In 1988, a brokerage was founded by “Johny Abuaitah”, which we call Windsor Brokers today. With 15 international awards and FSA, JSC, and CMA regulations, this company offers copy trading and a maximum leverage of 1:2000.

Traders at Windsor Brokers can access a broad range of trading instruments, including forex pairs, commodities, metals, indices, cryptocurrencies, ETFs and shares. These instruments can be traded across Prime, Zero and Zero VIP accounts.

Windsor Brokers Company Introduction and Regulation

Windsor Brokers isn't just a single entity; it's a brand name used by several regulated companies to offer investment services globally. This multi-jurisdictional approach allows them to cater to a diverse client base while adhering to various regulatory standards.

Let's break it down:

Parameters | Windsor Brokers International Ltd (Seychelles) | Seldon Investments Ltd (Jordan) | Windsor Markets Ltd (Kenya) | Windsor Global Markets Ltd (BVI) |

Regulation | FSA Seychelles | JSC | CMA Kenya | FSC British Virgin Islands |

Regulation Tier | 4 | 2 | 2 | N/A |

Country | Seychelles | Jordan | Kenya | British Virgin Islands |

Investor Protection Fund / Compensation Scheme | Insurance up to 5 M USD | None | Insurance up to 5 M USD | None |

Segregated Funds | Yes | N/A | Yes | N/A |

Negative Balance Protection | Yes | Yes | Yes | N/A |

Maximum Leverage | 1:2000 | 1:100 | 1:400 | 1:2000 |

Client Eligibility | Global (excl. USA, EEA, UK, …) | Jordan, Palestine, Iraq | Kenya | Global (excl. USA, EEA, UK, …) |

These respected financial authorities ensure that Windsor Brokers plays by the rules, maintaining a sound investment environment and protecting your interests as an investor.

The broker implements key safeguards such as negative balance protection, client fund segregation, and identity verification (KYC), but does not participate in formal investor compensation schemes.

Table of Specifications

When it comes to trading conditions, Windsor Brokers doesn't believe in one-size-fits-all. Their dynamic approach to leverage and margin requirements is designed to minimize risks while maximizing opportunities. Here's a snapshot of what you can expect from this CMA-regulated forex broker:

Broker | Windsor Brokers |

Account Types | Prime, Zero, VIP Zero |

Regulating Authorities | FSA, JSC, CMA, FSC |

Based Currencies | USD, EUR, GBP, JPY |

Minimum Deposit | $50 |

Deposit Methods | Bank wired, Credit/Debit Card [VISA, MasterCard] |

Withdrawal Methods | Bank wired, Credit/Debit Card [VISA, MasterCard] |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:2000 |

Investment Options | Copy trading |

Trading Platforms & Apps | MT4 |

Markets | Forex, Shares, Commodities, Indices, Energies, Metals, Treasuries, Crypto |

Spread | Floating from 0.0 pips |

Commission | Varies By the Market |

Orders Execution | NDD, STP |

Margin Call/Stop Out | 100%/20% |

Trading Features | Demo account, Islamic Account, Negative Balance Protection, Personal Manager, 0.0 Spreads |

Affiliate Program | Yes |

Bonus & Promotions | Yes |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Live Chat, Phone Call, Ticket, Indoor Meetings, Email |

Customer Support Hours | 24/7 |

Restricted Countries | USA, EEA Countries |

What are Windsor Brokers Account Types?

Choosing the right account type can make or break your trading experience. Windsor Brokers offers a trio of options to suit different trading styles and experience levels; Windsor Account Types:

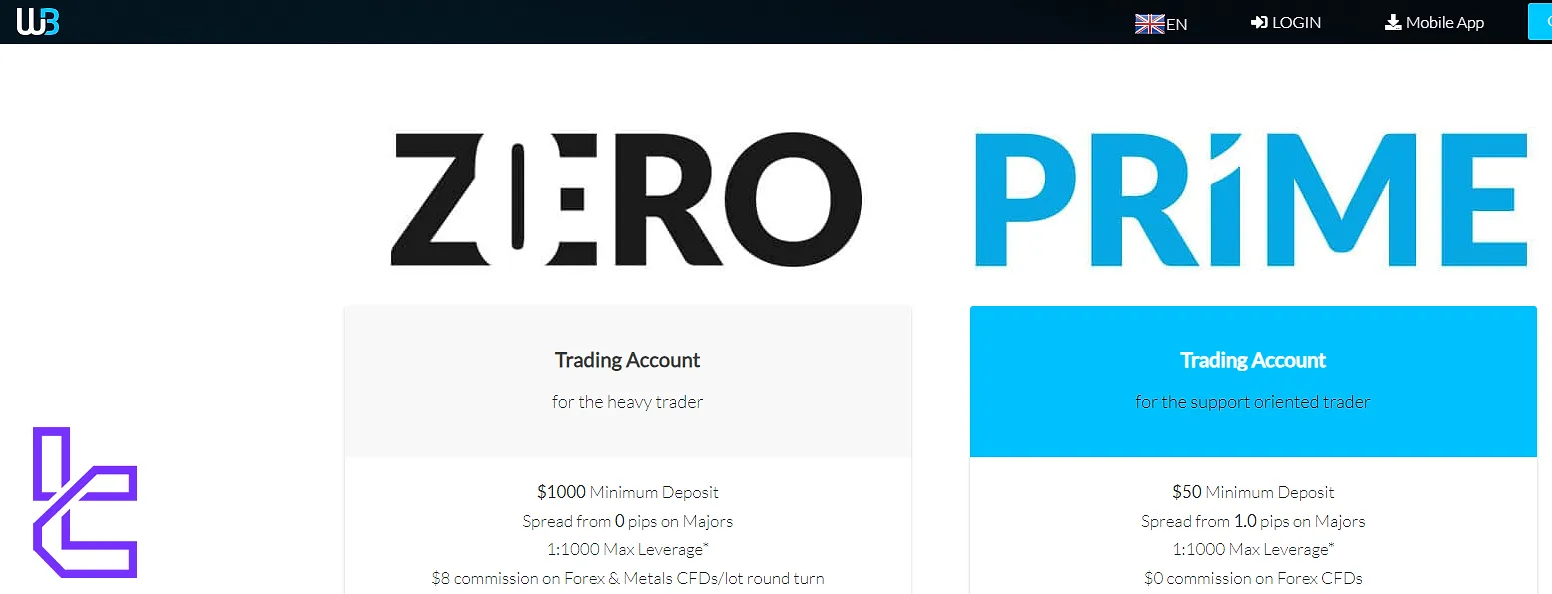

Specifics | Zero | Prime |

Minimum Deposit | $1000 | $50 |

Spreads | From 0.0 Pips | From 1.0 Pips |

Maximum Leverage | 1:2000 | 1:2000 |

Commissions | $8 on Forex, Metals and Crypto; 0$ on Other CFDs | $8 o Crypto, $0 on Other Instruments |

Minimum Trade | 0.01 | 0.01 |

Hedging | Allowed | Allowed |

Islamic Account | Available | Available |

Negative Balance Protection | Available | Available |

Personal Account Manager | Available | Available |

Stop Out | 20% | 20% |

Margin Call | 100% | 100% |

VIP ZERO account is the crème de la crème of traders with ultra-tight spreads and flexible commissions starting from $5 and higher trading volumes.

Whether you're taking your first steps in the forex market or you're a seasoned pro looking for institutional-grade conditions, Windsor Brokers has you covered.

The progression from PRIME to ZERO to VIP ZERO mirrors your journey from novice to expert, with each account type offering tools and features tailored to your evolving needs.

Pros and Cons

Every rose has its thorn, and every broker has its strengths and weaknesses. Let's put Windsor Brokers under the Trading Finder microscope:

Advantages | Disadvantages |

Wide Selection of Assets | No US Clients Accepted |

Low Minimum Deposit ($50 For Prime) | Only USD-Denominated Accounts |

Multiple Regulation Ensures Credibility | Mixed Customer Service Reviews |

Demo Account Available for Practice | Limited Direct Stock Trading |

Islamic/Swap-Free Accounts Offered | Few Trading Platforms |

Windsor Brokers shines with its forex offerings and regulatory compliance. The low entry barrier is a boon for beginners, while the demo account lets you test the waters risk-free.

However, the lack of USD account alternatives and the inability to serve US clients might be deal-breakers for some.

How to Open an Account in Windsor Brokers? Step-by-Step Guide!

Windsor Brokers registration is easier than it may seem; all you have to do is follow the instructions in the sections below.

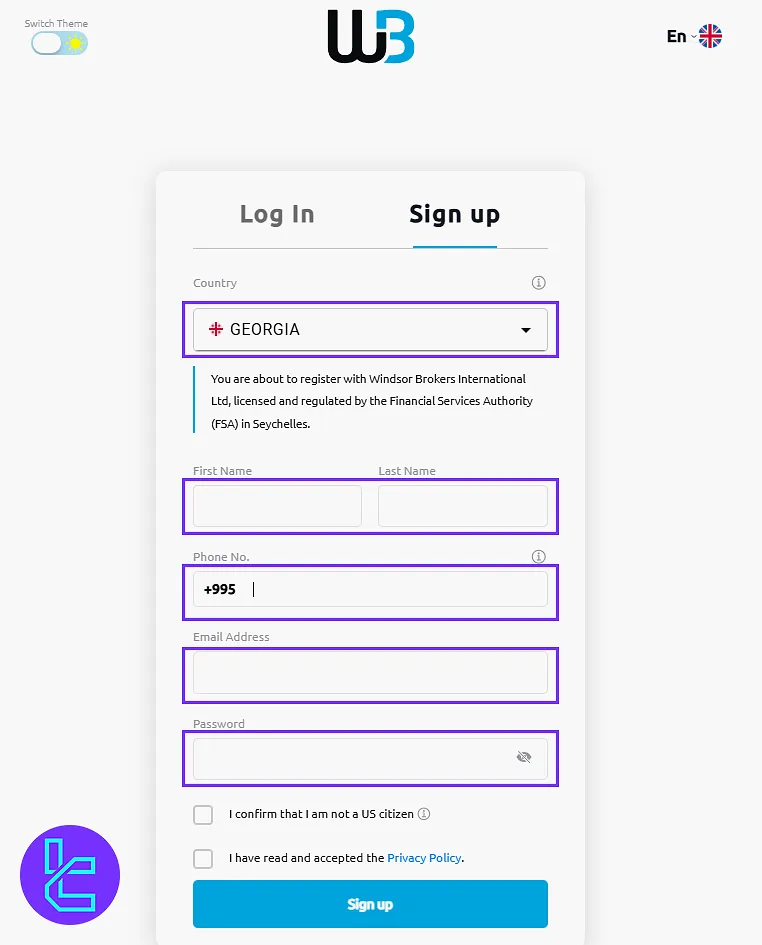

#1 Access the Windsor Website

Select “Go to Website" located at the top of this page. Once redirected, click on “Open Account” to begin.

#2 Fill Out the Sign-Up Form

Choose your country of residence, and submit your first name, last name, email, and a secure password.

Tick the box confirming you're not a U.S. resident and accept the terms and conditions. Click Sign Up to proceed.

