Switch Markets Deposit and Withdrawal include MasterCard, Crypto, Visa, BankWire, and E-wallets. It offers a 0% payout across all methods, with a flat network fee only on Digital Currencies.

Users can deposit a minimum of $50 and enjoy no maximum limits on funding.

BMO Bank, Zenith Bank, and FasaPay deposits over $500 or $1000 receive fee reimbursements up to $30.

List of Deposit and Withdrawal Methods in Switch Markets

The long list of deposit and withdrawal methods on Switch Markets Broker includes traditional, digital, and local solutions; Switch Markets Transaction Options:

- Credit/Debit Cards

- Bank Transfers

- Digital Currencies

- E-Wallets

- Local Payment Methods

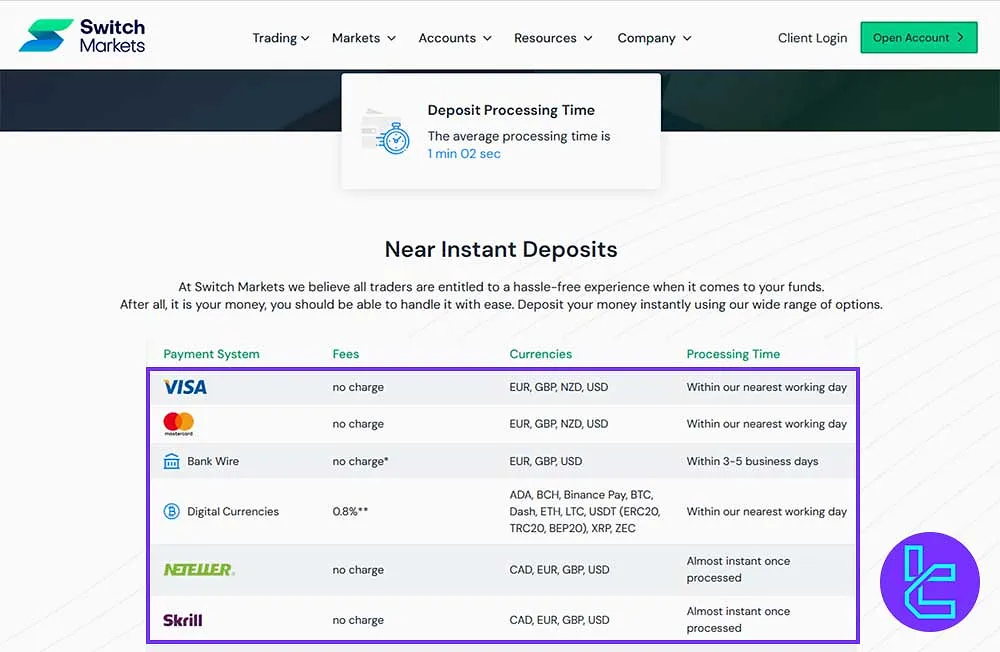

Switch Markets Deposit Methods

The broker offers 14 deposit options; Switch Markets Funding Methods:

- VISA

- MasterCard

- Bank Wire

- Digital Currencies

- Neteller

- Skrill

- Fasapay

- NganLuong.vn

- Perfect Money

- PayTrust88

- UnionPay

- Interac

- DragonPay

- VertuPay

Switch Markets Deposit Fees

All deposit fees are covered by the broker for most methods, with special coverage for high-value deposits; Switch Markets Funding Costs:

- Minimum Initial Deposit: $50 (or base currency;)

- Maximum Deposit: No limitations;

- Currency Conversion Fee: Applies when converting to a single base currency.

Switch Markets covers fees on BMO and Zenith Bank wires and up to $30 (or equivalent) in intermediary fees for deposits over $500; Deposits over $1000 via FasaPay are also fee-free.

Switch Markets Deposit Processing Time

Processing times depend on the payment method used; Switch Markets Funding Time:

Processing Time | Payment Methods |

Within our nearest working day | VISA, MasterCard, Digital Currencies, PayTrust88, UnionPay |

Within 3–5 business days | Bank Wire |

Within 3–4 business days | Interac |

Almost instantly, once processed | Neteller, Skrill, Fasapay, NganLuong.vn, Perfect Money, DragonPay, VertuPay |

Deposit Limits in Switch Markets

Minimum Initial Deposit is equivalent to $50 or base currency; Maximum Deposit has no limitations.

