Tradewill offers 3 account types [Standard, Pro, Tradewill] with 0 trading commission on the Pro account; the spreads start from 0.0 pips on other 2 accounts. The minimum deposit is $3 on the Tradewill account.

In addition, the broker provides access to over 100 instruments across Forex, Stocks, Indices, Precious Metals, and Cryptocurrencies, catering to diverse trading strategies and market exposure.

Tradewill Company Details and Regulating Authorities

Tradewill is a Forex broker with1.2M+ monthly active clients, $80B+ monthly trading volume, and over 16.8M registered traders. Founded in 2019, It operates under two entities. Each one will be introduced here:

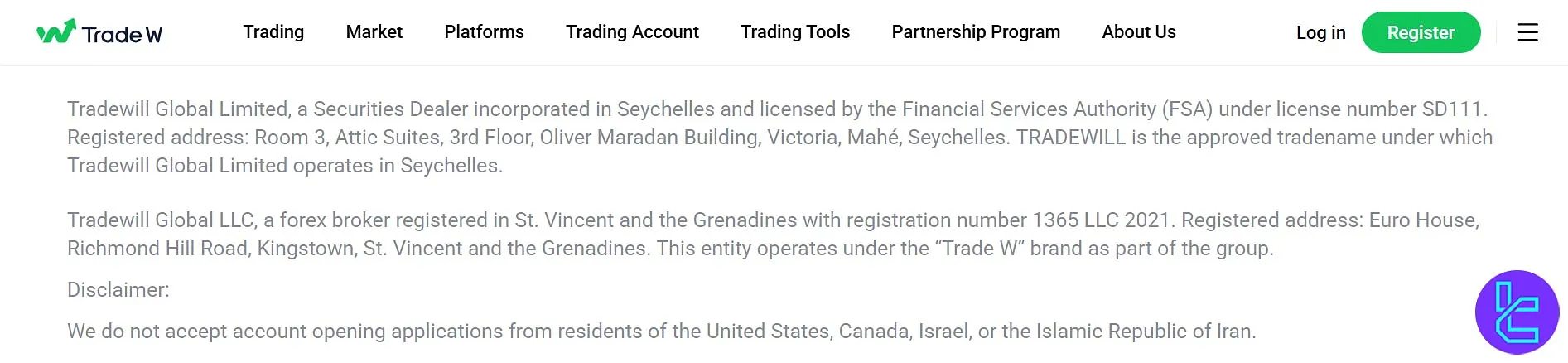

Entity Parameters / Branches | Tradewill Global Limited | Tradewill Global LLC |

Regulation | FSA Seychelles (Licence No. SD111) | Unregulated (SVG – 1365 LLC 2021) |

Regulation Tier | 4 | N/A |

Country | Seychelles | St Vincent & the Grenadines |

Investor Protection Fund / Compensation Scheme | None stated | None stated |

Segregated Funds | Not clearly stated | Not clearly stated |

Negative Balance Protection | No | No |

Maximum Leverage | Up to 1:500 | Up to 1:500 |

Client Eligibility | Global (except US, CA, IL, IR) | Global (except US, CA, IL, IR) |

The firm provides global traders with access to forex, indices, metals, and stocks via both MetaTrader 4 and its proprietary TradeW platform.

Its low $3 entry requirement and high leverage options position it as a competitive option for retail traders seeking flexibility and market variety.

Tradewill Specifications and Details

In every Forex broker review, we have an overview of the company's features. Here is Tradewill's:

Broker | Tradewill |

Account Types | Standard, Pro, Tradewill |

Regulating Authority | FSA |

Based Currencies | USD |

Minimum Deposit | $3 |

Deposit Methods | Credit/Debit Cards, Wire Transfer, Cryptocurrencies, E-Payment Systems, etc. |

Withdrawal Methods | Credit/Debit Cards, Wire Transfer, Cryptocurrencies, E-Payment Systems, etc. |

Minimum Order | 0.01 Lots |

Maximum Leverage | 1:500 |

Investment Options | None |

Trading Platforms & Apps | MetaTrader 4, Proprietary Platform |

Markets | Forex, Commodities, Stocks, Indices, Cryptocurrencies |

Spread | From 0 on Standard and Tradewill Accounts |

Commission | Zero on the Pro Account |

Orders Execution | Market |

Margin Call / Stop Out | N/A |

Trading Features | Economic Calendar, Trading Glossary, Profit Calculator, Margin Calculator |

Affiliate Program | Yes |

Bonus & Promotions | None |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Live Chat, Email, Ticket, Phone Call |

