SimpleFX verification is a mandatory 5-step process to access deposit, withdrawal, and trading features. To complete the KYC process, you need to provide proof of identity (POI), proof of address (POA), and complete the Liveness Check.

By verifying your account in the SimpleFX broker, traders can begin trading over 1000 instruments in 6 different markets, including Forex, metals, cryptocurrencies, commodities, equities, and indices.

SimpleFX User Authentication Process Tutorial

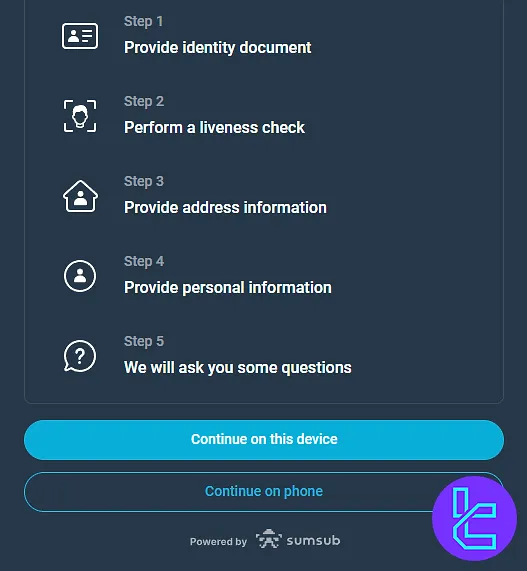

After completing SimpleFX registration, the 5-step KYC process must be completed. This procedure in the SimpleFX Forex Broker takes approximately 5 to 10 minutes.

SimpleFX broker verification steps:

- Accessing the Verification Section;

- Providing Identification Documents;

- Submitting a Live Video;

- Confirming Your Address;

- Entering Financial & Trading Information.

Before initiating the process, check the table below and ensure you have all the necessary information to verify your account.

