Skilling offers Standard and Premium as the primary account types, with theStandard requiring a minimum deposit of100 EUR and the Premium requiring 5,000 EUR.

It also offers copy trading through Skilling Copy, and traders have access to platforms like Skilling Trader, MetaTrader 4 (MT4), and Skilling cTrader.

Company Information and Regulation

Skilling is a Scandinavian forex and CFD broker that was founded in 2016. According to the data provided by the Crunchbase website, this company is currently located in Nicosia, Cyprus. Additional information on Skilling:

- Legal Name: Skilling (Seychelles) Ltd

- Regulation: Cyprus Securities and Exchange Commission (CySEC), Financial Services Authority of Seychelles (FSA), and Financial Conduct Authority (FCA)

Skilling maintains a reputation for compliance and transparency, with operations spanning multiple jurisdictions.

Here are the regulatory details of Skilling broker:

Entity Parameters / Branches | Skilling Limited |

Regulation | Cyprus Securities and Exchange Commission (CySEC) – License No. 357/18 |

Regulation Tier | Tier 1 |

Country | Cyprus |

Investor Protection Fund / Compensation Scheme | Member of the Investor Compensation Fund (ICF) – covers eligible retail clients up to €20,000 |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | Up to 1:30 for retail clients |

Client Eligibility | Services not available to residents of Belgium or any jurisdiction where CFD use is restricted |

Summary of Key Specifics

To give you a quick overview of what Skilling has to offer, here's a table summarizing the key specifics of this Forex broker:

Broker | Skilling |

Account Types | Standard, Premium |

Regulating Authorities | CySEC, FSA, FCA |

Based Currencies | USD, EUR |

Minimum Deposit | 100 EUR |

Deposit Methods | Neteller, Skrill, Credit/Debit Cards, Bank Wire Transfer, UnionPay, Fasapay, AstroPay, Trustly, Swish, etc. |

Withdrawal Methods | Neteller, Skrill, Credit/Debit Cards, Bank Wire Transfer, UnionPay, Fasapay, AstroPay, Trustly, Swish, etc. |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:200 |

Investment Options | Skilling Copy |

Trading Platforms & Apps | Skilling Trader, Metatrader 4, cTrader |

Markets | Forex, Shares, Commodities, Indices, Crypto |

Spread | From 0.1 Pip |

Commission | From zero |

Orders Execution | Market, Instant |

Margin Call/Stop Out | Not Specified/50% |

Trading Features | Negative Balance Protection |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, Ticket, Live Chat, Phone Call |

Customer Support Hours | Monday to Friday, between 06:00-22:00 CET |

Account Types (Specifics & Comparison)

Skilling offers 2 main account types to meet the needs of traders with different mindsets and experience levels. Let's break them down in the table below:

Account Types | Standard | Premium |

Min. Deposit | 100 EUR | 5,000 EUR |

Leverage (Retail – Professional) | 1:30 – 1:200 | 1:30 – 1:200 |

Micro Lot Trading | Yes | |

Stop Out Level | 50% | |

Scalping | Allowed | |

Negative Balance Protection | Yes | |

Also, this broker provides a demo account for trading without the risk of losing funds. Swap-free accounts are available for clients complying with Sharia law.

Pros and Cons

Like any broker, Skilling has its strengths and weaknesses. Here's a balanced look at the pros and cons:

Cons | Pros |

No US clients accepted | Regulated by high-tier authorities |

Relatively high minimum deposit | Access to popular platforms like MT4 and cTrader |

- | High diversity in trading instruments |

- | Negative balance protection |

Registration & Verification Tutorial

Skilling registration is similar to opening an account with other brokers. The process is fully digital, takes about 10 minutes, and adheres to KYC/AML compliance. Here's a step-by-step guide to help you sign up:

#1 Access the Skilling Website

Start by visiting the broker’s official site and clicking on “Sign Up” to initiate your application.