Customer Support Hours | 24/7 |

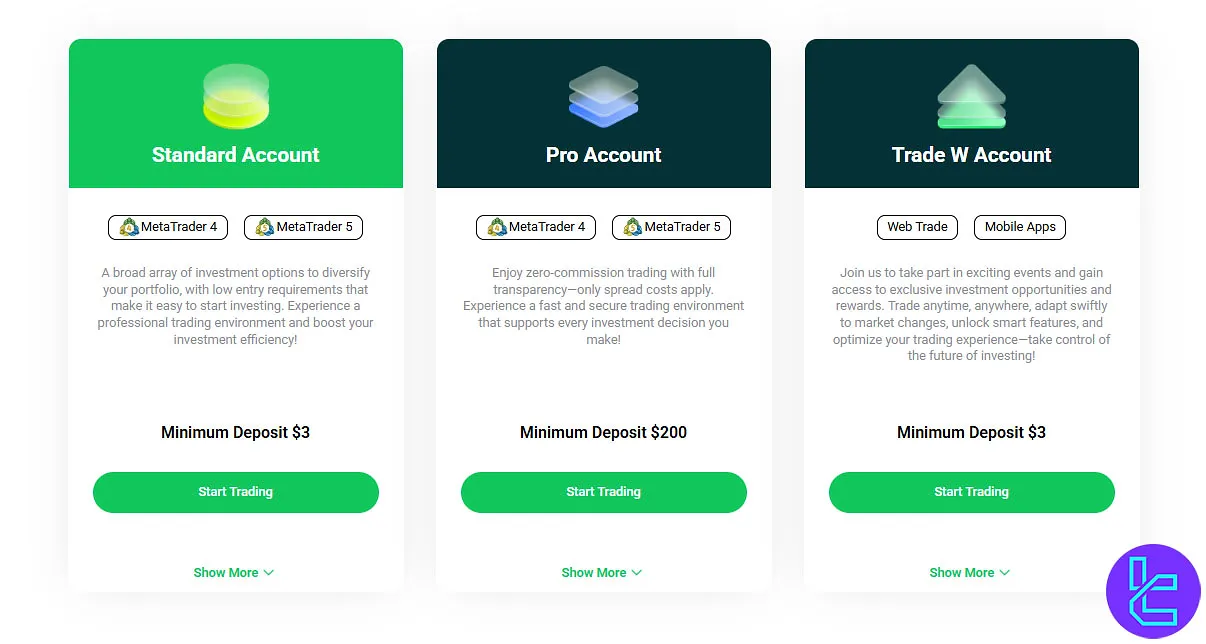

Account Types and Details

Tradewill offers three main account types. We will discuss these accounts in the table below:

Account Type | Standard | Pro | Tradewill |

Platform | MetaTrader 4 | Proprietary | |

Order Execution | Market | ||

Max. Leverage | 1:500 | ||

Min. Deposit (USD) | 3 | 200 | 3 |

Support for EAs | Yes | No | |

Moreover, a free demo account is available for testing trading strategies and getting familiar with the environment.

All accounts support over 300 instruments and allow full trading freedom, including scalping and EA usage.

Essential Pros and Cons to Know

The table below mentions the benefits and drawbacks of trading with Tradewill:

Pros | Cons |

Notably Low Initial Deposit Requirement | Not Regulated by Any Top-Tier Authorities |

Relatively High Leverage | No Copy Trading or Social Trading Features |

Decent Number of Trading Symbols | - |

Account Opening and Identity Verification on Tradewill

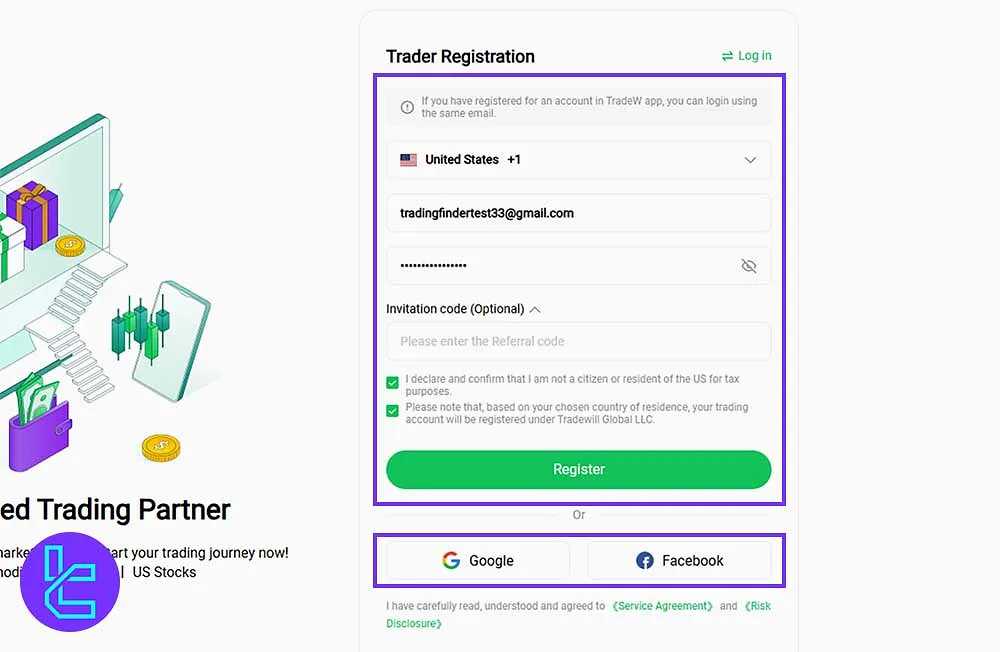

Opening an account on the Tradewill platform is seamless and takes under two minutes. Traders can register using their email or link existing Google/Facebook accounts for instant access.

During the Tradewill signup, you’ll secure your profile with a strong password and select your country of residence. The process ensures compliance with platform terms and sets the foundation for future account verification.

#1 Access the Official Signup Portal

Visit the Tradewill homepage and locate the “Register” or “Open an Account” button. These links lead you directly to the secure onboarding interface.

#2 Complete Your Profile Details

Fill out the registration form by entering:

- Email address

- Password

- Country of residence

- Invitation code (optional)

Agree to the platform’s Terms & Conditions, then click "Register".

#3 Complete the KYC Procedure

Once registered, proceed with identity verification via the user dashboard and upload the following documents:

- Proof of ID: National ID or Passport

- Proof of Address: Utility bill or Bank statement

Trading Platforms on TradeWill

Tradewill offers 2 trading terminals accessible on various devices. We will investigate them briefly in the next sections.

