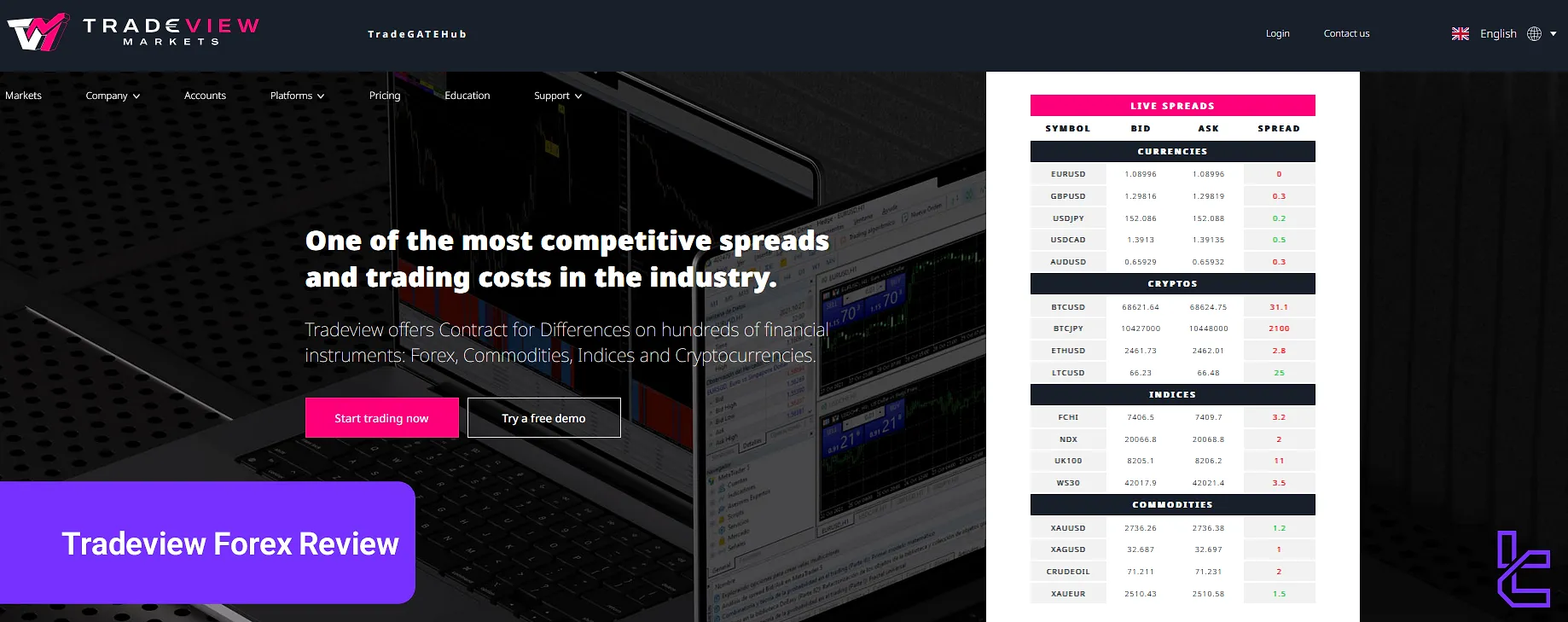

TradeView Markets is a multi-asset brokerage with 2 main account types [Innovative Liquidity Connector Type 7, Innovative Liquidity Connector Type 5]. It has an investment option titled "TradeGATEHub", a social trading platform.

The minimum deposit for the ILC5 account is $1,000. There's no initial deposit for the ILC7 account.

Company Introduction & Regulation Status

Tradeview, established in 2004 and founded and led by Timothy Furey, has been operating as an online Forex broker at the global level. The broker maintains multiple regulatory licenses, ensuring a high level of security and trustworthiness:

- Regulated by CIMA (Cayman Islands Monetary Authority) under license number 585163

- Licensed by MFSA (Malta Financial Services Authority) with license IS/93990

- Supervised by Labuan FSA (Financial Services Authority)

This multi-jurisdictional presence demonstrates their commitment to maintaining high regulatory standards and providing services to a global client base.

Here are most important details about broker’s branches and regulations:

Entity Parameters / Branches | Tradeview Ltd. (Cayman) | Tradeview Europe Ltd. (Malta) | TVM Global Ltd. (Labuan) | iLC Brokers Ltd. (Mauritius) | Tradeview Financial Markets S.A.C (Peru) | Tradeview Financial Advisors LLC (UAE) |

Regulation | CIMA (Lic. 585163) | MFSA | Labuan FSA (LL15870) | Mauritius FSC (GB20025800) | SUNARP | UAE SCA (CP-0000757) |

Regulation Tier | N/A | 1 | N/A | N/A | N/A | 1 |

Country | Cayman Is. | Malta | Malaysia | Mauritius | Peru | UAE |

Investor Protection Fund / Compensation | No | Up to €20k | No | No | No | No |

Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:400 | 1:30 | 1:400 | 1:400 | 1:400 | N/A |

Client Eligibility | Global (excl. US) | EU/EEA passporting | APAC / global | Global / pro & non-pro | Peru & LatAm markets | UAE / MENA clients |

The MFSA is a full member of both ESMA and the European Banking Authority, reinforcing Tradeview’s alignment with European compliance standards. While there’s no investor compensation scheme, the broker provides segregated accounts and negative balance protection.

The company's headquarters are located in Malta, with additional offices worldwide. Addresses:

- Malta: Floor 5, The Ferries Business Centre, Sliema SLM1632

- New York, US: The Townsend Building, 1123 Broadway

- Grand Cayman, Cayman Islands: KY1-1002, 5th Floor Anderson Square | 64 Shedden Rd, PO Box 1105

- Labuan, Malaysia: Block F Lazenda Warehouse 3 Jalan Ranca, 'Ranca 87000 F. T.

