TrioMarkets is a Forex broker with benefits such as over 500 tradable instruments, licenses from 3 financial authorities [CySEC, DFSA, FSC,] and a proprietary platform titled "TrioTrader."

The broker provides 4 account types [Basic, Standard, Advanced, Premium ECN.] The minimum deposit with this brokerage is $100, and leverage up to 1:500 is available.

Company Information and Regulation

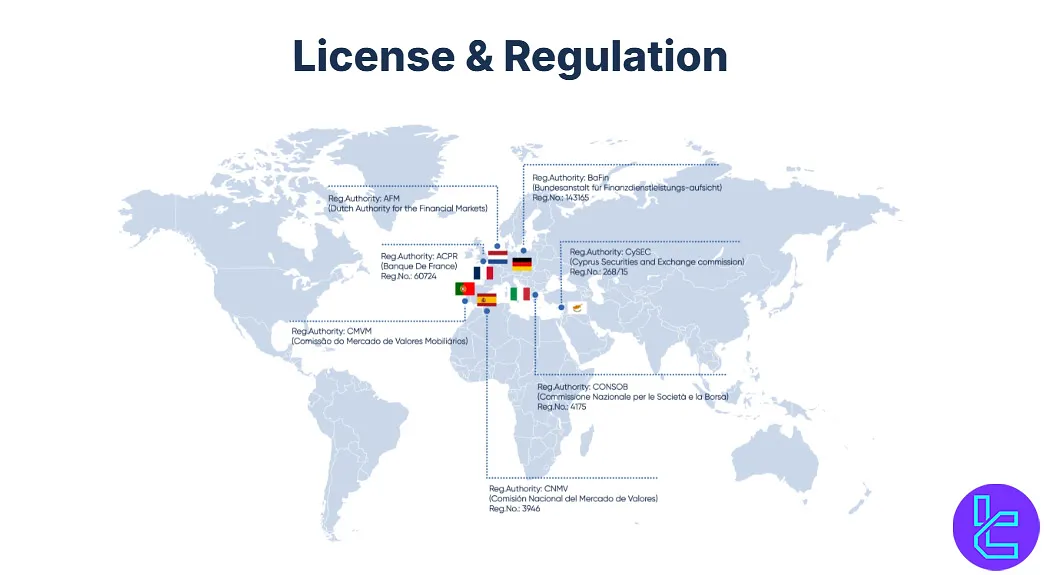

TrioMarkets stands as a regulated multi-asset broker, operating under strict regulatory oversight from two respected financial authorities plus a lower-tier one:

- CySEC (Cyprus Securities and Exchange Commission) under license #268/15

- FSC (Financial Services Commission Mauritius)

Founded in 2019 and headquartered in Limassol, Cyprus, TrioMarkets tries to prove its reliability to traders.

The Forex broker is authorized to provide services across multiple European jurisdictions, including France, Germany, Italy, the Netherlands, Portugal, and Spain.

The company ensures fund segregation, negative balance protection, and participates in a compensation fund, enhancing its overall trustworthiness.

Here are the key features you need to know about TrioMarkets broker:

Entity Parameters/Branches | Triomarkets Capital Ltd | EDR Financial Ltd |

Regulation | FSCMauritius | CySEC (also registered with BaFin, CNMV, CMVM, AFM, ACPR, CONSOB) |

Regulation Tier | N/A | 1 |

Country | Mauritius | Cyprus |

Investor Protection Fund / Compensation Scheme | N/A | ICF (up to €20,000) |

Segregated Funds | Yes | Yes |

Negative Balance Protection | No | Yes |

Maximum Leverage | 1:500 | 1:30 |

Client Eligibility | International (excluding US, Israel, Iran, DPRK) | EU/EEA residents |

Key Features and Specifics

Let's examine the key features and specifications that make TrioMarkets a financial multi-asset brokerage:

Broker | TrioMarkets |

Account Types | Basic, Standard, Advanced, Premium ECN |

Regulating Authorities | CySEC, DFSA, FSC |

Based Currencies | USD, EUR |

Minimum Deposit | $100 |

Deposit Methods | Visa, MasterCard, Bank Wire, Neteller, Local Payment Solutions |

Withdrawal Methods | Visa, MasterCard, Bank Wire, Neteller, Local Payment Solutions |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:500 |

Investment Options | PAMM/MAM Accounts |

Trading Platforms & Apps | MetaTrader 4, TrioTrader |

Markets | Forex, Shares, Cryptocurrencies, Indices, Metals, Energies |

Spread | From Zero on Premium – ECN Account |

Commission | Zero on Basic, Standard, and Advanced Accounts |

Orders Execution | Market |

Margin Call/Stop Out | 120%/50% |

Trading Features | Economic Calendar, Currency Converter, VPS |

Affiliate Program | Yes |

Bonus & Promotions | $50 Deposit Bonus, Cashback |

Islamic Account | No |

PAMM Account | Yes |

Customer Support Ways | Live Chat, Email, Phone Call, Ticket |

Customer Support Hours | 24/5 |

What Are The Account Types Offered by TrioMarkets?

