Scope Markets offers 40,000+ tradable assets through MT4 and MT5 platforms with access to CQG, IRESS, and Bloomberg data feeds.

The broker allows investing in Fractional Stocks with a minimum budget of $50 through the Scope Invest account and earning cashback of up to $8 through the Scope Elite account.

Scope Markets; An Introduction to the Broker and Its Regulatory Status

Scope Markets, founded in 2014, is a brand name of Rostro Group, serving a global clientele from over 200 countries.

Scope Markets operates under the regulatory oversight of the Financial Services Commission (FSC) of Belize (license number: 000274/325), which grants it a Tier-3 regulatory status. Key features of Scope Markets:

- Real stock investing

- Futures contracts

- Cash rebates on the Elite account

Founded as an STP (Straight-Through Processing) broker, Scope Markets delivers a global trading experience by combining advanced execution with a multi-asset catalog.

With support for popular platforms like MetaTrader 4, MT5, and Scope Trader across desktop and mobile, the broker appeals to both new and experienced traders.

Security is reinforced through SSL encryption and negative balance protection, while fast execution times cater to active traders navigating fast-moving markets.

However, it does not participate in investor compensation schemes, and clients should note that FSC-regulated entities typically offer fewer safeguards than brokers regulated in the UK or EU.

Here are the regulatory details of Scope Markets broker and its branches:

Entity Parameters / Branches | RS Global Ltd (Scope Markets Belize) | SM Capital Markets Ltd (Scope Markets Cyprus) |

Regulation | Financial Services Commission of Belize (FSC) | Cyprus Securities and Exchange Commission (CySEC) |

Regulation Tier | N/A | Tier 1 |

Country | Belize | Cyprus |

Investor Protection Fund / Compensation Scheme | None (no formal investor protection fund) | Covered by the Cypriot Investor Compensation Fund (ICF) - €20.000 |

Segregated Funds | Yes | Yes |

Negative Balance Protection | Yes | Yes |

Maximum Leverage | Up to 1:1000 | Up to 1:30 |

Client Eligibility | Global clients excluding USA, UK, EU, Australia, Canada, and other restricted or blacklisted jurisdictions | Residents of EEA (excluding Belgium), EFTA (Iceland, Liechtenstein, Norway excluding Switzerland), Belize, Cayman Islands, Kenya, Mauritius, Seychelles, UAE |

Scope Markets Specific Features

In this Scope Markets review section, we’ll explore the company’s offerings. Let’s see if it has what it takes to be among the Forex brokers.

Broker | Scope Markets |

Account Types | One, Islamic, Scope Invest, Scope Elite |

Regulating Authorities | FSC, CySEC |

Based Currencies | USD, EUR, GBP, AED |

Minimum Deposit | $10 |

Deposit Methods | VISA, MasterCard, Skrill, Neteller, International Bank Transfer, Local Bank Transfer, VietQR, MoMo, ZaloPay, UnionPay, DC/EP, AliPay |

Withdrawal Methods | VISA, MasterCard, Skrill, Neteller, International Bank Transfer, Local Bank Transfer, VietQR, MoMo, ZaloPay, UnionPay, DC/EP, AliPay |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:1000 |

Investment Options | Real Stock Trading, PAMM/MAM Accounts |

Trading Platforms & Apps | MT4, MT5 |

Markets | Forex, Metals, Energies, Indices, Shares, Fractional Stocks, Futures, Commodities |

Spread | Variable based on the account type |

Commission | Variable based on the account type |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 20% |

Trading Features | Real Stock Trading, CQG/IRESS Data Feeds, Swap-Free Trading, Mobile Trading |

Affiliate Program | Yes |

Bonus & Promotions | IB Net Deposit Offer, Cashback Rebate Program, Deposit Bonus |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, Phone, Ticket |

