SquaredFinancial EU is a Forex broker with a zero minimum deposit. Trading pairs on "SquaredPro" account have spreads starting from 1.2 pips. The maximum available leverage is 1:30 on the accounts with 4 base currencies [EUR, USD, GBP, CHF.]

The brokerage operates based on a margin call level of 100% and a 50% stop-out level.

SquaredFinancial EU provides access to over 2,000 CFD instruments across 5 markets, including Forex, Metals, Indices, Cryptocurrencies, and Stocks & ETFs. Clients can trade more than 40 currencies, 12 major indices, 4 key commodities, and 10 cryptocurrency pairs.

Company Information & Regulation Authorities

SquaredFinancial EU is a multi-asset broker headquartered in Limassol, Cyprus, founded in 2005. What really catches our eye is their solid regulatory framework - a respected authority, namely the Cyprus Securities and Exchange Commission (CySEC), supervises them under license number 379/17.

The company's head office is located at 205, Arch. Makarios Avenue, Victory House, Block A, 5th Floor, 3030, Limassol, Cyprus. SquaredFinancial EU has won many prestigious awards throughout the years, including:

- Most Reliable Broker, World Finance, 2024

- Best Trading Mobile App, Pan Finance, 2023

- Best Stock Provider, Global Brands Magazine, 2022

- Best Client Fund Security, Global Brands Magazine, 2022

- Best CFDs Broker, AtoZ Markets, 2022

Entity | SquaredFinancial (Cyprus) Limited |

Regulation | Cyprus Securities and Exchange Commission (CySEC), License No. 329/17 |

Regulation Tier | Tier 1 |

Country | Cyprus (EU) |

Investor Protection Fund / Compensation Scheme | Member of the Investor Compensation Fund (ICF), protects eligible clients up to €20,000 |

Segregated Funds | Yes |

Negative Balance Protection | Available |

Maximum Leverage | Up to 1:30 |

Client Eligibility | Accepts non-restricted jurisdictions; excludes UK, USA, Canada, Australia, New Zealand, FATF-listed, and sanctioned countries |

The broker also operates outside the EU through SquaredFinancial Global, regulated by the Seychelles FSA.

SquaredFinancial EU Summary Of Key Specifics

Like every other review article you can find on TradingFinder, in this section we will provide a table with specifications of the brokerage. Let's break down the essential details you need to know:

Broker | SquaredFinancial EU |

Account Types | SquaredPro, SquaredElite |

Regulating Authorities | CySEC |

Based Currencies | EUR, USD, GBP, CHF |

Minimum Deposit | From 0 |

Deposit Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, Alternative Payment Methods |

Withdrawal Methods | Credit/Debit Cards, E-Wallets, Bank Wire Transfer, Alternative Payment Methods |

Minimum Order | 0.01 |

Maximum Leverage | 1:30 |

Investment Options | None |

Trading Platforms & Apps | MetaTrader 5, Proprietary App |

Markets | CFDs on Forex, Metals, Indices, Futures, Energies, Shares & ETFs, Cryptocurrencies |

Spread | From 1.2 Pips on SquaredPro From Zero on SquaredElite |

Commission | None on SquaredPro $5 per Lot in SquaredElite |

Orders Execution | Market |

Margin Call/Stop Out | 100%/50% |

Trading Features | Economic Calendar, Trading Calculators |

Affiliate Program | Yes |

Bonus & Promotions | None |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Live Chat, Phone Call, Email, Ticket |

Customer Support Hours | Monday to Friday from 7:00 to 21:00 (GMT+3) |

Account Types Review and Comparison

SquaredFinancial EU does not offer much diversity in terms of live accounts, but it keeps things simple with two account types: SquaredPro & SquaredElite. In the table below, we will compare them:

Account Type | SquaredPro | SquaredElite |

Min. Deposit | 0 | $500 |

Base Currency | EUR, USD, GBP, CHF | |

Max. Leverage | 1:30 | |

Min. Order | 0.01 | |

Margin Call/Stop Out Level | 100%/50% | |

As you saw in the table, there's not much difference between the two accounts. The main difference is in their spreads and commissions, which we will get to later in the article.

There's also a demo account available for clients on the broker.

