VARIANSE offers access to 6 asset classes, including Crypto and Equities. The broker provides commission-free Forex / Oil trading through its Classic account with a1.0 pip spread markup. It accepts Neteller, Skrill, and Crypto payments.

VARIANSE offers maximum leverage up to 1:500 and operates under multiple regulations, including FCA, FSC, and the FSA SVG license, ensuring compliance and robust oversight across trading activities.

VARIANSE; An Introduction to The Broker and Its Regulatory Status

VARIANSE is a Mauritius-based brokerage company established in 2015.

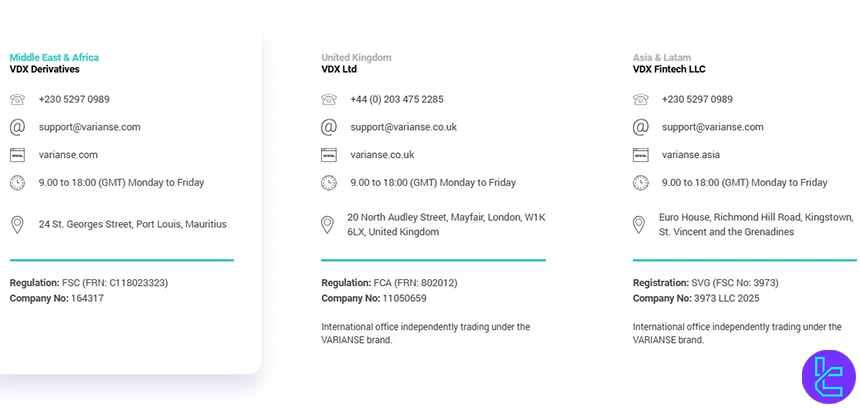

The broker operates through a group of companies in multiple jurisdictions with different licenses, including:

Entity Parameters / Branches | VDX Ltd (Varianse.co.uk) | VDX Derivatives (Varianse.com) | VDX Fintech LLC (Varianse.asia) |

Regulation | FCA (FRN 802012) | FSC (Licence C118023323) | Unregulated (FSA SVG) |

Regulation Tier | 1 | 3 | N/A |

Country | United Kingdom | Mauritius | St Vincent & Grenadines |

Investor Protection Fund / Compensation Scheme | FSCS (£85,000) | None stated | None stated |

Segregated Funds | Yes | Yes | Yes |

Negative Balance Protection | No | No | No |

Maximum Leverage | 1:500 | 1:500 | 1:500 |

Client Eligibility | UK (FCA clients) | Middle East & Africa | Asia & Latam |

The broker's commitment to regulatory compliance is further evidenced by its participation in client fund protection schemes, such as the UK's Financial Services Compensation Scheme (FSCS), which offers up to £85,000 per client.

VARIANSE Specific Features

The Forex broker has partnered with 20+ tier-1 liquidity providers and 3 Banks, including Barclays, Maybank, and MauBank, to provide fast and secure execution and transactions. Let’s take a quick look at what VARIANSE offers.

Broker | VARIANSE |

Account Types | Classic, ECN Pro, Prime |

Regulating Authorities | FCA, FSC |

Based Currencies | GBP, USD, EUR, PLN, AUD |

Minimum Deposit | $500 |

Deposit Methods | Bank Wire, Visa, MasterCard, Crypto, Neteller, Skrill |

Withdrawal Methods | Bank Wire, Visa, MasterCard, Crypto, Neteller, Skrill |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:500 |

Investment Options | Copy Trading |

Trading Platforms & Apps | MT4, cTrader |

Markets | Forex, Indices, Metals, Energy, Crypto, Equities |

Spread | Variable based on the account type |

Commission | Variable based on the account type |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 50% |

Trading Features | cTrader Copy, EarlyBird Fintwit Twitter Feed, Forex VPS |

Affiliate Program | Yes |

Bonus & Promotions | Referral |

Islamic Account | No |

PAMM Account | Yes |

Customer Support Ways | Email, Tel, Live Chat |

Customer Support Hours | 24/7 |

VARIANSE Broker Account Types

The company offers three distinct account types with different entry barriers and fee structures.

Features | Classic | ECN Pro | Prime |

Min Deposit | $500 | $5,000 | $50,000 |

Max Leverage | 1:500 | 1:500 | Negotiable |

FIX API | No | Yes | Yes |

Margin Call | 100% | 100% | 100% |

Stop Out | 50% | 50% | 50% |

Spreads from (pips) | 1.0 | 0.0 | 0.0 |

All accounts support base currencies in USD, EUR, GBP, PLN, and AUD and come with a free demo account.

