UOB Kay Hian offers flexible account options, including Robo, Cash, and UTRADE Edge, and a maximum leverage of 1:20.

Clients benefit from advanced trading platforms like MetaTrader 4 (MT4), UTRADE, and UTRADE FX Elite, equipped with tools like ShareExplorer, Stock Alerts, and TechAnalyzer.

Company Information & Regulation Status

UOB KayHian stands as a titan in the Asian brokerage landscape, boasting a rich history spanning over a century. As one of Asia's largest brokerage firms, it's backed by the formidable UOB Group, lending it an air of stability and trust.

With over two decades of active participation in the Stock Exchange of Thailand and a footprint of 56 offices across the country, UOB Kay Hian has solidified its position as a leading player in the region.

The company's reach extends far beyond its Singapore headquarters, with over 80 branches scattered across the globe.

Although UOB Kay Hian states on its official website that it operates more than 80 branches worldwide, detailed and comprehensive information about all these branches has not been published, with only limited data available for a few main offices.

For more details, refer to the table above:

Entity Parameters / Branches | Singapore (UOB Kay Hian Pte Ltd) | Hong Kong (UOB Kay Hian Ltd) | Malaysia (UOBKH Sdn Bhd) | Thailand (UOBKH PCL) | Indonesia (PT UOBKH Sekuritas) | Australia (UOBKH Pty Ltd) | China (Shanghai) | UK (UOBKH UK Ltd) | USA (UOBKH US Inc.) |

Regulation | MAS | SFC | SC Malaysia | SEC Thailand | OJK | ASIC | CSRC | FCA | SEC / FINRA |

Regulation Tier | 1 | 1 | 1 | 2 | 2 | 1 | 2 | 1 | 1 |

Country | Singapore | Hong Kong SAR | Malaysia | Thailand | Indonesia | Australia | China | UK | USA |

Investor Protection Fund / Compensation Scheme | ICS (up to SGD 50,000) | N/A | CMSL (RM 100,000) | N/A | N/A | N/A | N/A | FSCS (GBP 85,000) | SIPC (US$ 500,000) |

Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes | N/A | N/A | N/A |

Negative Balance Protection | No | No | No | No | No | N/A | N/A | N/A | N/A |

Maximum Leverage | 1:20 | 1:20 | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

Client Eligibility | Singapore residents & regional clients | Hong Kong & Mainland China clients | Malaysian residents | Thai residents | Indonesia residents | Australian residents | Mainland China investors | UKclients | US clients (institutional only) |

With an annual income exceeding THB 380 million, it combines scale and financial stability with user-focused platforms and services.

However, it's worth noting that even giants can stumble. In August 2022, the Monetary Authority of Singapore (MAS) imposed a hefty $375,000 fine on UOB KayHian for business conduct compliance failures.

This regulatory action is a stark reminder of the importance of stringent compliance in the financial services industry.

UOB KayHian Summary of Specifics

When choosing a Forex broker, the devil is in the details. UOB Kay Hian, while not the most extensive in terms of market access, offers a solid foundation for investors focusing on critical Asian and US markets. Let's break down the specifics:

Broker | UOB KayHian |

Account Types | Robo, Cash, UTRADE Edge |

Regulating Authorities | MAS |

Based Currencies | SGD |

Minimum Deposit | SGD5,000 for LFX |

Withdrawal/Deposit Methods | Electronic Direct Debit Authorization (eDDA), Faster Payment System (FPS), Bank Transfer, Cheque Deposit |

Minimum Order | N/A |

Maximum Leverage | 1:20 |

Investment Options | Investment banking |

Trading Platforms & Apps | UTRADE, UTRADE FX Elite, MetaTrader 4 (MT4) |

Markets | Equities, Bonds, CFDs, ETFs, LFX (Leveraged Forex), CFD Indices |

Spread | Varies |

Commission | Varies |

Orders Execution | N/A |

Margin Call/Stop Out | N/A |

Trading Features | ShareExplorer, Stock Alerts, TechAnalyzer, StockScreener, ChartGenie |

Affiliate Program | N/A |

Bonus & Promotions | YES |

Islamic Account | N/A |

PAMM Account | N/A |

Customer Support Ways | Email, Phone, Contact form |

Customer Support Hours | 8.30 am to 5.30 pm |

UOB Kay Hian's strength lies in its ability to offer a diversified portfolio across multiple asset classes.

Types of Trading Accounts

UOB Kay Hian offers 3 primary account types to cater to various trading needs:

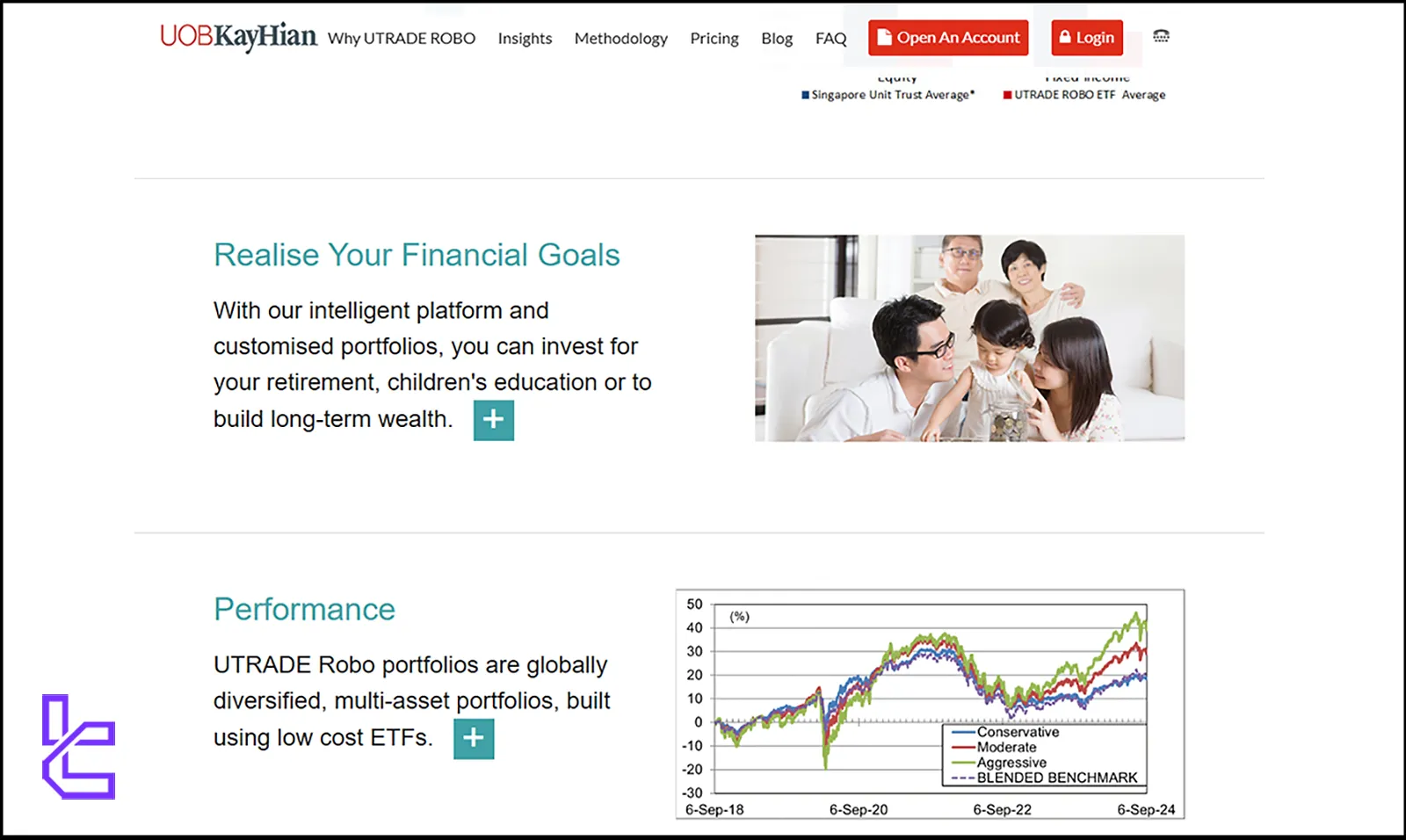

- Robo: Provides automated investment solutions, ideal for clients seeking a hands-off approach with portfolio management powered by technology;

- Cash: Designed for direct trading with full control, allowing clients to manage their investments independently with access to a broad range of markets and asset classes;

- UTRADE Edge: Tailored for active traders, offering advanced tools, features, and market insights to enhance trading strategies.

The minimum deposit varies by market: Thai exchange trading requires just THB 5,000, while access to U.S. or Hong Kong exchanges requires THB 50,000. Supported base currencies include SGD.

UOB KayHian’s Advantages and Disadvantages

Every broker has strengths and weaknesses, and UOB KayHian is no exception:

Advantages | Disadvantages |

Backed by the reputable UOB Group | Higher commissions for stocks and stock CFDs |

Supports different payment options | Limited regulation outside Singapore |

UOB Kay Hian's association with the UOB Group lends it a significant advantage regarding trust and stability. The broker's comprehensive range of investment instruments and Forex tutorials allows for diverse portfolio construction.

Signing Up & Verification Process

Setting up your trading profile with UOB Kay Hian, one of Asia’s leading brokerage firms, is quick yet follows a regulated onboarding flow.

Designed for Singapore citizens, PRs, and EP holders, this process allows you to access markets like stocks, CFDs, and leveraged instruments, all under one streamlined platform.

#1 Check Your Eligibility

Ensure you meet the prerequisites:

- Aged 18 or older

- Holder of Singapore citizenship, PR, or valid Employment Pass

- Not classified as a U.S. person, due to regulatory exclusions

#2 Select Your Account Type

On the UOB Kay Hian application portal, choose the type of trading account suited to your goals. Options include:

- Individual Securities Trading Account (for equities and ETFs)

- Contract for Differences (CFD) Account

- Leveraged Trading Account (for margin-based instruments)

Each account type has different trading permissions and risk profiles.

#3 Complete the Application Form

Fill in all required fields, including:

- Full name (as per NRIC or passport)

- Date of birth, nationality, and residency status

- Employment details, financial background, and trading experience

These inputs are essential for regulatory compliance and risk profiling.

#4 Upload Documents & Submit

Attach digital copies of:

- Identification documents (e.g., NRIC or passport)

- Proof of address (e.g., utility bill or bank statement)

- Any additional documents requested for CFD or leveraged accounts

Once done, review all entries for accuracy and click “Submit” to complete the application.

