Tier1FX is a forex broker regulated by theMalta Financial Services Authority (MFSA) and operates under the EU regulatory framework. Leverage depends on client classification, ranging from ESMA-limited levels for retail traders up to 1:200 for eligible non-retail clients.

The broker offers a single agency-based trading account with transparent commissions, covering forex pairs, spot metals, commodities, indices, and crypto CFDs. The minimum deposit requirement is 1,000 EUR, USD, or GBP.

General Information and Regulation of Tier1FX

Tier1FX (Hogg Capital Investments Ltd.) was founded in Malta in 2013 as an EU-regulated brokerage entity. It operates from Malta under MFSA licensing, focusing on transparent agency model execution and institutional-grade trading.

Below are some key general details:

- Registered Office: Nu Bis Centre, Mosta Road, Lija LJA9012, Malta

- Registration Number: C 18954

- Contact Phone: +356 23 27 3000, +356 23 27 3999

Tier1FX is passported throughout the EU and maintains formal registrations with Spain’s CNMV, Germany’s BaFin, and France’s AMF to support cross-border services under MiFID II compliance.

Here is key information about the Tier1FX:

Parameter / Entity branches | Hogg Capital Investments Ltd |

Regulation | MFSA |

Regulation Tier | Tier-2 |

Country | Malta |

Investor Protection Fund / Compensation Scheme | Up to €20,000 |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:200 |

Client Eligibility | EU/EEA clients and selected international clients (excluding restricted jurisdictions) |

Tier1FX Broker Specifications

Below is an overview of Tier1FX broker specifications based on official trading conditions and account data:

Broker | Tier1FX |

Account Types | Single live trading account |

Regulating Authorities | MFSA |

Based Currencies | EUR, USD, GBP |

Minimum Deposit | €1,000 or equivalent |

Deposit Methods | Bank Transfer |

Withdrawal Methods | Bank Transfer |

Minimum Order | 0.01 |

Maximum Leverage | 1:200 |

Investment Options | Direct Trading, Referral Agents, MAM |

Trading Platforms & Apps | MT4, JForex, FIX API |

Markets | Forex, Commodities, Precious Metals, Indices, Crypto CFDs |

Spread | Floating, as low as 0.3 for EUR/USD |

Commission | Variable, asset-based commissions (from 2.25 GBP / 2.50 EUR / 2.75 USD per lot per side on Forex) |

Orders Execution | STP/DMA execution |

Margin Call / Stop Out | 100%/50% |

Trading Features | Scalping, hedging, EAs allowed |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, Phone, Support Form, In-person |

Customer Support Hours | 24/5 |

Restricted Countries | USA, Turkey, India, Japan (and other restricted jurisdictions under MFSA/EU rules) |

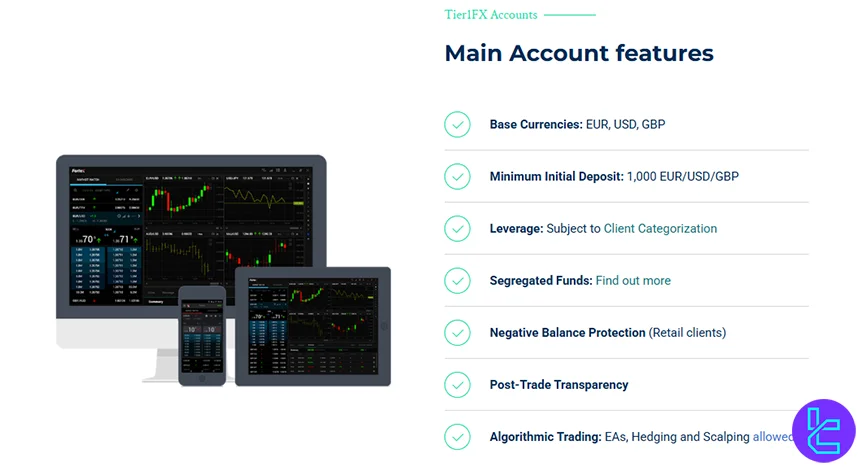

Account Types at Tier1FX

Tier1FX doesn’t segment live trading into multiple pricing tiers; rather, all live accounts share the same trading conditions including pricing, execution model, and available instruments.

The account variants (Individual, Joint, Corporate) differ only in ownership anddocumentation requirements, not in pricing structure or trading conditions.

Here is a comparison between these live accounts:

Parameter | Individual Live Account | Joint Live Account | Corporate Live Account |

Suitable For | Individual traders | Two individuals | Companies & legal entities |

Ownership Structure | Single account holder | Shared ownership | Company-owned |

Min Deposit | 1,000 EUR/USD/GBP | 1,000 EUR/USD/GBP | 1,000 EUR/USD/GBP |

Maximum Leverage | 1:200 | 1:200 | 1:200 |

Algorithm Trading | EAs, Hedging and Scalping allowed | EAs, Hedging and Scalping allowed | EAs, Hedging and Scalping allowed |

Tier1FX doesn’t offer swap-free / Islamic accounts. So, traders can’t hold positions overnight without paying or receiving swap interest. On the other hand, the broker provides clients with access to ademo account that can be used for a period of up to 60 days.