Verification Requirement | Yes/No |

Full Name | No |

Country of Residence | No |

Date of Birth Entry | No |

Phone Number Entry | No |

Residential Address Details | No |

Phone Number Verification | No |

Document Issuing Country | Yes |

ID Card (for POI) | Yes |

Driver’s License (for POI) | Yes |

Passport (for POI) | Yes |

Residence Permit (for POI or POA) | Yes |

Utility Bill (for POA) | Yes |

Bank Statement (for POA) | Yes |

2-Factor Authentication | No |

Biometric Face Scan | Yes |

Financial Status Questionnaire | No |

Trading Knowledge Questionnaire | Yes |

Restricted Countries | Yes |

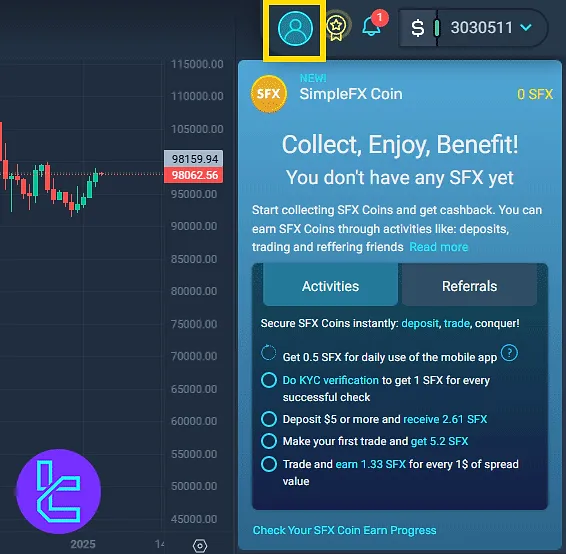

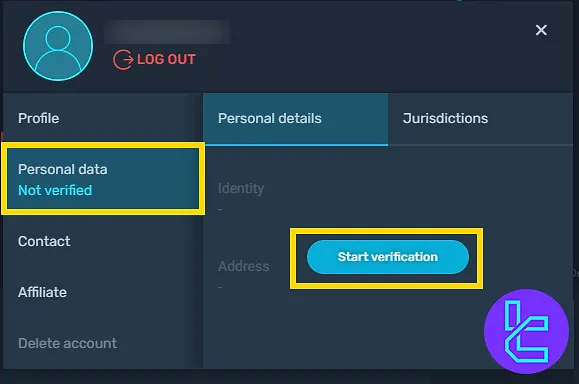

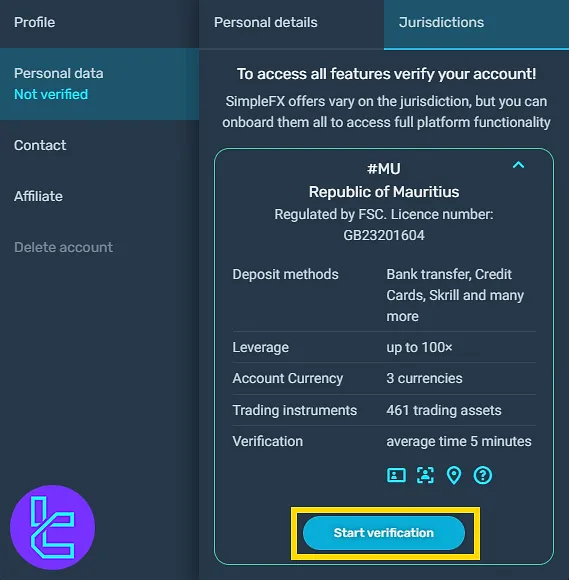

#1 Accessing the Verification Section

Log in to your SimpleFX account and navigate to the profile section using the "avatar" button.

Click on "Personal Data" and then "Start Verification".

Choose the relevant broker branch and click on "Start Verification" to proceed.

You will see the verification steps on your screen.

