TradeZero offers options trading with maximum leverage up to 6x and its spread starts from $0.0. The minimum order in TradeZero Broker is 0.01 lot and you can start trading with $500 minimum deposit. They also offer 1% deposit bonus and $0 commission for limit orders.

TradeZero provides trading access to U.S. stocks, ETFs, and equity options across major exchanges. The broker has also earned multiple awards, such as “Best Broker for Short Selling” and “Best Paper Trading Platform” at Benzinga Fintech Awards.

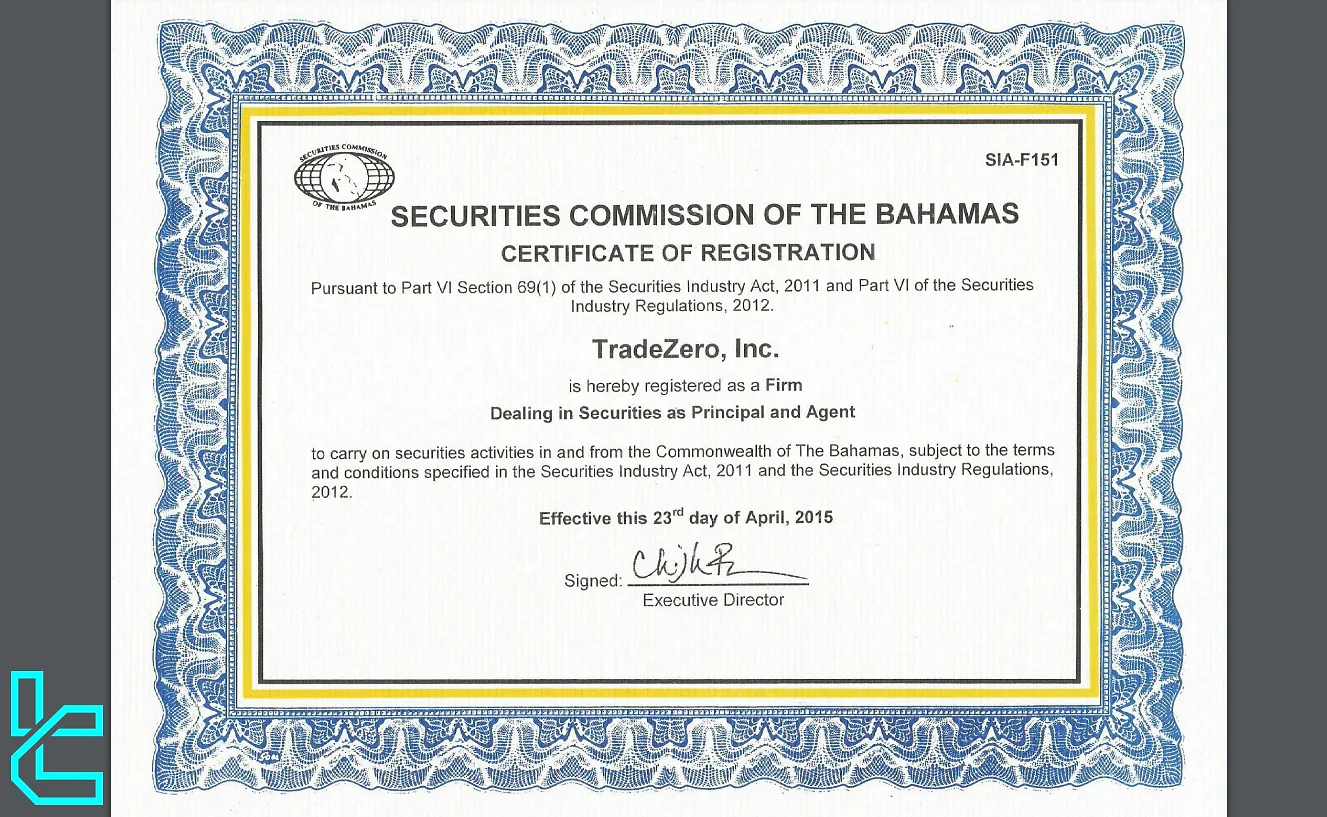

TradeZero Forex Broker Company Information & Regulation

TradeZero Forex Broker is a financial services firm that has been making waves in the trading community since its inception in 2015.

The company's mission is to empower traders by providing a progressive and innovative trading experience. TradeZero primarily caters to active traders seeking direct market access to NYSE, NASDAQ, AMEX, and OTC/Pink Sheets.

Here's what you need to know about TradeZero's company information and regulation:

- Headquarters: Nassau, Bahamas

- Founded: 2015

- Regulation: Registered with the Securities Commission of the Bahamas

- Membership: Bahamas Financial Services Board

The broker maintains segregation of client funds and stores cash and securities at third-party SIPC-member firms. While TradeZero does not offer third-party insurance or negative balance protection, there is no record of regulatory misconduct.

While TradeZero International is not directly regulated by the SEC or FINRA, its U.S. subsidiary, TradeZero America, is regulated by these authorities. This dual structure allows the company to serve both international andU.S. clients, albeit through separate entities.

It's important to note that TradeZero International does not accept clients from the United States, Canada, or the Bahamas due to regulatory restrictions. For traders in these countries, TradeZero America and TradeZero Canada are available as alternatives.

