Zero Markets has partnered with Wolves soccer club and some of the top liquidity providers, including Barclays, BNP Paribas, and Credit Suisse.

As a result, Zero Markets broker offers tight conditions like commission-free (except for Shares and ETFs) and swap-free trading with Raw spreads from 0.0 pips through its 3 main account types, including Islamic and Super Zero.

Zero Markets; Company Information and Regulation

Zero Markets Group is a Forex brokerage company operating through various entities with various licenses, including:

Entity Parameters / Branches | SVG (ZERO Markets LLC) | NZ (ZERO Markets NZ Ltd) | MU (Zero Financial Ltd) | AU (ZERO Securities Pty Ltd) |

Regulation | SVG FSA (registration) | FMA | FSC Mauritius | ASIC (AFSL 244040) |

Regulation Tier | N/A | 1 | 3 | 1 |

Country | St. Vincent & Grenadines | New Zealand | Mauritius | Australia |

Investor Protection Fund / Compensation Scheme | None | None | None | None |

Segregated Funds | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:500 | 1:30 | N/A | 1:30 |

Client Eligibility | Global (non-restricted) | NZ residents only | Global (non-restricted) | Australia residents |

The company was founded in 2017 in Australia. Zero Markets LLC is registered in St. Vincent and the Grenadines (LLN. 503 LLC 2020.)

Zero Markets Specifications

The forex broker is regularly audited by BDO Australia to ensure compliance with regulatory requirements. Thus, it offers some of the best trading conditions out there, including:

Broker | Zero Markets |

Account Types | Standard, Super Zero, Islamic Raw, Islamic Standard |

Regulating Authorities | ASIC, FMA, FSC, FSA |

Based Currencies | USD, EUR |

Minimum Deposit | 100 AUD |

Deposit Methods | Visa, MasterCard, Neteller, Skrill, EPay, SticPay, Apple/Google Pay, Crypto, Bank Wire, AIRTM, ZOTAPAY |

Withdrawal Methods | Visa, MasterCard, Neteller, Skrill, EPay, SticPay, Apple/Google Pay, Crypto, Bank Wire, AIRTM, ZOTAPAY |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:30 (ASIC, FSC) 1:500 (FSA) |

Investment Options | Copy Trading |

Trading Platforms & Apps | MT4, MT5, WebTrader, Signal Start |

Markets | Forex, Commodities, Indices, Shares, ETFs, Crypto |

Spread | From 0.0 pips |

Commission | From $0.0 per lot |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 50% |

Trading Features | Social trading (Signal Start), Autochartist plugin, Demo trading |

Affiliate Program | Yes |

Bonus & Promotions | Referral, IB, Money Mangers |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, Live Chat, Call back request, WhatsApp, Facebook Messenger, Tel |

Customer Support Hours | 24/5 |

Zero Markets Pros and Cons

The broker’s servers are located in the NY4 Equinix Data Centre in New York, ensuring fast executions. However, the company also has flaws, too.

Advantages | Disadvantages |

Regulated by multiple tier-1 authorities | No negative balance protection |

Competitive spreads and commissions | Limited educational resources |

Advanced copy trading features | No support for TradingView |

Free VPS service for eligible accounts | Not available to US traders |

The company’s robust regulatory framework, that we discussed earlier in this Zero Markets review, ensures that it adheres to strict financial standards, including client fund segregation and transparent pricing (no requotes or hidden fees.)

