Valutrades is a UK-based Forex broker regulated by the FCA financial authority. This broker provides 2 primary accounts, including Standard and ECN, with low spreads from 0.0 pips, $6 commissions, and a maximum leverage of 1:500.

Traders can trade instruments in 3 markets including forex, Commodity and index on the MT4, MT5, and Valutrades app trading platforms. Also, broker provides segregated account funds and negative balance protection options.

Valutrades Company Information & Regulatory Status

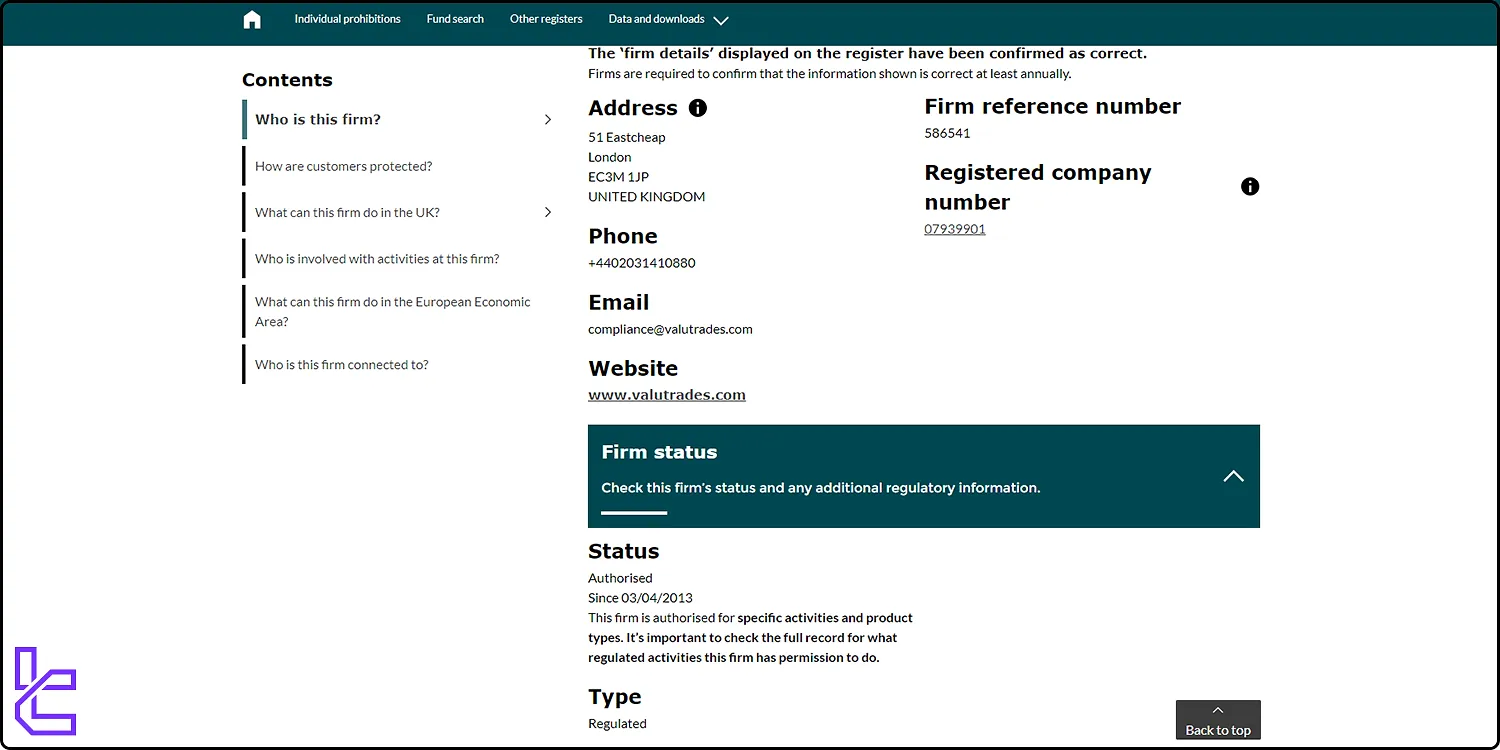

Valutrades is a well-established player in the financial services industry, offering a range of trading options, including foreign exchange (FX/Forex), commodities, and equity index CFDs. The company's commitment to regulatory compliance and transparency is evident in its dual regulation:

Entity Parameters / Branches | Valutrades Limited (UK) | Valutrades (Seychelles) Limited |

Regulation | FCA (FRN 586541) | FSA (SD028) |

Regulation Tier | 1 | 4 |

Country | United Kingdom | Seychelles |

Investor Protection Fund / Compensation Scheme | FSCS £85,000 | None |

Segregated Funds | Yes | Yes |

Negative Balance Protection | Yes | Yes |

Maximum Leverage | 1:30 | 1:500 |

Client Eligibility | UK residents | Global clients (excl. US, BE, IRN, DPRK) |

The FCA ensures robust client protections, including segregated funds, negative balance protection, leverage capped at 1:30, and coverage under the FSCS compensation scheme, up to £85,000 per eligible client, for Valutrades.

This dual regulation ensures that Valutrades adheres to strict financial standards and provides a secure trading environment for its clients.

Valutrades Broker Summary of Specifications

Valutrades stands out in the crowded Forex broker landscape by offering a personalized approach to trading services. The broker's commitment to customizing solutions for its clients sets it apart from many of its competitors. Here's a concise overview of Valutrades' key specifications:

Broker | Valutrades |

Account Types | Standard, ECN |

Regulating Authorities | FCA, FSA |

Based Currencies | USD, JPY, EUR, GBP, AUD |

Minimum Deposit | $0 |

Deposit Methods | Visa/MasterCard, Unionpay, Bank wired, Neteller, Skrill, crypto, PIX |

Withdrawal Methods | Visa/MasterCard, Unionpay, Bank wired, Neteller, Skrill, crypto, PIX |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:500 |

Investment Options | MT4 and MT5 EAs |

Trading Platforms & Apps | MT4, MT5 |

Markets | Forex, indices, commodities |

Spread | Floating from 0.0 pips |

Commission | From $6 |

Orders Execution | Market |

Margin Call/Stop Out | 100% / 50% |

Trading Features | Demo account, economic calendar, free signals |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | No |

PAMM Account | Yes |

Customer Support Ways | Email, live chat, phone |

Customer Support Hours | 24/5 |

Restricted Countries | Iran, USA, Democratic People’s Republic of Korea, Belgium |