Trading Platforms

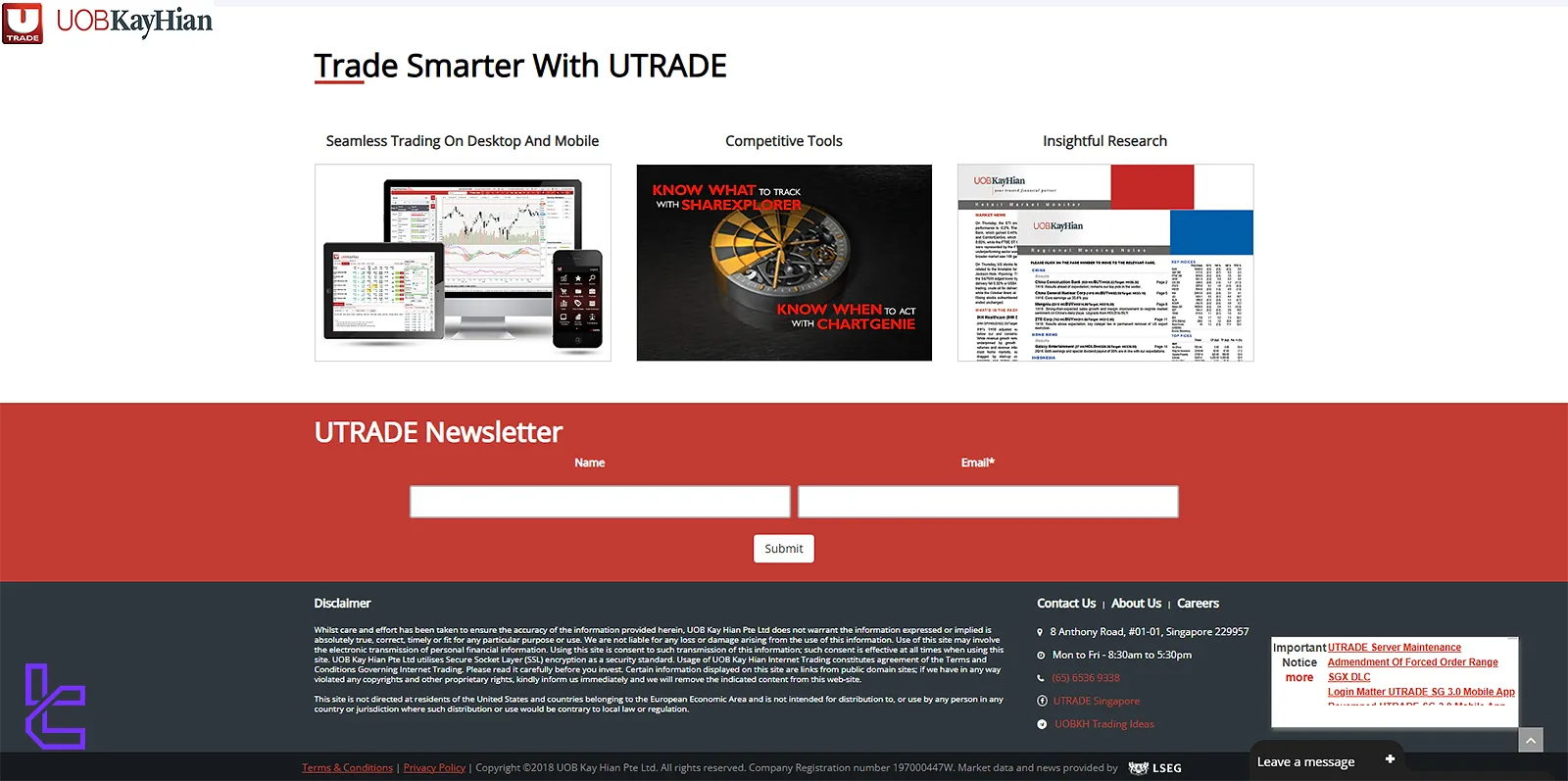

UOB KayHian offers a trio of robust trading platforms, each designed to cater to different trading styles and preferences:

- UTRADE

- UTRADE FX Elite

- MetaTrader 4 (MT4)

The industry-standard MT4 platform is also available, offering:

- A wide range of MT4 indicators and charting tools

- Automated trading capabilities through Expert Advisors (EAs)

- Apps for Android and iOS

All platforms feature real-time quotes, charting, technical analysis, and execution tools. Additional resources like Aspen offer streaming news from 20+ financial outlets and data from over 40 market providers, enhancing trading decisions through deeper insights.

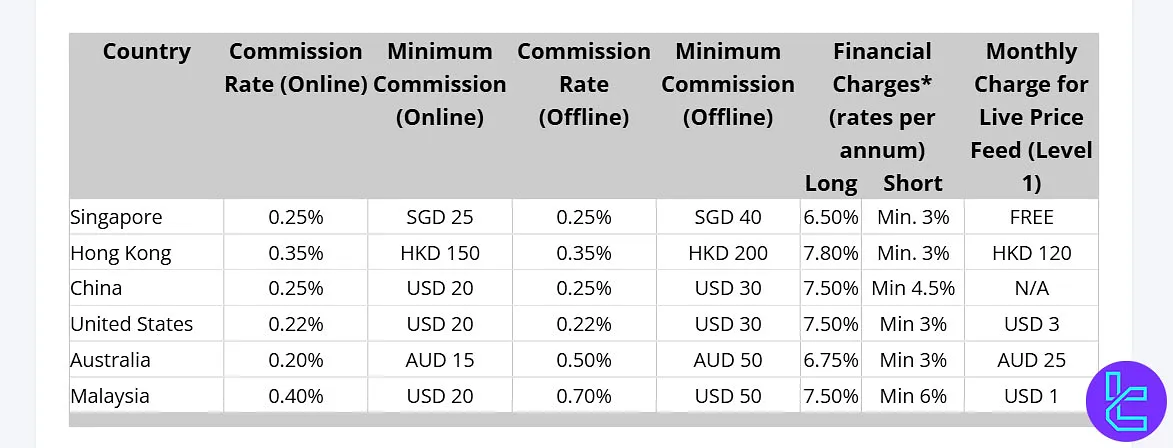

Spreads and Commission Structure

Understanding the cost structure is crucial when choosing a forex broker. UOB Kay Hian, as a bank-backed brokerage, offers competitive pricing, but it's important to note that specific spreads and commissions can vary based on the instrument and account type.

