TeleTrade is a Forex and CFD broker with spreads starting from 0.2 pips and trading commissions of at least 0.007%. The company offers Synchronous Trading as a copy trading service to its clients.

The support department provides its services via 4 channels [chat, call back request, ticket, email].

TeleTrade Broker Company Information & Regulation

TeleTrade, established in 1994, has grown to become a global player in the forex and CFD trading industry. With offices in 26 countries, this broker has certainly proven its staying power in the volatile world of forex trading.

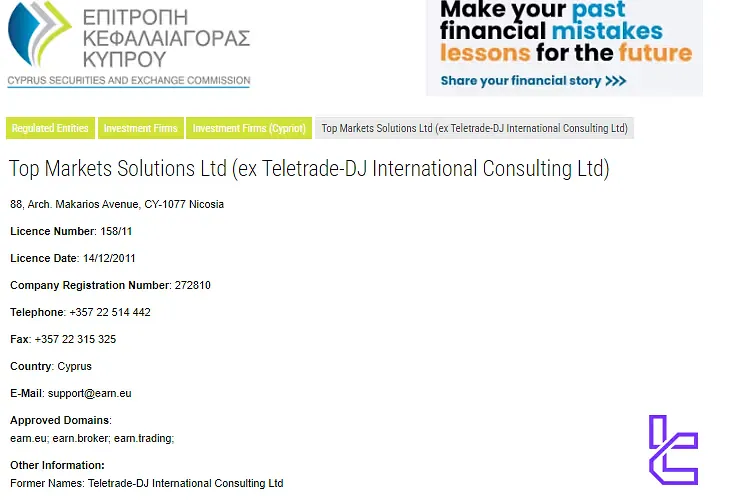

One of TeleTrade's strengths lies in its regulatory framework. The company operates under the supervision of the Cyprus Securities and Exchange Commission (CySEC), a top-tier authority. The TeleTrade CySEC license number is 158/11.

The broker serves retail and professional clients with access to a diverse set of global markets, including forex, metals, indices, energy products, shares, cryptocurrencies, and commodities.

Traders can choose between MetaTrader 4 and MetaTrader 5 platforms and benefit from flexible account options.

| Entity Parameters/Branches | Top Markets Solutions Ltd |

Regulation | CySEC |

Regulation Tier | 1 |

Country | Cyprus |

Investor Protection Fund/Compensation Scheme | Up to €20,000 Under ICF |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:500 |

Client Eligibility | European Clients |

TeleTrade Summary of Specifics

At this section of the review, we will have a look at the main specifics and features of the broker. TeleTrade Specifications:

Broker | TeleTrade |

Account Types | ECN, NDD, CENT |

Regulating Authorities | CySEC |

Based Currencies | USD, EUR |

Minimum Deposit | $10 |

Deposit Methods | Bank Transfers, Credit/Debit Cards, E-Payment Systems, Local Payment Options |

Withdrawal Methods | Bank Transfers, Credit/Debit Cards, E-Payment Systems, Local Payment Options |

Minimum Order | 0.01 lot |

Maximum Leverage | 1:500 |

Investment Options | Copy Trading |

Trading Platforms & Apps | MT4, MT5 |

Markets | Forex, CFDs on Stocks, Indices, Energies, Cryptocurrencies, Bonds, Commodities |

Spread | From 0.2 pips |

Commission | From 0.007% |

Orders Execution | Market, Instant |

Margin Call/Stop Out | 100%/20% |

Trading Features | Synchronous Trading |

Affiliate Program | Yes |

Bonus & Promotions | Equity Boost, Trading Competitions, Accruals |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Chat, Call Back Request, Ticket, Email |

Customer Support Hours | 24/7 |

TeleTrade Trading Account Types

This company offers a variety of account types to provide services for all users with different trading styles and preferences. In this section, we will explore each of them in detail in a table:

| Account Type | CENT | NDD | ECN |

Leverage | 1:500 | ||

Stop Out | 20% | ||

Platform | MT4/5 | MT4 | MT5 |

Note: Each account starts with a minimum deposit of $10.

Also, there's a demo account available on the broker, providing a risk-free practice environment for testing trading strategies and getting familiar with the interface.

