Trive provides a maximum leverage of 1:2000 with a minimum order size of 0.01 lots across all accounts. The Prime Plus account requires at least a 15,000 EUR deposit and costs a 5 EUR per lot commission with lower spreads than those of Classic and Prime.

This broker offers a wide range of CFD instruments, including Forex, indices, stocks, and commodities. Moreover, Trive Broker has received multiple industry awards and earned an impressive rating of 4.7/5 on the Trustpilot website.

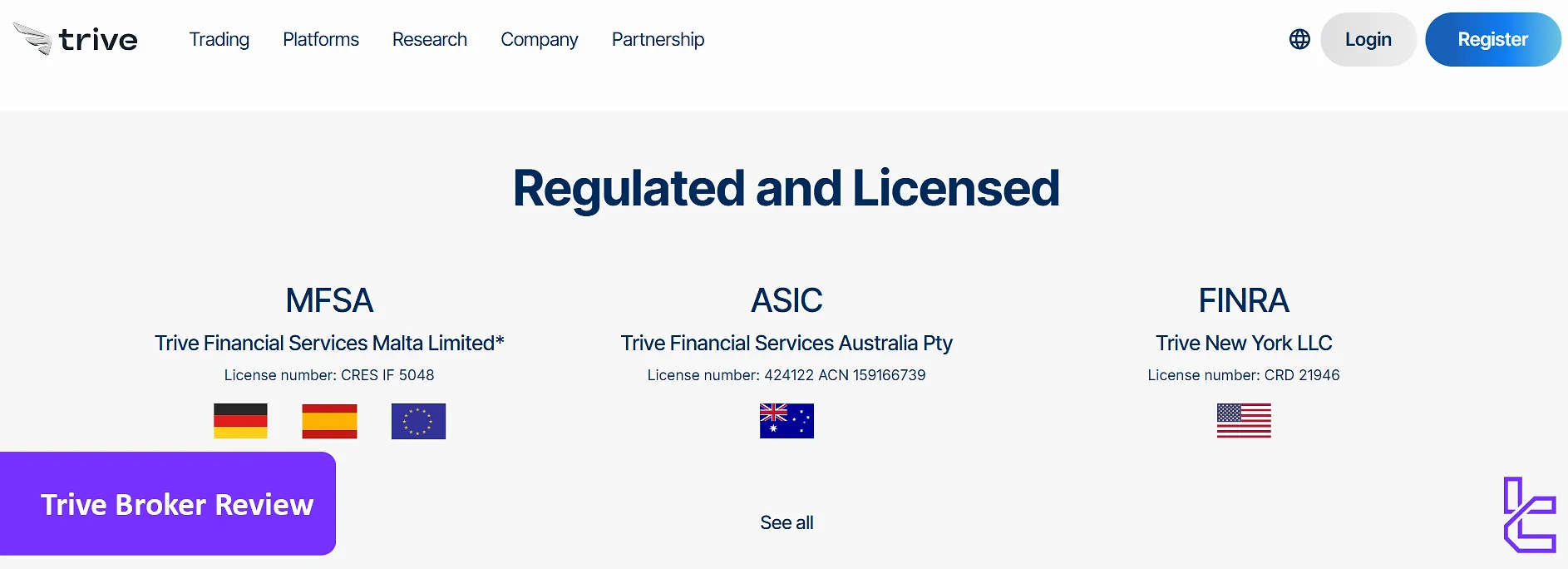

Company Details and Licenses

Trive is a financial broker founded in 2016, headquartered on Floor 5, The Penthouse, Lifestar, Testaferrata Street, Ta’ Xbiex XBX1403, Malta. Here's the lowdown on Trive's regulatory landscape:

Entity Features / Branches | Trive International Ltd | Trive New York LLC | Trive Financial Services Australia Pty Ltd | Trive Financial Services Europe Ltd | Trive Bank Hungary Zrt | Trive South Africa (Pty) Ltd | PT Trive Invest Futures | Trive Financial Services Ltd | Trive Türkiye |

Regulation | BVI FSC | FINRA & SEC | ASIC (AFSL 424122) | MFSA (CRES IF 5048), BaFin, CNMV | MNB | FSCA (FSP 27231) | BAPPEBTI | Mauritius FSC (GB21026295) | CMB |

Tier | 3 | 1 | 1 | 1 | 1 | 2 | 2 | N/A | 2 |

Country | BVI | USA | Australia | Spain, Germany | Hungary | South Africa | Indonesia | Mauritius | Turkey |

Compensation Scheme | No | N/A | No | Up to €20,000 (ICF) | Up to €20,000 (ICF) | No | No | No | N/A |

Segregated Funds | Yes | N/A | Yes | Yes | Yes | Yes | Yes | No | N/A |

Negative Balance Protection | Yes | N/A | Yes | Yes | Yes | Yes | No | No | N/A |

Maximum Leverage | 1:2000 | N/A | 1:30 | 1:30 | 1:30 | N/A | 1:400 | 1:2000 | N/A |

Client Eligibility | Global except restricted | US residents only (via NY) | Australian residents | EEA/EEA residents | Hungarian residents | South African residents | Indonesian residents | International clients (non-EEA) | Turkish residents |

This multi-jurisdictional approach not only underscores Trive's commitment to regulatory compliance but also offers traders a sense of security, knowing they're dealing with a broker that takes its responsibilities seriously.

