WeTrade offers CFDs on 6 asset classes, including Forex and Crypto, with leverage options of up to 1:2000. Commission-free trading on STP and Standard accounts requires a minimum deposit of $10. The broker offers up to $25,000 in cash prizes to its VIP clients.

WeTrade operates under multiple regulatory frameworks, including FSA SVG, Labuan FSA, FSA Seychelles, CySEC and ASIC, enabling broad international service coverage. The broker also supports swap-free (Islamic) accounts for clients requiring Sharia-compliant trading conditions.

WeTrade: An Introduction to the Company and Its Regulatory Status

WeTrade was established in 2015 and has its headquarters in Kingstown, Saint Vincent and the Grenadines. The company started serving Chinese clients in 2016.

The brand operates through two legal entities with different licenses in multiple jurisdictions, including:

Entity Parameters / Branches | WeTrade International LLC (SVG) | WeTrade Capital (Seychelles) Ltd | WeTrade Capital Ltd (Labuan) | WeTrade International CY Ltd (Cyprus) | WeTrade Capital (Australia) Pty Ltd |

Regulation | SVG FSA (LLC 1945/2022) | FSA Seychelles (SD196) | Labuan FSA (MB/22/0100) | CySEC (435/25) | ASIC (AFSL 544624) |

Regulation Tier | N/A | 4 | N/A | 1 | 1 |

Country | Saint Vincent & the Grenadines | Seychelles | Malaysia (Labuan) | Cyprus | Australia |

Investor Protection Fund / Compensation Scheme | None | None | None | ICF €20,000 | CSLR up to A$150,000 |

Segregated Funds | No | No | No | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:2000 | 1:2000 | 1:100 | 1:30 | 1:100 |

Client Eligibility | Global (except restricted) | Global (except restricted) | Global (non-Malaysia retail) | EU / EEA residents | Australia residents |

This structure allows WeTrade to serve clients worldwide while complying with local regulations and offering tailored investor protections in each jurisdiction.

WeTrade Table of Specifications

The Forex broker has partnered with top-tier liquidity providers, including J.P. Morgan, Deutsche Bank, and UBS, to provide robust trading conditions. Let’s take a quick look at WeTrade’s offerings.

Broker | WeTrade |

Account Types | STP, Standard, ECN, Islamic |

Regulating Authorities | FSA SVG, Labuan FSA, FSA Seychelles, CySEC, ASIC |

Based Currencies | USD |

Minimum Deposit | $10 |

Deposit Methods | USDT, Bank Wire, Local deposit |

Withdrawal Methods | UnionPay, Bank wire |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:2000 |

Investment Options | Copy Trading, MAM Accounts |

Trading Platforms & Apps | MT4, WeTrade App |

Markets | Forex, Metals, Energies, Stocks, Indices, and Crypto |

Spread | Variable based on the account type |

Commission | STP and Standard $0 ECN $7 |

Orders Execution | Market |

Margin Call / Stop Out | N/A / 20% |

Trading Features | Social Trading, MAM Solutions, VPS Trading, Commission-Free Accounts |

Affiliate Program | Yes |

Bonus & Promotions | TradeElite Rewards, UEFA Champions League Guessing Campaign, Rewards Mall, Swap-Free Campaign, Trading Blitz Race |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Live Chat, Email |

