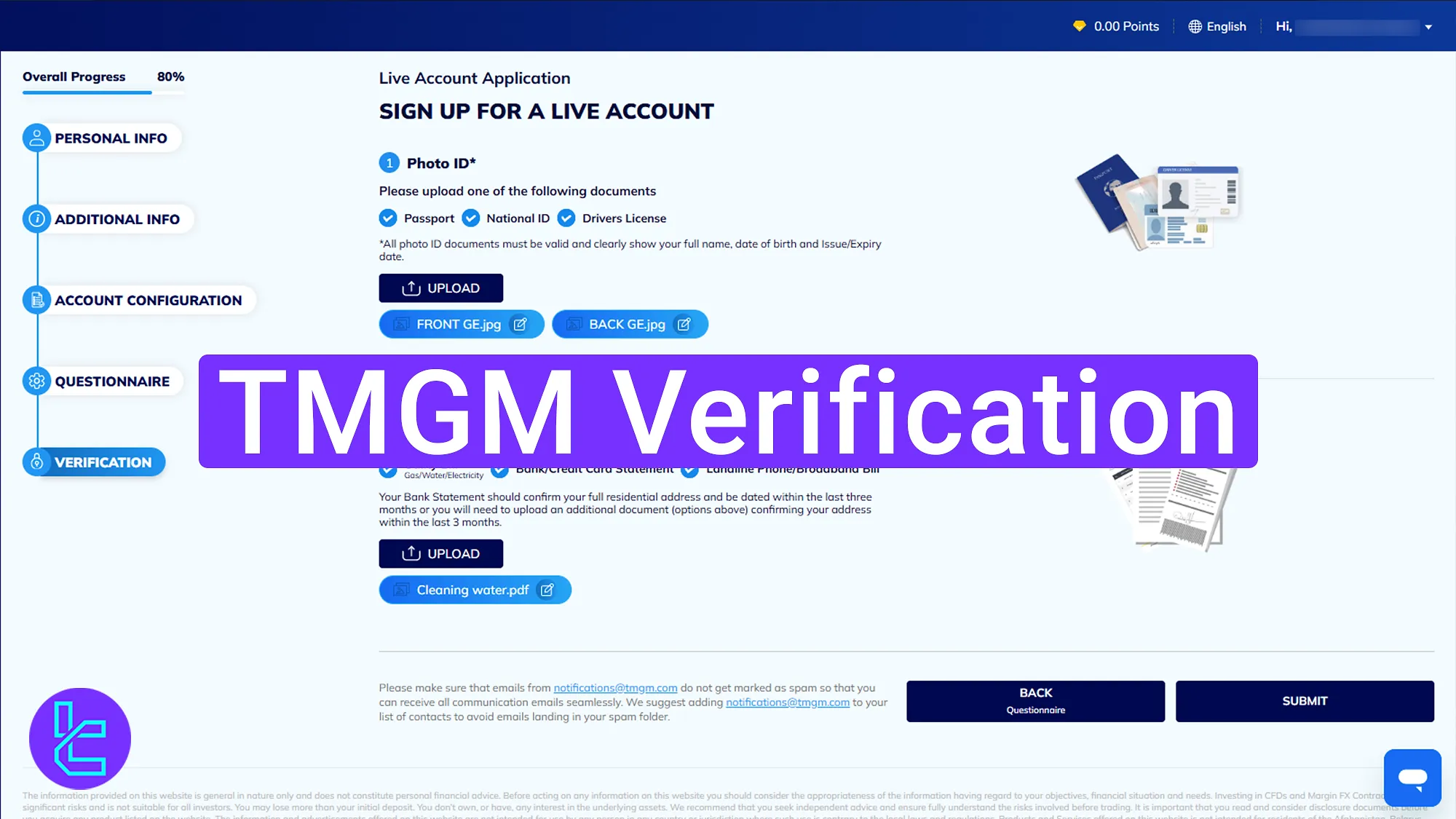

TMGM verification is an essential 3-step process to access trading features. The process includes Proof of Identity (POI) and Proof of Address (POA) verification.

By verifying your account in the TMGM broker, traders can benefit from Classic and Edge accounts with spreads from 0.0 pips and 1:1000 leverage.

TMGM Verification Process Tutorial

After completing TMGM registration, the 3-step authentication process must be completed to activate your TMGM broker account.

TMGM verification overview:

- Entering the Identity Verification Section;

- Providing ID and Address Documents;

- Checking Document Confirmation Status.

The table below offers deeper insights into the account verification requirements in the TMGM broker.

Verification Requirement | Yes/No |

Full Name | No |

Country of Residence | No |

Date of Birth Entry | No |

Phone Number Entry | No |

Residential Address Details | No |

Phone Number Verification | No |

Document Issuing Country | No |

ID Card (for POI) | Yes |

Driver’s License (for POI) | Yes |

Passport (for POI) | Yes |

Residence Permit (for POI or POA) | No |

Utility Bill (for POA) | Yes |

Bank Statement (for POA) | Yes |

2-Factor Authentication | No |

Biometric Face Scan | No |

Financial Status Questionnaire | No |

Trading Knowledge Questionnaire | No |

Restricted Countries | Yes |

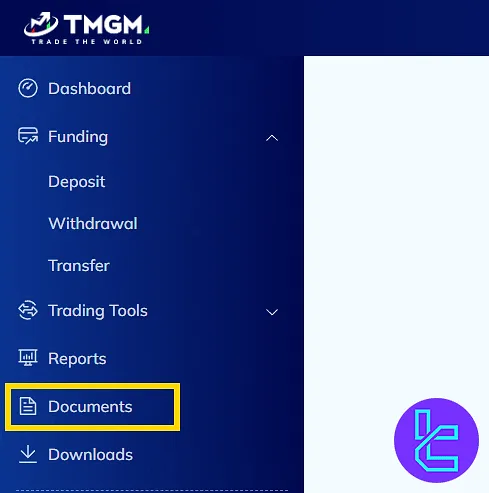

#1 Entering the Verification Section

To begin, log in to your TMGM dashboard and go to the "Documents" section.