Here are More information about branches:

Parameter / Branch | TradeZero International | TradeZero America, Inc. | TradeZero Canada Securities ULC | TradeZero Europe B.V. |

Regulation | Securities Commission of the Bahamas (SCB) | SEC & FINRA | CIRO | AFM (Netherlands) |

Regulation Tier | 4 | 1 | 1 | N/A |

Country | Bahamas | USA | Canada | Netherlands |

Investor Protection Fund / Compensation Scheme | N/A | SIPC – up to USD 500,000 | CIPF – up to CAD 1,000,000 | N/A |

Segregated Funds | N/A | Yes | Yes | N/A |

Negative Balance Protection | No | N/A | N/A | N/A |

Maximum Leverage | 1:6 | 1:4 | 1:3 | 1:2 |

Client Eligibility | Global (non-US / Non-Canada clients) | U.S. residents only | Canadian residents only | Netherlands residents only |

Summary of Specifics

To give you a quick overview of what TradeZero offers, here's a summary table of its key features:

Broker | TradeZero |

Account Types | Real |

Regulating Authorities | SCB Bahamas, CIRO, AFM, FINRA |

Based Currencies | USD |

Minimum Deposit | $500 |

Deposit/Withdrawal Methods | Bank Transfer |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:6 |

Investment Options | N/A |

Trading Platforms & Apps | ZeroPro, ZeroWeb, ZeroMobile, ZeroFree |

Markets | U.S Stocks, Options, ETFs |

Spread | From $0.0 |

Commission | Varies by Instrument |

Orders Execution | Market |

Margin Call/Stop Out | 50%/100% |

Trading Features | 6x Maximum Leverage, Deposit Bonus, 24/7 Support, No Pattern Day Trading Rule, $0 Commission for Limit Orders |

Affiliate Program | Yes |

Bonus & Promotions | Yes |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Indoor Meeting, Email, Phone Call, Live Chat |

Customer Support Hours | 24/7 |

TradeZero stands out for its powerful trading platforms, high intraday leverage, and extensive short-selling capabilities.

However, it's worth noting that the broker has limited product offerings compared to some competitors, focusing primarily on stocks, ETFs, and options.

What Accounts Are Offered by TradeZero?

TradeZero offers a variety of account features to cater to different trading styles and preferences. While they don't have traditional "account types" like some brokers, they provide flexible options within a single account structure. Here's what you need to know:

- Minimum Deposit: Start trading with $500

- Leverage Options: Up to 1:6 intraday leverage option for accounts over $500, 1:1 leverage for accounts under $500

- Commission-Free Trading: Enjoy $0 commissions on limit orders for stocks priced $1 and above (minimum 200 shares)

- Extended Trading Hours: Trade from 4:00 AM to 8:00 PM ET

- No Pattern Day Trading Rules: Trade as actively as you like without restrictions

TradeZero's account structure is designed to provide maximum flexibility for active traders, especially those interested in day trading and short selling.

While it doesn’t offer tiered account structures, traders with portfolios exceeding $25,000 receive a 10% discount on short locate fees.

The absence of pattern day trading rules and the availability of high leverage make it particularly attractive for aggressive trading strategies.

Stocks trading under $0.05 are not tradable. There is no Islamic account option, and demo trading is available with 15-minute delayed data.

Advantages and Disadvantages

Like any broker, TradeZero has its strengths and weaknesses. Here's a balanced look at what the broker offers:

Advantages | Disadvantages |

High Leverage Options Trading (Up to 6:1) | Not Regulated by U.S. Authorities [International Branch] |

Commission-Free Limit Orders | Limited Product Offerings (No Futures, Forex, Or Crypto) |

Powerful Trading Platforms | Higher Transfer and Wire Fees |

Extensive Short-Selling Tools | Monthly Platform Fee for Advanced Platforms |

24/7 Multilingual Support | No SIPC Insurance for International Clients |

Extended Trading Hours |

TradeZero excels in providing tools and features for active traders, particularly those interested in short selling. However, its limited product range and lack of U.S. regulation (for the international entity) may be drawbacks for some traders.