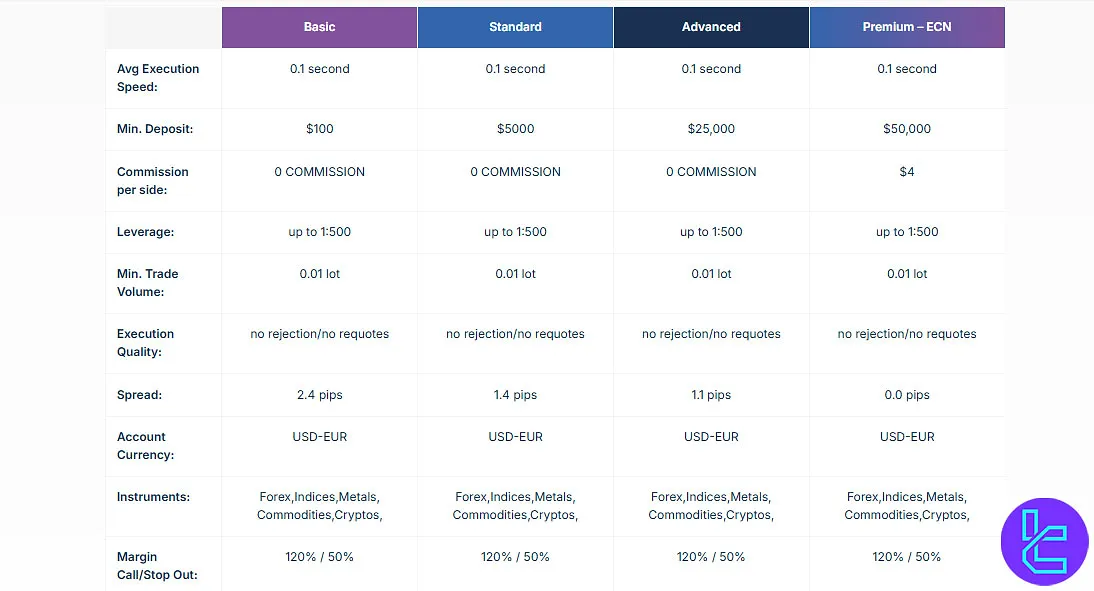

The company offers four account types designed to meet specific trading needs. However, there's not much difference among them except in spreads and commissions, which will be discussed later in this article. Let's look at each account's specifics and compare them:

Account Types | Basic | Standard | Advanced | Premium - ECN |

Avg. Execution Speed | 0.1 Second | |||

Min. Deposit | $100 | $5,000 | $25,000 | $50,000 |

Max. Leverage | 1:500 | |||

Min. Order Size | 0.01 Lot | |||

Account Currency | USD, EUR | |||

Margin Call/Stop Out | 120%/50% | |||

Islamic accounts are not available for eligible Muslim clients.

Note: Traders who register with the CySEC-regulated entity will be able to use leverage options of up to 1:30. However, offshore conditions suggest possible leverage up to 1:500.

Benefits and Drawbacks

Let's examine the pros and cons of trading with TrioMarkets, as they could be very determining in choosing a Forex broker or not:

Benefits | Drawbacks |

Regulated by Respected Authorities | High Minimum Deposit for Accounts |

+500 Trading Instruments | Relatively High Spreads On Basic Account |

High-speed Execution | Fees Charged on Withdrawals and Inactive Accounts |

Negative Balance Protection | - |

How to Open an Account and Verify on TrioMarkets

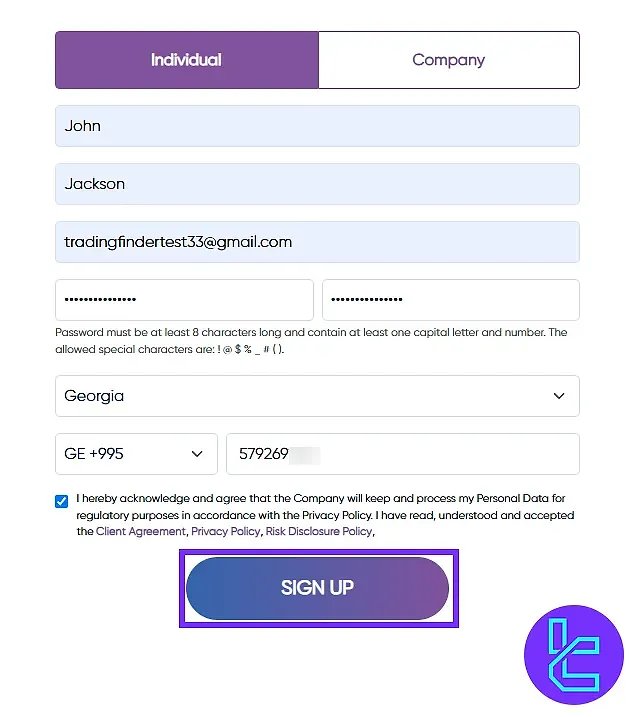

The TrioMarkets registration is quick and efficient, taking less than five minutes. The process involves submitting essential personal details, selecting an account type, and confirming your email address.

Once registered, users can access the dashboard and prepare for full account verification.

