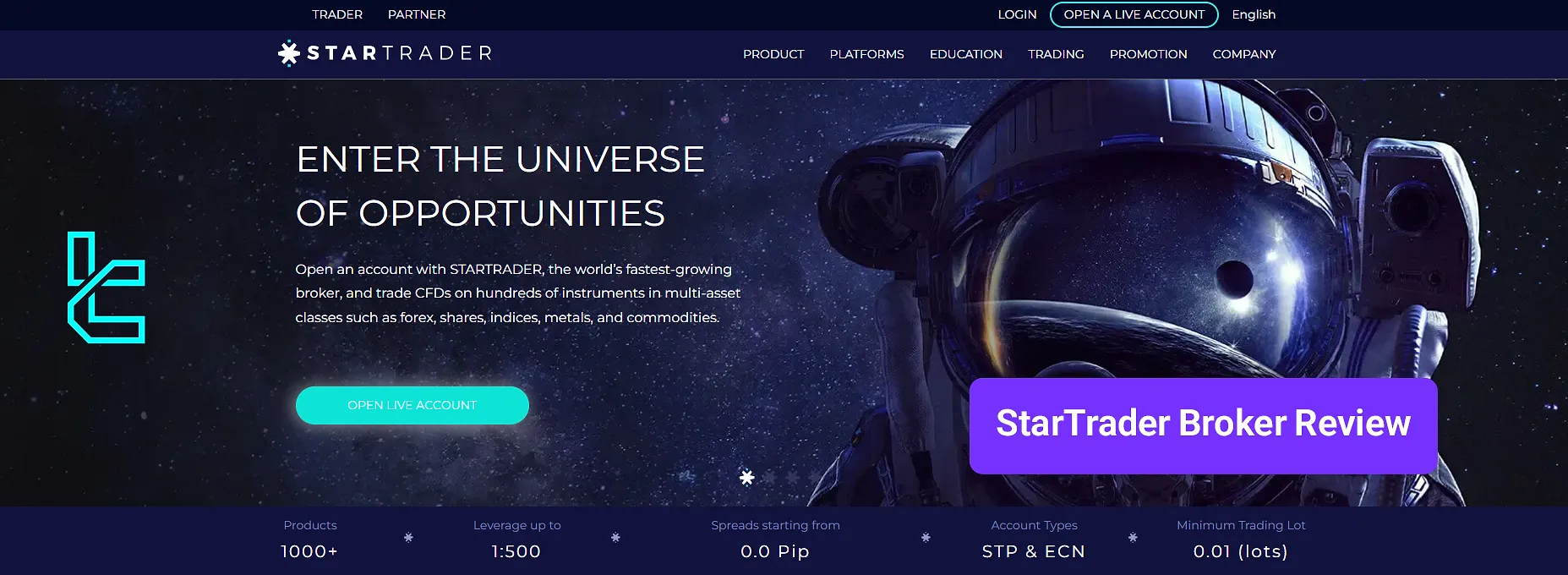

STARTRADER provides an STP/ECN platform offering 1000+ trading instruments with spreads from 0.0 pips for a minimum deposit of $50. The broker accepts PerfectMoney and Wise payments.

STARTRADER; Company Introduction and Regulation

Founded in 2012 and headquartered in Seychelles (Registration No. 8427362-1), StarTrader is a global multi-asset broker offering access to more than 1000 trading instruments, including over 50 forex pairs and 70+ global equities.

Clients can choose between two core account types (STP and ECN) and trade on widely trusted platforms, including MT4, MT5, WebTrader, and the proprietary StarTrader mobile app.

With leverage options of up to 1:500, spreads starting from 0.0 pips, and micro-lot trading from 0.01 lots, the broker caters to both beginners and experienced traders.

