TNFX is an ECN forex broker that offers various account types, such as Standard, Fix, VIP, Zero, Cent, and Demo accounts.

It provides competitive spreads starting from 0 pips with leverage up to 1:500 across most account types. The commissions for the Zero account are$5 per lot.

TNFX Company Information & Regulation Status

TNFX, as one of the Forex Brokers, has established itself as a prominent player in the forex trading landscape since 2019, offering a wide array of services to both individual and corporate clients. Here's what you need to know about the company:

Entity Parameters / Branches | TNFX Ltd (Seychelles) | TNFX LTD – Dubai Branch (Rep. Office) | Tiran Forex (SV) Ltd |

Regulation | FSA (SD133) | Representative Office (No license) | Unregulated (Registered IBC) |

Regulation Tier | 4 | N/A | N/A |

Country | Seychelles | UAE (Dubai) | Saint Vincent & the Grenadines |

Investor Protection Fund / Compensation Scheme | None | None | None |

Segregated Funds | Yes | Yes | Not stated |

Negative Balance Protection | Yes | Yes | Not stated |

Maximum Leverage | 1:500 | 1:500 | 1:500 |

Client Eligibility | Global (excl. USA, India, Cuba, Myanmar, North Korea, Iran and Sudan) | UAE / MENA | Global (excl. USA, India, Cuba, Myanmar, North Korea, Iran and Sudan) |

While this regulation provides a basic operational framework, the FSA is not recognized as a tier-1 or tier-2 financial authority.

As such, TNFX should be considered lightly regulated, and investors should exercise caution due to the limited oversight typical of offshore jurisdictions.

TNFX Broker Summary of Specifics

To give you a quick overview of what TNFX offers, here's a summary table of key specifics:

Broker | TNFX |

Account Types | Standard, Fix, VIP, Zero, Cent, Demo |

Regulating Authorities | FSA (Seychelles) |

Based Currencies | USD |

Minimum Deposit | $100 |

Deposit/Withdrawal Methods | Visa, Bank Transfer, Perfect Money, WebMoney, MasterCard, STICPAY, Advcash, Al-Taif, Payeer, India Payment, Asia Pay, Corapay, Ozow, PayRetailers, Credit Cards, Local depositor, Office transfers |

Minimum Order | 0.01 |

Maximum Leverage | 1:500 |

Investment Options | YES |

Trading Platforms & Apps | MT4, MT5 |

Markets | Forex, Commodities, Stocks, Indices |

Spread | From 0 |

Commission | $5 for Zero account |

Orders Execution | Market |

Margin Call/Stop Out | 100%/20% |

Trading Features | CopyTrading, Fixed spread |

Affiliate Program | YES |

Bonus & Promotions | YES |

Islamic Account | YES |

PAMM Account | YES |

Customer Support Ways | Live chat, Email, Phone, Ticket |

Customer Support Hours | 24/6 |

This comprehensive offering caters to a wide range of traders, from beginners to professionals, ensuring that TNFX can meet diverse trading needs and preferences.

