Spreadex is a multi-award-winning broker known for its dual focus on financial trading and sports betting. The Forex broker offers a diverse range of services, including financial spread betting, CFD trading, and many more.

The firm has been recognized for its outstanding customer service and mobile trading platforms, securing honors such as Best Spread Betting Provider (COLWMA 2020) and Best Mobile Trading Platform (ADVFN 2020), among others.

Spreadex; Company Introduction and Licenses

Spreadex, founded on 25 February 1999 by former City dealer Jonathan Hufford, has grown from a modest startup to one of the UK's leading financial services providers. The company’s net worth was reported at £111.5M in 2023, according to Company Check.

Spreadex provides access to thousands of instruments globally, available via dedicated apps for iPhone, iPad, and Android. Its offerings also extend to advanced market analysis, making it suitable for both retail and professional traders.

As you know, regulation and licensing are crucial aspects of any reputable broker. Spreadex operates under the watchful eye of the Financial Conduct Authority (FCA) in the UK.

Its FCA registration number is 190941, confirming its adherence to regulatory standards concerning client fund protection, operational transparency, and risk disclosure.

| Entity Parameters/Branches | Spreadex Ltd |

Regulation | FCA |

Regulation Tier | 1 |

Country | United Kingdom |

Investor Protection Fund/Compensation Scheme | FSCS Up to £85,000 |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:30 |

Client Eligibility | UK |

Spreadex CEO

Since 2003, David MacKenzie has been instrumental in shaping Spreadex’s trajectory, eventually taking over as CEO from Jonathan Hufford and driving both its trading and sports betting divisions forward.

- Guided marketing expansion, including sports sponsorship deals with Sunderland, Sheffield United, Burnley, and Millwall;

- Prioritized exclusive fan engagement initiatives through club partnerships;

- Promoted to CEO during a management reshuffle, succeeding Jonathan Hufford (now Non-Executive Director);

- Served as a Director at Spreadex before taking the top role;

- Joined Spreadex in 2003, bringing long-term industry insight;

- Spent much of his 20s in a music career before transitioning into finance and corporate leadership.

Spreadex Broker Table of Specifications

The company has been recognized by the Financial Times as one of the top 1000 fastest-growing companies in Europe, a testament to the Forex broker's continued success and excellent features, including:

Broker | Spreadex |

Account Types | Live |

Regulating Authorities | FCA |

Based Currencies | GBP, USD, EUR |

Minimum Deposit | Unlimited |

Deposit Methods | Credit/Debit Cards, Bank Transfer, Cheque, Apple Pay, Google Pay |

Withdrawal Methods | Credit/Debit Cards, Bank Transfer, Cheque, Apple Pay, Google Pay |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:30 |

Investment Options | None |

Trading Platforms & Apps | Proprietary Platform, TradingView |

Markets | Indices, Shares, FX, ETFs, Bonds, Interest Rates, Commodities, Crypto |

Spread | Starting from 0.60 pips on major forex pairs |

Commission | 0.1% for share CFDs |

Orders Execution | Market, Trailing Stop, Instant, Force Open, Guaranteed Stops |

Margin Call / Stop Out | 100% / 50% |

Trading Features | Spread Betting, Options Trading, CFDs |

Affiliate Program | Yes |

Bonus & Promotions | FT Subscription, TradingView Premium, Referral |

Islamic Account | No |

PAMM Account | Yes |

Customer Support Ways | Email, Live Chat, Phone |

Customer Support Hours | 24/4 Friday 00:00 - 21:15 Sunday 21:00 - 00:00 Saturday Closed |

Spreadex Account Types

Unlike many brokers that offer multiple account tiers, Spreadex keeps things simple with a single live account type for its financial trading services. This approach aligns with the company's ethos of making trading accessible to all. Key features of SpreadEX Live account:

- No minimum deposit requirement

- Access to 3000+ financial instruments

- Competitive spreads starting from 0.60 pips on major forex pairs

- Leverage up to 1:30 for retail clients (higher for professional clients, subject to eligibility)

- No commissions on most trades (spread betting)

- Advanced charting tools and market analysis

- Mobile trading apps for iOS and Android

It's worth noting that while Spreadexdoesn't offer traditional demo accounts, they do provide a "Try for Free" option on their sports spread betting platform, allowing new users to get a feel for how spread betting works without risking real money.