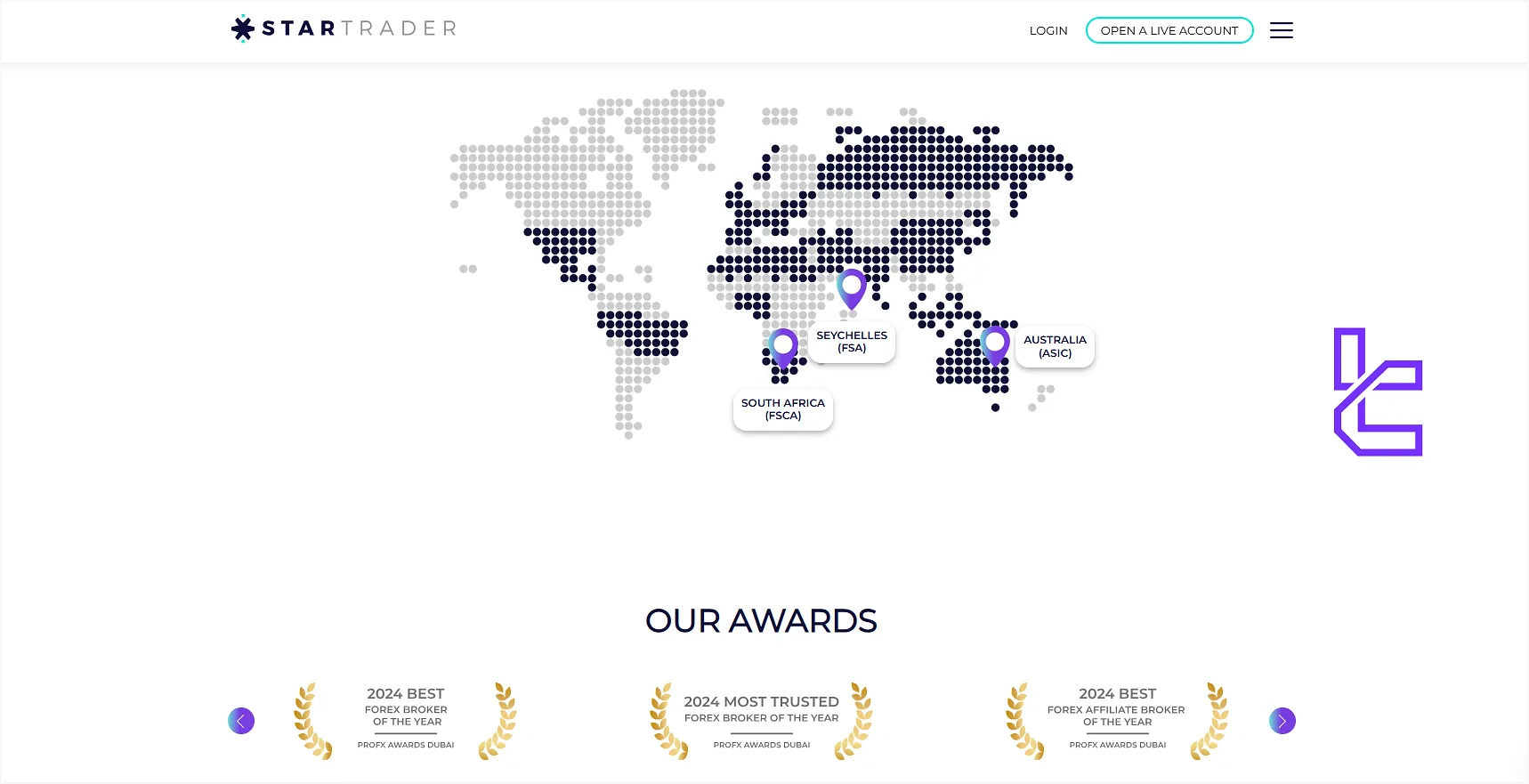

Regulated by multiple authorities, such as ASIC (Australia), FSA (Seychelles), and FSCA (South Africa), the broker operates with a high level of compliance and global recognition. StarTrader regulatory status:

| Entity Parameters/Branches | STARTRADER Global Financial Consultation & Financial Analysis | STARTRADER Prime Global Pty Ltd | STARTRADER Broker Limited | STARTRADER International Pty Ltd | STARTRADER Limited | STARTRADER Financial Markets Limited |

Regulation | SCA | ASIC | FCA | FSCA | FSA | FSC |

Regulation Tier | 2 | 1 | 1 | 2 | 3 | 3 |

Country | UAE | Australia | UK | South Africa | Seychelles | Mauritius |

Investor Protection Fund/Compensation Scheme | No | No | Up to £85,000 | No | No | No |

Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | No | Yes | Yes | No | No | No |

Maximum Leverage | 1:50 | 1:30 | 1:30 | 1:500 | 1:1000 | 1:1000 |

Client Eligibility | MENA | Australia | United Kingdom | Global | Global | Global |

Registration / License Number | 20200000241 | ACN 156005668 | 11380134 | 52464 | SD049 | GB24203371 |

Despite the varying regulator strength, all entities ensure the segregation of client funds and offer negative balance protection to mitigate trading risks.

Moreover, select branches (Seychelles and SVG entities) participate in third-party coverage schemes, including Financial Commission compensation (up to EUR 20,000) and a separate Excess of Loss Policy of up to $1 million.

Clients should be mindful of the jurisdiction they register under, as regulatory protections — particularly compensation eligibility — differ by entity.

StarTrader positions itself as a technologically-driven and regulation-compliant brokerage, appealing to global traders with its simple account structure, wide asset coverage, and flexible trading infrastructure.

StarTrader CEO

Peter Karsten leads StarTrader, a forex and CFD broker with offices in the Middle East and other regions, bringing over 20 years of financial industry expertise.

- Background: 20+ years in FX brokerage, platform tech, and global market expansion

- Leadership Goals: Regulatory licensing, MENA & Asia-Pacific growth, faster execution, multi-platform access

- Industry Presence: Active in expos, panels, and media promoting transparency and tech-driven trading

- Strategic Moves: Liquidity partnerships, stronger risk management, and localized client support

STARTRADER Specifications

STARTRADER offers a comprehensive trading experience with many features and services. Let’s take a quick look at what the Forex broker has to offer.

Broker | STARTRADER |

Account Types | STP, ECN |

Regulating Authorities | FCA, SCA, FSC, FSA, FSCA, ASIC |

Based Currencies | AUD, CAD, EUR, GBP, USD, NZD |

Minimum Deposit | $50 |

Deposit Methods | Visa/Mastercard, E-Wallet, International Bank Wire Transfer |

Withdrawal Methods | Visa/Mastercard, E-Wallet, International Bank Wire Transfer |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:1000 (Depend on the Country of Registration) |

Investment Options | Copy Trade services, MAM and PAMM Account |

Trading Platforms & Apps | Proprietary Mobile App, MT4, MT5 |

Markets | Forex, Commodities, Indices, Shares, Metals |

Spread | From 0.0 pips |

Commission | Variable based on the account type and instrument |

Orders Execution | Market |

Margin Call / Stop Out | N/A |

Trading Features | Copy Trading, MAM, PAMM, Knowledge Center, VPS, News Room, €20,000 compensation fund, Lloyd Insurance Coverage Up to $1M |

Affiliate Program | Yes |

Bonus & Promotions | Giveaways, 1% Switch Allowance, 20% bonus, 50%+20%, Affiliate Switch, VPS |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Phone, Ticket, Live Chat, Email |

Customer Support Hours | 24/6 |

STARTRADER Account Types

The company offers two main account types for different trading strategies and preferences: STP (Straight Through Processing) and ECN (Electronic Communication Network) accounts, with the following key features.

Features | STP | ECN |

Base Currency | AUD, CAD, EUR, GBP, USD, NZD | |

Order Execution Type | Market | Market |

Min Order Volume | 0.01 lots | 0.01 lots |

Demo account | Yes | Yes |

Spreads | From 1.0 pips | From 0.0 pips |

Commission | None (except for Indices) | Yes |

Both accounts offer market execution, support trade sizes from 0.01 up to 100 lots, and can be used on MT4 and MT5 platforms.