SquaredFinancial EU Islamic Account

While the EU branch doesn't offer an Islamic account option, you can access swap-free accounts through the broker's global entity.

The Islamic option is available on both account types and offers 24/5 support as well as a maximum leverage option of up to 1:500.

Benefits and Drawbacks

A table of pros and cons is a useful material that gives us a better picture of a company's services. Let's look at what makes SquaredFinancial EU shine and where they could improve:

Benefits | Drawbacks |

High-Reputation Regulating Authority | No Support Services on Weekends |

No Minimum Deposit on SquaredPro Account | Relatively High Costs in Trading |

Diverse Trading Symbols in Various Markets | - |

Sign Up and Verify on SquaredFinancial EU; Quick Tutorial

Creating an account with this broker involves a streamlined sign-up followed by mandatory identity verification. Once registered, traders gain access to the dashboard and evaluation services.

#1 Start from the Official Website

Visit the broker’s homepage and select “Open Account” or “Register” to begin.

Click the button as shown in the screenshot to start registration with SquaredFinancial EU

Click the button as shown in the screenshot to start registration with SquaredFinancial EU

#2 Create Your Live Account

Click on “Open Live Account” and proceed to the secure registration form.

#3 Enter Basic Information

Provide your details, including:

- Name

- Mobile number

- Account password

#4 Complete Address & Identity Details

Enter your address information and additional personal details as part of the onboarding process:

- Residential address

- Nationality

- Date of birth

#5 Submit Financial Information

Answer questions related to employment, income, and trading background to complete your profile.

#6 KYC Verification Requirements

Before accessing live trading or funding programs, upload the following documents:

- Government-issued ID (passport or national ID card)

- Proof of address (recent utility bill or bank statement)

SquaredFinancial EU Trading Platforms; Applications + Links

The broker offers two trading solutions with several applications on different operating systems: MetaTrader 5 and a proprietary mobile app. A Quick Overview of Trading Platforms in SquaredFinancial EU:

- Mobile App: One-click trading, customizable interface, portfolio management, and more

- MetaTrader 5: Access to over 2,500 algorithmic applications, tools for analytics, copy trading service, etc.

In the table below, you can find the links to each platform for your mobile devices:

Operating System | Android | iOS |

Mobile App | ||

MetaTrader 5 |

You can access a wide range of MT5 indicators on the TradingFinder website.

Spreads And Commissions Review

First, we are going to review the broker's trading costs based on account types. Look for this information in the table below:

Trading Account | SquaredPro | SquaredElite |

Average Spread for EUR/USD | From 1.2 Pips | From 0 |

Commission | None | $5 per Lot |

Note that the commission varies per product. Regarding fees in other parts and operations, there are no costs in deposits and withdrawals. Also, no inactivity fee is charged by the broker.

To get a more realistic view of the broker's spreads, here's a list of spread data on popular trading pairs at the time of writing this SquaredFinancial EU review:

Trading Instrument | Spread |

EURUSD | 1.1 pips |

USDJPY | 1.3 pips |

GBPUSD | 1.4 pips |

XAUUSD | $0.17 |

XAGUSD | $0.03 |

XTIUSD | $0.03 |

S&P 500 | $1 |

SquaredFinancial EU Swap Fees

SquaredFinancial applies overnight rollover interest, commonly known as swap fees, for positions held past the trading day. Trades opened before the daily cut-off incur rollover charges at the end of the session, while positions initiated after the cut-off are deferred until the next trading day.

Although swaps are not applied during weekends when markets are closed, banks continue calculating interest on trading positions held over this period, which is reflected in subsequent rollover adjustments.

Swap rates vary based on the direction of the position, with both positive and negative swaps applied depending on whether a client holds a long or short position.

For example, AUDCAD has a long swap of 1.93 points and a short swap of -6.34 points, while EURGBP’s long swap is -8.67 points and its short swap is 2.41 points.

All swap rates, along with spreads and leverage for each instrument, are provided on SquaredFinancial’s contract specification page. This allows traders to access precise overnight rollover information for informed decision-making and effective risk management.