Customer Support Hours | N/A |

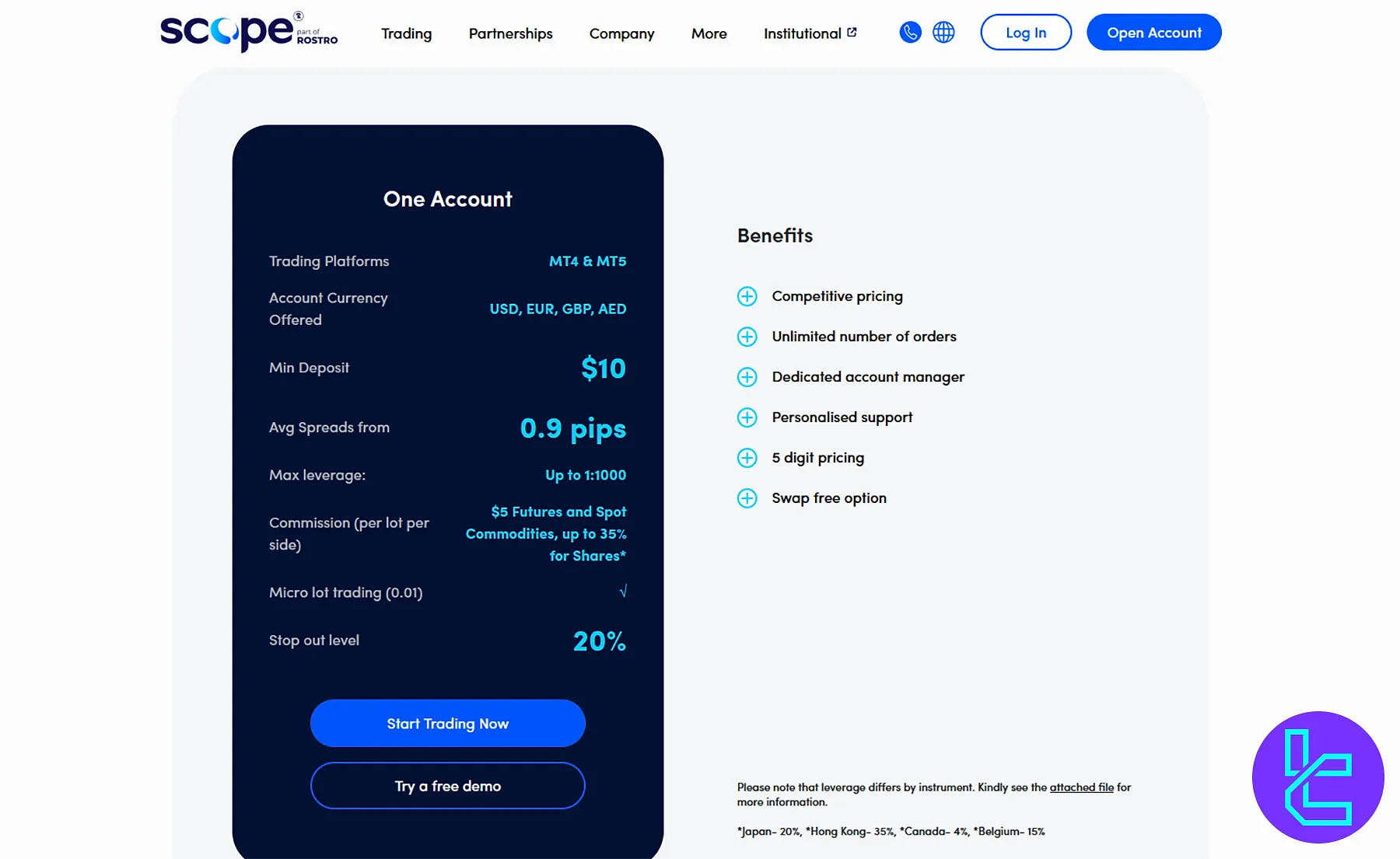

Scope Markets Broker Account Types

The company caters to a diverse range of traders by offering four account types designed to meet specific trading needs and preferences.

Features | One Account | Islamic | Scope Elite | Scope Invest |

Base Currency | USD, EUR, GBP, AED | |||

Min Deposit | $10 | $10 | $20,000 | $10 |

Avg Spreads from (pips) | 0.9 | 0.9 | 0.0 | 0.1 |

Max Leverage | 1:1000 | 1:1000 | 1:1000 | 1:1 |

Min Order Size | 0.01 Lots | 0.01 Lots | N/A | $50 |

Stop Out | 20% | 20% | 20% | 20% |

Swap-free trading is only available on specific CFD pairs, including XAU/USD, AUD/USD, EUR/USD, GBP/USD, NZD/USD, USD/CAD, USD/CHF, and USD/JPY.

The Scope Invest account allows trading Fractional Stocks as low as 1/100th of the share price on the MT5 platform.

Traders can also test the platform risk-free using a free demo account.

Scope Markets Pros & Cons

The broker was named among the top 100 brokers in the Middle East in 2023. Let’s weigh Scope Markets' upsides against downsides.

Pros | Cons |

Low minimum deposit ($10) | Tier-3 regulation |

Access to real stocks | High entry barrier for Elite accounts ($20,000) |

High leverage options (1:1000) | Geo-restrictions |

Access to industry-standard MT4 and MT5 | No support for Crypto trading |

Scope Markets Opening Account and KYC

The Scope Markets registration is a frictionless process that takes under 5 minutes. The process ensures compliance with regulatory standards while onboarding traders swiftly into a secure and professional trading environment.

#1 Start on the Official Website

Visit the Scope Markets homepage and click on the “Open Account” button. This will direct you to the account creation form.

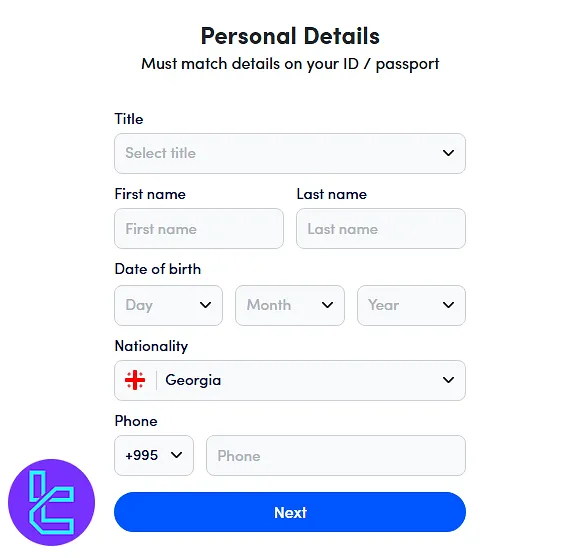

#2 Enter Personal and Contact Information

Begin by submitting your email address and setting a strong password. Agree to the terms, then continue by providing the following information:

- Full name

- Title

- Date of birth

- Country of residence

- Phone number

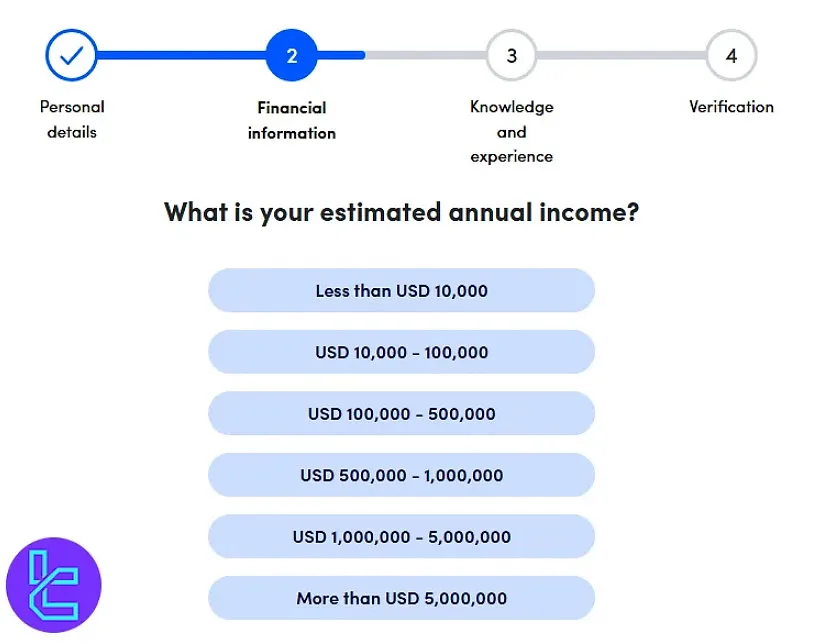

#3 Complete Financial & Experience Questionnaire

Confirm your residency status and declare whether you are a U.S. citizen. Next, fill out your financial profile with the following details:

- Employment type

- Income source

- Political exposure

Lastly, outline your trading experience across different instruments to complete the profile.

After these steps, you will be ready for the Scope Markets verification process and funding.