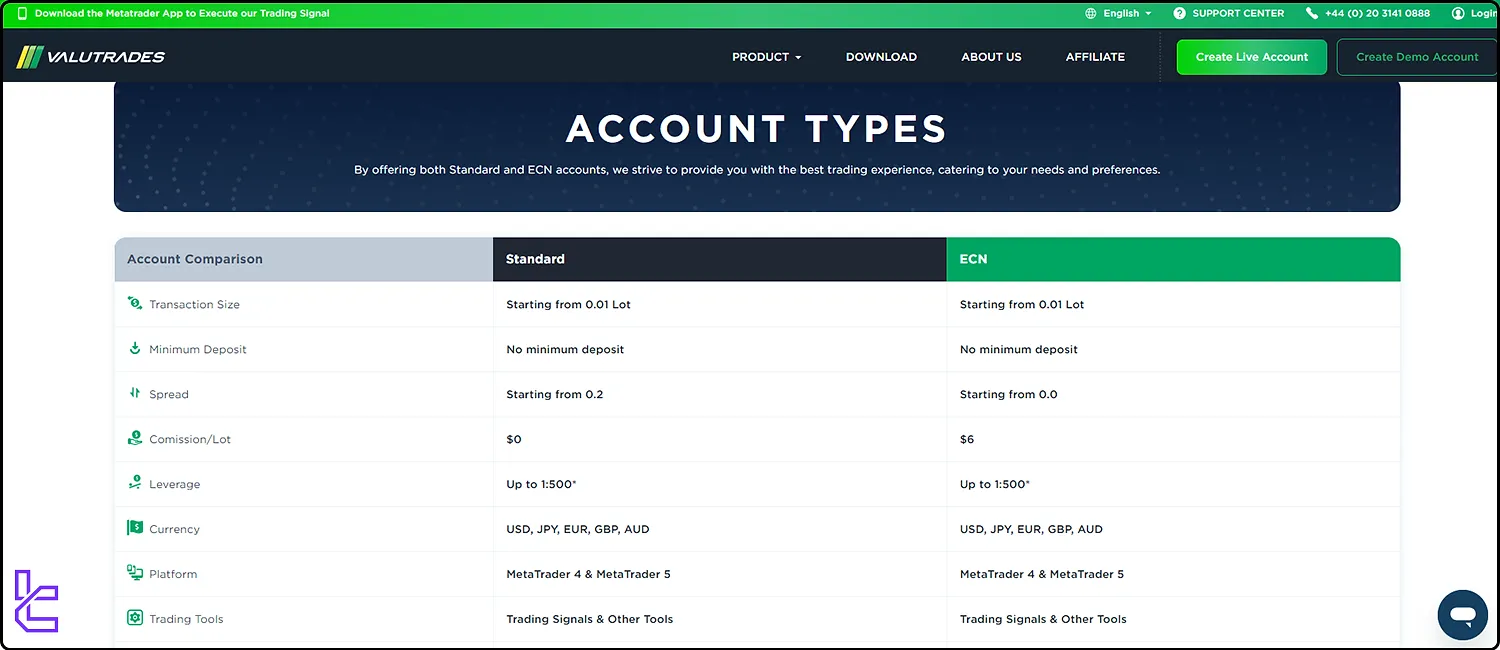

Valutrades Broker Accounts Overview

Valutrades caters to a diverse range of traders by offering multiple Standard and ECN account types. Here's a breakdown of the account type features:

Account types | Standard | ECN |

Minimum deposit | $0 | $0 |

Minimum trading volume | 0.01 Lot | 0.01 Lot |

Maximum Leverage | 1:500 | 1:500 |

Floating from 0.2 pips | Floating from 0.0 pips | |

Commission | $0 | $6 |

Trading platform | MT4, MT5 | MT4, MT5 |

Traders can choose the account type based on their trading needs

Valutrades also provides a Demo Account for beginner and professional traders. Key points of the demo account:

- Practice trading with virtual funds

- Access to all trading tools and resources

- Perfect for novice traders or those testing new strategies

Valutrades Broker Pros and Cons

When considering Valutrades as your broker, it's essential to weigh the pros and cons. Here's a balanced overview of the advantages and disadvantages:

Advantages | Disadvantages |

Tight spreads from 0.0 pips on major instruments | Limited asset selection compared to some competitors |

Low commission of $6 per lot | Not available to US customers |

Access to both MT4 and MT5 platforms | - |

FCA and FSA regulatory oversight | - |

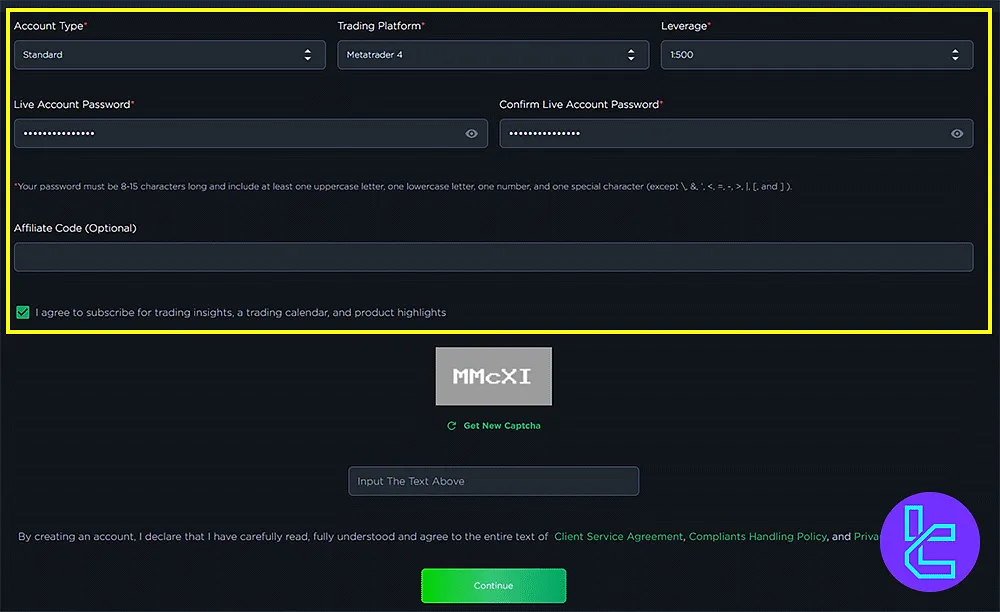

Valutrades Registration and Account Verification Guide

The Valutrades registration procedure is a straightforward process designed to get you trading quickly while ensuring compliance with regulatory requirements.