TeleTrade Important Advantages and Disadvantages

Let's weigh the pros and cons of trading with TeleTrade with a balanced measurement. TeleTrade Pros and Cons:

Advantages | Disadvantages |

Long-standing reputation (29+ years) | Not available in some countries |

| - | A license from a top-tier regulatory authority |

| - | Popular MT4 and MT5 platforms |

| - | Wide range of trading instruments |

| - | Copy trading and social trading options |

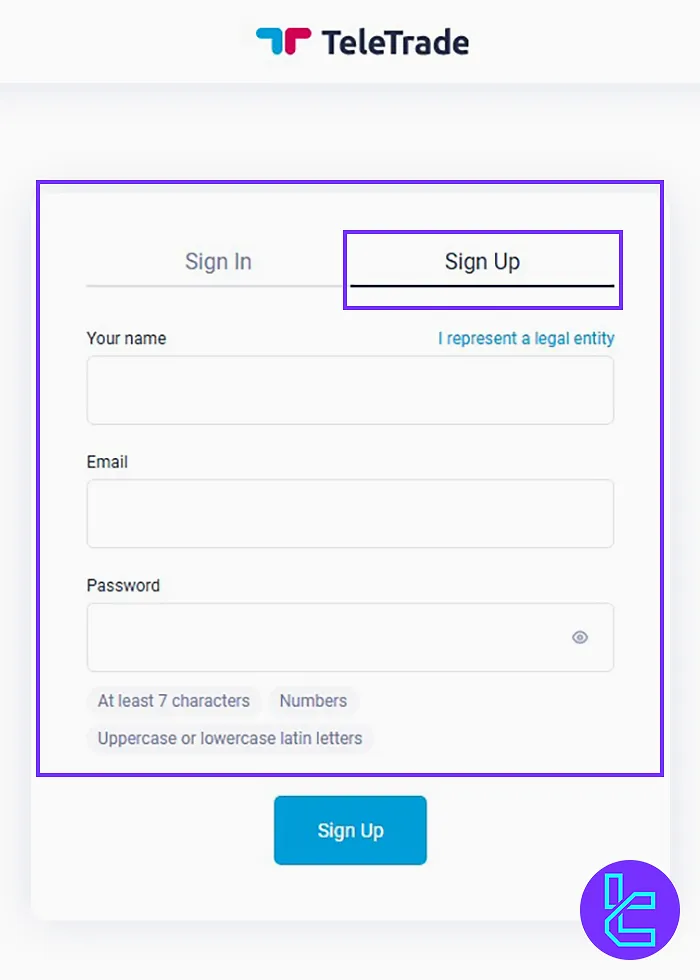

TeleTrade Signing Up & Verification: Complete Guide

The TeleTrade registration process takes just 5 minutes. New users must provide identity and contact information, choose login credentials, and submit a separate payment password for security.

The platform sends MetaTrader login credentials by email after account creation.

#1 Open the Signup Page

Go to the TeleTrade homepage and access the Personal Area. From there, click on the "Sign Up" section to begin creating your account.

#2 Fill in the Initial Details

Enter the following information:

- First name

- Email address

- Password (with a mix of uppercase, lowercase, numbers, and symbols)

Confirm the password and click "Sign Up".

#3 Complete Profile and Secure Your Account

Provide additional information, including:

- Surname

- Phone number

- Date of birth

- Residential address

- Employment and financial details

Then create and confirm a payment password. Accept the terms and click "Open an Account". Now, you can access the TeleTrade dashboard.

#4 Proceed with the KYC Procedure

Navigate to the "User Authentication" menu through the client area to initiate the TeleTrade verification process and upload supporting documents, including:

- Proof of Identity: Passport or National ID

- Proof of Address: Utility bill or Bank statement

- Selfie

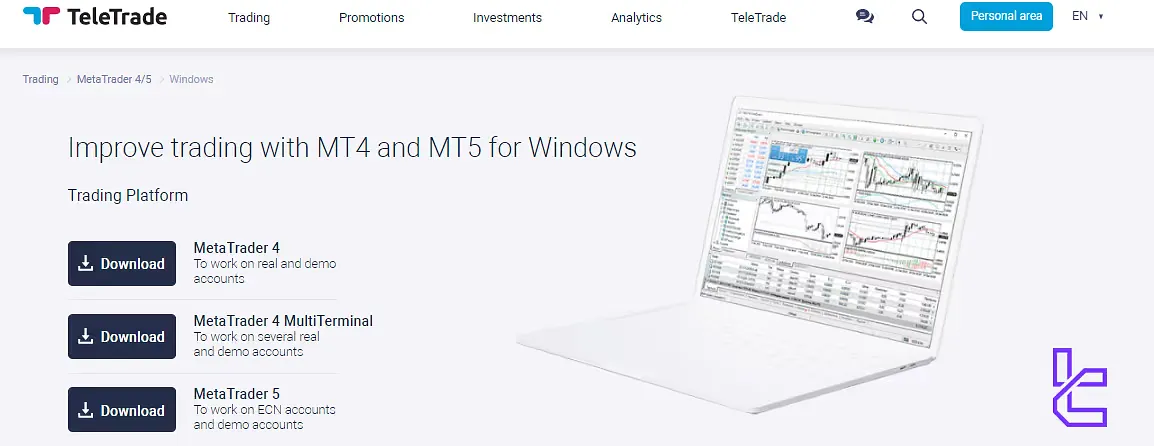

TeleTrade Broker Trading Platforms Overview

The broker provides access to industry-standard trading platforms. In other words, most popular platforms in financial markets are supported by this broker. TeleTrade Trading Platforms:

MetaTrader 4 (MT4): for real and demo accounts, available on desktop and mobile devices; Links:

MetaTrader 5 (MT5): Enhanced version of MetaTrader 4 with more timeframes and analytical objects; Links:

TradingFinder has developed a wide range of MT4 and MT5 indicators that you can use for free.

What is the Structure of Spreads and Commissions on TeleTrade?

Pricing structure on this broker varies depending on the account type. In this part, we review the costs for every type. Spreads and Commissions on TeleTrade:

| Account Type | Spread | Commission |

ECN | From 0.2 pips | 0.008% |

NDD | From 0.8 pips | 0.007% |

CENT | Not specified | Not specified |

The broker does not provide detailed information on operational costs, which is a downside.