- Bogota, Colombia: Av. El Dorado #68C – 61

- Lima, Peru: Los Mirtos 239 Urb, San Eugenio, Lince

Key Features and Specifics

Here's a comprehensive overview of Tradeview's key specifics and notable features:

Broker | TradeView Forex |

Account Types | Innovative Liquidity Connector Type 7, Innovative Liquidity Connector Type 5 |

Regulating Authorities | MFSA, CIMA, FSA, Mauritius FSC, SUNARP, SCA |

Based Currencies | USD, EUR |

Minimum Deposit | $0 |

Deposit Methods | Credit/Debit Cards, Neteller, Skrill, Bank Wire Transfer |

Withdrawal Methods | Credit/Debit Cards, Neteller, Skrill, Bank Wire Transfer |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:400 |

Investment Options | TradeGATEHub |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5 |

Markets | Forex, Metals, Commodities, Indices, Shares, Crypto |

Spread | From Zero |

Commission | $7 per Lot in Forex & Metals for ILC 7 Account $5 per Lot in Forex & Metals for ILC 5 Account |

Orders Execution | Market |

Margin Call/Stop Out | 100% |

Trading Features | Segregated Accounts for Funds, Demo Trading |

Affiliate Program | Yes |

Bonus & Promotions | None |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Live Chat, Email, Phone Call |

Customer Support Hours | 24/5 |

Trading Account Types and Comparison

Tradeview offers two account types, which are Innovative Liquidity Connector Type 7 (ILC 7) and Innovative Liquidity Connector Type 5 (ILC 5), but there's not much difference between them.

The only benefit of the latter over the former is its lower commission, which will be investigated later in this review.

Account Type | Innovative Liquidity Connector Type 7 | Innovative Liquidity Connector Type 5 |

Min. Deposit | From Zero | $1,000 |

Base Currency | USD, EUR | |

Max. Leverage | 1:400 | |

Min. Order Size | 0.01 Lot | |

Features | 5 Digit Trading, Hedging, Auto Trading, Scalping | |

Both accounts utilize Tradeview's Innovative Liquidity Connector technology, which offers "one of the tightest spreads and fastest execution", as claimed by the broker.

In addition to these accounts, a demo account is provided for improving trading skills without any risks.

Pros and Cons of Trading With Tradeview Forex

Let's examine the key benefits and drawbacks of trading with Tradeview, side by side, in the table below:

Pros | Cons |

Tight Spreads From 0.0 Pips With Innovative Liquidity Connector | No 24/7 Support Service Provided |

Multiple Regulatory Licenses | High Minimum Deposit for ILC Type 5 Account |

Fast Execution Speeds | - |

Social Trading Option | - |

Steps to Getting Started: Account Opening and Verification

The broker allows traders to create an individual account in just a few minutes using email or social login options. The Tradeview Markets registration process includes basic details entry, email verification, and account type selection.

#1 Access the Registration Page

Visit the Tradeview Markets official website, scroll down, and click on “Open an Account”. On the homepage, choose “Individual Account” to proceed to the sign-up form.

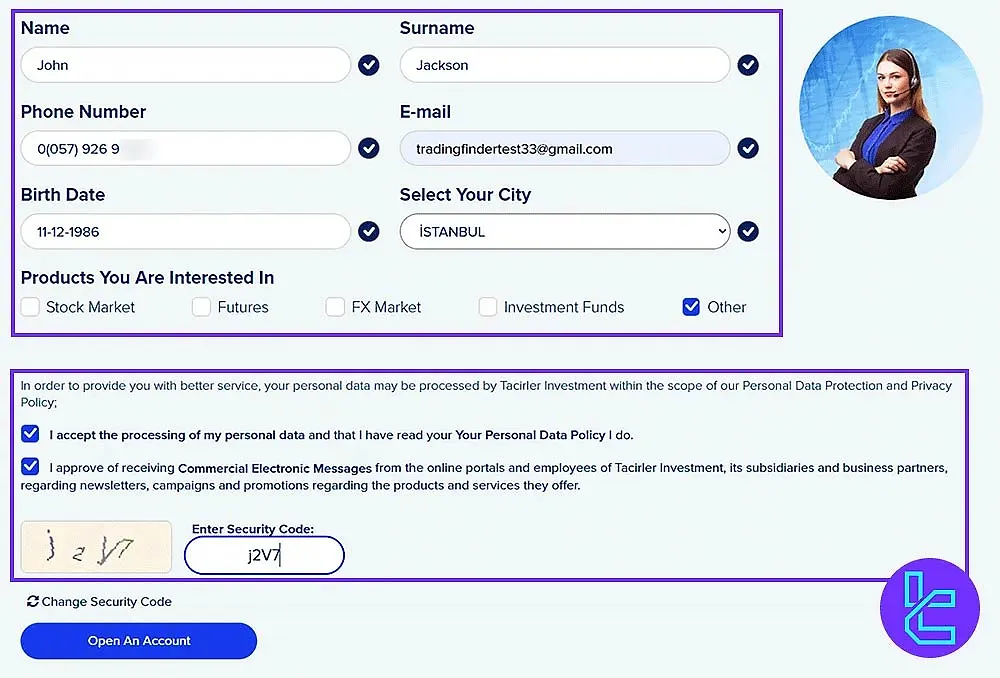

#2 Complete the Tradeview Forex Signup Form

There are three ways to open a new account:

- Manual

If you choose the manual option, fill in the required fields with:

- Email address

- Password

- Repeat password

Finally, confirm that you agree with the website’s terms by checking the box, then click “Get Started”.