Key Details and Specifics

Let's cut to the chase and break down what Trive brings to the table:

Broker | Trive |

Account Types | Classic, Prime, Prime Plus |

Regulating Authorities | FINRA, ASIC, MFSA, MNB, CMB, BAPPEBTI, SCA, FSC |

Based Currencies | EUR, USD |

Minimum Deposit | Zero |

Deposit Methods | Credit/Debit Cards, Neteller, Skrill, Online Banking |

Withdrawal Methods | Online Banking |

Minimum Order | 0.01 |

Maximum Leverage | 1:2000 |

Investment Options | None |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Proprietary Platform |

Markets | Stocks, ETFs, CFDs on Forex, Stocks, Indices, and Commodities |

Spread | From 0.1 Pip on Prime Plus Account |

Commission | None on Classic and Prime Account 5 EUR per Lot on Prime Plus Account |

Orders Execution | Market |

Margin Call/Stop Out | Not Specified |

Trading Features | Demo Account, Economic Calendar, Trading Central |

Affiliate Program | Yes |

Bonus & Promotions | None |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, Live Chat, Phone Call, Ticket |

Customer Support Hours | 24/5 |

Account Types & Comparison

Trive doesn't believe in a one-size-fits-all approach. Instead, they offer a trio of account types to match your trading style and skill level. Let's explore and compare their specifics:

Account Type | Classic | Prime | Prime Plus |

Min. Deposit | None | 2,500 EUR | 15,000 EUR |

Stop Out/Margin Call | 50%/3.33% | ||

Max. Leverage | 1:2000 | ||

Min. Order Size | 0.01 Lot | ||

The only real difference between these accounts is the spreads and commissions, which will be discussed later in this review.

All accounts support scalping, EA trading, and hedging with a minimum trade size of 0.01 lots.

Strengths and Weaknesses

All Forex brokers come with notable advantages and critical disadvantages. Let's weigh the pros and cons of trading with Trive:

Strengths | Weaknesses |

Licenses From Top-tier Authorities | No Copy Trading Features |

Competitive Spreads in Classic and Prime Accounts | Limited Leverage |

Various Trading Platforms | - |

The balance tilts favorably towards the broker's strengths, but as with any broker, it's crucial to consider how these factors align with your personal trading goals and style.

Account Creation and Verification

The Trive registration is a streamlined process requiring essential personal, employment, and financial details.

In just a few minutes, you’ll gain access to a regulated trading environment with support for CFDs, Stocks, and ETFs.Account setup involves verifying your identity and confirming your trading preferences.

#1 Begin the Registration

Go to the Trive homepage and click "Register" or "Open an Account".

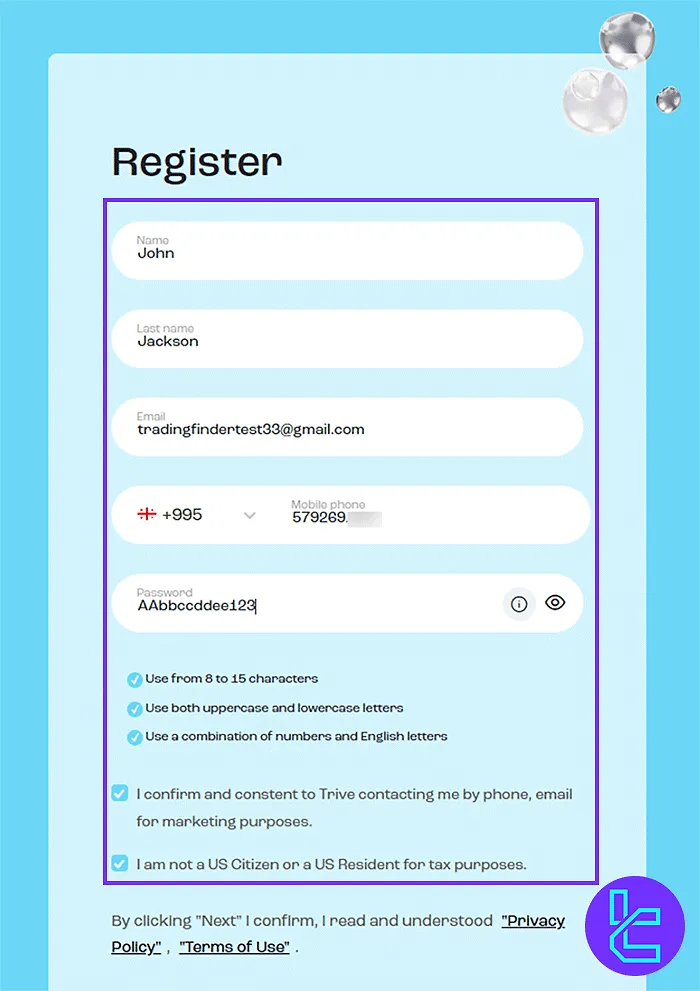

#2 Submit Personal Info

Fill out the registration form with the following details:

- Full name

- Mobile number

- Password

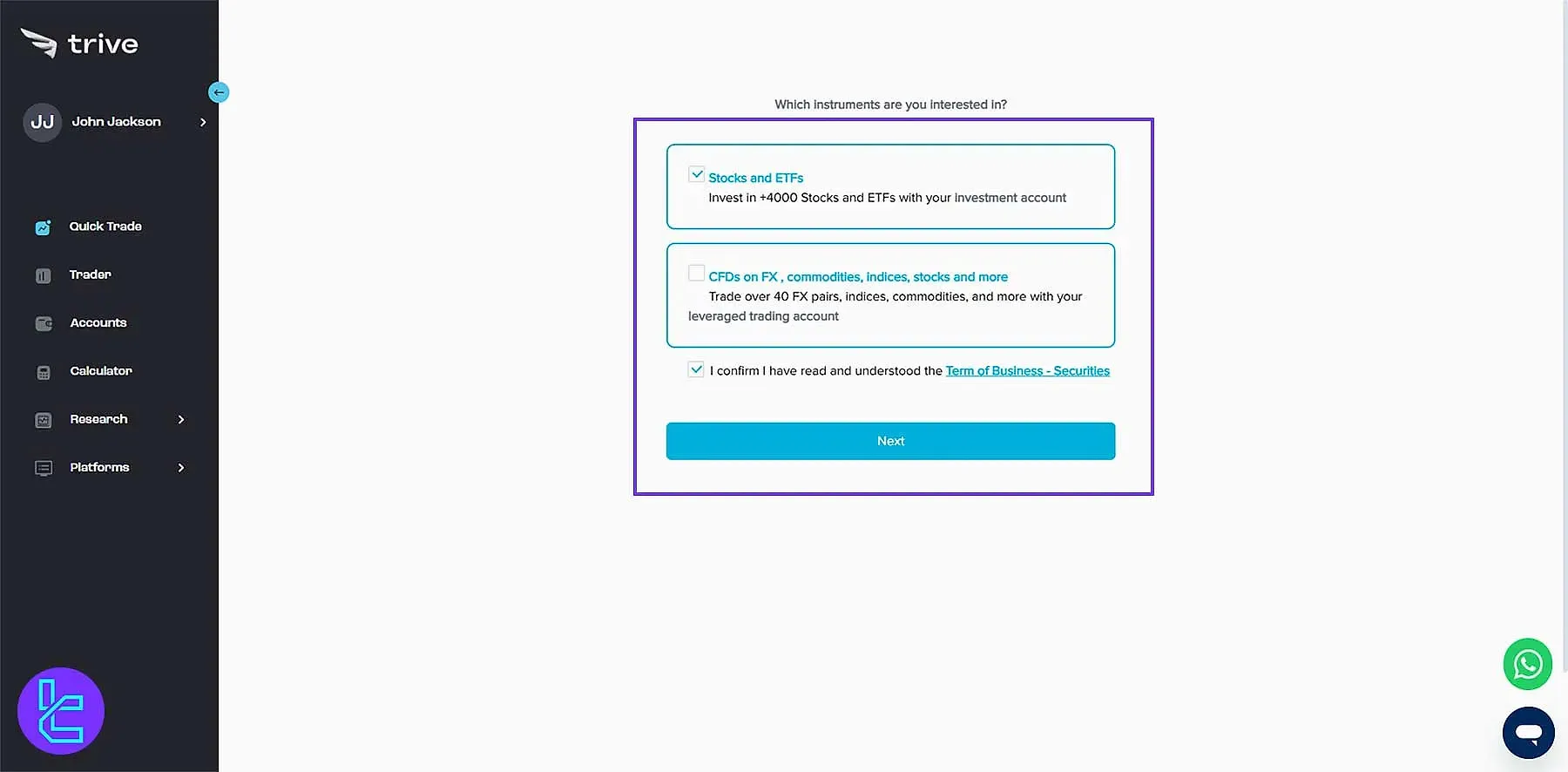

#3 Select Trading Preferences

Choose your trading type (e.g.,CFD or Securities) and confirm business terms.