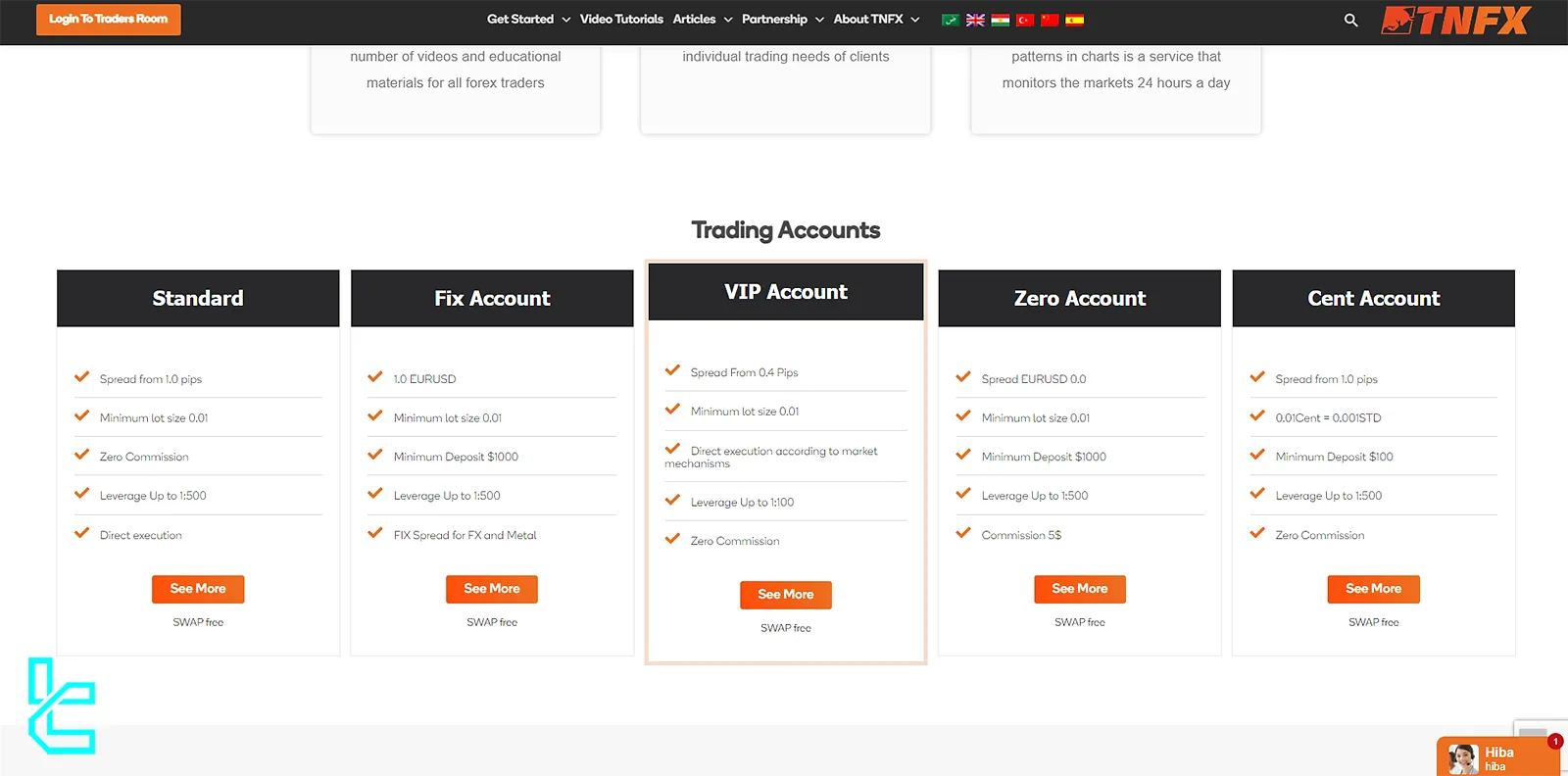

TNFX Types of Trading Accounts

TNFX broker offers a variety of account types to suit different trading styles and experience levels.

- The Standard and Fix accounts require minimum deposits of $100 and $1,000, respectively, with leverage options of up to 1:500;

- The VIP and Zero accounts also require $100,000 and $1,000 deposits to open, respectively, but the VIP account has reduced leverage at 1:100 while the Zero account maintains 1:500;

- The Cent account, ideal for beginners, requires only a $100 deposit and offers 1:500 leverage.

Let's break down each account type:

Account Type | Minimum Deposit | Leverage |

Standard | $100 | Up to 1:500 |

Fix | $1,000 | Up to 1:500 |

VIP | $100,000 | Up to 1:100 |

Zero | $1,000 | Up to 1:500 |

Cent | $100 | Up to 1:500 |

All account types offer swap-free Islamic options and support automated trading. This diverse range ensures traders of all levels and preferences can find an account that suits their needs.

The broker also offers Demo accounts to simulate the trading experience on the platform.

This tiered structure allows both novice and experienced traders to access the market with different capital requirements and risk exposure.

TNFX Broker’s Advantages and Disadvantages

Let's take a look at the pros and cons of trading with TNFX:

Advantages | Disadvantages |

Trusted and reliable MT4/MT5 platforms | Restrictions on certain regions |

Easy account opening process | High risk associated with leveraged trading |

Responsive customer support | - |

Variety of account types | - |

While TNFX offers many advantages, it's crucial to remember that forex and derivative trading carry significant risks.

Traders should carefully consider these factors and seek independent financial advice before engaging in trading activities.

TNFX Signing Up & Verification Process

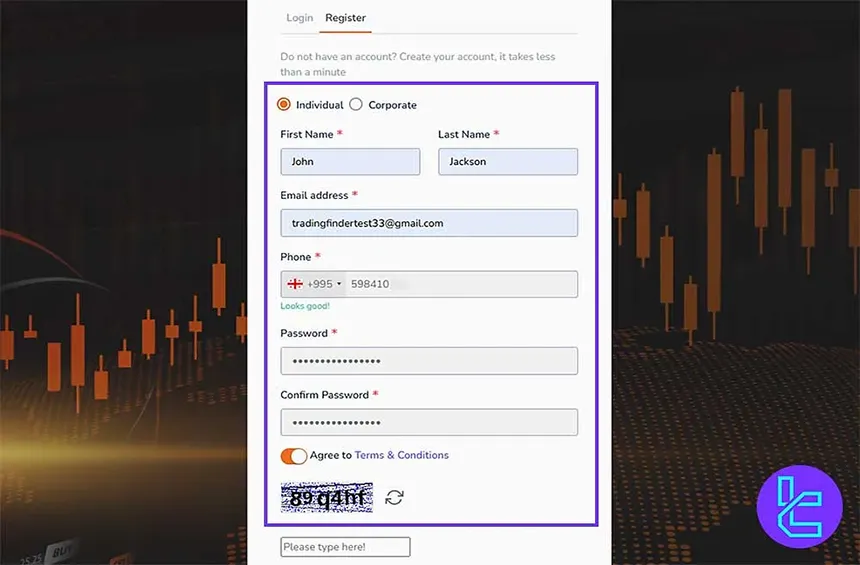

The TNFX registration is a fast and secure process that takes just a few minutes. Traders can choose between Individual or Corporate accounts and complete onboarding with simple contact verifications.

