Tacirler Yatırım is a prominent Forex broker that has been offering various financial services since its inception in 1991. This broker has 5,490 million TL in assets and 2,425 million TL in equity. Tacirler Yatırım has 26 offices in Turkey and is regulated by SPK.

Tacirler Yatırım Company Information & Regulation

Tacirler Yatırım Menkul Değerler Anonim Şirketi, commonly known as Tacirler Yatırım, is a well-established forex brokerage firm in Turkey. Since its inception in 1991, the company has built a strong reputation in the Turkish financial markets over the years. Here are some key points about the company:

- Regulation: Tacirler Yatırım is regulated by the Capital Markets Board of Turkey (SPK), ensuring adherence to financial standards and investor protection measures;

- Services: The company offers a wide range of investment services, including stock trading, derivatives (VIOP), Forex, asset management, and corporate finance.

- Experience: With over 30 years of experience in the Turkish financial market, Tacirler Yatırım has developed a deep understanding of local market dynamics.

Tacirler Yatırım Summary of Specifications

Here’s a general overview of Tacirler Yatırım broker:

Broker | Tacirler Yatırım |

Account Types | Real, demo |

Regulating Authorities | SPK |

Based Currencies | TRY |

Minimum Deposit | 50,000 TRY |

Deposit Methods | Bank transfer |

Withdrawal Methods | Bank transfer |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:10 |

Investment Options | Auto trading, portfolio management |

Trading Platforms & Apps | MT4, Tacirler Yatırım app |

Markets | Forex, indices, commodities, stocks, metals futures |

Spread | Floating from 0.5 pips |

Commission | No commission |

Orders Execution | Market |

Margin Call/Stop Out | 50%/20% |

Trading Features | Demo account, economic calendar |

Affiliate Program | No |

Bonus & Promotions | No |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, phone |

Customer Support Hours | 24/5 |

Restricted Countries | Iran, USA, North Korea, Canada, and more |

Tacirler Yatırım Broker Account Types Overview

Tacirler Yatırım offers two primary account types to cater to different investor needs:

- Real Accounts: These are live trading accounts where investors can trade with real funds in various financial markets;

- Demo Accounts: The demo account is available free of charge and provides an opportunity to test trading conditions using the MetaTrader 4 platform. To activate it, users must register on the official FXTCR website.

The minimum deposit required for live trading is 50,000 TRY, with the Turkish Lira (TRY) being the only supported account currency. The account offers a maximum leverage of 1:10. Notably, the broker does not support cent or PAMM account investment solutions, and trading terms remain the same for all users, regardless of deposit size.

Key features of Tacirler Yatırım accounts:

- Maximum leverage of 1:10, providing a balanced approach to risk management

- Access to multiple asset classes, including Forex, stocks, and commodities

- Real-time market data and advanced charting tools

- Risk management features to help control potential losses

Tacirler Yatırım Broker Benefits and Drawbacks

When considering Tacirler Yatırım as your broker, it's essential to weigh both the pros and cons:

Advantages | Disadvantages |

Regulated by SPK, ensuring reliability | Limited information available for international clients |

Diverse range of investment products | High minimum deposit of 50,000 TRY may deter smaller investors |

Over 30 years of experience in the industry | Only offers bank transfers for deposits and withdrawals |

| - | Lack of transparent data regarding trading fees |

How to Sign up and Verify in Tacirler Yatırım Broker?

Opening a trading account with Tacirler Yatırım requires just a few steps and grants access to products like FX and futures market. The process is designed for fast onboarding and includes secure data collection such as personal identification, contact information, and preferred trading instruments. Registration is available in both Turkish and English interfaces. Tacirler Yatırım registration:

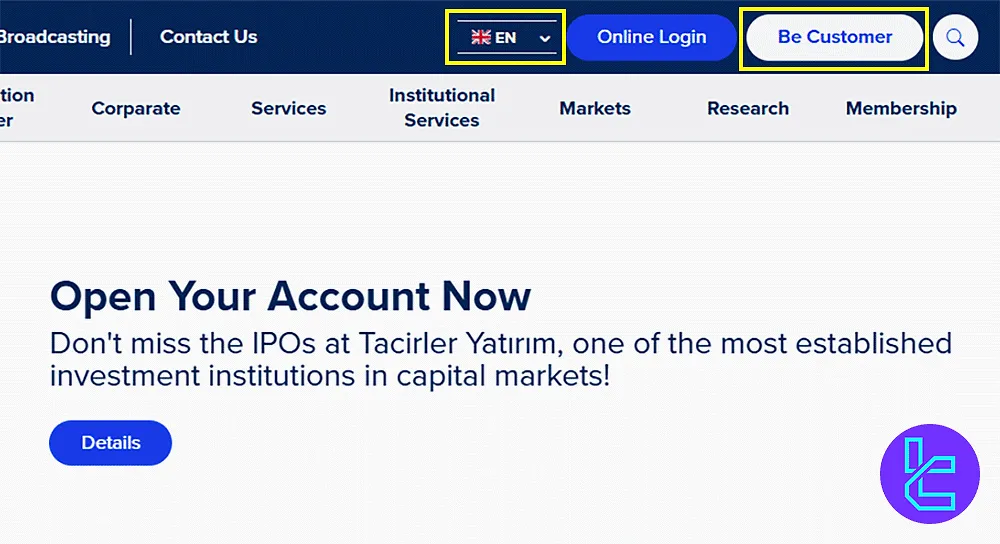

#1 Visit the Official Registration Portal

Go to the Tacirler Yatırım homepage, switch to the English version (if needed), and select “Be Customer” to launch the signup form.

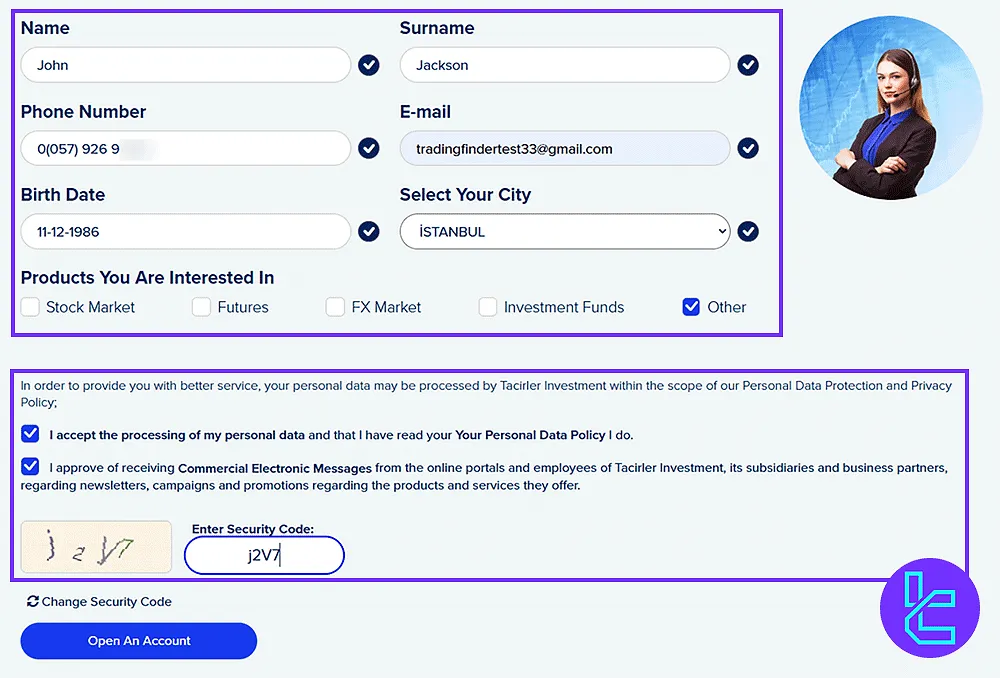

#2 Complete and Submit the Form

Enter your full name, mobile phone number, email address, birthdate, and city of residence. Choose your trading product, confirm the terms, pass the CAPTCHA, and hit “Open An Account.” A representative will follow up by phone or email to finalize the account setup.

Tacirler Yatırım Broker Trading Platforms Overview

Tacirler Yatırım offers two trading platforms for Forex and stock traders.

MetaTrader 4

MetaTrader 4 is renowned for its user-friendly interface and powerful features:

- Advanced Charting: Access to a wide range of technical indicators and drawing tools

- Automated Trading: Ability to use Expert Advisors (EAs) for algorithmic trading

- Custom Indicators: Option to create or import custom indicators

- Mobile Trading: MT4 mobile app for trading on-the-go

- Market Analysis: Built-in market analysis, technical analysis and news feed

- Multiple Order Types: Support for various order types, including stop-loss and take-profit orders

Download links:

Mobile App

For traders who prefer to have access to Tacirler Yatırım services wherever and whenever they want, it offers a mobile app with various features:

- Fast order execution

- Quick access to bulletins and analyses

- Price alerts

- Various tradable instruments, including Borsa Istanbul Indices, currency pairs, commodities, leading US, Europe, Japan, Germany, France, and England indices

Download links:

Tacirler Yatırım Fees (Spreads and Commissions)