StarTrader also supports Islamic accounts, a 30-day demo account with $100,000 in virtual funds, and PAMM functionality for investment-based strategies.

STARTRADER Broker Pros & Cons

The company provides fast and accurate order execution by partnering with top-tier liquidity providers and utilizing advanced technologies.

However, as with any broker, STARTRADER has its strengths and weaknesses.

Pros | Cons |

Competitive spreads, especially on ECN accounts | Limited research and educational content |

Multiple deposit and withdrawal options | High entry barrier |

24/6 customer support | No support for cryptocurrencies |

Multiple regulatory licenses | - |

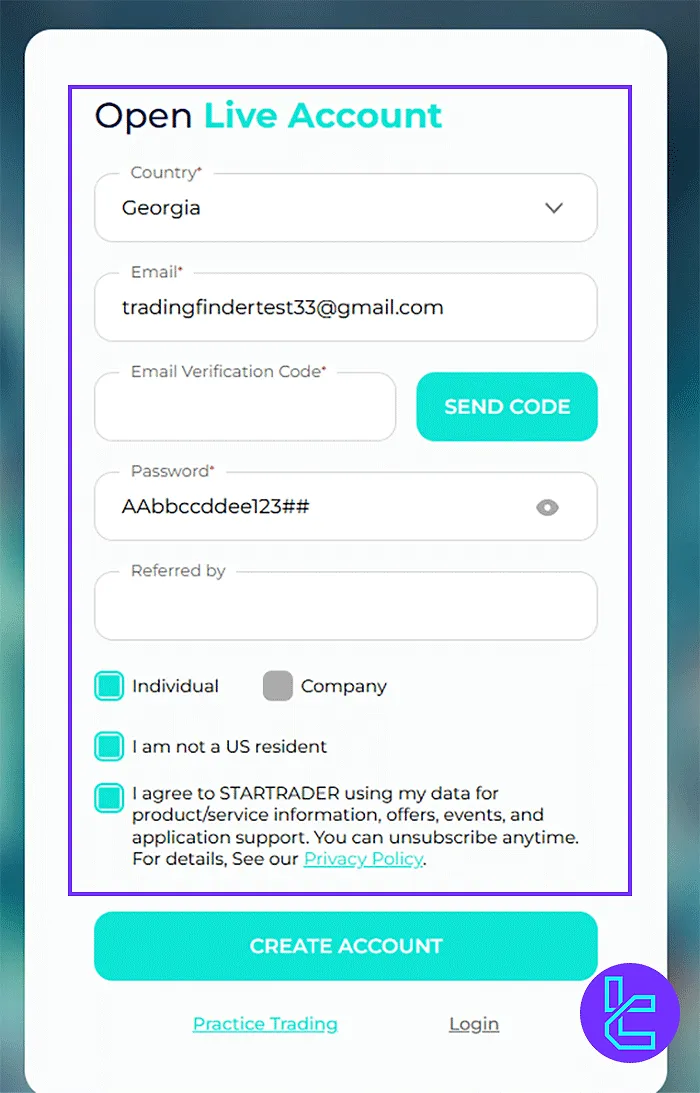

STARTRADER Account Opening and KYC Verification

Registering with Star Trader is a fast and streamlined process, enabling traders to access global financial markets through platforms like MetaTrader 5.

Whether you prefer Standard, Swap-Free, RAW, or PAMM accounts, the StarTrader registration process is completed in a few steps, all designed to suit both individuals and companies.

#1 Access the Star Trader Signup Page

Visit the official website and click "Open a Live Account" to get started.

#2 Fill Out the Basic Details

Enter the following information:

- Country of residence

- Email address

- Account password

Confirm whether you're registering as an individual or corporate account, declare your US residency status, and agree to the platform’s terms and conditions.

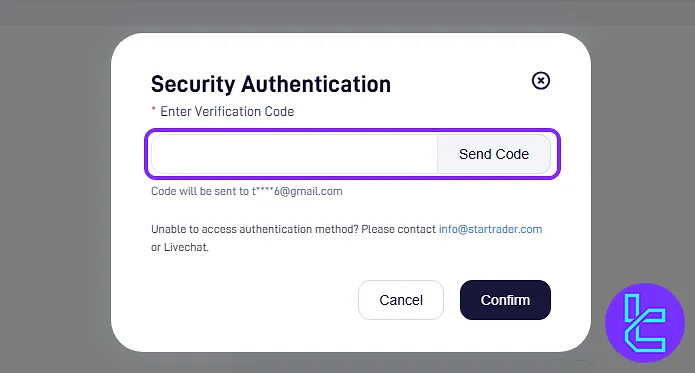

#3 Verify Your Email Address

Request the verification code, check your inbox, and paste the code into the registration form to proceed.

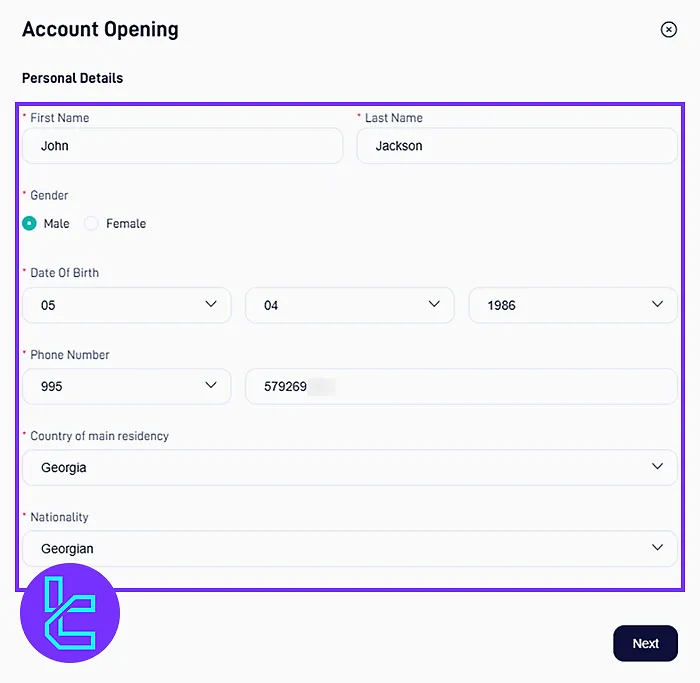

#4 Enter Personal Information

Provide your personal details, including:

- First and last name

- Gender

- Date of birth

- Phone number

- Nationality

- Country of residence

#5 Set Trading Preferences

Adjust your account settings by defining the following parameters:

- Trading platform (e.g., MetaTrader 5)

- Account type (Standard, Swap-Free, RAW, or PAMM)

- Account base currency

After confirming the terms, proceed to finalize your registration. To fully activate your trading account, you must complete the KYC verification procedure.