#1 Open an Account

Visit the TrioMarkets homepage and click "Open an Account". Fill out the form with the following information:

- Account type

- First and last name

- Email address

- Secure password

- Country of residence

- Mobile number

Accept theterms and conditions, then hit "Sign Up" to continue.

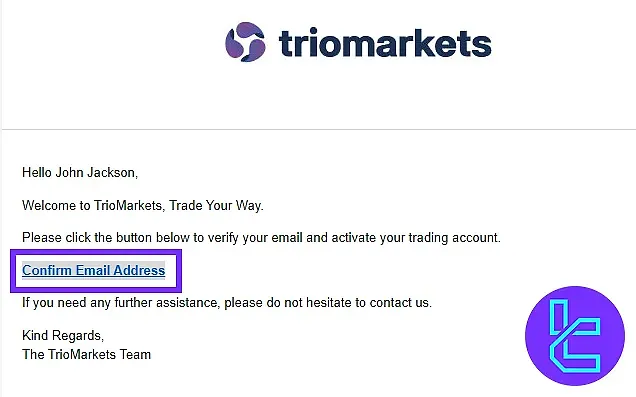

#2 Verify Your Email and Login

Check your inbox for a confirmation email from TrioMarkets. Click the verification link. Once confirmed, return to the site, click "Login", and access the trading dashboard.

#3 TrioMarkets Verification

Completing your TrioMarkets verification is a straightforward process that typically takes around 10 minutes. The procedure requires submitting documents for Proof of Identity (POI), Proof of Address (POA), and deposit confirmation. Ensuring that all documents are accurate and up-to-date can help expedite the KYC approval.

Below are the step-by-step actions required to finalize your verification:

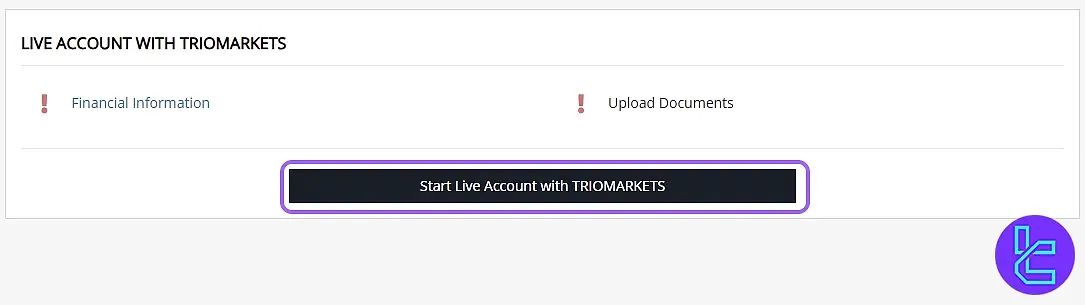

#1 Start Your Live Account

Access your TrioMarkets dashboard and click on the “Start live account with Triomarkets” button to initiate the verification process.

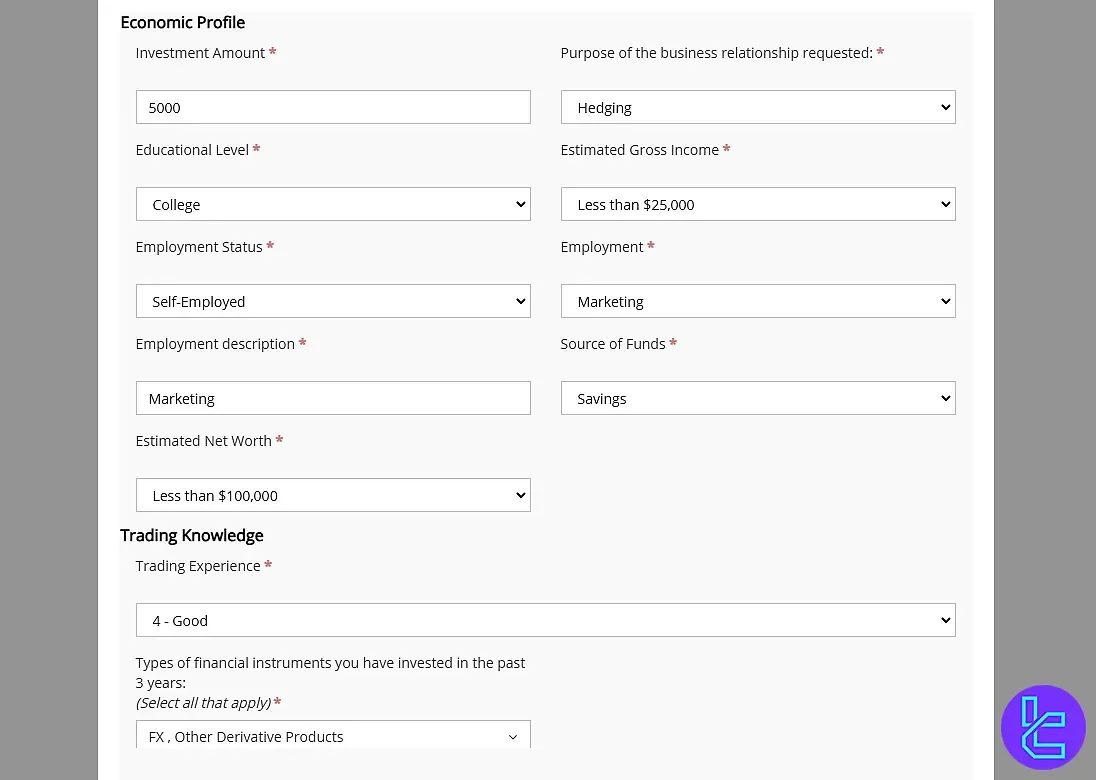

#2 Provide Financial and Trading Experience Details

Complete the required forms with information about:

- Financial status

- Employment details

- Trading experience

- Tax identification

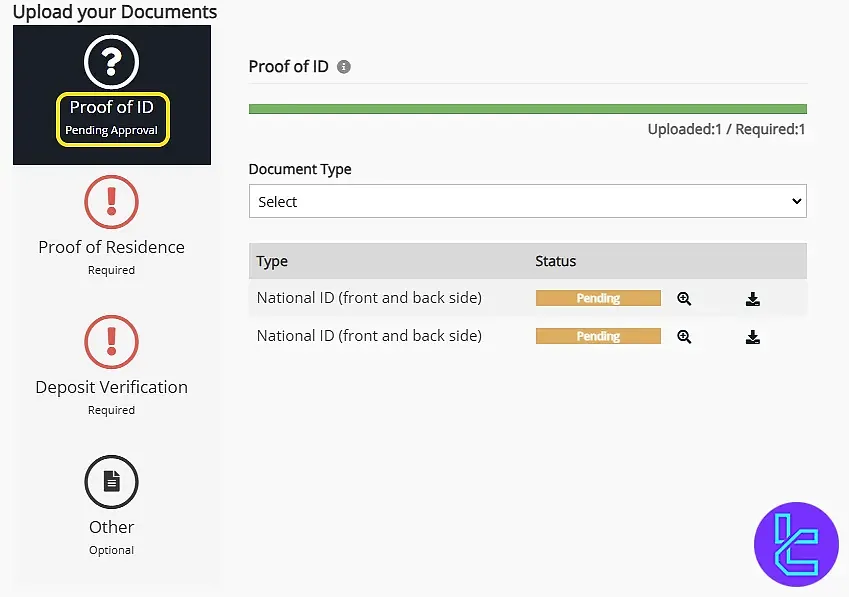

#3 Upload Government-Issued ID

Submit a clear copy of the front and back of your official ID. Accepted documents include:

- Passport

- ID Card

- Driving license

- Resident permit

Use the Browse button to select your files for upload.

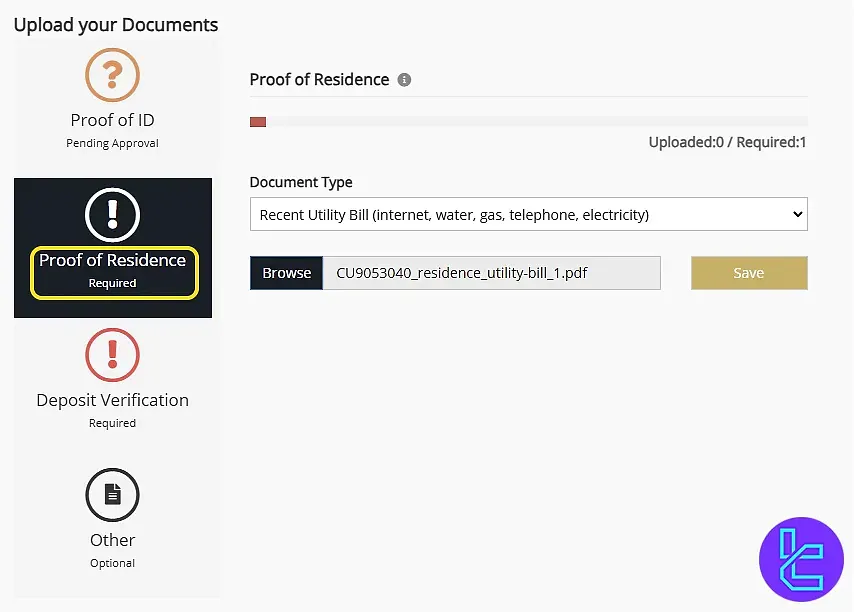

#4 Submit Proof of Residence

Provide a recent utility bill or bank statement dated within the last three months. Then, click “Proof of Residence”, choose your file, and upload to the system.