Customer Support Hours | N/A |

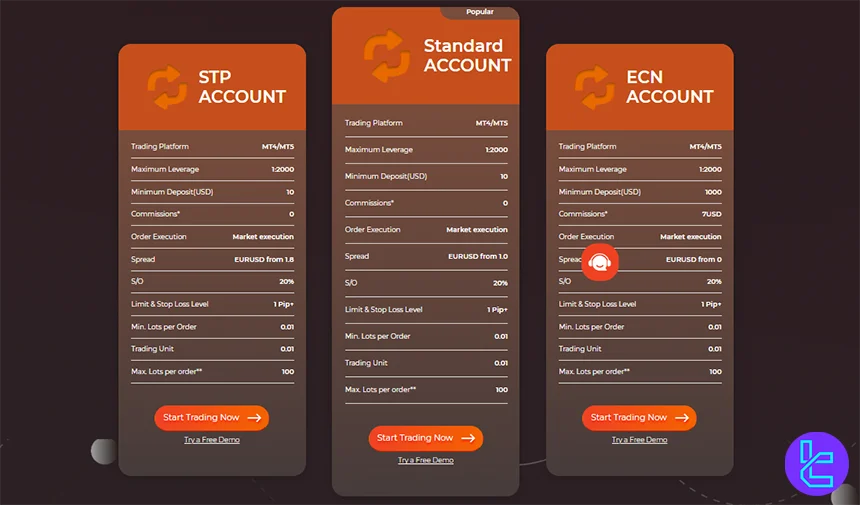

WeTrade Broker Account Types

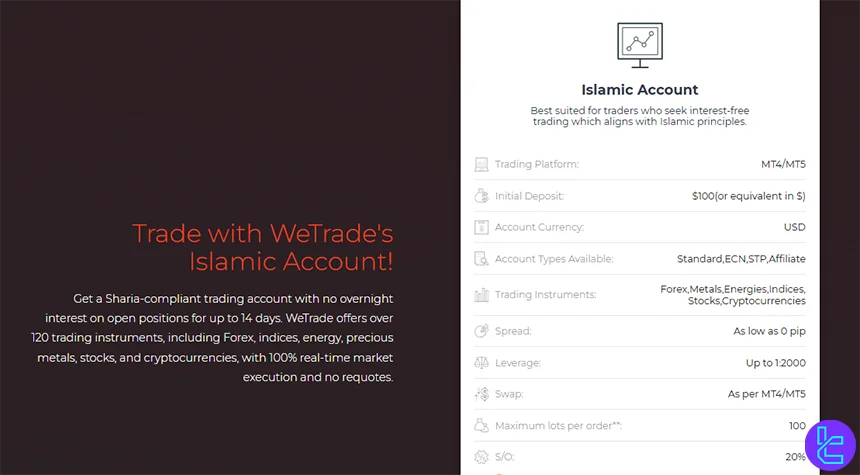

The company primarily offers 3 account types, including Standard, STP, and ECN. It also added an Islamic option to its offerings in 2023.

Features | STP | Standard | ECN |

Max Leverage | 1:2000 | 1:2000 | 1:2000 |

Base Currency | USD | USD | USD |

Min Deposit | $10 | $10 | $1000 |

Stop Out | 20% | 20% | 20% |

Limit & Stop Loss Level | +1 Pip | +1 Pip | +1 Pip |

Min Trade Size | 0.01 Lots | 0.01 Lots | 0.01 Lots |

Max Lots per Order | 100 | 100 | 100 |

WeTrade offers a variety of account types, with flexible leverage up to 1:2000 and low minimum deposits for beginner and professional traders.

The Swap-free (Islamic) option is available on all account types. However, the initial deposit to open an Islamic account is $100.

Advantages and Disadvantages

One of the upsides in this WeTrade review is the broker’s international partnerships.

The company is a partner of UNICEF and sponsors the “Phantom Global Racing”.

Pros | Cons |

Multiple global awards | Geo-restrictions |

Various promotions, including the Reward Mall | Off-shore regulation |

High leverage options (1:2000) | Limited asset offerings (120+) |

Low spreads from 0.0 pips | High entry barrier for ECN accounts ($1000) |

Account Opening and KYC on WeTrade

The broker has implemented an age restriction; clients must be above 18 years old. For a tutorial on WeTrade FX registration, check out the following sections.