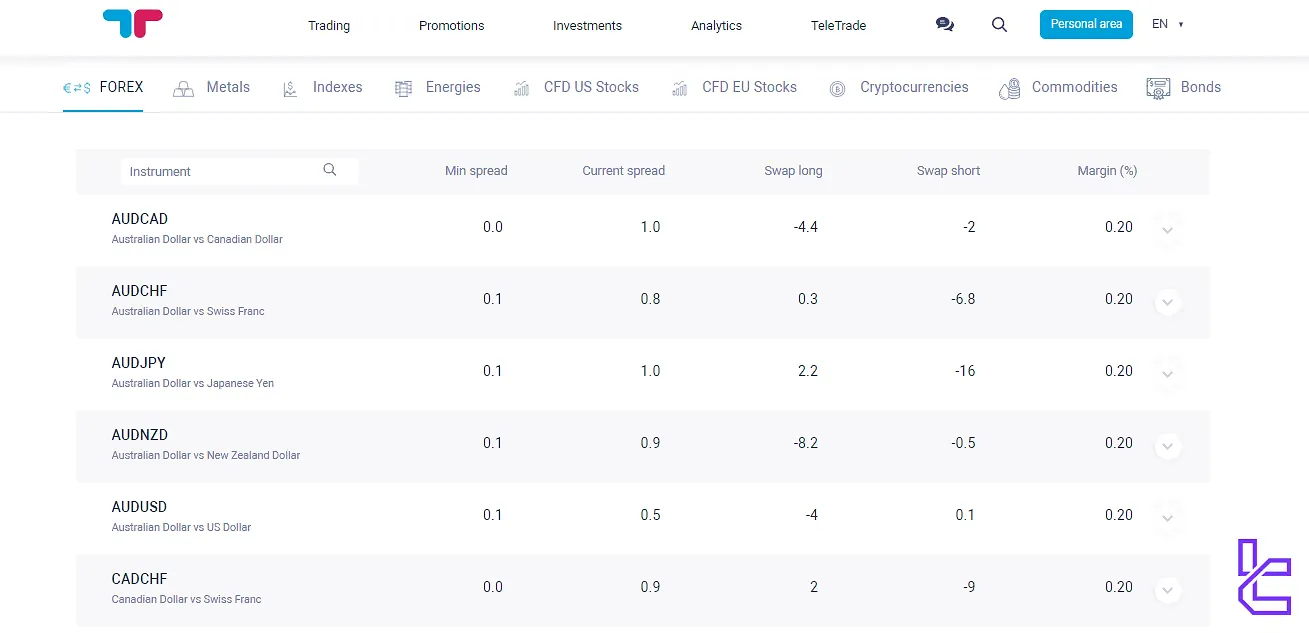

TeleTrade Swap Fees

TeleTrade applies overnight swap rates across Forex, Metals, Indices, Energies, Stocks, Cryptocurrencies, and Commodities, affecting both long and short CFD positions. Swap values vary by asset and trading direction. Examples from the Forex and Metal markets:

Instruments | Swap Long | Swap Short |

EURUSD | -11.50254 | 2 |

GBPUSD | -5.42044 | -2.8 |

EURJPY | 3.9 | -19.34186 |

XAUUSD | -56.62666 | 17 |

XAGUSD | -14 | 0.35539 |

All values apply per standard lot and are subject to change based on market conditions.

TeleTrade Non-Trading Costs

The broker is not transparent regarding inactivity fees. While we can say that there is a cost for dormant accounts on TeleTrade, the exact amount is not disclosed on the official website.

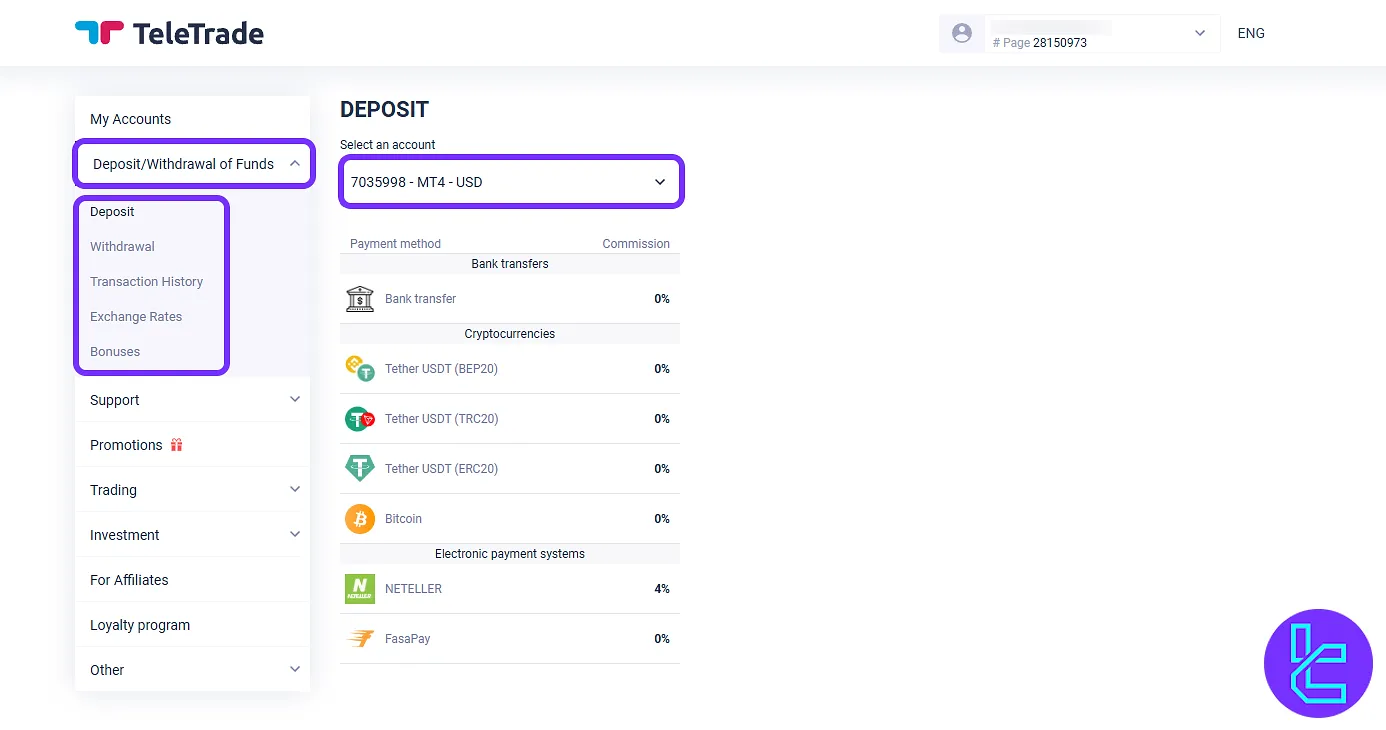

Deposit & Withdrawal Options Available on TeleTrade

The broker offers some of the popular methods for deposits and withdrawals. Note that these options might not be available for users from all regions. TeleTrade Payment Methods:

- Bank transfer

- Credit/Debit cards (Visa, Mastercard)

- E-wallets (FasaPay, Neteller)

- Cryptocurrencies

TeleTrade Deposits

While funding your account on TeleTrade is typically commission-free, you must pay a 4% fee when using the Neteller payment method.

Deposit Method | Min Deposit | Commission |

Open Banking | €10 | 0% |

Credit / Debit Cards | N/A | 0% |

Neteller | €2 | 4% |

FasaPay | €1 | 0% |

€1 | 0% | |

USDT (ERC20, TRC20, BEP20) | €1 | 0% |

USDC (ERC20, BEP20) | €1 | 0% |

TeleTrade Withdrawals

While the broker offers the same methods for withdrawals, fees range from 1% to 2% or include flat-rate charges. Processing times and costs are detailed transparently on the TeleTrade dashboard.

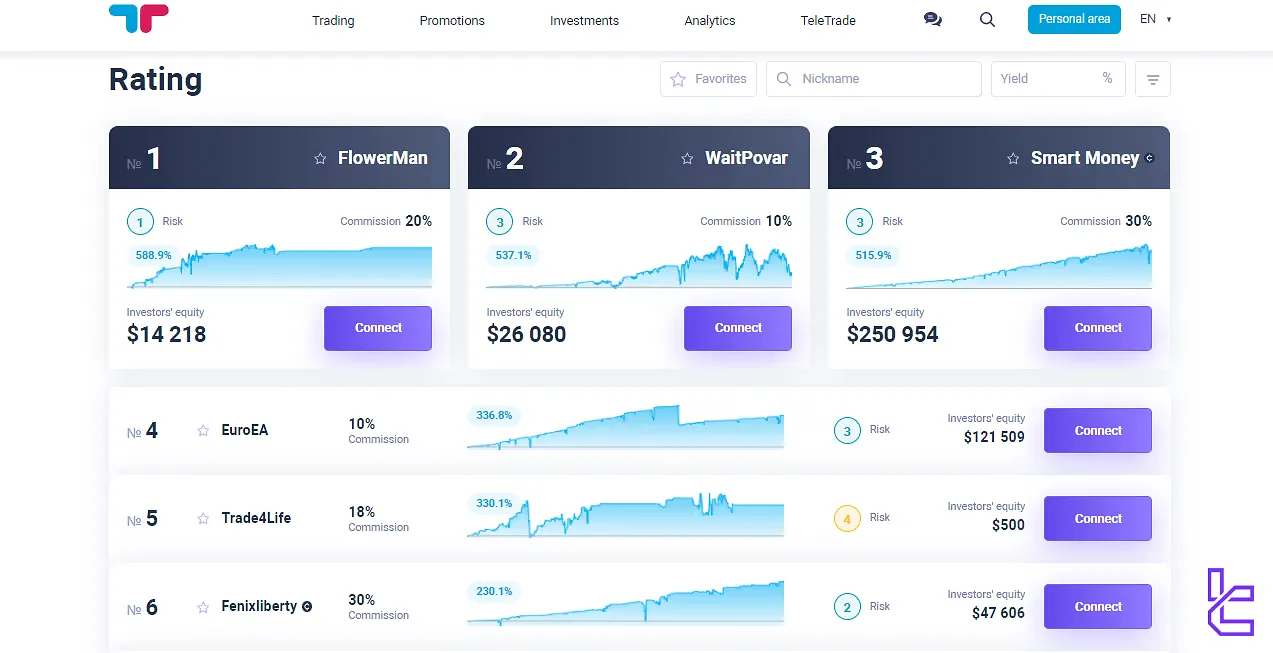

Copy Trading & Investment Options Offered on TeleTrade Broker

This financial company provides a copy trading service titled "Synchronous Trading" for those who want to benefit from experienced traders' strategies. Benefits of Copy Trading on TeleTrade:

- Easy-to-use interface for selecting and copying traders

- Detailed performance metrics and risk analysis

- Flexible investment amounts

- Ability to diversify across multiple strategies

Besides Synchronous Trading, TeleTrade has created an affiliate program with daily rewards, unlimited payouts, and other benefits.