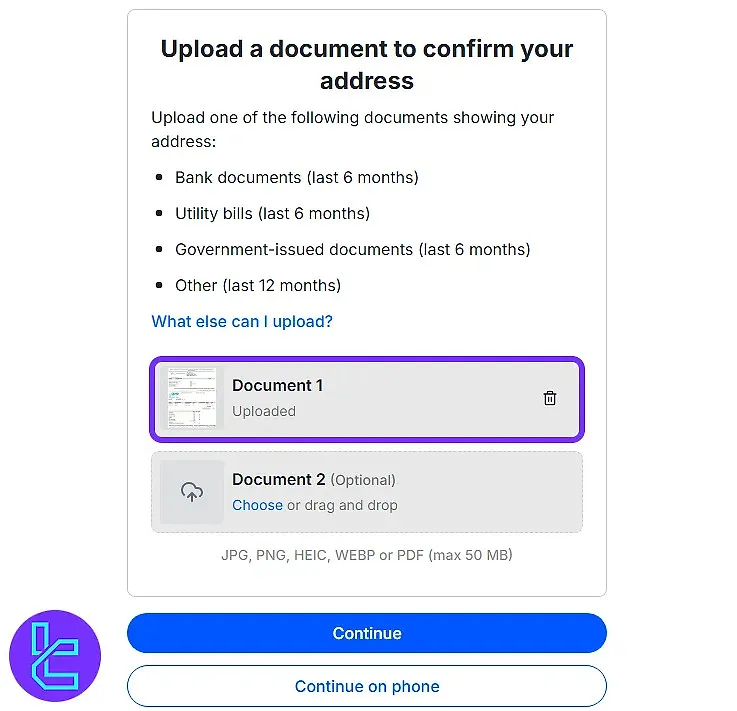

#4 Provide Supporting Documents

Upload supporting documents as part of the Know Your Customer (KYC) and AML policies.

- Proof of ID: Passport or Driving license

- Proof of Address: Utility bill, Tax bill, or Bank statement

Scope Markets Broker Platforms

In this Scope Markets review, we must mention that besides the MetaQuotes trading platforms [MetaTrader 4 & MetaTrader 5], the company provides access to multiple data feeds, including CQG, IRESS, and Bloomberg. The platform suite supports advanced order types, including:

- One-click trading

- OCO, stop-limit, and trailing stop orders

- Real-time alerts via email and mobile

- Full charting with drawing tools and indicators

MetaTrader 4

MetaTrader 4 (MT4) is a widely trusted trading platform known for its reliability and user-friendly interface. It supports multiple devices, allowing traders to access advanced tools and trade seamlessly anywhere:

- MT4 Android

- MT4 iOS

- Desktop

- Web

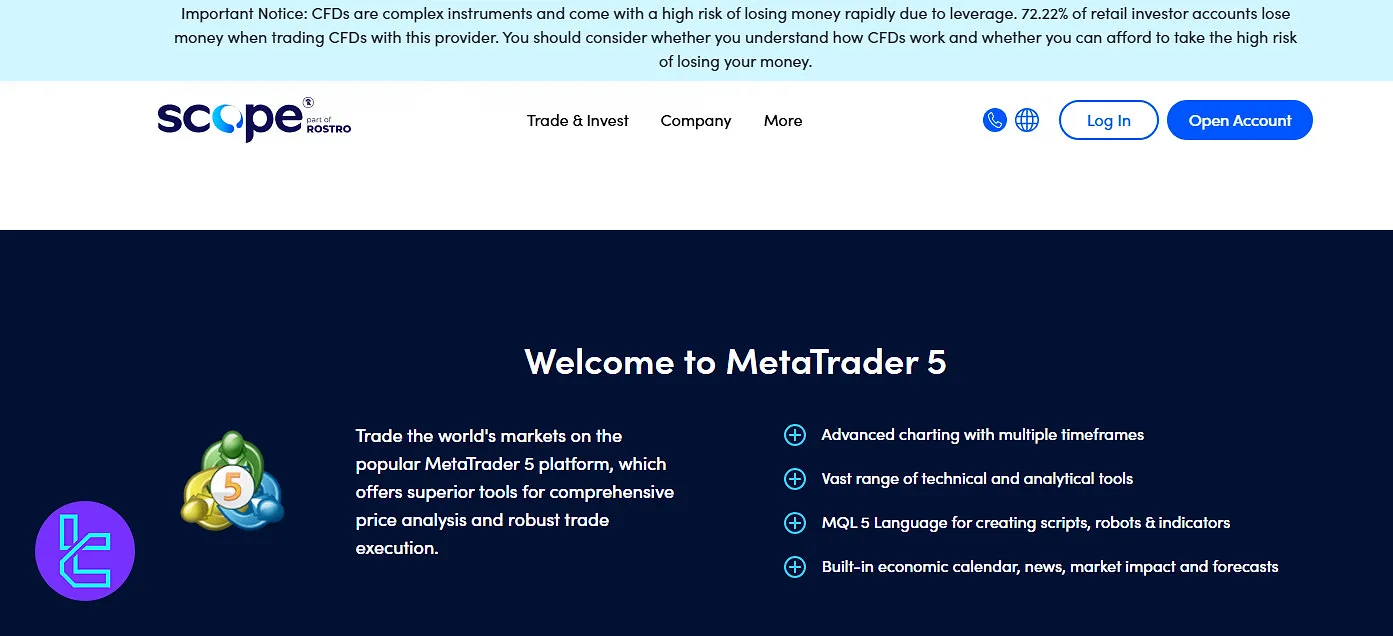

MetaTrader 5

MetaTrader 5 (MT5) is the next-generation platform offering enhanced features, more timeframes, and additional order types. It ensures a smooth trading experience across mobile, desktop, and web platforms:

- MT5 Android

- MT5 iOS

- Desktop

- Web

TradingFinder has developed a wide range of MT4 and MT5 indicators that you can use for free.

Scope Markets Fees and Commissions

The company has implemented a simple commission/spread fee structure that varies based on the account type and instruments.

Account Type | Spreads from (Pips) | Commission |

One | 0.9 | Futures and Spot Commodities $5 Japan Stocks 20% Hong Kong Stocks 35% Canada Stocks 4% Belgium Stocks 15% |

Islamic | 0.9 | $5 per lot per side |

Scope Elite | 0.0 | $3.5 per lot per side |

Scope Invest | 0.1 | 0% |

Deposit and withdrawal transactions are free of charge. However, if you reach the maximum number of withdrawal requests per day or week, further withdrawals will be charged 35 USD per transaction.