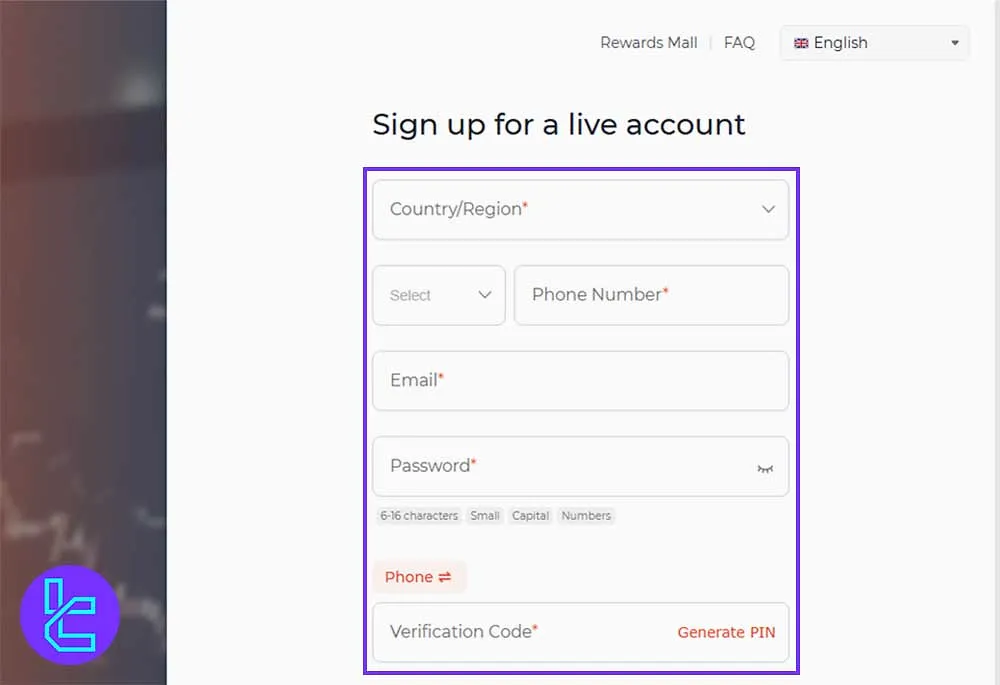

#1 Start the Registration from the WeTrade Homepage

Navigate to the official website and initiate the sign-up process by selecting “Register”. This leads you to the dedicated registration form.

#2 Enter Personal Information and Verify Your Phone

Fill out the form with your country, email, mobile number, and a secure password (including symbols and capital letters is recommended). Next, click “Generate PIN” to receive a phone verification code. Submit the code, agree to the platform’s terms, and click “Register”.

#3 Activate the Trading Account

Once registered, activate your account and access your user dashboard. Your trading profile is now ready, and you can move on to identity verification before placing any trades.

#4 Pass the KYC

Choose “Activate Your WeTrade Account” and click “Upload Now” to start the verification process. Then, please provide your residential address and upload a valid ID certificate, such as a driver's license, Passport, or Other Government-Issued Identification.

WeTrade App and Platforms

The broker has developed a proprietary mobile application for Android and iOS users and provides access to the robust MetaTrader 4 platform.

MetaTrader 4 (MT4)

WeTrade App

- Android Version (Not available on Google Play Store)

- WeTrade iOS

The company also supports the MetaQuotes MultiTerminal platform, which is designed to manage multiple accounts from one place.

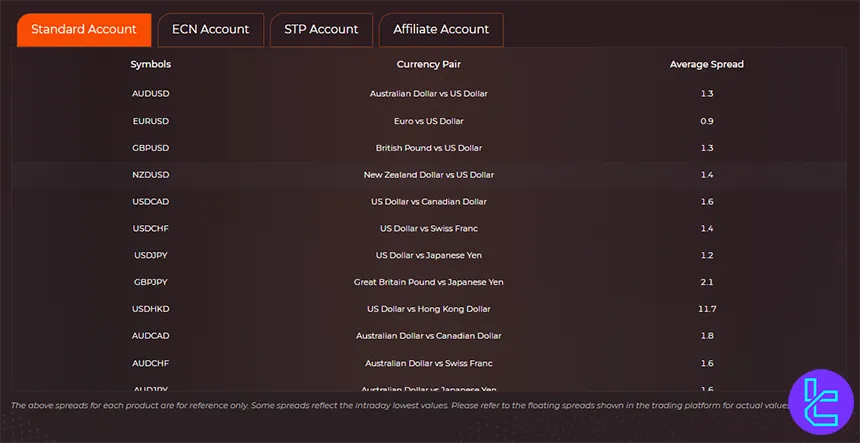

WeTrade Broker Fees Explained

The company provides commission-free trading through STP and Standard accounts with higher spreads.