Tier1FX Pros and Cons

Tier1FX is an EU-based brokerage operating under a straight-through processing framework. Rather than offering promotional features, the broker emphasizes infrastructure stability, regulatory compliance, and professional-grade market access.

Let’s take a closer look at the strengths and weaknesses of this broker:

Advantages | Disadvantages |

STP/DMA execution with no dealing desk intervention | Relatively high minimum deposit requirement (€1,000) |

Transparent spread and commission-based pricing | No swap-free / Islamic account option |

Access to institutional liquidity providers | Limited funding methods, mainly bank wire transfers |

Up to 1:200 leverage | No promotional option |

Referral agent program | - |

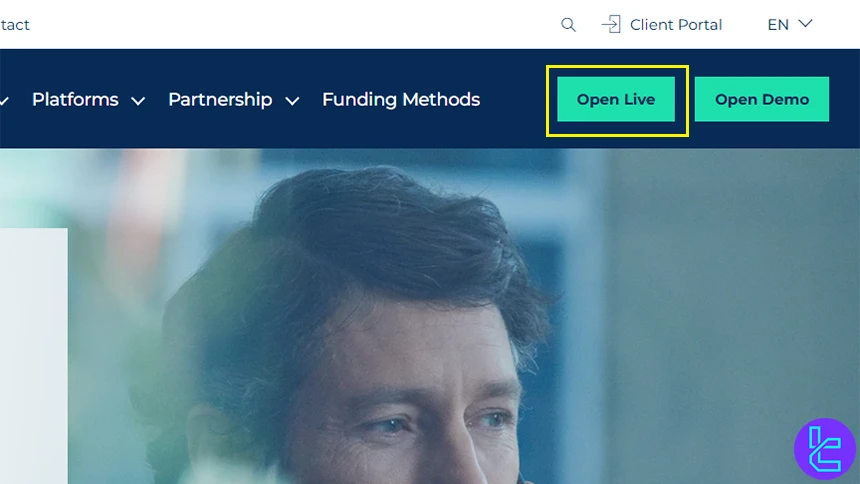

Opening Account and Verification at Tier1FX

To start trading and access Tier1FX’s full suite of services, account registration and verification are mandatory. Clients must be at least 18 years old to comply with regulatory requirements.

Here is a clear, step-by-step process to open a live trading account:

#1 Navigate to the Official Website

Visit the Tier1FX website and click on "Open Live" button to access the registration page.

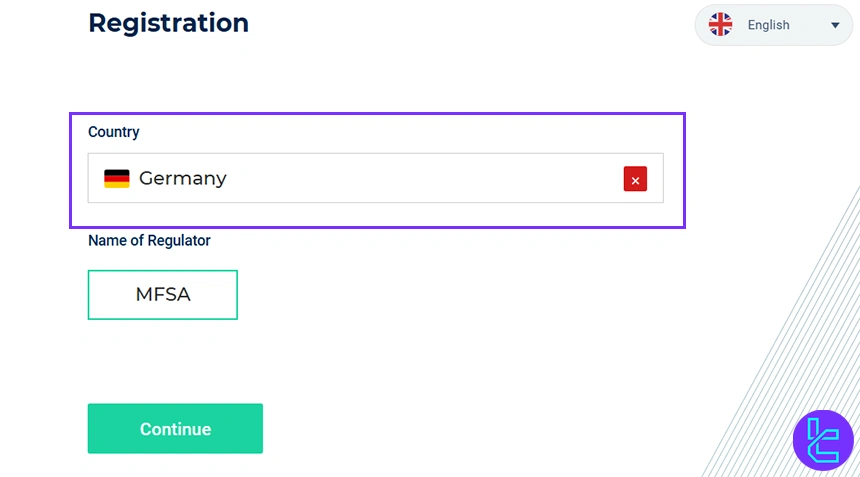

#2 Enter Login Details

Select your country from the dropdown menu to ensure correct regulatory compliance and account settings.

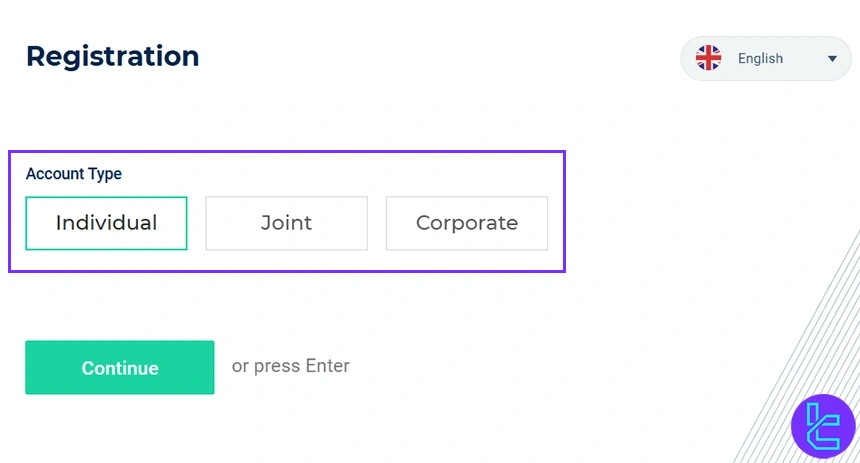

Then, choose your account type from the three available options, matching your trading needs and profile.