Spreadex Pros & Cons

The broker does not currently support demo accountsor copy trading features, which can be a letdown for potential clients.

To help you make an informed decision, let's break down the main advantages and disadvantages of using Spreadex as your broker.

Pros | Cons |

Offers popular TradingView platform | MetaTrader platform not supported |

Better-than-average spreads | No demo account available |

No inactivity fees | Limited educational resources compared to some competitors |

Customizable execution settings | Lack of 24/7 support |

Regulated by FCA | - |

Unique spread betting offerings | - |

Spreadex Broker Account Opening and Verification

Opening a trading account with Spreadex, whether for CFD or Spread Betting, is a structured process that prioritizes both compliance and account security.

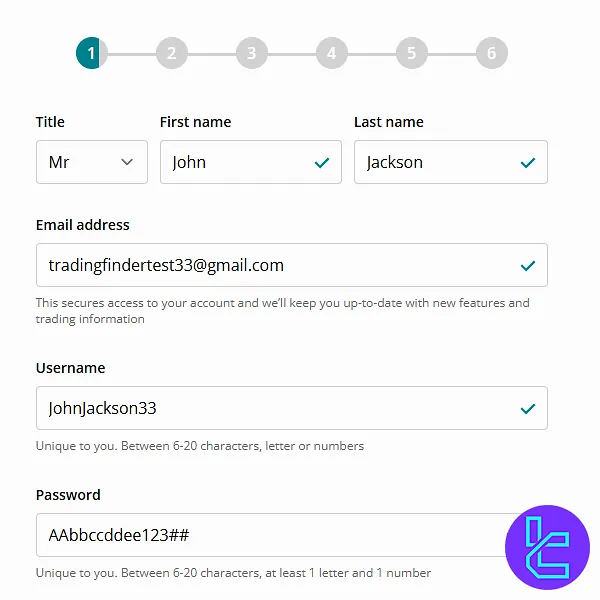

Traders must submit detailed personal, employment, and financial experience data to access Spreadex's trading features. Here's a step-by-step guide to Spreadex registration:

#1 Visit the Spreadex Website

Navigate to the broker's official website and click “Create an Account” under the Financial Trading section on the home page.

#2 Enter Personal Details

Provide your personal information, including:

- Title

- First and last name

- Username

- Account password

- Country of residence

- Nationality

Select between CFD or Spread Betting account types. Agree to the terms and conditions to continue.

#3 Add Contact Information

Fill out the contact form with the following details:

- Date of birth

- Mobile number

- Residential address

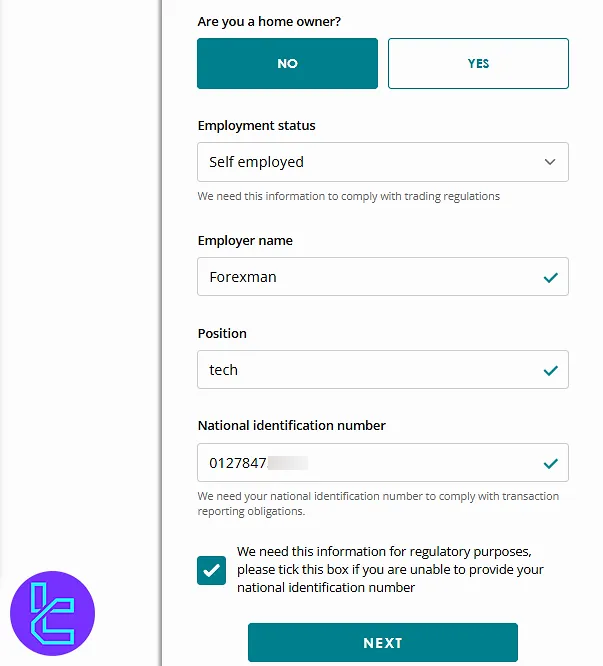

#4 Fill out the Employment and Trading Experience Forms

State the following parameters:

- Employment status

- Job title

- Company name

- Professional ID number

- Trading experience

#5 Finalize Security Settings

Select your account's settings, including:

- Base currency

- Security question (to protect your login credentials)

#6 Complete the Verification Process

The broker is required to verify your identity and address as part of anti-money laundering (AML) regulations. Required documents for Spreadex KYC:

- Proof of ID: A copy of a government-issued ID (passport, driver's license)

- Proof of Address: Recent utility bill or bank statement

Spreadex Trading Platforms [proprietary platform]

Spreadex supports trading across web and mobile platforms, through its proprietary dedicated apps for iPhone, iPad, and Android, as well as the robust TradingView platform.

The proprietary applications feature advanced charting for technical analysis, price alerts, one-click order execution, and robust security protocols like SSL encryption and Touch ID login.

The interface is user-friendly, and performance has earned it multiple awards for mobile functionality. Here are the download links for the platforms:

Spreadex Trading

TradingView

Spreadex has developed various advanced TradingView indicators that you can use for free.

Spreadex Commission and Spread

Understanding the cost structure is crucial when choosing a broker. Spreadex offers a competitive fee structure, but it's important to note that the costs can vary depending on thetype of trading you're engaged in (spread betting vs. CFD trading) and the specific markets you're trading.

Spread Betting Costs on Spreadex

- No commission is charged;

- Costs are built into the spreads;

- Spreads start from 0.60 pips on major forex pairs;

- Profits are tax-free for UK residents (subject to current tax laws).

CFD Trading Costs on Spreadex

- Commission charges apply for share CFDs;

- Typical commission is 0.1% of the trade value (minimum £10);

- Spreads are generally tighter than spread betting.