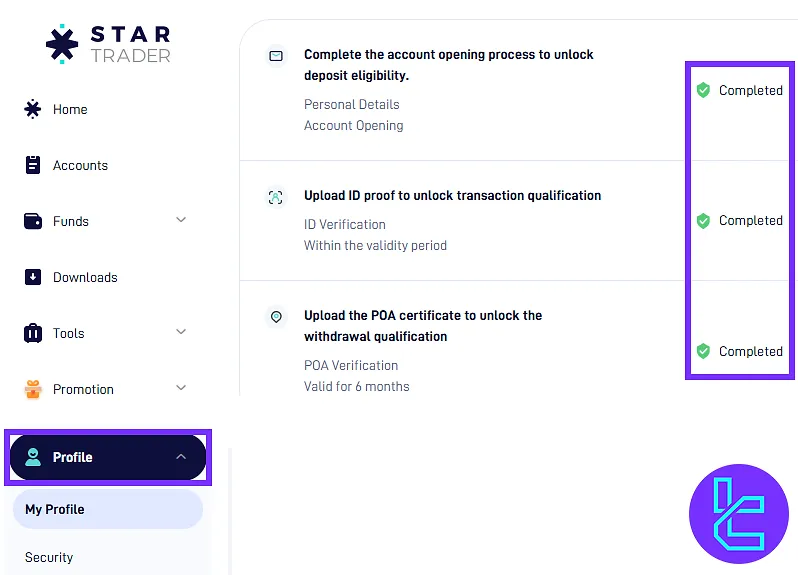

#6 Complete the KYC Process

Access your client area to initiate the StarTrader verification procedure. You'll be required to upload supporting documents, including:

- Proof of Identity: Passport or Driving license

- Proof of Address: Utility bill or Bank statement

STARTRADER Trading Platforms

We must discuss the available platforms in this STARTRADER review. The broker offers 3 different platforms, from the proprietary mobile app to the robust MetaTrader 4.

MetaTrader 4 (MT4)

The industry standard for forex trading with support foralgorithmic strategies (EAs), available on the following systems:

- MT4 Android

- MT4 iOS

- Desktop

- Webtrader

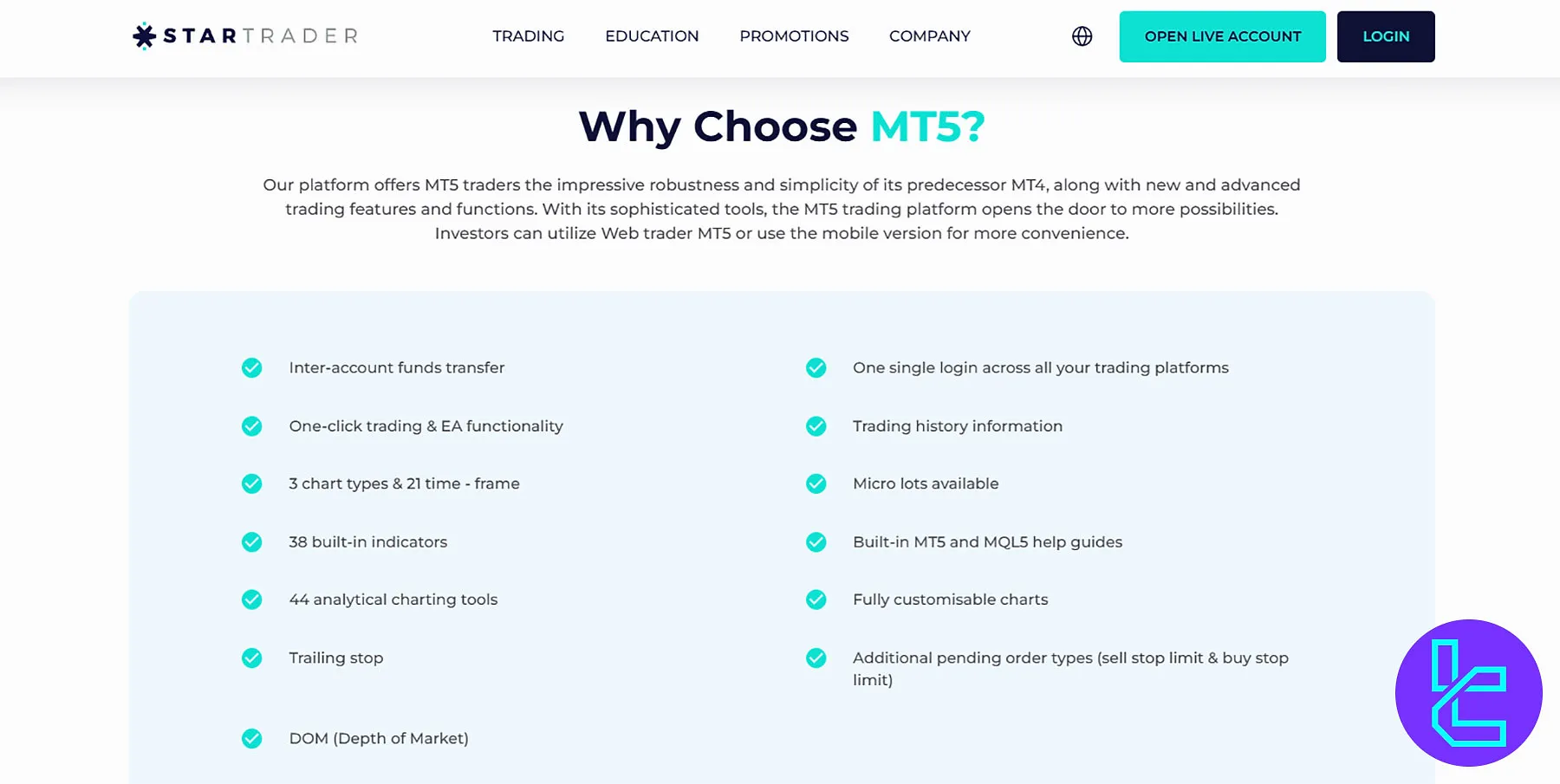

MetaTrader 5 (MT5)

A multi-asset platform offering advanced order types, additional indicators, and an integrated economic calendar.

- MT5 Android

- MT5 iOS

- Desktop

- Webtrader

STARTRADER App

A proprietary mobile app for on-the-go trading, equipped with essential charting and account management tools.

You can check TradingFinder's extensive list of MT4 indicators and MT5 indicators to access additional analytical tools for free.

STARTRADER Fees Explained

Understanding the fee structure helps you to plan your trading journey more accurately and maximize your profits. STARTRADER charges commissions on ECN accounts and STP (only Indices).

- STP (Standard) Account: Offers floating spreads embedded in the price, starting from 0.7 pips. No commission is charged (except for Indices);

- ECN Account: Delivers ultra-tight spreads from 0.0 pips, with a commission of $7 per lot. Best suited for scalpers and volume traders.

While spreads differ based on the account type, the asset class also plays a crucial role in the rates. STARTRADER STP account spread data :

Instrument | STP Min Spread (Pips) |

EURUSD | 1.4 |

GBPUSD | 1.8 |

USDJPY | 1.8 |

USOUSD | 3.0 |

UKOUSD | 3.0 |

XAGUSD | 2.4 |

XAUUSD | 1.7 |

AAPL | 0.7 |

Amazon | 1.4 |

NAS100 | 7.0 |

SPX500 | 3.6 |

StarTrader Swap Fees

Swap fees are calculated differently depending on the method used, and traders can view current rates directly in MetaTrader 4 or 5. Swap fee calculation methods include:

Here are the steps to check real-time rollover fees on MetaTrader:

- Desktop: Navigate to Market Watch, right-click the product, and select Specification

- Android: Go to the Quotes tab, tap product, check Symbol Properties

- iOS: Navigate to the Quotes tab, tap instrument, bring up Details

Swap rates are average to high, depending on position direction and asset.

StarTrader Non-Trading Fees

Non-trading costs are minimal as StarTrader does not impose fees on deposits, withdrawals, or inactivity.

STARTRADER Broker Payment Options

The company offers a wide range of payment options to cater to traders from different regions and with varying preferences. STARTRADER payment methods:

- Credit/Debit Cards: Visa and MasterCard

- International Bank Transfer: Bank Wire

- E-Wallets: SticPay, Perfect Money, and Wise

StarTrader Deposits

StarTrader enables fast and fee-free funding via cards, e-wallets, and crypto, while bank transfers take longer.

International telegraphic transfers have a ~$20 fee. Minimum deposit is 50 units with no maximum limit.

Deposit Method | Processing Time | Fee | Min Deposit | Max Deposit |

VISA / Mastercard | Instant (24/7) | None | 50 units | No limit |

Cryptocurrency | 1 hour | None | 50 units | No limit |

Wire Transfer | 2–5 business days | $20 (International TT) | 50 units | No limit |

STICPAY | Instant (24/7) | None | 50 units | No limit |

Bitwallet | Instant (24/7) | None | 50 units | No limit |

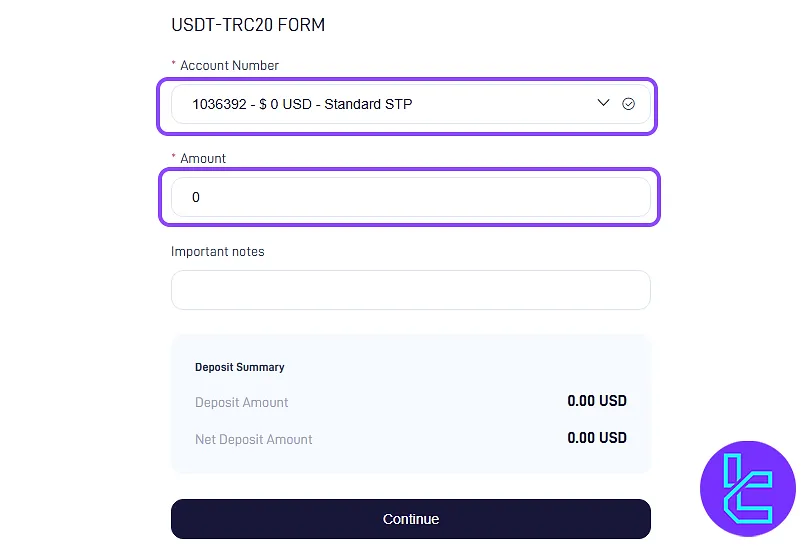

StarTrader TRC20 Deposit

Funding your account with USDT via the TRC20 network is quick and affordable, requiring a minimum of $50 and an average network fee of about $1. Key points about StarTradder TRC20 deposits:

- 5-step process: Navigate through the client dashboard to Funds, Deposit Funds, Cryptocurrency, USDT TRC-20, and Transfer & confirm;

- A QR code or wallet address is provided for transfer;

- Transaction status is trackable in "Transaction History"; processing usually completes within minutes;

- Works via personal crypto wallet or licensed exchange.