VARIANSE Pros & Cons

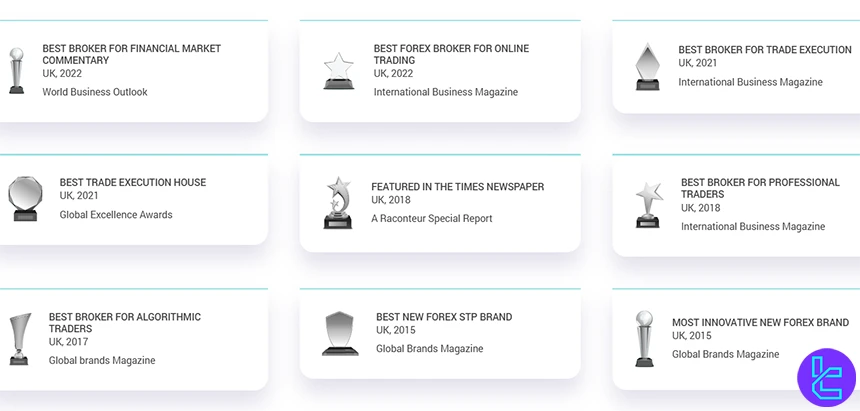

The company has won 10+ global industry awards, such as Best Forex Broker for Online Trading UK 2022 by International Business Magazine.

Let's examine the broker's strengths and potential drawbacks to provide a balanced view of VARIANSE's offerings.

Pros | Cons |

Direct market execution | High entry barrier (from $500) |

Tight spreads from 0.0 pips | Limited asset offerings (200+) |

High leverage options (1:500) | Lack of support for MT5 and TradingView |

Copy trading and API trading | - |

Account Opening and KYC

VARIANSE registration involves a straightforward process designed to comply with international KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations.

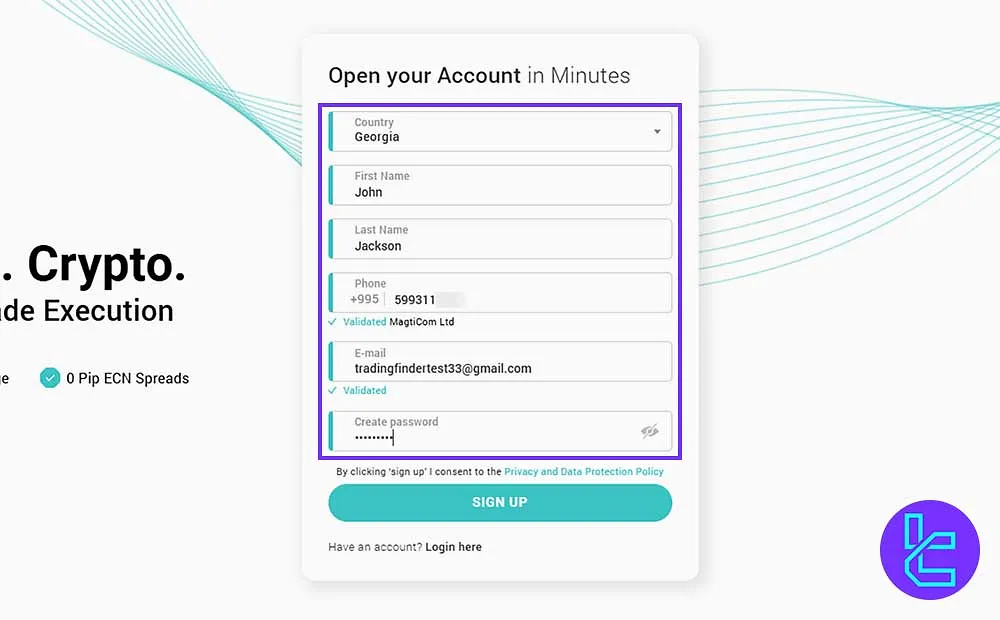

#1 Start from the VARIANSE Registration Page

Go to the official website and click on “Register” on the Varianse homepage to access the signup form.

#2 Complete the Form with Required Details

Input the following accurately:

- First and Last Name

- Country

- Email Address

- Mobile Number

Afterwards, create a Secure Password. Then, click “Sign Up” to proceed.

