RaiseFX is a forex broker that authorized by Financial Service Provider, regulated by the South African Financial Sector Conduct Authority (FSCA). The broker offers flexible trading leverage up to a maximum of 1:500 for approved accounts across selected markets.

RaiseFX provides access to over 500 assets including forex, indices, stocks, commodities, and cryptocurrencies through the MetaTrader 5 platform. Traders can open real and demo accounts to practice or trade live with the broker’s full product suite.

General Information and Regulation of RaiseFX

RaiseFX was created in November 2021 by Raise Global SA (Pty) Ltd as a trading broker and partner in financial markets. The company presents itself as a multi-asset broker offering diverse trading conditions and services through its platform.

Corporate Information (Official):

- Registered Address: 33 Impala Rd, Chislehurston, Sandton, 2196, South Africa

- Company Number: 2018/616118/07

- Phone: +44 114 697 5338

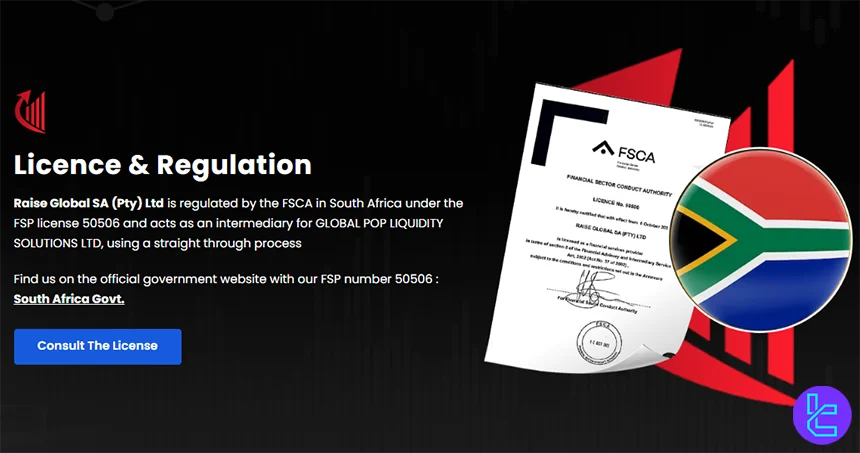

RaiseFX claims regulation by the Financial Sector Conduct Authority (FSCA) in South Africa under FSP license 50506, operating as an authorized Financial Service Provider.

Also, Raise EU Services D.B. Limited is a Cyprus-registered company acting as an independent representative of Raise Global SA (Pty) Ltd. Its role is limited to facilitating European payment services on behalf of the broker.

Here is key information about the RaiseFX:

Entity Parameters / Branches | Raise Global SA (Pty) Ltd |

Regulation | FSCA |

Regulation Tier | 2 |

Country | South Africa |

Investor Protection Fund / Compensation Scheme | None |

Segregated Funds | N/A |

Negative Balance Protection | Yes |

Maximum Leverage | 1:500 |

Client Eligibility | Global (restricted in EU, US, Singapore, Australia & other jurisdictions) |

RaiseFX Broker Specifications

RaiseFX operates as a multi-asset online trading broker, offering leveraged CFD trading services to international clients through its proprietary infrastructure and third-party trading platforms.

The table below summarizes the core trading specifications of RaiseFX:

Broker | RaiseFX |

Account Types | Real Account, Demo Account |

Regulating Authorities | FSCA |

Based Currencies | USD, EUR, GBP |

Minimum Deposit | €100 |

Deposit Methods | Visa/Master Card, Apple Pay, Google Pay, Bank Transfer, Local, Crypto |

Withdrawal Methods | Visa/Master Card, Apple Pay, Google Pay, Bank Transfer, Local, Crypto |

Minimum Order | 0.01 |

Maximum Leverage | 1:500 |

Investment Options | Copy Trading (Social Trading), Affiliate Program |

Trading Platforms & Apps | MetaTrader 5 |

Markets | Forex, Indices, Crypto, Stocks, Commodities |

Spread | Floating from 0.0 |

Commission | 0 |

Orders Execution | Market |

Margin Call / Stop Out | N/A |

Trading Features | Swap-free available, Technical indicators, Affiliate program, Cocial trading |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Phone, email, in-person |

Customer Support Hours | 24/5 |

Restricted Countries | EU, US, Australia, Singapore, North Korea |

Account Types at RaiseFX

RaiseFX offers traders a Real Account for live trading and a Demo Account for practice, both accessible via its official platform interface. The broker’s site emphasizes simple account opening and live trading access, but does not publish multiple officially named live account tiers.