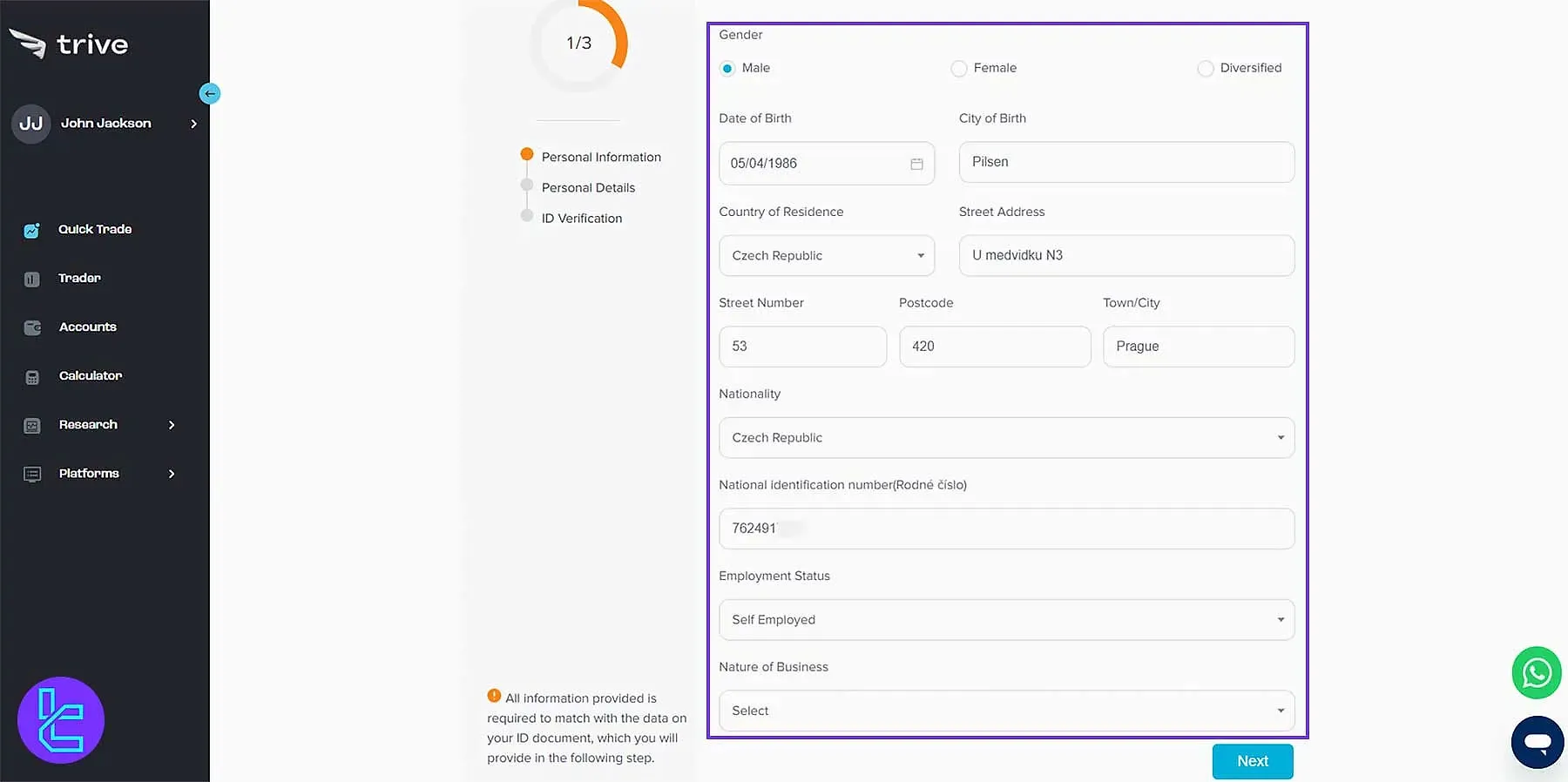

#4 Complete Personal & Employment Details

Enter your personal information, including:

- Date of birth

- Nationality

- ID number

- Address

- Employment status

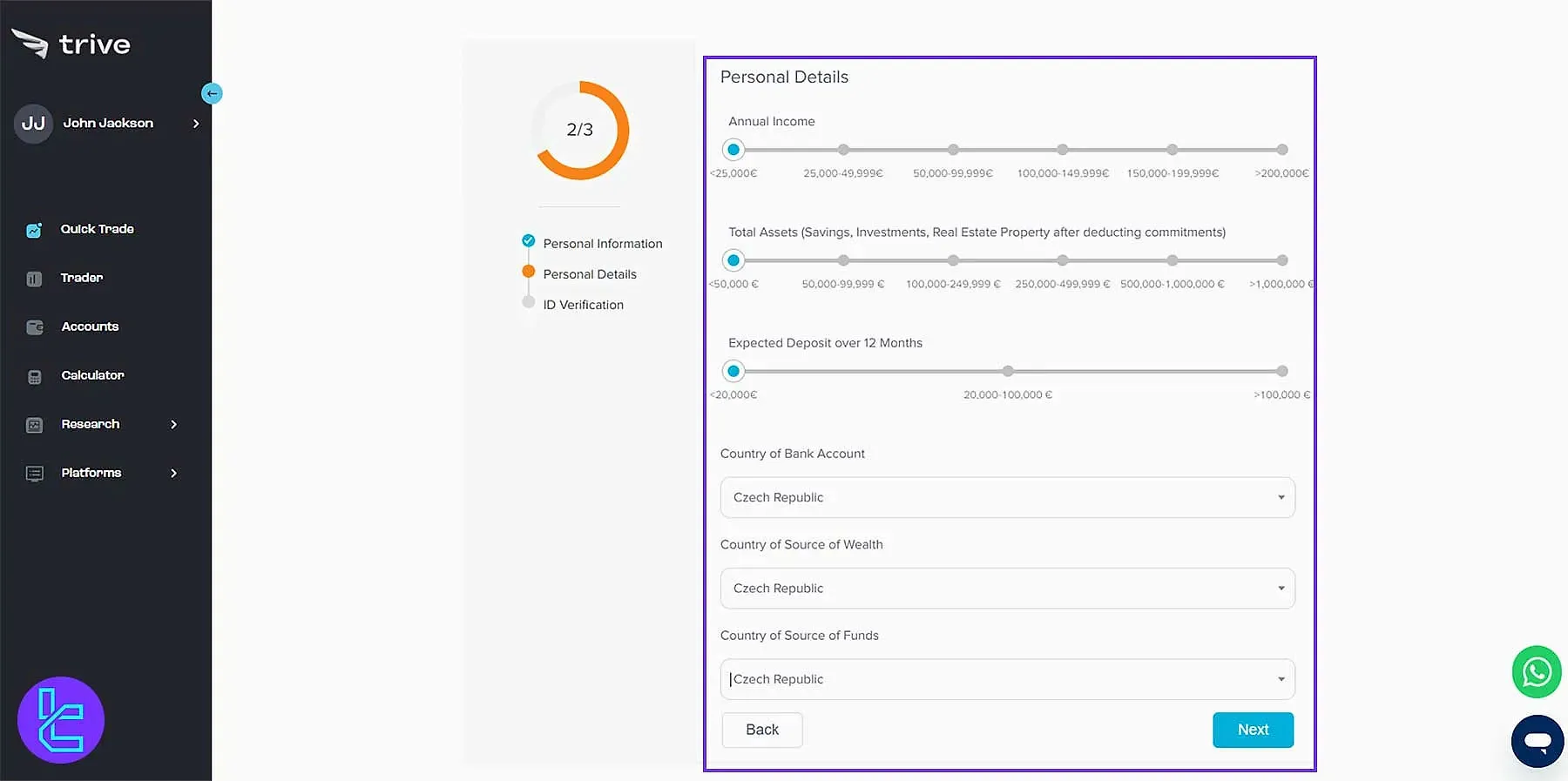

#5 Provide Financial Information

Submit your banking details and income level to finalize your account.

