Traders Trust is a Forex broker that offers trading services through its Classic, Pro, and VIP accounts. This broker has a $50 minimum deposit, 0% deposit and withdrawal fees, and high leverage (up to 1:3000).

Traders Trust offers Social Copy Trader and MAM accounts, which enable account managers to trade 200+ instruments and allow traders to earn passive income.

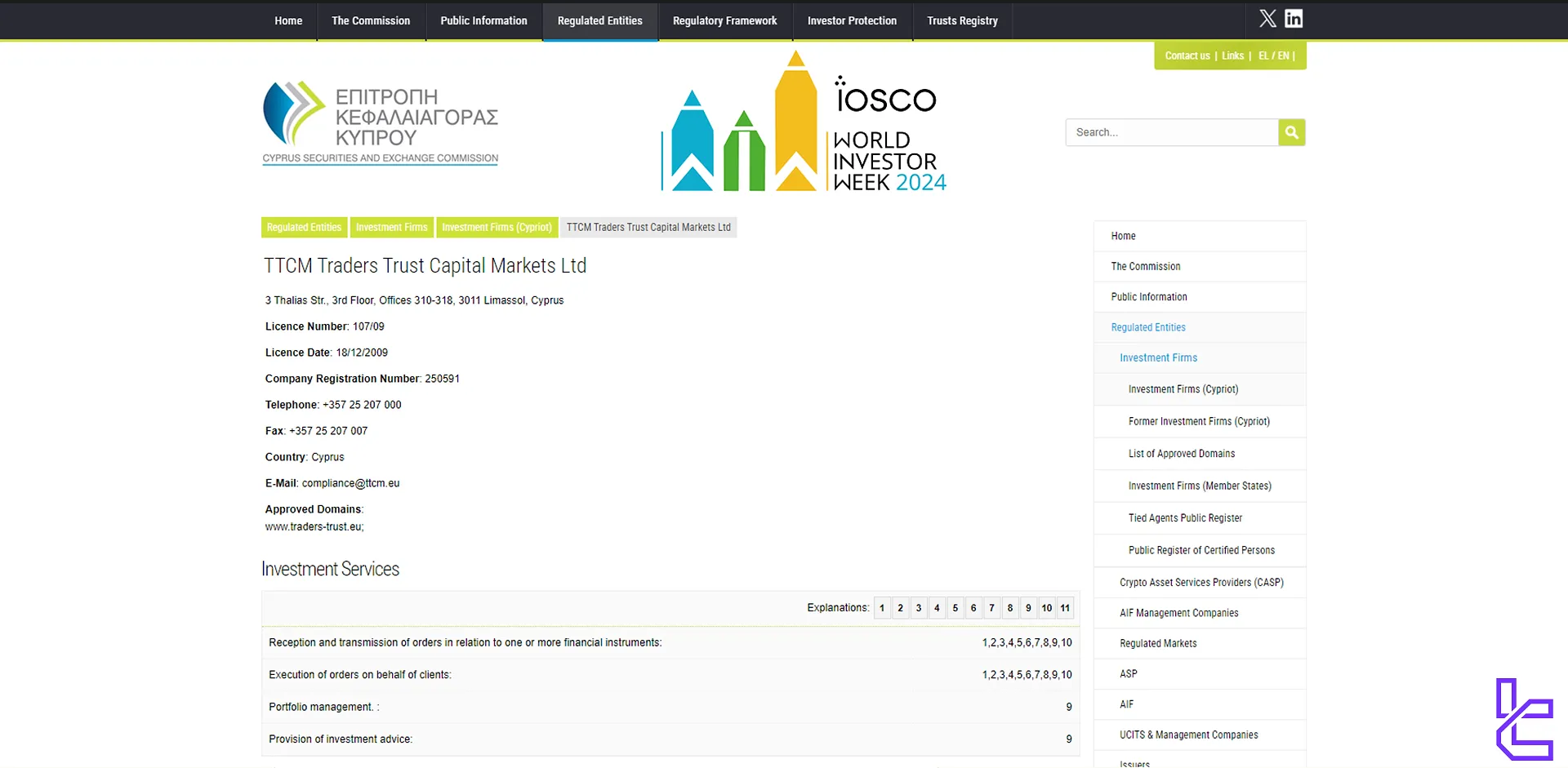

Traders Trust Broker Company Information & Regulation Status

Traders Trust has over a decade of experience providing trading services. The company operates under two main entities:

Entity Parameters / Branches | Traders Trust Ltd | TTCM Traders Capital Ltd | TTCM Traders Trust Capital Markets Ltd |

Regulation | FSA | BMA | CySEC |

Regulation Tier | 4 | 3 | 1 |

Country | Seychelles | Bermuda | Cyprus |

Investor Protection Fund | No | No | ICF (up to €20,000) |

Segregated Funds | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes |

Maximum Leverage | 1:3000 | 1:3000 | 1:30 |

Client Eligibility | All except Restricted Regions | All except Restricted Regions | EU / EEA clients |

The forex broker's operations comply with the European Union’s MiFID II framework. This regulatory oversight gives traders a sense of security and ensures that the broker adheres to strict financial standards.