Here is what you need to know about this account:

Feature | Real Account |

Platform | MetaTrader 5 |

Leverage | Up to 1:500 |

Markets Available | Forex, indices, crypto, stocks, commodities (500+ assets) |

Spread | Floating (live spreads on site) |

Minimum Deposit | EUR 100 |

Swap / Islamic Option | available |

RaiseFX offers swap-free / Islamic accounts, allowing traders to hold positions overnight without paying or receiving swap interest.

RaiseFX Pros and Cons

RaiseFX providing access to over 500 assets via MetaTrader 5 and features such as swap-free accounts for Islamic trading. While the broker provides essential trading services, certain regulatory and operational details remain limited on the official website.

The main advantages and disadvantages are summarized in the table below:

Advantages | Disadvantages |

Regulated by FSCA | No tier‑1 financial regulatory license |

Access to 500+ assets | No official investor protection or compensation scheme |

High leverage (up to 1:500) | Only MetaTrader 5 is offered; no MT4 or proprietary platform |

Swap-free / Islamic account available | - |

Affiliate / partner program supported | - |

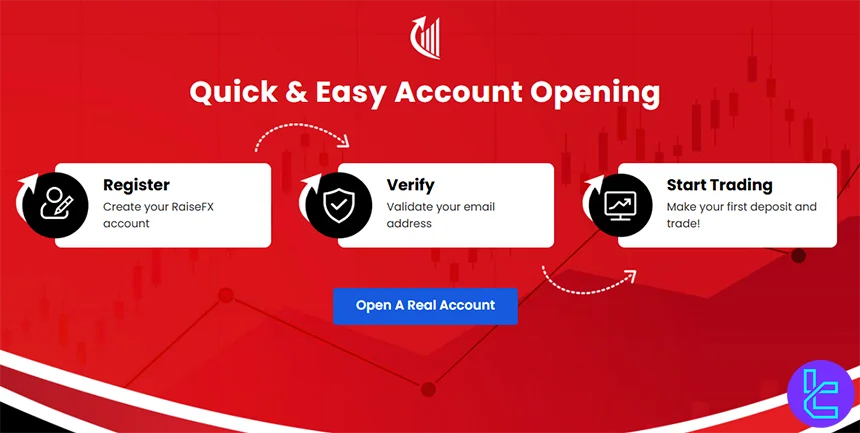

Opening Account and Registration at RaiseFX

Opening an account with RaiseFX is designed to be a simple and user-friendly process, fully guided through the broker’s official website. The registration procedure is structured to allow new traders to start trading quickly while ensuring basic verification through email.

The process consists of 4 main steps:

#1 Click on “Real Account” Button

Sign up on the RaiseFX website by clicking on “Real Account” Button. This step establishes your trading profile and grants access to the broker’s platform interface.

#2 Provide Basic Information

After clicking, you have to provide basic information in the next page; These information are as below:

- First name

- Last name

- Email address

- Password

- Phone number

- Date of birth

- Street

- Zip code

- City

- Country of residence

After providing the information, you must accept the terms and conditions, bonus agreement and subscribe to newsletter. Now, your account is ready to use.