Account Type | Spreads from (pips) | Commission |

STP | 1.8 | $0 |

Standard | 1.0 | $0 |

ECN | 0.0 | $7 |

Islamic | 0.0 | Based on the initial account type |

Transactions on WeTrade are charge-free and incur no handling fees.

Swap Fee at WeTrade

WeTrade’s swap (overnight) cost structure is fairly flexible; by default, swap is charged according to the standard MT4/MT5 rollover rates.

During a limited-time Swap‑Free Campaign, clients benefit from a 7-day zero‑swap period for both Forex and metals, followed by a reduced swap rate (50%) once the free period ends. After this campaign window, full MT4/MT5 swap rates are reinstated.

Here are some important official details:

- The 7-day swap‑free period covers all Forex and Metals trades under the campaign;

- For Forex trades (excluding JPY pairs), after 7 days without swap, a 50% discounted swap rate applies for the next 7 days;

- For Metals, the 50% reduced swap rate lasts for up to 14 days, after which full MT4/MT5 rates apply;

- On WeTrade’s Islamic account, swap is defined “as per MT5”, meaning that after 14 days of holding, MT5 swap fees may apply.

Non-Trading Fees at WeTrade

WeTrade imposes very limited non‑trading fees; according to their FAQ, there is no withdrawal fee for most methods, and they do not charge inactivity fees.

Their legal and policy documents also don’t list any account maintenance or commission fees, making the cost structure quite lean.

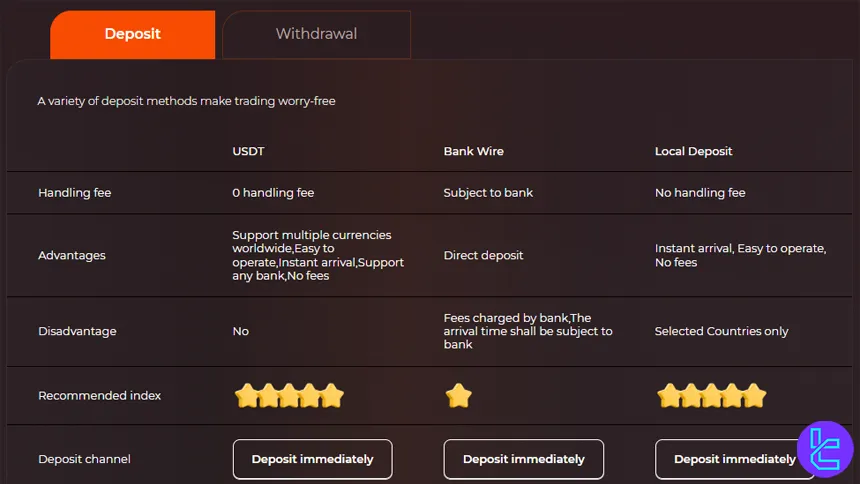

Withdrawal and Deposit

The lack of support for e-wallet payments is a disappointment in this WeTrade review. However, the broker offers UnionPay and Bank Wire methods for withdrawals. WeTrade deposit options:

- USDT (Tether)

- Bank Wire

- Local Deposit

Deposit Methods at WeTrade

WeTrade supports three funding options designed to suit different types of traders, including USDT, bank wire, and local payment methods.

Some methods have no handling fee, while others may depend on the banking institution. The system is designed to make deposits as smooth and fast as possible for all clients.