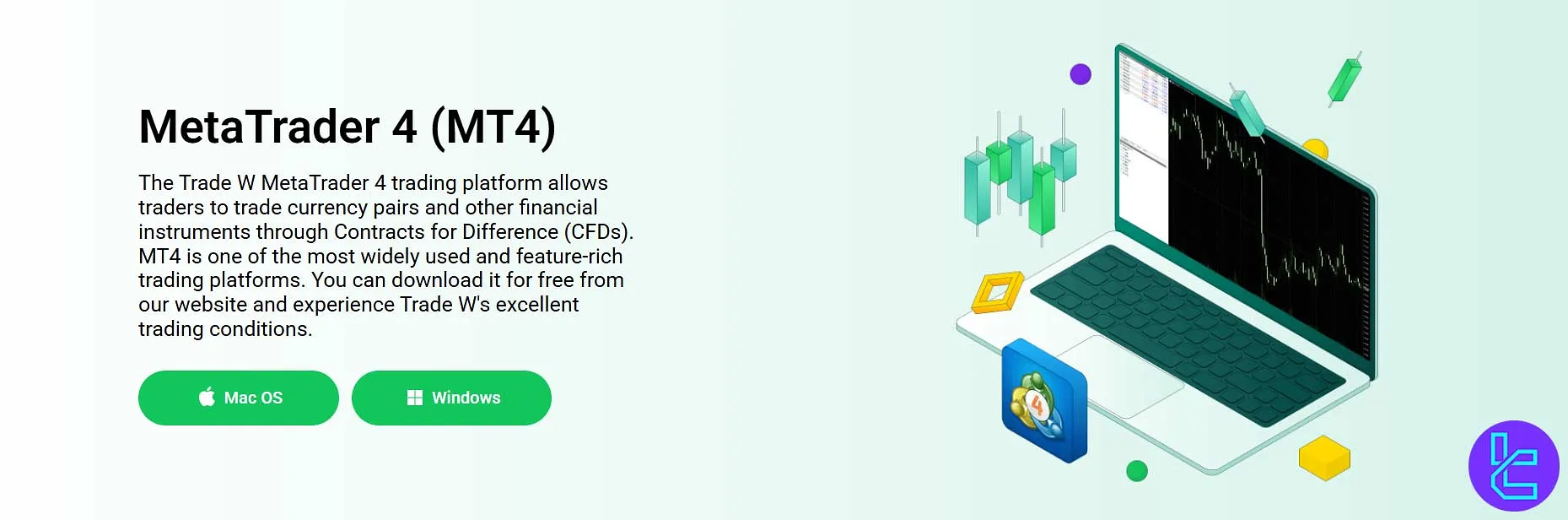

MetaTrader 4

MT4 is one of the most widely used platforms available in the industry, with a decent range of technical indicators. The platform is available on these operating systems:

TradingFinder has developed a wide range of MT4 indicators that you can use for free.

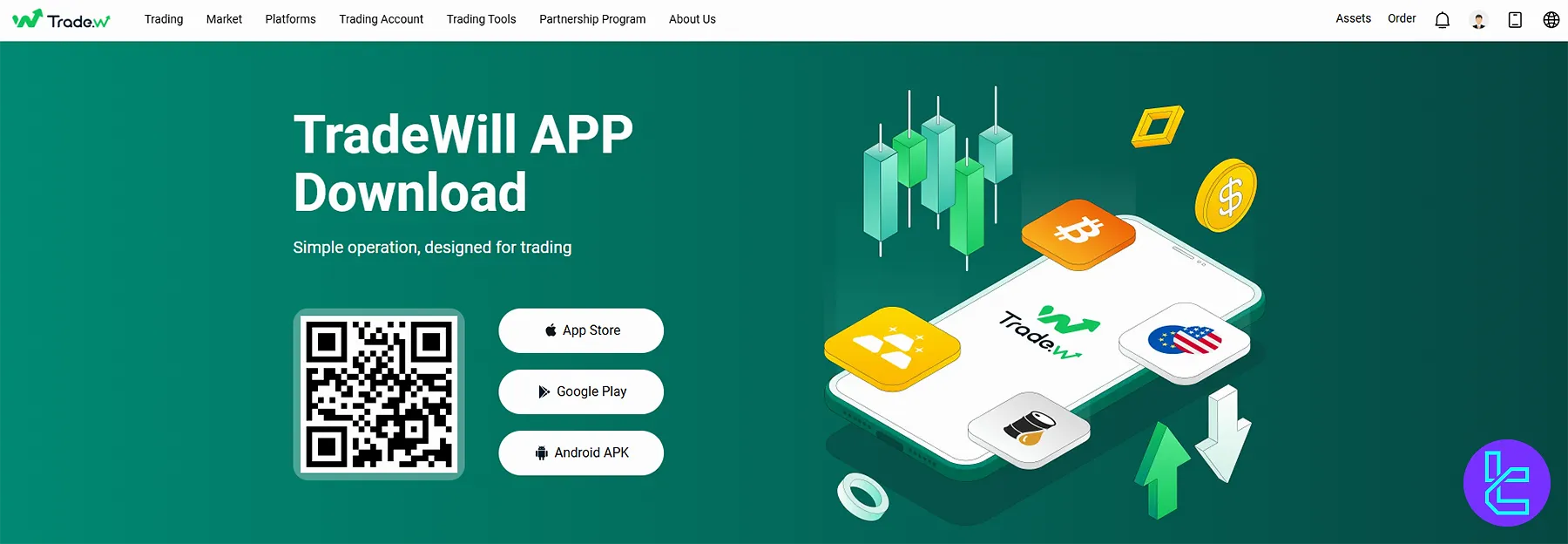

Proprietary Terminal

The broker has developed a platform with signal alerts, funding options, and other necessary features, which is available on:

Both platforms support real-time charting, technical indicators, and market execution. Devices supported include Windows, MacOS, Android, and iOS.

MT5 is notably absent, which may limit access to some advanced order types and trading tools for professional users.