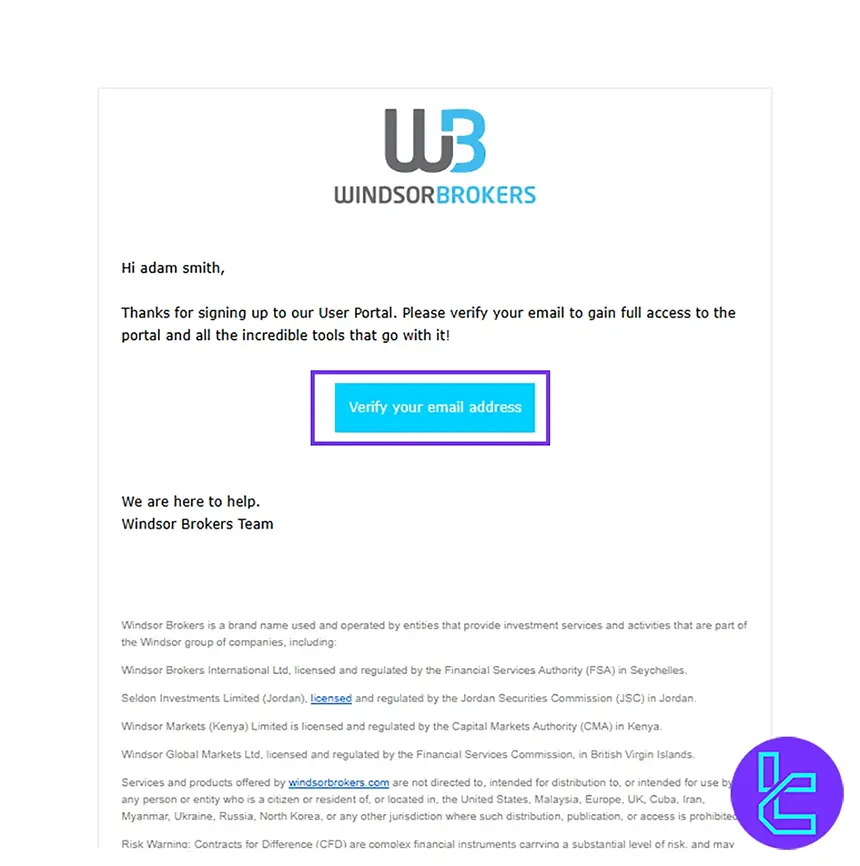

#3 Confirm Your Email Address

Check your inbox for Windsor’s confirmation email. Click the verification link inside to activate your account.

Afterward, you can complete your profile and access the Windsor dashboard.

#4 Windsor Brokers Verification

After registering with Windsor Brokers and verifying your email, completing Windsor Brokers verification is required to access the full trading platform.

Traders must follow an 8-step verification procedure to unlock all platform functionalities. This guide explains how to fill out the Investor Information and Trading Experience forms, as well as how to submit the required identity and residence documents.

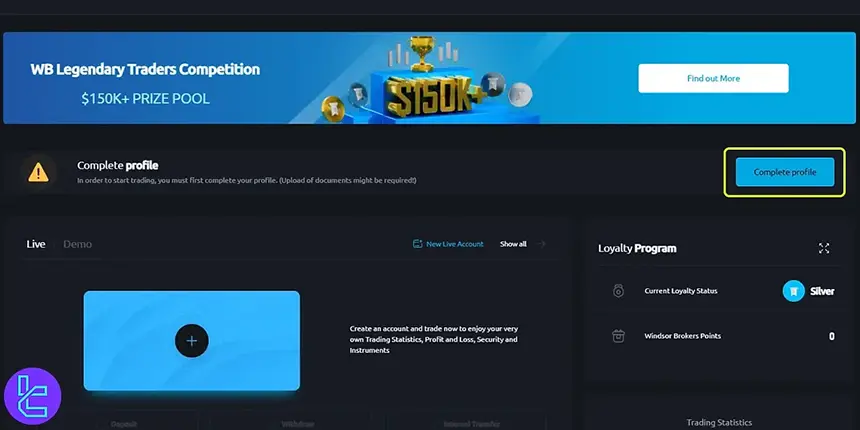

#1 Enter Windsor Account Verification Section

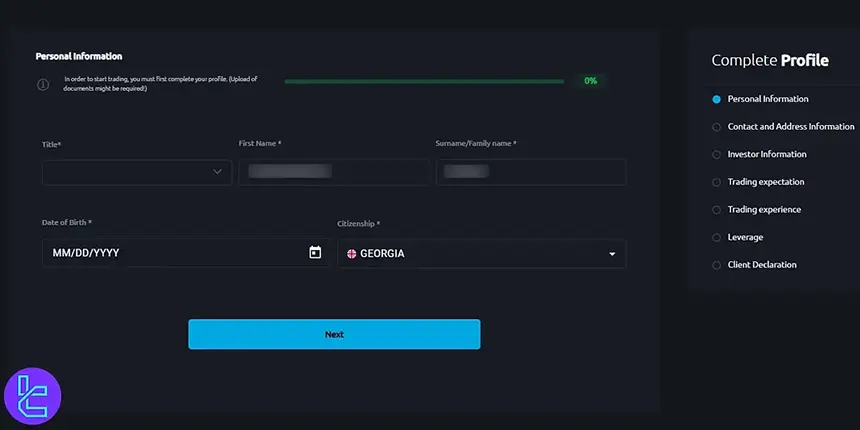

Click the "Complete Profile" button to begin.

On the subsequent page, provide your title, first and last name, date of birth, and country of residence.