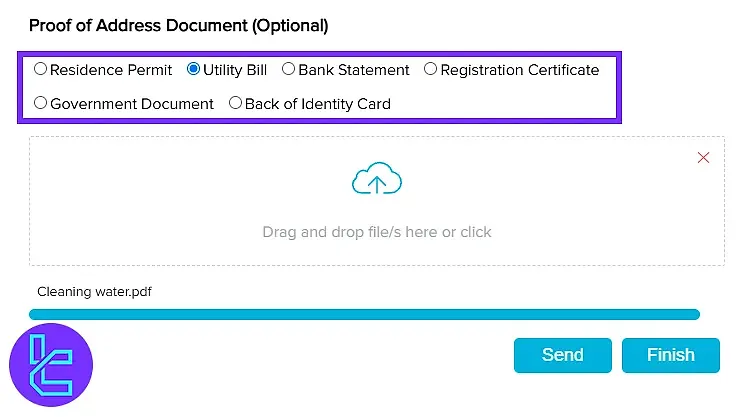

#6 Trive Account Verification

Completing Trive verification is essential for accessing the broker’s full range of trading and financial services. The process ensures compliance and security by requiring valid proof of identity (POI) and proof of address (POA), both issued within the last 3–6 months.

Traders can follow a straightforward three-step procedure to authenticate their accounts:

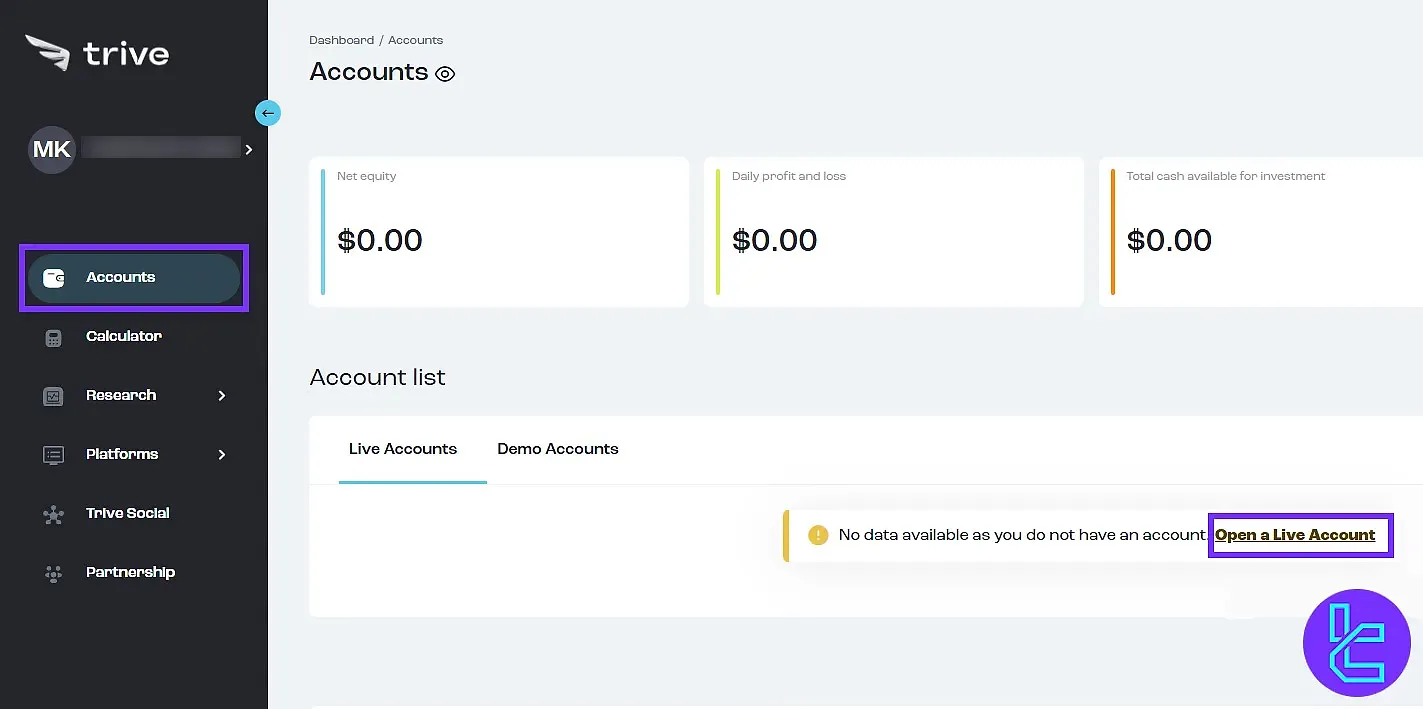

#1 Access the Verification Area

After logging into the Trive dashboard, navigate to the “Accounts” section and select “Open Live Account”.

This opens the verification interface where all document submissions take place.

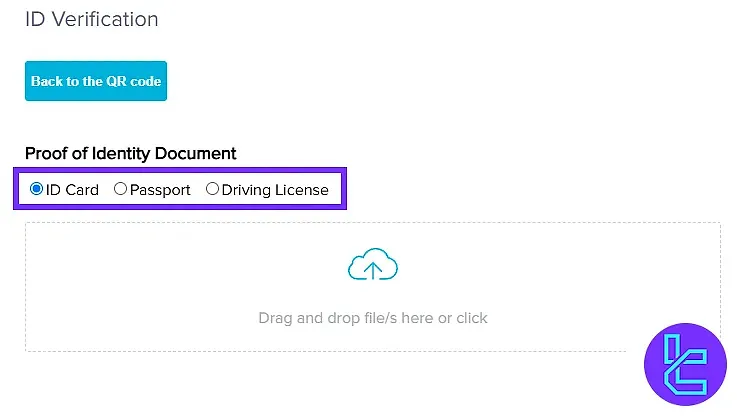

#2 Submit Identity and Address Documents

Click on "Upload Document" to begin the manual document submission. For identity verification, acceptable documents include:

- Passport

- National ID card

- Driver’s license

For proof of address, users can upload any of the following:

- Utility bills

- Bank statements

- Residence permits

- Registration certificates

- Government-issued documents

- Back side of identity card

Once selected, documents are uploaded via the Upload Document option, then confirmed by clicking Send and Finish.