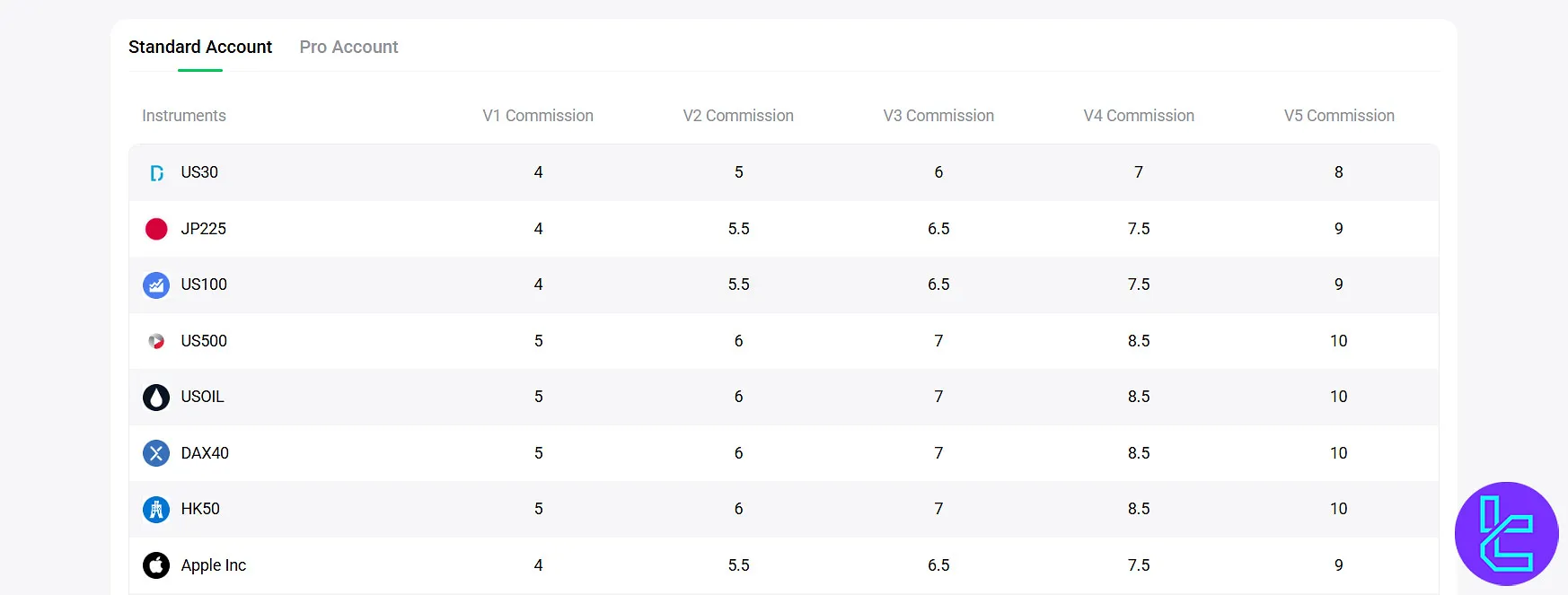

Spreads and Commission

Usually, the most important difference between various account types in a broker is in their spreads/commissions. Let's review these on Tradewill:

Account Type | Standard | Pro | Tradewill |

Min. Spread | 0.0 Pips | 10 Pips | 0.0 Pips |

Commission per Lot | $10-15 | 0 | $10-15 |

Based on our investigations, there are no other fees for deposits, withdrawals, or inactivity periods.

Swap fees apply for overnight positions, though detailed swap rates are not publicly listed. Overall, the pricing favors high-volume traders willing to pay fixed commissions for lower spreads.

Swap Fees at Tradewill

Transparency stands at the core of Tradewill’s trading philosophy, especially regarding swap and overnight financing costs. According to the broker’s official Account Overview, swap fees apply when a position remains open past the market close.

For forex, cryptocurrencies, and metals, the average swap is $3 per lot per day, while for indices it reaches $6 per lot per day.

Between clarity and cost control, here are a few essential highlights from Tradewill’s swap policy:

- Swap fees are calculated per lot per day, with exact amounts varying by instrument type;

- Swaps apply automatically when positions are held overnight on the MT4 platform;

- Swap-free / Islamic accounts are not available, meaning every overnight trade incurs a rollover fee.

Non-Trading Fees at Tradewill

Tradewill makes clear that besides trading costs, there are additional fees such as withdrawal charges and inactivity provisions that affect your overall account cost profile.

For example, the broker lists a minimum withdrawal threshold of $10 and mentions a nominal $1 administrative fee per withdrawal-order.

Now, here are the key non-trading fee details:

- Inactivity fee: according to fee analyses, there is no monthly inactivity charge listed;

- Deposit fee: the broker reports no fee for deposits in standard conditions.