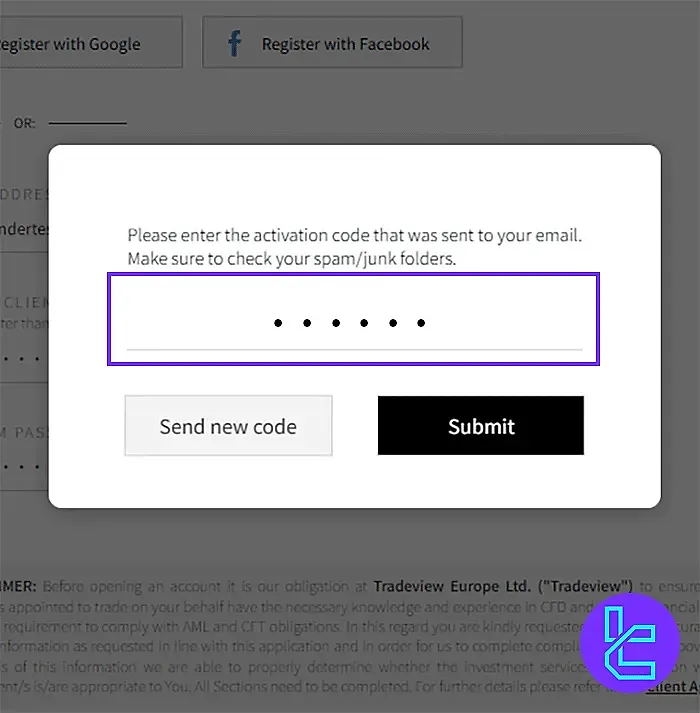

#3 Verify Your Email Address

Check your inbox for a 6-digit code sent by Tradeview Markets. Copy the code, paste it into the required field, and click “Submit” to complete verification.

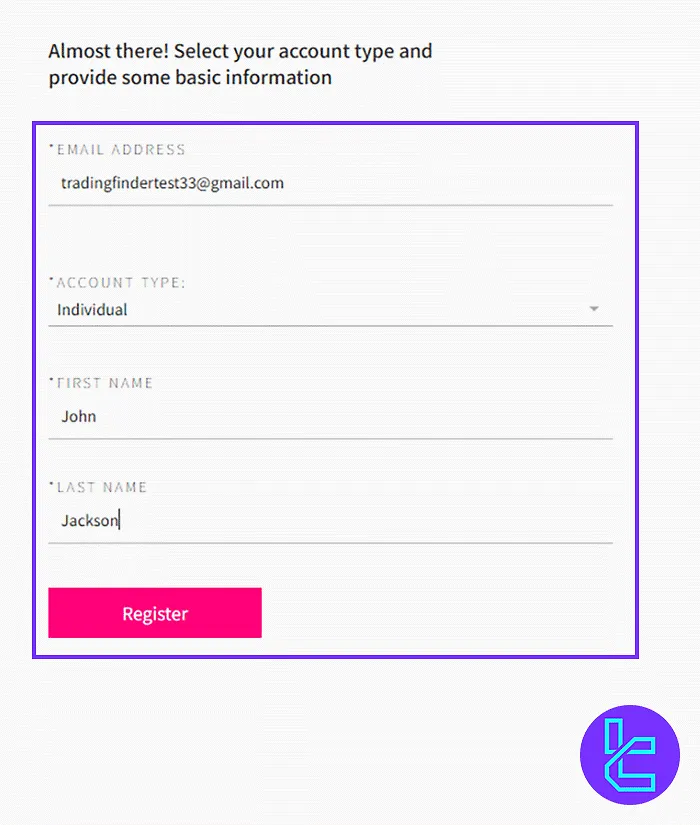

#4 Provide Personal Information and Confirm

After email verification, provide the following information:

- Account type

- First and last name

Click “Register” to finalize your application.

#5 Tradeview Forex Verification

Complete the Tradeview Markets verification with in six structured steps to unlock full trading functionality. The verification process ensures compliance with KYC requirements and secures your account.

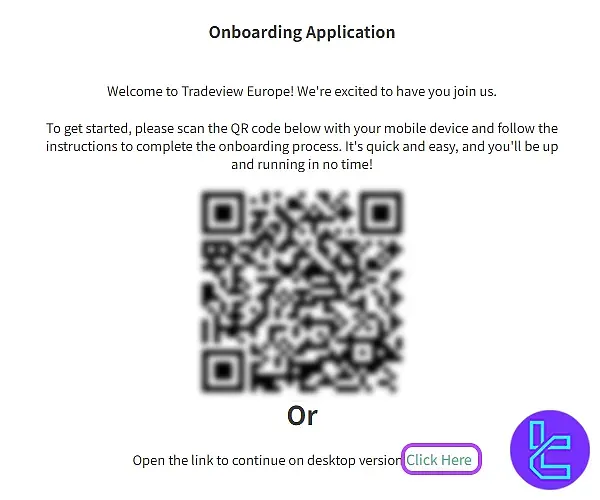

#1 Choose Your Approval Method

Select your preferred KYC process via mobile or desktop:

- Mobile: Scan the provided QR code to continue;

- Desktop: Click the desktop option to proceed through the verification workflow.

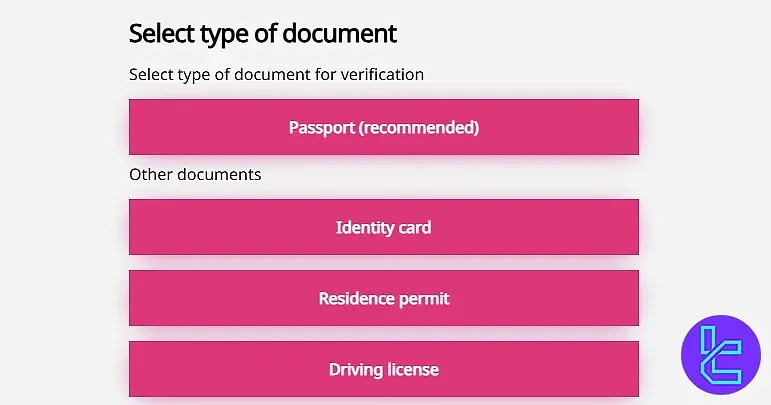

#2 Upload Proof of ID

Submit a valid identity document to confirm your identity:

- Passport

- ID Card

- Driver’s License

Ensure the document is clear, well-lit, and fully visible, then click “Next”.