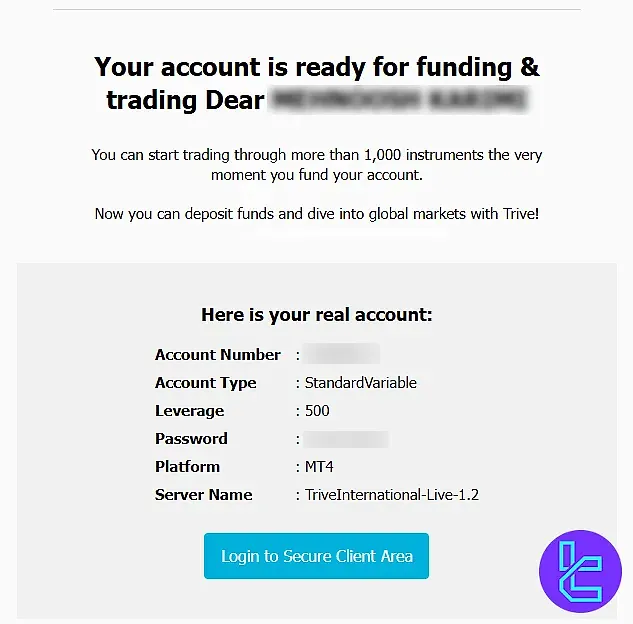

#3 Verify Authentication Status

Following submission, Trive reviews the documents. Traders receive an email notification once the account verification is approved, ensuring full access to the broker’s services.

Trive Forex Broker Trading Platforms

The discussed broker offers a trifecta of trading platforms for various operating systems and devices, each covering traders' essential needs with trading tools and helpful resources.

These platforms include two of the most popular software in the industry, MetaTrader 4 and MetaTrader 5, in addition to a proprietary application. Key Features of Trive Trader:

- Convenient trading with an easy-to-use interface

- Providing an overview of all your actions at a glance

- Customization at a high level

- Market data and updates in real-time

Whether you're an MT4 loyalist, an MT5 convert, or looking for something unique with Trive Trader, you've got options aplenty. Here are the download links in the table below:

Operating System | Android | iOS |

MT4 | ||

MT5 | ||

Trive Trader |

Traders can operate on desktop, web, and mobile platforms, with seamless multi-device synchronization.

TradingFinder has developed a wide range of MT4 and MT5 indicators that you can use for free.

Spreads in Trading And Other Commissions

Trive holds a competitive place when it comes to trading spreads. Let's review the costs of trading with the broker in its account types:

Account Type | Classic | Prime | Prime Plus |

Commission | None | 5 EUR per Lot | |

Spread | From 0.5 Pips | From 0.3 Pips | From 0.1 Pip |

Although the spreads and commissions in trading are decent, Trive charges a fee for deposits and withdrawals, which is a drawback for this company. Additionally, the broker does not provide a raw spread account.

You can use a profit calculator tool to predict a trade's outcome, considering fees and commissions.

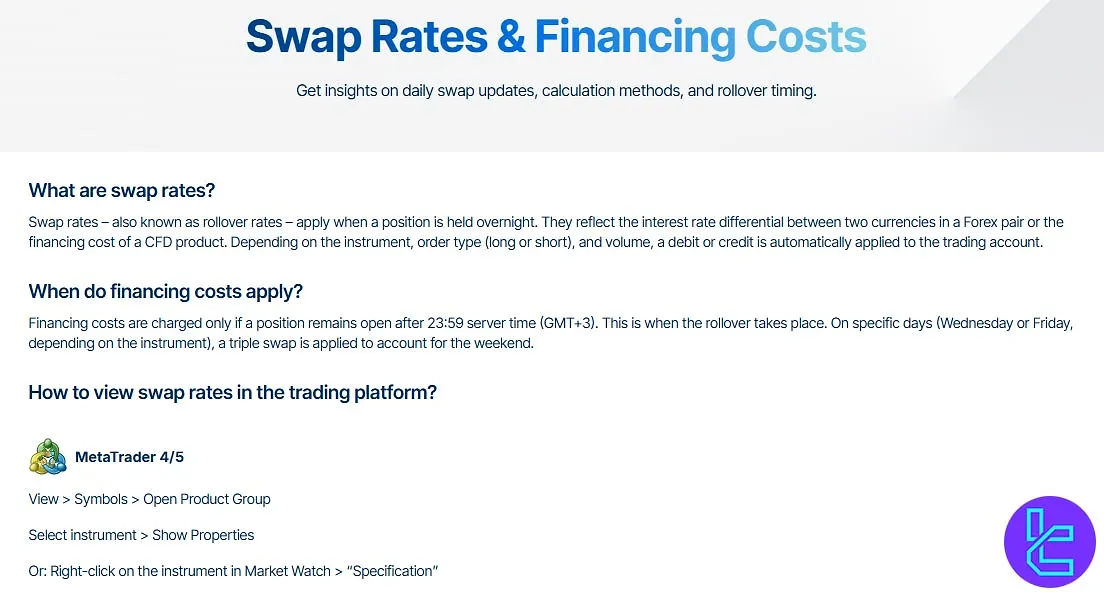

Swap Rates and Overnight Financing at Trive

Swap costs at Trive are applied whenever a position remains open past 23:59 (GMT+3). These rates vary by instrument and position type; for example, holding 1 lot of EUR/USD long overnight incurs a – $7.50 charge, while a short position on the same pair earns + $1.10.