- CFD Indices: Commission starts from US$0.20 per side

- CFD Equities (Singapore): 0.25% (min. S$25)

- CFD Equities (U.S.): 0.22% (min. US$20)

- CFD Equities (Australia): 0.20% (min. AU$15)

Forex trading spreads are relatively competitive, with EUR/USD at 1.8 pips and USD/JPY at 1.5 pips.

Stock commissions follow a flat 0.18% rate, with a minimum of S$18 for SGX trades and US$20 for U.S. shares.

There are no inactivity or platform fees, though a custody fee of S$2/month applies for SGX holdings. For more details, you can visit the website.

Swap Charges at UOB Kay Hian

UOB Kay Hian applies daily financing costs (swaps) to all Leveraged FX (LFX) positions held overnight.

Since LFX prices are quoted on the spot market (T+2 settlement), open trades are rolled forward automatically at 17:00 EST, generating a swap debit or credit based on Tier-1 liquidity providers market rates with a small markup 0.4 pips below USD 10,000 and 0.2 pips above.

Below are the most important operational points traders should be aware of:

- Swap rates are automatically applied to all LFX positions at rollover (17:00 EST) and depend on both trade size and underlying market swap prices;

- Additional markups apply to positions valued under USD $10,000, increasing effective financing costs;

- Overnight orders can be placed on multiple markets g., SG after 5:30 pm SGT, HK after 4:15 pm SGT, and US after 9:30 am SGT but weekend restrictions (Sat 6 am – Mon 6:05 am SGT) apply for SG and HK;

- Swap values may be credited or debited, depending on the interest rate differential between the traded currencies and market conditions.

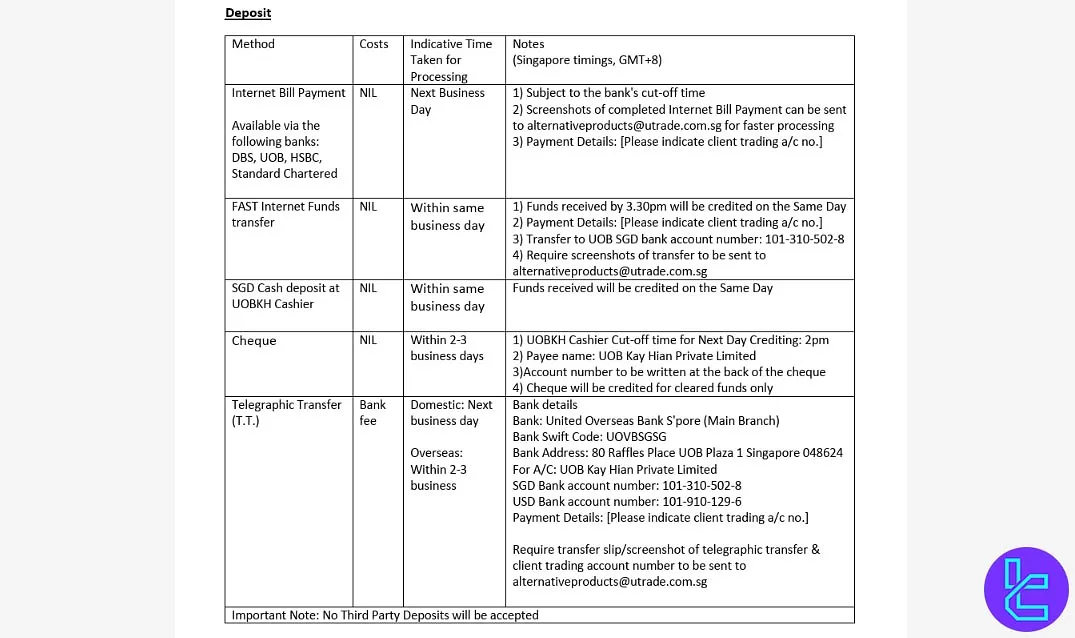

Non-Trading Fees at UOB Kay Hian

UOB Kay Hian applies no charges (NIL) for local deposits made via Internet Bill Payment, FAST transfer, cash deposit, or cheque. Only Telegraphic Transfers (T.T.) incur bank-imposed fees, especially for overseas transactions.

The broker does not publicly list any inactivity or dormant account fees, maintaining a transparent and cost-efficient structure for traders.

UOB KayHian Deposit & Withdrawal Methods

Efficient fund management is crucial for seamless trading experiences. Like many forex brokers, UOB KayHian offers several methods for depositing funds into trading accounts:

- Electronic Direct Debit Authorization (eDDA): This instant deposit option enables clients to transfer funds directly from their linked bank account through the UTRADE HK mobile app;

- Faster Payment System (FPS): UOB Kay Hian provides unique FPS IDs for various accounts, including Stocks, Stock Options, and Futures, to facilitate faster payments;

- Bank Transfer: Clients can send wire transfers in different currencies to UOB Kay Hian’s designated bank accounts, depending on the product type;

- Cheque Deposit: Clients can make cheque deposits by writing their UOB Kay Hian account number and name on the back of the cheque for accurate processing.