SquaredFinanical EU Non-Trading Fees

SquaredFinancial may impose non-trading charges on accounts that remain inactive for three months or longer. Inactivity is defined as the absence of trading activity, open positions, deposits, withdrawals, or currency exchange orders.

Accounts meeting this condition can be classified as dormant, and a monthly inactivity fee may be applied. Details regarding any charges for dormant accounts are outlined in the broker’s “Cost and Charges Policy,” available on the official website.

Currently, there is no information about specific inactivity fees on the mentioned page.

Additionally, withdrawal fees can be applied depending on the client’s account type or specific transaction. The current structure of applicable withdrawal fees is listed in full on SquaredFinancial’s website, ensuring transparency for all account holders.

Payment Options for Deposits & Withdrawals

More deposit and withdrawal methods in a broker lead to more compatibility for traders from various regions. SquaredFinancial EU offers diverse payment options:

- Credit/Debit Cards: VISA, MasterCard, etc.

- E-Wallets: Skrill, Neteller, and other platforms

- Bank Wire Transfer: Via bank accounts

- Alternative Methods: Crypto, etc.

Here are SquaredFinancial EU payment providers and their regulating authorities:

Payment Method | Company | Regulation |

Trust Payments | PayMaxis | Malta Financial Services Authority |

Payabl. | PowerCash | Central Bank of Cyprus |

Nuvei | SafeCharge | Central Bank of Cyprus |

Skrill | Skrill | Central Bank of Ireland |

SquaredFinancial EU Deposit

SquaredFinancial provides a range of deposit and withdrawal options for EU clients, designed to be efficient and convenient.

The broker supports traditional and digital funding channels, ensuring that clients can choose the method best suited to their trading accounts.

Clients can fund their accounts or withdraw earnings through several secure channels, including bank transfers, credit cards, e-wallets, and other alternative payment methods.

All options are designed to comply with regulatory requirements, including anti-money laundering (AML) and Know Your Customer (KYC) protocols.

Here are the SquaredFinancial EU deposit options:

Deposit Method | Description | Deposit Fee |

Bank Transfer | Standard wire transfers from EU banks; processing times typically 1–5 days | N/A |

Credit Cards | Visa and Mastercard accepted; instant deposits | N/A |

E-Wallets | Includes Skrill, Neteller, and other regulated e-wallets | N/A |

Alternative Payment Methods | Other methods supported by SquaredFinancial, including certain cryptocurrencies | N/A |