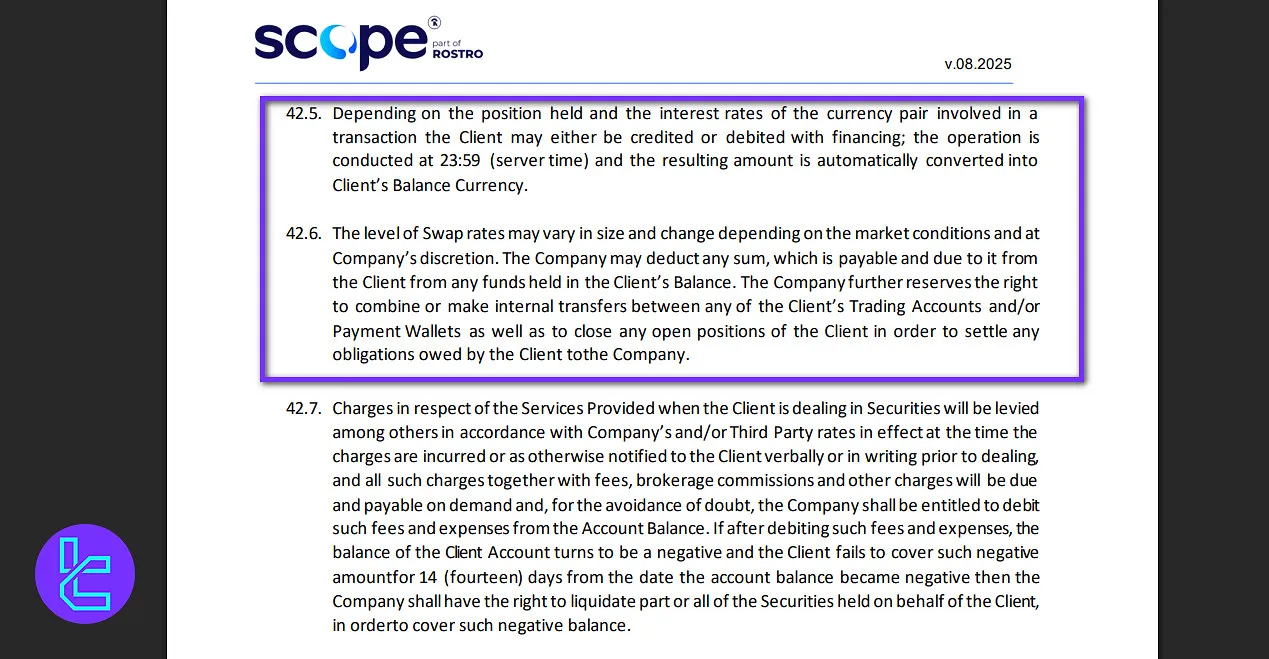

Scope Markets Swap Fees

For transparency, Scope Markets bases its swap calculations on overnight rates provided by liquidity providers, while maintaining the discretion to modify these rates whenever market conditions require.

The company applies its own interest structure, which may differ in value depending on currency pairs and market dynamics.

Swap operations are executed daily at 23:59 server time, automatically crediting or debiting the client’s balance currency based on the direction of the trade and the interest rate differential between the two currencies involved.

Swap values are variable and may be adjusted according to market volatility, liquidity conditions, or internal policy updates.

In cases where swap-related or other financial obligations are due, the Company reserves the right to deduct the owed amount directly from the client’s account and close open trading positions to settle outstanding balances.

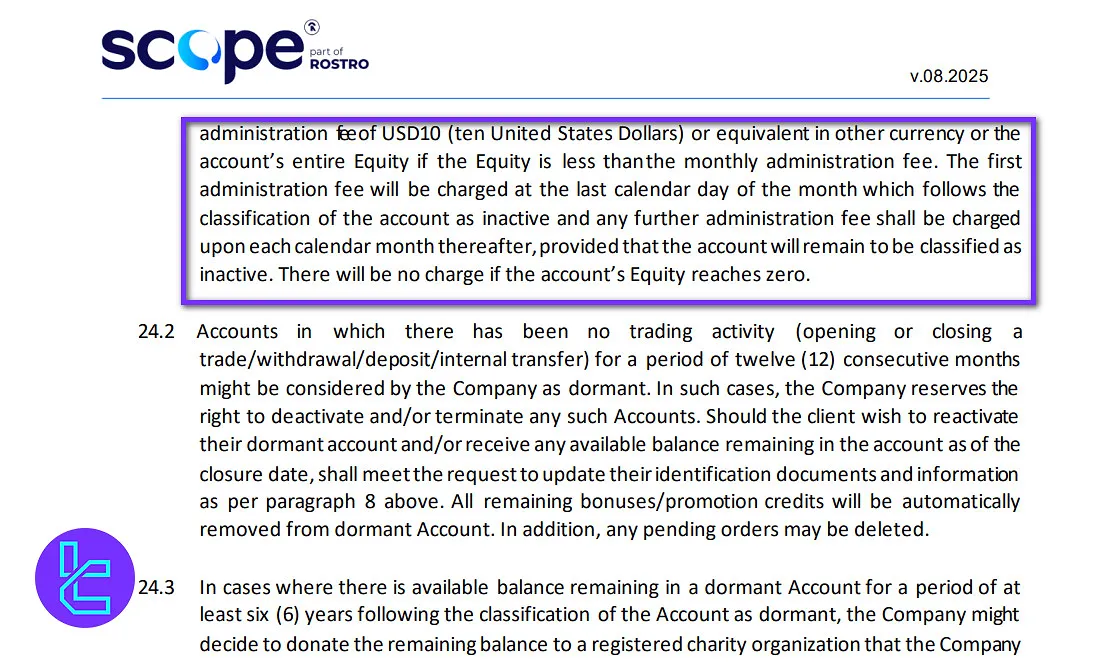

Scope Markets Non-Trading Fees

Trading accounts that remain inactive, meaning no trades, deposits, withdrawals, or internal transfers have occurred for a continuous period of six months, are classified by Scope Markets (RS Global Ltd) as dormant.