Unfortunately, Tacirler Yatırım isn’t transparent regarding the trading fees on its platforms. However, our evaluations revealed that the broker spread varies between 0.5 and 1.0 pips on major Forex pairs. For example, check the pairs below:

- EUR/USD: from 0.5 to 0.9 pips

- GBP/USD: from 0.5 to 1.1 pips

It’s worth mentioning that Tacirler Yatırım broker has a commission-free cost structure. Other fees in Tacirler Yatırım broker:

- No inactivity fee

- No deposit fee

- No withdrawal fee

Broker Deposit & Withdrawal Methods in Tacirler Yatırım

Tacirler Yatırım has specific requirements for deposits:

- Minimum Deposit: 50,000 TRY (Turkish Lira)

- Deposit Method: Bank transfer only

While this high minimum deposit may be a barrier for some traders, it also indicates that Tacirler Yatırım caters to more serious investors. The reliance on bank transfers is a major drawback that could discourage many traders from joining the platform. For withdrawal, traders should know that:

- The only withdrawal method is bank transfers

- Traders can withdraw USD or TRY

- Withdrawal processing hours are 9:00 to 16:00

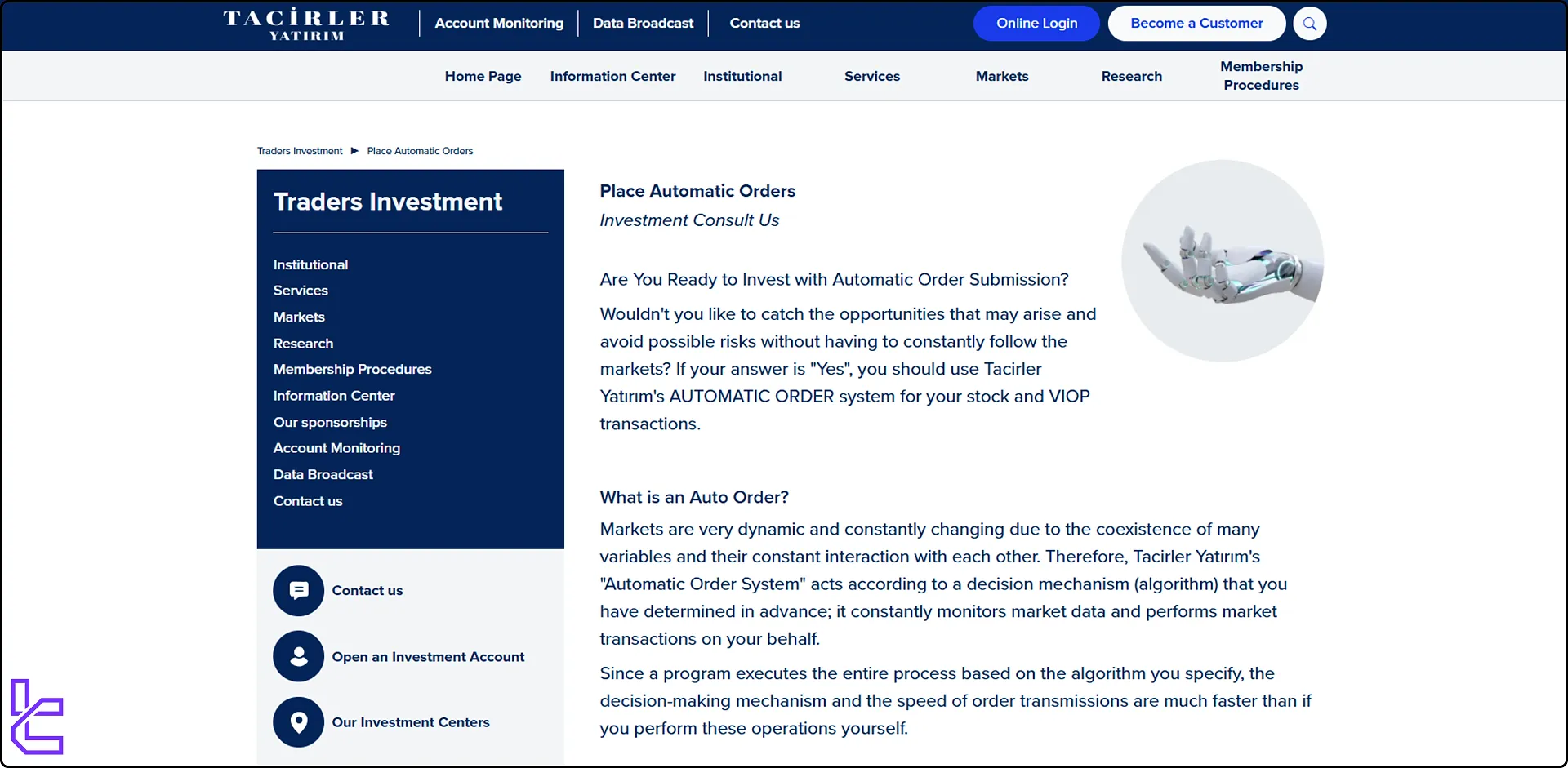

Copy Trading & Investment Options Offered on Tacirler Yatırım

Tacirler Yatırım broker offers several investment options to cater to different investor needs:

- Individual Portfolio Management: Tailored investment strategies based on individual client goals and risk tolerance with a 20% performance fee;

- Investment Consultant: Professional advice and guidance on investment decisions;

- Auto trading: Automatic order execution based on predefined parameters on stocks and VIOP.

These services provide flexibility for investors with varying levels of market knowledge and time commitment.

Tacirler Yatırım Markets & Instruments Overview

Tacirler Yatırım provides access to a diverse range of financial markets:

- Forex: Trading 50 major, minor, and exotic currency pairs

- Indices: Access to global stock market indices, including S&P 500 and FTSE 100

- Stocks: Trading individual company stocks, with a focus on Turkish equities

- Commodities: Including gold, silver, and oil

- Metal Futures: Trading contracts for future delivery of metals

With access to numerous asset classes, investors can diversify their holdings and leverage opportunities in multiple markets.

Tacirler Yatırım Broker Bonuses

Unfortunately, Tacirler Yatırım doesn’t offer any bonuses or affiliate programs at the moment. This can be a drawback for traders looking to increase their trading capital.

Tacirler Yatırım Broker Support Methods and Hours

Tacirler Yatırım provides customer support through:

- Email: destek@Tacirler.tr

- Phone: +902123554646

- Visit their physical office

The support team is active 24/5 but only offers help in Turkish.

Tacirler Yatırım Broker Restricted Countries

Here’s a list of countries Tacirler Yatırım doesn’t provide services in:

- United States

- Canada

- Japan

- North Korea

- Iran

- Iraq

- Belgium

- Sudan

Tacirler Yatırım User Reviews and Trust Scores

We couldn’t locate user reviews for Tacirler Yatırım on major review platforms like Trustpilot, Reviews.io, or ForexPeaceArmy. This lack of feedback can be a disadvantage for new traders seeking insights into the broker’s strengths and weaknesses before committing.

To get a clearer picture of the service quality, we recommend engaging with other traders on Tacirler Yatırım’s social media channels, such as Instagram and Twitter, where you can find firsthand experiences and updates from the community.

Tacirler Yatırım Educational Resources

Tacirler Yatırım appears to offer educational resources to its clients, including:

- Economic reports

- Market news

- Daily bulletins

- Global market reports

- Company and sector analysis

These educational materials can be valuable for traders looking to improve their market knowledge and make informed investment decisions.

Tacirler Yatırım Comparison with Other Brokers

Is Tacirler Yatırım a good choice in comparison with other brokers? Find the answer in table below:

| Parameters | Tacirler Yatırım Broker | IC Markets Broker | XM Broker | TMGM Broker |

| Regulation | SPK | FSA, CySEC, ASIC | ASIC, FSC, DFSA, CySEC | ASIC, VFSC, FSC, FMA |

| Minimum Spread | Floating from 0.5 pips | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips |

| Commission | No commission | From $3 | $0 (except on Shares account) | From $0.0 |

| Minimum Deposit | 50,000 TRY | $200 | $5 | $100 |

| Maximum Leverage | 1:10 | 1:500 | 1:1000 | 1:1000 |

| Trading Platforms | MT4, Tacirler Yatırım app | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | MT4, MT5, IRESS, TMGM Mobile App |

| Account Types | Real, demo | Standard, Raw Spread, Islamic | Micro, Standard, Ultra Low, Shares | EDGE, CLASSIC |

| Islamic Account | No | Yes | Yes | Yes |

| Number of Tradable Assets | Not Specified | 2,250+ | 1400+ | 12000+ |

| Trade Execution | Market | Market | Market, Instant | Market, Instant |

TF Expert Suggestion

Tacirler Yatırım presents itself as a well-established Turkish broker offering services to individual and institutional investors under regulatory oversight of the SPK financial authority.

Its offering of the popular MT4 platform, diverse range of tradable assets (Forex, indices, commodities, metals, futures, stocks), and focus on the Turkish stock and bonds market make it an interesting option for investors interested in financial markets in this country.

However, the high minimum deposit ($1500), lack of transparent data on platform fees, and limited information for international clients may be drawbacks for potential users.