Traders Trust Broker Summary of Specifications

Here's a quick overview of what Traders Trust offers:

Broker | Traders Trust |

Account Types | Classic, Pro, VIP |

Regulating Authorities | CySEC, FSA, BMA |

Based Currencies | USD, EUR, JPY, GBP |

Minimum Deposit | $50 |

Deposit Methods | Visa/MasterCard, Paypal, Bank wired, Neteller, Skrill, USDT, BTC |

Withdrawal Methods | Visa/MasterCard, Paypal, Bank wired, Neteller, Skrill, USDT, BTC |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:3000 |

Investment Options | Copy trading, MAM accounts |

Trading Platforms & Apps | MT4, cTrader |

Markets | Forex, indices, cryptocurrencies, oil, stocks, metals |

Spread | Floating from 0.0 pips |

Commission | From $1.5 per lot |

Orders Execution | Market |

Margin Call/Stop Out | 50%/20% |

Trading Features | Demo account |

Affiliate Program | Yes |

Bonus & Promotions | 50k convertible bonus, loyalty program, cashback rebate |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, live chat, phone |

Customer Support Hours | 24/5 |

Restricted Countries | Iran, Syria, North Korea, Lebanon, USA, Australia, and more |

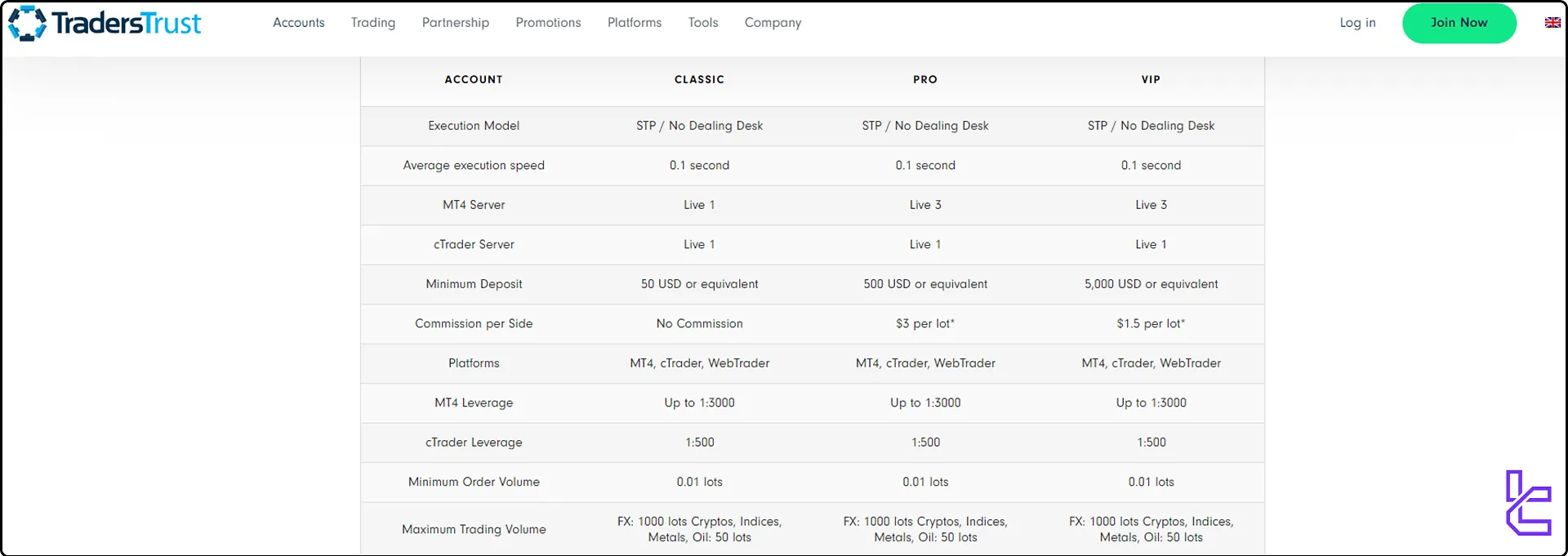

Traders Trust Account Types Overview

Traders Trust offers three main account types to cater to different trading styles and experience levels:

Account types | Classic | Pro | VIP |

Minimum deposit | $50 | $500 | $5,000 |

Minimum trading volume | 0.01 Lot | 0.01 Lot | 0.01 Lot |

Maximum Leverage | 1:3000 | 1:3000 | 1:3000 |

Spreads | Floating from 1.5 pips | Floating from 0 pips | Floating from 0 pips |

Commission | No | $3 per lot | $1.5 per lot |

All account types offer access to the full range of trading instruments and platforms. The main differences lie in the spread and commission structure, allowing traders to choose the account that best suits their trading strategy and volume.

It’s worth mentioning that Traders Trust also offers demo and Islamic accounts to its users.

Traders Trust Islamic Account

Traders Trust offers Islamic (swap-free) accounts that comply with Shariah principles. Upon approval, traders can operate without earning or paying interest on overnight positions.

However, swap-free terms may not apply to all trading instruments and may be subject to administrative conditions. Interested clients must request account conversion via the support team.

Traders Trust Advantages and Disadvantages

Considering the benefits and drawbacks of a Forex broker is critically recommended when choosing one. Let's take a look at the pros and cons of trading with Traders Trust:

Advantages | Disadvantages |

High leverage up to 1:3000 | No US clients accepted |

Competitive spreads from 0.0 pips | No MT5 platform |

Regulated by CySEC and FSA Seychelles | $25 inactivity fee |

Wide range of trading instruments | Outdated educational resources |

Traders Trust Registration and Verification

The Traders Trust registration process is fast and straightforward. In under five minutes, users can submit basic personal details, verify their email, and access their trading dashboard. The process is entirely free and requires no initial deposit.