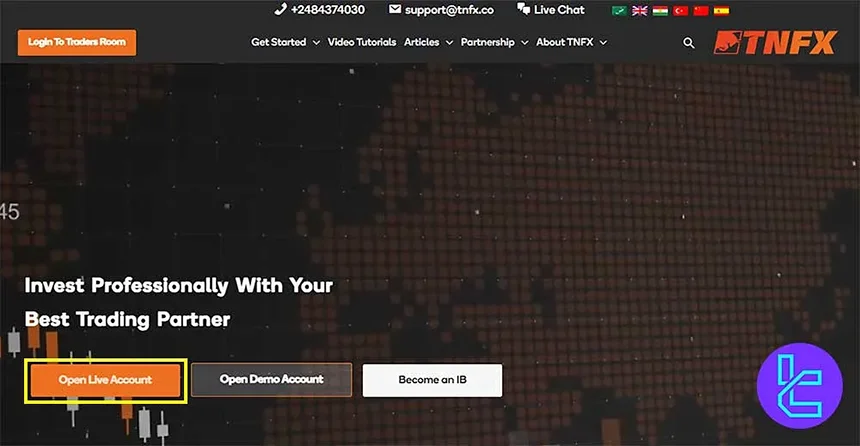

#1 Start from the TNFX Website

Visit the official TNFX site and click “Open Live Account” to begin the sign-up process.

#2 Complete the Registration Form

Select your account type and enter the following details:

- Full name

- Email address

- Mobile number

- Password

Confirm your account password and agree to the terms and conditions before clicking “Sign Up”.

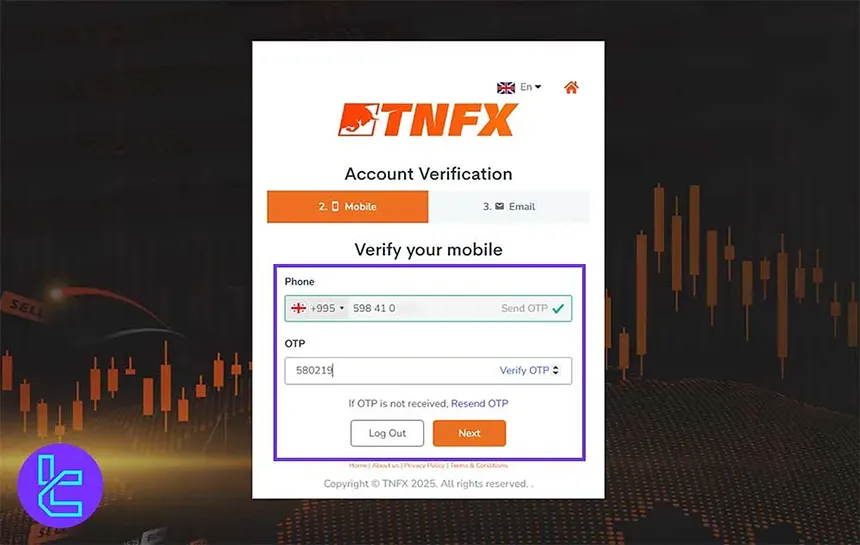

#3 Phone Verification via OTP

Click “Send OTP”, then enter the code received via SMS to verify your mobile number.

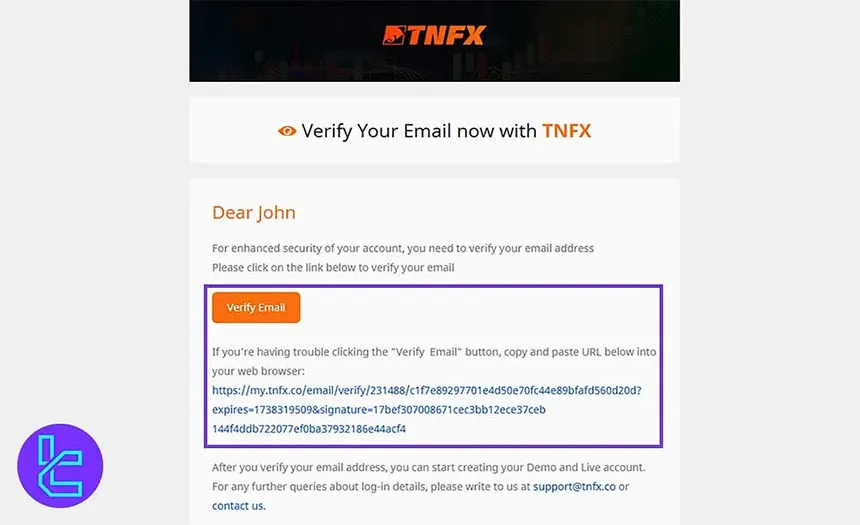

#4 Confirm Your Email Address

Check your inbox for the verification email from TNFX and click the confirmation link to activate your account.