Here are the main deposit methods and their key terms:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

USDT | Multiple (crypto) | $10 | 0 | Instant |

Bank Wire | USD | $10 | Subject to bank (WeTrade does not charge) | N/A |

Local Deposit | Local currency (varies by country) | $10 | 0 | Instant |

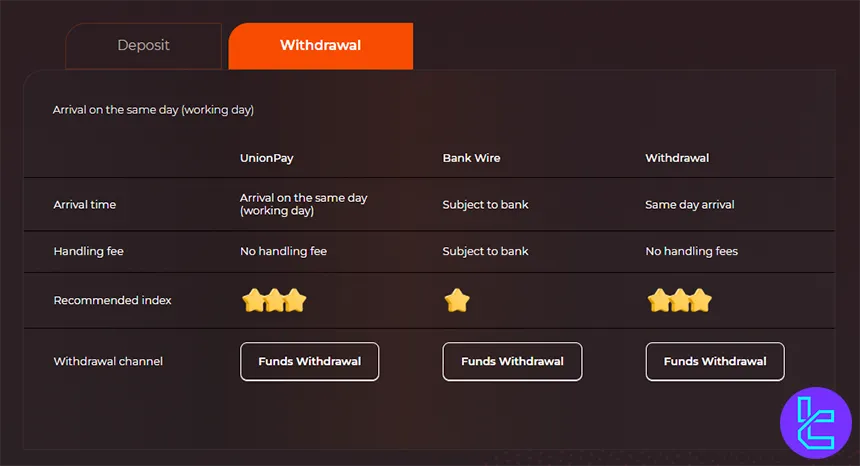

Withdrawal Methods at WeTrade

WeTrade provides a limited number of secure withdrawal options for its clients, mainly focusing on Bank Wire and UnionPay.

Withdrawals are generally free from broker fees, although third-party or bank charges may apply.

Here are the key withdrawal methods confirmed:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Bank Wire | USD | $5 | Subject to bank | N/A |

Union Pay | Local fiat | $5 | 0 | Same working day |

WeTrade Social Trading and MAM Solution

The company has developed a dedicated copy trading platform named WeTrade Social. It also offers MAM solutions for money managers and their clients.