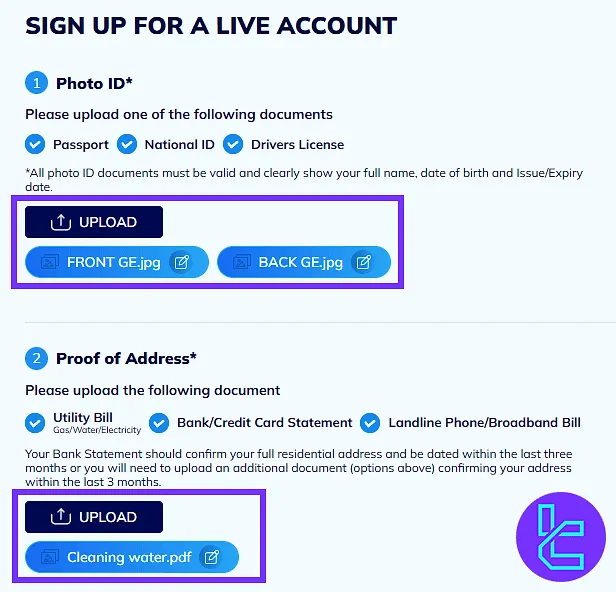

#2 Providing Identification and Address Documents

Click "Upload", then submit the front and back of your Identity document (passport, driver’s license, National ID), along with any approved proof of address document, ensuring it is dated within the last 3 months.

Once all documents are uploaded, click "Submit". The documents will then be reviewed by the TMGM support team.

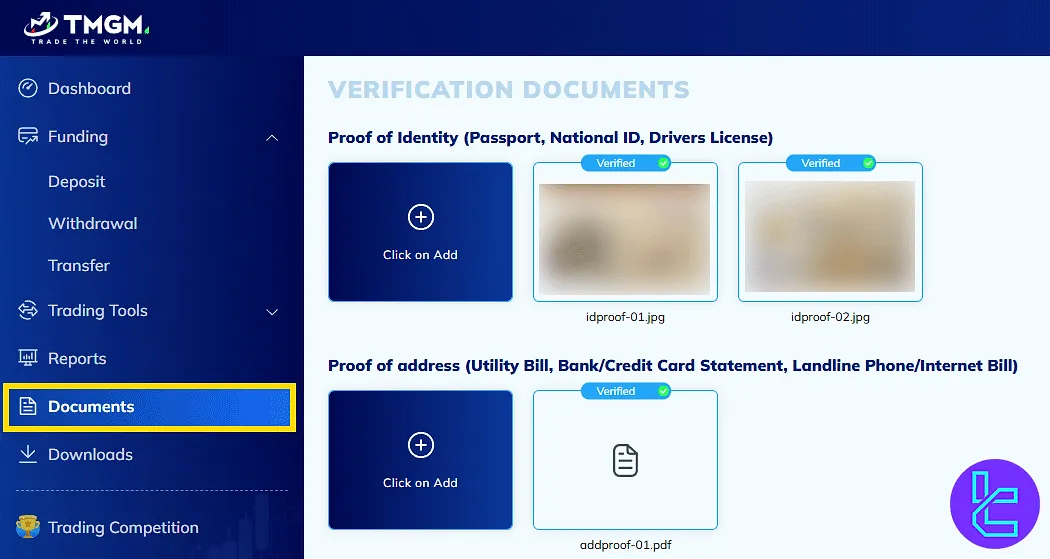

#3 Checking Document Verification Status

After submission, KYC status can be checked in the "Documents" section of the TMGM dashboard. Once the review is complete, the broker will also send a confirmation email.

TMGM Boker Verification Requirements vs Other Brokers

The table below offers a comparison of the user KYC process in TMGM and 3 other famous Forex brokers.

Verification Requirement | TMGM Broker | |||

Full Name | No | Yes | No | Yes |

Country of Residence | No | No | No | Yes |

Date of Birth Entry | No | Yes | No | Yes |

Phone Number Entry | No | No | No | No |

Residential Address Details | No | Yes | No | Yes |

Phone Number Verification | No | Yes | No | No |

Document Issuing Country | No | Yes | Yes | Yes |

ID Card (for POI) | Yes | Yes | Yes | Yes |

Driver’s License (for POI) | Yes | Yes | Yes | Yes |

Passport (for POI) | Yes | Yes | Yes | Yes |

Residence Permit (for POI or POA) | No | Yes | Yes | Yes |

Utility Bill (for POA) | Yes | No | Yes | Yes |

Bank Statement (for POA) | Yes | No | Yes | Yes |

2-Factor Authentication | No | No | No | No |

Biometric Face Scan | No | No | No | Yes |

Financial Status Questionnaire | No | Yes | No | No |

Trading Knowledge Questionnaire | No | Yes | No | Yes |

Restricted Countries | Yes | Yes | Yes | Yes |

TF Expert Suggestion

TMGM verification process can be completed in about 5 minutes and includes identity document submission (passport, ID card, or driver's license) and proof of address verification (bank statement or utility bill issued within the last 3 months).

With a verified account, users can manage their funds by learning about TMGM deposit and withdrawal methods and begin trading. More details are available on the TMGM tutorialpage.