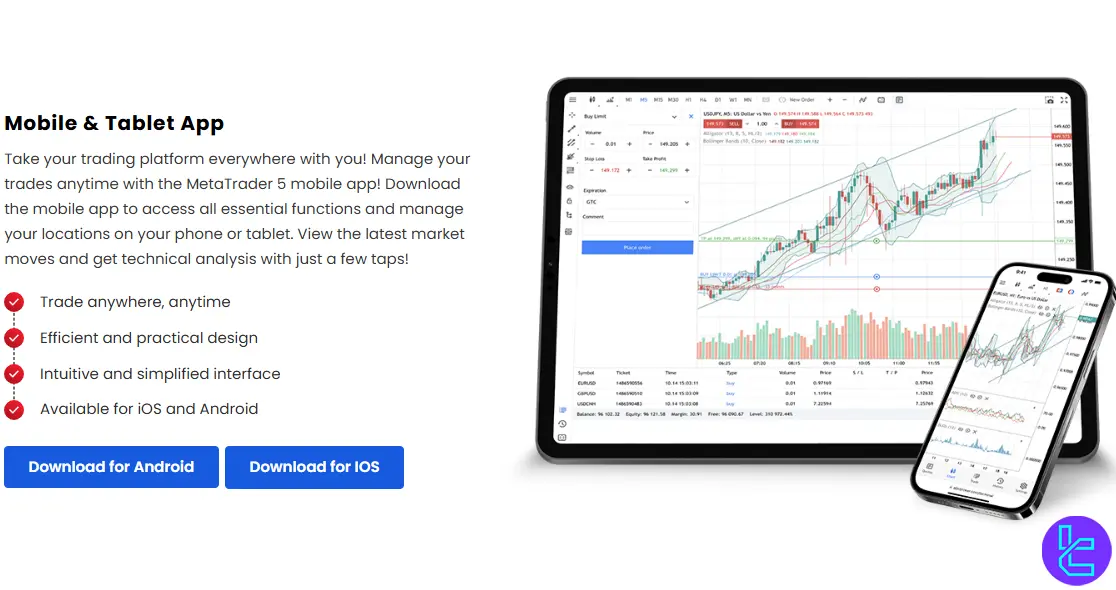

RaiseFX Broker Trading Platforms Overview

RaiseFX provides its traders with the MetaTrader5 (MT5) platform. MT5 on RaiseFX delivers a customizable interface, advanced charting tools, and support for automated trading strategies through Expert Advisors (EAs).

The platform is accessible on:

- Desktop (Windows and Mac)

- Mobile devices (iOS and Android)

MT5 supports unlimited chart windows, more than 60 technical indicators, 9 timeframes, and full access to over 500 tradable assets, including Forex, indices, cryptocurrencies, stocks, metals, and commodities.

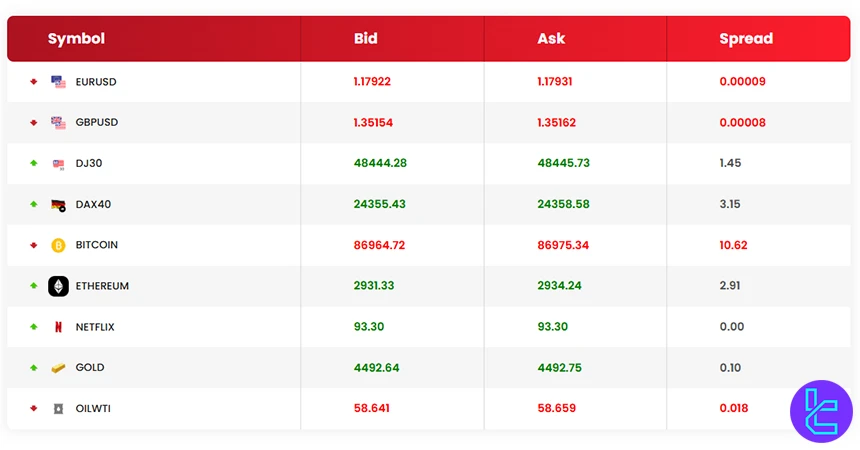

Spreads, Commissions and Account Fees Overview

RaiseFX states on its official site that traders can trade with no commission and benefit from tight, industry‑competitive spreads on its trading accounts.

The broker emphasizes simple pricing, where trading costs come primarily from the spreads rather than separate commissions, and asserts that all clients receive consistent spread conditions.

Below is a snapshot of live spreads as displayed on the official RaiseFX homepage:

Instrument | Spread (Live) |

EUR/USD | 0.00009 |

GBP/USD | 0.00008 |

DJ30 | 1.45 |

DAX40 | 3.15 |

Bitcoin | 10 |

Ethereum | 2.92 |

Netflix | 0 |

Gold | 0.09 |

oilWTI | 0.019 |

Note: All spread values are taken directly from RaiseFX’s official live spreads page and may change at any time depending on market conditions.

Swap Fee at RaiseFX

RaiseFX applies fixed swap charges on all instruments, independent of interest rate fluctuations, which provides full transparency for overnight trading costs. For example, the swap for a 1 lot EUR/USD position is 2 EUR.

Live accounts follow this fixed-swap system, ensuring compatibility with Islamic (swap-free) trading requirements.