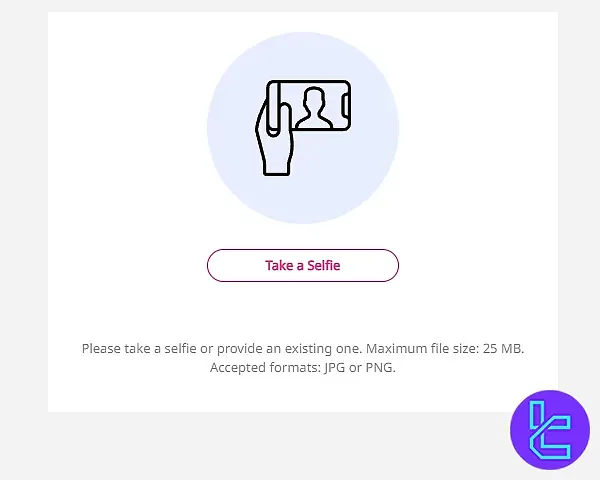

#3 Take a Selfie for Identity Confirmation

Capture a real-time selfie to complete identity verification:

- Click Take a Selfie;

- Follow the on-screen instructions carefully;

- Confirm by clicking Continue.

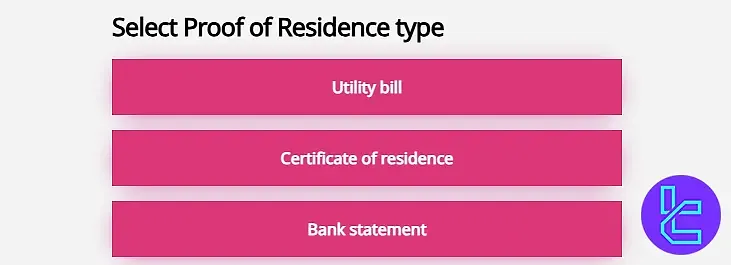

#4 Submit Proof of Residence

Provide an official document proving your address:

- Utility Bill

- Bank Statement

- Certificate of Residence

Ensure the document includes your name and registered address and was issued within the last 90 days.

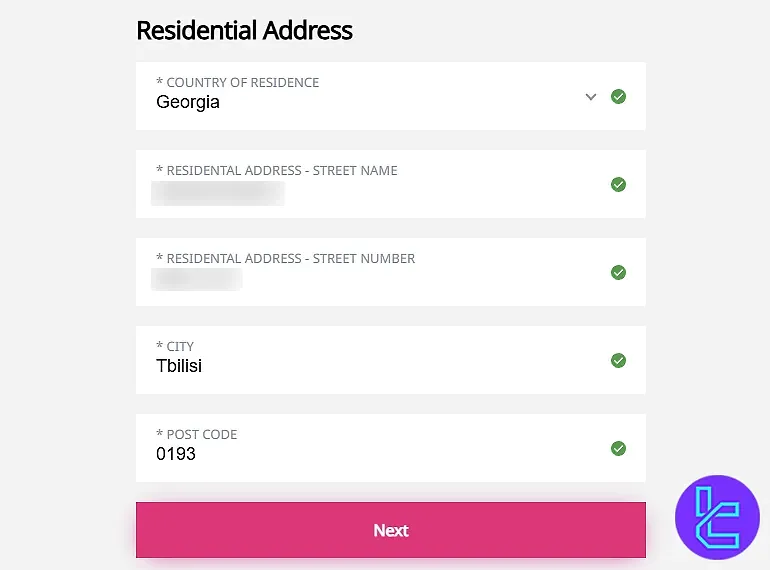

Then, enter your complete residential details:

- Country of residence

- Full street address

- City

- Postal code

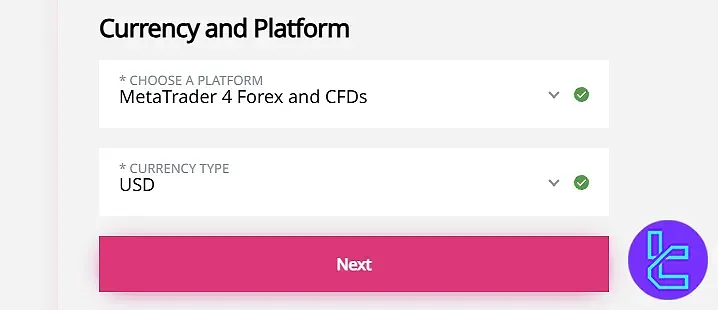

#5 Choose Your Trading Platform and Account Currency

Review personal information for accuracy; make edits if necessary to match documents. Then:

- Declare whether you are a US citizen or hold political affiliations;

- Select your preferred trading platform: MetaTrader 4 (MT4) or MetaTrader 5 (MT5);

- Choose your account-based currency, which will be used for all deposits, withdrawals, and trading activities.