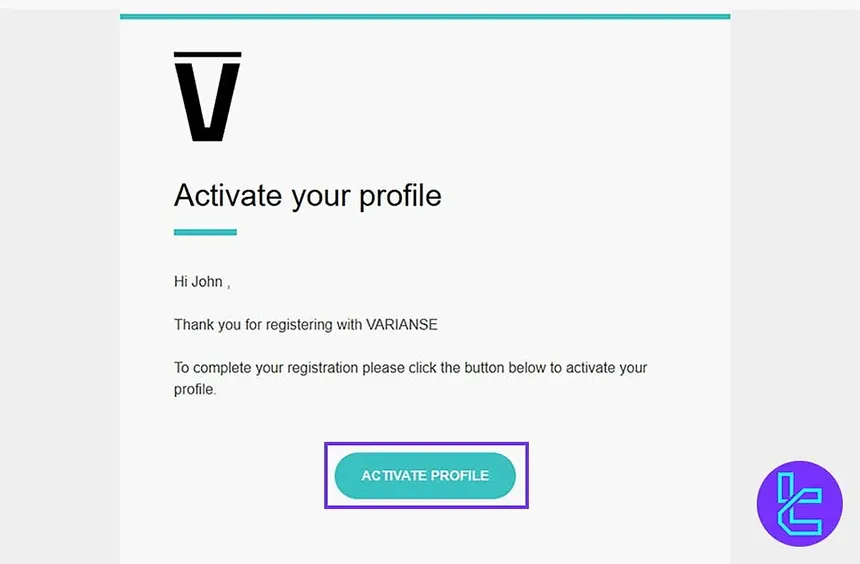

#3 Verify Your Email Address

Check your inbox and confirm your registration by clicking the activation link sent by VARIANSE. This step is mandatory for account activation.

#4 VARIANSE Verification Process

To access the full suite of trading and financial features on broker, completing the VARIANSE verification is essential.

The process is mandatory for activating a fully functional account and involves submitting standard identification documents such as a government-issued ID and a recent proof of address.

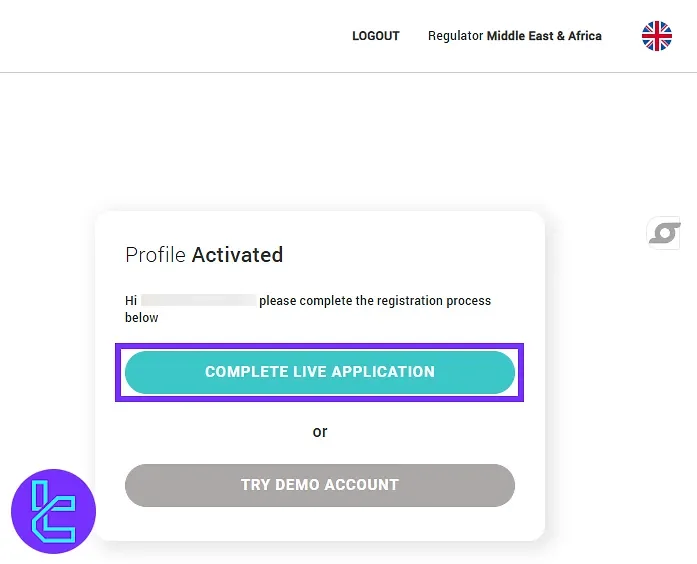

#1 Completing the Live Application Form

Firstly, access your VARIANSE dashboard and select "Complete Live Application" button.

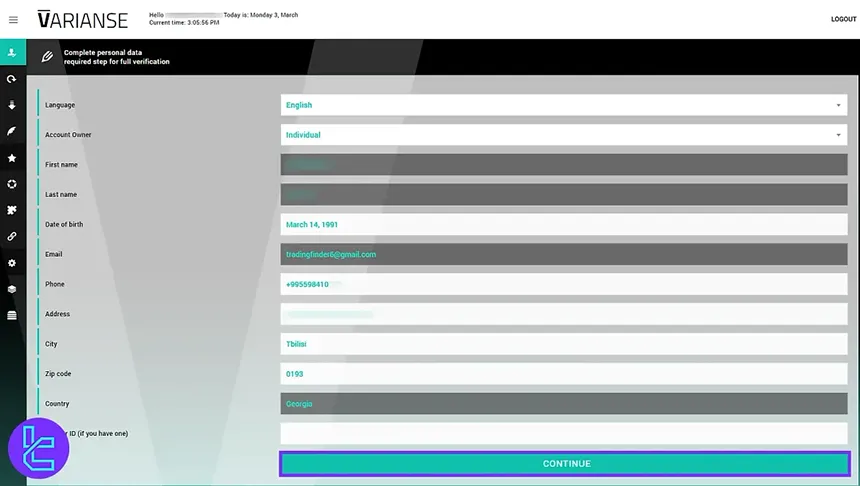

Next, you need to enter all following details:

- Language preference

- Account type

- Full name and date of birth

- Email and phone number

- Full residential address, city, postal code, and country

Now, click on “Continue” button.