Once an account is deemed inactive, the company applies a monthly administrative fee of USD 10 (or its equivalent in another currency). If the account’s equity balance is lower than this amount, the fee will instead equal the remaining equity.

The initial fee is deducted on the last calendar day of the month following the account’s classification as inactive, with subsequent deductions applied each month thereafter as long as inactivity persists. No charges are imposed once the account’s equity balance reaches zero.

Importantly, Scope Markets does not apply any deposit or withdrawal fees, meaning clients can transfer funds in or out of their accounts without additional costs.

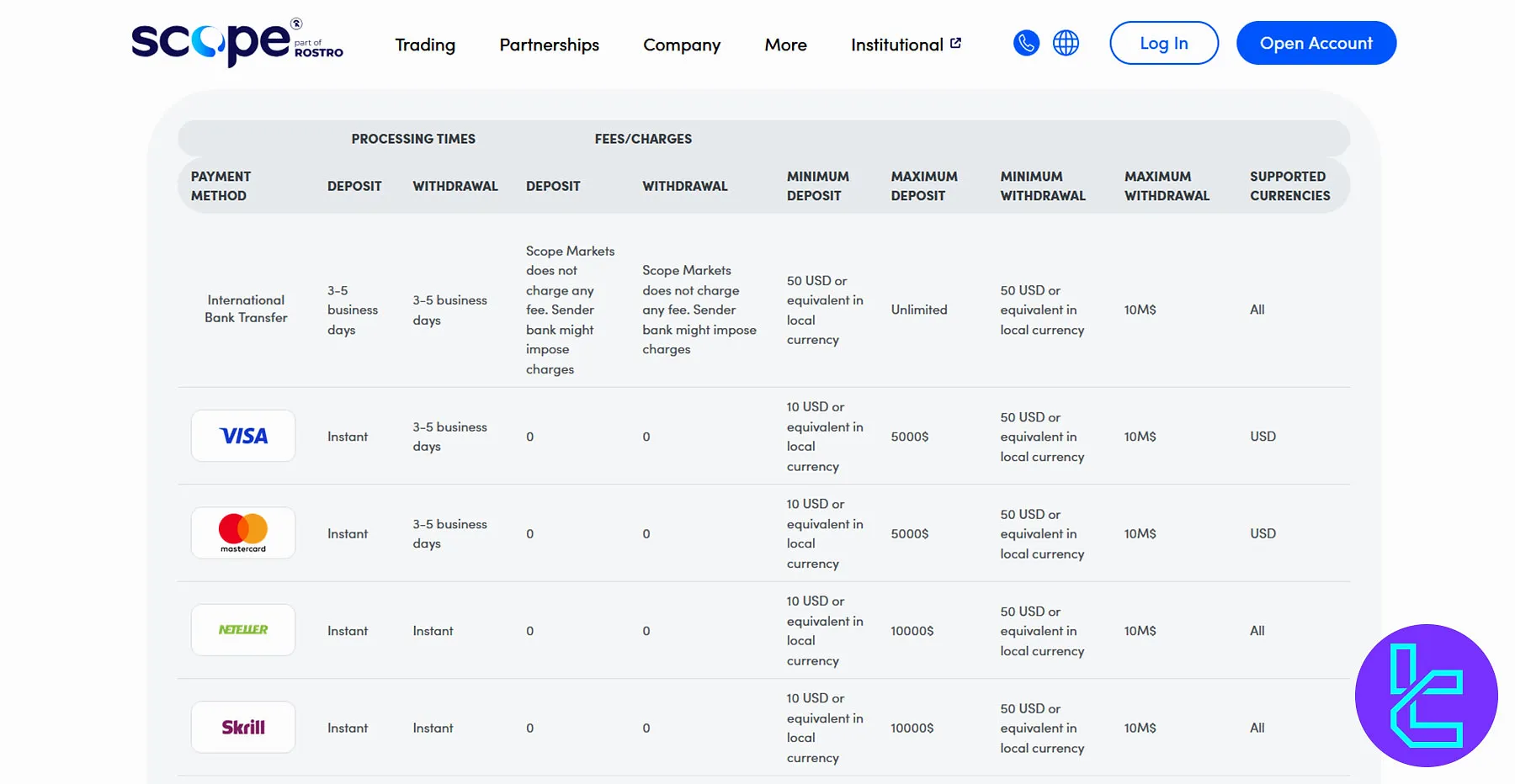

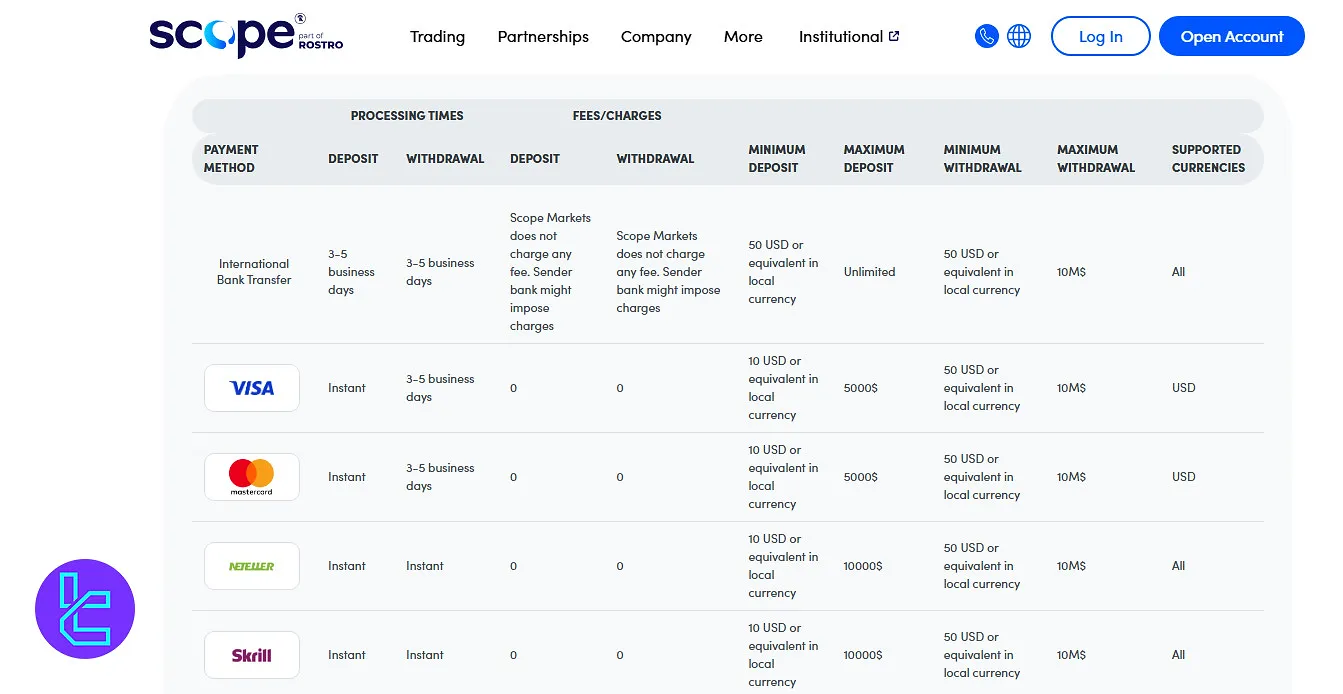

Scope Markets Broker Payment Methods

The company accepts Credit/Debit Card, Bank Wire, and e-Wallet payments. Note that withdrawal requests are processed using the same method as the deposit. Scope Markets Payment Options:

Payment Method | Min Deposit | Min Withdrawal |

VISA | $10 | $50 |

MasterCard | $10 | $50 |

Skrill | $10 | $50 |

Neteller | $10 | $50 |

International Bank Transfer | $50 | $50 |

ZolaPay | $10 | N/A |

VietQR | $20 | N/A |

MoMo | $10 | N/A |

UnionPay | $200 | N/A |

The broker also supports Local Bank Transfers, DC/EP, AliPay, THB QR Code, MYR QR Code, FPX, and VND QR Code payments.

Scope Markets Deposit

Scope Markets offers a diverse range of deposit options designed to accommodate traders from different regions and preferences. All supported payment methods are processed securely, with no deposit fees charged by the broker.

However, clients should note that intermediary or sending banks may apply additional costs independently.

Local bank transfers and regional e-wallets (including VietQR, MoMo, Zalo Pay, and Alipay) provide fast processing within 0–8 hours, depending on the method and currency. International bank transfers may require up to 3–5 business days for completion.