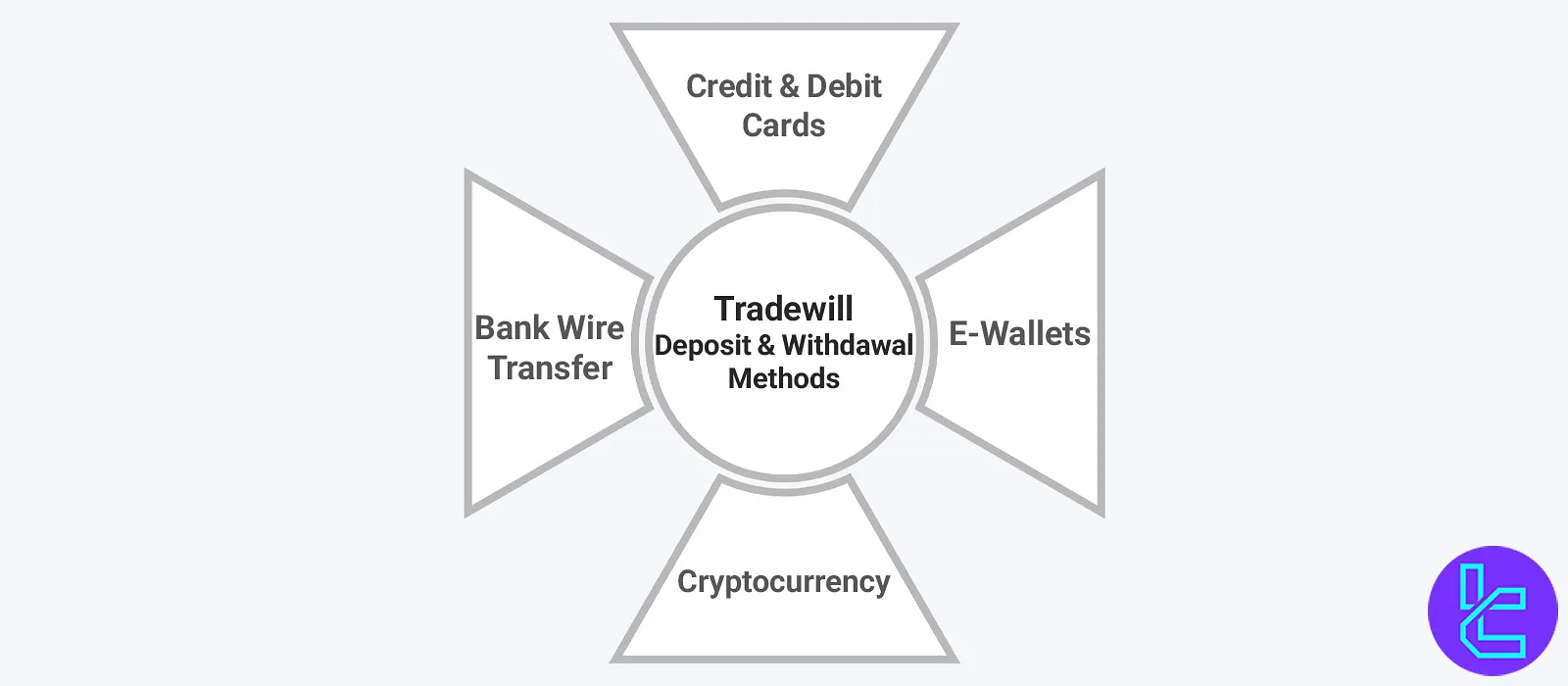

Funding Methods and Withdrawal Options on Tradewill

The brokerage does not go into detail regarding the payment choices; it has just stated that these methods are available:

- Credit/Debit Cards

- Wire Transfer

- Cryptocurrencies

- E-Payment Systems

- And more

The exact options might be different regarding the client's region. Withdrawals require a minimum of $10.

The broker has not publicly disclosed its deposit or withdrawal fees, so users are encouraged to verify charges via their account portal or customer service before initiating transactions.

Deposit Methods at Tradewill

Tradewill provides multiple funding options for traders, including bank transfers, cards, cryptocurrencies, and E‑Wallets. The minimum deposit is specified for some account types, and most methods have no deposit fee, allowing for quick and transparent account funding.

Here’s a breakdown of the main deposit methods:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Transfer | USD | $3 | $0 (broker) | 1‑5 business days |

Credit / Debit Card | USD | $3 | $0 (broker) | Instant to 2 business days |

Cryptocurrency (BTC / USDT) | BTC / USDT | $3 | $0 (broker) | Minutes to 1 hour |

E‑Wallets | USD | $3 | $0 (broker) | N/A |

Withdrawal Methods at Tradewill

TradeWill offers multiple withdrawal options that mirror its deposit methods, giving traders flexibility and ease of access to their funds. Each withdrawal has a minimum amount requirement of $10, and a fixed fee of $1 per transaction, ensuring transparency in all non-trading costs.

Here’s an updated summary of the main withdrawal methods:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Processing Time (approx.) |

Bank Transfer | USD | $10 | $1 per order | N/A |

Credit / Debit Card | USD | $10 | $1 per order | N/A |

Cryptocurrency (BTC / USDT) | BTC / USDT | $10 | $1 per order | 30 minutes |

E ‑ Wallets | USD | $10 | $1 per order | 30 minutes |

Are There Any Copy Trading Options or Other Investment Methods Provided on Tradewill?

Unfortunately, at the time of writing this article, the broker does not offer copy trading or any other investment features. We will update this webpage in case of any changes in this regard.