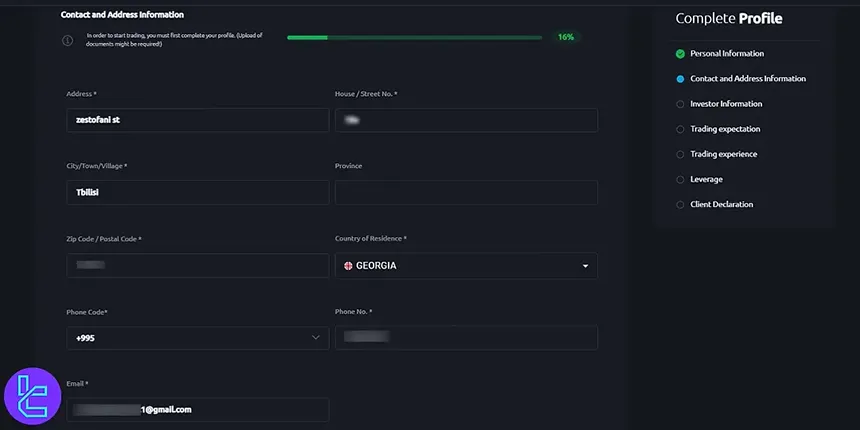

#2 Provide Your Residential Address

Enter your full residential details including street number, city, postal code, and country. Accuracy is crucial for verification purposes.

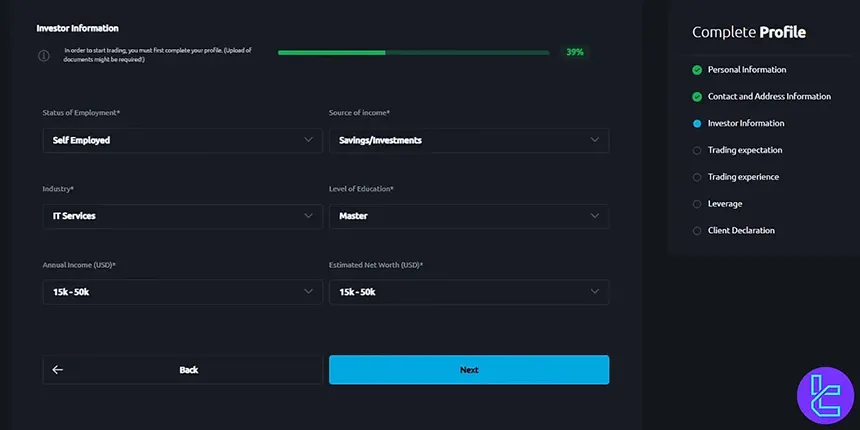

#3 Fill Out the “Investor Information” Form

Provide professional and financial information, including your occupation and estimated annual income.

Include details about your planned trading volume and source of capital intended for trading.

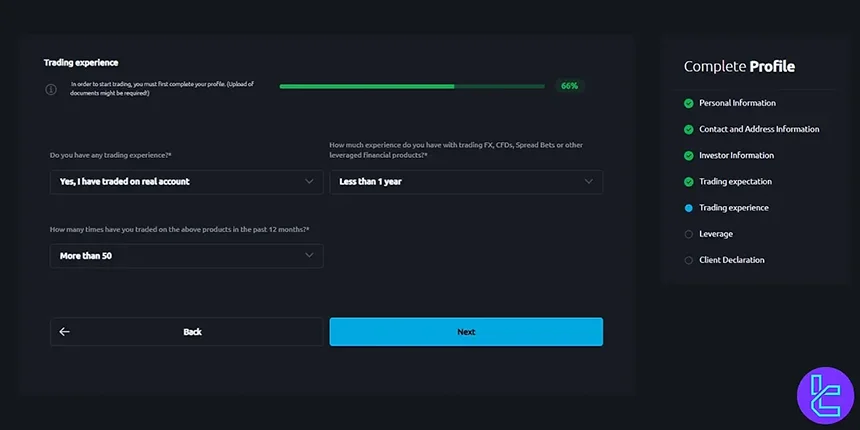

#4 Complete the “Trading Experience” Form

Respond to the questions based on your prior experience with trading.

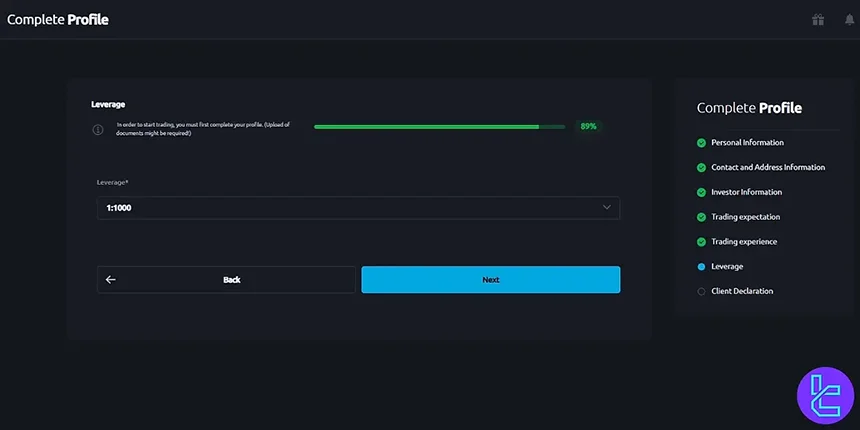

Select your preferred account leverage according to your experience and risk profile.

#5 Agree with Windsor Agreements

Carefully review the platform’s terms and conditions. After confirming your agreement by ticking the checkboxes, click “Finish” to proceed.