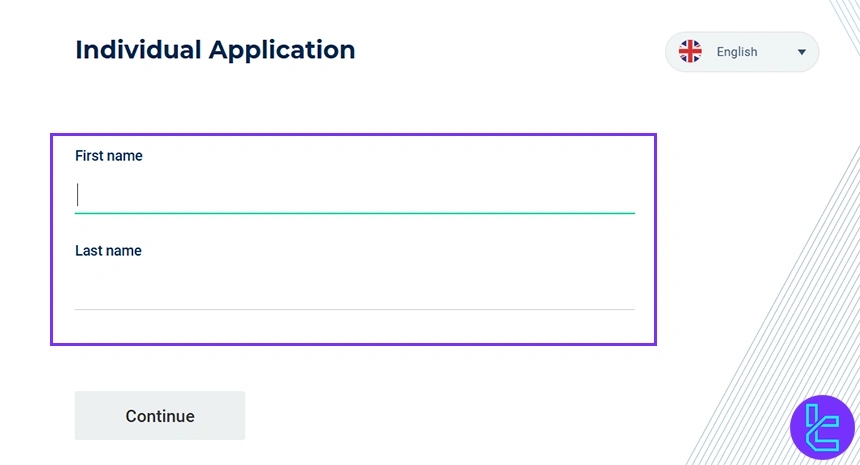

Now, enter your full name exactly as it appears on your official identification documents to avoid verification delays.

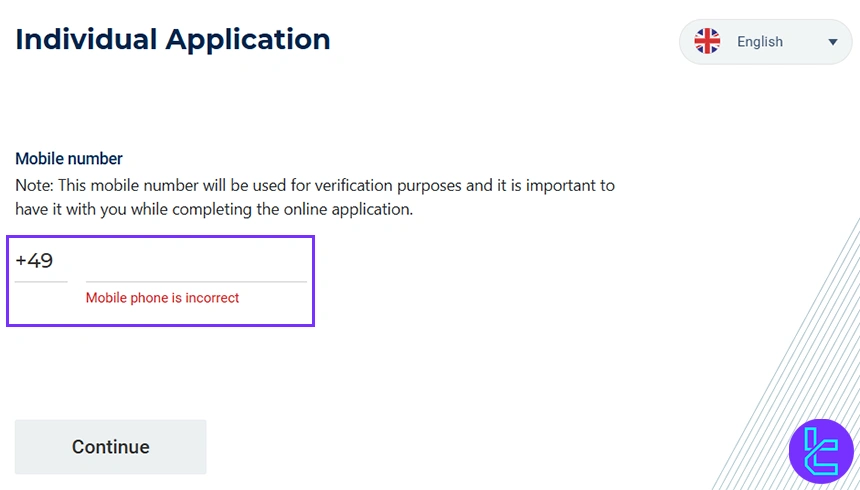

Then, provide your mobile phone number, which will later be used for KYC (Know Your Customer) verification and security notifications.

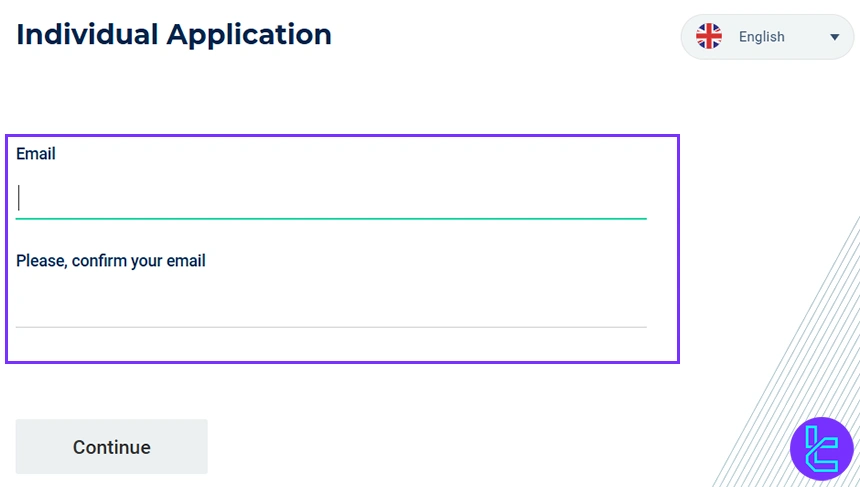

Then, enter your email address and confirm it by typing it again in the verification field to ensure accurate communication.

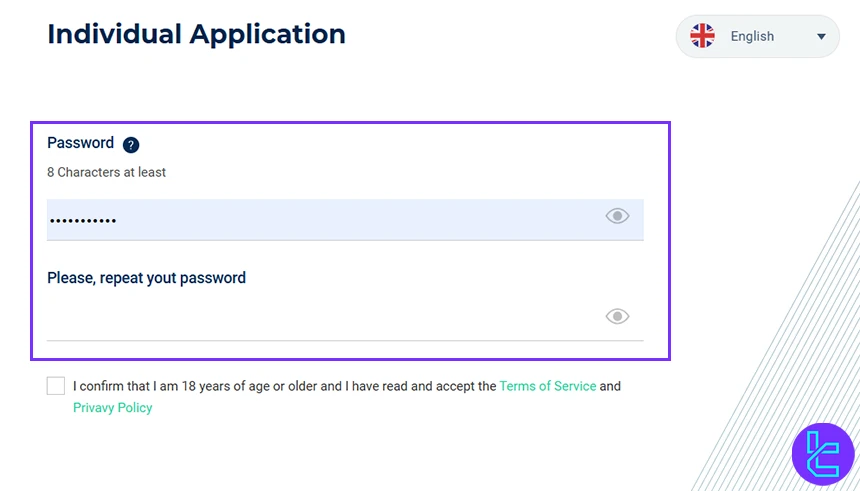

Finally, create a secure password with a minimum of 8 characters, including a combination of uppercase letters, lowercase letters, and numbers, to protect your account.