StarTrader Withdrawals

Withdrawals are processed via the same methods as deposits, offering 0% broker fees with potential third-party charges.

Transactions are handled promptly based on GMT cut-off times (before 07:30 GMT: same-day processing / after 21:00 GMT – next-day processing).

- Processing speed: Usually within 24 hours

- Minimum withdrawal: 30 units (or full account balance if less)

- Maximum withdrawal: No limit

- Fees: None from StarTrader; payment provider charges may apply

Note: Crypto transactions may incur blockchain network fees.

StarTrader TRC20 Withdrawals

StarTrader TRC20 withdrawal is a fast, low-cost process, typically completed in under 5 minutes with no broker commission fees. Key Points:

- 4-step process: Log in to the client portal and navigate to "Withdraw Funds", select account & amount, enter wallet, and confirm via email code;

- Transfers use the Tron (TRC20) network with minimal blockchain fees;

- Optional notes can be added to withdrawal requests;

- Track payout progress in Transaction History.

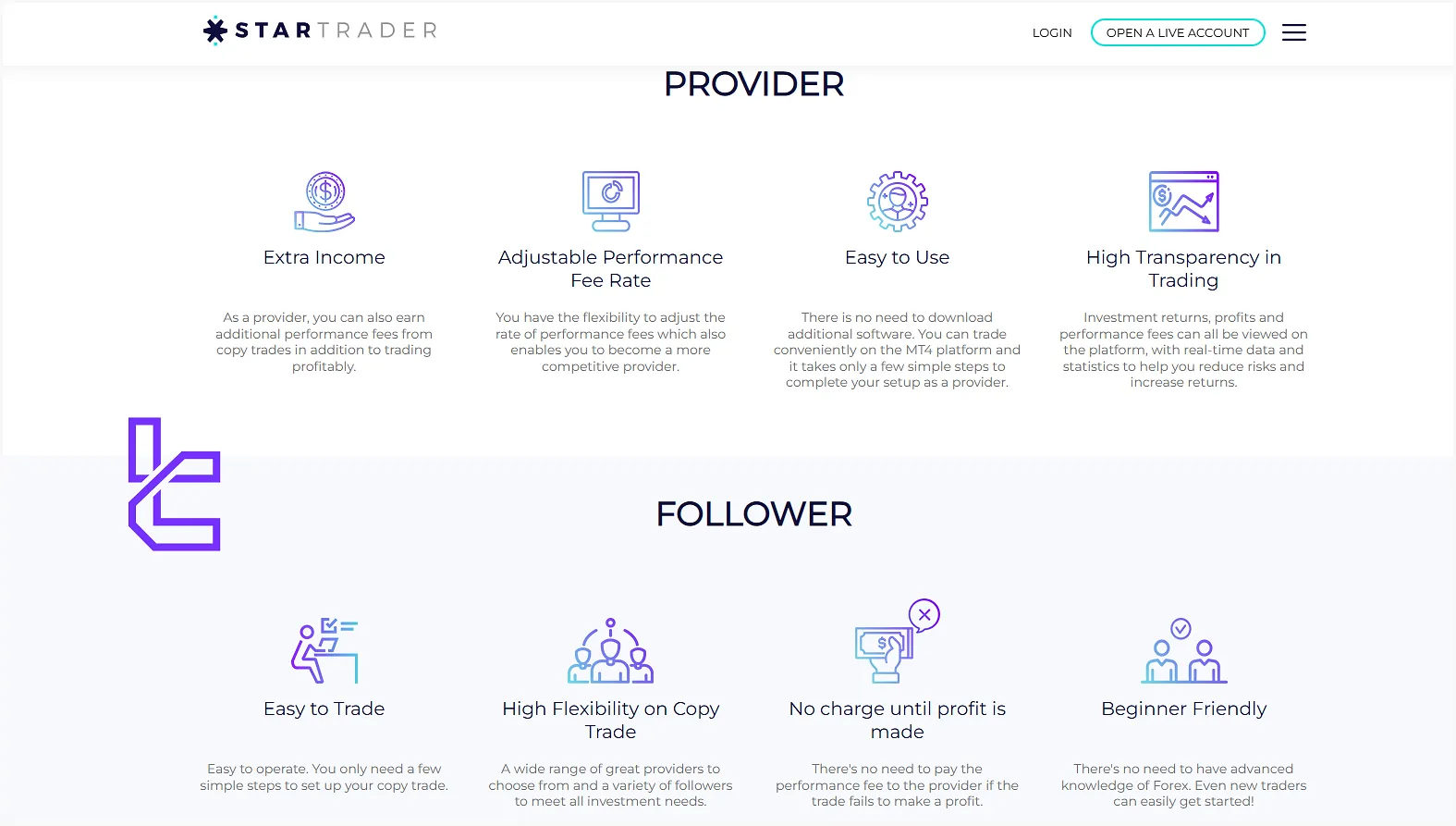

STARTRADER Copy Trading and Investment Plans

The broker offers MAM and PAMMaccounts. They also provide a comprehensive copy trading service.Key features of the STARTRADER copy trade:

- Available on MT4/5 and mobile app platforms

- Suitable for investors and strategy providers

- Adjustable performance fee rate

- Additional income for money managers

- No charges until a profit is made

- Diverse strategy selection filtered by performance, risk level, and trading instruments

STARTRADER has listed More than 2260 strategies on its copy trading service

STARTRADER has listed More than 2260 strategies on its copy trading service

StarTrader Financial Markets

StarTrader supports a diversified trading environment with access to over 1000 instruments across five major asset classes, from the Forex market to Stocks, allowing traders to diversify their portfolios and take advantage of various trading opportunities.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max Leverage |

Forex | CFDs | Over 50 | 50 - 70 currency pairs | 1:1000 |

Indices | CFDs | Over 20 | 10 - 20 instruments | N/A |

Stocks | CFDs | 700+ | 800 - 1200 | N/A |

Metals | CFDs | 6 trading pairs on Gold and Silver | 3 - 10 | N/A |

Commodities | CFDs | 10+ energy and agricultural product symbols | 10 - 20 | N/A |

ETFs | CFDs | 300+ | 20 - 30 | N/A |

Trading is exclusively offered via CFDs. Copy trading is integrated into the MT4 platform and the proprietary app, allowing investors to replicate strategies of top performers. Futures markets and real stock investing are not supported.