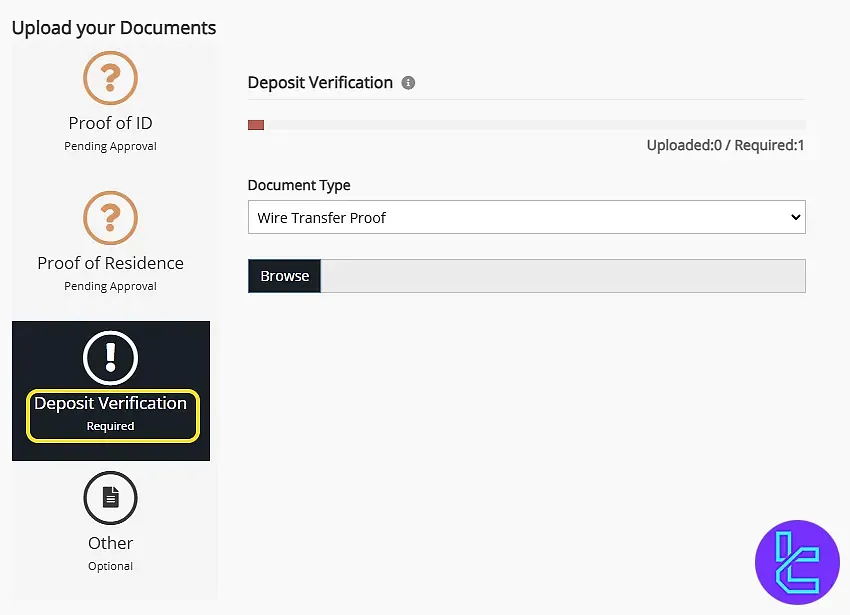

#5 Complete Deposit Verification

Upload a copy of your transaction record for deposit validation, such as a bank wire statement. Select “Deposit Verification”, browse your file, and save it to confirm the deposit.

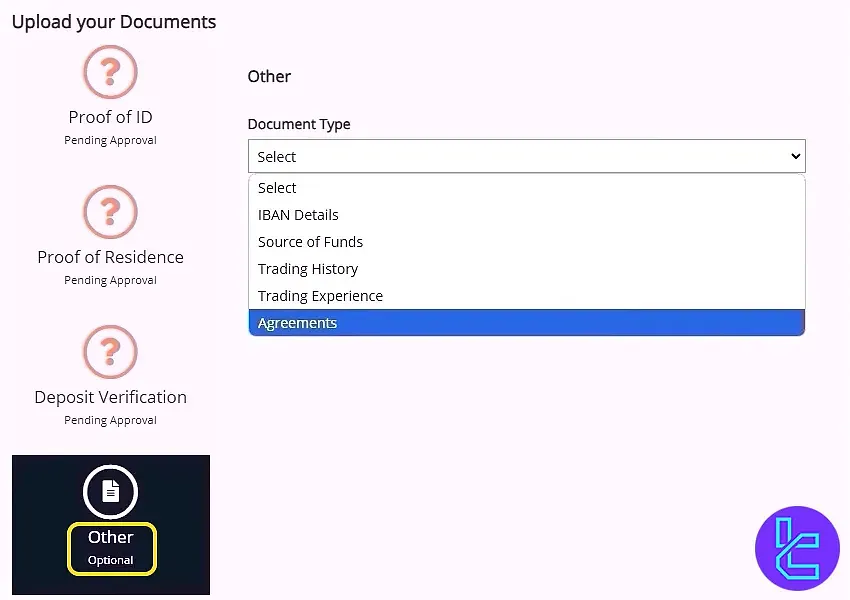

#6 Upload Additional Documents if Required

If any further documents are requested:

- Go to the “Other” section

- Select the relevant document type

- Upload your file and save

#7 Review Approval Status

Check the verification progress in “My Profile”. Once all documents are approved, your TrioMarkets account is fully verified and ready for trading.

Trading Platforms and Applications

TrioMarkets provides traders with two powerful trading platforms. One of them is the proprietary platform, TrioTrader. The other is MetaTrader 4, one of the most popular trading platforms in the world of financial markets.

To download the latter, you can go through these links:

While it lacks access to MT5 or third-party platforms like TradingView or cTrader, MT4 enables automated trading (EAs), robust technical analysis, and multi-asset execution.

Also, you can go to the "MetaTrader 4 Indicators" page on our website to download/install indicators for this platform.

TrioMarkets Spreads And Commissions Review

Spreads and commissions are charged by the brokers in various operations and situations, including trading, payments, inactivity periods, etc. Trading costs in TrioMarkets:

Account Type | Basic | Standard | Advanced | Premium - ECN |

Commission | Zero | $4 | ||

Spread | 2.4 Pips | 1.4 Pips | 1.1 Pips | Zero |

Note that the spread might change based on the market condition and the trading asset. Besides trading spreads and commissions, there are also a 1% fee for withdrawals made via credit/debit cards andSkrill. The price goes higher for other methods. Furthermore, an inactivity fee is charged.

Swap Fees at TrioMarkets

At TrioMarkets, overnight financing charges (known as swaps) are applied when positions are held open past midnight server time. These rates differ for each trading instrument and can be found in the broker’s official trading-conditions list.

For example, the EUR/USD swap long is -13.299 and the swap short is 3.745 per standard lot, clearly showing how interest-rate differentials and broker spreads directly affect traders’ overnight costs.

Below are the most relevant details related to TrioMarkets’ swap policy:

- For commodities like gold (XAUUSD), the long swap reaches -59.271 and the short swap 15.020, representing one of the higher overnight costs;

- Triple swaps are charged every Wednesday night to account for weekend rollover, in line with standard market practice;

- Swap calculation occurs daily at 00:00 GMT+2 and depends on the account’s base currency and instrument type;

- No official mention of swap-free or Islamic accounts is provided on the broker’s website.