Minimum deposit thresholds start as low as USD 10 (or local equivalent), while maximum deposit limits vary by method. Supported currencies include USD, VND, MYR, IDR, THB, and CNY, offering flexibility for traders across multiple jurisdictions.

Here are the full details of each deposit method:

Payment Method | Processing Time | Deposit Fee | Minimum Deposit | Maximum Deposit | Supported Currencies |

International Bank Transfer | 3–5 business days | No fee (sender bank may charge) | 50 USD or equivalent | Unlimited | All |

Visa | Instant | 0 | 10 USD or equivalent | 5,000 USD | USD |

Mastercard | Instant | 0 | 10 USD or equivalent | 5,000 USD | USD |

Neteller | Instant | 0 | 10 USD or equivalent | 10,000 USD | All |

Skrill | Instant | 0 | 10 USD or equivalent | 10,000 USD | All |

Local Bank Transfer | 0–8 hours | 0 | 10 USD or equivalent | 10,000 USD | VND, MYR, IDR, THB |

VietQR | 0–8 hours | 0 | 20 USD or equivalent | 10,000 USD | VND |

Mo Mo | 0–8 hours | 0 | 10 USD or equivalent | 10,000 USD | VND |

Zalo Pay | 0–8 hours | 0 | 10 USD or equivalent | 10,000 USD | VND |

CUP (China UnionPay) | 0–8 hours | 0 | 200 USD or equivalent | 6,895 USD | CNY |

DC/EP (Digital Currency Electronic Payment) | 0–8 hours | 0 | 50 USD or equivalent | 685 USD | CNY |

Alipay | 0–8 hours | 0 | 50 USD or equivalent | 2,760 USD | CNY |

THB QR Code | 0–8 hours | 0 | 10 USD or equivalent | 5,440 USD | THB |

MYR QR Code | 0–8 hours | 0 | 110 USD or equivalent | 10,000 USD | MYR |

MYR FPX | 0–8 hours | 0 | 10 USD or equivalent | 6,000 USD | MYR |

VND QR Code | 0–8 hours | 0 | 10 USD or equivalent | 10,000 USD | VND |

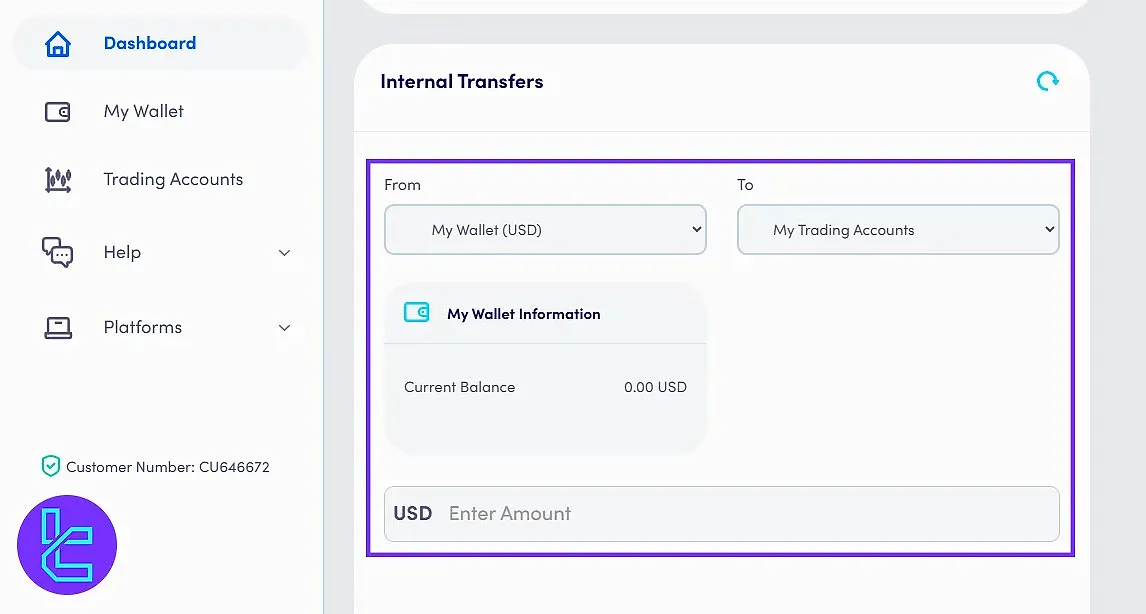

Internal Transfer from the Scope Markets Dashboard

The Scope Markets dashboard serves as a centralized hub where traders can monitor and manage all aspects of their trading activity.