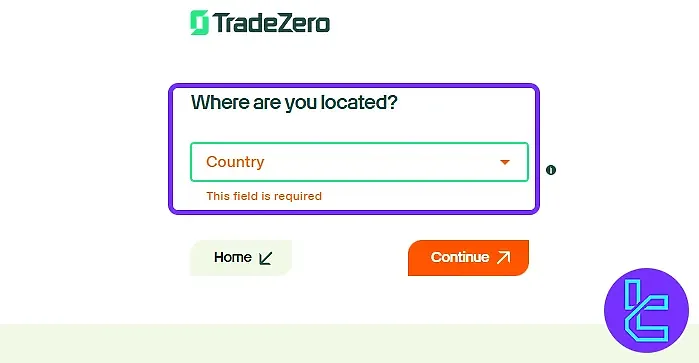

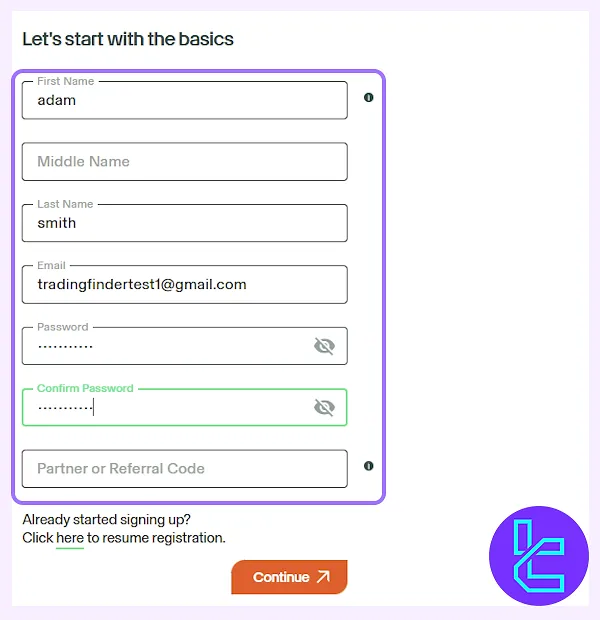

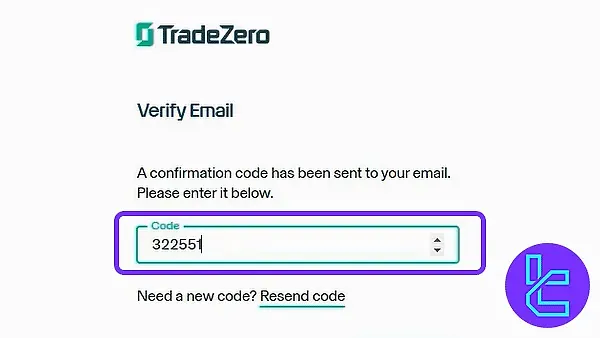

How Can I Sign-Up in TradeZero? Easy and Comprehensive Guide!

Creating a TradeZero account takes just a few minutes and follows a 4-step streamlined process. Users are required to enter their personal information, select theircountry of residence, and complete email verification.

The TradeZero registration ensures your access to the regulated trading environment and prepares your account for future KYC compliance.

#1 Access the Sign-Up Portal

Head to the official TradeZero website and click on "Sign Up" to open the registration interface.

#2 Select Your Country

Choose your residential country, as it determines your platform access and trading terms.

#3 Enter Personal Details

Provide the following information:

- First and last name

- Secure password

#4 Verify Your Email

Check your inbox for a verification code and enter it to activate your account and begin trading.

#5 Complete the Verification Procedure

Upload the required verification documents, including:

- Government-issued ID: Passport or Driver's license

- Proof of Address: Utility bill or bank statement

The verification process usually takes 1-2 business days. Once approved, you'll have full access to TradeZero's trading platforms and features.

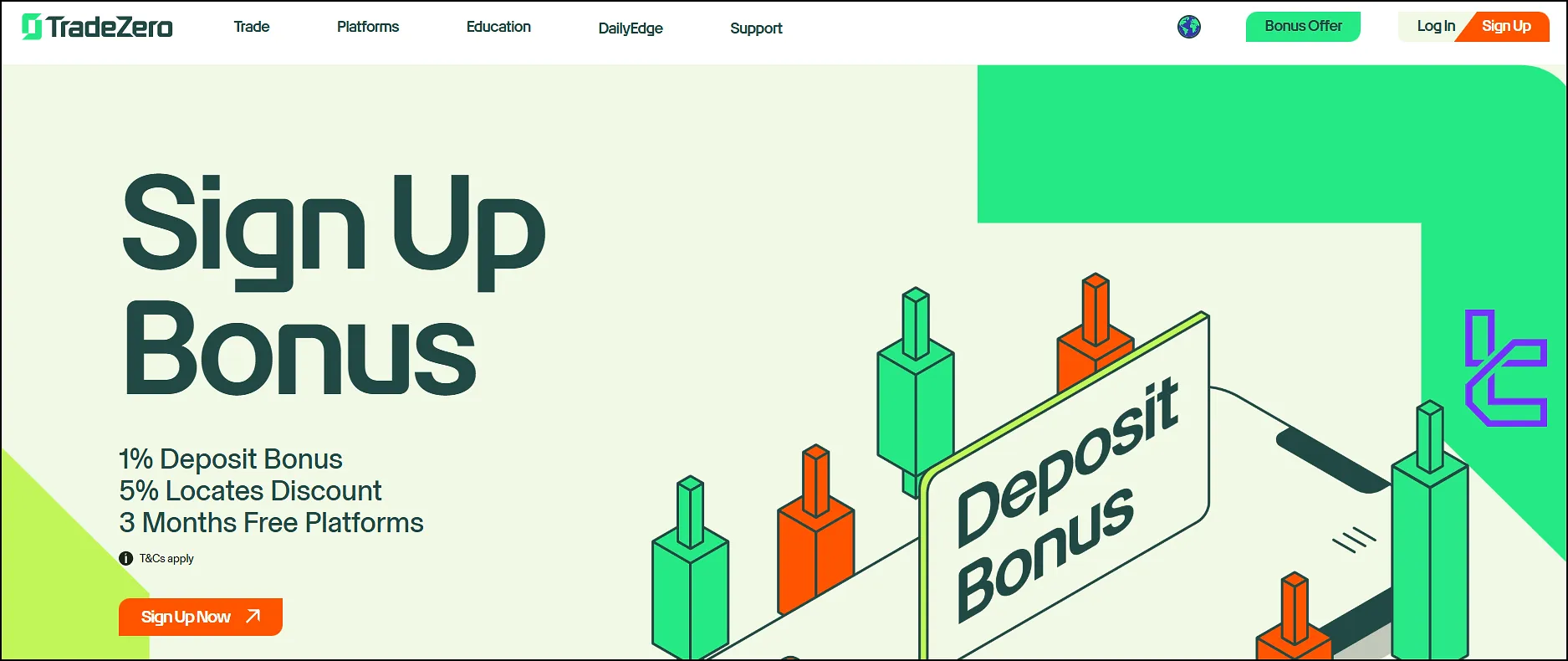

Remember, TradeZero offers a 3-part bonus for new signups, including a deposit bonus, discounted locates, and free access to their ZeroPro platform for three months. Be sure to check the current promotional offers when you sign up!

What Are TradeZero Options Trading Platforms?