Non-Trading Fees at TrioMarkets

TrioMarkets provides transparent disclosure of its non-trading fees, primarily outlined in the “Deposits & Withdrawals” section of its official website. The broker specifies exact percentage-based costs for different transaction types.

Notably, TrioMarkets does not mention any inactivity or dormant account fee in the main sections of its website, though such details are defined in its Client Services Agreement.

Below are some of the key non-trading fee details officially stated by the broker:

- Visa / Mastercard / Neteller withdrawals are subject to a 1% fee based on the total withdrawal amount;

- Bank wire withdrawals incur a 1.5% fee, with a minimum of USD 15 and a maximum of USD 50 (depending on the account’s base currency);

- According to the Client Services Agreement, the company reserves the right to apply a monthly inactivity fee of 30 units (base currency) if an account remains idle.

Payment Options in TrioMarkets Broker

This brokerage offers a limited range of funding methods to its clients. This is a drawback for TrioMarkets, but might not be a critical one. Deposit and Withdrawals:

Payment Method | Min. Deposit | Min. Withdrawal |

Bank Wire Transfers | $100 | |

VISA | $5 | $50 |

MasterCard | $5 | $50 |

Neteller | $5 | $50 |

Local Payment Solutions | Varies | |

Note: Withdrawal processing may take up to 3 business days.

Deposit Methods at TrioMarkets

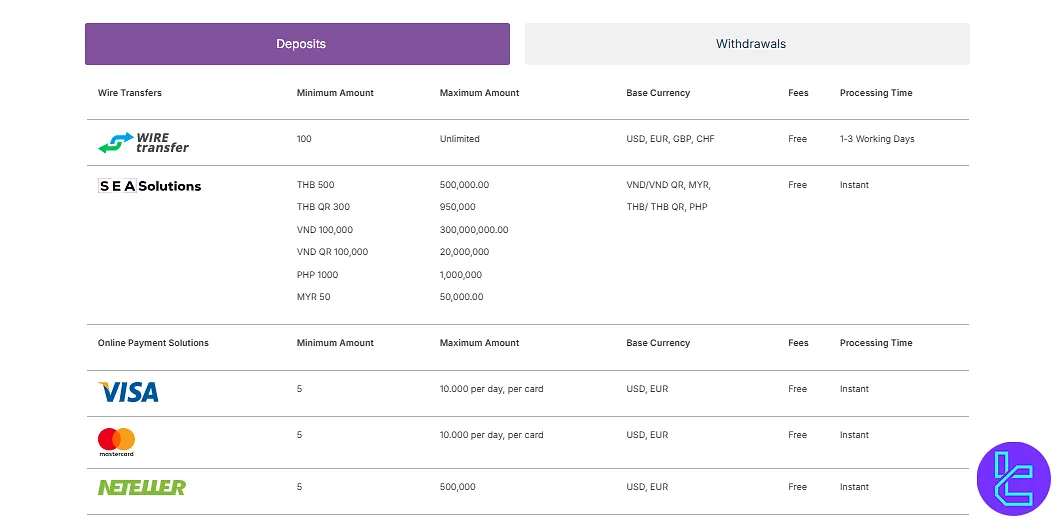

Here is a detailed look at the deposit methods offered by TrioMarkets, one of the trading brokers making it easier for traders to fund their accounts with clarity and speed.

The broker supports both classic bank wire transfers as well as a range of localized online payment solutions, which means you can pick the method that best fits your region and currency.

And here are how those deposit methods stack up:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Wire Transfer | USD, EUR, GBP, CHF | 100 | Free | 1–3 working days |

SEA Solution | VND/VND QR, MYR, THB/ THB QR, PHP | THB 500 THB QR 300 VND 100,000 VND QR 100,000 PHP 1000 MYR 50 | Free | Instant |

Visa/Master Card | USD, EUR | 5 | Free | Instant |

Wire Transfer | USD, EUR | 5 | Free | Instant |

Withdrawal Methods at TrioMarkets

TrioMarkets offers a variety of withdrawal methods designed to provide flexibility, speed, and transparency for clients across multiple regions.

Each method comes with clearly defined minimum amounts, fees, and expected processing times, ensuring traders can efficiently manage their funds.

Below is a detailed overview of the available withdrawal options:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Wire Transfer | USD, EUR, GBP, CHF | 100 | 1.5% | 1–3 working days |

SEPA | EUR | 50 | 7€ | 1–3 working days |

SEA Solution | VND/VND QR, MYR, THB/ THB QR, PHP | THB 500 THB QR 300 VND 100,000 VND QR 100,000 PHP 1000 MYR 50 | 1% | 1Working day |

Visa/Master Card | USD, EUR | 50 | 1% | 1Working day |

Wire Transfer | USD, EUR | 50 | 1% | 1Working day |

Copy Trading Platform and Investment Options On TrioMarkets

TrioMarkets offers sophisticated copy trading solutions through their PAMM/MAM accounts. These are master accounts that handle multiple sub-accounts by money managers.

