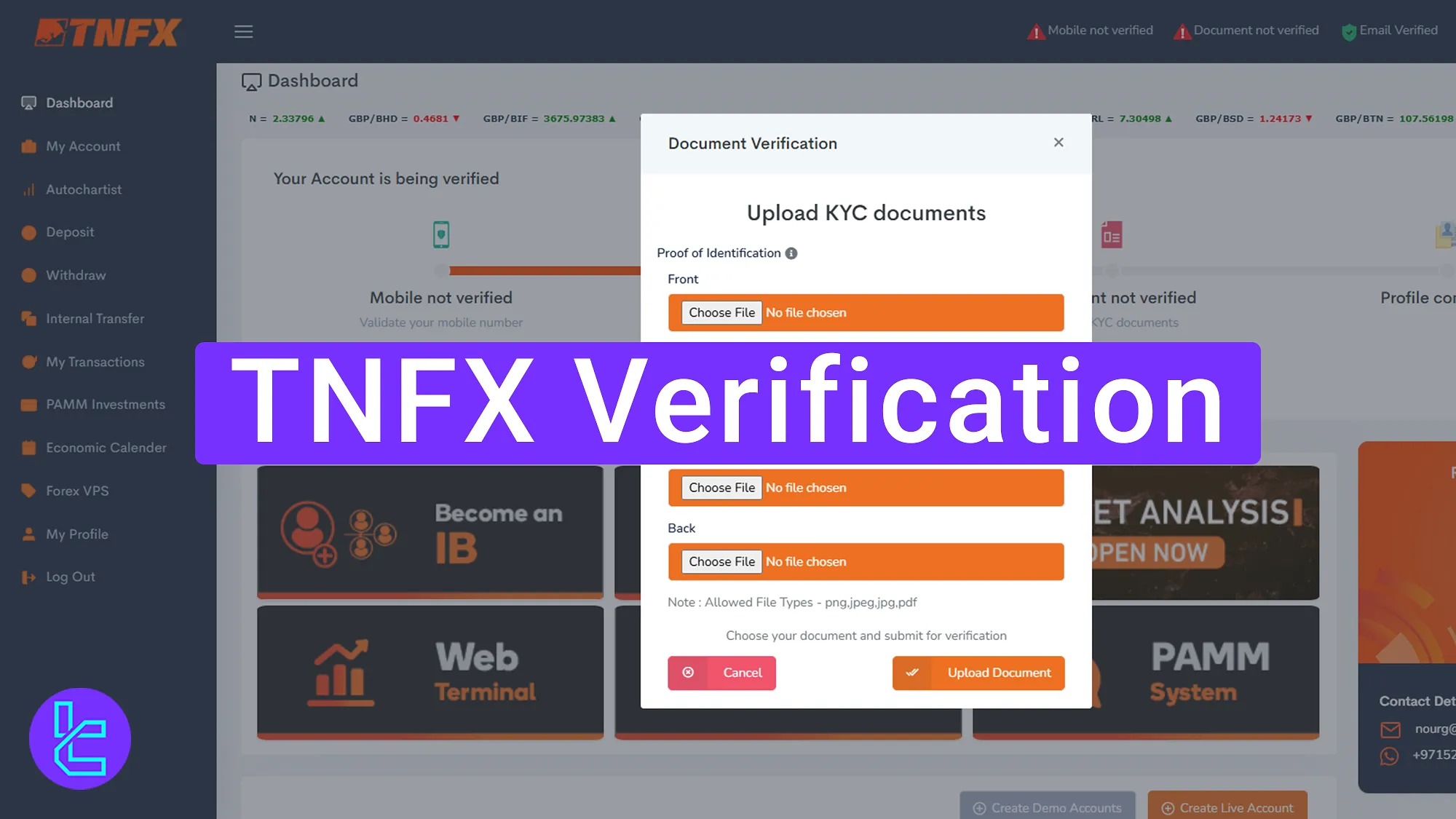

TNFX verification is a simple 3-step process that enables full access to deposits and withdrawals. Users are required to upload identity documents and proof of address issued within the last 6 months.

TNFX KYC Process Overview

After finalizing TNFX registration, complete the following 3 steps to authenticate your account and unlock TNFX broker trading features.

TNFX verification key steps:

- Access the TNFX KYC section from the dashboard;

- Upload proof of identity and proof of address documents;

- Check the authentication status.