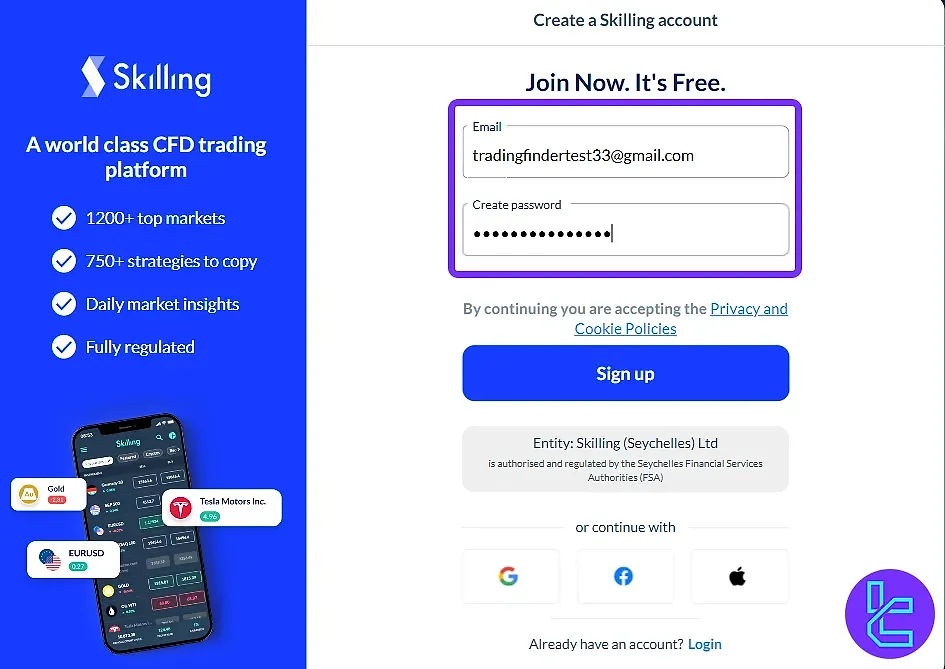

#2 Create Login Credentials

Submit your email and a secure password to begin. Confirm you're not a U.S. resident to proceed.

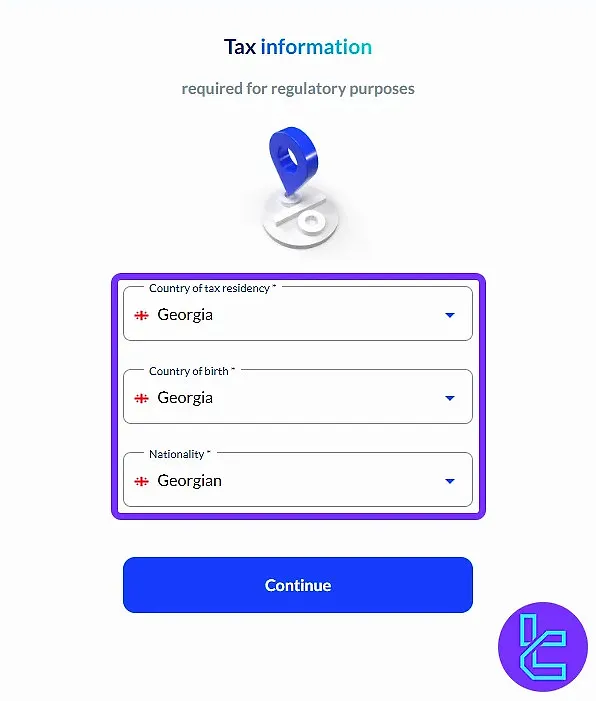

#3 Complete Personal & Tax Information

Enter your information, including:

- Name

- Birth date

- Phone number

- Country of residence

- Tax jurisdiction

- Nationality

#4 Submit Address Details

Provide your full residential address, including postal code and city, ensuring all data matches your verification documents.

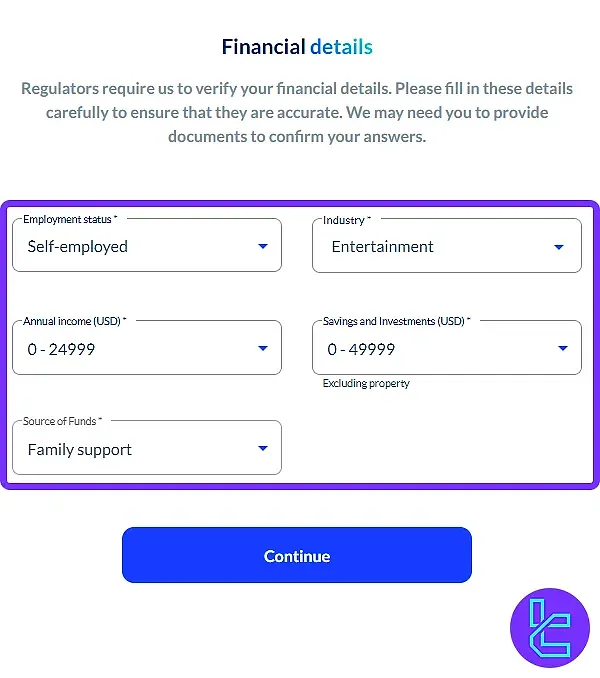

#5 Fill Financial & Experience Forms

Disclose your employment status, annual income, source of funds, and trading experience to comply with MiFID II regulations. Agree to the terms and finalize registration.

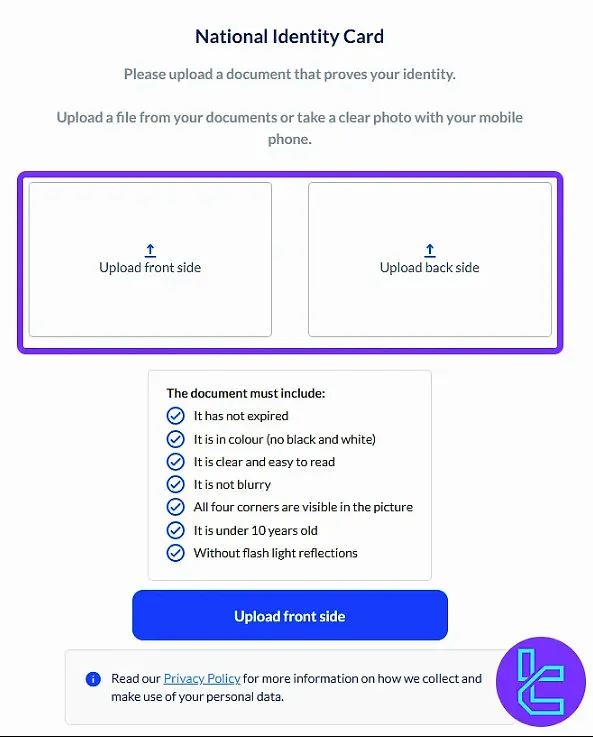

#6 Complete the Verification Process

Log in to the Skilling dashboard and navigate to the "Verify Your Identity" tab to initiate the KYC procedure. You must upload the following documents:

