | MetaTrader 4, MetaTrader 5, Mobile Proprietary App | MT4, MT5, cTrader, Web Trader, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | Demo, Real | Classic, ECN, Demo | Standard, Pro, Raw+, Elite | Standard, Premium, VIP, CIP |

Islamic Account | N/A | No | Yes | Yes |

Number of Tradable Assets | N/A | N/A | 2100+ | 45 |

Trade Execution | Market | Market | Market, Pending | Market, Instant |

Conclusion and Final Words

QNB Invest is a Turkish brokerage company with ties to Qatar National Bank (QNB). The company provides access to various markets, including Forex and Fixed Income Securities (e.g., Warrants, Eurobonds, and ETFs) through MT5 and QNB ProTrader platforms.