For withdrawals, the process is equally straightforward:

- Online clients can submit the Online Fund Withdrawal Form;

- Other clients need to contact their Account Executive or submit the Fund Withdrawal Form.

Deposits and withdrawals are free of charge, but a $300 minimum applies to withdrawals. Accepted base currencies include USD, THB, and HKD.

Deposit Methods at UOB Kay Hian

UOB Kay Hian provides multiple secure funding channels to accommodate clients across different regions, supporting a variety of local currencies, including SGD, THB, USD, HKD, and MYR.

Most local deposit methods carry no fees (NIL), while Telegraphic Transfers (T.T.) may incur standard bank charges, especially for cross-border payments. All deposits must come from the client’s own bank account, and a minimum deposit of SGD 5,000 or equivalent applies to all currencies.

Here’s a summary of the main deposit methods:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Internet Bill Payment (DBS, UOB, HSBC, Standard Chartered) | Local (SGD, THB, MYR) | SGD 5,000 or equivalent | 0 | Next business day (subject to bank cut-off) |

FAST / Local Bank Transfer | Local (SGD, THB, MYR) | SGD 5,000 or equivalent | 0 | Same business day (before 3:30 pm local time) |

Cash Deposit at UOBKH Cashier | Local (SGD) | SGD 5,000 | 0 | Same business day |

Cheque Payment | Local (SGD, HKD, MYR) | SGD 5,000 or equivalent | 0 | 2–3 business days (cut-off 2 pm) |

Telegraphic Transfer (T.T.) | SGD, USD, HKD, MYR | SGD 5,000 or equivalent | Bank fee applies | Domestic: next business day / Overseas: 2–3 business days |

Withdrawal Methods at UOB Kay Hian

Based on information provided on the official UOB Kay Hian website, clients can request withdrawals from their Trust Account at any time. All withdrawals must be directed to the client’s own bank account and follow standard settlement procedures.

Certain withdrawal types may incur bank-imposed fees, while local transfers are mostly free or subject to minimal charges.

Here’s a structured summary of the main withdrawal methods:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Processing Time |

Local Bank Transfer / FAST | SGD, THB, MYR | N/A | 0 (internal); bank fees may apply | Same business day if request before cut-off; otherwise next business day |

Telegraphic Transfer (T.T.) | SGD, USD, HKD, MYR | N/A | Up to S$40 per remittance; USD transfers min bank charge USD 30 | Domestic: next business day; Overseas: 2–3 business days |

Withdrawal via Trading Representative | SGD, THB, USD, HKD, MYR | N/A | 0 (internal); may incur bank charges | Subject to standard Trust Account settlement timelines |

Copy Trading & Investment Options

While UOB KayHian broker doesn't explicitly offer a copy trading feature, it's worth understanding this concept as it's becoming increasingly popular in the forex trading world. Copy trading allows investors to automatically replicate the trades of successful traders, providing an accessible entry point for beginners.

UOB Kay Hian also offers investment options as part of its corporate finance services. As a leading brokerage and financial advisory firm, it provides a broad range of corporate finance solutions, including financial advisory and investment banking services for both individual and institutional clients. UOB Kay Hian specializes in underwriting and placement for primary and secondary listings, giving clients access to capital markets.

Tradable Markets & Symbols Overview

UOB KayHian offers a comprehensive suite of tradable markets and symbols, from the Forex market to global exchanges, catering to diverse investment preferences:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Equities (Stocks / Cash Trading) | Local and global stocks (cash) | N/A | 1500+ | 1:1 |

ETFs | Exchange-Traded Funds | N/A | 300+ | N/A |

ETNs / Structured Products | Structured notes and ETNs | N/A | 100+ | N/A |

CFDs on Indices | Major global stock indices | N/A | 15+ | N/A |

CFDs on Equities | Individual stocks CFDs | N/A | 500+ | 1:10 |

Leveraged Forex (LFX) | Currency pairs | N/A | 60+ | N/A |

Bonds / Fixed Income Products | Bonds and fixed income instruments | N/A | 150+ | N/A |