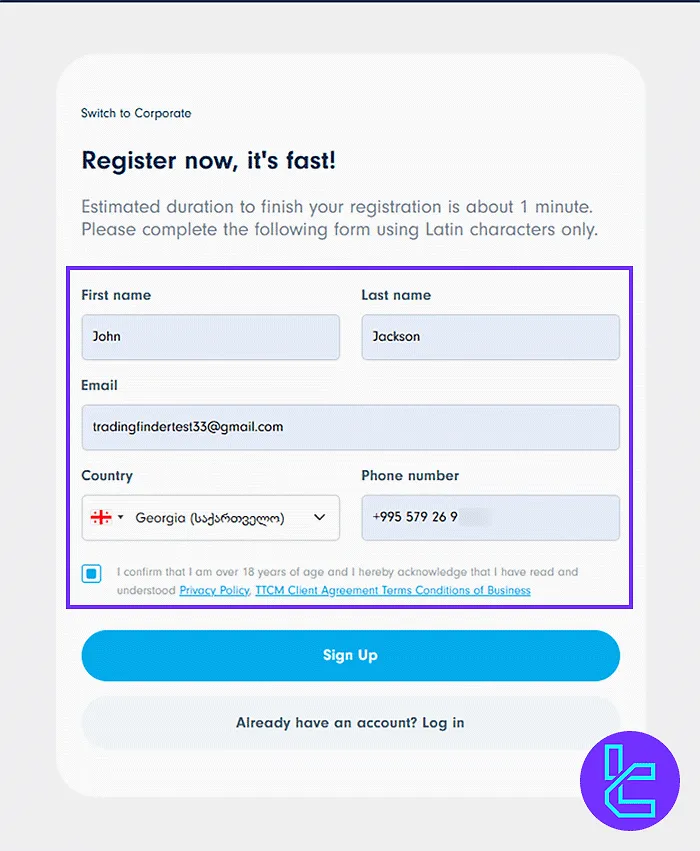

#1 Open the Traders Trust Registration Page

Go to the official Traders Trust website and click on “Open an Account”. Then, select the “Join Now” option to access the registration form.

#2 Enter Basic Details

Fill in the application form with the following details:

- Full name

- Email address

- Country of residence

- Phone number

Agree to the terms and conditions by checking the box, then click “Sign Up” to proceed.

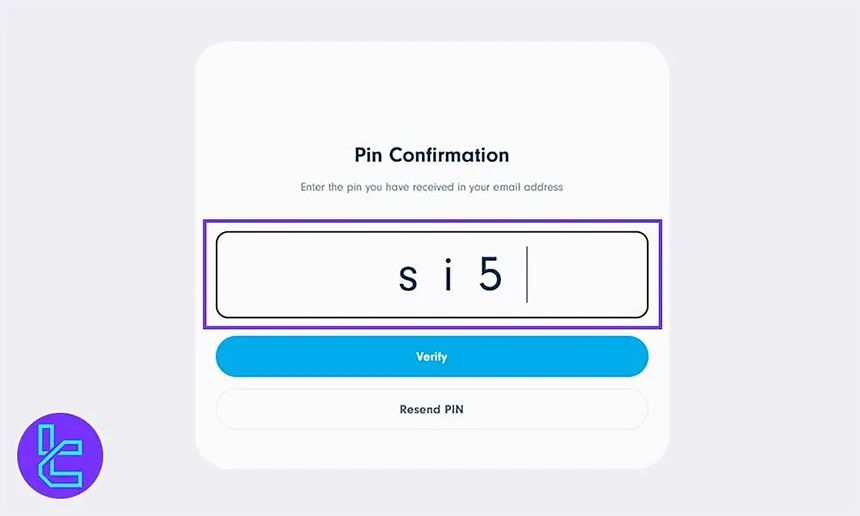

#3 Verify Your Email Address

A verification email with a PIN code will be sent to your inbox. Copy the PIN, paste it into the verification field on the website, and click “Verify”. After confirmation, log in and accept the terms again to access your dashboard.

#4 Complete the KYC Procedure

Log in to your client dashboard, navigate to the KYC section, and provide additional personal information. At the end, you must upload supporting documents to complete Traders Trust Verification, including:

- Proof of ID: Passport or National ID

- Proof of Address: Utility bill or Bank statement

Traders Trust Broker Trading Platforms and Applications

Let’s go through the trading platforms and apps in our Traders Trust review. This broker offers two popular trading platforms, including MetaTrader 4 and cTrader.

Traders Trust MetaTrader 4 (MT4)

- Industry-standard platform

- User-friendly interface

- Advanced charting tools

- Available on desktop, web, and mobile

If you are interested in exploring the platform's indicators, you can visit the MT4 indicator page on the website.

Links:

Traders Trust cTrader

- Modern and intuitive platform

- Advanced order types

- Available on desktop, web, and mobile

- Over 50 indicators and 6 zoom levels

Links:

The choice between MT4 and cTrader often comes down to personal preference, with cTrader offering a more modern interface and some advanced features that may appeal to certain types of traders.

Traders Trust Fees, Spreads, and Commissions

Traders Trust offers straightforward pricing across its account types:

Account type | Spread | Commission |

Classic Account | From 1.5 Pips | No commission |

Pro Account | From 0.0 Pips | $3 per lot per side |

VIP Account | From 0.0 Pips | $1.5 per lot per side |

This tiered structure allows traders to select a cost model that aligns with their strategy and trade frequency.