#1 Begin at the Valutrades Official Website

Navigate to the official site and select the "Create Live Account" button. This will lead you directly into the onboarding portal.

#2 Fill Out Your Basic Profile

Input your email address, birth date, and residency country. Choose between Valutrades UK or Valutrades Seychelles as your regulatory preference.

#3 Define Your Trading Setup

Select whether you want an ECN or Standard account, then pick between MT4 or MT5. Set your preferred leverage ratio and account currency.

#4 Secure Your Account and Confirm Terms

Set a strong password (8–15 characters), agree to the platform’s terms, and complete a captcha or security check. If you have an invitation code, enter it here.

#5 Verify Your Identity on Valutrades

To comply with the KYC requirements, follow these instructions:

- Submit a government-issued ID to verify your identity (passport, driver's license, etc.);

- Provide proof of address document (utility bill, bank statement, etc.).

Valutrades Broker Trading Platforms

Valutrades offers a diverse range of trading platforms to suit different trader preferences and needs:

Valutrades App

- All-in-one solution for forex, commodities, and indices trading

- Features seamless account management

- Provides real-time trading signals

- Available Android devices

MetaTrader 4 (MT4)

- Globally recognized forex trading platform

- Offers comprehensive charting and analysis tools

- Supports automated trading through Expert Advisors (EAs)

- Available for Windows, Mac, and mobile devices

Links:

- MT4 Android

- MT4 iOS

- Windows

- Mac

MetaTrader 5 (MT5)

- Multi-asset trading terminal with enhanced features

- Advanced charting capabilities and technical indicators

- Supports a wider range of markets compared to MetaTrader 4

- Available for Windows, Mac, and mobile devices

Links:

- MT5 Android

- MT5 iOS

- Windows

- Mac

Valutrades Fees (Spreads and Commissions)

Valutrades offers competitive pricing structures compared to other brokers. Here's an overview of their spreads and commissions:

Account types | Spread | Commission |

Standard | From 0.2 Pips | No commission |

ECN | From 0.0 Pips | From $6 |

Key points to consider:

- Overnight financing charges (swaps) apply for positions held beyond the daily cut-off time

- No inactivity fee

- 5% processing fee for withdrawal

All the details about spreads, commissions and even swap fees are completely clear for all traders.

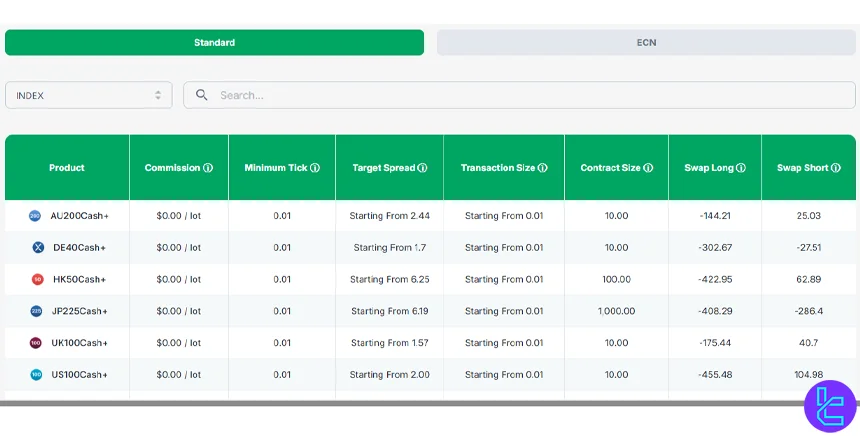

Swap Fee at Valutrades Broker

Valutrades applies precise overnight financing on each symbol. For example, the current Swap Long for EUR/USD is -9.47 while the Swap Short stands at 3.03 per lot.

These swap charges are applied daily at rollover and vary only according to the instrument’s specification page.

With that in mind, here are a few key points from the official specifications:

- XAUUSD carries a Swap Long of -60.17 and a Swap Short of 25.52 per lot (one of the highest differentials among metals);

- Valutrades does not offer swap-free or Islamic accounts. All trading accounts are subject to standard swap charges;

- Swap values are listed individually for every symbol under “Swap Long” and “Swap Short”, and each value is calculated per one standard lot;

- Many forex majors show asymmetric swap structures (e.g., positive credit on shorts, negative charge on longs), reflecting interest-rate spreads;

- Indices and commodities often show much larger swap figures (e.g., US30Cash+ at -867.15 / 208.66), important for holding positions overnight.