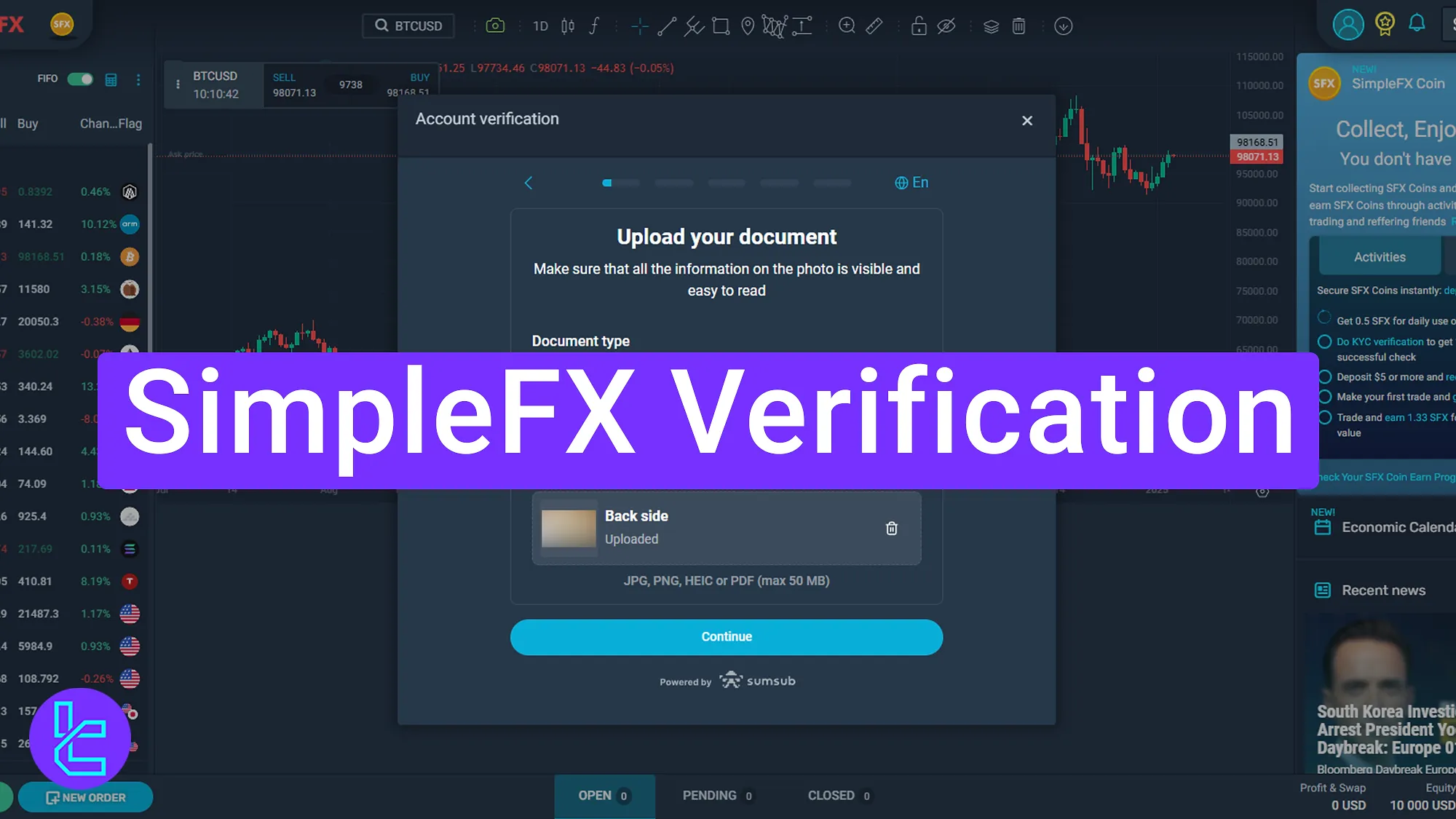

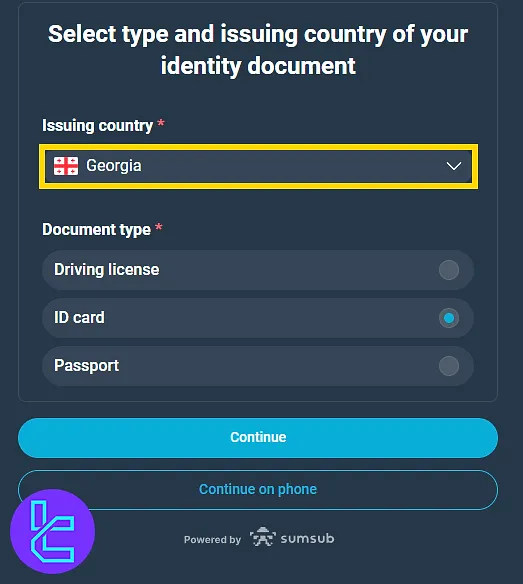

#2 Providing Identification Documents

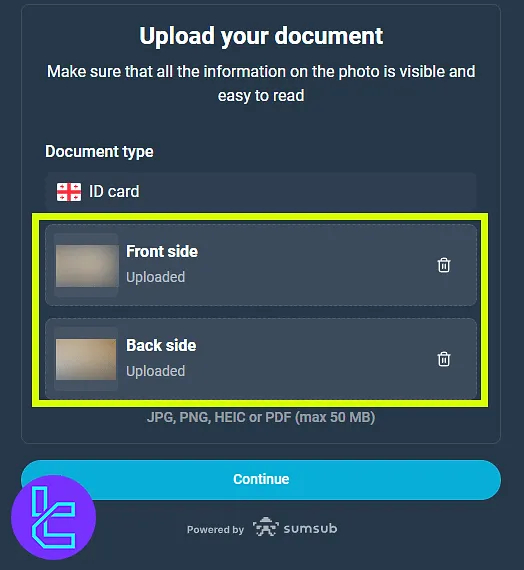

Select "the Issuing country" and choose "document type" to upload. Accepted documents include a passport, national ID card, or driver’s license.

Then Upload the front and back images of the document.

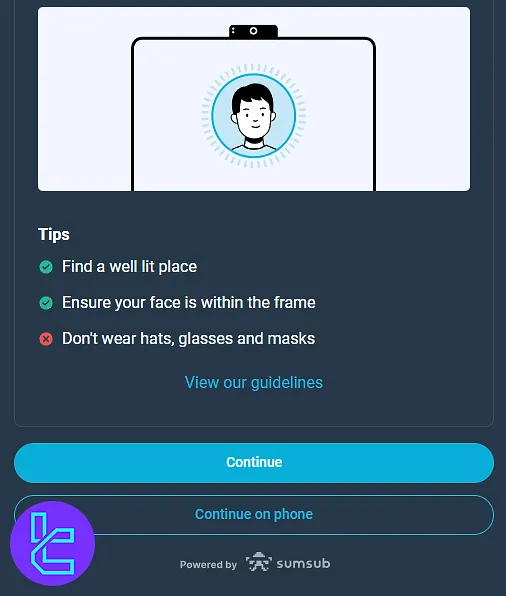

#3 Submitting a Live Video

A live facial scan is required using the device’s camera. The Liveness Check ensures that the user is real and matches the provided ID.

This step can be completed using either a computer or a mobile phone.

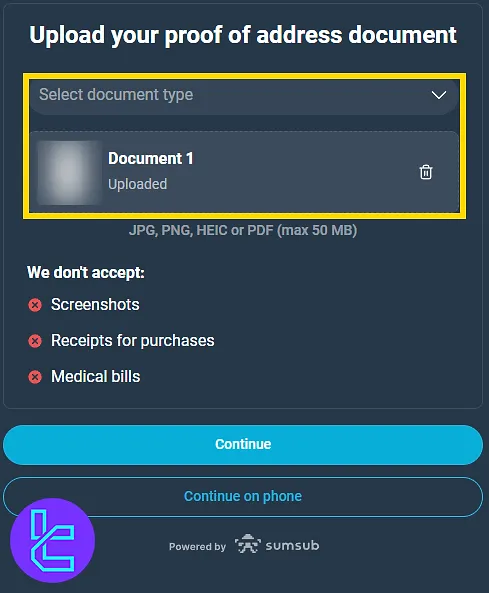

#4 Confirming Your Address

Select and upload an accepted document, such as a utility bill, bank statement, or residence permit, to verify your address.