Spreadex Swap Fees

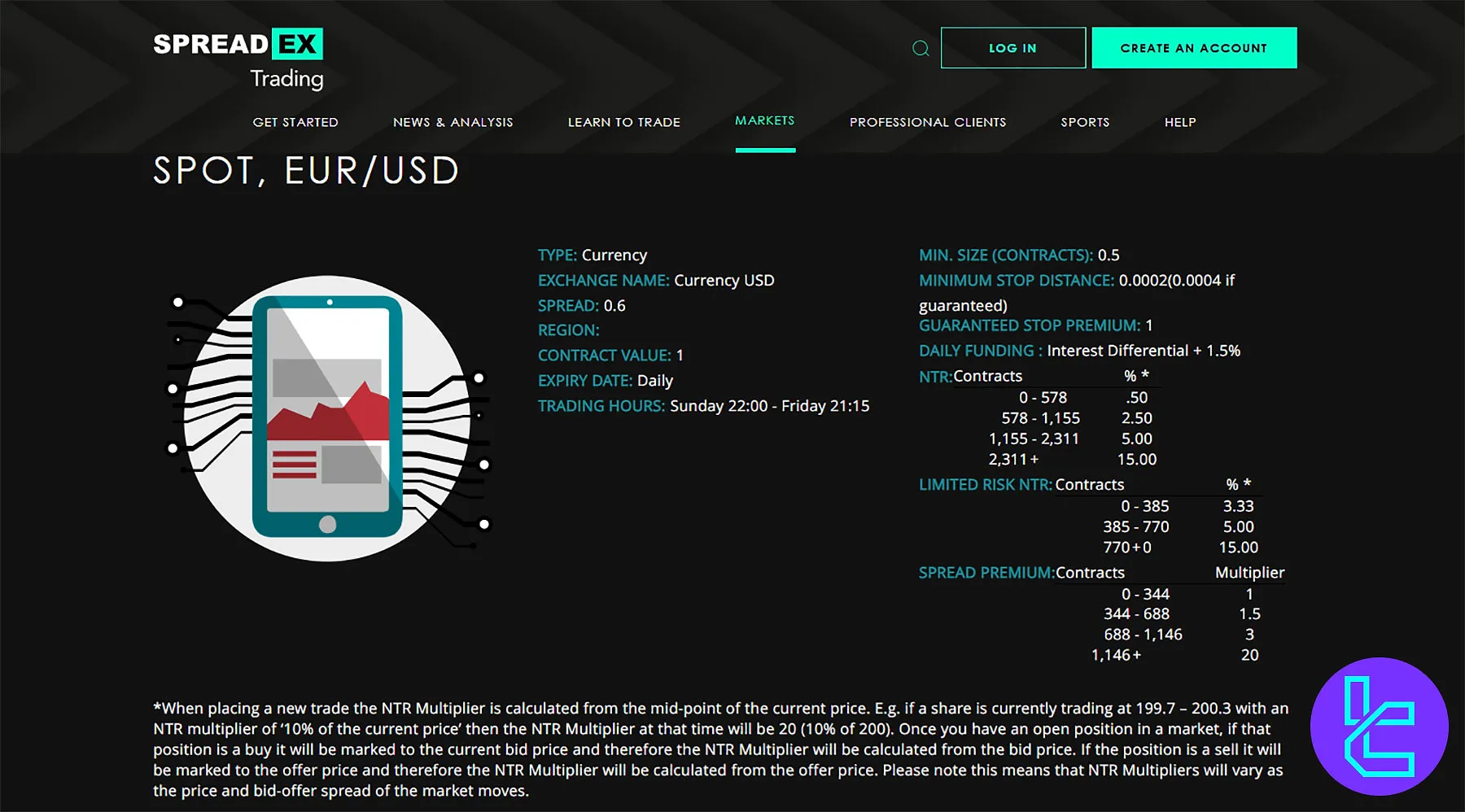

Rollover fees and margin interest are asset-specific and disclosed in the broker's tiered NTR system, accessible via their official website.

The daily funding for forex pairs is "Interest Differential + 1.5%". To figure out the interest differential, check out these NTR examples for various instruments:

- EURUSD NTR (Forex): Ranging from 0.5% to 15%

- SPX 500 NTR (Indices): Ranging from 0.5% to 35%

- Gold NTR (Commodities): Ranging from 0.5% to 25%

- Euribor, Dec 25 NTR (Bonds): Ranging from 0.3% to 5%

- Destiny Tech100 NTR (ETFs): Ranging from 10% to 100%

Spreadex Rollover Fees on Stocks

Holding a rolling share position past the exchange close (16:30 for UK shares) incurs a swap fee, reflecting the cost of leverage options when only a fraction of the trade value is deposited.

- Calculation:

- Example Long: £50 Barclays at 200p, ARR 0.5% → swap fee = £0.96/day

- Example Short: £50 Barclays at 200p, ARR 5% → credit = £0.55/day

- Impact for Shorts: Swap fee can be positive (credit) or negative (charge) depending on ARR vs 3% threshold

- Weekend Rule: Swap fees are tripled on Fridays to cover weekends; bank holidays charged similarly

Spreadex Non-Trading Costs

Spreadex follows a transparent pricing structure with no deposit, inactivity, or sign-up fees.

Spreadex Broker Payment Methods

The company offers a variety of payment methods to cater to different user preferences and needs.

- Credit/Debit Cards: Visa, MasterCard, Maestro

- Bank Transfer: Available for deposits and withdrawals

- Apple Pay: Instant transactions

- Google Pay: Similar to Apple Pay, but for Android users

- Cheques: Accepted for deposits with longer processing time (5-7 business days)

Spreadex Deposits

Spreadex offers a range of secure deposit options, from instant online card payments to traditional bank transfers and cheques.