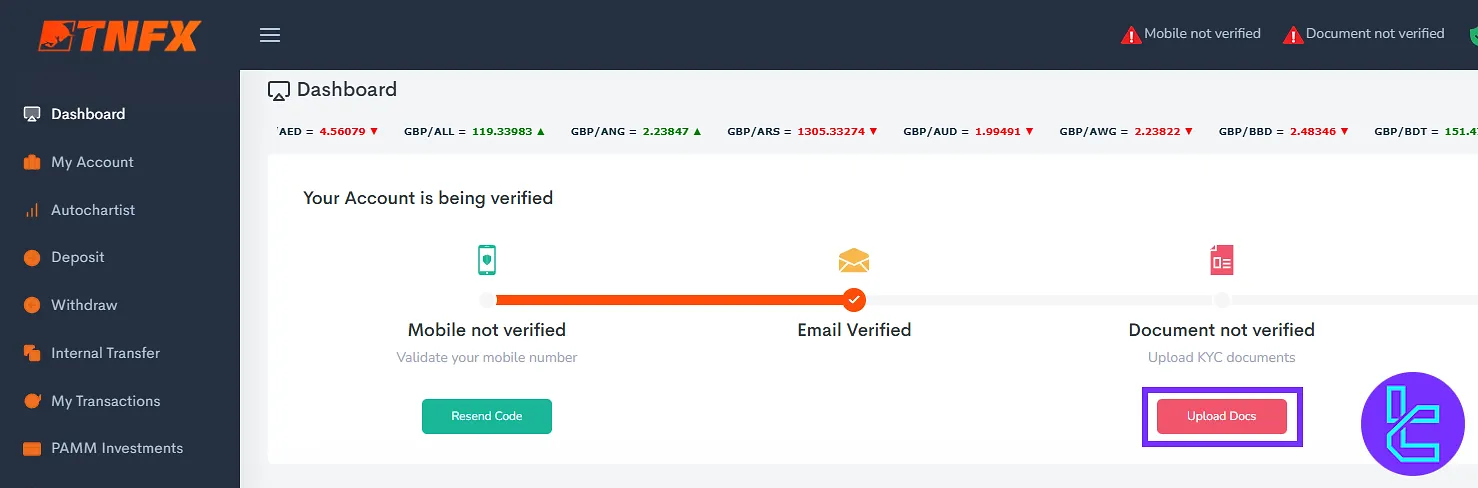

#1 Accessing the TNFX KYC Section

Begin this process by following these steps:

- Log in to your TNFX account;

- Navigate to the "Upload Docs" section on the dashboard.

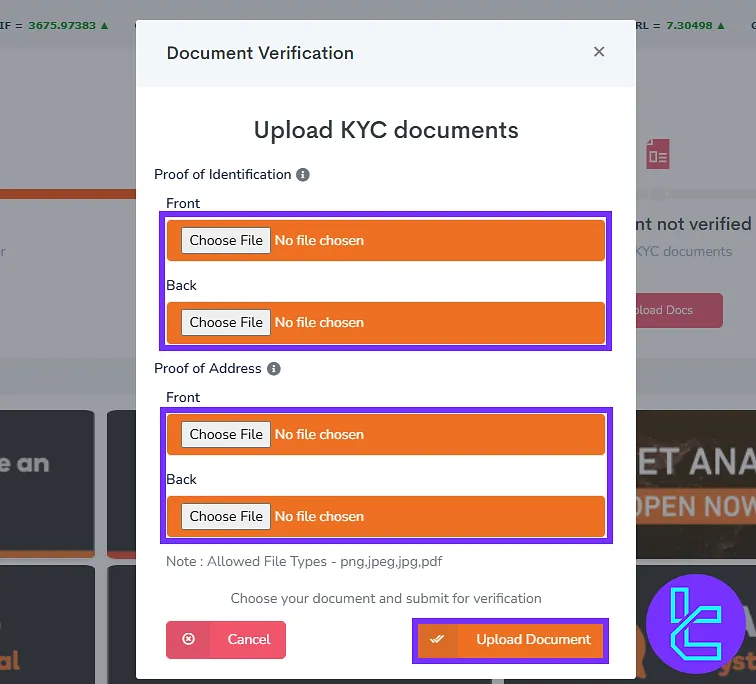

#2 Uploading Proof of Identity and Address Documents

In the TNFX authentication area, upload both front and back images of a valid identity document. Accepted documents include:

- National ID card

- Passport

- Driver’s license

Below the identity section, upload a valid proof of address. Accepted documents include:

- Utility bill (no older than 6 months)

- Bank statement

Now, click on the "Upload Document" button to submit them for review.

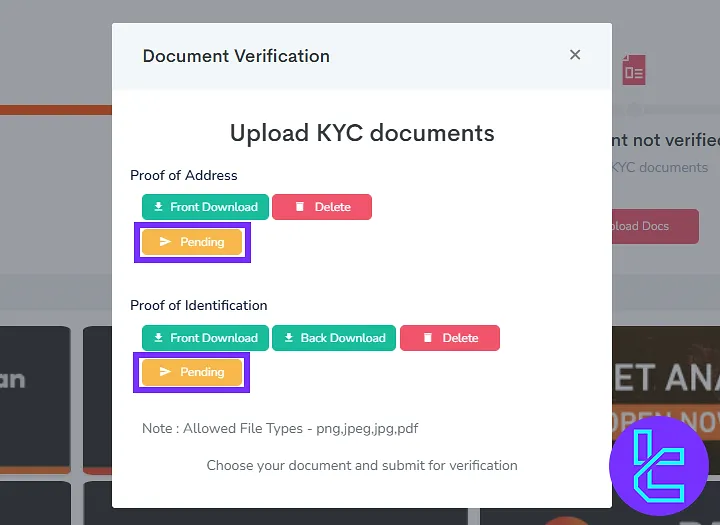

#3 Checking the TNFX Authentication Status

Return to the "Upload Docs" section from the dashboard to check the document review status. If documents meet all requirements, TNFX typically completes the verification within 1 hour.

TF Expert Suggestion

The TNFX verification process can be completed in 5 minutes if documents are prepared in advance. Submitted files are usually reviewed within 1 hour.

Now that you have a verified account, you can manage funds using the TNFX deposit and withdrawal methods available on the platform. More detailed instructions are avilable on the TNFX tutorial page.