TNFX Account Verification Guide

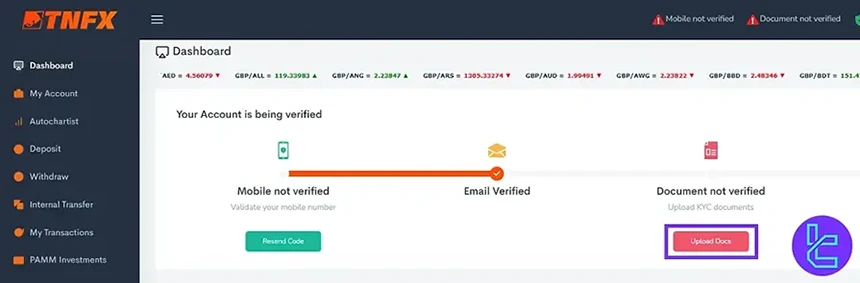

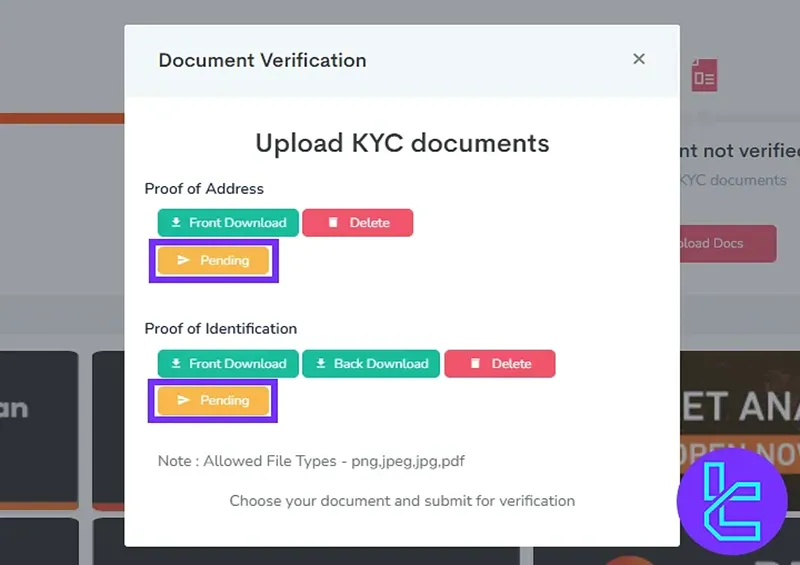

To fully activate your TNFX account and access all trading functionalities, including deposits and withdrawals, completing the TNFX verification process is essential. This process consists of a streamlined three-step KYC procedure designed for efficiency and security.

#1 Access the KYC Section

Start this process by following these steps:

- Log in to your TNFX account;

- Navigate to the “Upload Docs” area on your dashboard to begin the verification process.

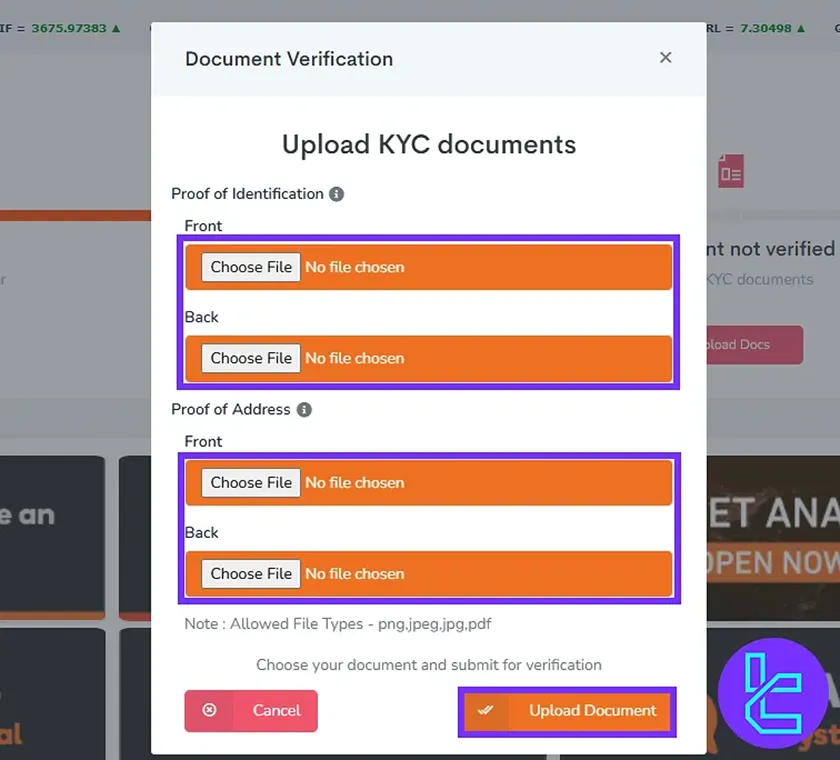

#2 Submit Identity and Address Documentation

In the KYC portal, upload both front and back images of a valid identification document. Accepted forms include:

- National ID card

- Passport

- Driver’s license

For proof of address, provide one of the following documents, ensuring it is no older than six months:

- Utility bill

- Bank statement

Once uploaded, click “Upload Document” to submit your files for review.