Other than the mentioned option, there are no other methods and facilities for traders to earn passive income with TrioMarkets.

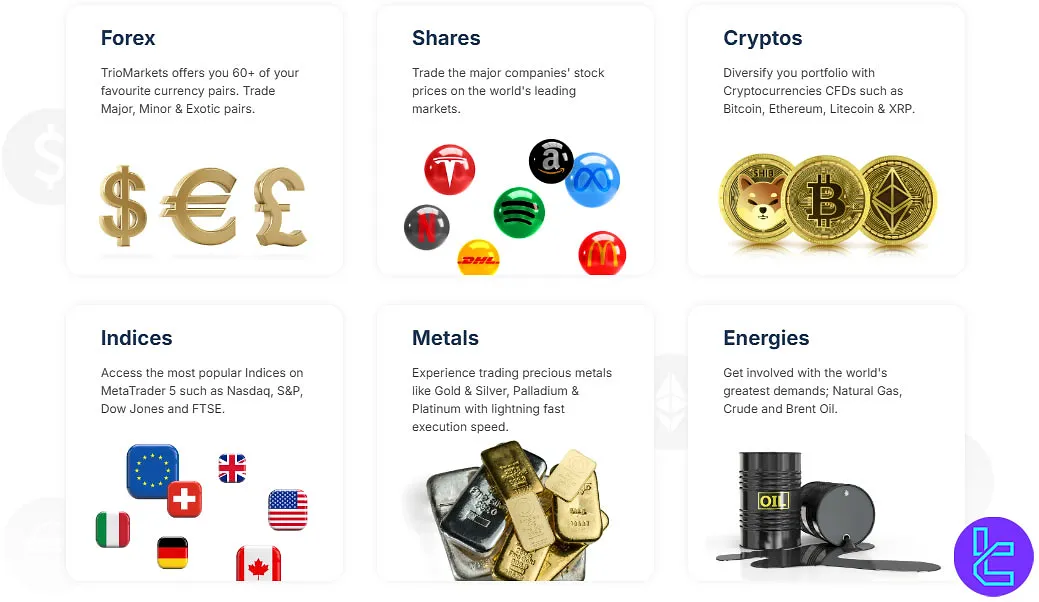

Available Instruments and Trading Assets

Usually, Forex brokers are not limited to currency pairs and cover other markets besides them. TrioMarkets provides access to diverse financial markets:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Major, minor & exotic currency pairs | 50+ | ~60–70 | 1:500 |

Indices | Spot CFDs on major global indices | 9 | ~10–20 | 1:100 |

Metals | Precious metal CFDs (Gold, Silver, etc.) | 4 | ~5–10 | 1:100 |

Energies | Energy commodity CFDs (Crude Oil, Natural Gas) | 3 | ~5–10 | 1:50 |

Shares | Equity CFDs on major companies | 300+ | ~150–500 | 1:5 |

Crypto CFDs (Bitcoin, Ethereum, Litecoin, etc.) | 3 | ~5–6 | 1:2 |

With TrioMarkets, traders can diversify their portfolios and access multiple global markets through one powerful trading platform.

Does TrioMarkets Offer Any Bonuses & Promotions?

Brokers use bonuses to attract new clients and keep their current traders loyal and motivated. Current promotional offers in TrioMarkets include:

- $50 Deposit Bonus: $50 on the first deposit for new clients

- Cashback: Earn up to 15% for every traded lot with the broker

It's important to note that while these offers seem attractive, they are subject to terms and conditions.

TrioMarkets Awards

TrioMarkets proudly highlights its recognition in the financial services industry, showcasing a track record of awards that underscore its commitment to excellence.

These accolades reflect the broker’s regional strength and operational quality rather than generic marketing claims.

Below you’ll find the most noteworthy awards the broker has received from official sources:

- Most Transparent Trading Platform – 2024 – World Business Outlook

- Most Trusted Trading Platform – 2024 – World Business Outlook

- Best Forex Broker – 2024 – World Business Outlook

- Most Trusted Forex Broker – 2024 – Finance Derivative Magazine

Support Services: Methods to Contact The Broker

The support section is one of the most significant factors when investigating a broker since working with brokerages is about your money. TrioMarkets provides customer support through multiple channels:

- Email: support@triomarkets.com

- Phone Call: +44 20 376 936 49

- Ticket: On the "Contact Us" section on the website

- Live Chat: Accessible through the official website

There's no 24/7 support provided by the broker, and the team is available Monday to Friday around the clock.

Banned Countries and Restricted Regions

Some countries are restricted from most brokers' services due to international sanctions or local regulations. Based on the official website, TrioMarkets cannot accept clients from the following regions:

- United States

- State of Israel

- Islamic Republic of Iran

- Romania

- Republic of Indonesia

- North Korea

This list may change based on regulatory requirements. Also, it's not necessarily the full list. Always check the latest restrictions on the official website.