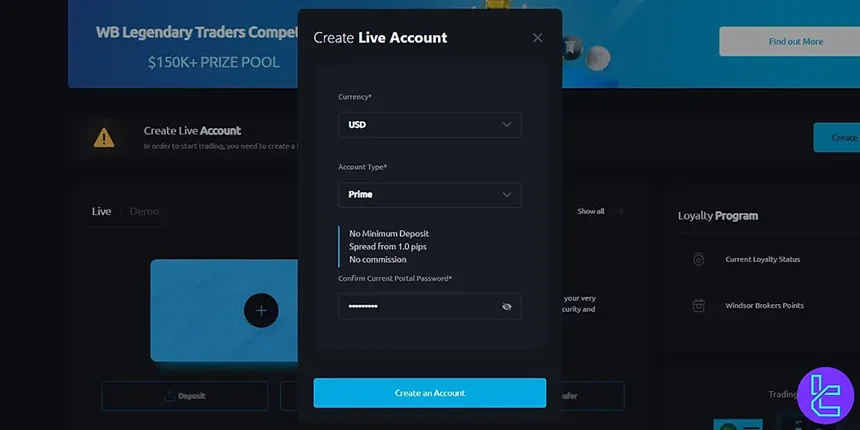

#6 Choose Your Account Details

Select your account type, Prime or Zero, then choose your base currency. Finally, create a secure password for the client portal.

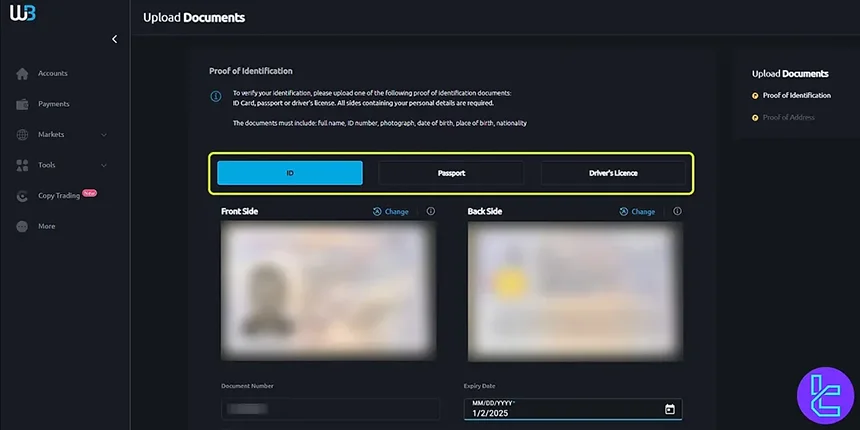

#7 Upload Proof of Identity Documents

On the identity verification page, upload a government-issued ID, passport, or driver’s license. Ensure both front and back images are provided. Enter the document number and expiration date, then click “Submit Proof of Identification”.

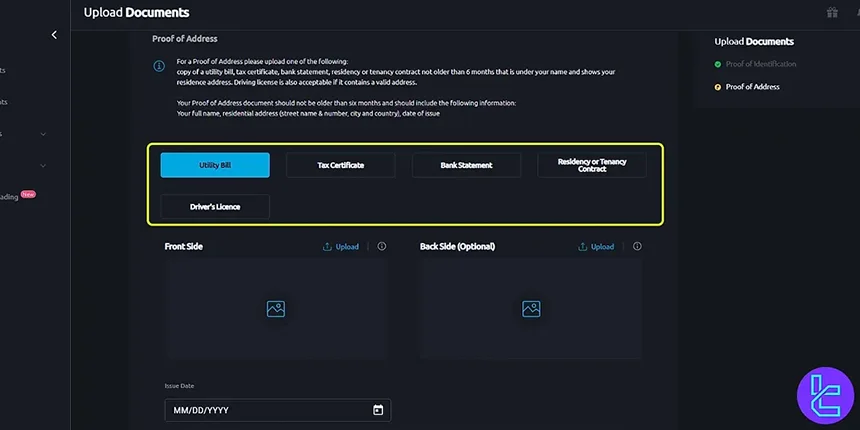

#8 Upload Proof of Address Documents

Provide proof of residence such as a utility bill, bank statement, tax certificate, driver’s license, or residency permit. Upload both sides of the document, enter its number and expiration date, and click “Submit Proof of Residence”.

Trading Platforms

When it comes to platforms, Windsor Brokers doesn't reinvent the wheel – they polish it to a high shine. The star of the show is MetaTrader 4 (MT4), available in various flavors:

- Windows: The full-fat desktop experience with all the trimmings

- MAC: Complete application with all features for Mac users

- WebTrader: Trade from any browser, no download necessary

- Android: Android app for trading on the go

- iOS: Optimized for everything that runs with iOS, including iPad or iPhone

Windsor Brokers also offers their own mobile app for Android and iOS, giving you a taste of their custom-built trading experience.

However, the low variety of trading platforms and the lack of support for other platforms, including cTrader and MetaTrader 5, are some of Windsor's major weaknesses. Download Links:

Windsor Brokers Fee Structure

Let's talk money – specifically, how much of it stays in your pocket. Windsor Brokers' fee structure is competitive, but it pays to know the details:

Specifics | Zero | Prime | VIP Zero |

From 0.0 Pips | From 1.0 Pips | Tighter Spreads Than Standard Zero Account | |

Commission | $8 On Forex, Metals and Crypto; 0$ On Other CFDs | $8 O Crypto, $0 On Other Instruments | Flexible Commission From $5 Per Round-Turn |

Swap Fee at Windsor Brokers

When a position is held overnight at Windsor Brokers, a rollover (swap) charge or credit is applied based on the interest rate differential of the instrument. Swap on FX and other applicable products is tripled on Wednesdays.

The fee can vary by symbol and in some cases results in a net debit even on long positions.

To break down the most practical points:

- Swap is calculated using the formula "swap value × pip value in USD × number of lots";

- Swap applies only to FX, spot metals, spot indices and CFD shares, not all instruments;

- Swap-free / Islamic accounts replace swaps with a daily storage fee that is always negative;

- Storage fees on swap-free accounts are tripled on Fridays for weekend rollover.