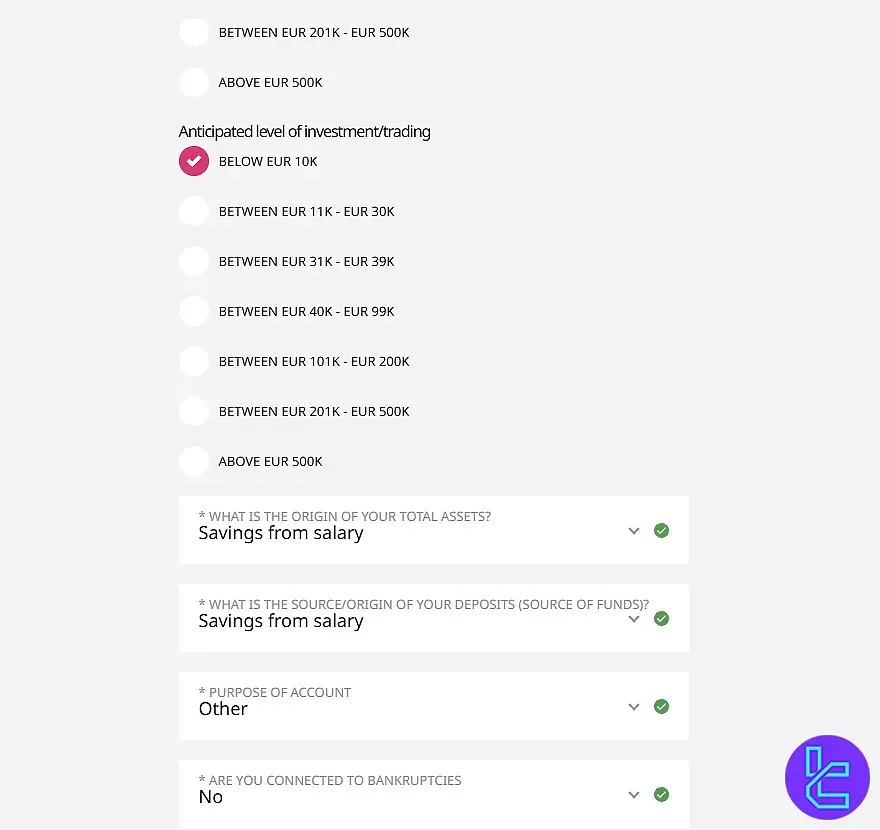

#6 Enter Financial and Employment Details

Provide details about your employment status, job type, annual income, total assets, and overall financial background, and respond to the questions below:

- What is the origin of the assets?

- What is the source of your deposit?

- What is the purpose of the account?

- Are you connected to bankruptcies?

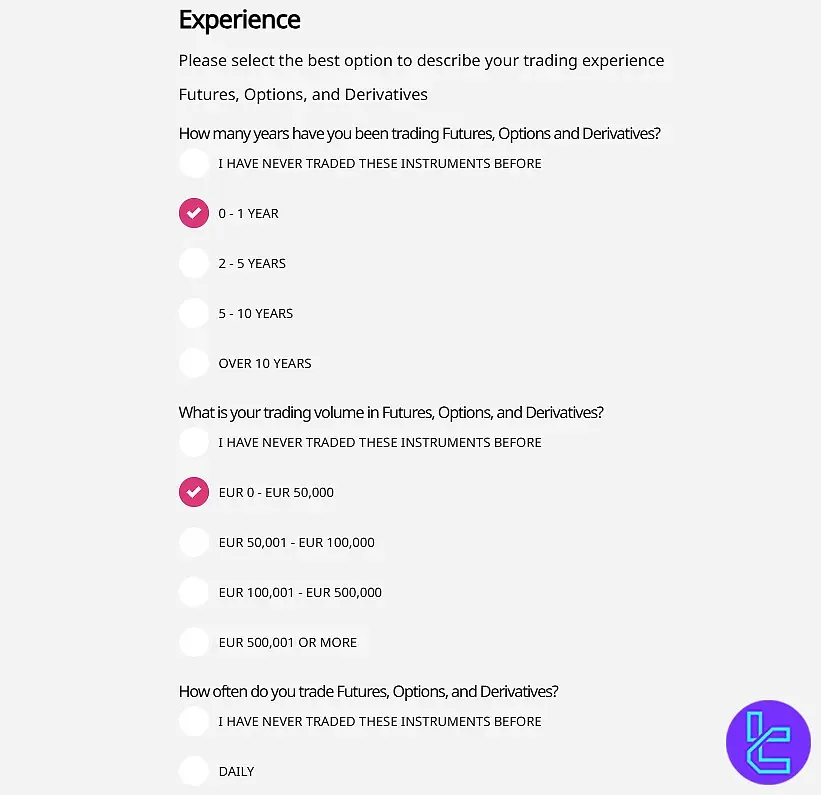

Next, answer questions regarding your financial knowledge, education, and trading experience.

Read and accept the terms and risk policies by checking the required boxes. Enter your digital signature, click Next, and submit all documents for review.

You will receive an email once your Tradeview Markets account has been fully verified.

Available Platforms for Trading With TradeView

There are many trading terminals available in the industry for brokers, but some of the most common and most used ones are MetaTrader 4 and MetaTrader 5.

Tradeview offers these popular options to its clients, which include technical indicators and tools, charting capabilities, Expert Advisors, etc.

In the list below, we will provide the links to these platforms for different operating systems:

TradingFinder has developed a wide range of MT4 and MT5 indicators that you can use for free.

Spreads and Commissions Structure

Based on our investigations, the main fees in brokerages are divided in these categories:

- Spreads

- Trading commissions

- Inactivity fees

- Deposits commissions

- Withdrawal costs

Tradeview applies fees in 4 of the 5 mentioned parts. Spreads and Commissions Overview:

Account Type | ILC 7 | ILC 5 |

Spread | From Zero Pips | |

Commission per Round Lot in Forex & Metals | $7 | $5 |

Commission per Round Lot in Indices | $1 | |

Commission per Round Lot in Cryptocurrencies | 0.15% | |

You can use our Forex profit calculator tool to estimate a trade's outcome, considering commissions.

The broker charges a $10 monthly fee for inactive accounts. Also, a withdrawal commission is charged from 0-1.5%.