While third-party payments are not accepted, clients can choose from multiple convenient methods, including Apple Pay, Google Pay, and Easy Bank Transfer.

Deposit Method | Processing Time | Fee | Special Notes |

UK Debit Card (Visa, Switch/Maestro, Mastercard) | Instant (online or phone) | £1 charge for deposits under £50 | First payment can be made online or via phone with Customer Services |

Credit Card (Visa, Mastercard) | Instant (online or phone) | £1 charge for deposits under £50 | Available both online and over the phone |

Bank Transfer | 1–3 business days | None | Sort Code: 20 06 05, Account No: 70370320; quote your Spreadex account number as reference |

Cheque | Several business days (until cleared) | None | Must be payable to Spreadex Ltd from an account in your name |

Direct Debit | Collected every Tuesday | None | Set up over phone or by Direct Debit mandate; can also transfer closed-trade funds if no open positions |

Apple Pay / Google Pay | Instant | None | Available online or in the iOS/Android apps under Deposit/Withdraw Funds |

Easy Bank Transfer | Instant | None | Available via website or app; select “Easy Bank Transfer” under Deposit or Withdraw Funds |

Note: E-wallets such as PayPal, Neteller, and Moneybookers are currently unsupported.

Spreadex Withdrawals

Withdrawals are generally processed using the same method used for deposits. Spreadex offers multiple secure withdrawal options, including fast card payouts, bank transfers, and cheques.

The minimum withdrawal is £5 in cleared funds not tied to open position margins. International and non-GBP bank transfers may incur additional charges.

Withdrawal Method | Processing Time | Minimum / Maximum Limits | Special Notes |

UK Debit/Credit Card | Instant (within 2 hours of approval) for eligible issuers; otherwise, 2–5 business days | Min £5 / Max £25,000 (£2,500 for Mastercard) | Must withdraw back to the same card used for deposit; multiple withdrawals per day allowed |

Bank Transfer (GBP) | Within 2 business days | Min £5 | Funds sent directly to linked bank account |

International Bank Transfer / Non-GBP | Varies by destination | Min £5 | Suitable for overseas accounts or non-GBP currencies |

Cheque | Several business days (until cleared) | Min £5 | Payable to account holder only |

Direct Debit Credit Return | Collected as per Direct Debit schedule | Min £5 | Only if a Direct Debit is set up; credit returned when no open positions |

How to Withdraw Funds from Spreadex?

- Online: Go toMy Account → Withdraw Funds and follow the on-screen steps;

- Phone: Call the Back Office team at 01727 895 000;

- Email: Send your request to info@spreadex.com.

Spreadex Copy Trading and Growth Plans?

It's important to note that the broker does not offer a copy trading software for crypto or other markets. This absence is a significant consideration for traders who rely on or enjoy these services.

However, the integration with TradingView enables you to exploit the benefits of a rich trading community with over 50M users and start social trading.

Spreadex Financial Instruments

The wide range of over 3,000 trading instruments is one of the most significant upsides in this Spreadex review. The broker offers a wide array of financial instruments, including the Forex market, commodities, ETFs, and Crypto assets.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max Leverage |

Forex | CFDs, Spread Betting | Over 60 | 50 - 70 currency pairs | Major pairs 1:30 Minor pairs 1:20 |

Indices | CFDs, Spread Betting | Over 30 | 10 - 20 instruments | 1:20 |

Stocks | CFDs, Spread Betting | 3000+ from 15+ countries | 800 - 1200 | 1:5 |

ETFs | CFDs, Spread Betting | 200+ | 20 - 30 | 1:5 |

Bonds | CFDs, Spread Betting | 8 Interest Rate Futures | N/A | 1:5 |

Commodities | CFDs, Spread Betting | 30+ instruments like Gold, Brent, and Cotton | 15 - 30 instruments | Gold 1:20 Others 1:10 |

Cryptocurrencies (Only for professional clients) | CFDs, Spread Betting | Major digital currencies like Bitcoin | 20 - 30 instruments | 1:2 |

The broker also provides access to Options contracts and Futures markets (CFDs).