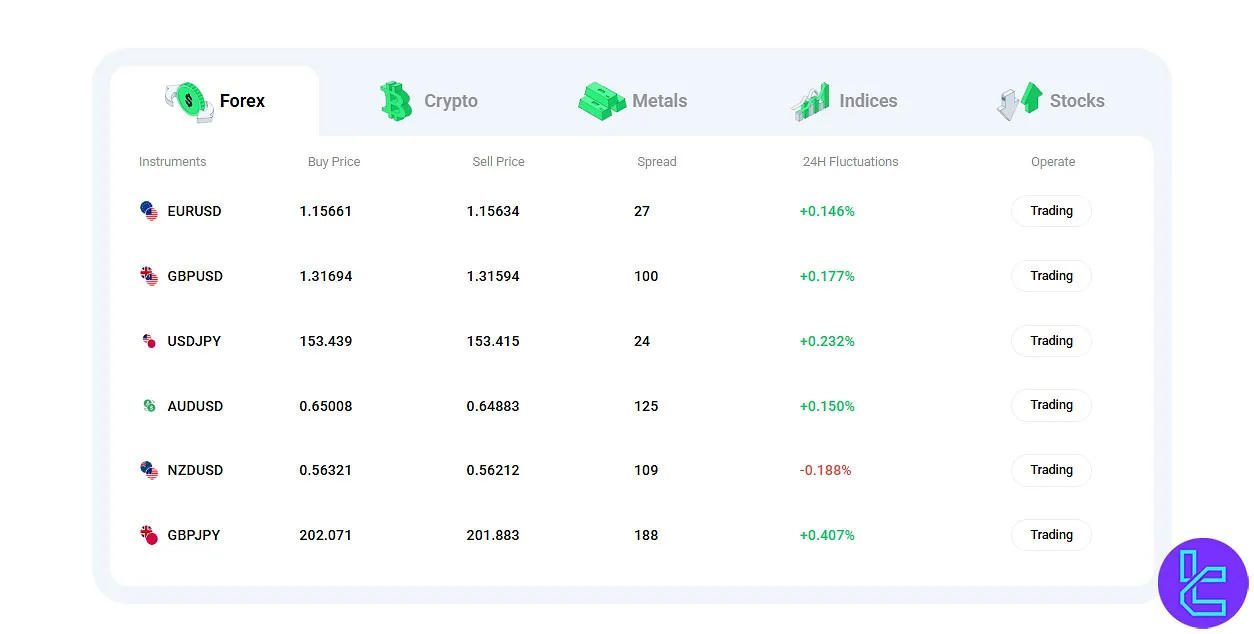

Tradable Instruments and Markets

Tradewill offers traders access to a diverse portfolio of over 100 financial instruments across five major markets, including Forex, Stocks, Indices, Precious Metals, and Cryptocurrencies.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Currency pairs | 30+ | 45-70 | 1:500 |

Stock | Individual company stocks | N/A | 100+ | N/A |

Indices | Futures contracts | 9 | 5-20 | 1:500 |

Precious Metals | Gold, silver and other metals | 3 | 2-5 | 1:500 |

Cryptocurrency | Digital currencies as CFDs | 40+ | 10-30 | N/A |

The platform provides competitive leverage, flexible trading conditions, and a range of instruments, ensuring broad market exposure.

Are There Any Bonuses or Promotions Offered by Tradewill?

As of this review, this broker does not offer any specific bonuses or promotions. While this might seem like a drawback, remember that it is not a necessary feature in a financial brokerage.

Tradewill Awards

Tradewill has received recognition in the industry for its service quality and reliability. The most notable Tradewill award is “Best Broker in Southeast Asia”, presented at the Forex Expo Dubai to Tradewill Global LLC.

According to broker’s official sources, no other awards have been publicly announced.

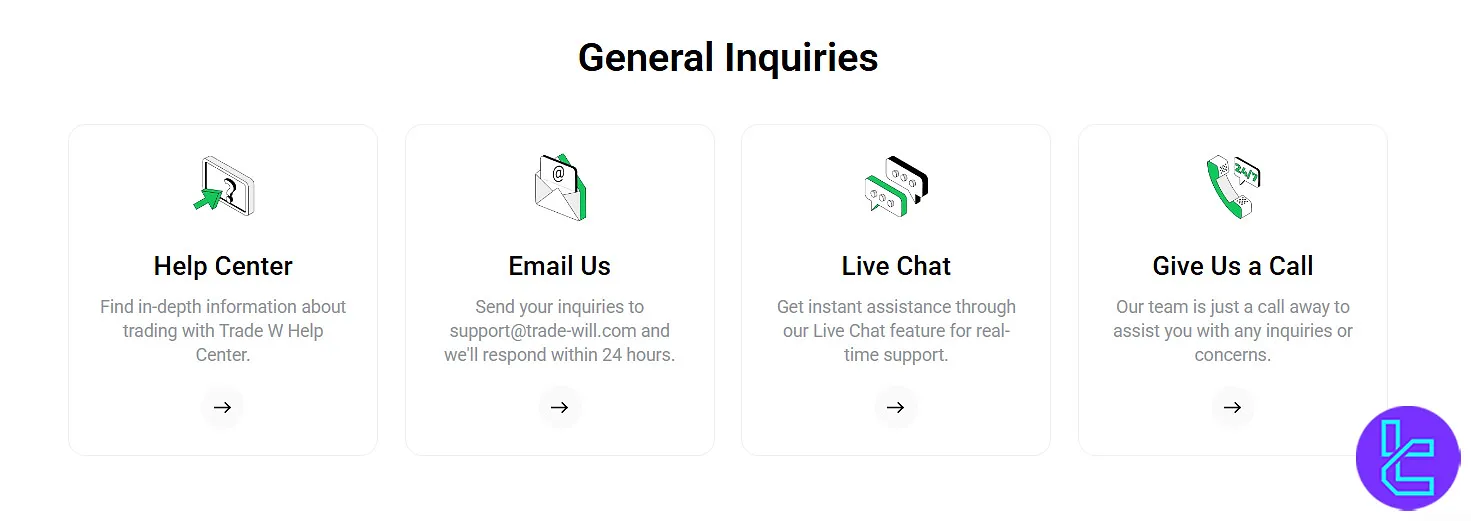

Support Channels and Open Hours

Tradewill provides 24/7 customer support through multiple channels:

- Email: support@trade-will.com

- Live Chat: Available on the website

- Phone: +248 4224249

- Ticket System: Accessible via the site

The round-the-clock support is a nice touch, especially for traders operating in different time zones.

Which Countries Are Denied By Tradewill?

