Mirae Asset Sharekhan is a Forex broker established in India with ₹40 per round lot for trading commodities. The fee for futures markets is 0.02% of the transaction value.

The broker provides its services via 2 trading platforms [Trade Tiger, Mirae Asset Mirae Asset Sharekhan App]. The support department is available 24/7.

Mirae Asset Sharekhan Company Information & Regulation Licenses

Mirae Asset Sharekhan, founded in 2000 and formerly a subsidiary of BNP Paribas, a French multinational universal bank, since November 2016, stands as a testament to the evolution of India's financial markets.

The company operates by this motto: "Designed for the serious". Key points about Mirae Asset Sharekhan:

- Regulated by the Securities and Exchange Board of India (SEBI)

- Registered with major exchanges such as NSE and BSE

- Boasts over 3M customers

- Present in 1100+ cities through more than 130 branches and 4,200+ business partners

With over 1.4 million clients and 400,000+ daily trades, the broker blends strong regulatory credibility with expansive market access.

The Forex broker maintains a national footprint across 500+ Indian cities, as well as an international presence in the UAE, catering to both resident and non-resident Indian investors.

Here are the regulatory details of Mirae Asset Sharekhan:

Entity Parameters / Branches | Mirae Asset Sharekhan Financial Services Limited (formerly Sharekhan BNP Paribas Financial Services Limited) |

Regulation | Regulated by the Securities and Exchange Board of India (SEBI), Reserve Bank of India (RBI), and registered with BSE, NSE, MCX, NSDL, and CDSL |

Regulation Tier | N/A |

Country | India |

Investor Protection Fund / Compensation Scheme | Covered under SEBI Investor Protection Fund and Exchange-level Investor Protection Funds (BSE, NSE, MCX) |

Segregated Funds | Yes |

Negative Balance Protection | N/A |

Maximum Leverage | 1:1 |

Client Eligibility | Available to resident and non-resident Indian clients (NRIs) meeting SEBI KYC norms; not available to U.S. or other restricted jurisdictions |

Specifications and Features

In this section, we will provide a table containing some of the key specifics of Mirae Asset Sharekhan as a broker to help you get a general perspective of it:

Broker | Mirae Asset Sharekhan |

Account Types | Regular Demat, Repatriable Demat, Non- repatriable Demat, Regular Demat, Repatriable Demat, Non- repatriable Demat, Equity Trading, Commodity Trading, Discount Broking, Full-Service Trading |

Regulating Authorities | SEBI |

Based Currencies | INR |

Minimum Deposit | 1 INR |

Deposit Methods | Bank Transfer |

Withdrawal Methods | Bank Transfer |

Minimum Order | Not Specified |

Maximum Leverage | 1:1 |

Investment Options | Demat Account |

Trading Platforms & Apps | TradeTiger, Mirae Asset Sharekhan App |

Markets | Forex, Futures, Stocks, Commodities, Options, Mutual Funds |

Spread | Not Specified |

Commission | Currency Options: ₹5 per side per lot Commodity Options: ₹20 per lot for each side Equity Delivery Brokerage: 0.3% on market rate or min. 100 INR per share Equity Intraday Brokerage: 0.02% on market rate or min. 100 INR per share Equity Options: 20 INR per side per lot Currency, Commodity, and Equity Futures: 0.02% of transaction value Annual Maintenance Charges: Zero only for the first year |

Orders Execution | Not Specified |

Margin Call/Stop Out | Not Specified |

Trading Features | Extended Trading Hours |

Affiliate Program | Yes |

Bonus & Promotions | Bonus Shares |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Live Chat, Phone Call, Ticket, Email Address |

Customer Support Hours | 24//7 |

Mirae Asset Sharekhan's long-standing history, coupled with its embrace of technology, positions it as a bridge between traditional brokerage services and modern online trading platforms.

Account Types

Mirae Asset Sharekhan offers a diverse range of account types to cater to various investor needs. However, this diversity could confuse some traders; hence, we will try to keep it simple and understandable.