TradeZero offers a suite of trading platforms to suit different trader preferences and needs:

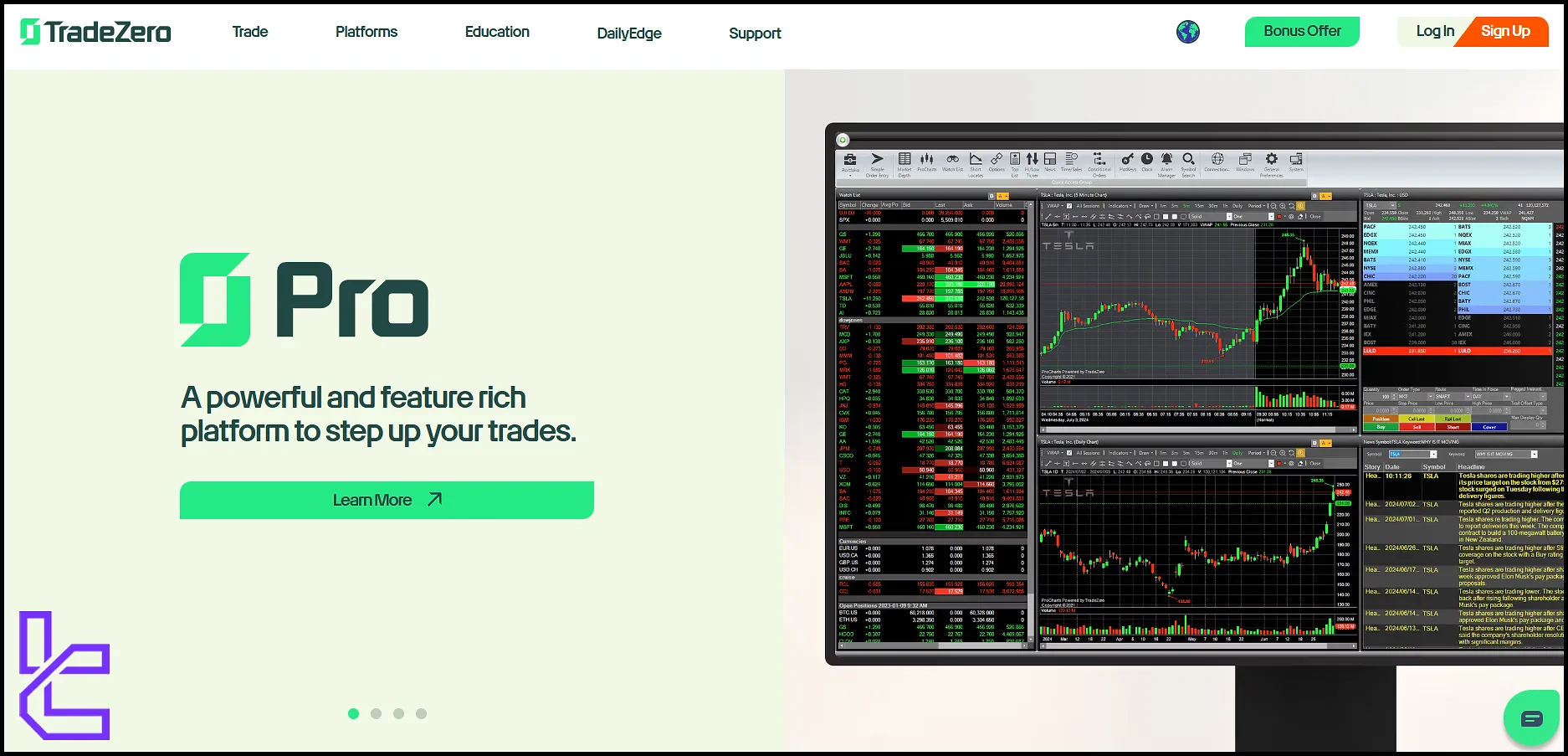

ZeroPro

A powerful desktop platform built for professional traders requiring advanced tools and flexibility:

- Advanced charting with over 60 indicators

- Level 2 market depth

- Customizable layouts and hotkeys

- Real-time news and market data

ZeroPro delivers professional traders comprehensive tools for efficient, high-quality market analysis.

ZeroPro is one of the trading platforms of TradeZero Options

ZeroPro is one of the trading platforms of TradeZero Options

ZeroWeb

A versatile web platform enabling access from any device without downloads or installations:

- Access from any device with internet connection

- Similar functionality to ZeroPro

- No download required

ZeroWeb allows traders convenient, fast access to markets directly through any browser.