- Proof of Identity: Passport or Driving license

- Proof of Residence: Utility bill or Bank statement

Now that you have completed the Skilling verification process, you can fund your account and start trading.

Skilling Forex Broker Trading Platforms

Usually, brokers provide access to various trading platforms for more convenience. Skilling offers 3 platforms to suit different trader preferences. In the next sections, we will have an overview of each.

Skilling Trader

This is the proprietary platform designed by the broker itself. Features:

- User-friendly interface ideal for beginners

- Advanced charting tools and technical indicators

- One-click trading and customizable workspace

Download the platform for your device through these links:

Skilling cTrader

It’s a popular third-party platform known for its advanced features. Specifics:

- Customizable interface with detachable charts

- Advanced order types and risk management tools

- Suitable for both novice and experienced traders

Skilling MetaTrader 4 (MT4)

MetaTrader 4 is ideal for traders who prefer a familiar, time-tested platform. Key Points:

- Industry-standard platform with a loyal user base

- Extensive library of technical indicators and expert advisors

- Advanced charting capabilities and automated trading options

Check TradingFinder's list of MT4 indicators to access additional analytical tools.

How Is The Spreads and Commissions Structure in Skilling?

Trading costs are so critical when it comes to calculating the net profit. Skilling offers affordable pricing across its account types. Here's a breakdown of the spreads and commissions in trading:

Account | Spread | Fees |

Standard | From 0.8 Pips | None |

Premium | From 0.1 Pip | $40 per Million |

Regarding other operations, there are no costs for inactive accounts or in withdrawals and deposits.

Skilling Swap Fees

All swap charges are automatically calculated, displayed in the trade ticket before execution, and settled in the account’s base currency.

While the adjustment is typically applied once per weekday, the Wednesday swap is charged three times to account for the weekend period.

For Forex pairs, the swap reflects the interest rate differential between the Tomorrow Next Deposit Rates (TNDR) of the two currencies involved, adjusted by Skilling’s markup.

Depending on rate direction, traders may receive or pay the rollover fee, occasionally negative on both sides due to added commissions.

Formula:

- Pip value = 10 for most pairs

- Pip value = 1,000 for JPY, HUF, and THB pairs

- Pip value = 100 for RUB and CZK pairs

- The result is divided by 10 because swap values are expressed in cents

For index CFDs, swap values are tied to the interbank rate of the index’s currency plus the company’s markup.

Formulas:

Standard markup: 3.5% (Buy) and 3% (Sell)