The broker uses a floating spread model, meaning spreads can widen during volatile market conditions. Traders Trust other fees:

- No deposit or withdrawal fees

- Standard currency conversion fee

- Rollover fees for overnight positions held open

- $25/Mon inactivity fee

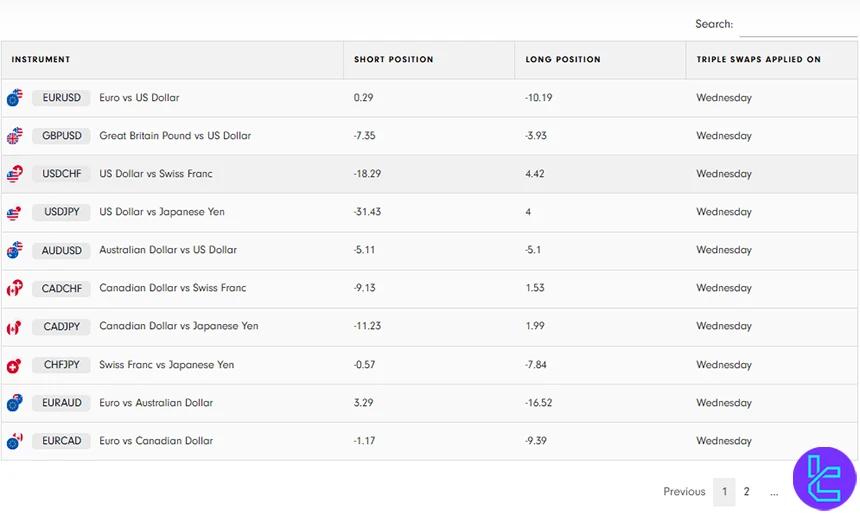

Swap Fee at Traders Trust

Traders Trust publishes exact swap rates for every instrument, showing the overnight cost or credit applied per lot for example, EURUSD long positions incur –10.19 points while short positions receive +0.29 points.

The broker also provides Swap-Free / Islamic accounts where swaps are waived for a limited period before a fixed holding fee applies.

Below are the most important operational details you need to know:

- Islamic accounts offer up to 7 days of swap-free trading on many forex pairs, after which a fixed “holding fee per lot/day” is charged according to the instrument;

- Holding fees vary by asset, and examples published include around 5 USD per lot per day for several major FX pairs after the swap-free period;

- All swap values are listed in points per lot, enabling traders to calculate precise overnight costs based on position size and duration.

Non-Trading Fees at Traders Trust

Traders Trust does not charge standard trading fees, but some non-trading costs may apply depending on account activity, instrument type, and specific conditions related to deposits, withdrawals, or swap-free accounts.

Below are the main points you need to know about potential non-trading fees:

- Deposit and withdrawal fees: Normally zero, but banking/transfer charges may apply under special conditions;

- Minimum withdrawal: $50 (or equivalent) per transaction;

- Conditional penalty fee: If trading volume is extremely low or a transfer is returned, fees up to 5% of the transaction plus banking costs may be charged;

- No account maintenance / inactivity fees: Officially, there are no fees simply for holding an account open;

- Currency conversion: Fees may apply depending on deposit/withdrawal currency relative to account currency.

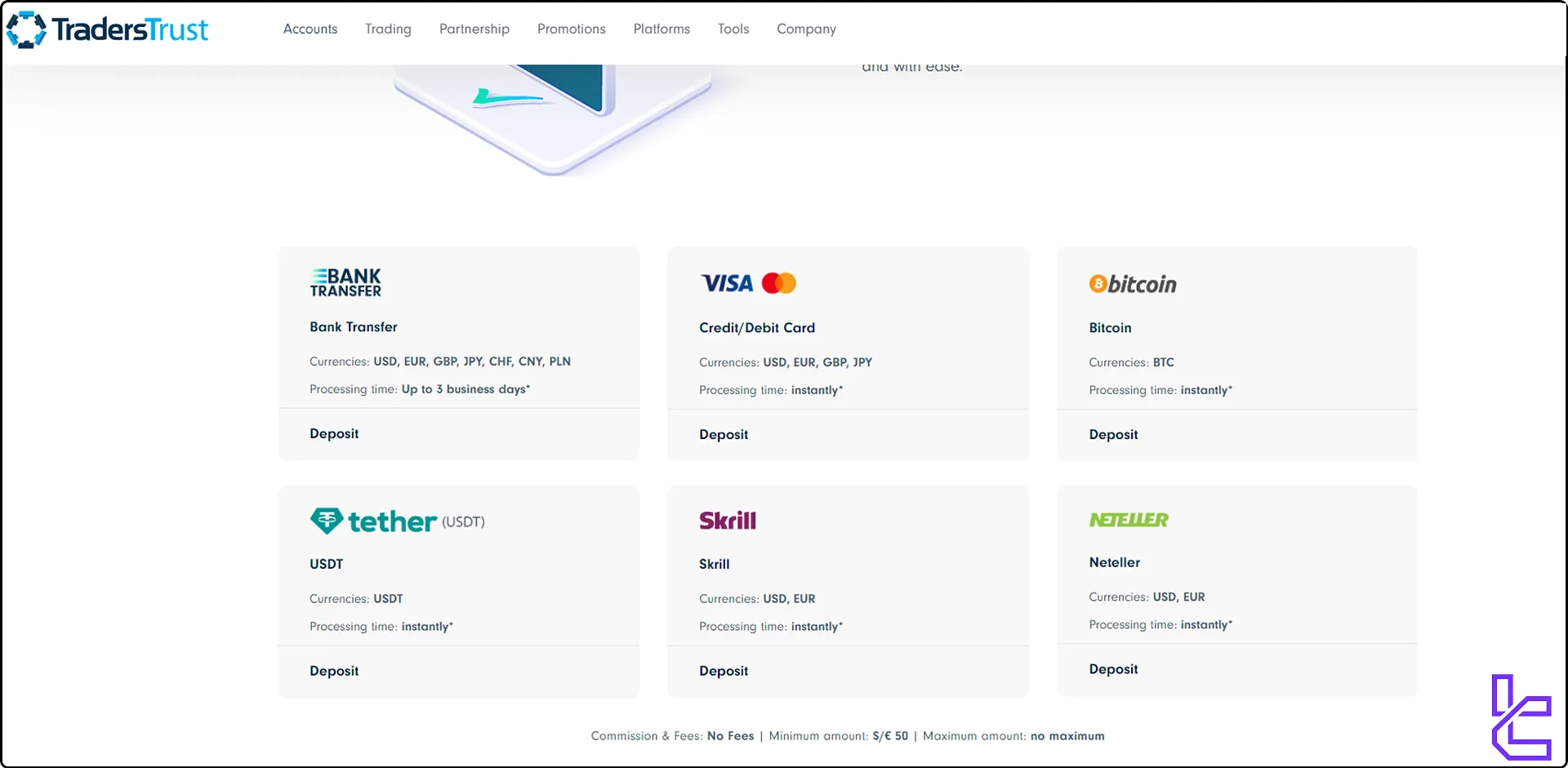

Traders Trust Deposit & Withdrawal Options

Like many other Forex brokers, Traders Trust offers a variety of deposit and withdrawal methods to cater to traders worldwide:

- Bank wire transfer

- Credit/debit cards (Visa, Mastercard)

- E-wallets (Skrill, Neteller)

- Cryptocurrencies (Bitcoin, USDT)

Key points about deposits and withdrawals:

- No fees charged by Traders Trust for deposits or withdrawals

- Minimum deposit: $50

- Most methods process instantly, except bank transfers (1-3 business days)

- Withdrawal requests processed within 24 hours

The broker's commitment to fee-free deposits and withdrawals, along with quick processing times, is a significant advantage for traders.

Deposit Methods at Traders Trust

Traders Trust offers a variety of secure deposit methods, carefully selected from global payment providers to ensure both safety and convenience.

Clients can fund their accounts instantly via digital wallets or cryptocurrencies, or use traditional bank transfers with competitive processing times.

Below is a detailed overview of the deposit options currently available at Traders Trust:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Transfer | USD, EUR, GBP, JPY, CHF, CNY, PLN | $/€ 50 | No Fees | Up to 3 business days |

Credit/Debit Card | USD, EUR, GBP, JPY | $/€ 50 | No Fees | Instant |

Bitcoin (BTC) | BTC | $/€ 50 | No Fees | Instant |

USDT | USDT | $/€ 50 | No Fees | Instant |

Skrill | USD, EUR | $/€ 50 | No Fees | Instant |

Neteller | USD, EUR | $/€ 50 | No Fees | Instant |

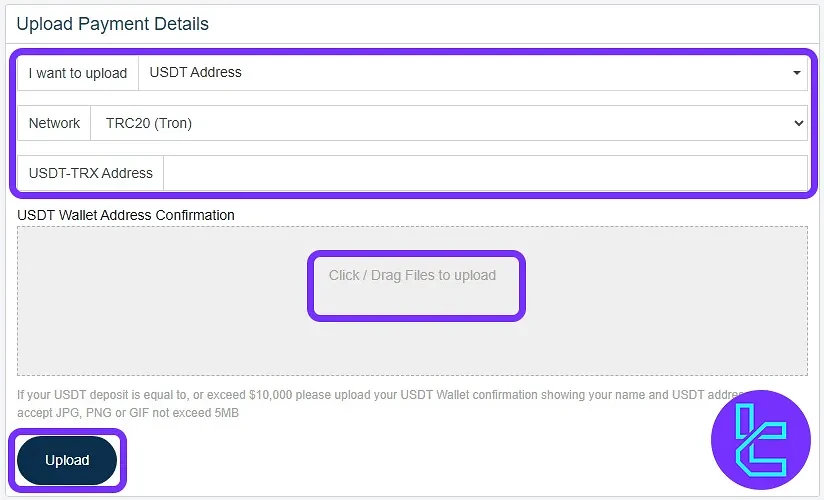

Traders Trust TRC20 Deposit

Depositing USDT to a Traders Trust account via the TRC20 (Tron) network is straightforward, secure, and efficient. Traders Trust TRC20 deposit involves three main steps including wallet verification, blockchain selection and payment confirmation.

Also, the minimum deposit is $50, and sending funds to any address outside the TRC20 network will result in permanent loss.

#1 Choosing Top-Up Method and Uploading Wallet Info

To start the process:

- Navigate to the "Funds" section in the left-hand menu;

- Click on "Deposit Funds";

- Select your preferred wallet and click the Tether (USDT) icon;

- Click on "Upload Payment Details".

On the following screen, enter your USDT wallet address, choose the "TRC20 (Tron)" network, and upload a screenshot of your wallet address for verification. After completing these steps, click "Upload".