Non-Trading Fees at Valutrades Broker

Valutrades outlines its non-trading fee structure through its official funding and account documentation, indicating no standard broker-imposed charges for basic account operations.

Based on these disclosures:

- No monthly maintenance or inactivity fees appear in the public account documentation;

- Valutrades lists zero fees for deposits across supported payment methods;

- Withdrawal processing follows the original funding method without stated broker-side charges;

- Payment-provider or regional banking fees may apply, depending on the user's chosen method.

Valutrades Deposit & Withdrawal Methods

Valutrades offers a diverse range of deposit and withdrawal options to cater to its global clients:

- Bank Wire Transfer

- Skrill

- Neteller

- Cryptocurrency

- PIX (for Brazilian clients)

- UnionPay (for Asian clients)

Key points to remember:

- No minimum deposit

- Valutrades aims to process withdrawal requests within 24 to 72 hours

- 3 free withdrawals per month

Valutrades' diverse payment options reflect its commitment to providing a seamless customer experience across different regions.

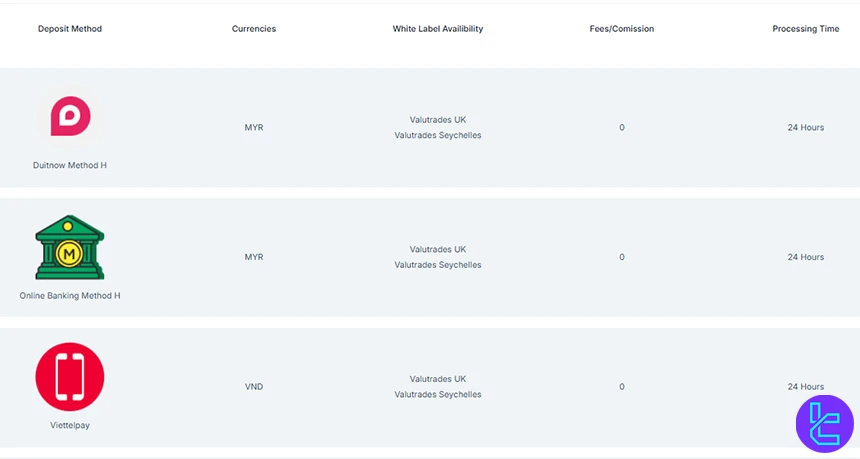

Deposit Methods at Valutrades

Valutrades provides a wide range of deposit methods, supporting multiple currencies and offering both UK and Seychelles clients seamless funding.

All methods listed on the official site show no broker-imposed fees and generally process funds within 24 hours. This ensures quick, cost-free account funding across a variety of local and international payment channels.

Here are all the funding methods:

Deposit Method | Currencies | Minimum Amount | Deposit Fee | Funding Time |

Duitnow Method H | MYR | No minimum deposit | 0 | 24 Hours |

Online Banking Method H | MYR | No minimum deposit | 0 | 24 Hours |

Viettelpay | VND | No minimum deposit | 0 | 24 Hours |

Viet Bank | VND | No minimum deposit | 0 | 24 Hours |

Momopay | VND | No minimum deposit | 0 | 24 Hours |

Viet QR | VND | No minimum deposit | 0 | 24 Hours |

Thai Local Bank | THB | No minimum deposit | 0 | 24 Hours |

Prompt Pay | THB | No minimum deposit | 0 | 24 Hours |

Alipay Method Z | CNY | No minimum deposit | 0 | 24 Hours |

Alipay Method M | CNY | No minimum deposit | 0 | 24 Hours |

Skrill QCO | USD, EUR, GBP, JPY, AUD | No minimum deposit | 0 | 24 Hours |

Sticpay | USD, EUR, GBP, JPY, AUD | No minimum deposit | 0 | 24 Hours |

Manual Bank Transfer - Barclays & Natwest & VSY Banks | USD, EUR, GBP, JPY, AUD | No minimum deposit | 0 | 3–5 Working Days |