Demat Accounts

The word "Demat" comes from dematerialization, which is the conversion of paper-based shares and securities into an electronic form. In these accounts, you hold and store the asset in an electronic form:

- Regular Demat: For resident Indians trading in equities

- Repatriable Demat: For NRIs (Non-Resident Indians) trading globally with fund repatriation

- Non-repatriable Demat: For NRIs trading without fund repatriation

Trading Accounts

Trading accounts are a kind of bridge between the demat account and the bank account of the investor:

- Equity Trading: For stocks, futures, and options trading

- Commodity Trading: For commodity market trading

- Discount Broking: Low-cost option for experienced traders

- Full-Service Trading: Comprehensive services for new or busy investors

- Online Trading: Buying and selling shares online

- Offline Trading: For the traditional way of buying and selling assets

- 2-in-1 Trading: Combines the demat account and the corresponding trading account of the investor

- 3-in-1 Trading: Integrates the demat account, the trading account, and the linked bank account

Mirae Asset Sharekhan Advantages And Disadvantages

Knowing about the pros and cons of Forex brokers helps us make a better decision between them with a more balanced mindset:

Advantages | Disadvantages |

A Long History Operating Since 2000 | Learning Curve For New Users On Advanced Platforms |

Research-backed Recommendations | Trading Platforms May Be Slower Than Some Alternatives |

Zero-cost Dial-N-Trade Service | Limited Forex Pair Offerings Compared To Global Brokers |

Account Opening & Verification Guide

Mirae Asset Sharekhan offers a seamless account opening experience, fully online and compliant with SEBI and KYC norms.

Whether you're an equity investor or a derivatives trader, the registration is optimized for quick access to the Sharekhan TradeTiger platform and mutual fund investments.