Premium accounts: 2.5% markup

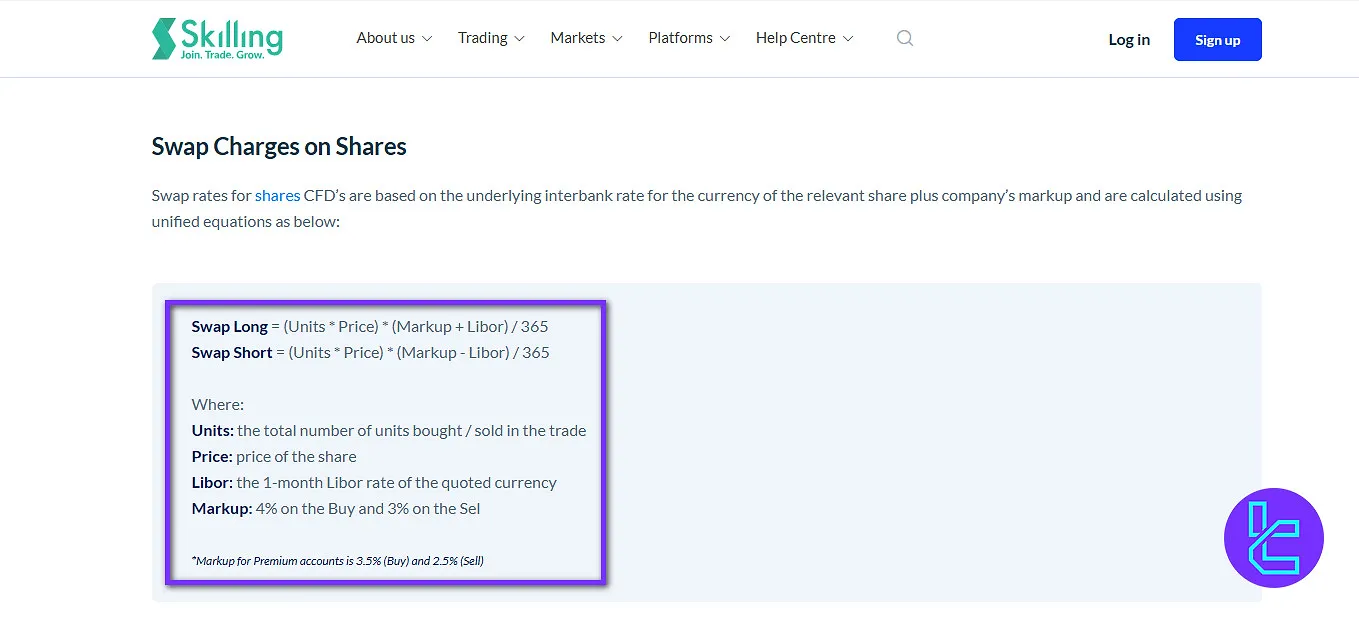

Share CFD swaps follow a similar structure, based on the LIBOR rate of the share’s currency plus markup.

Formulas:

Standard markup: 4% (Buy) and 3% (Sell)

Premium accounts: 3.5% (Buy) and 2.5% (Sell)

For Crypto CFDs, the overnight charge is applied as a percentage of the market price, reflecting volatility and liquidity conditions specific to digital assets.

Skilling Non-Trading Fees

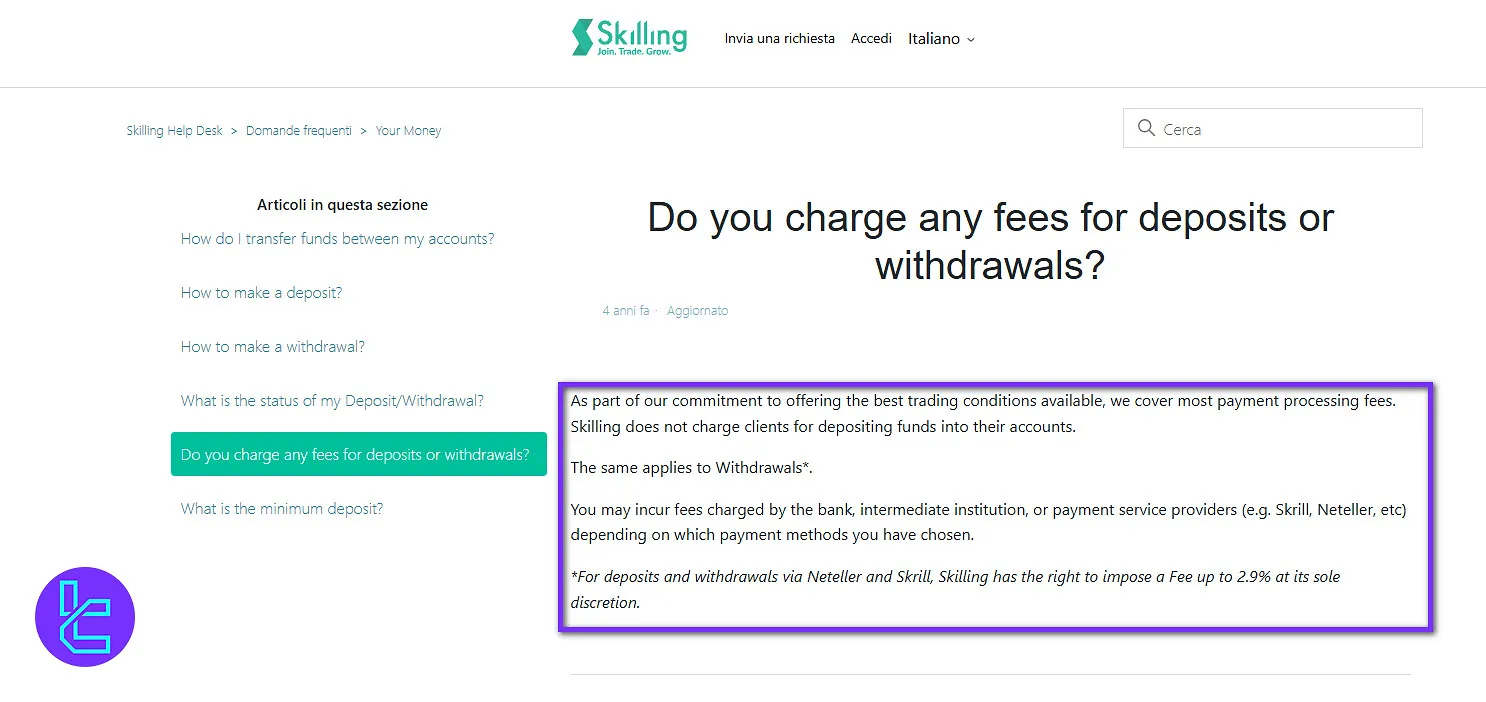

Skilling maintains a transparent fee structure and typically absorbs most payment processing costs. Deposits into trading accounts are free of charge, and the same policy generally applies to withdrawals.