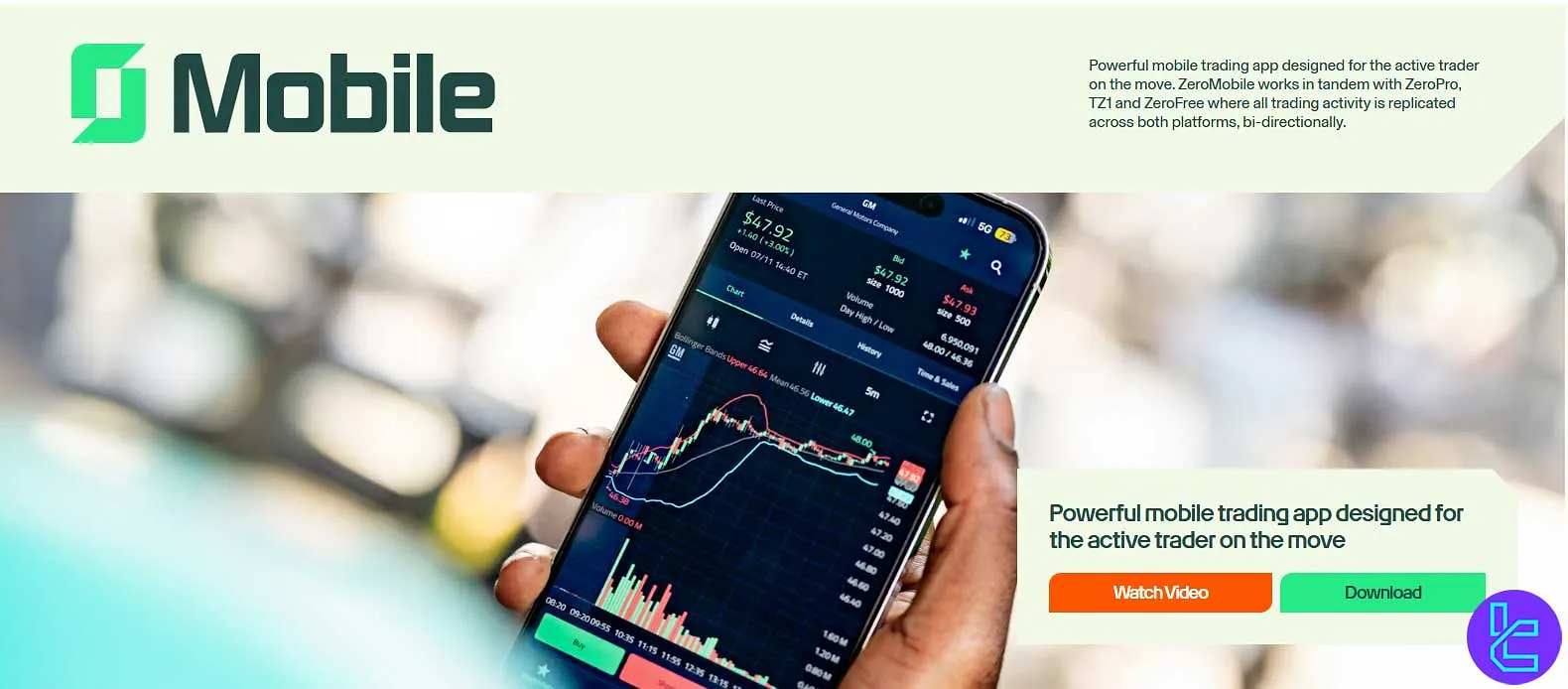

ZeroMobile

A mobile app offering real-time trading and essential tools for trading on the go:

- Available for iOS and Android

- Real-time quotes and charts

- Place trades on the go

ZeroMobile keeps traders connected and fully operational from anywhere at any time.

ZeroFree

A beginner-friendly, free platform providing simple trading features for casual users:

- Free to use

- Limited features compared to other platforms

- Suitable for beginners or casual traders

ZeroFree gives new traders an accessible and risk-free environment to practice trading.

All platforms offer real-time data, advanced order types, and access to TradeZero's short locate feature. The choice of platform depends on your trading style, technical requirements, and whether you're willing to pay for advanced features.

How Much Are TradeZero Fees and Commission?

TradeZero's commission structure is designed to be competitive, especially for active traders. Here's a breakdown of their fees:

Stocks priced $1 and above

- $0 commission for limit orders (200+ shares)

- $0.005 per share for market orders (min $0.99, max $9.99)

Stocks under $1

- 5% of trade value (min $0.99, max $9.99)