What Markets & Symbols Can We Trade on TeleTrade?

This brokerage offers a vast variety of markets available for trading on MT4 and MT5 platforms, from the Forex market to US & EU Stocks.

Note: The availability of trading instruments may vary based on your account type.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max Leverage |

Forex | CFDs | Over 60 | 50 - 70 currency pairs | 1:500 |

Indices | CFDs | 20 global indices | 10 - 20 instruments | 1:200 |

Stocks | CFDs | Over 100 | 800 - 1200 | Not Specified |

Metals | CFDs | 17 pairs (Gold, Silver, Aluminum, Platinum, Palladium, Nickel, Lead, Zinc, and Copper) | 3 - 10 symbols | 1:500 |

Energies | CFDs | 3 instruments (WTI, BRENT, and NGAS) | 3 - 10 instruments | 1:200 |

Cryptocurrencies | CFDs | 80+ digital assets | 20 - 30 instruments | Not Specified |

Soft Commodities | CFDs | 7 instruments (e.g., Coffee, Corn, Sugar, and Wheat) | 5 - 15 symbols | 1:100 |

This diversity supports portfolio expansion and sector-specific trading strategies.

Bonuses and Promotions Offered on TeleTrade

The broker offers several attractive bonuses and promotions. Each of these bonuses is given on a specific condition. TeleTrade Promotions:

- Equity Boost: Earn 100% of your first deposit as a bonus

- Trading Competitions: Chance to win up to $10,000 in investments

- Accruals: Premium interest rates to boost capital

These promotions are designed to attract new clients and reward active traders. However, always read the terms and conditions carefully, as bonuses often come with specific trading volume requirements.

TeleTrade Awards

TeleTrade has earned widespread recognition across Europe, the CIS, and global markets for its commitment to service excellence and client trust.

Over the past 15+ years, the company has been honored by major financial expos, professional associations, and independent industry juries for its leadership in the Forex market. Key TeleTrade Awards and Recognitions:

- Most Reliable Forex Broker (2015–2017): Masterforex-V EXPO

- Best Broker for Beginners & Best Service for Managers: KROUFR Awards

- Brand #1 in Russia: National Trust Award, Kremlin Palace

- Best Analytics Provider: Multiple years by Masterforex-V

- Best CFD Broker: Forex Expo Awards

- Company of the Year: Multiple national business awards across Russia and Ukraine

- International Star for Quality Leadership: BID Convention, Paris

How & When to Contact Support on TeleTrade

Customer support is of utmost importance on financial platforms. The broker provides these services through various channels. TeleTrade support channels:

- Email: support@teletrade.org

- Phone: +442080895636

- Live Chat: Available on the website

- Callback Request: Fill out a form for a return call

The official website states that the company's support department operates 24/7. Office-based support is available in Cyprus and across several EU countries, Monday to Friday, 09:00–18:00 local time.

TeleTrade Restricted Countries: Can I Register with This Broker?

Because of international regulatory restrictions, the company does not accept clients from certain countries, including:

- United States

- Canada

- Iran

- North Korea

- Yemen

- Other FATF blacklisted countries

It's important to check the most up-to-date list on the official website or contact their support for specific country restrictions.