Here are some additional key points derived from the official swap policy:

- Swap amounts are fixed and listed per 1 lot for each instrument at broker’s website;

- Swap for a 1 lot DowJones30 position is 5 USD;

- All swaps are not influenced by interest rates, supporting predictable overnight costs.

Non-Trading Fees at RaiseFX

RaiseFX’s official documentation indicates that, beyond trading costs, certain non‑trading fees may apply depending on account activity. The client agreement states that inactivity and administration fees can be charged to dormant accounts.

Additionally, tax obligations may apply as required by law, though these are not standard broker fees.

Here are key points on RaiseFX’s non‑trading fee structure based on official documentation:

- Inactivity fee: 50 USD / 50 EUR / 50 GBP for accounts without trading activity for 3 consecutive months;

- Administration fee: 100 USD / 100 EUR / 100 GBP applied to cover account maintenance costs;

- Tax obligations: May apply as required by law, but are not standard broker fees;

- No explicit deposit, withdrawal, or currency conversion fees are listed in the official materials.

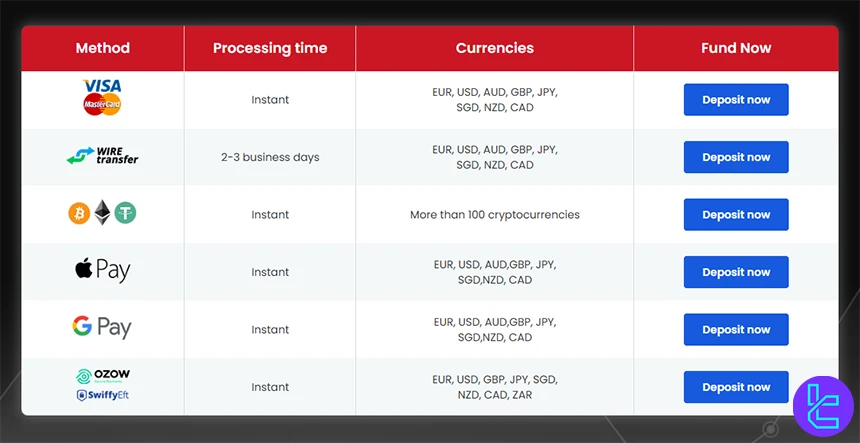

RaiseFX Broker Deposit & Withdrawal Methods

RaiseFX offers several funding and payout solutions that cover traditional banking, card payments, digital wallets, and cryptocurrencies.

According to the broker’s official payment page, all methods support multiple base currencies and are processed through centralized payment channels.

The supported payment methods are listed below:

- Visa & MasterCard

- Bank wire transfer

- Cryptocurrencies

- Apple Pay

- Google Pay

- OZOW / SwiffyEFT

Deposit Methods at RaiseFX

RaiseFX allows clients to fund their trading accounts using both fiat and digital payment solutions, with most deposit methods processed instantly.

Bank wire transfers follow standard banking timelines, while card, wallet, and crypto deposits are credited without delay.

The table below summarizes the official deposit conditions:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Visa & MasterCard | EUR, USD, AUD, GBP, JPY, SGD, NZD, CAD | 100 EUR | Not specified | Instant |

Bank wire transfer | EUR, USD, AUD, GBP, JPY, SGD, NZD, CAD | 100 EUR | Not specified | 2–3 business days |

Cryptocurrencies | 100+ cryptocurrencies | 100 EUR | Not specified | Instant |

Apple Pay | EUR, USD, AUD, GBP, JPY, SGD, NZD, CAD | 100 EUR | Not specified | Instant |

Google Pay | EUR, USD, AUD, GBP, JPY, SGD, NZD, CAD | 100 EUR | Not specified | Instant |

OZOW / SwiffyEFT | EUR, USD, GBP, JPY, SGD, NZD, CAD, ZAR | 100 EUR | Not specified | Instant |

Withdrawal Methods at RaiseFX

RaiseFX processes withdrawals using the same channels available for deposits, in line with its internal verification and compliance procedures.

After submitting a withdrawal request from the trader room, clients receive a confirmation email within 24 hours, and the funds are credited to the selected bank account within 2-3 business days.

Copy Trade and Other Investment Options of RaiseFX

RaiseFX provides traders with more than basic execution services by introducing social trading and partner-based trading options.

These investment features are tailored to both strategy providers and client communities, enabling commission structures and revenue-sharing models.