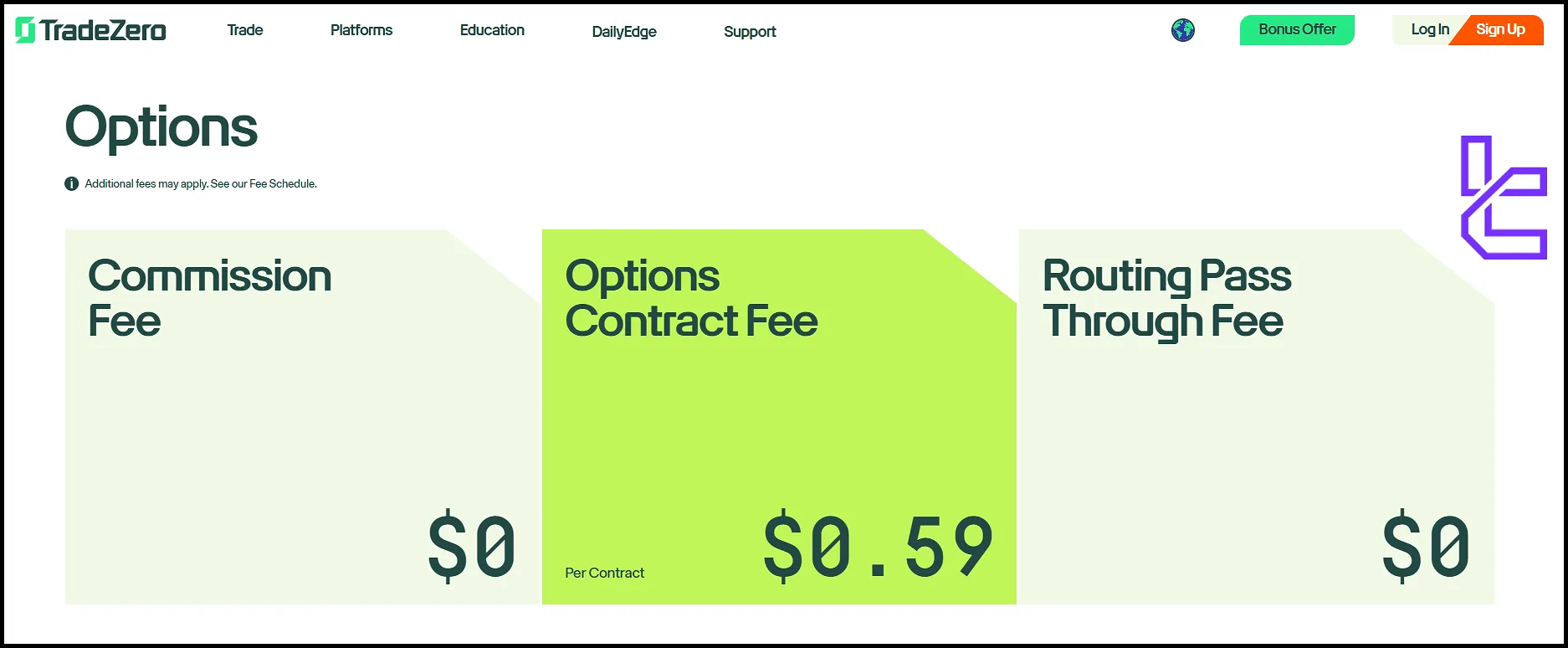

Options

- $0.59 per contract

- $0.0 Routing pass through fee

- $0.0 Commission fee

Options Fees in TradeZero Broker

Options Fees in TradeZero Broker

Platform Fees

- ZeroPro: $59 per month

- ZeroMobile: Free

TradeZero Other Fees

Besides the fees that we mentioned, there are some other fees that you should consider:

- Inactivity Fee: $0

- Outgoing Withdrawals: $15

- Reorgs: $35 for reverse splits and symbol changes

- Incoming Deposit: $15 for all deposits

- Broker Assister Trades: $30 per trade

Swap Fees at TradeZero

At TradeZero, swap costs apply primarily to short positions held overnight, known as Overnight Borrow Fees. These fees are estimated on the day the position is held and finalized two business days later (T+2) based on the clearing firm’s rate.

For instance, a short opened on March 17 2025 would have its final overnight borrow charge posted on March 19 2025.

These points highlight the key mechanics of TradeZero’s swap fee policy:

- Overnight borrow fees accrue daily until the short position is covered, and the rate varies depending on stock availability and market borrow cost;

- On Thursdays after 8 PM ET, a three-day fee (Thursday–Friday–Saturday) is applied to account for weekend settlement;

- Odd-lot positions (fewer than 100 shares) are rounded up to the nearest 100 for fee calculation purposes;

- Traders can preview projected costs using the Overnight Borrow Calculator available inside the TradeZero client portal.

Non-Trading Fees at TradeZero

TradeZero maintains a transparent cost structure with clearly defined non-trading fees covering account services, transfers, and platform maintenance.

These charges apply outside of direct trading activity, for example, outgoing wire fees or account transfers, ensuring operational efficiency while maintaining regulatory compliance.

Below are the key non-trading fees every trader should know:

- Outgoing Account Transfer (ACAT): USD 125 per request when transferring assets to another brokerage;

- Wire Withdrawal: USD 50 per outgoing domestic or international wire; incoming wires are USD 25;

- Returned ACH or Check Fee: USD 50 applied to failed or reversed electronic or check transactions;

- Unqualified Account Maintenance Fee: USD 5 quarterly for inactive accounts under USD 100 in equity;

- Corporate Account Platform Fee: USD 300 monthly if equity falls below USD 50,000.

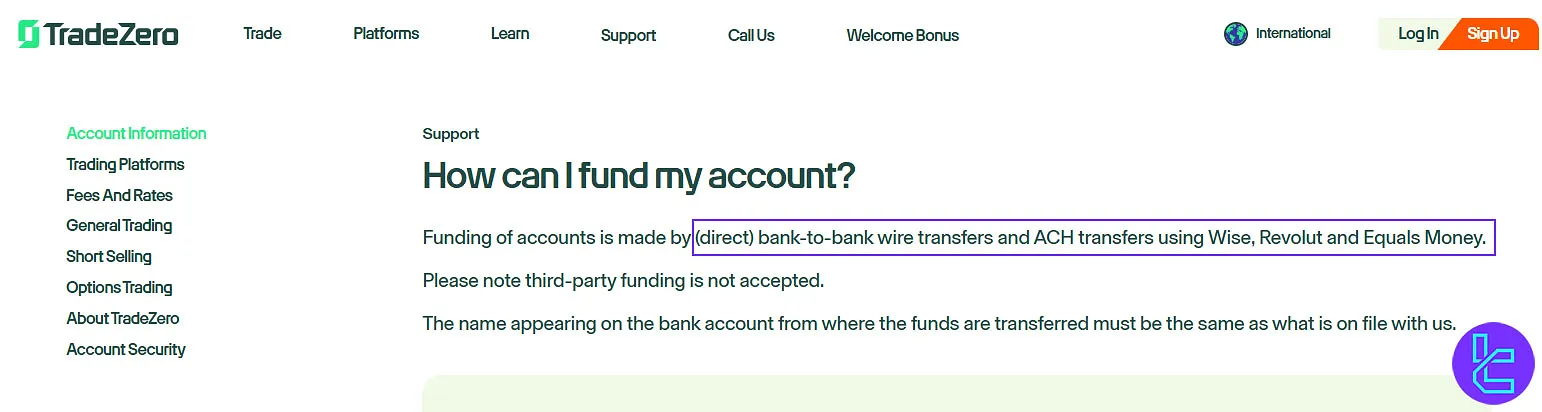

What are the Available Payment Methods at TradeZero?

TradeZero International supports two main funding and withdrawal methods: direct bank-to-bank wire transfers and ACH transfers via trusted providers such as Wise, Revolut, or Equals Money.