However, depending on the selected payment method, such as bank transfers or digital wallets like Skrill and Neteller, external fees from banks or intermediaries may apply.

Skilling also reserves the right to apply a fee of up to 2.9% on Skrill and Neteller transactions at its discretion.

A trading account is classified as inactive when no deposits, withdrawals, or trading operations (opening or closing positions) occur for six consecutive months.

In such cases, Skilling may introduce an inactivity fee after providing prior notification to the account holder.

How to Deposit and Withdraw on Skilling

This broker offers a diverse range of deposit and withdrawal methods, which is broader than that of most other brokers. In the list below, we will mention some of the important ones:

- Neteller

- Skrill

- Credit/Debit Cards (VISA, Mastercard)

- Bank Wire Transfer

- UnionPay

- Fasapay

- AstroPay

- Trustly

- Swish

You can choose a method that suits you best based on your region and preferences.

Skilling Deposit

Skilling provides several convenient deposit options designed to accommodate different trader preferences. Processing times and limits vary depending on the chosen payment method:

Deposit Method | Processing Time | Key Terms |

Debit / Credit Card (Visa, MasterCard) | Instant | Maximum €10,000 per transaction and €40,000 per day (subject to acquirer adjustments) |

Bank Transfer | 1–7 business days | Duration depends on your bank’s internal processing policies |

Alternative Methods (Skrill, Neteller, PayPal, etc.) | Instant | Deposits process instantly, but withdrawals are only available via bank transfer |

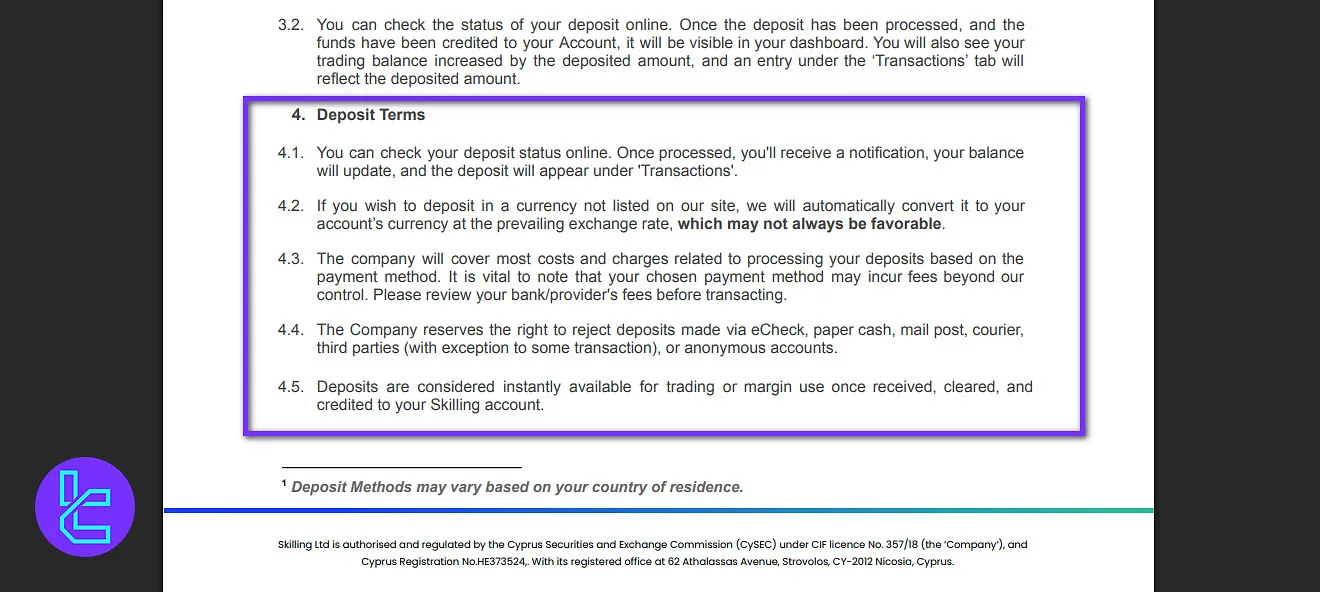

Once funds are credited to your Skilling Account, the updated balance becomes visible in the dashboard under the “Transactions” section.

If you deposit in a currency not supported by Skilling, it will be automatically converted to your account’s base currency at the current exchange rate, which may fluctuate.

Skilling generally covers most deposit-related fees, though external providers, such as banks or digital payment platforms, may charge additional costs. It is advisable to confirm any potential third-party fees in advance.

The company does not accept deposits via eChecks, mailed cash, couriers, third-party, or anonymous accounts, except in certain verified cases. Once processed, deposits are immediately available for trading or margin use in your Skilling account.

Transactions and Activities on the Skilling Dashboard

The Skilling Dashboard provides a centralized space for managing all trading, financial, and analytical operations within a single interface.

It contains eight structured sections designed to streamline market analysis, trade execution, reporting, and account management.

Traders can monitor their open trading positions, order history, and transaction records directly through the Trading Panel and Reports sections.

The Activity tab logs every trade action, while the Transactions tab keeps a verified record of deposits and withdrawals, filterable by date or account.