Copy Trading

RaiseFX’s official platform supports copy trading, which enables a follower’s account to automatically mirror the trades opened and closed by a master account in real time.

Users can define their own strategy name and commission plan. Also, they can begin earning through tools such as VIP entry fees, performance fees, management subscription fees, and revenue-sharing on follower trading volumes.

Partnership Program

RaiseFX also offers partnership and affiliate programs that allow individuals, influencers, and professionals to collaborate with the broker and earn by referring clients, sharing trading strategies, or integrating marketing efforts.

The broker highlights tailored plans and support for the long-term development of partner business activities.

Tradable Markets and Financial Instruments at RaiseFX

RaiseFX’s provides access to more than 500 tradable financial instruments across multiple asset classes via its trading platform.

These markets include forex pairs, CFD contracts on indices, commodities, stocks, and cryptocurrencies, allowing traders to diversify strategies under a single trading environment.

The table below outlines the main tradable market categories and their key parameters:

Category | Type of instruments | Number of symbols | Competitor average | Max. leverage |

Major, minor & exotic FX pairs | 100+ | 70-100 | 1:500 | |

Indices | Global index CFDs | N/A | 20-30 | 1:100 |

Commodities | Metals & energy CFDs | N/A | 15-30 | 1:20 to 1:500 |

Stocks | Share CFDs (US & global) | 300+ | 50-200 | 1:10 |

Cryptocurrencies | Crypto CFDs | N/A | 50-100 | 1:20 |

Bonuses and Promotions at RaiseFX

RaiseFX does not list any active bonus or promotion offers on its main website pages. However, there is an official bonus agreement document referenced in the broker’s legal documentation.

Bonuses are offered at the broker’s discretion and can amount to a maximum of €2,000 based on a client’s profile and trading activity. The terms clarify that bonus funds cannot be withdrawn or transferred and will be removed immediately if the account balance reaches zero or if any withdrawal is made.

RaiseFX Broker Awards

RaiseFX Awards reflect the broker’s recognition across multiple industry segments and regional markets, based on evaluations by well-known financial and business publications.

These acknowledgements are tied to specific performance areas such as trading conditions, reliability, partnerships, and client services.

Some of the most notable awards include:

- Best Broker Conditions, Africa 2025 by Global Excellence Chronicle Magazine

- Best Affiliate Programs, Africa 2025 by International Business Magazine

- Most Reliable Broker. 2024 by Finance Feeds

- Best Trading Conditions, Africa 2024 by International Business Magazine

- Best Customer Service, Africa 2023 by World Business Outlook

RaiseFX Customer Support

RaiseFX provides dedicated customer support to assist traders with account management, technical inquiries, and general trading questions. The broker emphasizes accessibility across

multiple channels, ensuring clients can reach the support team efficiently for timely resolution. Official information from the broker highlights phone, email, and in-person support as primary contact methods.

Below is a summary of the officially listed support channels:

Support Channel | Details |

Phone | +44 114 697 5338 |

support@raisefx.com | |

In-person | 33 Impala Rd, Chislehurston, Sandton, 2196, South Africa |

RaiseFX Banned Countries

RaiseFX operates globally but imposes restrictions on certain jurisdictions to comply with regulatory requirements and internal compliance policies. Clients from restricted countries are not eligible to open accounts or use the broker’s trading services.

The officially restricted countries include:

- European Economic Area (EEA) countries

- Australia

- North Korea

- Singapore

- United States

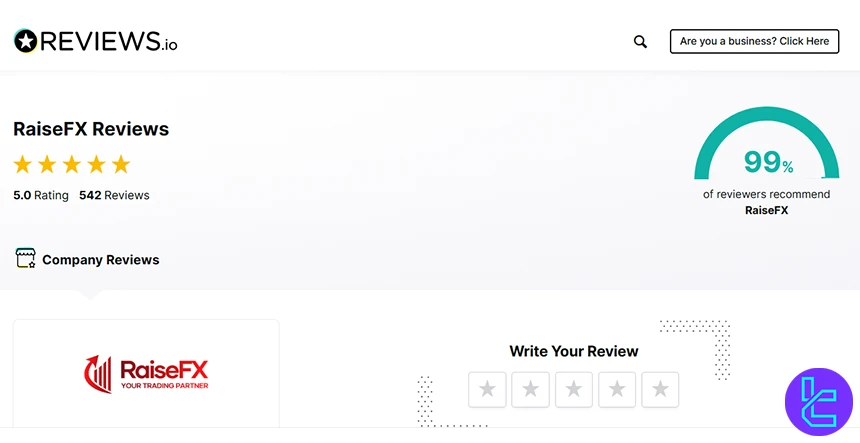

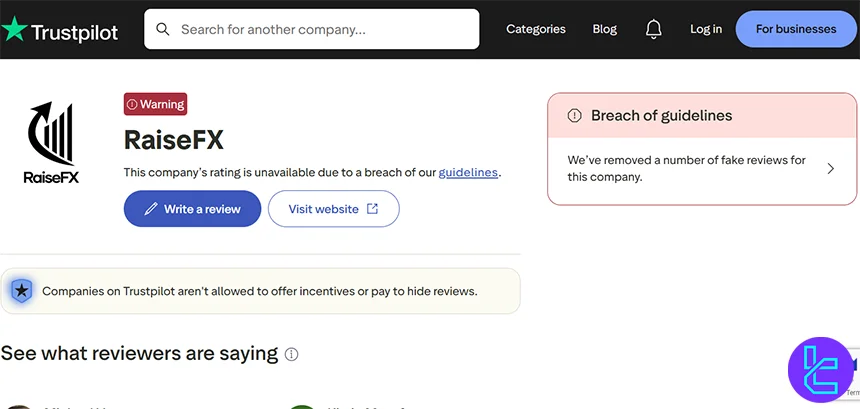

RaiseFX on Review Websites

Overall, RaiseFX shows a highly inconsistent review profile across public rating platforms, with notable differences between reported scores. For example, Reviews.io presents more positive ratings, while Forex Peace Army reflects much more critical feedback.

Meanwhile, Trustpilot currently displays no rating, as multiple reviews were removed due to a breach of guidelines involving fake reviews, making the available review data fragmented and inconclusive.

Below is a table summarizing RaiseFX’s scores from several review platforms:

Review Website | Score |

N/A | |

Forexpeacearmy | 1/5 |

Reviews.io | 5/5 |

RaiseFX Educational Resources & Market Tools

RaiseFX does not present a dedicated educational section or a structured set of learning resources such as trading courses, webinars, video tutorials, or written guides. In terms of market tools, RaiseFX primarily relies on the built-in functionalities of its trading platform rather than offering proprietary analytical or educational tools on its website.

RaiseFX in Comparison with Other Brokers

Here is a comparative overview of RaiseFX alongside several well-established brokers operating in the global financial markets:

Parameter | RaiseFX | |||

Regulation | FSCA | FCA, SCB, CMVM, BACEN, CVM | FCA, ASIC, CySEC, MAS, EFSA, DFSA, AFSC, FMA | ASIC, FSCA, VFSC, FCA, CIMA |

Minimum Spread | Floating | From 0.5 pips | From 0.5 pips | 0.0 pips |

Commission | $0 | Varies Based on Spread, Trade Size & Pip Value | $0 | From $0 |

Minimum Deposit | $100 | $0 | $100 | $20 |

Maximum Leverage | 1:500 | 1:400 | 1:30 | 1:1000 |

Trading Platforms | MT5 | MT4, MT5, ActivTrader, TradingView | Proprietary Platform | MT4, MT5, ProTrader, TradingView, proprietary application |

Account Types | Live, Demo | Professional, Individual, Demo | Retail, Professional | Standard STP, Standard Cent, Raw ECN, Pro ECN, Swap Free |

Islamic Account | Yes | Yes | No | Yes |

Number of Tradable Assets | 500+ | 1000+ | 2800+ | 1000+ |

Trade Execution | Market | Market Execution, Pending Order, Buy Limit, Sell Limit, Buy Stop, Sell Limit, Buy Stop Limit, Sell Stop Limit | Market | Market |

Final Words

RaiseFX operates under FSCA regulation and offers maximum leverage of up to 1:500. The broker provides access to forex, commodities, indices, shares, and cryptocurrencies, covering more than 500 tradable instruments across multiple global financial markets.

The broker relies on the MetaTrader 5 trading platform and supports diverse deposit and withdrawal methods, including cards, bank transfers, cryptocurrencies, and digital wallets. RaiseFX has also received several industry awards, primarily from regional and sector-focused financial publications.