- Social Trading: 540 strategies with profits of up to 22818%

- MAM: Two allocation methods, such as equal distribution or percentage-based

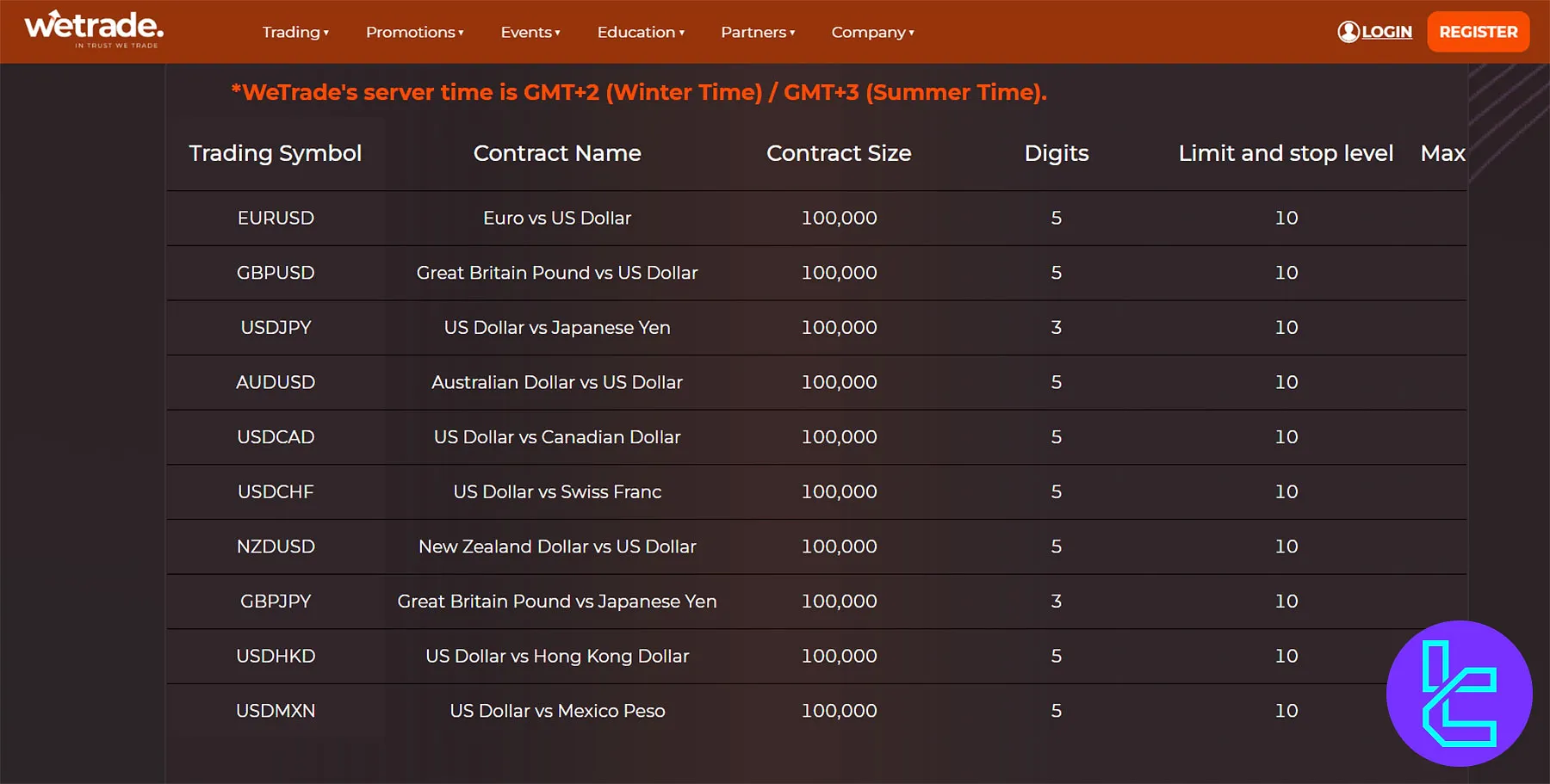

WeTrade Markets

WeTrade offers over 120 tradable instruments across six main asset classes including Forex, metals, cryptocurrencies and 3 more.

These instruments providing traders with flexible leverage and diversified trading opportunities worldwide.

Here are all you need to know:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Major, minor, exotic currency pairs | 37 | ~60–80 | 1:2000 |

Metals | Precious metals (gold, silver, etc.) | 3 | ~5–10 | 1:2000 |

Energies | Oil, gas (CFD) | 2 | ~5–8 | 1:100 |

Indices | Global market indices (CFD) | 10 | ~20–30 | 1:100 |

Stocks | US and HK stock CFDs | 61 | ~200–500 | 1:10 |

Crypto CFDs | 10 | ~10–30 | 1:50 |

WeTrade’s instrument selection combines breadth and leverage flexibility, enabling traders to diversify their portfolios efficiently across multiple asset classes.

WeTrade Promotions

The broker introduced the “Rewards Mall”, a loyalty program, in 2018. The wide range of promotional offerings is one of the upsides in this WeTrade review.

- Rewards Mall: One point for each traded lot on Forex, Metals, and Energies

- UEFA Champions League Guessing Campaign: Reward Points as prizes for correctly guessing the outcomes of UEFA matches

- WeTrade Social: A $2 cashback for every lot traded by your followers

- Trading Blitz Race 2025: 3-month demo trading competition with a $5,000 monthly prize

- Swap-Free Campaign: Trading Forex and Metals without swaps for 7 days and half prices for the next 7 days

- VIP Program: Up to $25,000 in cash rewards, Diamond MT4 account number, rewards coupon up to 93%, and 12% additional points