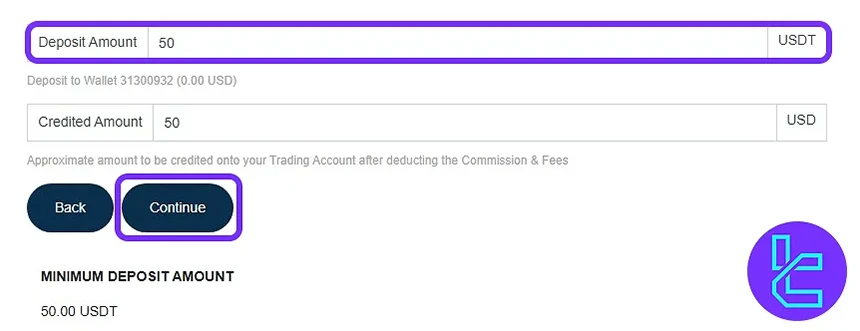

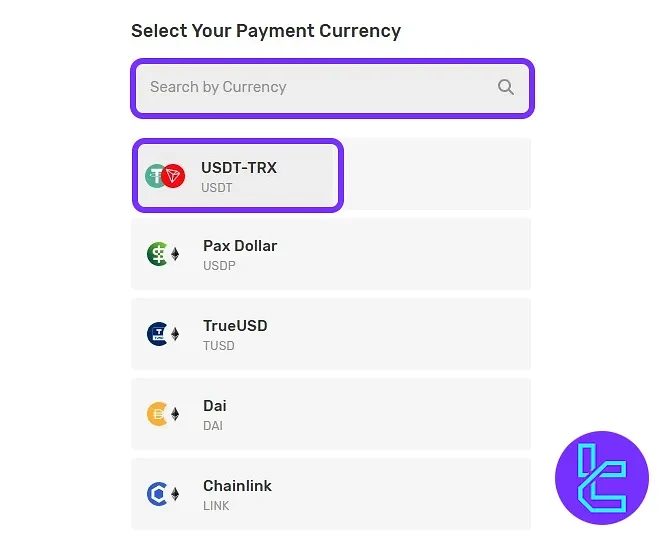

#2 Entering Amount and Completing the Payment

Once your wallet information is submitted, enter the deposit amount and press "Continue".

Select "USDT-TRX" as the payment currency.

The system will display a wallet address and a corresponding QR code. Open your wallet application and send the exact amount to complete the deposit.

#3 Verifying Your TRC20 Transaction

After completing the payment, return to the "Funds" section. Open "Transaction History" to confirm the status of your transfer.

Withdrawal Methods at Traders Trust

Withdrawal methods at Traders Trust mirror the deposit options, ensuring consistency and convenience for clients. Withdrawals are designed to be fast and secure, with most methods processed within just “1 business day”.

When making a withdrawal, you should pay attention to the following:

- A minimum withdrawal of $/€ 50 applies, and certain conditional fees may be charged in specific situations;

- If a withdrawal is canceled/returned by the bank, TTCM may charge the equivalent banking fees;

- In case of low trading volume (<1% of deposited amount in lots) or detected fraudulent activity, fees may include up to 5% of the total deposit/withdrawal plus banking costs.

Traders Trust TRC20 Withdrawal

Withdrawing USDT from a Traders Trust account using the TRC20 (Tron) network is simple and secure. The Traders Trust TRC20 Withdrawal process can be completed in four steps, starting from the payout section.

The minimum withdrawal amount is $50, and funds are transferred directly to your verified TRC20 wallet.

This step-by-step guide ensures a smooth and efficient TRC20 withdrawal experience.

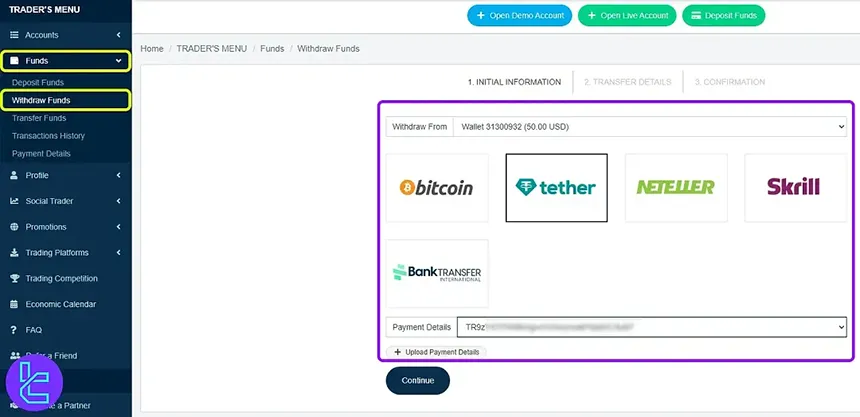

#1 Enter the Payout Section and Complete the TRC20 Cash Out Details

To initiate the withdrawal:

- Log in to your Traders Trust dashboard;

- Navigate to the "Funds" section from the left-hand menu;

- Click "Withdraw Funds";

- Select the trading account you want to withdraw from and choose Tether (USDT) as the withdrawal method;

- Under "Payment Details", enter your verified TRC20 wallet address, making sure it has already been saved in your profile.

#2 Enter the Cash Out Amount

Specify the amount you wish to withdraw (minimum $50) in Tether, then click "Continue" to move forward.

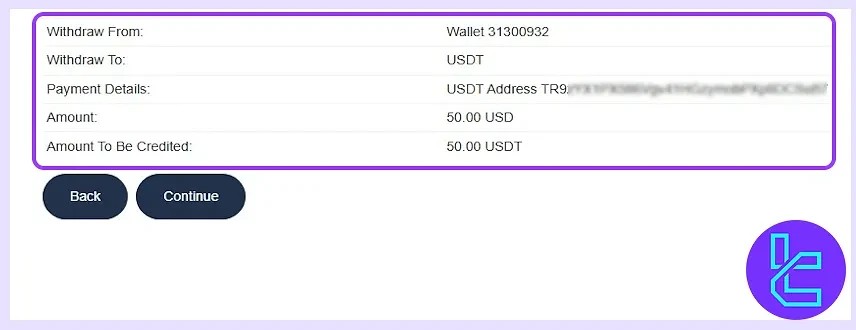

#3 Review and Confirm Fund Request Details

Carefully check all cash-out details, including the wallet address and withdrawal amount. Once verified, click "Continue" to submit your request.

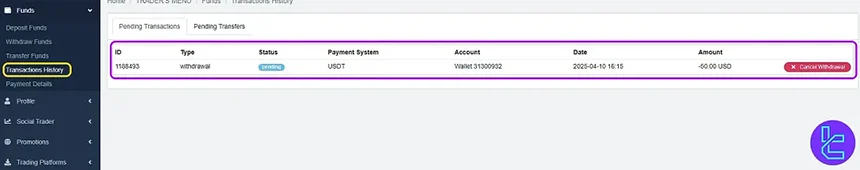

#4 Wait for Processing and Final Approval

Your withdrawal request will be marked as Pending. It typically changes to Approved within one business day. You may cancel the request any time before it is approved.