Unlike some brokers that offer multiple options like credit cards, e-wallets, or cryptocurrencies, TradeZero focuses on these secure, bank-based methods to ensure compliance and reliability.

Traders must ensure that the bank account name matches the trading account holder’s name to comply with AML regulations.

Processing times and potential fees depend on the external bank and chosen transfer method, and all deposits and withdrawals are ultimately credited in USD.

Deposit Methods at TradeZero

TradeZero offers a streamlined funding process with only two approved deposit methods: direct bank‑to‑bank wire transfers and ACH transfers through trusted providers like Wise, Revolut, or Equals Money.

All deposits must originate from a bank account matching the account holder’s name on file, and funds are ultimately credited in USD, even if converted from another currency.

The key details of these funding options are summarized below:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank ‑ to ‑ Bank Wire Transfer | USD | US$ 500 | US$ 15 | N/A |

ACH Transfer via Wise / Revolut / Equals Money | USD | US$ 500 | No fee | N/A |

Withdrawal Methods at TradeZero

TradeZero allows clients to withdraw funds and profits using two primary methods: direct bank‑to‑bank wire transfers and ACH transfers via Wise, Revolut, or Equals Money.

Withdrawals must be sent to a bank account matching the account holder’s name to ensure security and compliance. Processing is fast and transparent, with requests before 2:30 pm ET typically handled the same day, and a maximum transfer time of 5 business days.

The key withdrawal details are summarized in the table below:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Processing Time |

Bank ‑ to ‑ Bank Wire Transfer | USD | $100 | US$ 15 | Requests before 2:30 pm ET processed same day; max 5 business days |

ACH Transfer via Wise / Revolut / Equals Money | USD | $100 | US$ 5; $50 for returned ACH | Requests before 2:30 pm ET processed same day; max 5 business days |

Is Copy Trading & Investment Options Available at TradeZero International?

TradeZero focuses primarily on providing tools for active, self-directed traders. As such, they do not offer traditional copy trading or social trading features.

Their platforms are designed for traders who want to execute their own strategies rather than following or copying others.

Tradable Markets & Symbols Overview

The fact that we realized in the TradeZero review is that this broker specializes in providing access to U.S. markets, focusing primarily on stocks, ETFs, and options. TradeZero Instruments:

Category | Type of Instruments | Number of Symbols* | Competitor Average † | Max. Leverage |

Equities & ETFs | U.S. Stocks, OTC, ETFs | N/A | ~3,000–4,000 | 1:6 intraday / 1:2 overnight |

Options | Equity options (single & multi‑leg) | N/A | ~1,000–2,000 | 1:6 intraday / 1:2 overnight |

The platform provides real-time market data and allows for extended hours trading from 4:00 AM to 8:00 PM ET, giving traders more opportunities to act on market movements.

The broker does not offer forex, cryptocurrencies, commodities, metals, or bonds. This makes it best suited for U.S. equity-focused traders rather than those seeking cross-asset diversification

Does TradeZero Options Offer Bonuses?

TradeZero International offers an attractive bonus package for new clients, designed to give traders a head start:

- 1% Deposit Bonus: Receive a 1% bonus on your initial deposit with maximum amount of $1,000;

- 5% Locates Discount: Get a 5% discount on short locate fees for the first 3 months;

- 3 Months Free Platform Access: Free access to ZeroPro and ZeroWeb platforms for 3 months.

These promotions can provide significant value, especially for traders planning to actively use TradeZero's advanced features like short selling and the ZeroPro platform.

However, always read the full terms and conditions before taking advantage of any bonus offers.

TradeZero Awards

All the TradeZero awards highlight the broker’s consistent recognition in the financial trading industry.

Over the years, TradeZero has been acknowledged for excellence in short selling, innovative trading tools, and advanced practice environments, demonstrating its commitment to supporting active traders with high-quality, reliable services.

Here are the most important awards that broker achieved until now:

- Five-time winner of “Best Broker for Short Selling” at the Benzinga Fintech Awards (2020–2024)

- Winner of “Best Paper Trading Platform” at the Benzinga Fintech Awards in 2024

TradeZero International Customer Support

TradeZero provides multiple channels for customer support, ensuring that traders can get help when they need it:

- Live Chat: Available 24/7, accessible directly from the TradeZero website and trading platform

- Call center hours: 8 AM to 5 PMET on weekdays

- Email Support: support@tradezero.co, Suitable for non-urgent inquiries or detailed questions

- Indoor Meetings: TradeZero may occasionally host events or seminars for traders

TradeZero's customer support is available in multiple languages, including English, Arabic, Italian, Portuguese, and Spanish, catering to a global client base. The 24/7 live chat option is particularly valuable for traders operating in different time zones or outside regular business hours.

Restricted Countries: Which Countries Are Banned from Using?

TradeZero International has restrictions on accepting clients from certain countries due to regulatory and compliance reasons:

- United States (served by TradeZero America)

- Canada (served by TradeZero Canada)

- Bahamas

- Afghanistan

- China

- Cuba

- Iran

- North Korea

- Russia

- Syria

- Venezuela

This list is not exhaustive and may change based on evolving international regulations. It's always best to check directly with TradeZero for the most up-to-date information on country restrictions.

TradeZero Broker Trust Scores & Reviews

The TradeZero Trustpilot profile has garnered generally positive reviews from users, reflected in its high score of 4.5/5 based on 2,970+ reviews. Here's a breakdown of the key points from user feedback:

Positive Aspects:

- Advanced trading software and powerful charting tools

- Real-time market data and fast order execution

- Excellent short-selling capabilities, even for hard-to-borrow stocks

- Responsive customer service and 24/7 live chat support

- Comprehensive educational resources

Areas of Concern:

- Some users report issues with account withdrawals

- Occasional trade rejections, particularly for penny stocks

- Technical problems reported by a small number of users

Overall, TradeZero review appears to be well-regarded by active traders, particularly those focused on day trading and short selling. The platform's advanced features and competitive pricing structure are frequently praised.