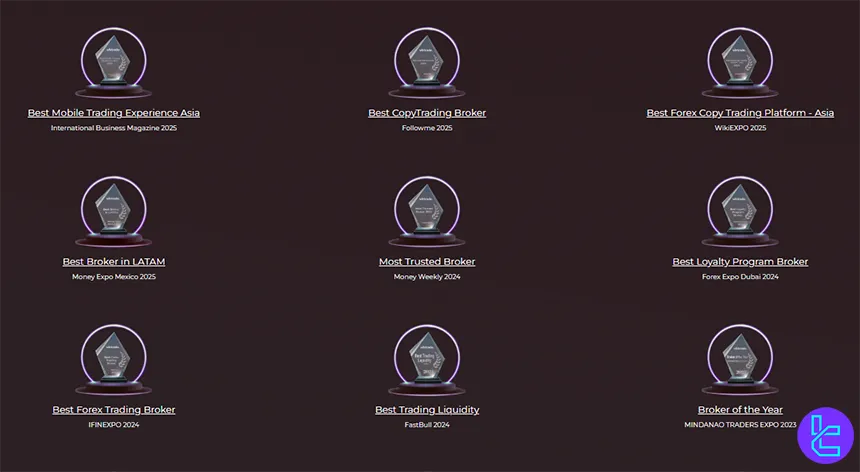

WeTrade Broker Awards

WeTrade has been widely recognized for its excellence; the broker has won multiple prestigious Awards, highlighting its strong reputation and commitment to service quality.

WeTrade awards highlight excellence in mobile trading, copy trading, and client loyalty, reflecting the broker’s leadership in global trading markets.

Here are some of the major awards in the requested order:

- Best Mobile Trading Experience Asia – International Business Magazine 2025

- Best CopyTrading Broker – Followme 2025

- Best Forex Copy Trading Platform – Asia – WikiEXPO 2025

- Best Broker in LATAM – Money Expo Mexico 2025

- Most Trusted Broker – Money Weekly 2024

- Best Loyalty Program Broker – Forex Expo Dubai 2024

How to Reach WeTrade Broker Support?

The company lacks a dedicated call center. It only offers a live chat feature and email for inquiries.

- Email: globalsupport@wetradefx.com

- Live Chat: Available on the official website

The online user reviews praise the customer support team for their prompt and helpful responses and services.

Geo-Restrictions

Due to regulatory requirements, the broker fails to provide services in certain jurisdictions, including:

- United States of America

- Canada

- Haiti

- Iran

- Suriname

- Democratic Republic of Korea

- Puerto Rico

- Occupied Area of Cyprus

- Syria

- Cuba

- Japan

- Russia

- Belarus

- Sudan

Always check the broker's terms and conditions or contact customer support to confirm availability in your region.