Designed with over 15 dedicated sections, it provides quick access to essential tools such as Wallet, Trading Accounts, Internal Transfers, Market Hours, and more, all structured for intuitive navigation and efficiency.

Among these, the Internal Transfer feature allows traders to move funds seamlessly between their wallet and trading accounts.

By selecting the source and destination accounts, entering the desired amount, and submitting the request, users can instantly reallocate capital to optimize their trading setup.

Integrated within the main panel, this function simplifies fund management without needing external platforms, giving traders a fast, secure, and transparent way to control their account balances directly from the Scope Markets client area.

Scope Markets Withdrawal

Scope Markets provides a wide range of withdrawal options that mirror its deposit methods, ensuring smooth and efficient fund transfers for traders worldwide.

The broker does not charge any withdrawal fees, though intermediary or receiving banks may apply separate charges depending on the payment provider.

Withdrawal requests are typically processed within 3–5 business days for bank transfers and instant to a few hours for e-wallets and local payment systems such as Skrill, Neteller, MoMo, and VietQR.

Minimum withdrawal amounts generally start at USD 50 (or the local currency equivalent), while maximum limits can reach up to USD 10 million, depending on the method used.

Supported currencies include USD, VND, MYR, IDR, THB, and CNY, covering a broad range of global clients.

Below is a concise overview of Scope Markets withdrawal options:

Payment Method | Processing Time | Withdrawal Fee | Minimum Withdrawal | Maximum Withdrawal | Supported Currencies |

International Bank Transfer | 3–5 business days | No fee (receiving bank may charge) | 50 USD or equivalent | 10,000,000 USD | All |

Visa | 3–5 business days | 0 | 50 USD or equivalent | 10,000,000 USD | USD |

Mastercard | 3–5 business days | 0 | 50 USD or equivalent | 10,000,000 USD | USD |

Neteller | Instant | 0 | 50 USD or equivalent | 10,000,000 USD | All |

Skrill | Instant | 0 | 50 USD or equivalent | 10,000,000 USD | All |

Local Bank Transfer | 0–8 hours | 0 | 50 USD or equivalent | 10,000,000 USD | VND, MYR, IDR, THB |

THB QR Code | 0–8 hours | 0 | 50 USD or equivalent | 2,720 USD | THB |

MYR QR Code | 0–8 hours | 0 | 50 USD or equivalent | — | MYR |

MYR FPX | 0–8 hours | 0 | 50 USD or equivalent | — | MYR |

VND QR Code | 0–8 hours | 0 | 50 USD or equivalent | — | VND |

Copy Trading and Investment Plans

While the company doesn’t provide direct copy trading services, it has developed PAMM and MAM solutions for money managers.

It also doesn’t offer investment plans. However, it allows for investment in real stocks through the Scope Invest account. Scope Markets PAMM and MAM accounts features:

- Available on the MT5 platform

- Compatible with EA trading

- Partial order close, pending orders, and full SL and TP

Scope Markets Broker Trading Instruments

The wide range of40,000 instruments is one of the bright sides of this Scope Markets review. The company offers 8 asset classes, from the Forex market to stocks and futures contracts.

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | Major, minor, and exotic currency pairs | 79 pairs | 50–70 currency pairs | 1:1000 |

Metals | Spot contracts on Gold, Silver, Platinum, and Palladium | 12 instruments | 10–15 metals | 1:1000 |

Energies | Spot contracts on Crude Oil, Brent Oil, Natural Gas, and Low Sulphur Gasoil | 4 instruments | 3–5 energies | 1:500 |

Indices | CFDs on major global stock indices (e.g., Nikkei 225, FTSE 100, Abu Dhabi 15, Nasdaq 100) | 18 indices | 10–20 indices | 1:1000 |

Shares | CFDs on individual company stocks across global markets | 2,365 shares | 800–1,200 shares | 1:6 |

Fractional Stocks | Real shares of international companies | 2,300 stocks | 2,000–2,500 | 1:1 |

Futures | CFDs on futures contracts (e.g., DAX, Brent Oil, US Dollar Index, Copper) | 24 contracts | 15–25 | 1:500 |

Commodities | CFDs on agricultural assets (Cocoa, Coffee, Sugar, Wheat) | 4 instruments | 5–10 | 1:10 |

Cryptocurrencies are not available. This multi-asset offering suits traders seeking variety without leaving the MetaTrader ecosystem.

Scope Markets Bonus Offerings

The broker offers various promotional plans, from traditional deposit bonuses to comprehensive partnership programs.

- Deposit Bonus: 50% or 100% extra funds up to $100,000 on deposits

- Scope Invest Welcome Gift: 10% boost on the first account top-up

- IB Net Deposit: Up to $5,000 cash gifts every month for qualified IBs in addition to the agreed-upon commission

- Cashback: Up to $8 rebates for Elite clients

You can use TradingFinder's Forex Rebate Calculator to get aofn accurate estimate on your cashback earnings.

Scope Markets Awards

Scope Markets is part of a globally recognized financial group that has earned multiple distinctions for excellence in the trading industry.

The company’s achievements reflect its consistent performance and commitment to quality service across different areas of online trading.

List of recent Awards:

- Best Broker of the Year (2024) by ProFX Awards

- Best Retail CFDs Broker (2024) by fmls Awards

- Best Innovative Broker (2024) by SmartVision

- Best Partnership Programme (2024) by Forex Expo

- Best MT4 Broker (2024) by Global Forex Awards

- The Best MT5 Broker (2023) by Global Forex Awards

The collection of these Scope Markets awards positions the broker among the notable brokers recognized for innovation, client service, and platform quality.

Scope Markets Broker Client Service

The broker won the “Best Trading Support” at the Global Forex Awards 2023 and the “Best Customer Support” at the World Forex Awards 2020. Scope Markets support channels:

customerservice@scopemarkets.com | |

Tel | +442030516959 |

Ticket | Through the “Contact Us” page |

Support is available in English, Arabic, Spanish, German, and Vietnamese with a typical response time of under 24 hours. Also, each client is assigned a personal account manager for tailored assistance.