#3 Monitor Verification Status

Return to the “Upload Docs” section to check the progress of your submission. If all documents meet TNFX requirements, verification is usually completed within one hour.

TNFX Trading Platforms

TNFX provides traders access to the industry-leading MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. Here's what you need to know:

MetaTrader 4 | MetaTrader 5 | Web Terminal |

User-friendly interface | More advanced features than MT4 | Browser-based trading platform |

Advanced charting tools | Enhanced analytical tools | No software installation required |

Expert Advisors (EAs) for automated trading | A wider range of tradable assets | Replicates MT4/MT5 functionality |

- | Improved backtesting capabilities | - |

TNFX's provision of these popular platforms ensures that traders have access to powerful tools for executing theirtrading strategies across various devices and operating systems.

TradingFinder has developed a wide range of MT4 and MT5 indicators that you can access for free.

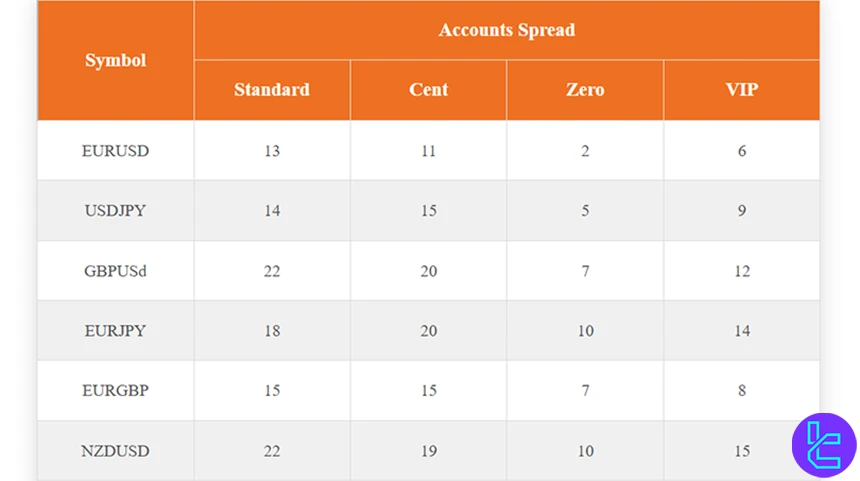

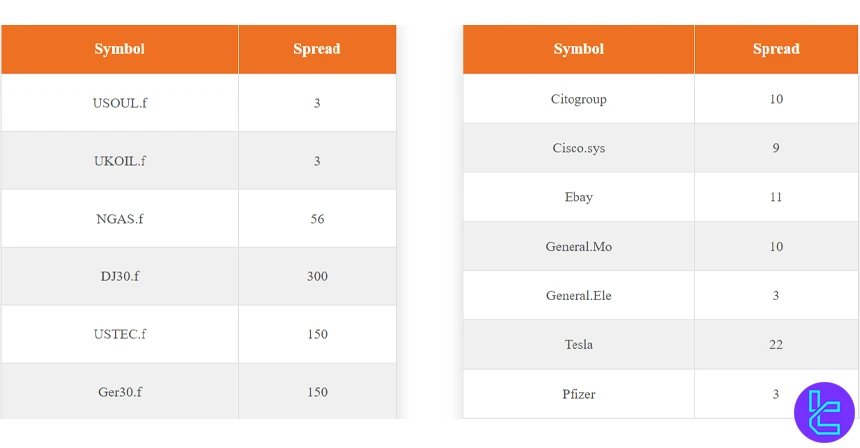

TNFX Spread and Commission Structure

TNFX provides competitive spreads based on account type. The Zero account offers the tightest conditions, starting at 0.0 pips for major pairs like EUR/USD.

Account | Spread | Commission |

Standard | From 1.0 pips | Zero |

Fix | FIX Spread (FX, Metal) | Zero |

VIP | From 0.4 pips | Zero |

Zero | As low as 0.0 pips for EUR/USD | $5 per lot |

Cent | From 1.0 pips | Zero |

TNFX's variable spreads fluctuate based on market liquidity, with tighter spreads during high liquidity periods.

These spread models are designed to accommodate both scalpers and long-term traders based on trading strategy and risk tolerance.

Swap Fee at TNFX Broker

TNFX charges an overnight funding (swap) fee for all trades kept past the daily settlement time, and this fee can be positive or negative, depending on the instrument. TNFX explicitly states that extending a contract to the next settlement date incurs a swap fee.

Here are some key details about broker’s swap:

- The Zero, Cent, and VIP accounts are explicitly marked as swap-free / Islamic accounts on TNFX’s website;

- According to TNFX, the swap is calculated as “One Point / Exchange Rate * Lot Size * Swap Value in Points”.

Non-Trading Fees at TNFX Broker

TNFX applies an inactivity (dormant) fee of up to USD 10 if a client’s account has no transactions for 12 months, and this can be charged annually.