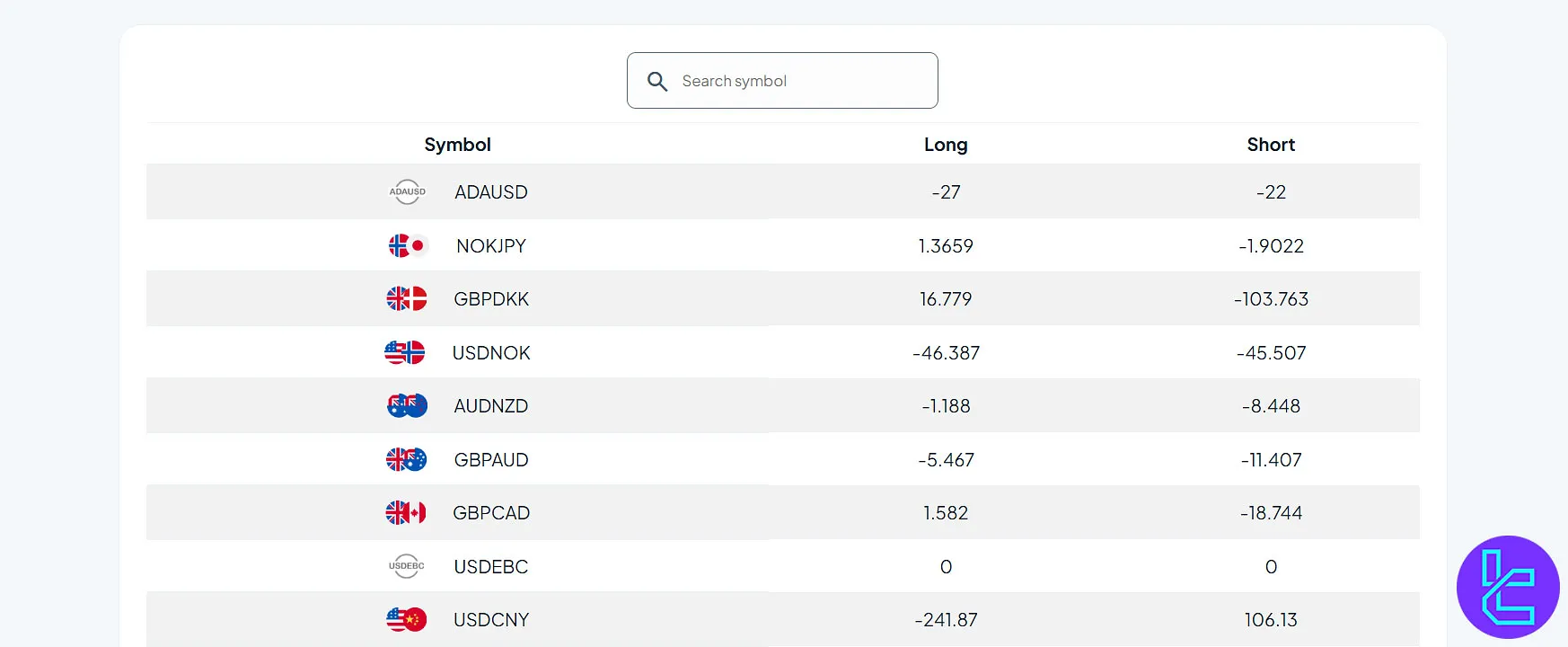

Swap Fee at Tradeview Forex

Tradeview Forex publishes a dedicated “Forex Rollover Rates” page that lists its overnight swap charges when a position is held past the close of trading.

For example, a long EURUSD position might incur or earn a specified rate depending on the interest-rate differential and currency pair. Traders are therefore exposed explicitly to these swap costs rather than only spreads or commissions.

Here are several important details from the official page that every trader should check:

- The swap values apply daily at the end of the trading day and affect open positions overnight;

- For EURUSD, the long (buy) overnight rollover is -11.77 points, and the short (sell) overnight rollover is +1.54 points;

- On account types or conditions where swaps may be converted or waived, you should verify the branch-specific terms;

- Swap-free / Islamic accounts are available on request; they follow Shariah rules and waive overnight swaps.

Non-Trading Fees at Tradeview Forex

Tradeview Forex provides limited public information regarding its non-trading fees across different account types. While some details are available on platform usage, specific amounts or conditions are not fully disclosed.

Traders are therefore encouraged to contact the broker’s support team directly for the most accurate and up-to-date fee information.

Here are the most relevant non-trading fee details mentioned by Tradeview Forex:

- Platform fees: Stock platforms charge monthly access fees from $180 to $250 depending on type;

- Inactivity rules: Accounts without trading activity for extended periods may incur service charges.