STARTRADER Broker Bonus and Promotions

The broker offers a variety of bonuses and promotions to attract new clients and reward existing ones, including:

- 1% Switch Allowance: A 1% bonus on the initial deposit for traders switching from other brokers

- 50%+20%: A 50% deposit bonus + additional 20% on subsequent deposits

- 20%: 20% extra funds on deposits above $250

- Affiliate Switch: Up to $5,000 bonus for a $100,000 net deposit, plus additional percentages for higher amounts for affiliates transferring their clients to STARTRADER

- Giveaways: Gifts and reward giveaways, such as Amazon Vouchers, Apple world Travel Adaptor, and AirPods Pro, based on trading activity

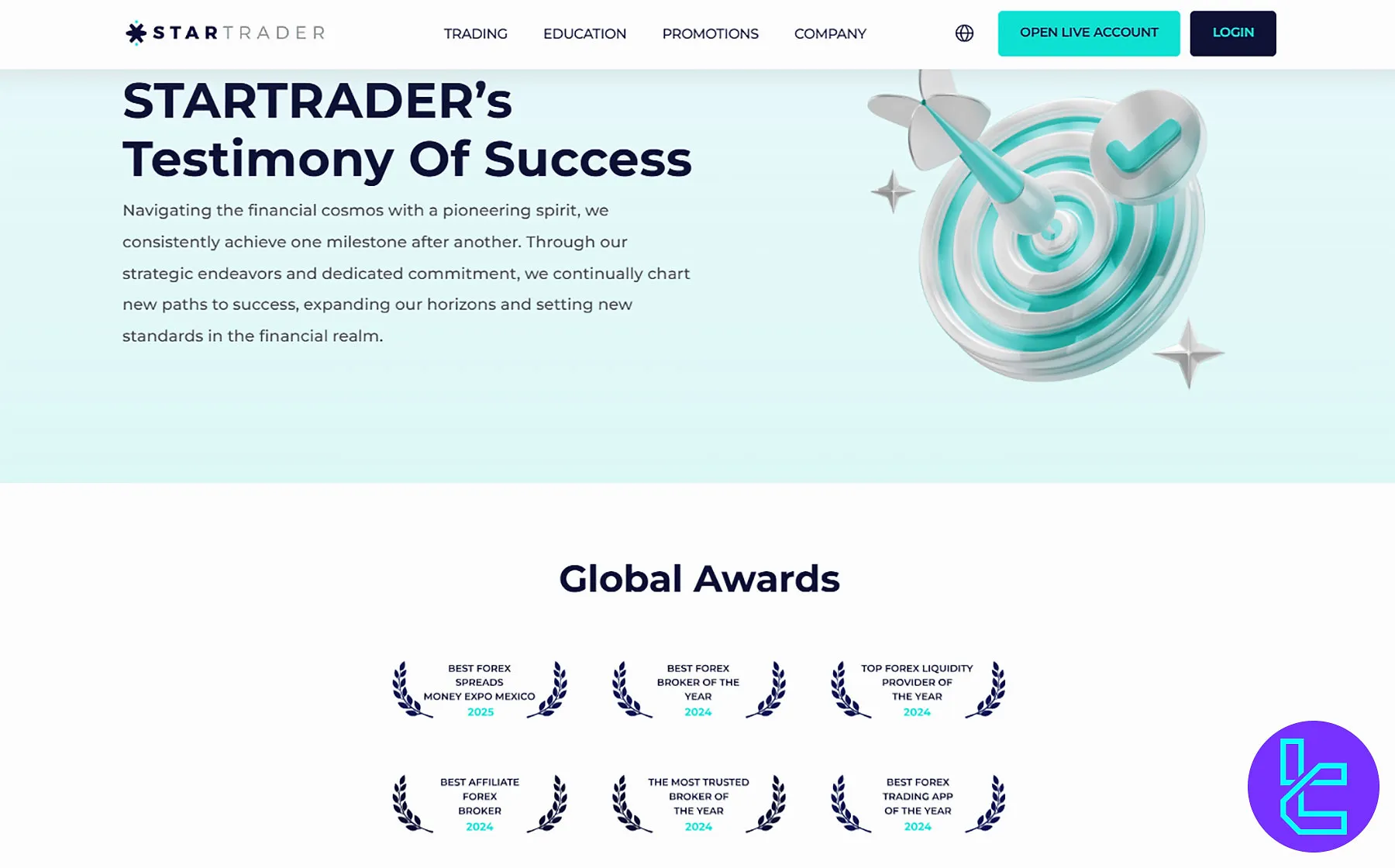

StarTrader Awards

The company continues to set benchmarks in the forex industry, earning global recognition through innovation, client focus, and a strong ethical foundation. Recent StarTrader awards:

- Best Forex Spreads 2025

- Best Forex Broker of the Year 2024

- Top Forex Liquidity Provider 2024

- Best Affiliate Forex Broker 2024

- Trusted Broker of the Year 2024

- Best Forex Trading App of the Year 2024

How to Reach STARTRADER Support?

The company provides 24/6 support through various channels, including email, phone, ticket, and live chat.

info@STARTRADER.com | |

Tel | +248 4325865 |

Live Chat | Available on the official website |

Ticket | Through the “Contact Us” page |

STARTRADER Restricted Countries

The company, like many online brokers, operates under specific regulatory frameworks and, therefore, has restrictions on the regions it can serve.