Non-Trading Fees at Windsor Brokers

When it comes to non-trading fees, Windsor Brokers keeps costs relatively transparent; there are no deposit fees, but withdrawals may incur a fixed charge per transaction, depending on the method.

However, the broker reserves the right not to cover withdrawal costs for clients with very little or no trading activity on their account.

Here are the key non-trading cost points to know:

- Deposit fees: Windsor does not charge clients for deposits, though their payment provider might;

- Withdrawal fee: $3 / €3 / £3 for same-day withdrawals in major currencies, depending on method;

- Inactivity / low-activity risk: If the account has “no or minimal trading activity”, Windsor may refuse to cover payment provider fees on withdrawals;

- Bonus-account termination: For the $30 welcome-bonus account, inactivity of 30 days (within a 6-month validity window) can result in cancellation of credit and associated profit.

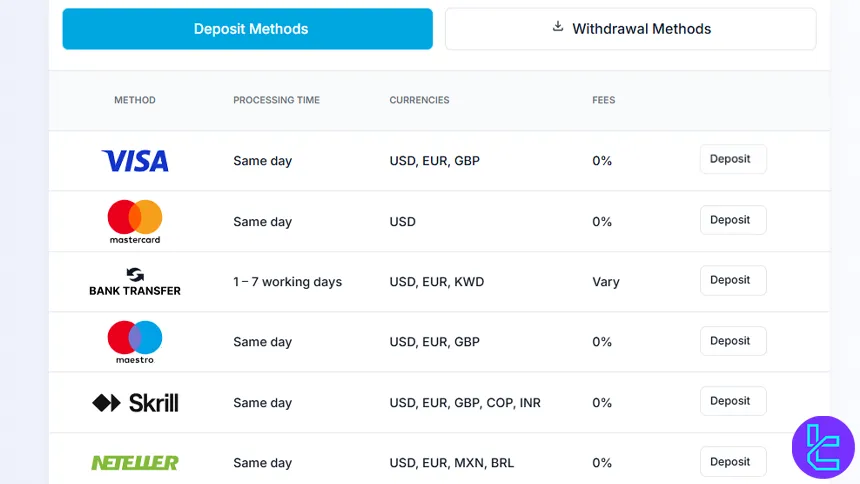

What are Windsor Brokers Payment Methods?

Getting money in and out of your trading account should be hassle-free, and Windsor Brokers seems to agree. Windsor Brokers Forex Payment Methods:

- VISA

- Mastercard

- Wire transfers

Key points of withdrawal and deposit in Windsor:

- Same-day processing for most funding methods

- Withdrawal times vary from same-day to 5-7 days

- Some methods have a $25,000 max limit with no fees

- Funds go back to the initial deposit source first

- Additional verification for withdrawal may be required

- Active bonuses must be fully traded before withdrawal

Pro Tip: Always check the specific terms for your region. South African traders, for instance, have slightly different options and fees compared to other regions.

Deposit Methods at Windsor Brokers

When funding a Windsor Brokers account, clients can choose from multiple electronic and banking methods that support different currencies and regions.

According to the broker, all deposits are processed without any fees charged by Windsor itself. The availability of each method may vary depending on the client’s country of residence and account profile.

Based on this, the primary deposit options are:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Credit / Debit Card | USD, EUR, GBP | $50 | 0% | Same day |

Bank Wire Transfer | USD, EUR, KWD | $50 | Depends on bank | 1–7 working days |

E-Wallets (Neteller, Skrill) | USD, EUR, GBP, COP, INR, MXN, BRL | $50 | 0% | Same day |

Withdrawal Methods at Windsor Brokers

When you request a withdrawal from your Windsor Brokers account, you can use the same payment methods as for deposits: credit/debit cards, bank wire or e-wallets.

Withdrawal requests are processed within one business day, but the time for funds to reach your account depends on the method used.

Here are the details:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Processing Time |

Credit / Debit Card | USD, EUR, GBP | Not specified | $3 / €3 / £3 per transaction | Same day |

Bank Wire Transfer | USD, EUR, KWD | Not specified | Variable (depends on bank) | 1–7 working days |

E-Wallets (Neteller, Skrill) | USD, EUR, GBP, COP, INR, MXN, BRL | Not specified | Variable | Same day |

Does Windsor Support Copy Trading?

In the Windsor Broker review, we found out that they support copy trading. For those who'd rather follow than lead, Windsor Brokers' copy trading feature is a game-changer. Here's how it works:

- Strategy Providers: Set up profiles showcasing their trading prowess

- Investors (Followers): Browse and select providers based on performance and risk appetite

- Automatic Copying: Begins once you activate a subscription

- Pay for Success: Fees are only charged on profitable trades

Remember, though, copy trading isn't a magic bullet. It carries its own risks, and you should always do your due diligence before following any strategy provider.

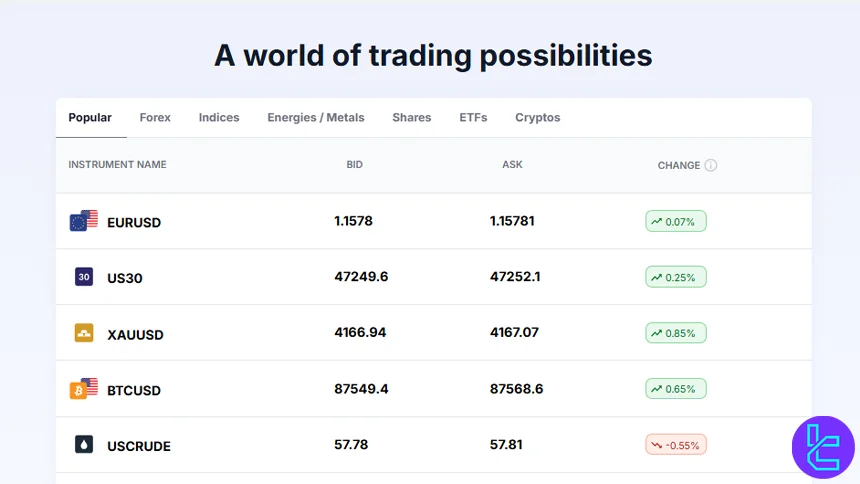

What Markets are Available on Windsor Brokers Forex?