Markets Red Flag Countries

While the broker serves clients from 200 countries globally, some restrictions exist.

The broker provides services in Europe through its EU branch. Scope Markets prohibited countries:

- Australia

- Austria

- Indonesia

- Malta

- Myanmar

- Puerto Rico

- Singapore

- United Kingdom

- United States of America

- Afghanistan

- Central African Republic

- Congo, Democratic Republic of the

- Cuba

- Guinea-Bissau

- Haiti

- Iran (Islamic Republic of)

- Iraq

- Korea (Democratic People's Republic of)

- Libya

- Mali

- Russian Federation

- Somalia

- South Sudan

- Sudan

- Syrian Arab Republic

- Yemen

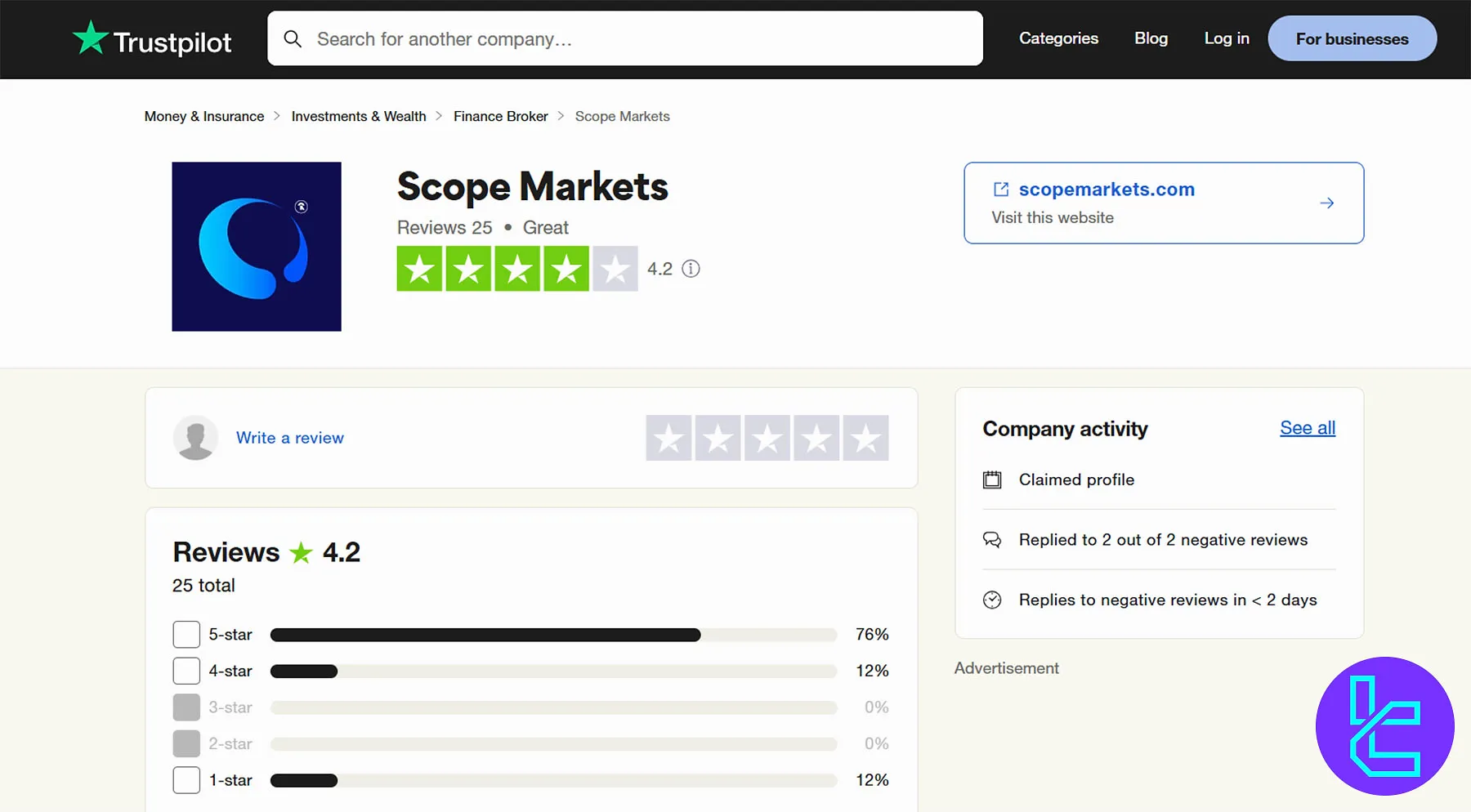

Scope Markets User Experience

Despite the wide range of products and long track records, few Scope Markets reviews exist on reputable platforms.

4.2 out of 5 based on 25 comments | |

Forex Peace Army | 1.654 out of 5 based on 13 ratings |

88% of reviews on the company’s TP profile are positive (4-star and 5-star).

Scope Markets Education

The lack of comprehensive educational resources is one of the few disappointments in this Scope Markets review. The website has dedicated only one page to CFD & Forex trading education. It has also developed an Economic Calendar.

You can check TradingFinder's Forex education for additional resources.

Scope Markets Compared to Other Brokers

The table below compares Scope Markets' features and services with those of other brokerage companies:

Parameter | Scope Markets Broker | IC Markets Broker | XM Broker | LiteForex Broker |

Regulation | FSC | FSA, CySEC, ASIC | ASIC, FSC, DFSA, CySEC | CySEC |

Minimum Spread | From 0.0 pips | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips |

Commission | From $0.0 | From $3 | $0 (except on Shares account) | From $0.0 |

Minimum Deposit | $10 | $200 | $5 | $50 |

Maximum Leverage | 1:1000 | 1:500 | 1:1000 | 1:30 |

Trading Platforms | MT4, MT5 | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App |

Account Types | One, Islamic, Scope Invest, Scope Elite | Standard, Raw Spread, Islamic | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo |

Islamic Account | Yes | Yes | Yes | No |

Number of Tradable Assets | 40,000+ | 2,250+ | 1400+ | N/A |

Trade Execution | Market | Market | Market, Instant | Market |

Conclusion and Final Words

Scope Markets provides access to 8 asset classes, including Forex and Futures, with leverage options of up to 1:1000.

The minimum deposit starts from $10 with Skrill and Neteller as payment methods. The broker has a great score of 4.2/5 on TrustPilot.