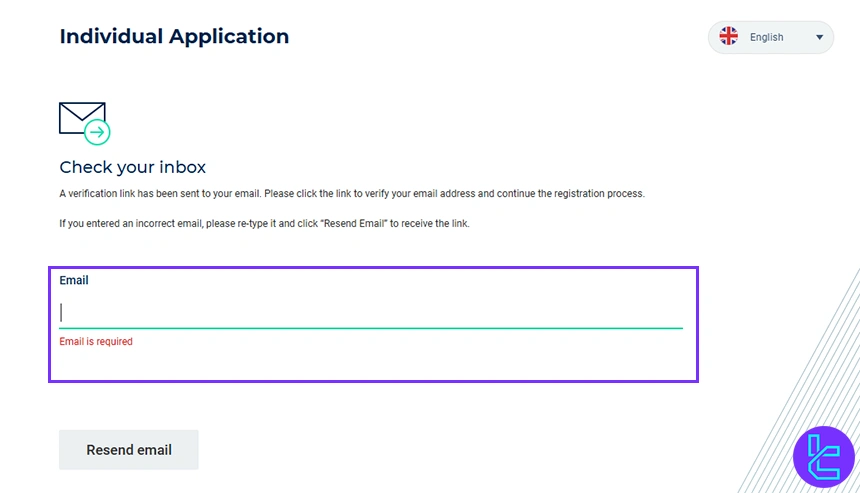

#3 Verify Email

Once you complete the initial registration form, Tier1FX will send a verification email to the address you provided. Click the link to activate your account and proceed to the next step.

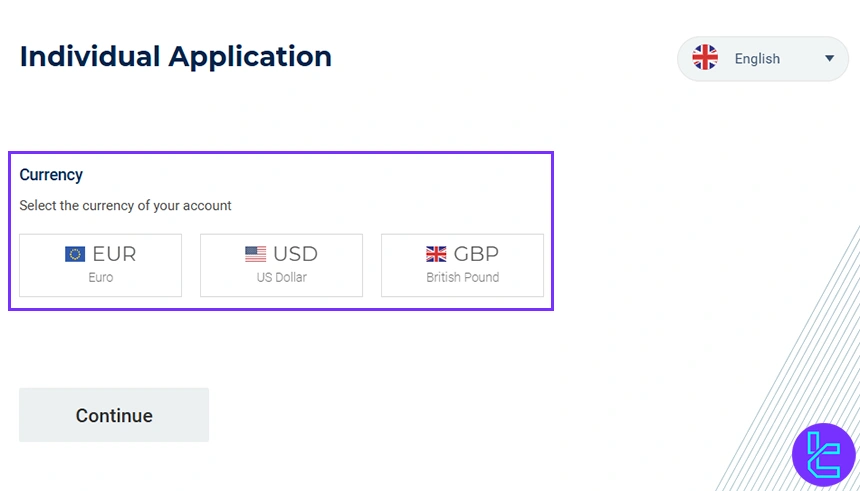

#4 Enter Account Settings

At this stage, you need to configure your account preferences, including:

- Base currency (EUR, USD, GBP)

- Trading platform (MT4, JForex, or FIX API)

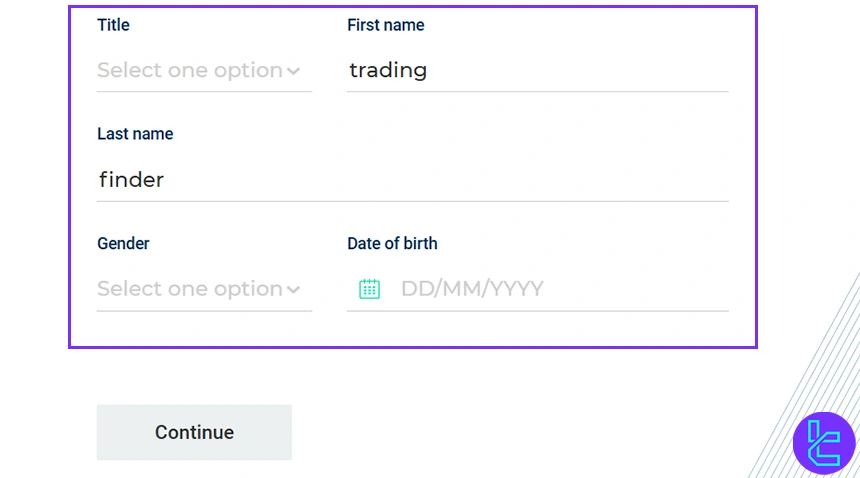

#5 Enter Personal Information

In this step, you are required to provide your personal details, including:

- Full name

- Date of birth

- Gender

- Contact information

- Residence details

Ensure all information is accurate and matches your official documents. Once completed, click “Continue” to proceed to the next step.