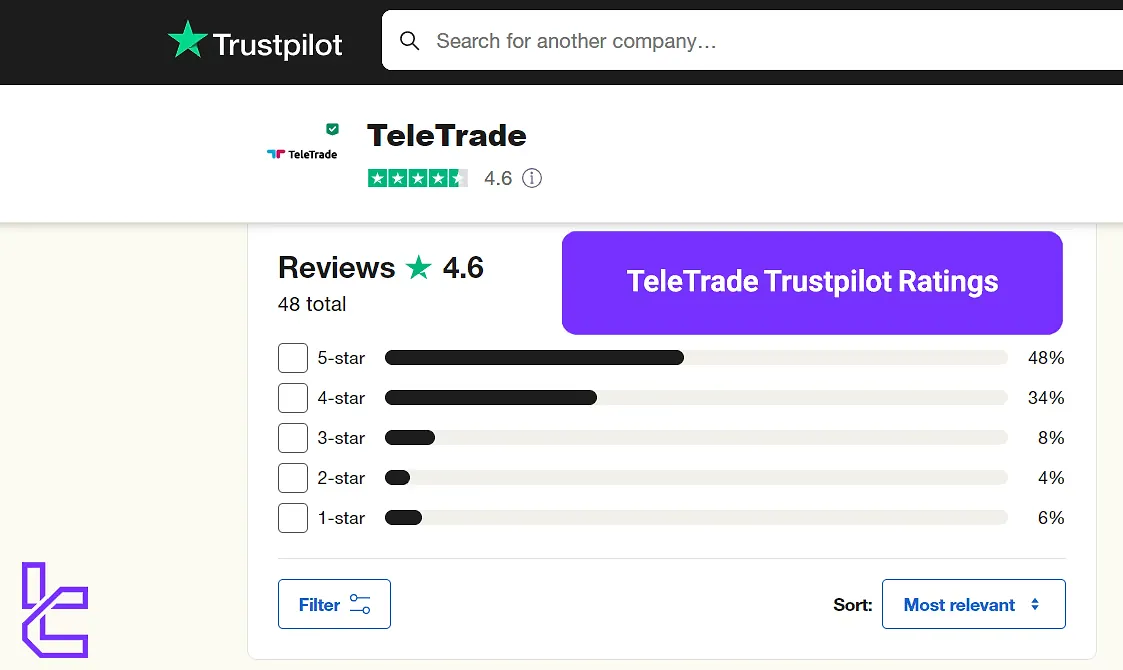

TeleTrade Trust Ratings & Reviews

The broker has received good reviews from traders and industry experts. Here's an overview of the TeleTrade Trustpilot profile:

- 4.6 out of 5, based on +40 ratings

- The profile has been claimed by the company

- No replies from the broker to the negative reviews

- 48% of reviews are 5-star

Based on the user scores on the Trustpilot website, we can say that most users are content with the broker's services.

Educational Training Program on TeleTrade

TeleTrade offers a training program in the form of online and offline courses for users. Training Program features:

- Classes in groups or individually

- Courses for any level of skills

- Expert traders as teachers with solid experience

- Accessible through the official website

TeleTrade equips traders with a suite of trading tools to enhance decision-making:

- Real-time market news and quotes

- Technical analysis reports and expert commentaries

- Interactive charting tools

- Economic calendar and interest rate monitors

- Holiday schedules and trading session insights

These tools are accessible via the platform and website, aiding both discretionary and systematic traders.

You can also use TradingFinder's Forex education for additional resources.

TeleTrade vs Top Forex Brokers

Let's take a quick look at TeleTrade's offerings and see where it stands in comparison with other players in the market.

Parameter | TeleTrade Broker | |||

Regulation | CySEC | None | FSA, CySEC, ASIC | FCA, FSCA, CySEC, SCB |

Minimum Spread | From 0.2 pips | 0.1 Pips | From 0.0 pips | From 0.0 pips |

Commission | From 0.007% | $0 | Average $1.5 | From $0 |

Minimum Deposit | $10 | $10 | $200 | $100 |

Maximum Leverage | 1:500 | 1:3000 | 1:500 | 1:500 |

Trading Platforms | MT4, MT5 | MT4, MT5 | Metatrader 4, Metatrader 5, cTrader, IC Markets Mobile | MT4, MT5, cTrader, Web Trader, Mobile App |

Account Types | ECN, NDD, CENT | Standard, Premium, VIP, CIP | Standard, Raw Spread, Islamic | Standard, Pro, Raw+, Elite |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 500+ | 50+ | 2,100+ | 2,100+ |

| Trade Execution | Market, Instant | Market, Instant | Market | Market, Instant |

TF Expert Conclusion and final words

TeleTrade is a brokerage offering over 60 currency pairs for trading. The spreads on the NDD account start from 0.8 pips and the commission for the ECN account is 0.008% or more.

Users on "Trustpilot" have given the broker a 4.6/5, with over 40 reviews.