PIX | BRL | No minimum deposit | 0 | 24 Hours |

Binance Pay | USDT, USDC | No minimum deposit | 0 | 24 Hours |

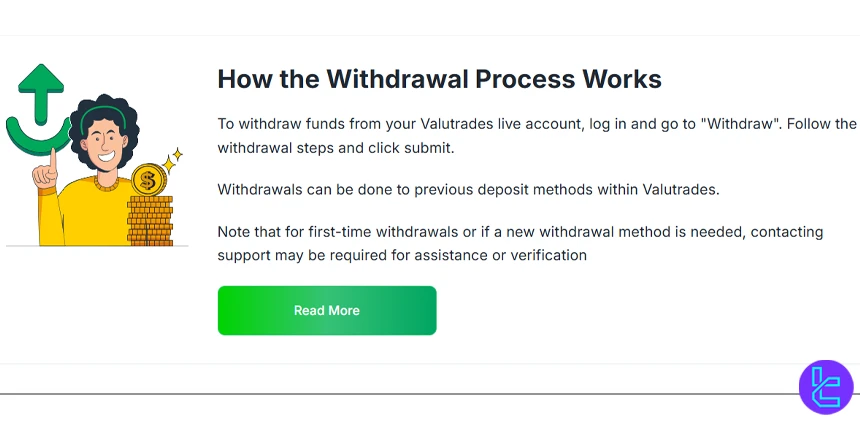

Withdrawal Methods at Valutrades

Valutrades provides clients with a structured withdrawal process designed to ensure security and consistency. Withdrawals must follow the broker’s official procedures, generally using the same method as the original deposit.

The platform guides clients through verification and processing to ensure smooth fund transfers.

Key points from Valutrades withdrawal:

- For Bank Transfers and e-wallets, the first three withdrawals per month are free; subsequent withdrawals incur a 5% fee;

- Processing times vary by method; typically, 1–5 business days for bank transfers and near-instant for electronic wallets;

- Withdrawal requests are processed through the Client Area, with the broker verifying all account and funding details before approval;

- Minimum and maximum amounts depend on the chosen currency and withdrawal method, and may vary by region;

- Clients may need to contact support when using a new withdrawal method for the first time to verify account details.

Copy Trading & Investment Options Offered by Valutrades Broker

Valutrades offers copy trading capabilities through Expert Advisors (EAs) on both MetaTrader 4 and MetaTrader 5 platforms. This feature allows traders to automatically replicate the trades of successful strategies or traders.

Key aspects of copy trading on Valutrades:

- Accessible through MT4 and MT5 EAs

- Allows diversification across multiple strategies

- Suitable for both novice and experienced traders

- Provides potential for passive income generation

However, it's crucial to remember that past performance doesn't guarantee future results, and copy trading still carries risks.

Valutrades Broker Tradable Instruments

Valutrades offers a focused selection of trading markets including Forex, Commodities and Indices. These categories cover major global instruments, allowing traders to participate in highly liquid and widely recognized markets.

The broker offers competitive leverage for all available instruments.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Major FX Pairs | 28+ | 40-60 | 1:500 |

Commodities | Gold, Silver, Oil | 4 | 5-20 | N/A |

Indices | Global Cash Indices | 8 | 5-15 | N/A |

Unfortunately, Valutrades’ instruments are limited compared to other major brokers. For example, the broker doesn’t offer cryptocurrencies or bonds.