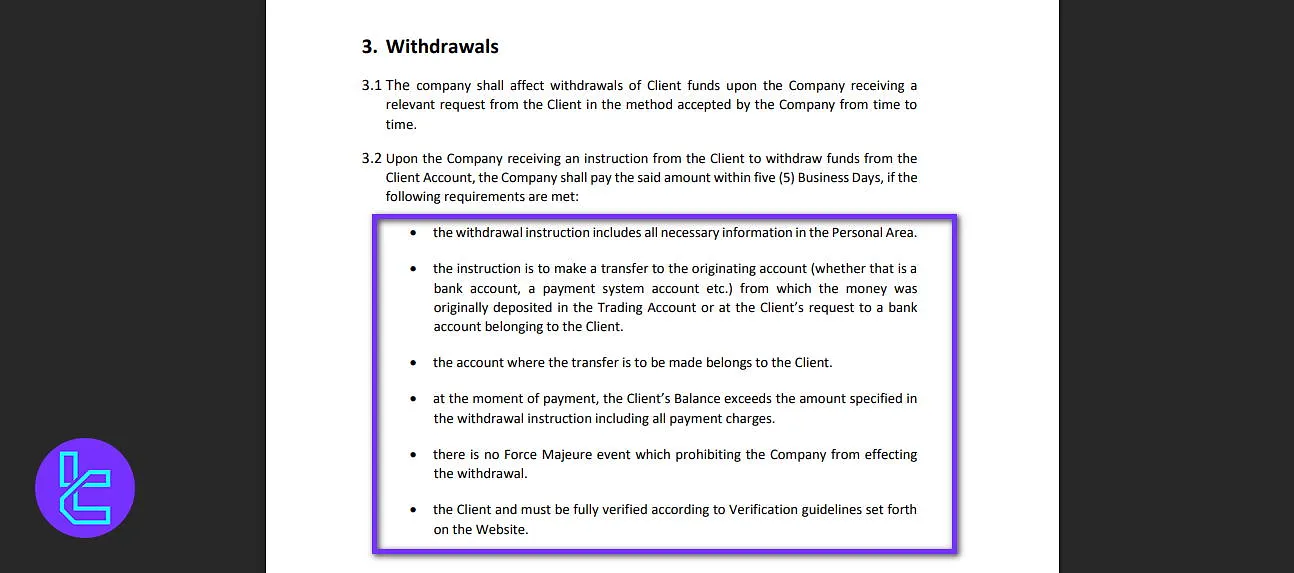

SquaredFinancial EU Withdrawal

SquaredFinancial offers multiple withdrawal channels for EU clients, ensuring fast and secure access to funds.

The broker maintains compliance with regulatory standards, including KYC and AML requirements, to protect clients and their transactions.

Withdrawal options are designed to accommodate different preferences, whether using traditional banking, digital wallets, or alternative methods.

Clients can initiate withdrawals using a variety of methods, each with specific processing times and minimum requirements. Below you can see the 4 withdrawal methods available:

Method | Description | Withdrawal Fee |

Bank Transfer | Standard wire withdrawals; processing typically takes 3–5 business days | depending on the client’s account type or the specific transaction |

Credit Cards | Visa and Mastercard are supported; usually processed within a few business days | depending on the client’s account type or the specific transaction |

E-Wallets | Includes Skrill, Neteller, and other regulated e-wallets | depending on the client’s account type or the specific transaction |

Alternative Payment Methods | Other supported methods, including select cryptocurrencies | depending on the client’s account type or the specific transaction |

Copy Trading Service & Other Investment Solutions

Actually, based on the latest available information, SquaredFinancial EUdoesn't provide any options or services for copy trading purposes and earning passive income.

Which Markets Are Available for Trading on SquaredFinancial EU?

This broker does good work in providing diverse trading instrument options. It offers CFDs on an extensive range of asset classes, from the Forex market to ETFs and Cryptocurrencies.

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | Standard, Micro, Ultra Low accounts | +40 currency pairs (including EUR/USD, GBP/USD) | 50–70 currency pairs | 1:30 |

Metals & Commodities | CFDs on Gold, Silver, Oil, and Natural Gas | 4 main commodities | 10–20 instruments | 1:10 |

Indices | CFDs on global indices (including DAX 40, JAPAN 225, CHINA 50) | 12 indices | 10–20 indices | 1:20 |

Cryptocurrencies | CFDs on digital assets (including BTC, ETH, ADA, and more) | 10 pairs | 10–15 pairs | 1:2 |

Stocks & ETFs | CFDs on shares via NASDAQ, NYSE, and NYSE MKT | Over 1000 global stocks | 800–1200 | N/A |

SquaredFinancial EU claims on its website that it offers more than 2,000 CFD trading instruments.

Bonuses and Promotions

Based on the investigations done on various sources, SquaredFinancial EU currently maintains a no-bonus policy in compliance with strict regulatory requirements. This approach reflects their commitment to:

- Transparent trading conditions

- Regulatory compliance

- Focus on core trading services

- Long-term client relationships

SquaredFinancial EU Awards

SquaredFinancial has received multiple industry awards in recent years, highlighting its offerings across trading platforms, client security, and brokerage services.

- Best Trading Mobile App (2023): Awarded by Pan Finance, recognizing the broker’s mobile trading platform for usability and performance;

- Best Stock Provider (2022): Recognized by Global Brands Magazine for the breadth and quality of stock instruments offered;

- Best Client Fund Security (2022): Also from Global Brands Magazine, acknowledging robust fund protection and regulatory compliance;

- Best CFDs Broker (2022): Awarded by AtoZ Markets for excellence in CFD trading services and product range;

- Most Reliable Broker (2024): Recognized by World Finance, reflecting consistent operational reliability and service standards.

These Squared Financial EU awards demonstrate SquaredFinancial’s commitment to secure trading, diverse instruments, and reliable technology for EU clients.