However, as with any broker, it's important to consider both the positive and negative feedback when making your decision.

Educational Resources

This broker offers a comprehensive education program to help traders enhance their skills and stay informed about market trends; TradeZero Educational Resources:

Live Sessions

These live sessions provide direct insights and actionable strategies for active traders:

- Regular webinars featuring Wall Street professionals

- Topics include risk management, options trading, market analysis, and trading psychology

- Speakers include Peter Tuchman, Bob Iaccino, David Green, Felix Frey, and Richie Naso

Live Sessions give traders hands-on learning opportunities with experienced market professionals.

Blog

The TradeZero blog delivers timely market analysis and educational content for all traders:

- Frequently updated with market insights and trading strategies

- Covers a wide range of topics suitable for beginners and experienced traders

- Includes practical how-to guides for using TradeZero's platforms and tools

The Blog helps traders apply practical strategies and stay informed in real markets.

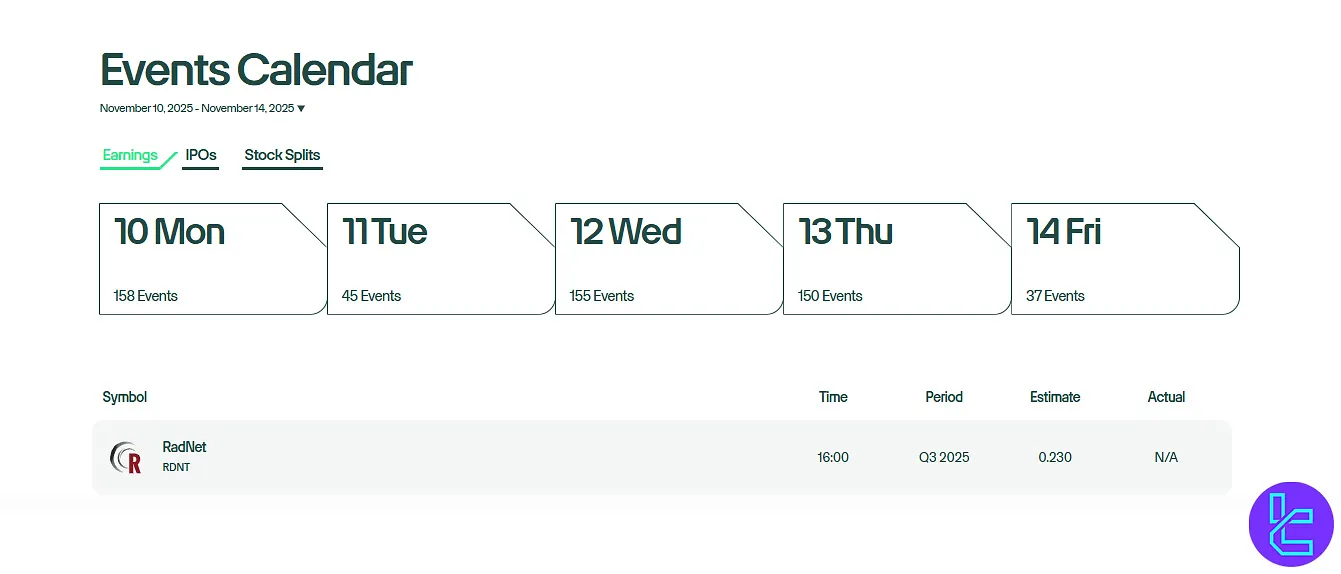

Event Calendar

This calendar allows traders to plan participation in events and maximize learning opportunities:

- Comprehensive schedule of upcoming educational events

- Includes live sessions, platform walkthroughs, and market briefings

- Allows traders to plan their learning and stay engaged with the TradeZero community

The Event Calendar ensures traders remain organized and never miss important educational sessions.

You can also check TradingFinder's Forex education section for additional resources.

TradeZero Comparison Table

The table below compares TradeZero's features with popular Forex brokers:

Parameter | TradeZero Broker | |||

Regulation | SCB Bahamas | None | FSA, CySEC, ASIC | Cent, Zero, Pro, Premium |

Minimum Spread | From 0.0 Pips | 0.1 Pips | From 0.0 pips | 0.0 Pips |

Commission | From $0.0 | None | Average $1.5 | From Zero |

Minimum Deposit | $500 | $10 | $200 | From $0 |

Maximum Leverage | 1:6 | 1:3000 | 1:500 | 1:2000 |

Trading Platforms | ZeroPro, ZeroWeb, ZeroMobile, ZeroFree | MT4, MT5 | Metatrader 4, Metatrader 5, cTrader, IC Markets Mobile | MT4, MT5, Mobile App |

Account Types | Real | Standard, Premium, VIP, CIP | Standard, Raw Spread, Islamic | Cent, Zero, Pro, Premium |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | N/A | 50+ | 2,100+ | 1,000+ |

| Trade Execution | Market | Market, Instant | Market | Market, Buy Stop, Stop Loss, Limit, Take Profit |

TradingFinder Expert Conclusion and Final Words

No pattern day trading rules, 4 trading platforms [ZeroPro, ZeroWeb, ZeroMobile, ZeroFree], %1 deposit bonus and 5% locates discount are available to trade 3 markets [U.S Stocks, Options, ETFs] in TradeZero.

On the other hand, No investment option [copy trading e.g] and no SIPC insurance are available in this broker.