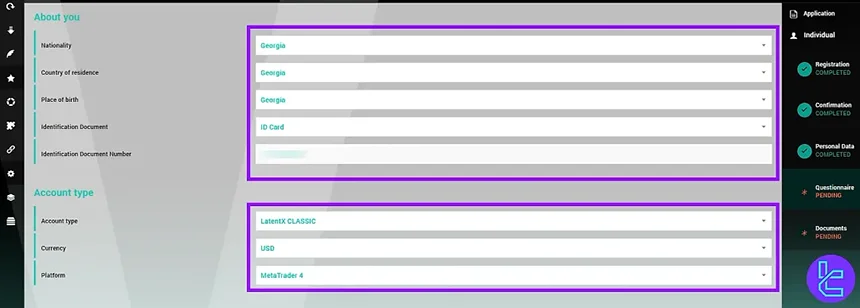

Next, fill in all the mandatory fields:

- Nationality

- Country of residence

- Place of birth

Then, select document type (ID card, driver’s license, passport) and ID number. Now, select your account type, trading platform and leverage.

Next, enter your banking information including:

- IBAN

- SWIFT code

- Account holder name

- Bank name

- Bank address

Then, provide details about your financial background and trading experience, accept the platform’s terms by checking all required boxes, and enter your full name before clicking "Continue" to finalize this step.

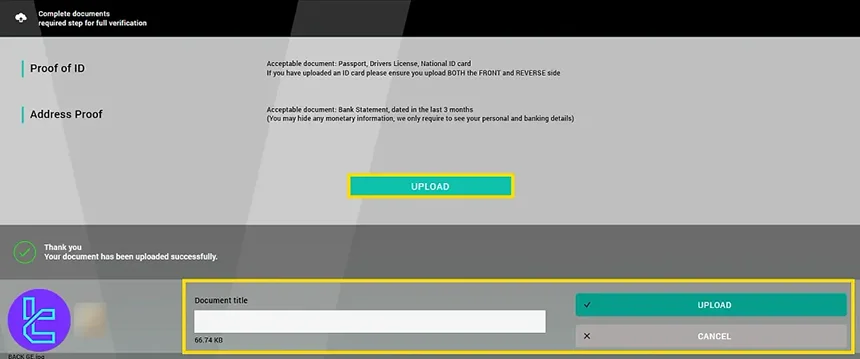

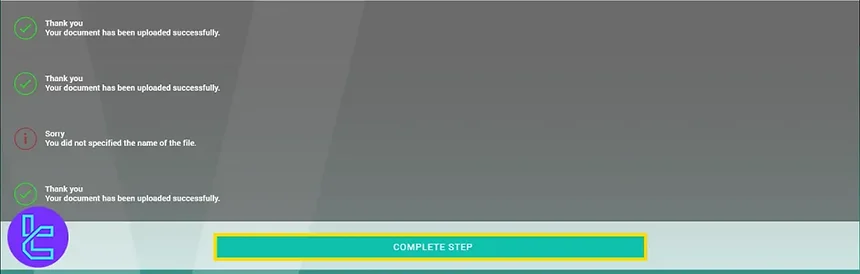

#2 Uploading Your Documents

Click "Upload" to submit your identification documents. Provide a valid proof of ID (both sides) and a recent proof of address (e.g., bank statement issued within the last 3 months) and upload them.

Once all documents are uploaded, select "Complete Setup" to submit your KYC request.

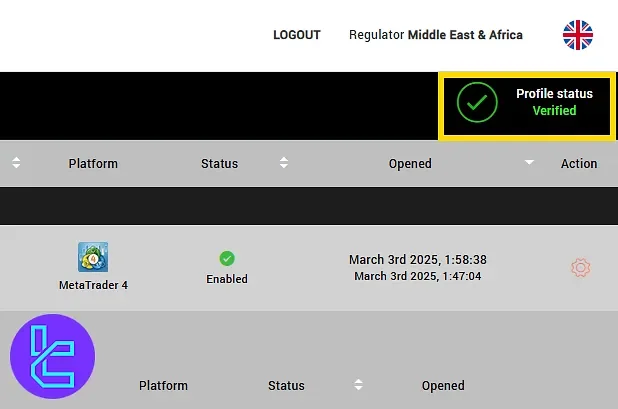

#3 Checking Your KYC Status

Monitor your verification progress directly from the dashboard. When the review is complete, the account will be marked as "verified" in the top-right section, confirming full access to trading functionalities.