#6 Enter Financial Information

In this step, Tier1FX requires you to provide your financial details. The requested details include:

- Approximate Annual Income

- Approximate Liquid Assets

- Available Funds for Trading

- Source of Funds for Trading

- Anticipated Initial Deposit

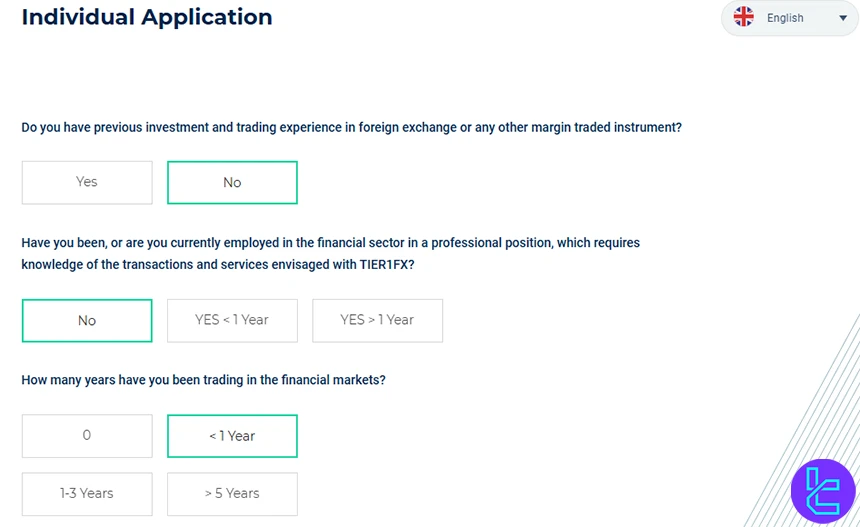

#7 Classification & Regulatory Assessment

In this stage, Tier1FX collects information to assess your trading experience, knowledge, and regulatory classification. This ensures compliance with EU regulations and helps tailor account settings to your profile.

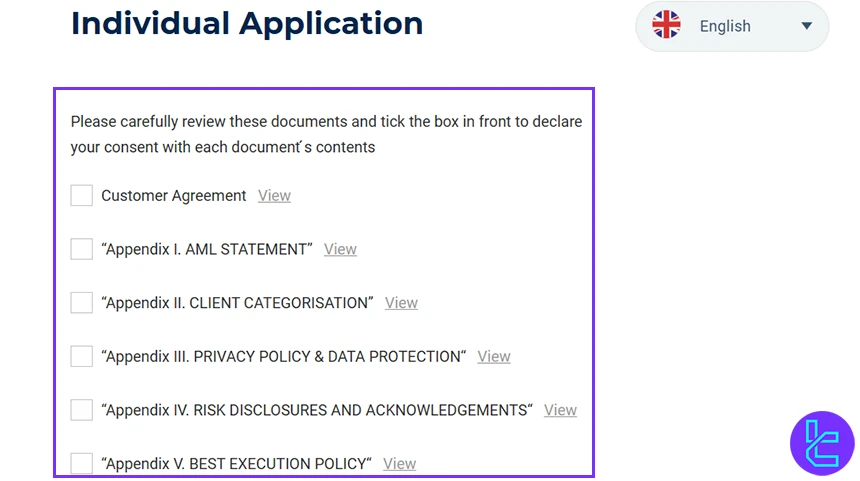

#8 Terms and Conditions Agreement

In this step, you are required to carefully read Tier1FX’s Terms and Conditions and Privacy Policy. After reviewing, confirm your acceptance by ticking the checkboxes to proceed with your account setup.

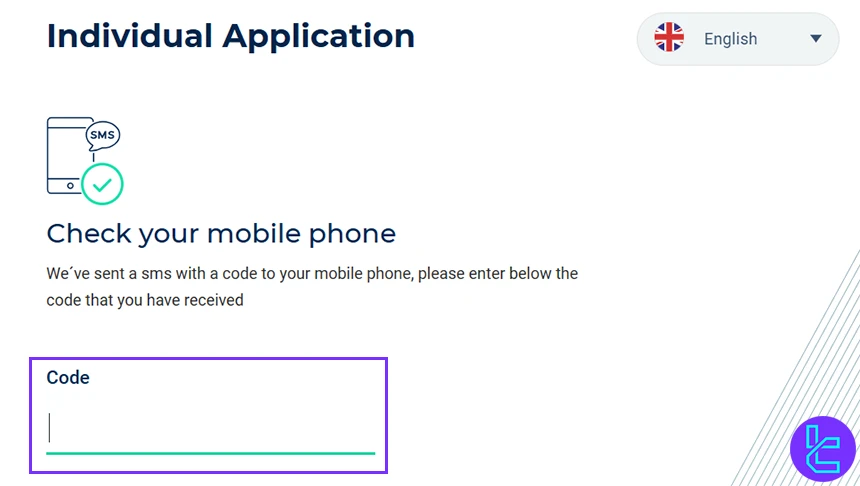

#9 Mobile Verification

Tier1FX will send a verification code to your mobile phone. Enter this code to complete the registration process and activate your live trading account.