These are the most important non-trading fee points:

- Maintenance: the inactivity fee covers compliance and account-maintenance costs, according to their Client Services Agreement;

- Deposit: Under the Local Depositor Policy, the local depositor must not deduct any commission from client deposits.

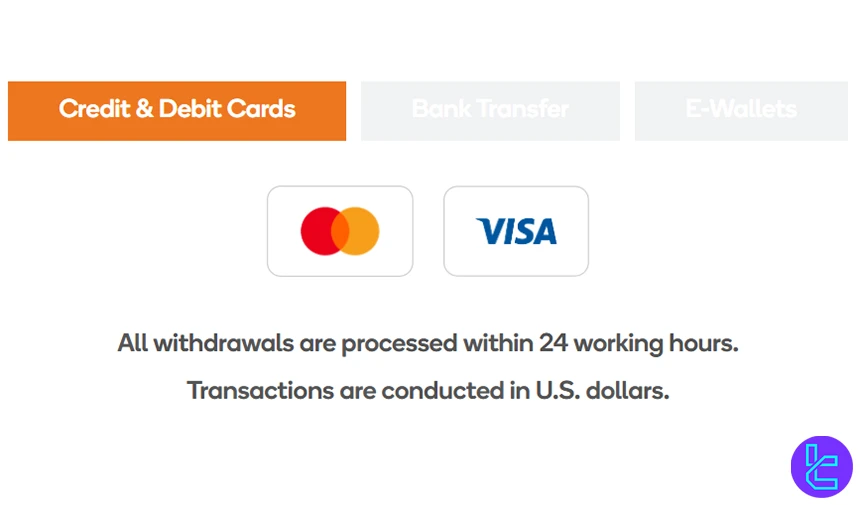

TNFX Broker Deposit & Withdrawal Methods

TNFX provides a range of convenient deposit and withdrawal options:

- WebMoney

- Payeer

- Asia Pay

- Visa

- STICPAY

- Advcash

- Corapay

- Ozow

- MasterCard

- Credit Cards

- Bank Transfer

- Local depositor

- Perfect Money

- Al-Taif

- Office transfers

- India Payment

This diverse range of payment options, quick processing times, and fee-free transactions make managing your trading funds with TNFX convenient and cost-effective.

Deposits via credit cards and Asia Pay are processed within a minute, while local bank transfers are cleared in under an hour. Office transfer deposits may take up to 24 hours. Withdrawals are processed within 24 working hours, offering swift fund accessibility.

Deposit Methods at TNFX

TNFX highlights multiple online funding channels for live accounts, including Visa/MasterCard cards, bank transfers and e-wallets, all listed on its official Deposit & Withdrawal Methods page.

The broker promotes “fast & easy” deposits, with e-wallets and cards shown as near-instant options, while bank transfers depend on banking hours.

And based on that official information, the key methods are:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Visa / MasterCard (Credit & Debit Cards) | USD | $100 | None | Instant |

Bank Transfer | USD | $100 | None | Depends on bank processing |

e-Wallet (e.g. STICPAY, Perfect Money) | USD | $100 | None | Instant |

Withdrawal Methods at TNFX

Withdrawals at TNFX use the same methods as deposits, including Visa/MasterCard, Bank Transfer, and e‑Wallets like STICPAY and Perfect Money. Simply complete and submit a Withdrawal form, and TNFX will process your request promptly.

Here are some important points about withdrawals:

- Minimum Withdrawal is USD 50;

- All withdrawals are processed within 24 working hours.