VARIANSE Apps and Platforms

In this VARIANSE review, we would like to mention that the broker provides traders with access to the robust MetaTrader 4 and cTrader platforms.

MetaTrader 4 (MT4)

- MT4 Android

- MT4 iOS

- Desktop

- Web

cTrader

- cTrader Android

- cTrader iOS

- Desktop

- Web

While MetaTrader 4 offers 30 built-in analytical tools, you can check TradingFinder’s MT4 indicators for additional tools.

VARIANSE Broker Fees and Commissions

The company offers competitive pricing across its account types, with a transparent fee structure:

Fee | Classic | ECN Pro | Prime |

FX/Metals Spreads from (pips) | 1.0 | 0.0 | 0.0 |

FX/Metals Commission | $0 | $3.50 per lot per side | Negotiable |

CFDs Commission | Oil: $0 Indices: $0.5 per lot per side Equities: 0.1% ($10 min) Crypto: 0.07% | ||

Non-trading fees are minimal. There are no inactivity or withdrawal charges.

Swap Fee at VARIANSE

Swap (overnight financing) forms a core part of VARIANSE’s pricing whenever a trade remains open past the 17:00 New York rollover.

Depending on the instrument and the long/short direction, the swap can be either a cost or a credit. Also, a triple-swap applies mid-week for FX and metals, and on Fridays for oil and indices.

With these mechanics in mind, here are several key points:

- VARIANSE offers a swap-free / Islamic account option for eligible clients who request it;

- The broker calculates swap using the formula: Trade Size × Opening Rate × Daily Swap %;

- Daily swap percentages differ for long vs. short and must be checked per instrument in the official spec tables;

- Dividend adjustments affect index-CFD overnight costs, debiting longs and crediting shorts.

Non-Trading Fees at VARIANCE

Non-trading fees at VARIANSE mainly arise from payment processing and currency conversions, while several other administrative costs remain minimal or absent.

The broker does not apply an inactivity fee, and withdrawal charges are generally not imposed by VARIANSE itself. Exact conversion and payment-method fees depend on the client’s currency and transfer route.

With these details in mind, here are the key points:

- Deposits are processed with fees of 0% for bank wires, 1.5% for cards, 3.9% for e-wallets, and 1% for crypto;

- Currency conversions for deposits, withdrawals or internal transfers apply at mid-market FX rate ±2%;

- Withdrawals are free on VARIANSE’s side, though intermediary banks or processors may charge their own fees.