#10 Verification & KYC

Tier1FX requires identity and residence verification to comply with regulations. Submitting official documents completes KYC, activates your live account, and ensures secure, compliant trading.

Tier1FX Broker Trading Platforms Overview

Tier1FX provides a range of professional trading platforms, including MetaTrader 4 (MT4), JForex, and FIX API. Each platform connects directly to Tier1 liquidity pools via a DMA-STP execution model, ensuring low-latency, transparent, and reliable trading. Traders can choose the platform that best fits their strategy and workflow.

MetaTrader 4 (MT4)

MetaTrader 4 is a widely used trading platform suitable for forex and CFD trading. It offers advanced charting tools, automated trading through Expert Advisors (EAs), and a customizable trading environment for discretionary and algorithmic traders.

JForex

JForex is a professional trading platform designed for advanced and algorithmic traders. It supports automated strategies, advanced order types, and detailed market analysis tools, making it suitable for multi-asset trading and strategy development.

FIX API

FIX API provides direct market access for institutional clients and professional traders who require customized trading solutions. It enables ultra-low latency execution and full control over order management, making it ideal for high-frequency and algorithmic trading strategies.

Tier1FX provides an MT4 to FIX API Bridge, enabling traders to run MT4 Expert Advisors on a FIX API account. This is without re-coding, while benefiting from low-latency execution and professional trade reporting.

Spreads, Commissions and Account Fees Overview

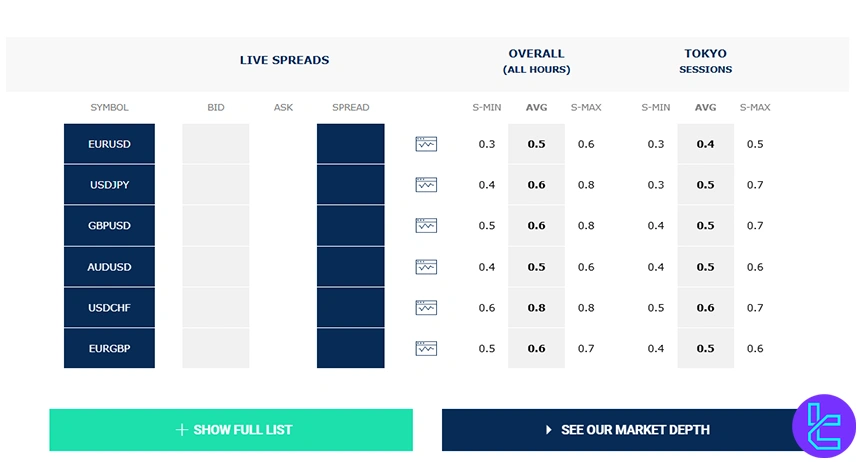

Tier1FX operates a commission-based pricing model combined with floating spreads, sourced directly from institutional liquidity providers. On major forex pairs, average spreads typically range from around 0.5 to 0.8 pips, depending on the instrument and trading session.

Spreads are variable across all market sessions and tend to remain tighter during periods of higher liquidity, such as the London and New York sessions. The table below outlines the average live spreads observed across key forex instruments and trading sessions:

Symbol | Overall (AVG) | Tokyo Session (AVG) | London Session (AVG) | New York Session (AVG) |

EUR/USD | 0.5 | 0.4 | 0.4 | 0.4 |

USD/JPY | 0.7 | 0.6 | 0.6 | 0.7 |

GBP/USD | 0.8 | 0.6 | 0.5 | 0.6 |

AUD/USD | 0.6 | 0.5 | 0.5 | 0.5 |

USD/CAD | 0.8 | 0.7 | 0.7 | 0.7 |

USD/CHF | 0.8 | 0.7 | 0.7 | 0.7 |

In addition to spreads, Tier1FX applies transparent, asset-specific commissions, charged per side and varying by instrument type and account base currency. For example, commissions on forex trades start from €2.50 / $2.75 / £2.25 per lot per side, based on the account’s base currency.

Trading commissions at Tier1FX broker:

Instrument Type | EUR Accounts | USD Accounts | GBP Accounts |

Forex | €2.50 per lot / side | $2.75 per lot / side | £2.25 per lot / side |

Commodities | €3.00 per lot / side | $3.25 per lot / side | £3.25 per lot / side |

CFDs | €0.25 per contract / side | $0.30 per contract / side | £0.25 per contract / side |

Crypto CFDs | 0.10% of notional value | 0.10% of notional value | 0.10% of notional value |

Swap Fee at Tier1FX

At Tier1FX, swap fees (overnight financing charges) are applied when you keep a position open past the trading day’s rollover time. The amount is determined by the specific swap rate for each currency pair and the position direction. For example, holding a EUR/USD position overnight at Tier1FX results in -13.65 USD long and 2.13 USD short swap.

Key points about swap at Tier1FX include:

- Values are calculated per 1 standard lot (100,000 units);

- Holding a USD/JPY position overnight at Tier1FX results in +1.87 USD long and -32.40 USD short swap;

- Tier1FX does not currently offer swap-free accounts.