Spreadex Broker Promotion and Bonus Plans

The company understands the importance of incentivizing both new and existing customers. Here are some of their standout promotions.

- Financial Times: Deposit £500 in your new account and receive a 6-month gift subscription;

- TradingView Premium: Open an account with an initial balance of £500 and get a premium account for 3 months;

- Affiliate: Various payment schemes, including CPAs, are available;

- Referral: Earn £500 for each qualified referred client.

Spreadex Awards

Spreadex has been recognized repeatedly for excellence in customer service, platform reliability, and trading technology. Key awards:

- 2025: Best Spread Betting Firm for Customer Service – Investment Trends Leveraged Trading Awards (5th win)

- 2024: Best Spread Betting Provider – City of London Wealth Management Awards

- 2024: Best Spread Betting Broker – Good Money Guide Awards

- 2024: Best Spread Betting Platform – ADVFN International Finance Awards

- 2024: Best Spread Betting App – Spread-Bet.co.uk

- 2020, 2018, 2016: Best Spread Betting Firm – City of London Wealth Management Awards

- 2019: Best Spread Betting Firm – Good Money Guide Awards

- 2017: Best Spread Betting Firm – EGR Operator Awards

How to Reach Spreadex Customer Support

The company prides itself on providing excellent customer support through various channels. Traders can reach customer service via email or telephone, with a guaranteed response time of under 24 hours.

However, there’s a downside to it. Support is not available 24/7. The team assists you 24 hours a day, Monday to Thursday (Friday 00:00 - 21:15, Sunday 21:00 - 00:00, and Saturday Closed).

fins@spreadex.com | |

Phone | +44 1727 895 151 |

Live Chat | Quick responses during business hours |

Spreadex Broker Restricted Countries

The company offers its financial markets services globally, and there are almost no restrictions for any specific regions. However, if your country of residence prohibits these types of services, the responsibility is yours.

Spreadex User Satisfaction and Trust Scores

One of the most important topics in this Spreadex review is user satisfaction.

Spreadex has received only five negative reviews on TrustPilot and has replied to 4 of them within a month

Spreadex has received only five negative reviews on TrustPilot and has replied to 4 of them within a month

The broker, with over two decades of experience, has garnered impressive user satisfaction ratings.

4.5 out of 5 based on 112 comments | |

Reviews.io | 3.1 out of 5 based on 15 reviews |

Spreadex Broker Education Hub

The company is committed to trader education, offering a robust “Education Hub” which covers various topics, from trading strategies to fundamental analysis.

- Introduction to financial markets

- Spread Betting and CFD Trading

- Trading with Spreadex

- Trading strategies

- Chart analysis

- Economic calendar and weekly market updates

- Technical analysis via chart patterns and candlestick signals

- A regularly updated trading blog

Educational support includes beginner-focused guides such as “What Is CFD Trading?” and “How to Place a Spread Bet”, though it may not suffice for complete novices.

You can check TradingFinder's Forex education section for additional resources.

Spreadex vs Other Brokers

The table below compares Spreadex features and services with other Forex brokers:

Parameter | Spreadex Broker | Exness Broker | HFM Broker | FxPro Broker |

Regulation | FCA | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB |

Minimum Spread | From 0.6 pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $0.0 | From $0.2 to USD 3.5 | From $0 | From $0 |

Minimum Deposit | N/A | $10 | From $0 | $100 |

Maximum Leverage | 1:30 | Unlimited | 1:2000 | 1:500 |

Trading Platforms | SpreadEX App, TradingView | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App |

Account Types | Live | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 3,000+ | 200+ | 1,000+ | 2100+ |

Trade Execution | Market, Instant | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending |

Conclusion and Final Words

Spreadex provides access to 3000+ instruments across 8 asset classes, including Forex, ETFs, and Crypto. CFD trading comes with a commission of 0.1% withminimum amount set to £10.