Under My Account, users can manage personal data, verification documents, and trading profiles, while the Deposit and Withdrawal tab allows secure fund transfers through methods like bank wire, cards, Skrill, or Neteller.

Skilling Withdrawal

Skilling provides multiple withdrawal options to suit different trader preferences. Processing times vary depending on the chosen payment channel and external banking procedures:

Withdrawal Method | Processing Time | Key Terms |

Debit / Credit Card (Visa, MasterCard) | Depends on issuer/processor | Withdrawals limited to deposited amount. Expired or lost cards require a bank letter; funds may be sent via bank transfer instead |

Bank Transfer | 1–7 business days | Funds usually received within one week. Minimum withdrawal: €15 / $15 after fees |

Alternative Methods (Skrill, Neteller, PayPal, etc.) | Instant (usually) | Processed via the same deposit method; may revert to bank wire in rare verified cases |

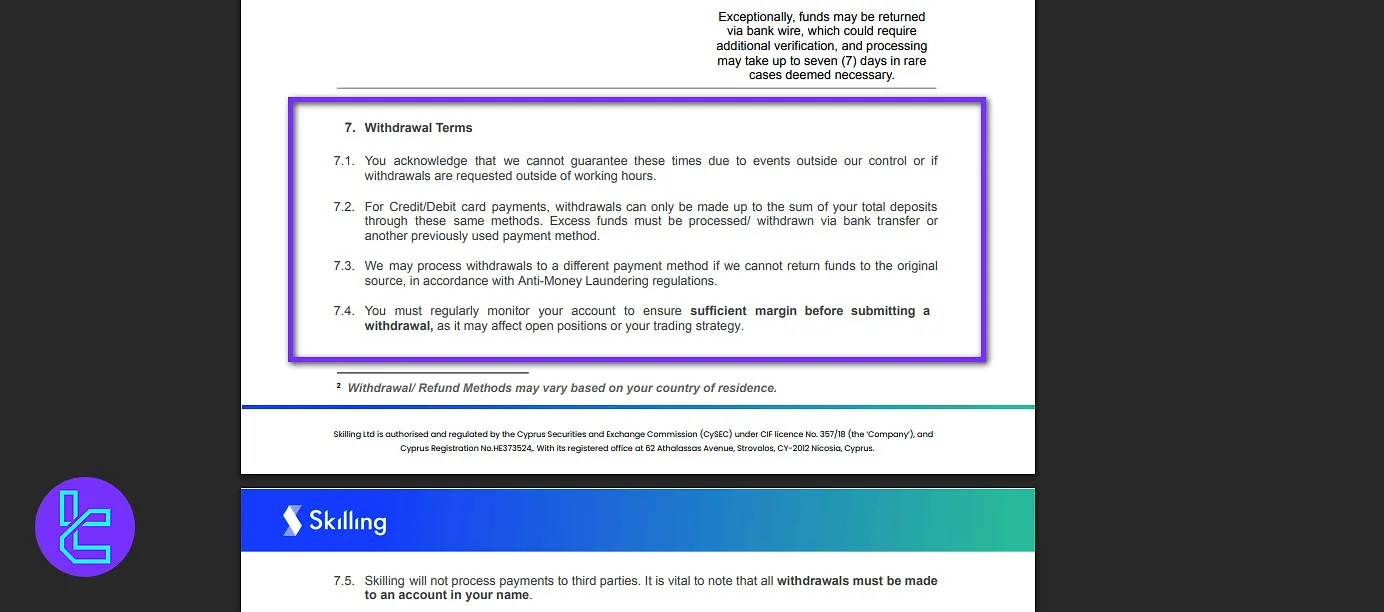

While Skilling aims to process withdrawals promptly, actual completion times depend on banking networks and third-party intermediaries. Requests made outside of business hours may experience delays.

Withdrawals to third-party or anonymous accounts are strictly prohibited all funds must be transferred to accounts registered under the same name as the Skilling account holder.

If a withdrawal is requested without prior trading activity, Skilling may apply a Non-Trading Fee of 2.5% of the withdrawal amount. Traders can avoid this fee by executing a trade before submitting the withdrawal request.

Clients are entitled to one free withdrawal per day for most payment methods (excluding bank wire). Additional withdrawals on the same day may incur the following costs:

- €15 for SEPA transfers

- €25 / $25 / 260 SEK/NOK for SWIFT transfers

In compliance with Anti-Money Laundering (AML) regulations, Skilling may process withdrawals via a different method if funds cannot be returned to the original payment source.

Copy Trading & Investment Options Offered on Skilling

The brokerage offers a robust copy trading feature through its Skilling Copy platform. This innovative tool allows traders to:

- Follow and copy 400+ successful strategies

- Diversify their portfolio by copying multiple traders

- Adjust allocation and risk settings for each copied trader

- View detailed performance metrics and trading history

While copy trading can be an excellent way for beginners to get started or for busy individuals to participate in the markets, it's important to remember that past performance doesn't guarantee future results.

Tradable Markets & Instruments

Traders on Skilling can access over 1,200 CFDs spanning five major asset classes, from the Forex market to shares and indices.