Non-Trading Fees at Tier1FX

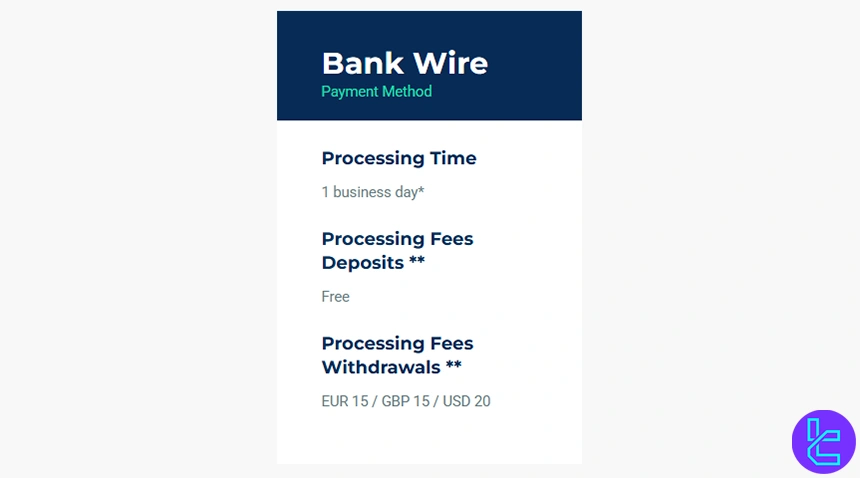

At Tier1FX, non-trading fees cover deposits, withdrawals, and account maintenance. These fees are designed to be transparent and minimal, ensuring that clients pay only for services that involve actual processing or third-party costs.

For example, Tier1FX does not charge fees for deposits, while bank-wire withdrawals incur a small fixed fee depending on the currency.

Key points about non-trading fees at Tier1FX include:

- Bank-wire withdrawals are charged $20 / €15 / £15, depending on account currency;

- There is no ongoing account maintenance or dormant account fee for accounts inactive less than one year;

- Currency conversions between accounts may incur a small conversion spread, based on the current FX rate.

Tier1FX Broker Deposit & Withdrawal Methods

Based on official information published by Tier1FX, the broker supports bank‑based funding solutions designed to facilitate secure and compliant transfers between your personal bank account and your trading account. All funding is processed through the Client Portal.

Deposit Methods at Tier1FX

Tier1FX allows clients to fund their trading accounts via bank transfer using a bank account in the same name as the trading account holder. The broker doesn’t charge fees on deposits, although intermediary or issuing bank fees may apply.

Also, the deposits in a currency different from the account’s base currency may be converted at Tier1FX’s settlement rate.

The main deposit conditions are:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Wire Transfer | USD, EUR, GBP | USD 1,000 (equivalent) | 0% (broker side) | 1 business day |

Withdrawal Methods at Tier1FX

Tier1FX processes withdrawals through bank wire transfer back to the original funding bank account. Withdrawals must be requested via the Client Portal, and as with deposits, funds are returned only to a personal account under the same name as the trading account.

Withdrawal requests are generally processed by Tier1FX within 1 business day, though final receipt times may extend to 3-5 business days for international transfers.

The key withdrawal details are:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Bank Wire Transfer | USD, EUR, GBP | No minimum | USD 20 / EUR 15 / GBP 15 | 3-5 business days |

Copy Trade and Other Investment Options of Tier1FX

Tier1FX primarily focuses on direct trading execution with its DMA‑STP model and does not provide built‑in social trading or copy trading features in the client interface.

However, the broker supports structured managed trading solutions through professional systems and offers a referral partnership program to expand participation.

The following sections explain how each investment option operates in detail:

Managed Account Solutions (MAM)

Tier1FX offers an advanced Multi‑Account Management (MAM) solution tailored for asset managers and professional traders who want to manage multiple client accounts within a unified environment.

MAM account Key aspects include:

- Real‑time reporting

- Flexible investor joining schedules

- Automated fee distribution

- Detailed allocation precision

Referral Agent Program

Tier1FX provides a Referral Agent program that allows partners to benefit by referring clients to the broker. This program features flexible remuneration packages and tools to manage leads and client activity through a scalable multi‑level structure.

Referral Agents can track registrations, trading volume, and rebates with dedicated support from the broker.

Tradable Markets and Financial Instruments at Tier1FX

Tier1FX offers access to a broad range of financial instruments, allowing traders to participate in diversified global markets. Through the broker’s DMA‑STP pricing infrastructure, clients can trade forex, precious metals, commodities, index CFDs, and cryptocurrency CFDs, with pricing sourced from deep liquidity pools.

Some useful details in this area can be found in the table below:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Major, minor and exotic currency pairs | 57 | 40–80 | 1:200 |

CFDs on popular crypto pairs | 4+ | 5-30 | 1:2 | |

Metals | Spot precious metals (e.g., Gold, Silver) | 3+ | 2-5 | N/A |

Commodities | Spot commodities (e.g., oil, gas) | 4+ | 3-8 | N/A |

Indices | Major global index CFDs | 11+ | 8-15 | N/A |

Bonuses and Promotions at Tier1FX

Tier1FX does not offer any bonuses or promotional incentives as part of its product suite. Rather than providing deposit bonuses, welcome bonuses, or reward campaigns, the broker emphasizes its commitment to delivering high‑quality execution, deep liquidity, and advanced trading infrastructure.