Valutrades Bonuses and Promotion

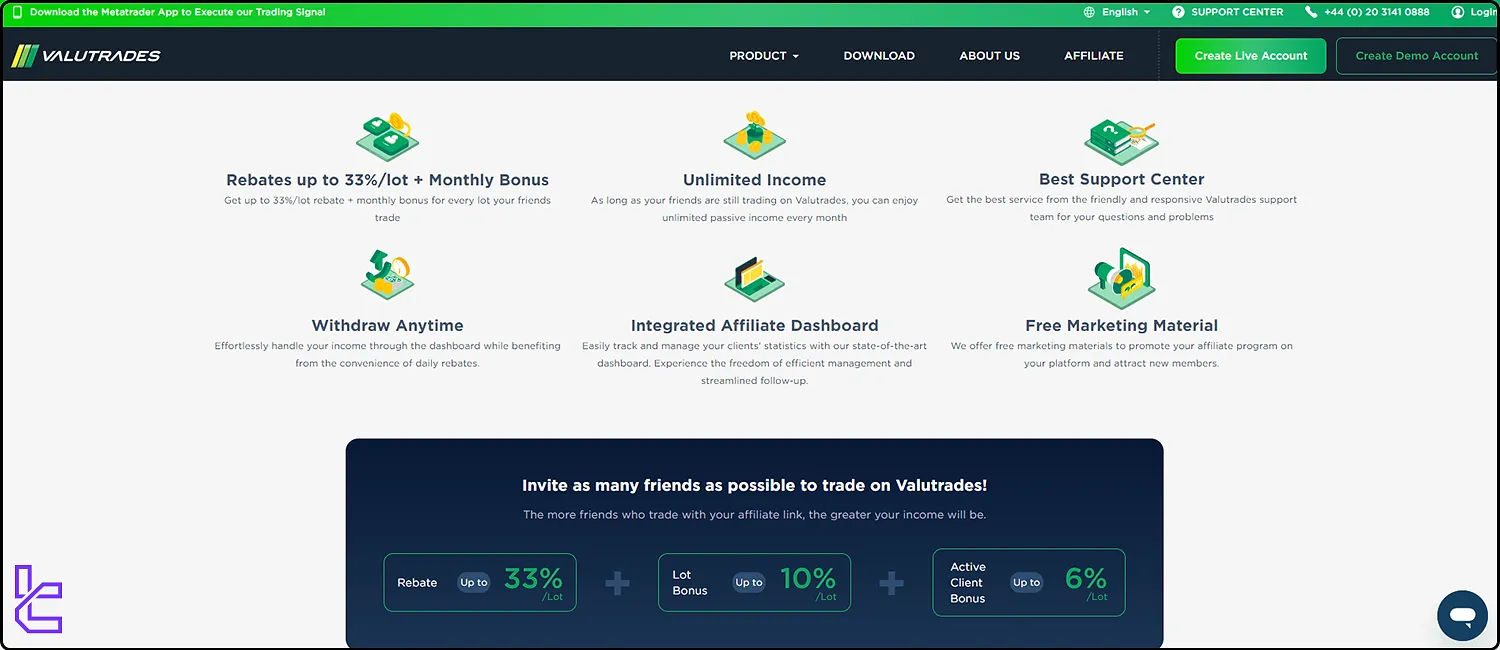

Currently, Valutrades focuses on its affiliate program as its primary promotional offering. This program provides an opportunity for individuals to earn passive income by referring new clients to Valutrades.

Key features of the Valutrades Affiliate Program:

- Earn rebates up to 33% per lot traded by referred clients

- Monthly bonus opportunities based on performance

- Integrated dashboard for tracking client activities

- Free marketing materials provided

While traditional trading bonuses are not currently offered, the affiliate program presents a unique opportunity for those looking to monetize their network within the trading community.

Valutrades Broker Awards

Official Valutrades sources provide no information regarding broker awards. There is no dedicated section, page or mention of any awards or recognitions on the website.

Valutrades Broker Support Channels

Valutrades provides comprehensive customer support to assist traders at every step of their journey. The broker offers multiple channels for client communication:

- Live Chat: available on the website

- Whats App: Available through the footer of the website

- Phone Support: +44 (0) 20 3141 0888

- Email: support@valutrades.com

- Support Center: Answers to various questions

Valutrades emphasizes a personal approach to customer service, aiming to provide tailored solutions to meet individual trader needs.

Valutrades Restricted Countries

While Valutrades serves clients in over 180 countries, there are certain jurisdictions where the broker's services are restricted due to regulatory requirements. Here’s a list of countries banned from creating an account in Valuetraders broker:

- USA

- Belgium

- Iran

- Democratic Republic of Korea

It's crucial for potential clients to verify their eligibility to open an account with Valutrades based on their country of residence.