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | Major, Minor & Exotic Currency Pairs | 70+ currency pairs | 50–70 currency pairs | Up to 1:200 |

Shares | CFDs on global company stocks | Over 900 global stocks | 800–1200 | Up to 1:5 |

Indices | CFDs on major global indices | 15+ indices | 10–20 indices | Up to 1:200 |

Commodities | Metals, energy, and soft commodities | Around 15 instruments | 10–20 instruments | Up to 1:20 |

Cryptocurrencies | CFDs on major and emerging crypto pairs | 40+ crypto pairs | 30–50 crypto pairs | Up to 1:2 |

This broad selection allows users to build diverse portfolios and trade under one roof.

Bonuses and Promotions for Clients

As of the latest update, Skilling does not offer any bonuses or promotions. This is in line with stricter regulatory requirements, particularly from CySEC, which has placed restrictions on bonus offerings by forex brokers.

Skilling Awards

Skilling has been recognized across multiple regions for its trading platform performance and reliability. The broker received several distinctions at the Global Forex Awards 2022, including:

- Best Forex Trading Platform LATAM - Global Forex Awards 2022

- Best Forex Trading Platform Global - Global Forex Awards 2022

- Best Forex Trading Platform Europe - Global Forex Awards 2022

These Skilling awards highlight the broker’s consistent development of trading technology and user experience within the CFD and Forex markets.

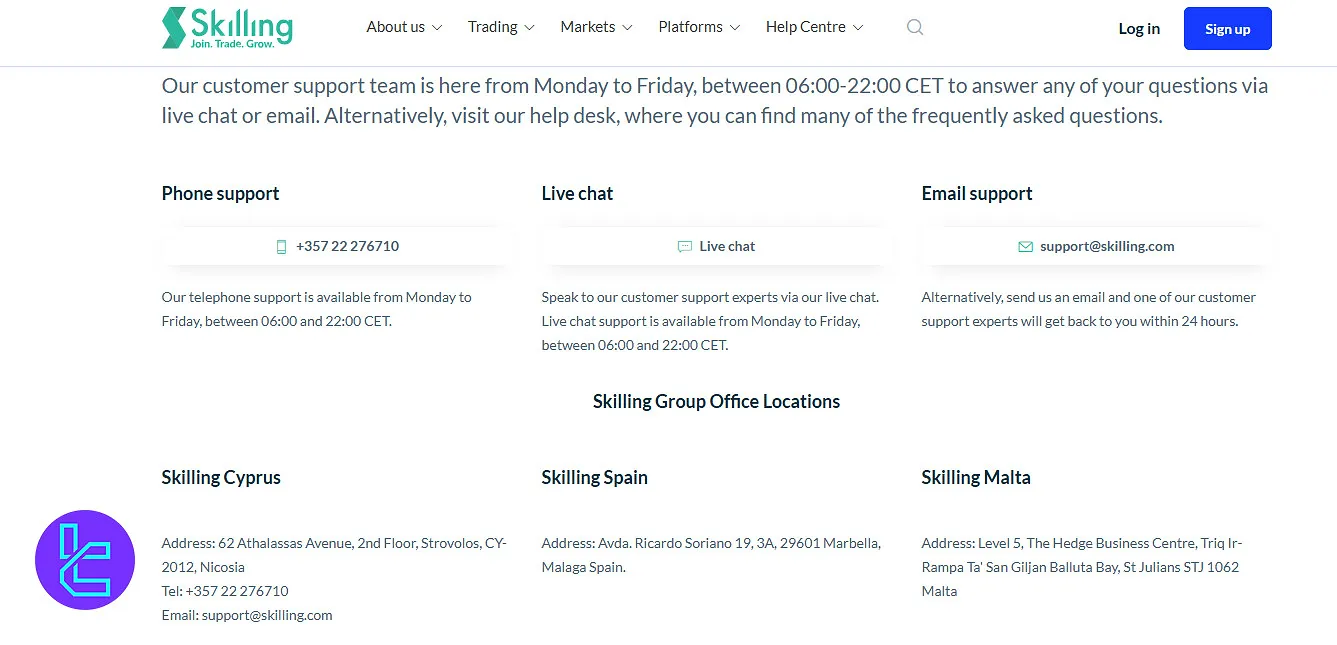

Support Contact Methods and Working Schedule

The way a client contacts the broker's support team can have a significant impact on the process of solving the problem. Skilling provides 4 popular channels for customer support:

- Live Chat: Available directly from the website

- Email: support@skilling.com

- Phone Call: +357 22 276710

- Support Ticket System: Available through the client portal

Unfortunately, the company does not provide its customer service 24/7. Based on the information available on the website, the team answers your questions from Monday to Friday, between 06:00 and 22:00 CET.

Support is available in over 12 languages, including English, German, French, and Chinese.

List of Restricted Countries; Can I Trade On Skilling?

Skilling, while available in many countries worldwide, does have restrictions on where it can offer its services. Here's a list of some key restricted countries:

- United States

- Japan

- Canada

- Australia

- New Zealand

- Iran

- North Korea

- Syria

- Cuba

- Sudan

If you're unsure about your eligibility to open an account with Skilling, it's best to reach out to their customer support team for clarification before attempting to register.