Tier1FX Broker Awards

As of the information available on Tier1FX’s official website, the broker does not list any formal industry awards or recognitions in its published content. There is no dedicated Awards section on the official Tier1FX site that highlights industry accolades, awards, or rankings received by the broker.

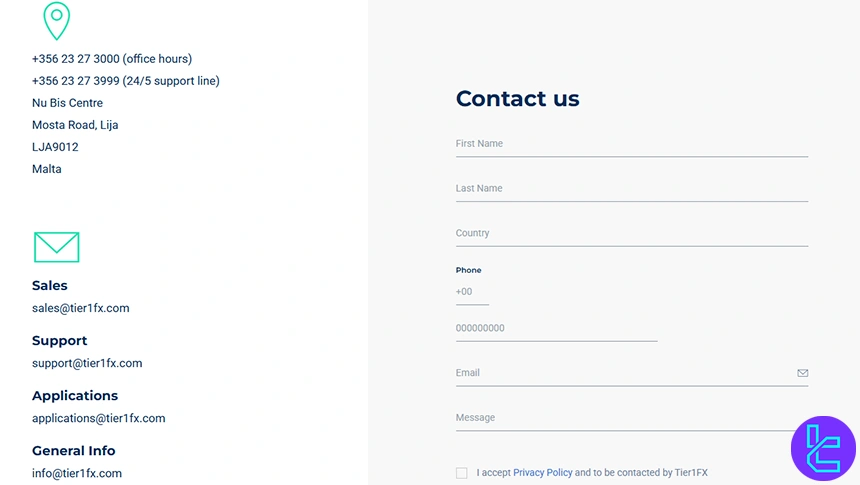

Tier1FX Customer Support

Tier1FX offers several channels for clients to reach its support team, ensuring timely assistance for account management, trading inquiries, and platform issues. Users can find the most suitable method according to their individual needs and circumstances in the table below:

Support Channel | Details |

support@tier1fx.com | |

Contact Form | Available on the contact page |

Phone | +356 23 27 3000 (office hours), +356 23 27 3999 (24/5 support line) |

In-person | Nu Bis Centre, Mosta Road, Lija, LJA9012, Malta |

FAQs | Comprehensive FAQ section on the official website |

This variety of funding methods ensures flexibility and convenience for clients when managing their trading accounts.

Tier1FX Banned Countries

Tier1FX is a regulated EU broker operating under strict compliance requirements. Due to regulatory restrictions and jurisdictional limitations, the broker does not accept applications from residents of certain countries where financial services cannot be offered under its licensing framework.

Countries currently restricted from opening a Tier1FX account include:

- United States

- Japan

- Iran

- North Korea

- Turkey

- India

- American Samoa

- Guam

- Northern Mariana Islands

- Puerto Rico

- US Virgin Islands

Tier1FX on Review Websites

The performance and reputation of Tier1FX have been evaluated across several review platforms, reflecting a mix of user feedback. On Trustpilot, for example, Tier1FX holds an average score of 3.8 out of 5, based on 2 reviews submitted by actual users.

Below is a summary of Tier1FX’s ratings from notable review sources:

Review Website | Score |

3.8/5 | |

Not yet rated (user reviews present) |

Tier1FX Educational Resources & Market Tools

Tier1FX does not provide dedicated educational resources or structured market analysis on its official website. Clients can access demo accounts, platform guides, and FAQs, but comprehensive learning materials, webinars, or trading courses are not offered by the broker.

Tier1FX in Comparison with Other Brokers

Here’s a side-by-side comparison of Tier1FX against several prominent brokers, highlighting key features and trading conditions in the global financial markets:

Parameter | Tier1FX | |||

Regulation | MFSA | ASIC, FSCA, VFSC, FCA, CIMA | CFTC, SEC, FCA, ASIC, MAS, CIRO, FSA, CySEC | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA |

Minimum Spread | Floating from 0.3 pips | 0.0 pips | From 0.0 pts | 0.0 Pips |

Commission | Varies Based on Asset | From $0 | From $0.0 | From $0 |

Minimum Deposit | $1,000 | $20 | $100 | $100 |

Maximum Leverage | 1:200 | 1:1000 | 1:50 | 1:400 |

Trading Platforms | MT4, JForex, FIX API | MT4, MT5, ProTrader, TradingView, proprietary application | MT5, TradingView, Proprietary Platform | MT4, MT5, Web Trader, Mobile App |

Account Types | Individual, Joint, Corporate | Standard STP, Standard Cent, Raw ECN, Pro ECN, Swap Free | Standard, Raw Spread, MetaTrader | Standard, Demo, Professional |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 90+ | 1000+ | 5500+ | 1250+ |

Trade Execution | STP/DMA execution | Market | Market, Instant | Instant |

Final Words

Tier1FX is regulated by the Malta Financial Services Authority (MFSA) and provides access to Forex, commodities, indices, and cryptocurrencies. The broker offers a maximum leverage of 1:200 for retail clients.

Tier1FX provides MetaTrader 4, JForex, and FIX API platforms, supports MAM accounts and affiliate programs. Also, the broker offers multiple customer support channels to assist traders efficiently, including email, phone and contact form.