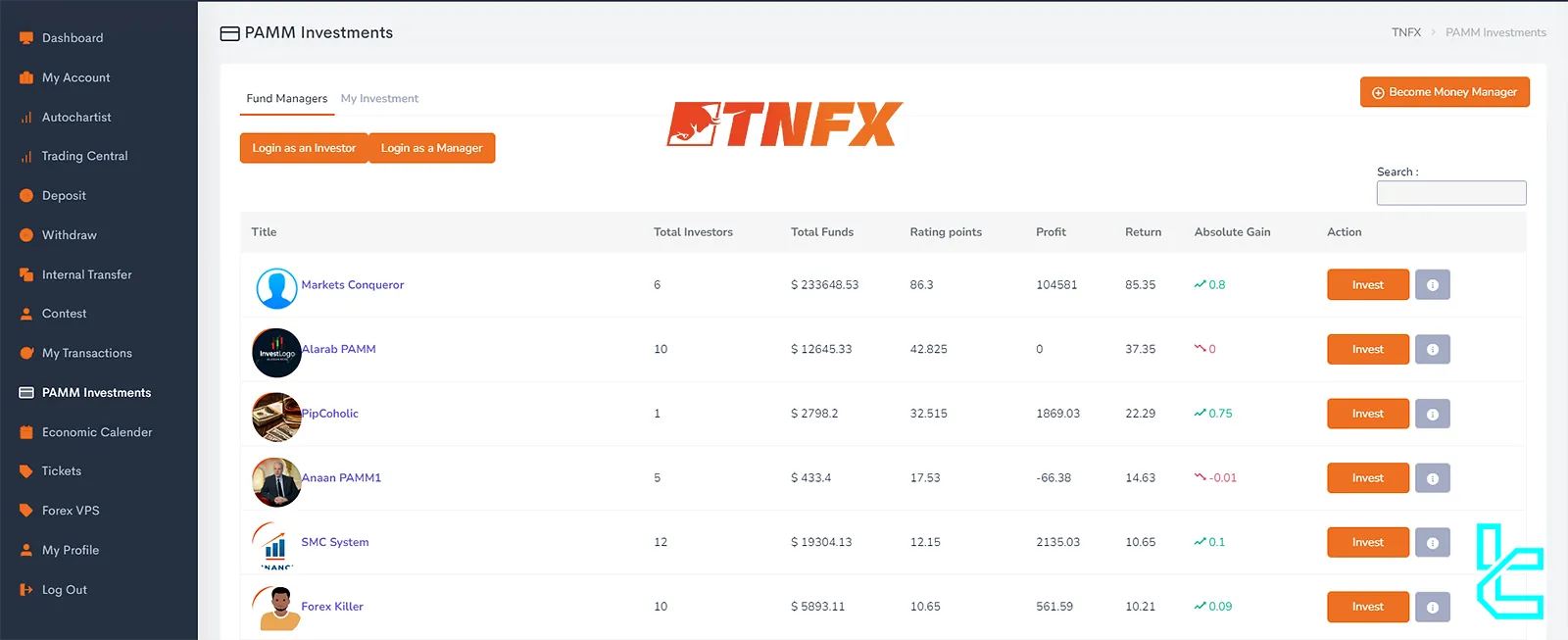

Copy Trading & Investment Options Offered on TNFX Broker

TNFX offers both Copy Trading and PAMM (Percentage Allocation Management Module) options, catering to traders who want to leverage the expertise of others.

Feature | Description | Key Benefits |

Copy Trading | Automatically replicate trades of successful traders | Suitable for beginners, customizable risk levels and allocation |

PAMM | Invest in professionally managed accounts | Diversify portfolio with different strategies, real-time monitoring |

These features allow traders to benefit from others' expertise while controlling their investment levels and risk exposure.

TNFX Tradable Markets & Symbols Overview

TNFX provides access to a wide range of financial markets, from the Forex market to indices.

For full technical details such as, refer to the table above:

Category | Type of Instruments | Number of Symbols (approx.) | Competitor Average | Max. Leverage |

Forex | Spot currency pairs (CFDs) | 50+ | ~70 | 1:500 |

Metals | Precious metals (CFDs, e.g., Gold, Silver, Copper) | 7 | ~5–10 | 1:500 |

Energies | Oil, Natural Gas (CFDs) | 3 | ~3–6 | 1:100 |

Futures CFDs | 3 | ~20–50 | Not explicitly stated | |

Equities | US, EU, HK stocks (CFDs) | 135+ | ~100–250 | 1:20 |

Indices | Major global indices (CFDs, e.g., DJ30, USTEC, Ger30) | 15 | ~10 | 1:100 |

Cryptocurrency CFDs | 13 | ~10–20 | Not explicitly stated |

TNFX empowers traders with comprehensive market access, combining high leverage options and diverse instruments to suit all strategies.

TNFX Bonuses and Promotions

TNFX broker doesn't offer traditional trading bonuses, they do provide other incentives:

- $100 Birthday Gift: Credited to your account on your birthday

- $50 No-Deposit Bonus: Available to new clients who complete KYC

TNFX also offers an Affiliate Program:

- Tiered commission structure

- Earn up to $10 per standard contract traded by referred clients

- Cashback Rebate Program for Introducing Brokers (IBs)

- Commission rates from 15% (Minimum range of number of accounts) to 55% (Minimum range of deposit)

These programs allow traders to earn additional income and rewards while trading with TNFX.

You can utilize TradingFinder's Rebate Calculator to get an estimate of your cashback earnings.

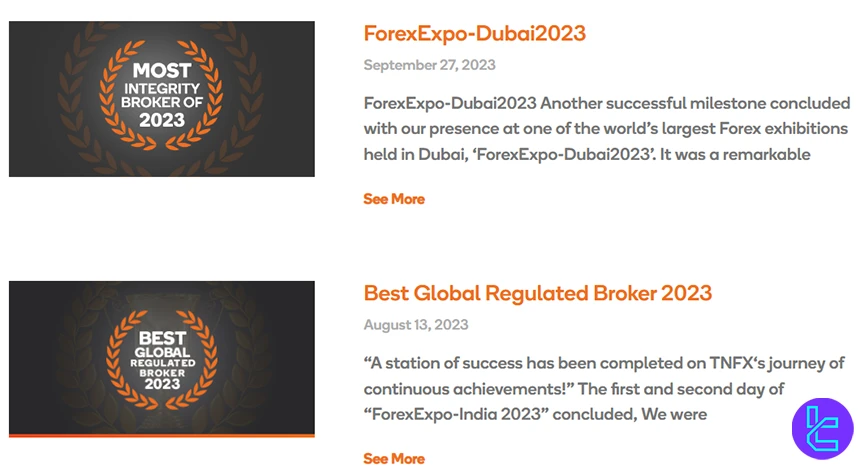

TNFX Broker Awards

Broker TNFX has received numerous awards over the years. TNFX Awards, granted by reputable platforms and organizations such as ForexExpo, highlight the broker’s quality services and credibility.

here are some of the most notable awards:

- Best Global Regulated Broker; awarded by ForexExpo in 2023;

- Best ECN Broker in the Middle East; awarded by ForexExpo in 2022;

- Smart Vision Investment Expo Egypt Award; received at the Smart Vision Expo in 2021;

- Most Trusted Broker in the Middle East; awarded at the Forex Traders Summit in 2021.