Similarly, a GER40 long position results in a – €3.72 swap per day. The exact swap is automatically calculated in your trading account based on the contract size, tick size, and rate.

Below are several key facts every trader should know about Trive’s swap policy:

The swap formula used by Trive is:

- Traders can view current daily swap values directly in MetaTrader 4/5 (Market Watch > Specification) or in Trive Trader (Instrument Info);

- Swap-free / Islamic accounts are not available at Trive.

Non-Trading Fees at Trive Broker

Non-trading fees at Trive cover costs beyond standard trading, including account maintenance, inactivity, and fund transfers.

These charges vary depending on account type, funding method, and trading activity, and are applied automatically according to the broker’s official policies.

Here are the key points every trader should know:

- Accounts with no trading activity for six months are subject to a monthly inactivity fee of €10;

- Bank transfers for leveraged trading accounts are free, while investment account withdrawals via bank transfer incur a 0.5% fee (min €10, max €50);

- Deposits or withdrawals via cards or e-wallets may incur a 1.5% transaction fee;

- Trive reserves the right to apply other maintenance or processing fees according to its Terms of Business.

Funding Options and Payment Methods in Trive

The company covers some of the most common and popular options among brokers for depositing to and withdrawing from your account. Here's a brief look at these methods:

- Bank Transfers: Online bank payments

- Credit/Debit Cards: Visa and Mastercard

- Alternative Payments: E-wallets such as Skrill and Neteller

However, as stated on the company's website, you can withdraw funds from your account only using the online banking option.

Withdrawals are processed within 1–5 business days, depending on the method. Minimum deposit requirements vary by method and region.

Deposit Methods at Trive

Funding your Trive account is designed to be fast, secure, and flexible, accommodating both international and regional payment preferences. The broker supports major card networks, online banking solutions, and country-specific local options, allowing traders to deposit in USD or EUR.

Trive emphasizes instant processing for card and e‑wallet deposits, while bank transfers are completed within standard banking times.

Below is a clear overview of the main deposit methods currently supported:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Local Bank Transfer | INR, CNY, THB, VND, KRW, ZAR, UGX, TZS, KES, GHS, BRL, MXN, NGN | $1 | $0 | 1 business day |

International Bank Transfer | EUR, USD, GBP | $1 | $0 | 2–5 business days |

Credit/Debit Card | EUR, USD, GBP, JPY, CHF, CAD | $1 | 1.5% | Instant |

Alternative Payments (eg Neteller, Skrill, iDeal) | EUR, USD | $1 | 1.5% | Instant |

Withdrawal Methods at Trive

According to Trive’s official website, withdrawals from investment accounts are only possible via bank transfer, making it the sole method for fund outflow.

A 0.5% fee applies, with a minimum of €10 and maximum of €50, depending on the withdrawal amount. In contrast, CFD accounts allow free withdrawals, giving traders flexibility without additional charges.

Copy Trading Options and Investment Programs

Unfortunately, Trive doesn't currently offer copy trading, social trading, or other features purposed for earning passive income. This might be a drawback for traders looking to mirror successful strategies and those who are interested in investment options of any kind in general.

However, this can always change. Check the website and other official sources in order to be informed of any updates in this regard.

Trading Instruments in Trive Broker

Trive Broker provides clients with a broad and diversified selection of trading instruments. Traders can access multiple global markets through CFDs and direct investments in underlying assets.

The broker’s offering includes Forex pairs, commodities, indices and equities, all accessible through a unified and intuitive trading environment.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Shares | Direct global shares for investment | 5000+ | 3,000 – 7,000 | N/A |

Forex CFD | Major, minor, and exotic currency pairs | 40+ | 60 – 100 | 1:500 |

Commodities CFD | Precious metals and energy (Gold, Silver, WTI, Brent, etc.) | 9 | 20 – 30 | N/A |

Index CFD | Global indices (AEX25, AUS200, CAC40, DAX40, etc.) | 16 | 15 – 25 | N/A |

Stock CFD | CFDs on individual equities | N/A | 1,000 – 3,000 | N/A |

Overall, the broker provides more than 10,000 trading symbols, including CFDs and direct instruments.

Bonuses And Promotions Offered by the Broker

We investigate the website and relevant sources to find out if there are any promotional programs. As of this review, Trive doesn't offer any bonuses or promotions. This is most probably because of their regulation status since some authorities do not allow bonuses on financial companies.

Always check their website for the most up-to-date information on any special offers.

Trive Broker Awards

Trive has been recognized for its outstanding performance and transparency across global financial markets.

Trive awards and achievements highlight the company’s commitment to innovation, trust, and client-focused service.

Below are some of the most notable industry recognitions the broker has earned:

- Most Trusted Broker Global – 2023 (by Global Forex Awards)

- Most Reliable and Transparent Broker Global – 2023 (by Global Forex Awards)

- Best Trading Support Asia – 2023 (by Global Forex Awards)

- Best Brokerage Services for Beginners Asia – 2023 (by Global Forex Awards)

- Top CFD Broker – 2023 (by Top Securities Brokers)

- Top Overall Broker – 2023 (by Top Securities Brokers)

Support Contact Channels and Opening Hours

We recommend you against underestimating the support services in a financial company because it could become so critical in special occasions. Support Channels in Trive:

- Ticket: In the "Help Center" section of the website;

- Email: hello@trive.com;

- Phone: +356 203 41530;

- Live Chat: Available through their website.