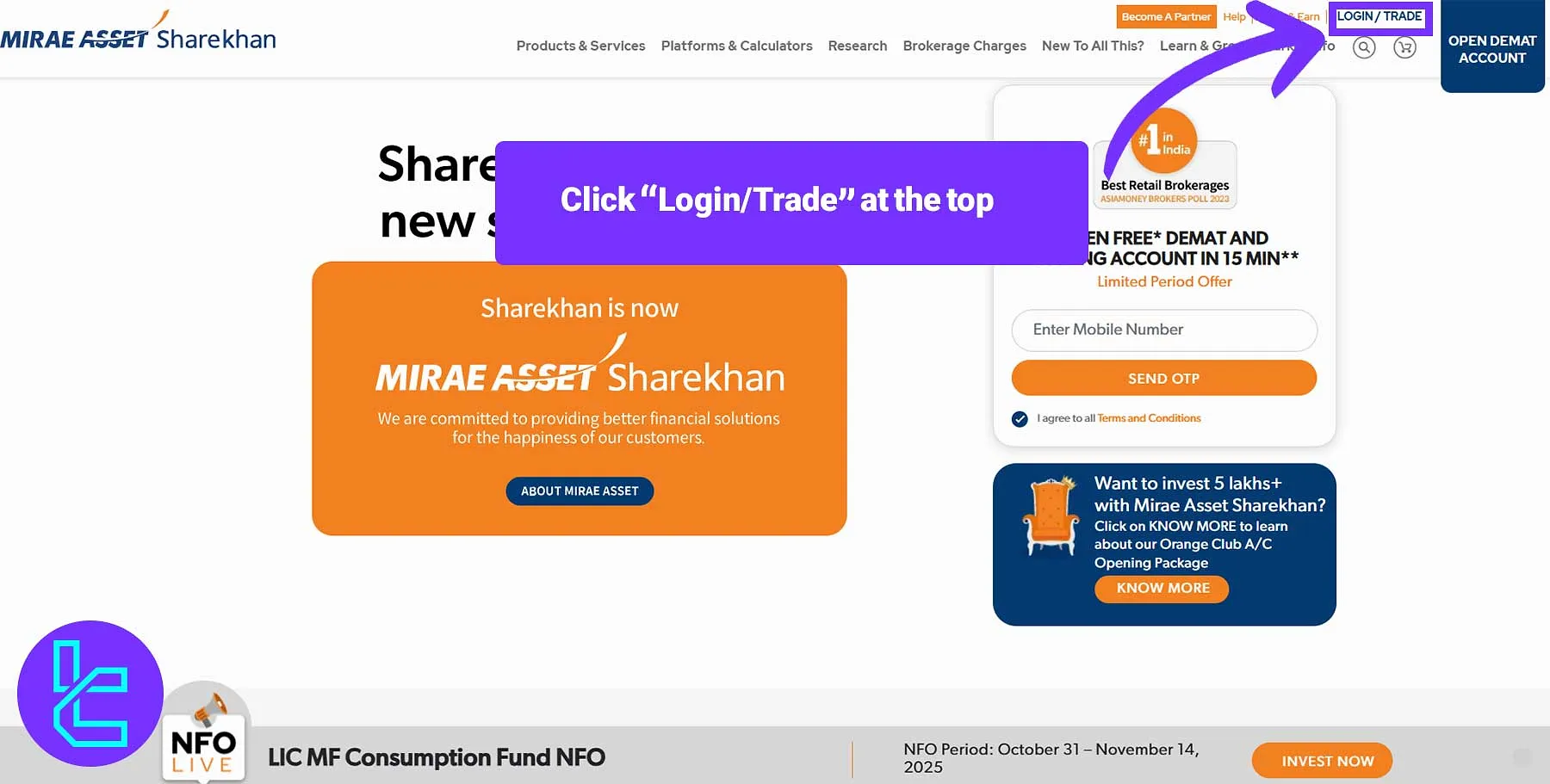

#1 Go to the Official Mirae Asset Sharekhan Website

From the homepage, click on "Login/Trade" to access account services.

#2 Start Your Application

Click on "Open an Account" and initiate the digital signup flow.

#3 Enter Personal Information

Fill out the registration form with the following details:

- Full name

- Mobile number

- Email ID

- Residency status

- Country of residence

#4 Complete KYC Verification

As part of the identity verification process required under Indian regulatory standards, you must provide the following documents:

- PAN card

- Aadhaar

- Proof of Address: Utility bill or Bank statement

Trading Platforms

Mirae Asset Sharekhan offers two primary trading platforms for the Forex market, stocks, and other markets. We will have a quick look at each one here:

Sharekhan TradeTiger

The platform supports real-time heatmaps, IPO monitoring, advanced order types like bracket orders, and comprehensive portfolio views.

- Desktop-based advanced trading platform

- Features sophisticated trading tools and technical analysis

- Offers real-time market data and research integration

- Includes automated risk-reward calculation and intelligent order placement

Mirae Asset Sharekhan App

For mobile users, the app ensures reliable performance, even on limited bandwidth, with real-time prices and smooth trade execution.

- A mobile-friendly platform for on-the-go trading

- Offers most features of TradeTiger in a mobile-optimized interface

- Provides real-time market updates and portfolio tracking

Both platforms are developed in-house, ensuring seamless integration with the brokerage's services and continuous improvements based on user feedback.

What is the Commission and Fee Structure?

Brokers earn money by charging their clients for various operations. Mirae Asset Sharekhan provides a clear and informative table on its website regarding costs:

- Currency Options: ₹5 per side per lot

- Commodity Options: ₹20 per lot for each side

- Equity Delivery Brokerage: 0.3% on market rate or min. 100 INR per share

- Equity Intraday Brokerage: 0.02% on market rate or min. 100 INR per share

- Equity Options: 20 INR per side per lot

- Currency, Commodity, and Equity Futures: 0.02% of transaction value

- Annual Maintenance Charges: Zero only for the first year (INR 400 further on)

Mirae Asset Sharekhan Swap Fees

Mirae Asset Sharekhan does not publicly disclose any information regarding swap or overnight rollover fees on its official website.

Neither the pricing section nor the margin trading documentation specifies how overnight trading positions are charged or whether funding costs apply.

Traders seeking details on swap rates or overnight financing are advised to contact Mirae Asset Sharekhan’s support team directly, as no transparent fee schedule or mention of such charges is available in the broker’s published materials.

Mirae Asset Sharekhan Non-Trading Fees

Deposits made through NEFT (National Electronic Funds Transfer) or RTGS (Real-Time Gross Settlement) are processed within a few hours and carry no transaction cost, making them the standard methods for funding accounts.