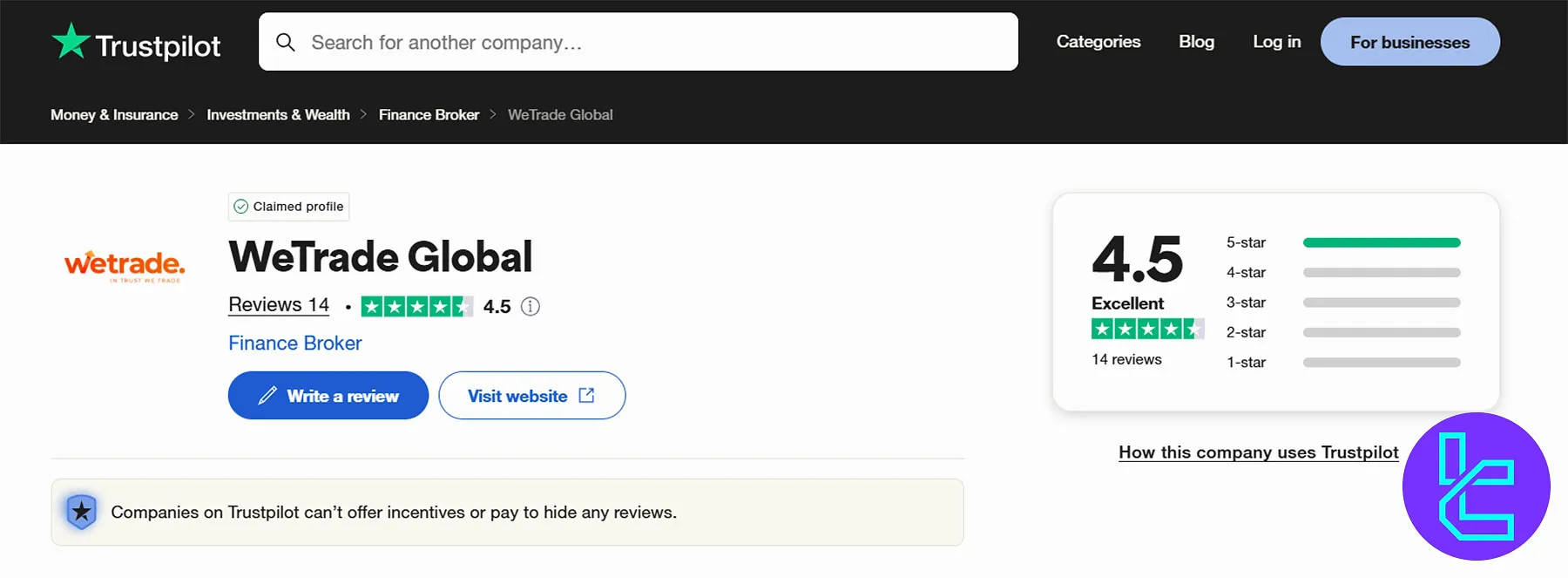

User Experience

There are not many WeTrade reviews on rating platforms. However, the few submitted comments paint a positive image of the broker and its services.

Google Reviews | 5 out of 5 based on 18 ratings |

4.5 out of 5 based on 14 reviews |

All the online reviews from the two platforms mentioned are 5-star (the highest rating). It's worth noting that the brokerage company claimed the profile on the mentioed website.

Educational Offerings

The broker has partnered with Jasper Lawler to provide weekly market insights and technical analysis. It also offers various learning materials and tools through its website's “Learn to Trade” and “Trading Central” sections.

- Learn to Trade: Candlestick Patterns, Videos, and Terminology

- Trading Central: Economic Calendar, MT4 Indicators, Analyst Views, and Web TV

WeTrade Compared to Other Brokers

Here's a comprehensive comparison between the reviewed broker and some other players in the industry:

Parameter | WeTrade Broker | Errante Broker | FBS Broker | Alpari Broker |

Regulation | FSA SVG, Labuan FSA, FSA Seychelles, CySEC, ASIC | CySEC, FSA | FSC, CySEC | MISA |

Minimum Spread | 0.0 Pips | From 0.0 pips | From 0.0 Pips | From 0.0 Pips |

Commission | From Zero | From $0.0 | From $0.0 | From $0.0 |

Minimum Deposit | $10 | $50 | $5 | $50 |

Maximum Leverage | 1:2000 | 1:1000 | 1:3000 | 1:3000 |

Trading Platforms | MT4, WeTrade App | Metatrader 4, Metatrader 5, cTrader, Mobile App | MT4, MT5, Mobile App | MetaTrade 4, MetaTrade 5, Mobile App, Web Trader |

Account Types | STP, Standard, ECN, Islamic | Standard, Premium, VIP, Tailor Made | Standard | Standard, ECN, Pro ECN, Demo |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 120+ | 150+ | 550+ | 120+ |

| Trade Execution | Market | Market | Market | Market |

Conclusion and Final Words

WeTrade offers access to 120+ trading instruments through the MT4 platform and WeTrade app, with spreads starting at 0.0 pips. It accepts USDT (deposit) and UnionPay (withdrawal) transactions. The broker has a Trustpilot score of 4.5 out of 5.