Traders Trust Copy Trading and Investment Options

Traders Trust offers Social Copy Trader and MAM accounts for its users:

Traders Trust Social Copy Trader

Traders Trust Social Copy Trader allows users to mirror the strategies of expert traders in real time, making trading accessible for beginners. The copy trading feature offers a user-friendly platform where traders can follow top performers and execute the same trades automatically.

Traders Trust MAM Account

The Multi-Account Manager allows traders to manage multiple client accounts and execute strategies on all the accounts simultaneously. This enables high-performing traders to charge clients and receive commissions for their knowledge and skills.

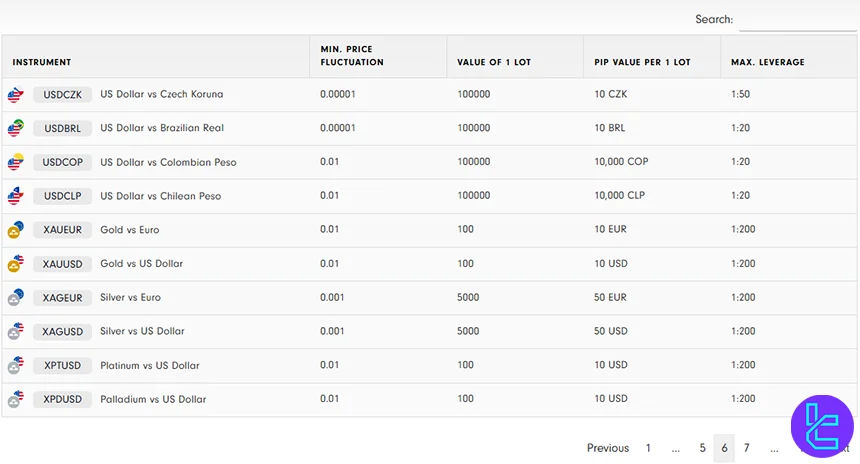

Tradable Markets & Symbols in Traders Trust

Traders Trust offers a wide range of 200+ trading instruments across various asset classes, from the Forex market to Stocks and Cryptocurrencies.

Leverage options and instrument variety are optimized to meet competitive market standards, while ensuring flexibility and risk management for traders.

Below is a detailed overview of the available instruments at Traders Trust:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Currency pairs | 64 | 50-75 | 1:3000 |

Indices | Major global stock indices | 9 | 8-15 | 1:100 |

Metals | Gold, Silver, Platinum | 10 | 3-10 | 1:200 |

Stocks | CFDs on popular US and European stocks | 97 | 80-200 | 1:20 (Mostly 1:3) |

Bitcoin, Ethereum, Litecoin | 10 | 5-15 | 1:10 | |

Oil | US and UK oil | 3 | 2-5 | 1:25 |

This wide range of assets enables traders to diversify across multiple markets from a single platform.

Traders Trust Broker Bonuses

Traders Trust offers several attractive promotions:

50K Convertible Bonus:

- 100% bonus on deposits up to $50,000

- Convertible to real cash through trading

- Available in MT4 Classic and Pro account

- Minimum deposit $300

Partner Loyalty Program:

- Earn by becoming a Traders Trust partner

- Receive up to 3% commission from direct clients

Cashback Rebate:

- Trade for at least 10 round turn lots per day

- Earn up to $2,000 daily cashback

Traders can also request a free VPS by trading at least 5 round turns in 1 month and keep their account balance over $2k

Traders Trust Awards

The official Traders Trust website does not mention any awards or recognitions. There is no dedicated page or reference confirming that the broker has received any industry accolades.

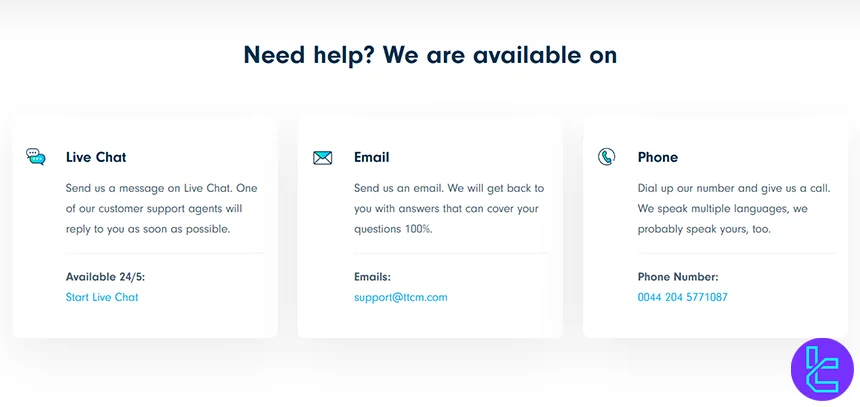

Traders Trust Support Channels

Traders Trust provides 24/5 customer support through multiple channels:

- Live Chat: Available on the website for quick inquiries

- Email: support@ttcm.com

- Phone: +442045771087

- FAQ section: Comprehensive answers to common questions

The support team is known for its responsiveness and ability to assist in 6 languages, enhancing the overall trading experience.