Although these transfers are slower than instant payment gateways, they remain the most cost-effective option.

Regarding maintenance, Mirae Asset Sharekhan offers zero Annual Maintenance Charges (AMC) for the first year, after which a fee of INR 400 per year applies to maintain the Demat account.

Deposit & Withdrawal Methods

Based on our investigations and the reliable data at hand, the company does not support any modern and convenient methods for deposits and withdrawals.

In other words, there's only the "Bank Wire Transfer" option available for making payments with this brokerage. This can be considered a drawback in the opinion of many traders.

Mirae Asset Sharekhan Deposit

Clients can add funds to their Mirae Asset Sharekhan trading account only from bank accounts registered or linked with their account.

Multiple methods are available, ranging from instant online transfers to traditional offline options, each with specific processing times, costs, and requirements.

Here are the details about the deposit methods available on Mirae Asset Sharekhan:

Method | Description | Processing Time | Charges / Notes |

Payment Gateway (Netbanking / Debit Card) | Uses secure gateways like BillDesk or Razorpay to transfer funds directly from the registered bank account. Credit or charge cards are not allowed | Instant/same day | Rs. 10–20 per transaction; ideal for transferring larger amounts in one go |

NEFT / RTGS | Standard bank transfer methods recognized by SEBI. Requires entering bank details accurately (IFSC, branch) | 2–3 hours; same day for amounts > ₹2 lakhs; only during banking hours | No broker fee; subject to bank operating hours and holidays |

IMPS | Real-time 24×7 transfer method via bank account | Instant | May incur bank transaction charges |

Wallets / UPI | Mobile wallet or UPI app-based transfers linked to your bank account | Instant | Typically free; requires preloaded funds for wallets |

Cheque / Demand Draft | Traditional offline transfer for clients preferring non-digital methods | 2–3 business days | Slower method; mainly used for offline account funding |

Standing Instruction | Automated recurring transfer setup from the registered bank account according to client preference | As per schedule | Convenient for systematic deposits; charges depend on underlying bank method |

Mirae Asset Mirae Asset Sharekhan Withdrawal

Clients can withdraw funds from their Mirae Asset Sharekhan trading account only to bank accounts registered or linked with their account.

Withdrawals must be initiated through the trading platform, and different methods may have specific processing times and conditions.

In the table below, you can find the details for each withdrawal method:

Method | Description | Processing Time | Charges / Notes |

NEFT / RTGS | Funds are transferred directly from the trading account to the registered bank account using standard banking channels | 1–2 business days; RTGS may process faster during banking hours | No broker fee; depends on bank operating hours |

IMPS | Instant fund transfer to the linked bank account available 24×7 | Within minutes | May incur bank transaction charges |

Cheque | Mirae Asset Sharekhan issues a cheque for withdrawal to the registered address or bank account | 3–5 business days | Slower method; mainly used if bank details cannot be processed electronically |

Standing Instruction / Auto-Payout | Automated recurring withdrawals can be set up to transfer funds on a schedule | As per schedule | Convenient for regular payouts; underlying method charges may apply |

Copy Trading & Investment Options

While Mirae Asset Sharekhan doesn't offer a dedicated copy trading feature, it provides various investment options through its Demat account.

The broker's research team provides recommendations and investment ideas, which can be a valuable resource for investors looking to build their portfolios.

Mirae Asset Sharekhan Broker Tradable Markets & Symbols

Mirae Asset Sharekhan offers a broad range of investment products, including equities, ETFs, mutual funds, government and corporate bonds, futures market, options, and currency derivatives. Forex trading is available exclusively through futures contracts

Some brokers are mainly focused on Forex trading, while others prioritize other markets. Mirae Asset Sharekhan belongs to the second group:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | Major currency pairs (USD/INR, EUR/INR, GBP/INR, JPY/INR) and cross-currency pairs | 55 Currency Pairs | 50–70 currency pairs | 1:1 |

Stocks | Equities listed on BSE and NSE | Over 1,000 Indian stocks | 800–1,200 | N/A |

Commodities | MCX-listed commodities (Gold, Silver, Crude Oil, etc.) | Around 15 instruments | 10–20 instruments | N/A |

Futures | Equity, commodity, and currency futures | Dozens of contracts (BSE/NSE/MCX) | 30–50 contracts | N/A |

Options | Equity and currency options | Multiple strikes across key stocks & currencies | 50–100 symbols | N/A |

Mutual Funds | Wide range of mutual fund schemes across asset classes | 2,000+ schemes | 1,500–2,000 schemes | N/A |

Crypto and CFDs are not supported. All trading is executed on India's primary exchanges, NSE and BSE, with over 130 ETFs and 50+ fund providers accessible to retail clients.