Mutual Funds / Unit Trusts | Mutual funds / unit trusts | N/A | 1000+ | N/A |

Options / Derivatives | Options and other derivatives | N/A | 200+ | N/A |

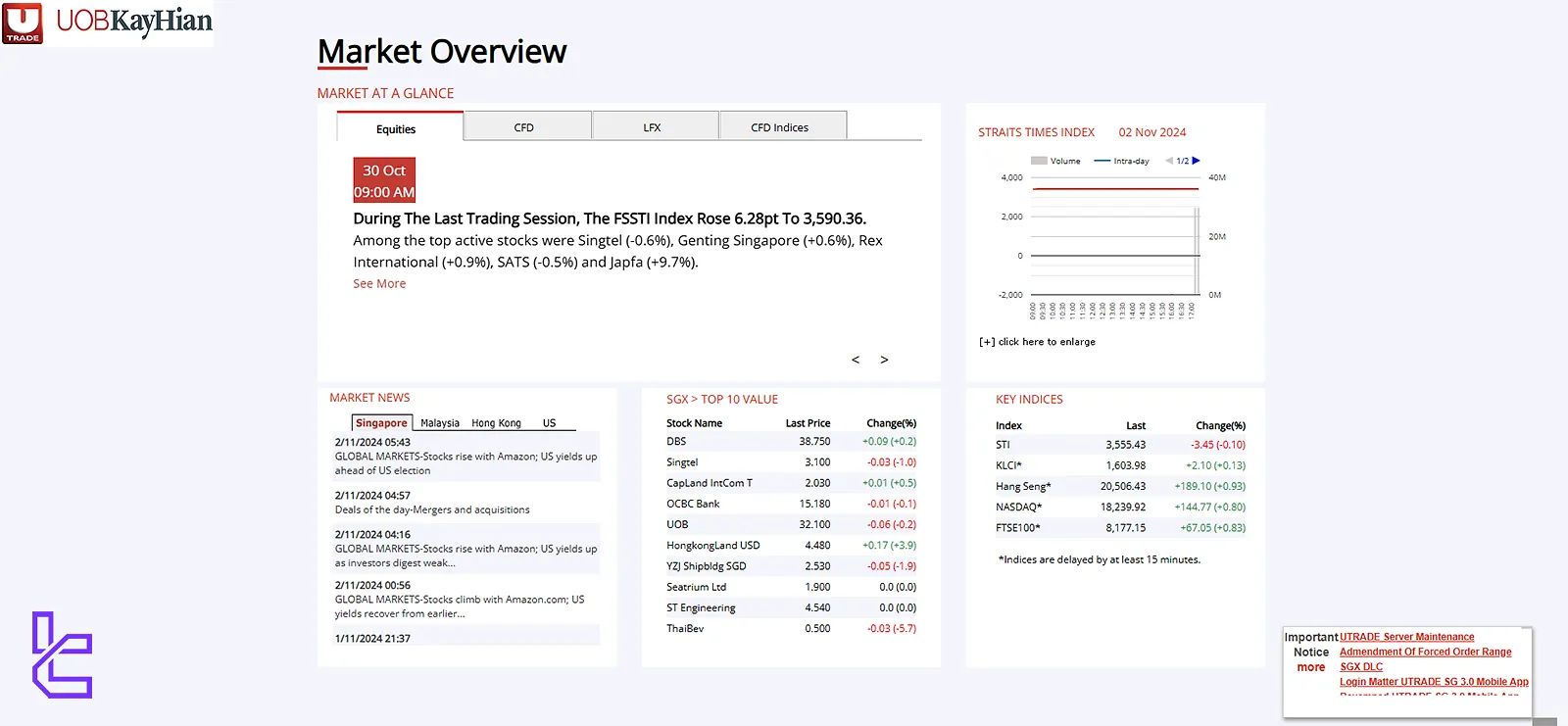

UOB Kay Hian provides access to a diverse range of global markets through its UTRADE platform:

Available Market | Traded Currency |

Hong Kong Exchanges (HKEX) | HKD, CNY, USD, EUR |

Singapore Exchange (SGX) | SGD, HKD, JPY, AUD, CNY, USD, EUR |

Thailand (SET) | THB |

U.S. Markets (NYSE, NASDAQ, AMEX, NYSE ARCA) | USD |

Canada (TSX, TSXV) | CAD |

Australia (ASX) | AUD |

Bursa Malaysia | MYR |

China A Shares (HK-SSE/SZSE) | CNY (via HK-Shanghai/Shenzhen Stock Connect) |

London (LSE) | GBp (Pence), GBP (Pound) |

Certain markets, such as the U.S. OTC markets, are not accessible. China A-shares traded through Stock Connect are subject to specific restrictions, such as no contra trading or naked short selling and professional investor-only access to ChiNext and STAR markets.

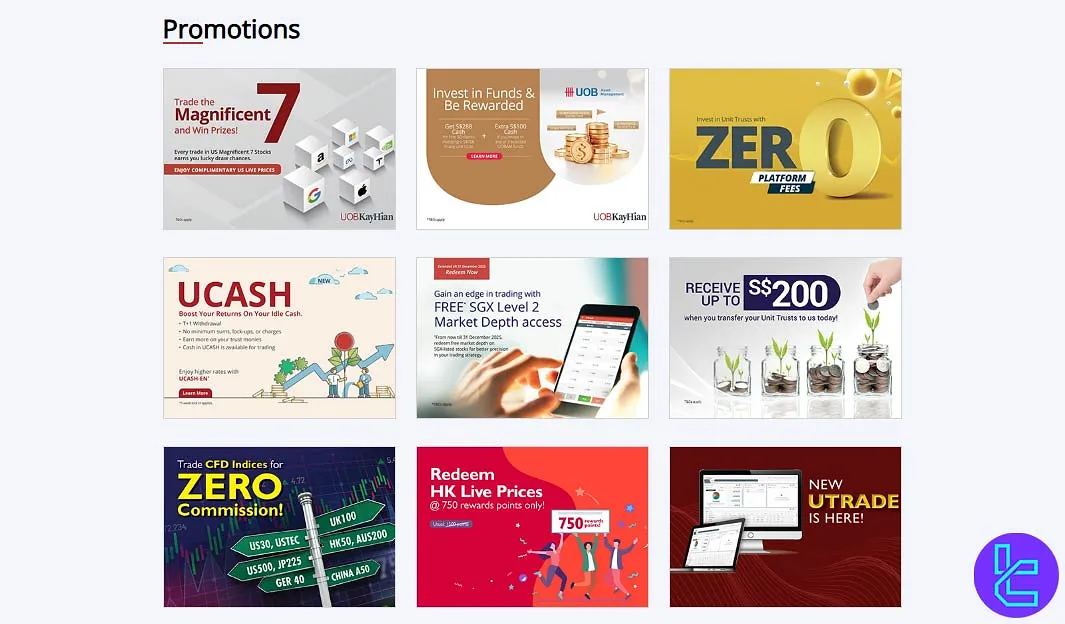

Bonus Offerings and Promotions

UOB Kay Hian, operating under the UTRADE brand, offers various promotional offers to attract and retain clients. Here are some of the options:

- Win a trip to Tokyo;

- Boost your yield with UCASH-Enhanced;

- Transfer your unit trust;

- Enjoy zero commission CFD Indices.