Windsor Brokers offers a diverse range of trading instruments across multiple asset classes, catering to both retail and professional traders.

From major and exotic currency pairs to commodities, indices, and cryptocurrencies, the broker provides access to over 50 FX pairs and hundreds of other instruments, each with competitive leverage.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Currency CFDs (majors, minors, exotics) | 45 | ~ 40–70 | 1:2000 |

Indices | Global Indices CFDs | 15+ | ~ 10–30 | 1:700 |

Commodities | Soft & Hard Commodities CFDs | 6 | ~ 20–40 | 1:50 |

Metals | Spot Metals CFDs | 7 | ~ 5–10 | 1:500 |

Crypto CFDs | 10 | ~ 20–100 | 1:500 | |

Shares | Share CFDs | 150+ | ~ 100–200 | 1:20 |

Energies | Energy CFDs | 5 | ~ 5–20 | 1:200 |

Treasuries | Treasury CFDs | 4 | ~ 5–10 | 1:250 |

ET Fs | ETF‑CFDs | 12 | ~ 10–50 | 1:20 |

This breadth allows traders to build diversified strategies while taking advantage of flexible margin requirements and dynamic market conditions.

Windsor Brokers Bonus and Promotional Plans

Windsor Brokers Forex knows how to sweeten the deal for its traders and has 3 promotional plans:

- $30 Deposit Bonus: For new Prime Account holders, available in USD, EUR, GBP, or JPYwith a simple 3-step application process

- Loyalty Programme: Earn points based on trading volume, Redeem points for additional trading balance, Availablذents

- Legendary Traders Competition: $150,000+ prize pool, Potential for lucrative rewards

These promotions add an extra layer of value to your trading experience. Just remember to read the terms and conditions carefully – bonuses often come with specific trading requirements.

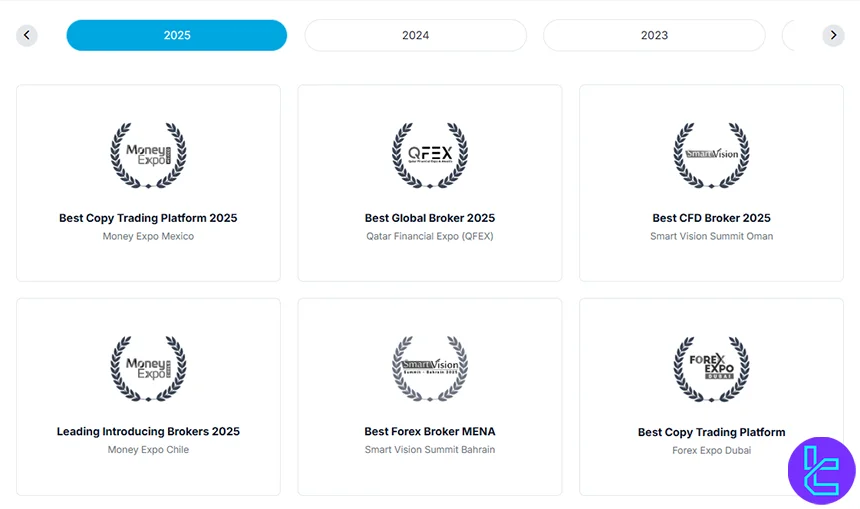

Windsor Brokers Awards

Windsor Brokers has earned a remarkable reputation in the financial trading industry, consistently being recognized for excellence in service, technology, and customer support.

The broker’s commitment to innovation and reliability is highlighted by numerous prestigious Windsor Brokers awards, which showcase their global impact.

Here are some of the most notable awards:

- Best Copy Trading Platform 2025 – Money Expo Mexico

- Best Global Broker 2025 – Qatar Financial Expo (QFEX)

- Best CFD Broker 2025 – Smart Vision Summit Oman

- Leading Introducing Brokers 2025 – Money Expo Chile

- Best Forex Broker MENA 2025 – Smart Vision Summit Bahrain

- Top 100 Trusted Financial Institutions 2025 – Smart Vision Summit Financial Markets Awards