Available and Active Bonuses and Promotions

We examined the Mirae Asset Sharekhan's website, and found out that there are no bonuses currently available similar to those offered by other Forex brokers. However, the company issues bonus shares to clients.

The bonus is one share for each security in the investor's portfolio. This measure is taken for increasing the company's overall part in the stock market.

Mirae Asset Sharekhan Awards

Mirae Asset Sharekhan has consistently earned recognition for its long-standing presence in India’s financial sector.

The company has been acknowledged among the Most Trusted Brands of India (2024–2025) by Marksmen Daily in the BFSI category, highlighting its credibility and strong client relationships.

In addition, the broker ranked #1 in India’s Best Retail Brokerages according to the Asiamoney Brokers Poll 2023, reflecting its continued excellence in serving retail investors through technology-driven trading platforms and transparent financial practices.

These Mirae Asset Sharekhan awards reinforce the broker’s position as one of the leading full-service brokerages in India’s evolving capital markets landscape.

Support Contact Channels And Working Schedule

Mirae Asset Sharekhan offers multiple support channels that are more than enough for contacting the team:

- Live Chat: Available only for registered traders

- Phone: +91 022 2575 3200, +91 022 2575 3500, +91 022 6115 1111

- Email: myaccount@sharekhan.com

- Support Ticket: Can be raised via website or mobile app

The unavailability of a live chat option for people without an account is disappointing. Customer service in this brokerage is available 24/7.

Restricted Countries: Can I Trade on Mirae Asset Sharekhan?

The company primarily serves the Indian market and NRI investors. While there isn't a publicly available list of restricted countries, these regions are most probably banned from the company's services:

- Islamic republic of Iran

- North Korea

- Iraq

- Afghanistan

- Sudan

- Lebanon

- Cuba

- And other sanctioned countries

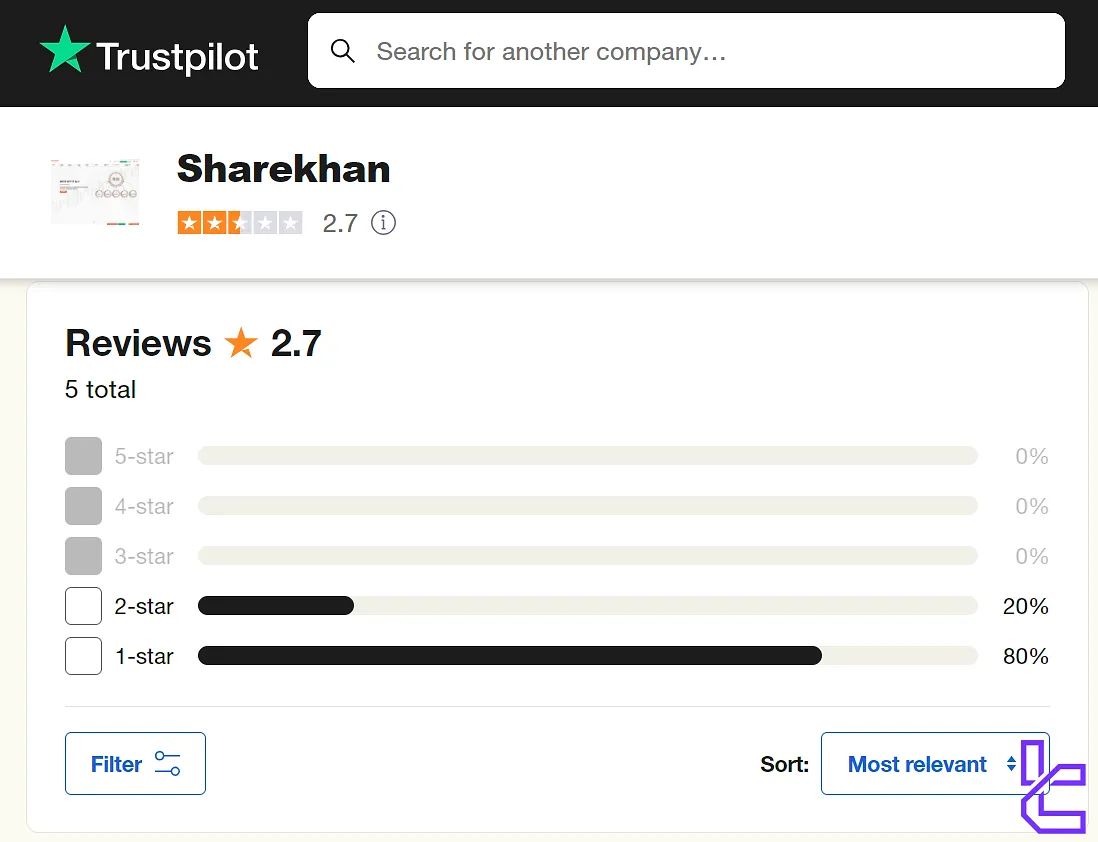

Trust Scores and Company Evaluation

Trust rating is one of the most important factors in deciding whether to rely on a broker. Typically, we visit websites such as Trustpilot for this evaluation.

The Mirae Asset Sharekhan Trustpilot profile has a lower-than-average rating, 2.7 out of 5 based on 5 comments.

However, the number of ratings is not enough to consider this score a reliable one.

Education Content and Resources

Mirae Asset Sharekhan tries to provide a helpful suite of educational content on its website, and it does an acceptable job:

- Sharekhan Classroom: Free educational materials, including videos, articles, and webinars for trading and investing

- Blog: Articles on market, finance, trading, trading strategies, and related topics

The broker’s 3R research model Right Sector, Right Stock, Right Price underpins its investment recommendations and market insights.

Also, the website has calculators and tools for investment planning and portfolio tracking. These resources would be helpful for both novice and experienced investors.

You can also use TradingFinder's Forex education section to access comprehensive materials.

Mirae Asset Sharekhan vs Other Brokers

Let's check Mirae Asset Sharekhan's standing in comparison with other platforms:

Parameter | Mirae Asset Sharekhan Broker | AMarkets Broker | FXTM Broker | Fusion Markets Broker |

Regulation | SEBI | FSA, FSC, MISA, FinaCom | FSC | ASIC, VFSC |

Minimum Spread | N/A | From 0.0 pips | From 0.0 pips | From 0.0 pips |

Commission | From 0.02% | From $0.0 | Variable | From $0.0 |

Minimum Deposit | 1 INR | $100 | $200 | $0 |

Maximum Leverage | 1:1 | 1:3000 | 1:3000 | 1:500 |

Trading Platforms | TradeTiger, Mirae Asset Sharekhan App | MetaTrade 4, MetaTrade 5, Mobile App | MT4, MT5, FXTM Trader App | MetaTrader 4, MetaTrader 5, TradingView, cTrader |

Account Types | Regular Demat, Repatriable Demat, Non- repatriable Demat, Regular Demat, Repatriable Demat, Non- repatriable Demat, Equity Trading, Commodity Trading, Discount Broking, Full-Service Trading | Standard, ECN, Fixed, Crypto, Demo | Advantage, Stocks Advantage, Advantage Plus | Zero, Classic, Swap-Free |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | N/A | 550+ | 1000+ | 250+ |

Trade Execution | N/A | Instant, Market | Market, Instant | Market, Instant |

Conclusion and final words

Mirae Asset Sharekhan is a financial brokerage that offers features like investment recommendations and a zero-cost Dial-N-Trade service. The broker processes payments via only 1 method [Bank Transfers.]

The minimum deposit for getting started with this brokerage is 1 INR. The company's score on the Trustpilot website is 2.7/5.