To get the most up-to-date information on current promotions, it's recommended that you visit the "Promotions" section of the broker's website.

UOB Kay Hian Awards

UOB Kay Hian’s official websites across its regional branches do not maintain a dedicated awards page or gallery. There are no images or comprehensive listings of accolades publicly displayed on the Singapore, Malaysia, or Hong Kong sites.

However, some official documents and media releases reference that the broker has received notable industry awards. These highlights include:

- 2023 – Best Retail Participating Organization in Malaysia by Bursa Malaysia, recognizing top performance in retail brokerage;

- 2023 – Best Retail Equities Participating Organisation (Non-Investment Bank), second runner-up by Bursa Malaysia;

- 2024 – Best Customer Service – Brokerage in Singapore, ranked second by The Straits Times, acknowledging regional client service excellence.

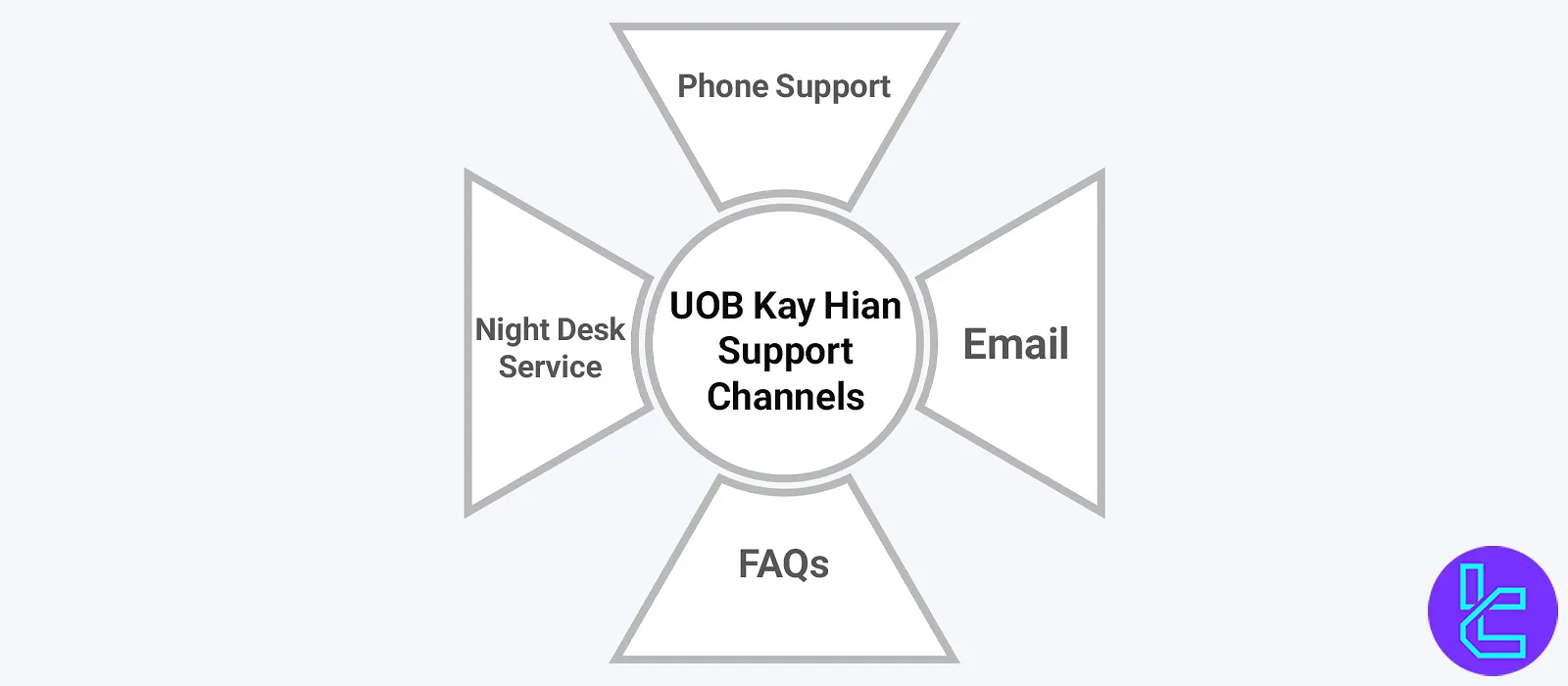

UOB KayHian’s Support Team and Hours

Quality customer support is crucial in the fast-paced world of trading. UOB KayHian offers several channels for client support:

- Phone Support:+65 6536 9338

- Email:contact@utrade.com.sg

- Business Hours:8:30 AM to 5:30 PM, Monday to Friday (excluding public holidays)

- FAQ: Get the answers of many impotant questions

For traders active in US markets, UOB KayHian provides a Night Desk service:

- 10:00 PM to 2:00 AM (Standard Time)

- 9:00 PM to 1:00 AM (Daylight Saving Time)

UOB KayHian commits to acknowledging complaints or disputes within 1 business day and resolving them within 7 business days, demonstrating their commitment to client satisfaction.