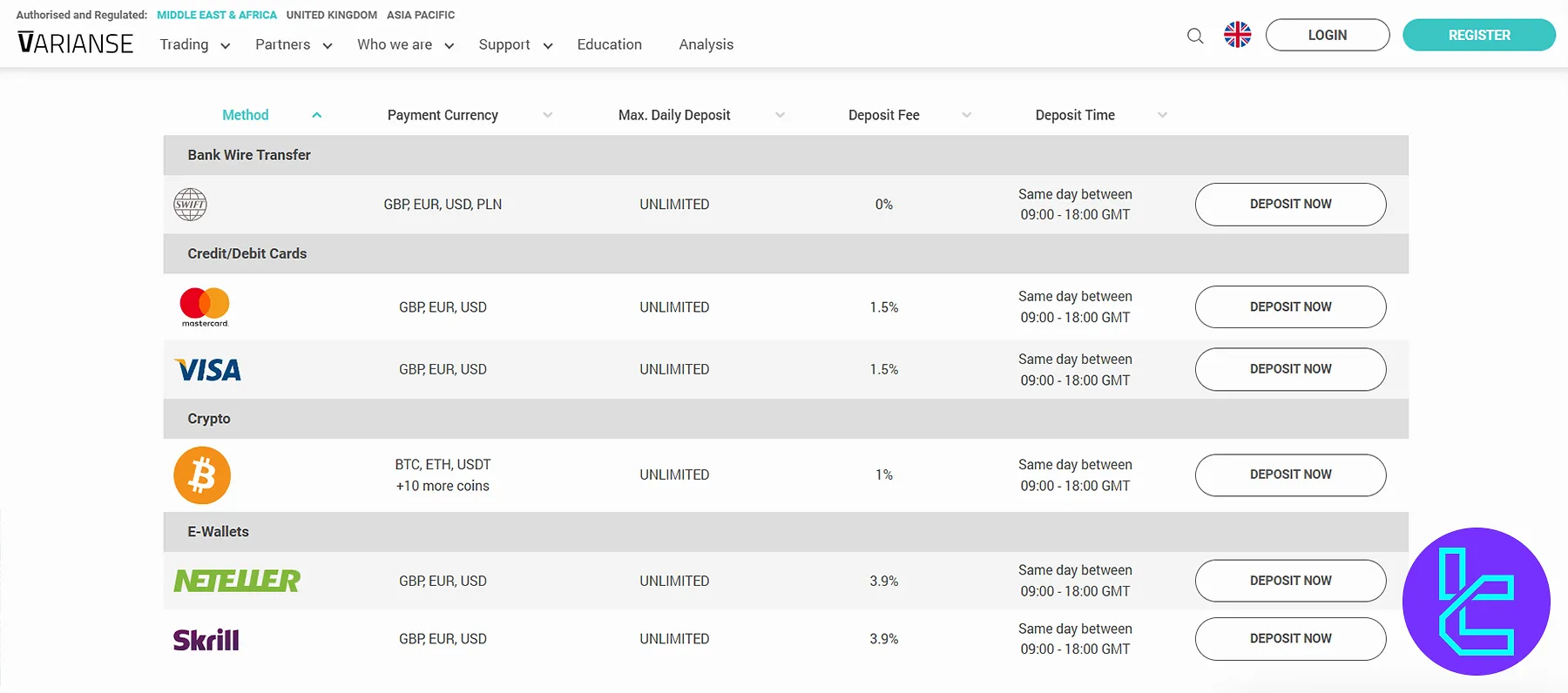

VARIANSE Withdrawals & Deposits

The broker holds clients’ funds in segregated accounts at Barclays Bank in London to ensure safety. VARIANSE supports a variety of funding options, including:

Method | Deposit Fee |

Bank Wire | 0% |

Visa | 1.5% |

MasterCard | 1.5% |

Crypto (BTC, ETH, USDT, and 10 more coins) | 1% |

Neteller | 3.9% |

Skrill | 3.9% |

Note that withdrawals are processed via bank transfers, with a minimum of 100 currency units.

How Can You Deposit Funds at VARIANSE?

VARIANSE supports multiple deposit methods across different currencies, giving traders flexibility in how they fund their account.

Each method has defined fees (or none) and typically processes within the business day if completed during working hours.

Below are a breakdown of the main deposit options and their terms:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Wire Transfer | GBP, EUR, USD, PLN | no minimum | 0% | Same day between 09:00 - 18:00 GMT |

Credit / Debit Card | GBP, EUR, USD | no minimum | 1.5% | Same day between 09:00 - 18:00 GMT |

E-Wallets (Skrill, Neteller) | GBP, EUR, USD | no minimum | 3.9% | Same day between 09:00 - 18:00 GMT |

Crypto (e.g. BTC, ETH, USDT + other coins) | BTC, ETH, USDT +10 more coins | no minimum | 1% | Same day between 09:00 - 18:00 GMT |

How Can You Withdraw Funds from VARIANSE?

VARIANSE allows withdrawals using the same methods as deposits, giving clients flexibility in retrieving their funds.

Each withdrawal method has defined minimum amounts and processing times, and the broker typically does not charge any fees for standard transactions.

Here’s a detailed breakdown of withdrawal options:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Bank Wire Transfer | GBP, EUR, USD, PLN | 100 | 0% | 1–3 business days (same-day processing) |

Credit / Debit Card | GBP, EUR, USD | 100 | 0% | 1–3 business days |

E ‑ Wallet | GBP, EUR, USD | 100 | 0% | 1–3 business days |

Crypto (BTC, ETH, USDT etc.) | Various crypto | 100 | 0% | 1–3 business days |

Does VARIANSE Offer Copy Trading Services or Investment Plans?

The broker provides a comprehensive solution for investors and money managers called cTrader Copy, with the following features:

- Complete control over the copied strategies

- Comprehensive trading history of strategy providers

- Ability to chat with money managers before investing

- Daily payouts for managers

- Fully automated and flexible fee structures

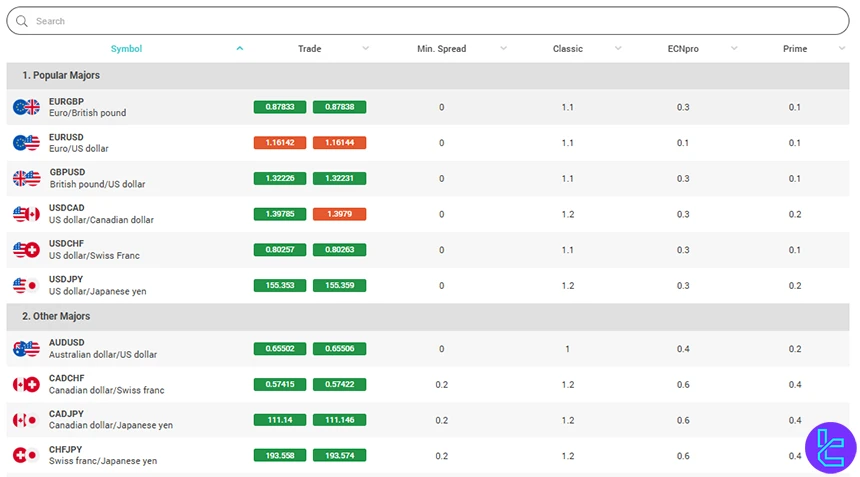

VARIANSE Broker Tradable Assets

The company offers a diverse range of tradable assets (200+) through CFDs across six asset classes, from Forex to Crypto.

This table summarizes the available instruments:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex (FX) | Forex currency pairs (major, minor, exotic) | 44 | 40-60 | 1:500 |

Cryptocurrency CFDs | Major cryptocurrencies (as CFDs) | 23 | 15-30 | 1:5 |

Metals CFDs | Precious metals (e.g. gold, silver) | 2 | 2-5 | 1:250 |

Energy CFDs | Oil / energy contracts | 2 | 1-4 | 1:167 |

Indices CFDs | Global indices (stock‑market indices) | 10 | 5-15 | 1:333 |

Equities CFDs | US / global equities (CFDs) | 121 | 50-200 | 1:5 |

To expand your knowledge about Foreign Exchange and its characteristics, check TradingFinder’s Forex education.

VARIANSE Promotional Offerings

The company offers individual bonus programs based on the client’s region. Upon registering, talk to the support team about promotions. VARIANSE has also implemented various partnership programs, including:

- Money Managers: A comprehensive MAM solution supporting MT4 accounts

- Introducers: Competitive commissions for referring new clients

VARIANSE Broker Awards

VARIANSE proudly showcases its portfolio of Awards, highlighting its recognition across multiple jurisdictions and trading styles.

VARIANSE awards reflect external industry validation for execution excellence, broker quality, and support for professional traders.

Below are some of the most notable honors they list:

- Best Broker for Financial Market Commentary – UK, 2022

- Best Forex Broker for Online Trading – UK, 2022

- Best Broker for Trade Execution – UK, 2021

- Best Trade Execution House – UK, 2021

- Best Broker for Professional Traders – UK, 2018

Customer Support

VARIANSE prides itself on providing 24/7 client service through various channels, from Live Chat to Call Center.

support@varianse.com | |

Tel (Mauritius) | +230 5297 0989 |

Tel (UK) | +44 (0) 203 475 2285 |

Live Chat | Available on the official website |

Therefore, you can always connect with the broker’s support team in the shortest possible time to resolve any issues.

VARIANSE Broker Geo-Restrictions

While VARIANSE operates globally, it has indicated on its official website that residents of the United States are not accepted. However, it’s safe to assume that the broker doesn’t provide services to some FATF-sanctioned countries due to regulatory compliance.