SquaredFinancial EU Support Channels and Active Hours

The support department might seem unimportant to many traders, but it's one of the mostcritical parts of a broker's services. SquaredFinancial EU covers all of the common and popular channels for contacting customer support:

- Live Chat: On the website

- Email: support@squaredfinancial.eu

- Phone: +35722090227

- Tickets: Detailed query handling, available on the website

Based on the available information, this department offers services in 7 Languages, which is an advantage, but, on the other hand, it's only available Monday to Friday from 7:00 to 21:00 (GMT+3).

Many users have praised the support team for its high-quality, prompt responses, and professionalism.

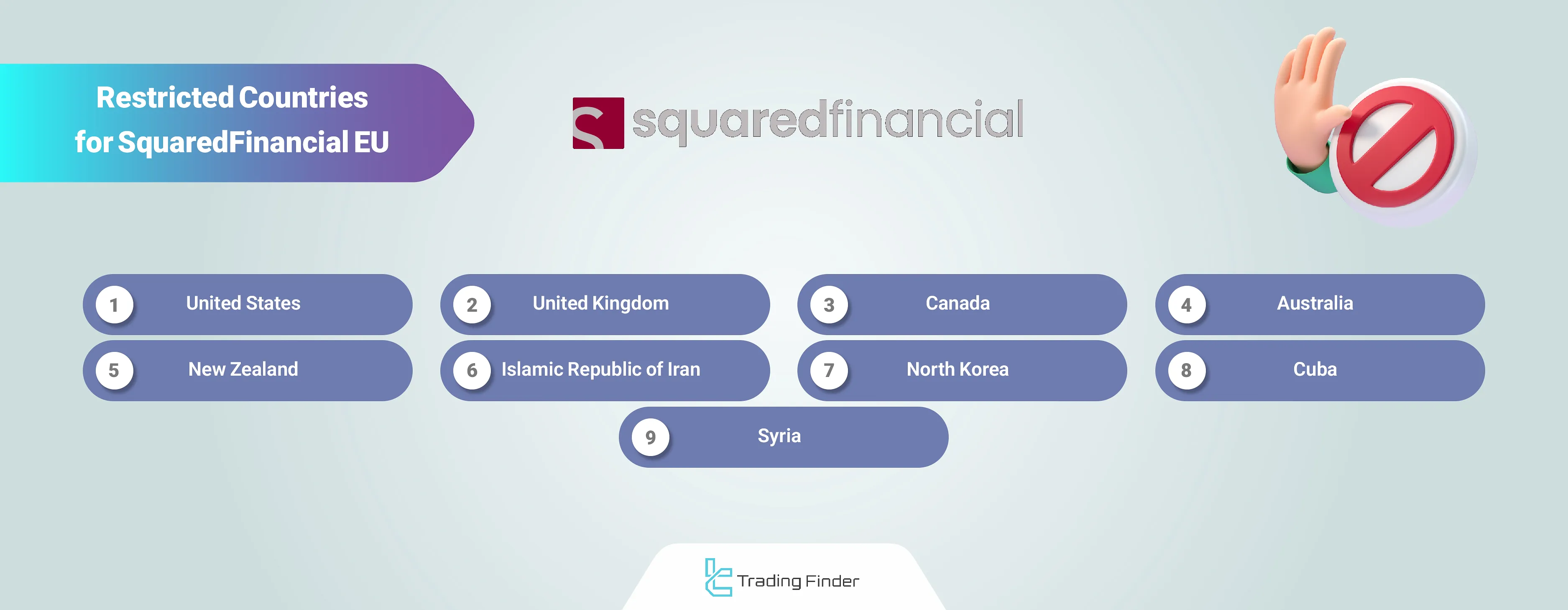

Which Countries Are Restricted from SquaredFinancial EU's Services?

Financial brokers cannot provide their trading services to clients from all regions due to local laws, international sanctions, etc. List of SquaredFinancial EU's Banned Countries:

- United States

- United Kingdom

- Canada

- Australia

- New Zealand

- Iran

- North Korea

- Cuba

- Syria

There are some other restricted regions. For the full list, check the broker's official websites.