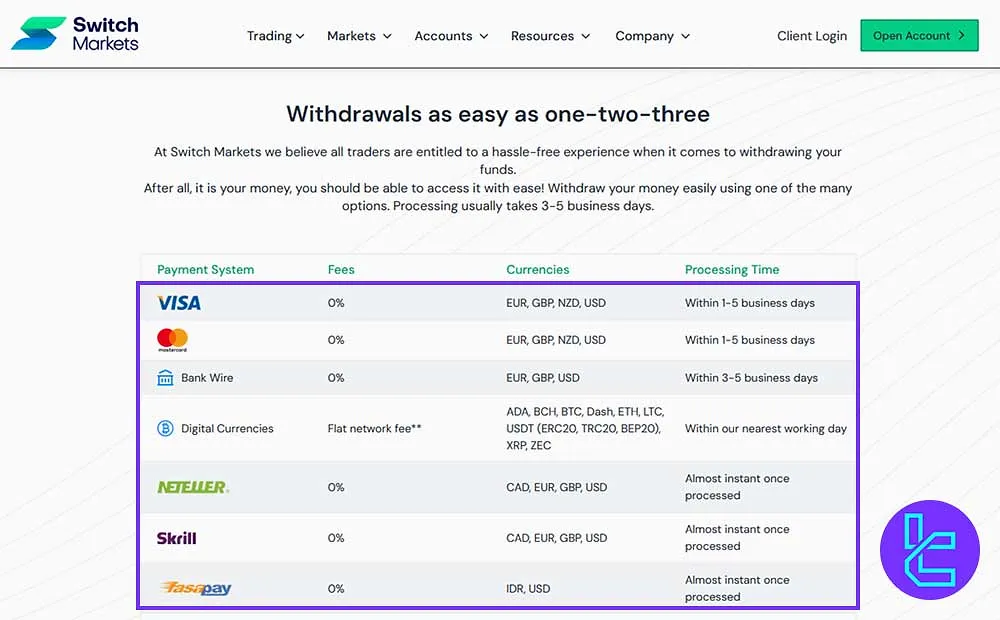

Switch Markets Withdrawal Methods

Switch Markets allows clients to use the same methods for withdrawals as deposits; Switch Markets Payout Options:

- VISA

- MasterCard

- Bank Wire

- Digital Currencies

- Neteller

- Skrill

- Fasapay

- NganLuong.vn

- Perfect Money

- PayTrust88

- UnionPay

- Interac

- DragonPay

- VertuPay

Switch Markets Withdrawal Fees

Withdrawals from Switch Markets come with 0% fees for all options, except for Digital Currencies with a Flat network fee.

Processing Time for Switch Markets Withdrawal

Processing times vary depending on the selected withdrawal method; Switch Markets Payout Time:

Withdrawal Method | Processing Time |

VISA | Within 1–5 business days |

MasterCard | Within 1–5 business days |

Bank Wire | Within 3–5 business days |

Digital Currencies | Within the nearest working day |

Neteller | instantly once processed |

Skrill | instantly once processed |

Fasapay | instantly once processed |

NganLuong.vn | instantly once processed |

Perfect Money | instantly once processed |

PayTrust88 | Within the nearest working day |

UnionPay | Within the nearest working day |

Interac | Within 3–4 business days |

DragonPay | Within 1–3 business days |

VertuPay | Almost instantly once processed |

Limits for Switch Markets Withdrawal

There is no limit for maximum withdrawal. It is also notable that Neteller is not available to EU residents.

Writer’s Opinion and Conclusion

Switch Markets Deposit and Withdrawal with Neteller, Skrill, and Perfect Money allow almost instant processing.

Withdrawals via Bank Wire, MasterCard, or Interac take 1–5 days or up to 3–5 days.

Switch Markets supports the same method of payouts through VISA, PayTrust88, or VertuPay.

For more guides about the broker, visit Switch Markets Tutorials.