This broker, similar to other brokerages in financial markets, cannot provide its services to all regions in the world. Here is the short list of restricted countries by Tradewill:

- United States

- Canada

- Israel

- Iran

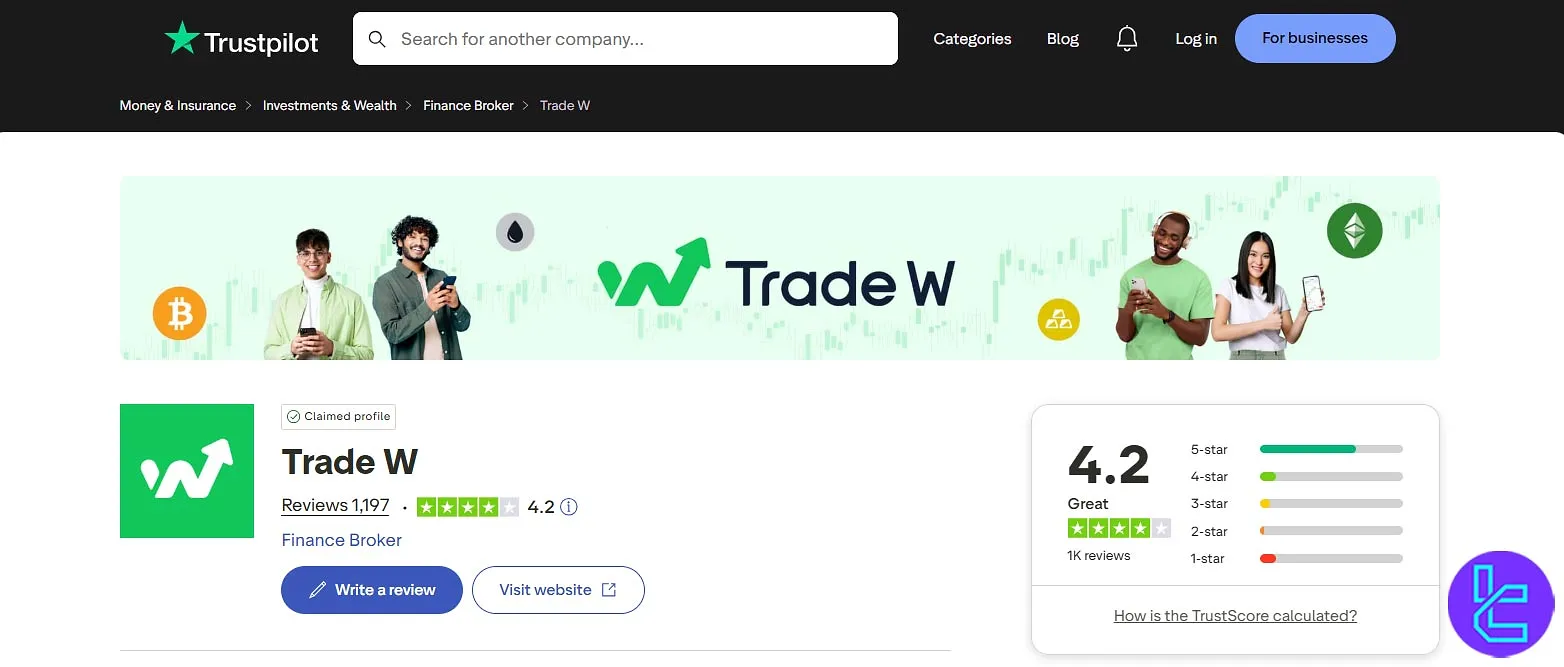

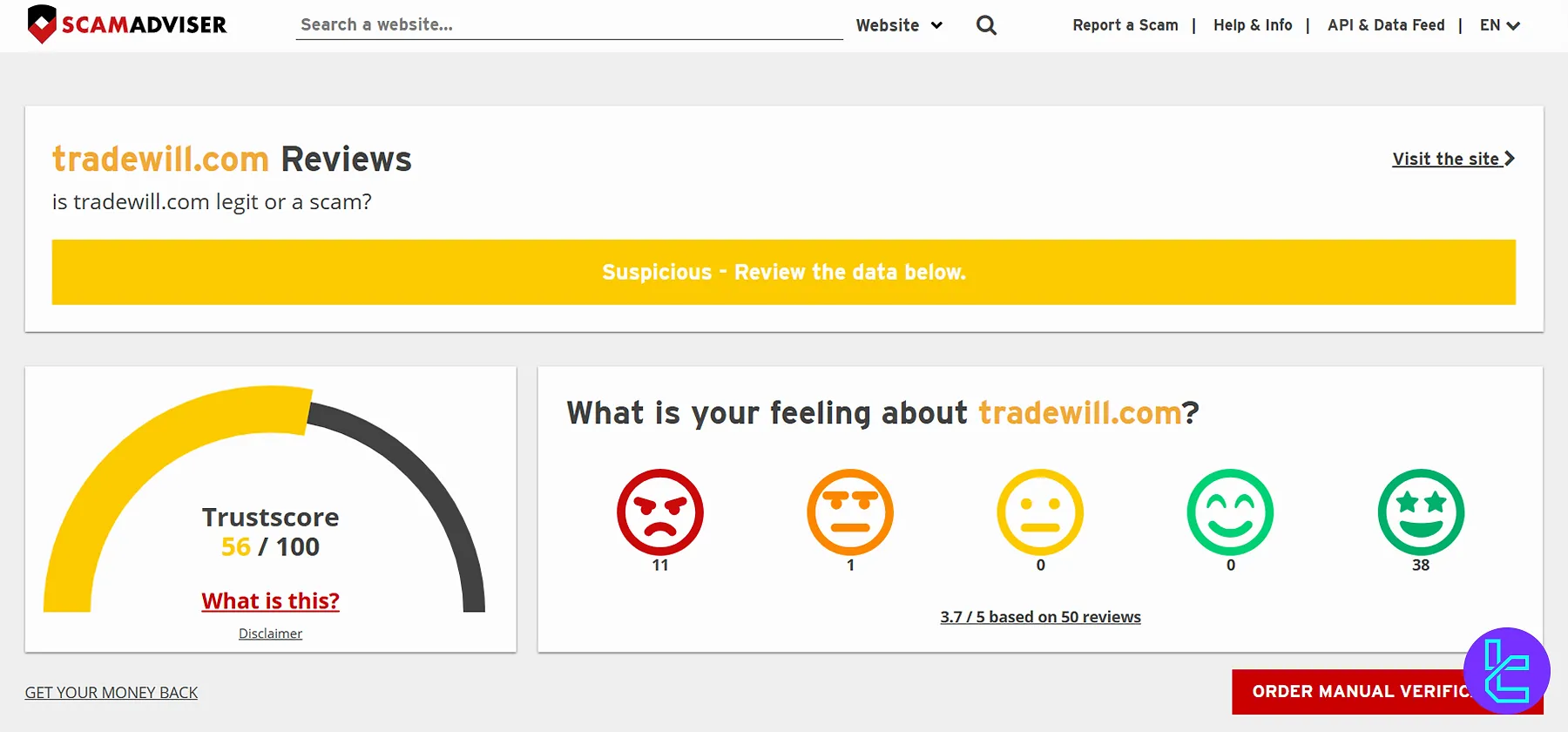

Trust Scores and User Evaluations

TradeWill's scores on Trustpilot and other reputable sources indicate a generally acceptable picture. Here is an overview:

- Trustpilot: 4.2/5 with +1000 user reviews

- ScamAdviser: 56/100 Trustscore

- ForexPeaceArmy: 1.8/5 (3 reviews)

The number of scores on FPA is too low; therefore, we cannot consider that rating as a reliable one.

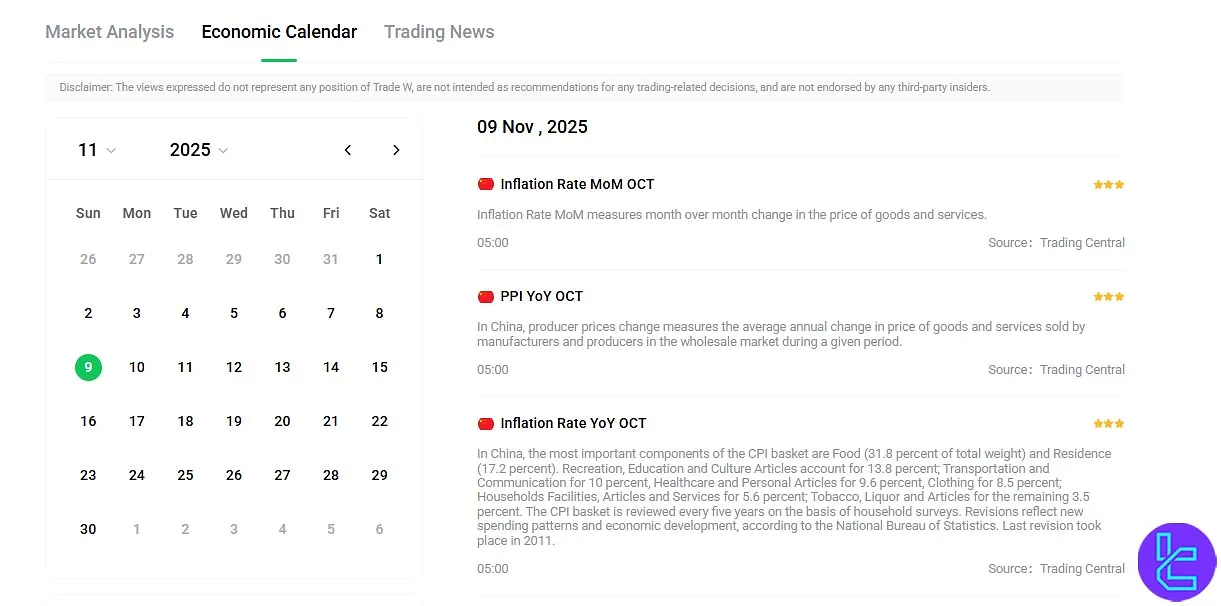

Educational Content and Resources

Tradewill offers some educational resources, including:

- Trading glossary

- Economic calendar

- Market news and analysis

- Video tutorials

However, the educational content is somewhat limited compared to other brokers. Traders, especially beginners, might need to supplement their learning with additional resources such as our Forex education page.

Tradewill vs Popular Brokers