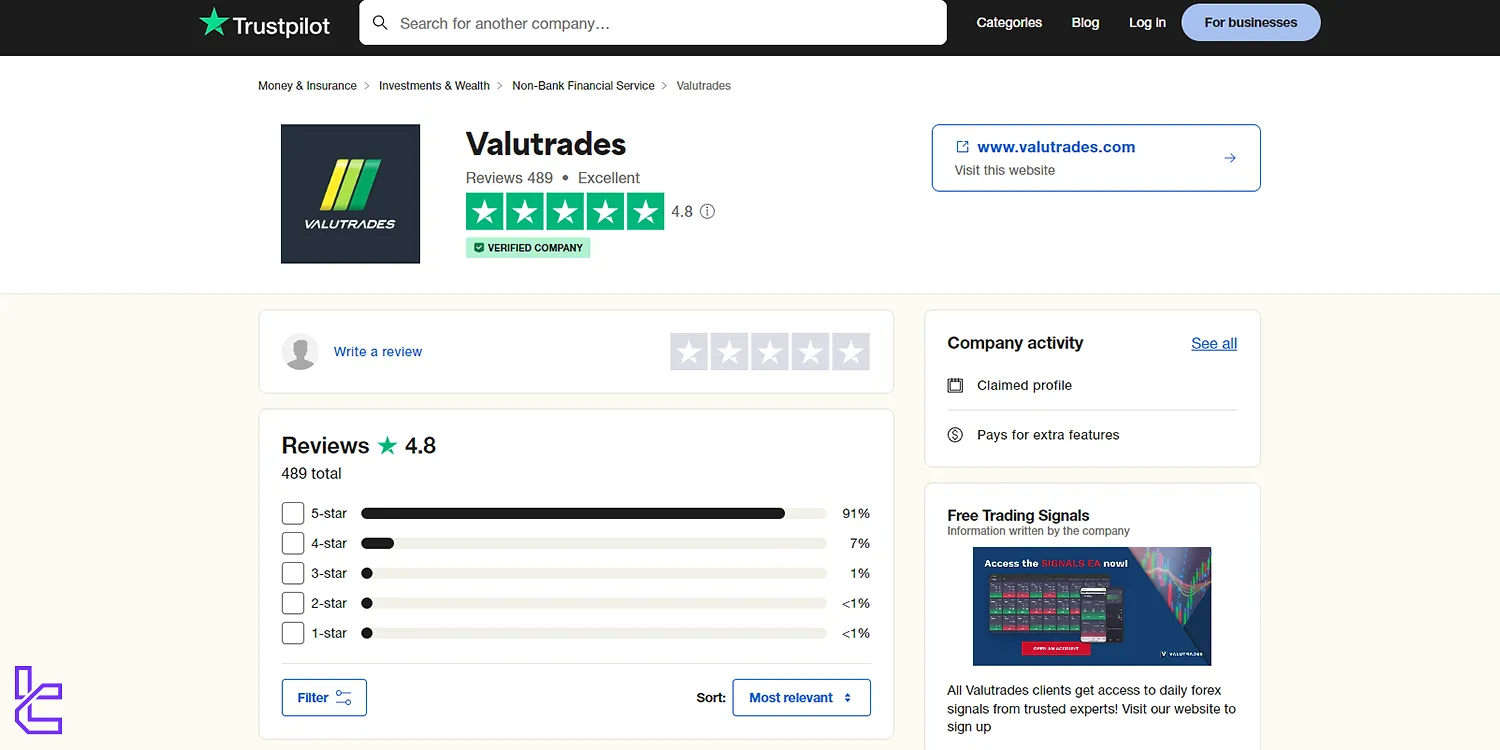

Trust Scores & User Reviews Regarding Valutrades Services

Trust and reputation are crucial factors when choosing a forex broker. Valutrades has established a solid presence in the industry since its inception in 2012. Here's an overview of its trust scores and reviews:

- Valutrades Trustpilot overall score: 4.8 out of 5 stars

- Total number of reviews: Over 480

- 5-star reviews: 91%

Valutrades Broker Educational Resources

Unfortunately, Valutrades doesn’t offer extensive educational resources for beginner traders. They haven’t updated their blog posts since 2023 which disapoints inexperienced market participants.

Trades who need educational materials could check out IG markets and Interactive brokers’ offering to satisfy their needs.

Table of Comparison Against Brokers

Valutrades' services and features should be evaluated in comparison to those of other brokerages before calling it a day with this review:

Parameter | Valutrades Broker | Exness Broker | HFM Broker | FxPro Broker |

Regulation | FCA, FSA | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB |

Minimum Spread | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $6 | From $0.2 to USD 3.5 | From $0 | From $0 |

Minimum Deposit | $0 | $10 | From $0 | $100 |

Maximum Leverage | 1:500 | Unlimited | 1:2000 | 1:500 |

Trading Platforms | MT4, MT5 | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App |

Account Types | Standard, ECN | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | N/A | 200+ | 1,000+ | 2100+ |

Trade Execution | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending |

TF Expert Suggestion

With 6 different deposit and withdrawal methods, 3 free withdrawals per month, and availability of services in 182 countries, Valutrade has made a name for itself in the brokerage space.

However, a limited selection of tradable markets (only Forex, indices, and commodities) and $6 commissions are drawbacks traders need to consider before joining Valutrades.