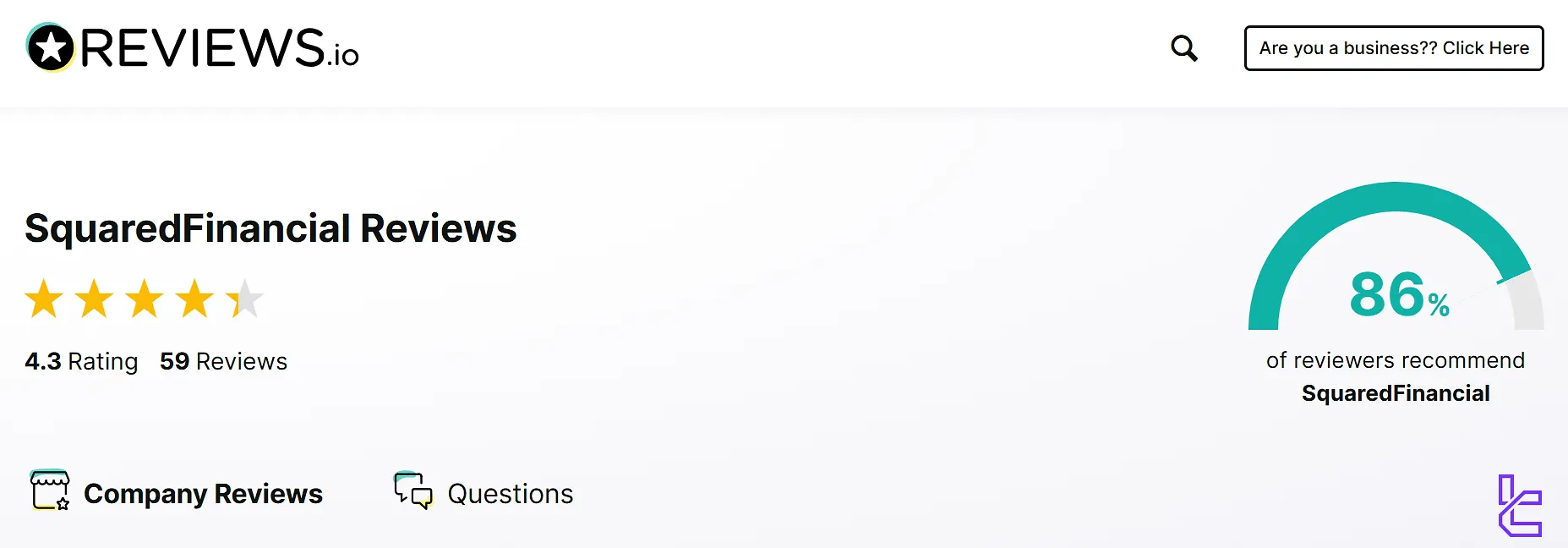

Trust Scores & Reviews

Some platforms such as Trustpilot and REVIEWS.io are purposed for submitting user scores of companies. Let's examine SquaredFinancial EU's reputation across major review platforms:

- SquaredFinancial EU REVIEWS.io: 4.3/5 with 59 scores, 86% of reviewers recommend the broker

- ForexPeaceArmy: 1.4 out of 5, only 4 reviews

Except for the second-mentioned website, which has too low ratings to be considered a reliable source for evaluation, SquaredFinancial EU has received decent trust scores on relevant websites.

Here are the broker's upsides and downsides based on the user reviews:

Upsides | Downsides |

Tight spreads | Mixed signals in the trade room |

Strong regulatory framework | Market manipulation |

Good customer support | Limited withdrawal options (Only via the funding source) |