Here's a comparison table reviewing Tradewill's offerings in comparison with the top players in the industry:

Parameter | Tradewill Broker | |||

Regulation | FSA | None | ASIC, FSC, DFSA, CySEC | Cent, Zero, Pro, Premium |

Minimum Spread | From 0.0 Pips | 0.1 Pips | From 0.6 Pips | 0.0 Pips |

Commission | From $0.0 | None | From Zero | From Zero |

Minimum Deposit | $3 | $10 | $5 | From $0 |

Maximum Leverage | 1:500 | 1:3000 | 1:1000 | 1:2000 |

Trading Platforms | MetaTrader 4, Proprietary Platform | MT4, MT5 | MT4, MT5, Mobile App | MT4, MT5, Mobile App |

Account Types | Standard, Pro, Tradewill | Standard, Premium, VIP, CIP | Micro, Standard, Ultra Low, Shares | Cent, Zero, Pro, Premium |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 100+ | 50+ | 1,400+ | 1,000+ |

| Trade Execution | Market | Market, Instant | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit |

Conclusion And Final Words

Tradewill provides a list of 100+ financial instruments across 4 markets [Forex, commodities, stocks, indices].

The ScamAdviser platform has given a Trustscore of 56/100 to the brokerage and 40+ users have given an average rating of 3.9/5 to it on "Trustpilot".