The broker claims on its website that the support team is available 24/5. Therefore, there's no customer service on weekends.

Restricted Countries and Regions

While Trive operates globally, they do have restrictions in place similar to other brokers in the industry. Here's a list of banned regions:

- United States

- United Kingdom

- Iran

- North Korea

- Myanmar

- Other sanctioned countries

- Any other jurisdiction deemed high-risk by Trive's compliance team

These restrictions are mostly because of local laws or international sanctions. Always check the most current list on the broker's website or contact their support for specific country-related queries.

Trust Ratings and Review Scores

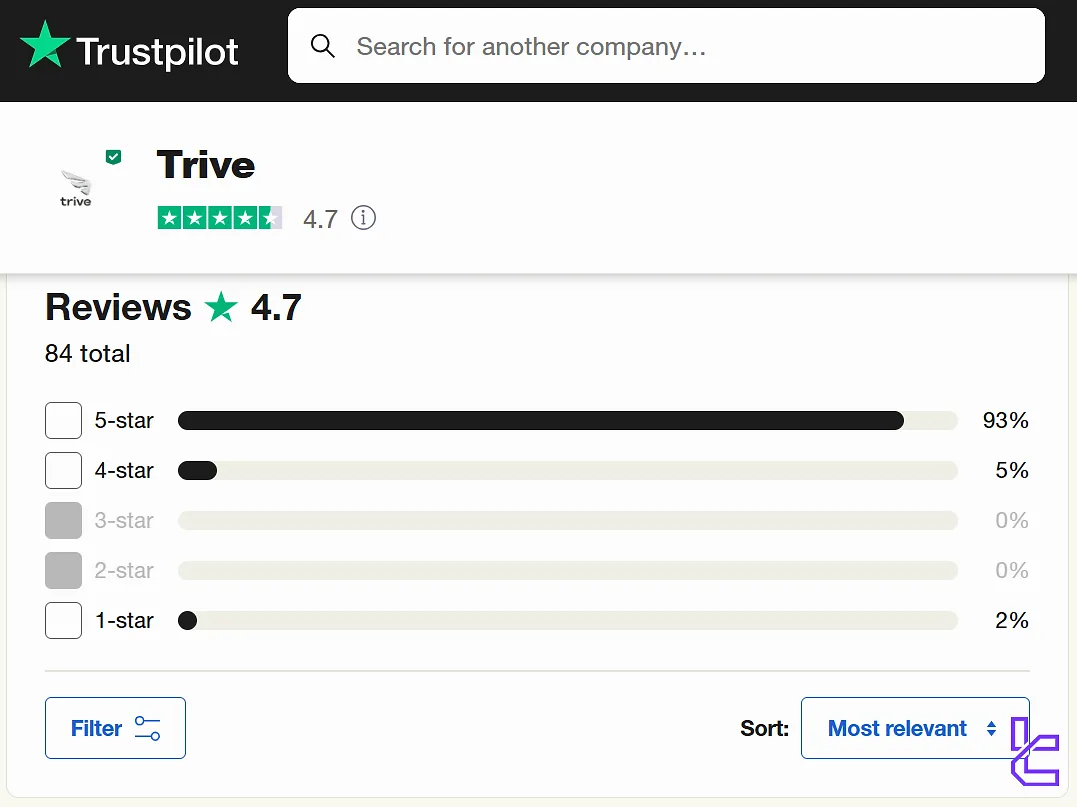

User reviews are found on websites such as "Trustpilot" as instruments for evaluating a company's services. At the time of writing this article, Trive has garnered generally positive feedback from the trading community on the mentioned website. Let's get into the details of the Trive Trustpilot profile:

- The rating is 4.7/5 based on +80 reviews;

- More than 90% of reviews are 5-star ratings;

- The company has claimed the profile on the website.

Note that these scores might change in the future, as users can always freely submit their reviews on the platform.

Educational Materials and Resources

Trive has not put much effort into providing extensive and helpful educational content to its clients. To be precise, the educational resources on the discussed broker are limited to:

- Help Center: A searchable page containing frequently asked questions with their corresponding answers

- Webinar: Only one event, which is not even in the English language

You can also check TradingFinder's Forex education section to access additional learning materials.

Trive Comparison Table

A comprehensive comparison between Trive and other top brokers:

Parameter | Trive Broker | XM Broker | Exness Broker | FxPro Broker |

Regulation | FINRA, ASIC, MFSA, MNB, CMB, BAPPEBTI, SCA, FSC | ASIC, FSC, DFSA, CySEC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | FCA, FSCA, CySEC, SCB |

Minimum Spread | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $0.0 | $0 (except on Shares account) | From $0.2 to USD 3.5 | From $0 |

Minimum Deposit | $0 | $5 | $10 | $100 |

Maximum Leverage | 1:2000 | 1:1000 | Unlimited | 1:500 |

Trading Platforms | MetaTrader 4, MetaTrader 5, Proprietary Platform | MT4, MT5, Mobile App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, cTrader, Web Trader, Mobile App |

Account Types | Classic, Prime, Prime Plus | Micro, Standard, Ultra Low, Shares | Standard, Standard Cent, Pro, Raw Spread, Zero | Standard, Pro, Raw+, Elite |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 10,000+ | 1400+ | 200+ | 2100+ |

Trade Execution | Market | Market, Instant | Market, Instant | Market, Pending |

Conclusion And Final Words

Trive is a brokerage with a 4.7/5 trust score on Trustpilot based on +80 reviews. The Prime account requires a minimum of 2,500 EUR deposit, with no commissions and spreads starting from 0.3 pips. The broker works with 2 base currencies [EUR, USD].