Traders Trust Restricted Countries

While Traders Trust serves clients globally, there are some restrictions. The broker does not accept clients from:

- North America: USA, Canada

- South America: Cuba, Venezuela, Puerto Rico

- Africa: Guyana, Lao People’s Democratic Republic, Uganda, Sudan

- Asia: Afghanistan, Syria, Iran, Iraq, North Korea, Japan, Yemen

- Australia and New Zealand

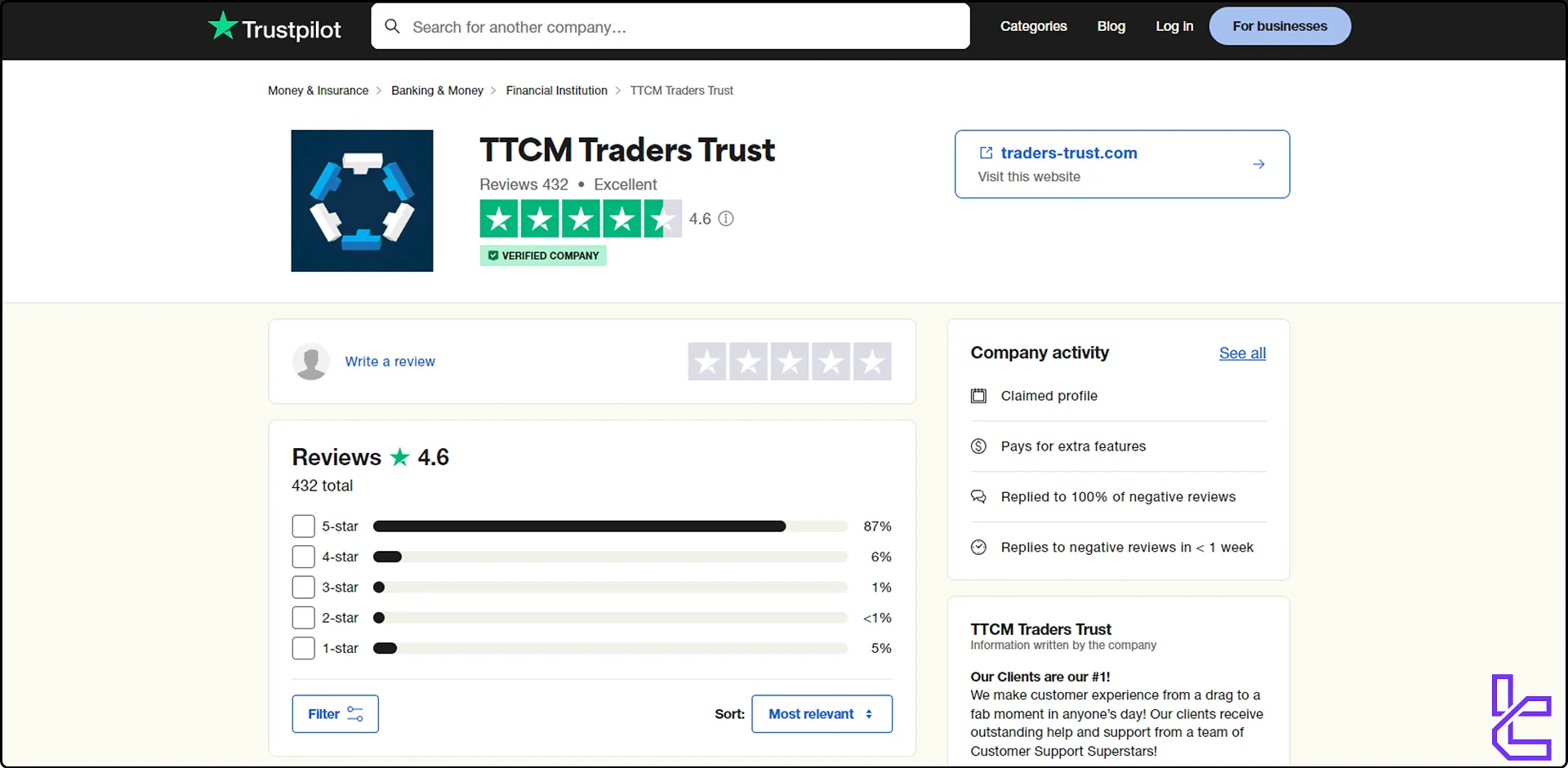

Trust Scores and Reviews of Traders Trust Broker

The Traders Trust Trustpilot profile has generally received positive feedback.

- Rating: 4.6 stars out of 5

- 5-star reviews: 87%

- Total number of reviews: Over 430

While the broker maintains a good overall reputation, as with any financial service, individual experiences may vary.

Traders Trust Broker Educational Resources

Traders Trust's educational offerings are somewhat limited and outdated. Their education page hasn’t been updated for over 3 years. Beginners might need to supplement their learning with external resources.

You can use TradingFinder's Forex education section to access additional learning materials.

Traders Trust Comparison Table

The table below provides a comprehensive comparison between Traders Trust and other brokers:

Parameter | Traders Trust Broker | LiteForex Broker | HFM Broker | FXGlory Broker |

Regulation | CySEC, FSA, BMA | CySEC | CySEC, DFSA, FCA, FSCA, FSA | No |

Minimum Spread | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips | From 0.1 Pips |

Commission | From $1.5 | From $0.0 | From $0 | $0 |

Minimum Deposit | $50 | $50 | From $0 | $1 |

Maximum Leverage | 1:3000 | 1:30 | 1:2000 | 1:3000 |

Trading Platforms | MT4, cTrader | MetaTrader 4, MetaTrader 5, Mobile Proprietary App | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | Classic, Pro, VIP | Classic, ECN, Demo | Cent, Zero, Pro, Premium | Standard, Premium, VIP, CIP |

Islamic Account | Yes | No | Yes | Yes |

Number of Tradable Assets | 200+ | N/A | 1,000+ | 45 |

Trade Execution | Market | Market | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Instant |

TF Expert Suggestion

Traders Trust tries to offer excellent services with low trading commissions (from $1.5 per lot), a $50k convertible bonus, and a low execution time of 0.1 seconds.

However, the high minimum deposit on the VIP accounts ($5000), the lack of MT5 trading platform, and its unavailability in multiple countries such as the US, Australia, Japan, etc., are important points to consider.