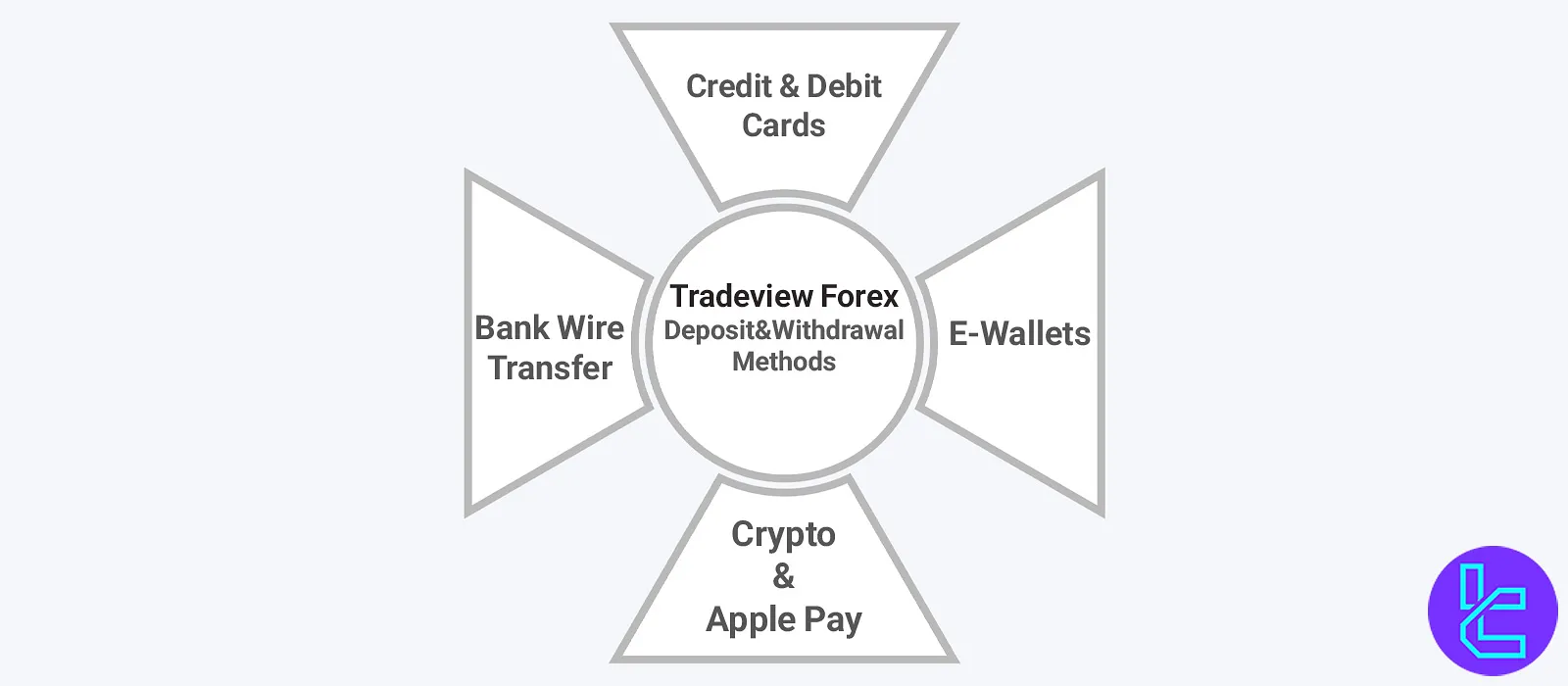

What Methods Are Offered for Deposits & Withdrawals?

Tradeview Forex offers several secure and well-known payment options to accommodate global traders:

- Credit/Debit Cards: Visa and Mastercard accepted

- E-Wallets: Skrill and Neteller available

- Bank Wire Transfer: Accessible in most regions

- Crypto & Apple Pay: Accessible in some regions

All withdrawals must be made via the original funding method, and third-party payments are prohibited.

Deposit Methods at Tradeview Forex

Tradeview lists multiple deposit methods such as bank wires, credit/debit cards, and digital wallets, yet it does not clearly publish minimum amounts, exact fees, or standard processing times for each method.

The lack of full transparency on funding-conditions means traders are encouraged to check in their client portal or contact support for precise funding details.

Here are the available method types and the general conditions found:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Wire Transfer | USD, EUR, GBP, JPY, CAD, AUD | $100 | N/A | N/A |

Credit/Debit Card | USD, EUR, GBP, JPY, CAD, AUD | $100 | N/A | N/A |

Digital Wallets | USD, EUR, GBP, JPY, CAD, AUD | $100 | N/A | N/A |

Crypto (region-dependent) | Crypto coins | $100 | N/A | N/A |

Apple Pay (region-dependent) | USD, EUR, GBP, JPY, CAD, AUD | $100 | N/A | N/A |

Withdrawal Methods at Tradeview Forex

Tradeview offers multiple withdrawal options mirroring its deposit methods, such as bank wire transfers, credit/debit cards, and digital wallets. While the processes are generally straightforward, the broker clearly specifies a minimum withdrawal amount of $30 for all clients.

Traders should note that exact processing times and any associated fees may vary depending on the chosen method and region.

Here are the main withdrawal methods and general conditions:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Wire Transfer | USD, EUR, GBP, JPY, CAD, AUD | $30 | N/A | Up to 3 days |

Credit/Debit Card | USD, EUR, GBP, JPY, CAD, AUD | $30 | N/A | Within 24 hours |

Digital Wallets | USD, EUR, GBP, JPY, CAD, AUD | $30 | N/A | Within 24 hours |

Crypto (region-dependent) | Crypto coins | $30 | N/A | Within 24 hours |

Apple Pay (region-dependent) | USD, EUR, GBP, JPY, CAD, AUD | $30 | N/A | Within 24 hours |

Copy Trading & Investment Methods

Based on our investigations, Tradeview does not directly offer any copy trading or other ways to earn passive income. Actually, it sponsors a social trading website called TradeGATEHub.

However, while we clicked on the link to the mentioned website, a message appeared disclaiming any responsibilities for the content shown on TradeGATEHub.

What Are The Trading Instruments on Tradeview Forex?

Tradeview Forex offers a diverse selection of markets with numerous tradable assets, allowing traders to access forex, stocks, futures, and commodities. This variety provides flexible opportunities to build strategies across multiple financial instruments efficiently.

Let's have an overview here:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Currency pairs (spot & CFDs) | 60+ | 50-80 | 1:400 | |

Stocks | US equities and on-exchange stocks (Apple, Netflix, Amazon, Tesla) | 5000+ | 2000-6000 | 1:6 |

Exchange-traded futures | N/A | 2500-7000 | N/A | |

Commodities | Precious metals (gold, silver, etc.) | 6+ | 3-10 | N/A |

Indices | Global indices (US, Europe, Asia) | 9+ | 10-25 | N/A |

Cryptocurrencies (Bitcoin, Ethereum, Litecoin, others) | 5+ | 3-10 | 1:10 |

Tradeview does not currently offer bonds, options, or ETFs.

Does Tradeview Forex Broker Provide Any Bonuses?

Based on our investigations of the broker, it currently does not offer any bonus promotions. This might be because of the regulations. Nevertheless, always check the official sources for any changes and updates regarding the matter.

Awards and Recognitions of Tradeview Forex

Tradeview Forex has earned multiple prestigious awards for its excellence across trading services, regulation, and customer support. These accolades highlight the broker’s commitment to high standards, innovation, and client satisfaction.

Below are some of the most notable awards and recognitions received by Tradeview Forex:

- Best Multi-Asset Broker – Forex Traders Summit, Dubai 2025

- Best CFDs Broker – Rankia, Uruguay 2025

- Highest Value Broker – Money Expo, Mexico 2025

- Best Islamic Account – Forex Expo, Dubai 2024

- Best CEO – Smart Vision, Dubai 2024

How and When to Contact Support

Tradeview provides its customer services through common channels used by many other brokers. Let's take a quick look:

- Email: support@tradeview.eu

- Phone Call: +356 20311017

- Live Chat: On the website

As stated on the broker's official website, it offers support on a 24/5 (GMT) schedule. Therefore, no support is offered on weekends. This is a downside for this multi-asset brokerage company.