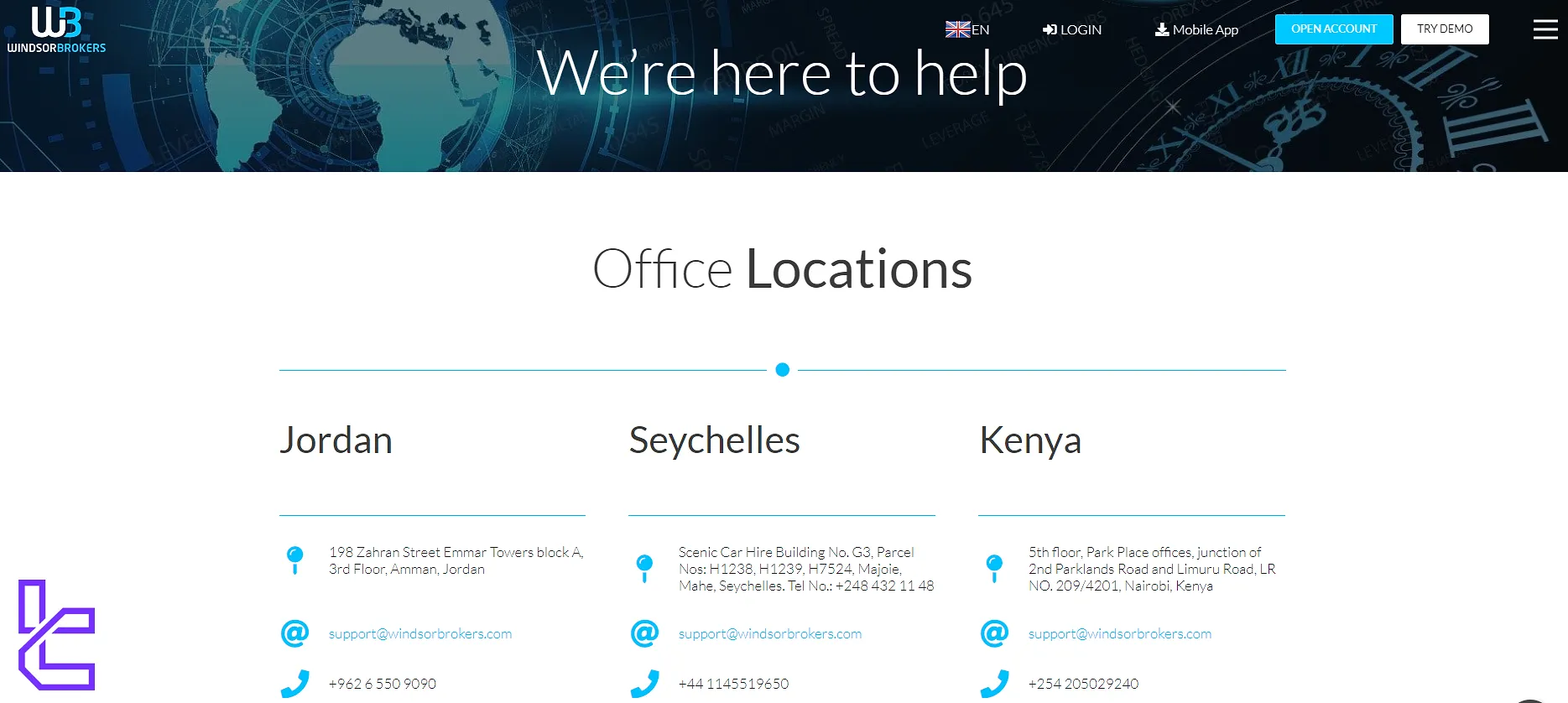

Customer Support

When you need help, Windsor Brokers offers multiple support channels:

Phone Support:

- Jordan: +962 6 550 9090

- Seychelles: +44 1145519650

- Kenya: +254 205029240

Email Support:

support@windsorbrokers.com

Offices:

- Amman, Jordan: Emmar Towers block A, 3rd Floor

- Mahe, Seychelles: Scenic Car Hire Building

- Nairobi, Kenya: Park Place offices

In addition to the above methods, live chat is another way to communicate with Windsor support, which is active 24 hours a day and answers users' questions.

Windsor Brokers Restricted Countries

Windsor Brokers serves clients worldwide through its various regulated entities. But not everyone can use the Windsor Brokers' services. Here's the scoop on geo-restrictions:

- Major Exclusion: The United States is a no-go zone. US citizens or residents can't access Windsor Brokers' services;

- EEA Restrictions: The European Economic Area is also off-limits for Windsor Brokers International Ltd.

Always check if your country is on the approved list before attempting to open an account.

Windsor Brokers Trust Score

In the Windsor Brokers Review, we discovered that the company's trust score on various websites, including Trustpilot and ForexPeaceArmy, combines different opinions. Windsor Brokers Forex Trust Scores:

- Trustpilot: 2.8 out of 5 based on 53 reviews

- Windsor ForexPeaceArmy: 1.7 out of 5 based on 182 reviews

Does Windsor Brokers Provide Educational Materials?

Windsor Brokers takes trader education seriously. Here's what they offer:

Free Forex Webinars

- Cover technical and fundamental analysis

- Topics include Fibonacci levels and more

- Suitable for all skill levels

- Register through the user portal

Educational Videos

- Available on the website

- Cater to beginners and advanced traders

- Help elevate trading knowledge

Forex Glossary

- Comprehensive list of trading terms

- Helps demystify industry jargon

Windsor Brokers in Comparison to Its Competitors

Here's a table comparing the broker's specifics against the industry:

Parameter | Windsor Brokers | XM Broker | Exness Broker | AMarkets Broker |

Regulation | FSA, JSC, CMA, FSC | ASIC, FSC, DFSA, CySEC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | FSA, FSC, Misa, FinaCom |

Minimum Spread | Floating from 0.0 pips | From 0.6 Pips | From 0.0 Pips | From 0.0 pips |

Commission | From Zero | $0 (except on Shares account) | From $0.2 to USD 3.5 | From $0.0 |

Minimum Deposit | $50 | $5 | $10 | $100 |

Maximum Leverage | 1:2000 | 1:1000 | Unlimited | 1:3000 |

Trading Platforms | MT4 | MT4, MT5, Mobile App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MetaTrade 4, MetaTrade 5, Mobile App |

Account Types | Prime, Zero, VIP Zero | Micro, Standard, Ultra Low, Shares | Standard, Standard Cent, Pro, Raw Spread, Zero | Standard, ECN, Fixed, Crypto, Demo |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 190+ | 1400+ | 200+ | 550+ |

| Trade Execution | NDD, STP | Market, Instant | Market, Instant | Instant, Market |

Expert Conclusion and Final Words

Windsor Brokers offers 3 account types [Prime, Zero, VIP Zero], copy trading, $50 minimum deposit, 0.0 pips spread, and0 commission. However, this company has flaws; Windsor does not serve US clients, and its only trading platform is Metatrader 4!