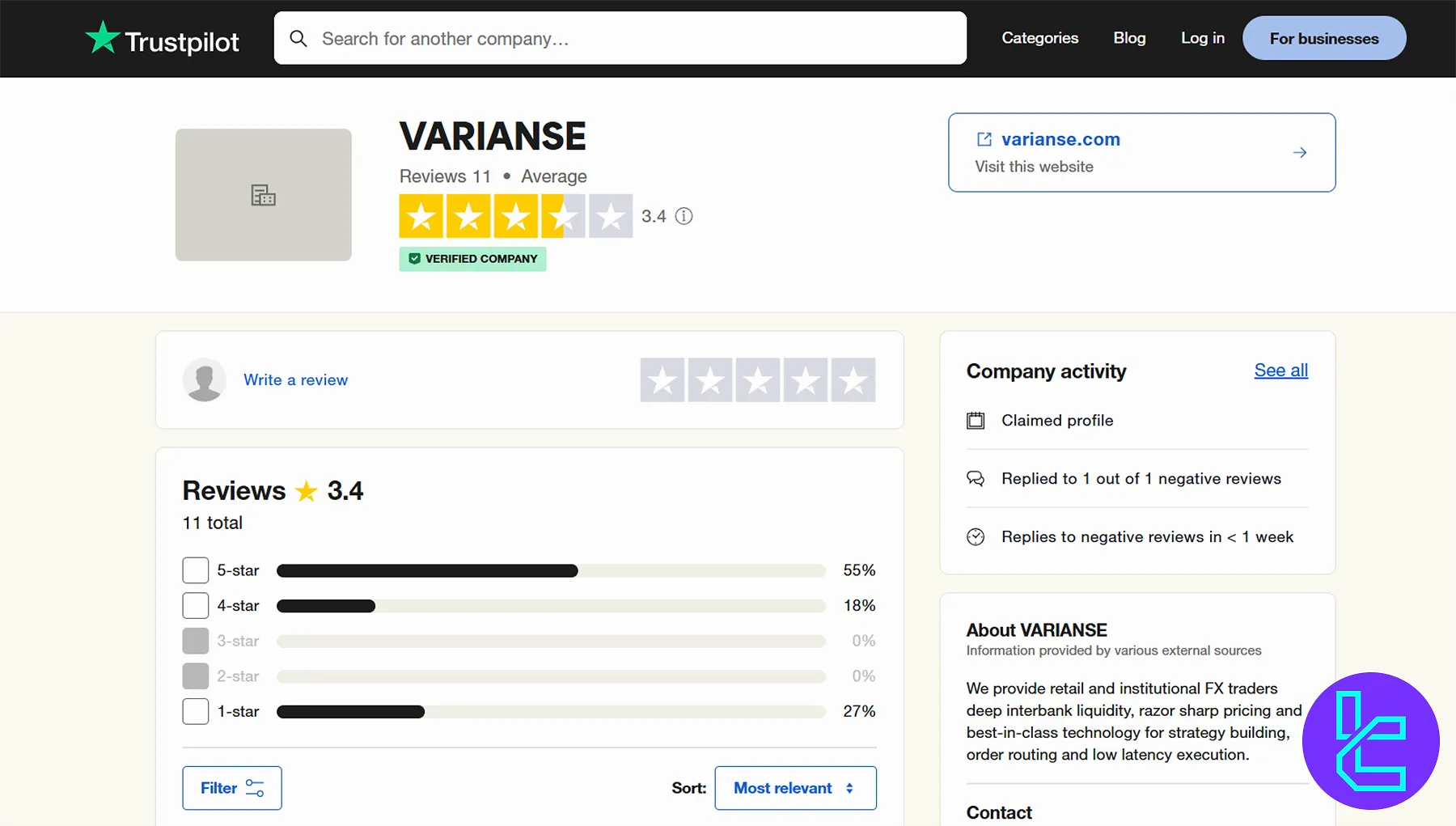

VARIANSE Trust Score

Exploring VARIANSE reviews on websites like ForexPeaceArmy helps us get a sense of what customers think of their broker.

TrustPilot | 3.4/5 based on 11 ratings |

Forex Peace Army | 3.748/5 based on 8 reviews |

VARIANSE TrustPilot profile has 11 comments, showcasing an average performance on the broker’s part.

Educational Offerings

VARIANSE features a dedicated Forex education section on its website, covering various subjects, including:

- Economics & Markets

- Product Review

- Risk Management

- Strategies

VARIANSE Against Other Brokers

This table here is a direct and side-by-side comparison of VARIANSE with some of the top brokers:

Parameters | VARIANSE Broker | HFM Broker | FXGlory Broker | Alpari Broker |

Regulation | FCA, FSC | CySEC, DFSA, FCA, FSCA, FSA | No | MISA |

Minimum Spread | 0.0 Pips | From 0.0 Pips | From 0.1 Pips | From 0.0 Pips |

Commission | From $0 | From $0 | $0 | From $0.0 |

Minimum Deposit | $500 | From $0 | $1 | $50 |

Maximum Leverage | 1:500 | 1:2000 | 1:3000 | 1:3000 |

Trading Platforms | MT4, cTrader | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5 | MetaTrade 4, MetaTrade 5, Mobile App, Web Trader |

Account Types | Classic, ECN Pro, Prime | Cent, Zero, Pro, Premium | Standard, Premium, VIP, CIP | Standard, ECN, Pro ECN, Demo |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 200+ | 1,000+ | 45 | 120+ |

Trade Execution | Market | Market, Instant | Market, Instant | Market |

Conclusion and Final Words

VARIANSE provides access to 200+ trading instruments with leverage options of up to 1:500 and a minimum deposit of $500. The broker has an average TrustPilot score of 3.4 and doesn’t accept US clients.