Smooth deposit and withdrawal | Mandatory KYC for withdrawals |

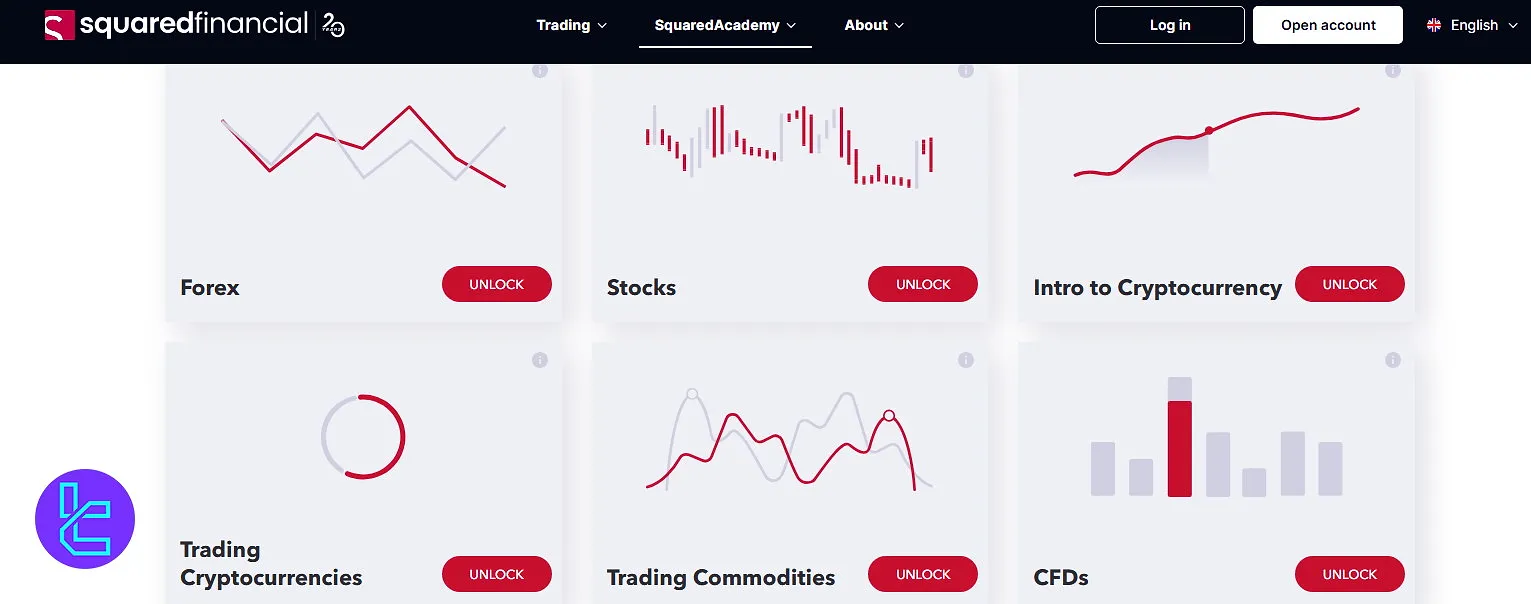

Education Content

The broker provides good and useful resources purposed for educating traders. Let's have a quick introduction of the SquaredAcademy section on the official website:

Education:

- E-books: Courses on Forex, cryptocurrencies, CFDs, trading psychologies, etc.

- Video Tutorials: Educational videos created in lessons for learning various topics

- Glossary: A dictionary of terms and phrases related to financial markets and trading

Analysis:

- Daily News: Videos containing news related to markets

- Market Watch: Lists of trading assets with weekly, monthly, and yearly changes

- Newsfeed: Short summaries of financial news around the globe

You can also access comprehensive learning materials through TradingFinder's Forex education section.

SquaredFinancial EU vs Other Brokers

Let's examine the broker's offerings and services in comparison with popular platforms in the market:

Parameter | SquaredFinancial EU Broker | Exness Broker | HFM Broker | FxPro Broker |

Regulation | CySEC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB |

Minimum Spread | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $0.0 | From $0.2 to USD 3.5 | From $0 | From $0 |

Minimum Deposit | From $0.0 | $10 | From $0 | $100 |

Maximum Leverage | 1:30 | Unlimited | 1:2000 | 1:500 |

Trading Platforms | MetaTrader 5, Proprietary App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App |

Account Types | SquaredPro, SquaredElite | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 2,000+ | 200+ | 1,000+ | 2,100+ |

Trade Execution | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending |

Conclusion And Final Words

SquaredFinancial EU broker has received a 4.2/5 overall score out of +50 reviews on the REVIEWS.io website. The ScamAdviser platform has given a "trustscore" of 96/100 to the discussed company.

You must make a deposit of at least $500 to open a SquaredElite account.