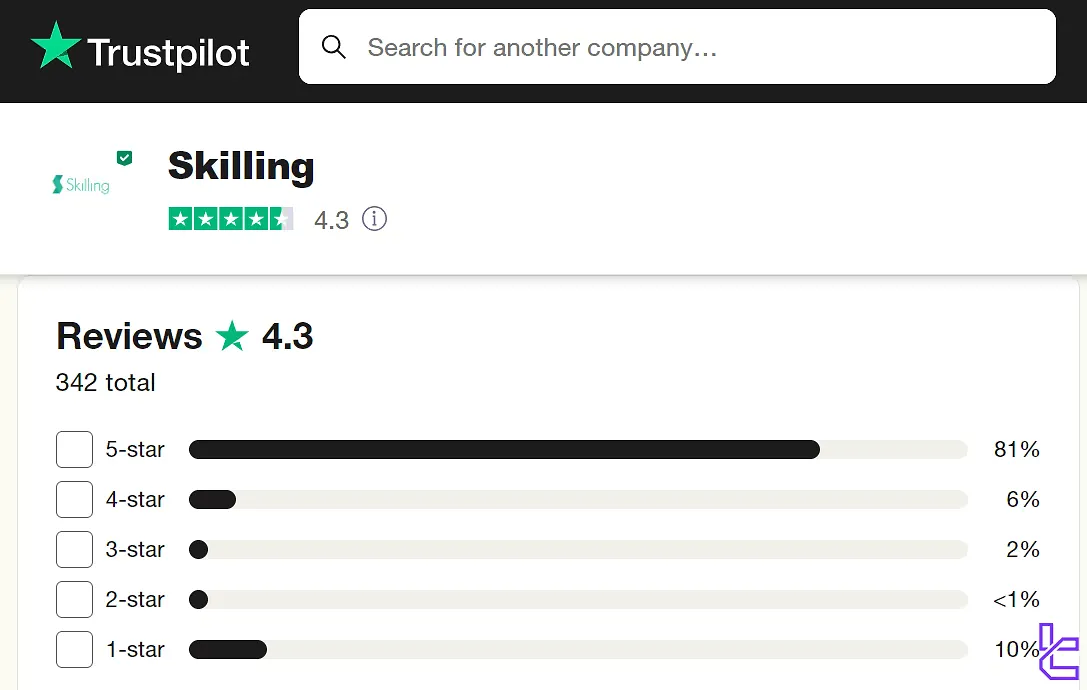

Trust Scores & Evaluations

Skilling has received generally positive scores from traders on review platforms, including Trustpilot, as evidenced by its ratings on popular review platforms:

- Skilling Trustpilot: 4.3/5 stars, based on more than 300 reviews, with +80% being 5-star

- ForexPeaceArmy: 3.7/5 stars, only 3 ratings, not reliable enough

According to the reviews, there's a generally positive sentiment towards Skilling's platforms andtrading conditions.

However, it's important to approach online reviews with a balanced perspective. While they provide valuable insights into user experiences, not all traders have the same point of view.

Education Resources On The Website

Skilling offers a range of educational resources to help traders enhance their skills and knowledge. These resources are provided in 3 forms:

- General and comprehensive articles on topics like Forex and CFD

- Blog posts in a more detailed way

- Education Centre consisting of lessons on trading, market analysis, strategies, etc

Traders can also use TradingFinder's Forex education and crypto tutorials for additional resources.

Skilling Comparison Table

Let's take a quick look at Skilling's services in comparison with top forex brokers.

Parameter | Skilling Broker | TMGM Broker | AvaTrade Broker | Tickmill Broker |

Regulation | CySEC, FSA, FCA | ASIC, VFSC, FSC, FMA | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA | FSA, FCA, CySEC, LFSA, FSCA |

Minimum Spread | From 0.1 pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $0.0 | From $0.0 | $0 | From $0.0 |

Minimum Deposit | €100 | $100 | $100 | $100 |

Maximum Leverage | 1:200 | 1:1000 | 1:400 | 1:1000 |

Trading Platforms | Skilling Trader, Metatrader 4, cTrader | MT4, MT5, IRESS, TMGM Mobile App | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader | Metatrader 4, Metatrader 5, Metatrader Web, Mobile App |

Account Types | Standard, Premium | EDGE, CLASSIC | Standard, Demo, Professional | Classic, Raw |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 1,200+ | 12000+ | 1250+ | 620+ |

Trade Execution | Market, Instant | Market, Instant | Instant | Market |

Conclusion and Final Words

Skilling provides competitive trading conditions like leverage ranging from 1:30 to 1:200.

Commissions start from $0, and the broker supports Neteller, Skrill, Credit/Debit Cards, Bank Wire Transfer, and many others as deposit and withdrawal methods.

However, Skilling’s services are restricted in countries like the United States, Japan, Canada, Australia, and New Zealand. Skilling with a 4.3/5 rating on Trustpilot adds to its reliability.