TNFX Broker Support (Phone, Live chat, Email)

TNFX offers multilingual customer support, primarily in English and Arabic, catering to a broad base of traders, including those in the MENA region.

Support is available 24 hours a day, six days a week through live chat, email, and telephone. While the service is responsive during trading days, weekend support is currently not provided.

- Phone Support: +2484374030

- Email Support: support@tnfx.co

- Live Chat

TNFX's multi-channel support ensures traders can get help when needed, enhancing the overall trading experience.

TNFX Broker List of Restricted Countries

TNFX, in compliance with international regulations, does not provide services to residents of certain countries:

- United States

- India

- Cuba

- Myanmar

- North Korea

- Iran

- Sudan

This restriction is due to local laws and regulations in these countries that prohibit or limit the use of foreign brokerage services.

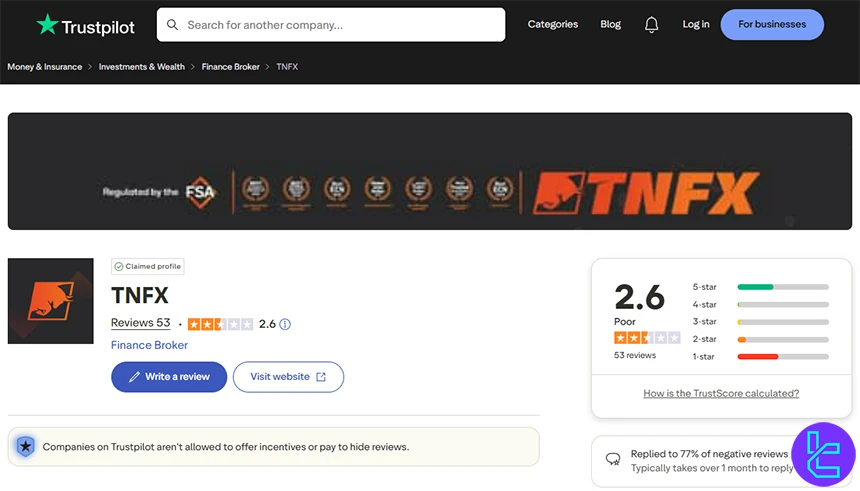

TNFX Broker Trust Scores & Reviews on Trustpilot

TNFX has garnered a generally positive reputation in the trading community. The TNFX Trustpilot has received a rating of 2.6 out of 5.

Positive Aspects | Areas of Concern |

Efficient withdrawal process | Challenges with withdrawing commissions for some users |

Competitive fee structure | Lack of multilingual support beyond Arabic and English |

Honest technical support | - |

It's important to note that while TNFX has a strong overall rating, individual experiences may vary. Potential traders should consider both positive and negative feedback when making their decision.

Education on TNFX Broker

TNFX offers educational content to help traders improve their trading skills; TNFX Educational Materials:

- Video Tutorials (Market analysis techniques)

- Trading Webinars

- Articles

These resources are for traders of all levels, from beginners to advanced, and help them make better trading decisions.

You can also check TradingFinder's Forex education section for additional learning materials.

TNFX Comparison Table

The table below provides a comprehensive comparison between TNFX and other platforms:

Parameter | TNFX Broker | IC Markets Broker | XM Broker | LiteForex Broker |

Regulation | FSA | FSA, CySEC, ASIC | ASIC, FSC, DFSA, CySEC | CySEC |

Minimum Spread | From 0.0 Pips | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips |

Commission | From $0.0 | From $3 | $0 (except on Shares account) | From $0.0 |

Minimum Deposit | $100 | $200 | $5 | $50 |

Maximum Leverage | 1:500 | 1:500 | 1:1000 | 1:30 |

Trading Platforms | MT4, MT5 | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App |

Account Types | Standard, Fix, VIP, Zero, Cent, Demo | Standard, Raw Spread, Islamic | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo |

Islamic Account | Yes | Yes | Yes | No |

Number of Tradable Assets | 285+ | 2,250+ | 1400+ | N/A |

Trade Execution | Market | Market | Market, Instant | Market |

Conclusion and final words

TNFX offers traders features such as CopyTrading, PAMM accounts, and an Affiliate Program with commission rates ranging from 15% to 55%.

It offers many deposit and withdrawal methods, including Visa, MasterCard, WebMoney, Payeer, STICPAY, and bank transfers.

The broker’s 24/6 customer support service through live chat, email, phone, and ticket systems adds to its reliability.