What Countries and Regions Are Restricted?

Clients from some countries and regions in the world cannot trade in Tradeview because of local regulations, international sanctions, laws, etc. The list of these countries include:

- United States

- North Korea

- Iran

- Syria

- Cuba

- Sudan

- Other sanctioned countries

Traders should verify their country's eligibility before opening an account. For the full list, contact the company directly.

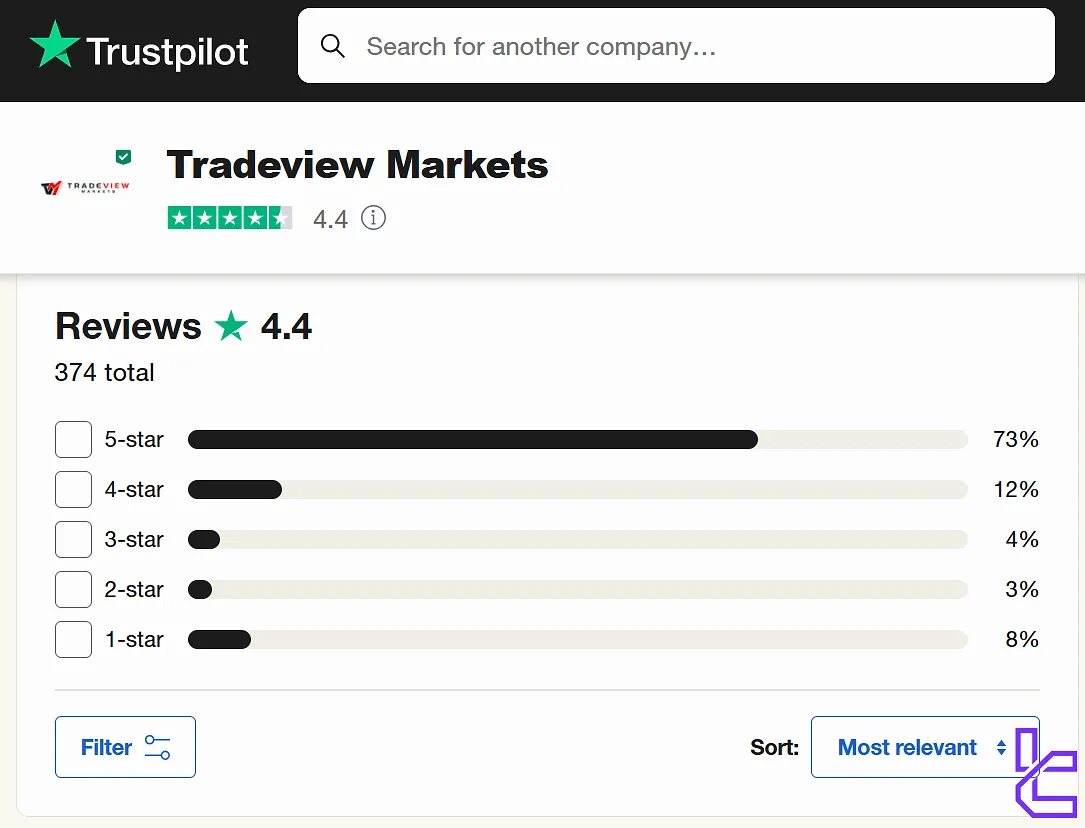

Trust Reviews & User Scores

Traders have the option to submit trust scores for brokers on reputable websites, including Trustpilot and ForexPeaceArmy. Tradeview has received reviews on both mentioned platforms:

- Trustpilot: 4.4 out of 5, based on more than 370 scores;

- TradeView Markets ForexPeaceArmy: 4.09/5 with over 130 ratings.

As you saw, this broker has achieved high scores from users for its services.

Educational Resources and Content

Tradeview Forex does not currently offer extensive resources for educating traders. To be precise, the "Education" page on the website consists of 3 main sections:

- TradeGATEHub: Mentioned earlier in the review

- Surf's Up!: Analysis, news events, and key insights affecting the market (registration required)

- TradeView Academy: Not available yet, coming soon

The broker offers market commentary and regional macroeconomic analysis through its “Rhino Report” publication. It also includes practical trading tools such as an economic calendar and pivot calculators.

Comparison of TradeView Markets with Other Brokers

The table below provides a comprehensive overview of TradeView Markets' services in comparison with those of other brokerage companies:

Parameter | TradeView Markets Broker | TMGM Broker | AvaTrade Broker | Tickmill Broker |

Regulation | MFSA, CIMA, FSA, Mauritius FSC, SUNARP, UAE SCA | ASIC, VFSC, FSC, FMA | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA | FSA, FCA, CySEC, LFSA, FSCA |

Minimum Spread | From 0.0 pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $5.0 | From $0.0 | $0 | From $0.0 |

Minimum Deposit | $0 | $100 | $100 | $100 |

Maximum Leverage | 1:400 | 1:1000 | 1:400 | 1:1000 |

Trading Platforms | MetaTrader 4, MetaTrader 5 | MT4, MT5, IRESS, TMGM Mobile App | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader | Metatrader 4, Metatrader 5, Metatrader Web, Mobile App |

Account Types | Innovative Liquidity Connector Type 7, Innovative Liquidity Connector Type 5 | EDGE, CLASSIC | Standard, Demo, Professional | Classic, Raw |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 600+ | 12000+ | 1250+ | 620+ |

Trade Execution | Market | Market, Instant | Instant | Market |

Conclusion and Final Words

Tradeview Forex provides trading symbols with spreads starting from 0 pips. The trading commission per round lot for Forex and metals is $7 in ILC 7 account and $5 in ILC 5 account.

Trading fees per round lot for indices across both accounts is $1. In trading cryptocurrencies, the cost is 0.15% of the order size.