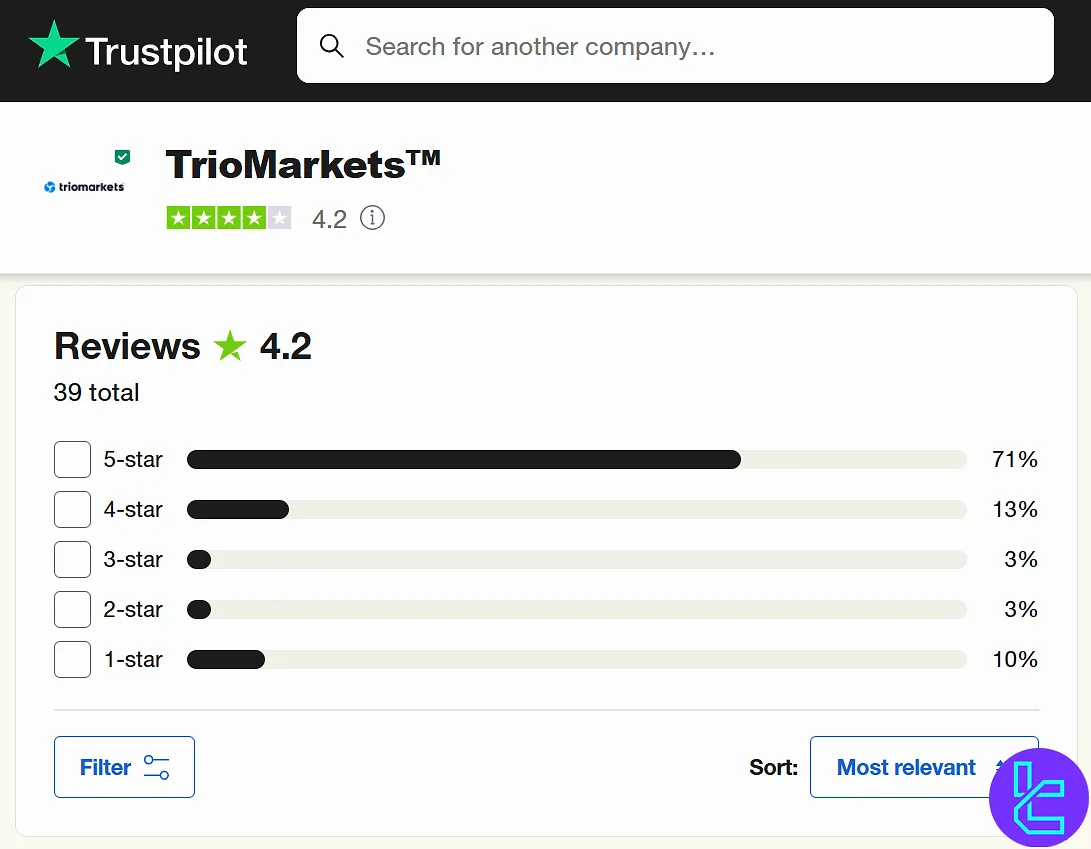

What Are The Trust Ratings of TrioMarkets on Reputable Sources?

It's always recommended to check out trust scores on websites such as "Trustpilot" or "REVIEWS.io". In this section, we will have an overview of the TrioMarkets Trustpilot profile:

- 4.2 out of 5

- More than 30 reviews

- Over 70% of scores being 5-star

- 10% of ratings being 1-star

TrioMarkets has received an overall acceptable score from users and reviewers.

Educational Materials and Resources

TrioMarkets offers basic educational resources, such as market commentary and an economic calendar, but lacks advanced materials like webinars or structured courses.

However, the lack of educational services shouldn't be considered a real disadvantage, because brokers are not meant for such purposes.

You can check TradingFinder's Forex education section for additional resources.

TrioMarkets Comparison Table

Let's compare TrioMarkets' features and services with some popular Forex brokers:

Parameter | TrioMarkets Broker | |||

Regulation | CySEC, DFSA, FSC | FSA, CySEC, ASIC | CySEC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Minimum Spread | From 0.0 pips | 0.0 Pips | 0.0 Pips | 0.0 Pips |

Commission | From $0.0 | Average $1.5 | From Zero | From $0.2 to USD 3.5 |

Minimum Deposit | $100 | $200 | $50 | $10 |

Maximum Leverage | 1:500 | 1:500 | 1:30 | Unlimited (Subject to account) |

Trading Platforms | MetaTrader 4, TrioTrader | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MetaTrader 4, MetaTrader 5, Mobile Proprietary App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Account Types | Basic, Standard, Advanced, Premium ECN | Standard, Raw Spread, Islamic | Classic, ECN, Demo | Standard, Standard Cent, Pro, Raw Spread, Zero |

Islamic Account | No | Yes | No | Yes |

Number of Tradable Assets | 500+ | 2,250+ | N/A | 200+ |

| Trade Execution | Market | Market | Market | Market Execution, Instant Execution |

Conclusion And Final Words

TrioMarkets provides 4 support channels [Live Chat, Email, Phone Call, Ticket] that are available 24/5. Also, it offers trading assistance tools such as an economic calendar, a currency converter, and access to VPS.

The company has received a trust score of 4.2/5 on "Trustpilot" with more than 30 reviews; over 70% of ratings are 5-star.