Red flag countries on STARTRADER:

- Afghanistan

- Cuba

- Eritrea

- Iraq

- Islamic Republic of Iran

- Israel

- Liberia

- Libya

- Malaysia

- Nicaragua

- Pakistan

- Russian Federation

- Somalia

- Syrian Arab Republic

- Sudan

- United States

- Italy

- Ukraine

- France

- Spain

- Estonia

- Slovenia

- Finland

- Denmark

- Indonesia

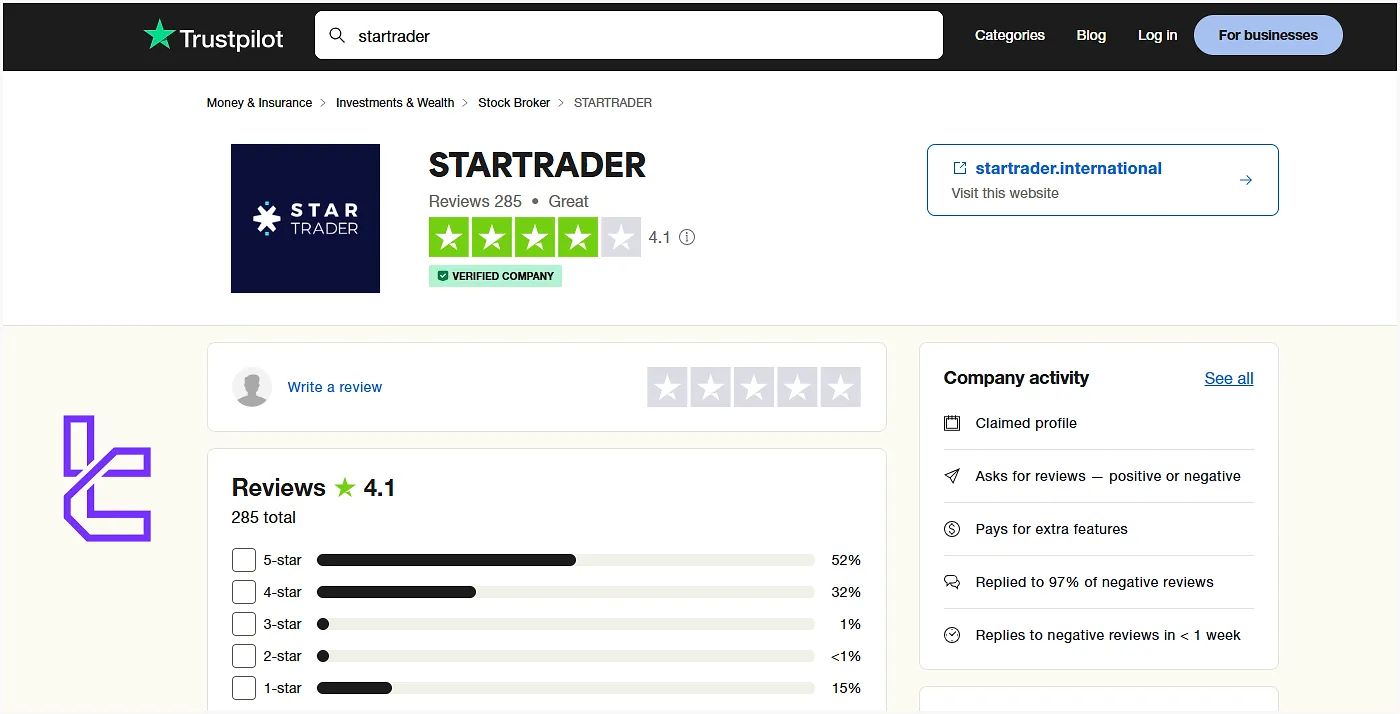

STARTRADER Trust Score

User Satisfaction is one of the most important topics in this STARTRADER review.

85% of reviews on the STARTRADER’s TrustPilot profile are 4-star and 5-star

85% of reviews on the STARTRADER’s TrustPilot profile are 4-star and 5-star

The company’s trust score can be assessed through various independent review platforms.

4.1 out of 5.0 based on 285 reviews | |

Reviews.io | 1.4 out of 5.0 based on 8 ratings |

Does StarTrader Broker Provide Educational Materials?

The company offers a modest suite of educational and research tools. Its Knowledge Center provides introductory articles and strategy overviews aimed at beginners.

The platform also includes an economic calendar and weekly market insights highlighting key support and resistance levels. StarTrader educational resources:

- Knowledge Center: A to Z of trading for beginners and intermediates

- Webinars: Webinars, seminars, and workshops provided by market experts

- Economic Calendar: A list of scheduled FX economic events

- News Room: Market trends, expert comments, economic events, and many more

Check TradingFinder's Forex education section for additional resources.

STARTRADER Comparison Table

Let's check the broker's services and compare them with other platforms.

Parameter | STARTRADER Broker | IC Markets Broker | XM Broker | LiteForex Broker |

Regulation | FCA, SCA, FSC, FSA, FSCA, ASIC | FSA, CySEC, ASIC | ASIC, FSC, DFSA, CySEC | CySEC |

Minimum Spread | From 0.0 pips | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips |

Commission | From $0.0 | From $3 | $0 (except on Shares account) | From $0.0 |

Minimum Deposit | $50 | $200 | $5 | $50 |

Maximum Leverage | 1:1000 | 1:500 | 1:1000 | 1:30 |

Trading Platforms | StarTrader App, MT4, MT5 | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App |

Account Types | STP, ECN | Standard, Raw Spread, Islamic | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo |

Islamic Account | Yes | Yes | Yes | No |

Number of Tradable Assets | 1,000+ | 2,250+ | 1400+ | N/A |

Trade Execution | Market | Market | Market, Instant | Market |

Conclusion and Final Words

STARTRADER provides spot and futures trading with leverage up to 1:500 via its two account types: STP and ECN. The company utilizes the robust MetaTrader 4/5 platforms for fast executions.

STARTRADER broker also offers MAM, PAMM, and copy trading features for money managers and investors. The wide range of services has gained the company a great score of 4.1 on TrustPilot.