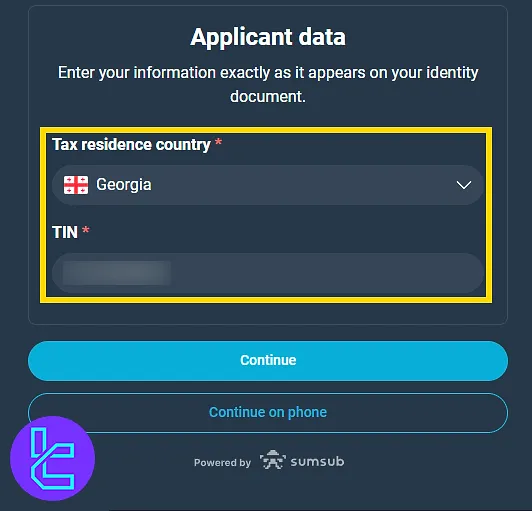

Then, select the country you live in and provide tax details.

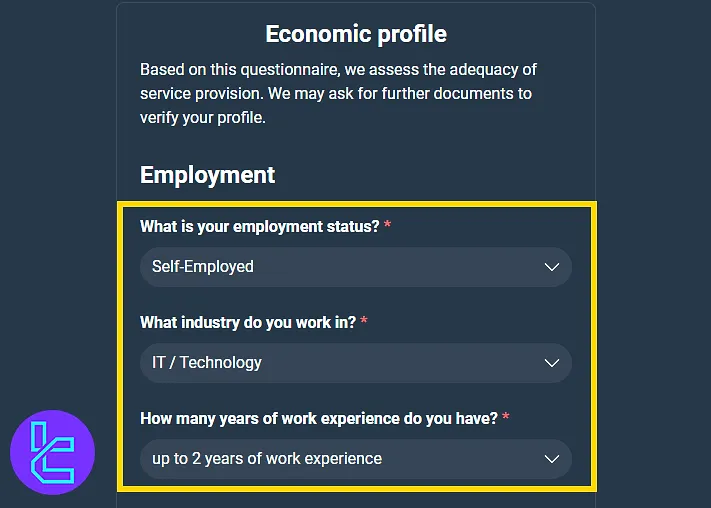

#5 Entering Financial & Trading Information

At the end of the process, you should enter details about your job, income, and trading history.

The review process may take anywhere from a few minutes to a few hours. Once completed, a confirmation message will appear.

SimpleFX KYC Requirements vs 3 Other Brokers

The table below allows traders to understand the differences in the account authentication process in SimpleFX and 3 Other Brokers.

Verification Requirement | SimpleFX Broker | |||

Full Name | No | No | Yes | Yes |

Country of Residence | No | No | Yes | Yes |

Date of Birth Entry | No | No | Yes | Yes |

Phone Number Entry | No | No | Yes | No |

Residential Address Details | No | No | Yes | Yes |

Phone Number Verification | No | No | Yes | No |

Document Issuing Country | Yes | No | Yes | Yes |

ID Card (for POI) | Yes | Yes | Yes | Yes |

Driver’s License (for POI) | Yes | Yes | Yes | Yes |

Passport (for POI) | Yes | Yes | Yes | Yes |

Residence Permit (for POI or POA) | Yes | Yes | Yes | Yes |

Utility Bill (for POA) | Yes | Yes | No | Yes |

Bank Statement (for POA) | Yes | Yes | No | Yes |

2-Factor Authentication | No | No | No | No |

Biometric Face Scan | Yes | Yes | Yes | No |

Financial Status Questionnaire | No | No | No | No |

Trading Knowledge Questionnaire | Yes | No | No | No |

Restricted Countries | Yes | Yes | Yes | Yes |

TF Expert Suggestion

SimpleFX verification is a 5-step process that takes approximately 5 to 10 minutes, but document review may take longer. To check your KYC status, proceed to the "Profile Section" on the broker's dashboard.

With your account now verified, you can begin trading by transferring funds using SimpleFX's deposit and withdrawal methods. For more details, visit the SimpleFX tutorialpage.