List of Restricted Countries

UOB Kay Hian broker imposes geographical restrictions for its brokerage services. The restricted countries include:

- United States

- European Economic Area Countries

This policy ensures compliance with regulatory requirements and maintains the integrity of the brokerage's operations.

Trust Scores & Customer Reviews

While specific trust scores for UOB KayHian are not readily available, the broker's reputation can be gauged through various factors:

- Regulatory Status

- Company Backing

- Market Position

However, some areas of improvement must be noted:

- Higher minimum commissions for stocks/stock CFDs compared to some competitors

- User interface that some find outdated

- Limited market access compared to global brokers

Overall, UOB KayHian appears well-suited for investors seeking a trusted, diversified platform backed by a central bank, particularly those focused on Asian markets.

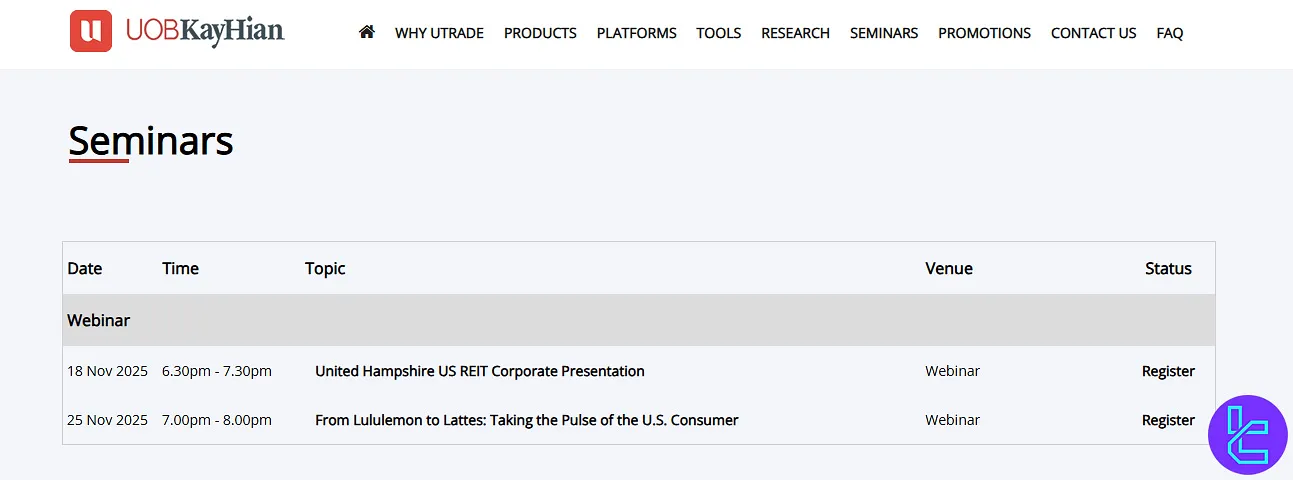

Educational Content on the UOB KayHian broker

UOB KayHian places a strong emphasis on investor education, offering a variety of resources to help clients enhance their trading skills and market knowledge:

- Seminars and Webinars: Regular sessions covering various topics

- Research Reports: In-depth analysis of markets, sectors, and individual stocks

- Newsletters: Regular updates on market trends and investment opportunities

Educational seminars are held at the Bangkok headquarters, but online webinar content is currently unavailable, which may limit engagement for remote learners.

These educational initiatives demonstrate UOB Kay Hian's commitment to empowering investors with knowledge and tools for informed decision-making.

You can also use TradingFinder's Forex tutorials for additional learning materials.

UOB Kay Hian Comparison Table

The table below compares UOB Kay Hian's features with popular Forex brokers:

Parameter | UOB Kay Hian Broker | |||

Regulation | MAS | None | FSA, CySEC, ASIC | Cent, Zero, Pro, Premium |

Minimum Spread | From 1.5 pips | 0.1 Pips | From 0.0 pips | 0.0 Pips |

Commission | From $0.2 | None | Average $1.5 | From Zero |

Minimum Deposit | SGD 5,000 | $10 | $200 | From $0 |

Maximum Leverage | 1:20 | 1:3000 | 1:500 | 1:2000 |

Trading Platforms | UTRADE, UTRADE FX Elite, MetaTrader 4 (MT4) | MT4, MT5 | Metatrader 4, Metatrader 5, cTrader, IC Markets Mobile | MT4, MT5, Mobile App |

Account Types | Robo, Cash, UTRADE Edge | Standard, Premium, VIP, CIP | Standard, Raw Spread, Islamic | Cent, Zero, Pro, Premium |

Islamic Account | N/A | Yes | Yes | Yes |

Number of Tradable Assets | N/A | 50+ | 2,100+ | 1,000+ |

| Trade Execution | N/A | Market, Instant | Market | Market, Buy Stop, Stop Loss, Limit, Take Profit |

Conclusion and final words

About UOB Kay Hian, features like ChartGenie, StockScreener, and TechAnalyzer enhance trading strategies, while promotional offers such as zero commission on CFD Indices provide added value.

UOB Kay Hian offers comprehensive deposit and withdrawal options, including eDDA, FPS, bank transfer, and cheque deposits.

However, higher minimum fees for some products and a $375,000 fine imposed by MAS in August 2022 for compliance failures highlight improvement areas.