Zero Markets Broker Account Types

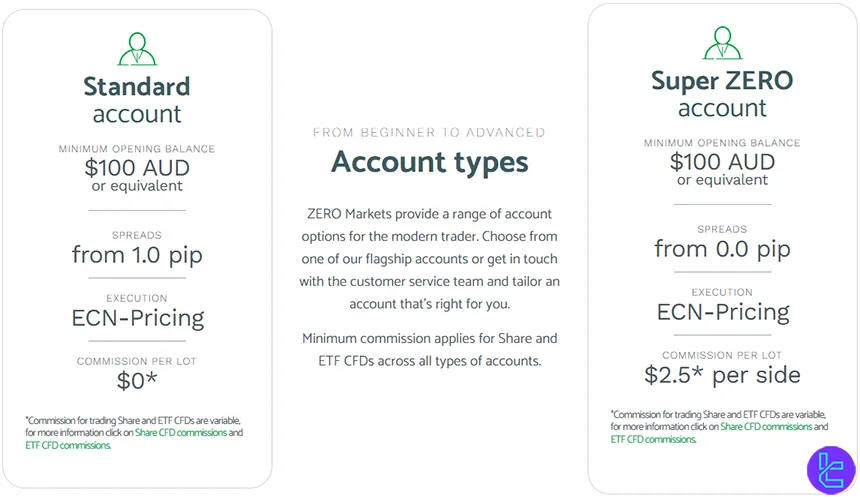

The company caters to a diverse trading community with 4 main account types, including Standard, Super Zero, Islamic Standard, and Islamic Raw, with the following key features:

Features | Standard | Super Zero | Islamic Standard | Islamic Raw |

Min Deposit | 100 AUD | 100 AUD | 100 AUD | 100 AUD |

Execution | ECN-Pricing | ECN-Pricing | ECN-Pricing | ECN-Pricing |

Min Trade Size | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots |

Trading Spreads from (Pips) | 1.0 | 0.0 | 1.0 | 0.0 |

Commission | $0.0 | $2.5 per side | $0.0 | $2.5 |

The brokerage accepts several base currencies for the accounts, including AUD, USD, EUR, GBP, etc. All accounts include a negative balance protection.

Registration and KYC

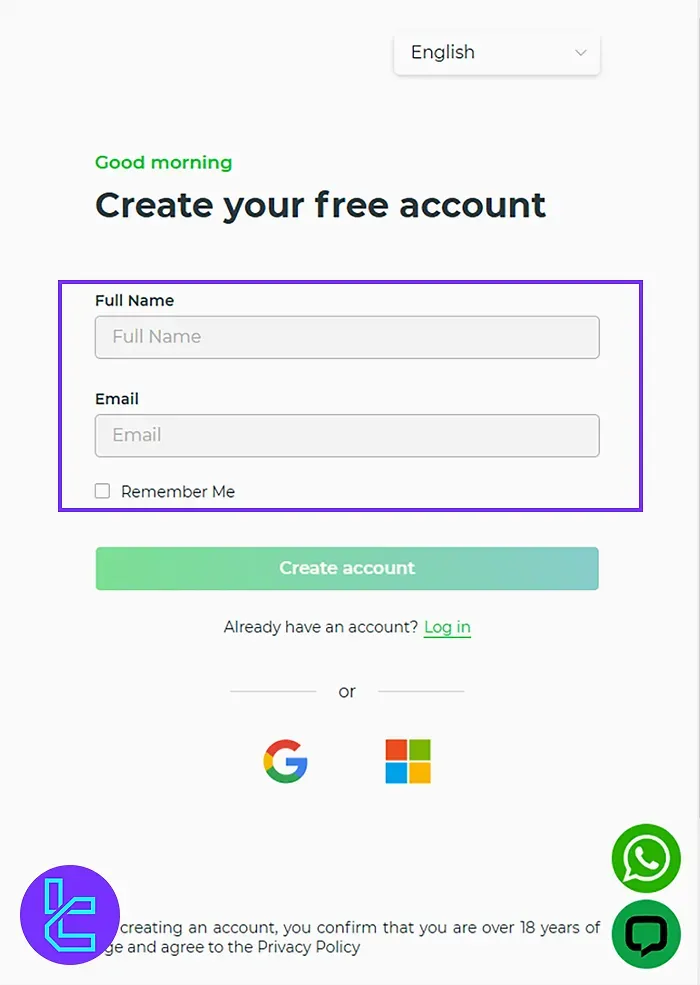

Getting started with Zero Markets Registration is a straightforward process, but it requires thorough electronic verification to meet regulatory standards and guarantee account security. This process also ensures a smooth onboarding experience for new traders.

#1 Start from the Official Broker Page

Begin by navigating to the official Zero Markets website, typically accessed via a trusted review source. From the homepage, select “Open Account” to enter the signup flow.

#2 Provide Your Information on Zero Markets & Confirm Your Email

Follow the steps below to complete registration:

- Input your full name and email address carefully;

- Select “Remember Me” to store your login information in the browser;

- Then, click “Create Account” to proceed.

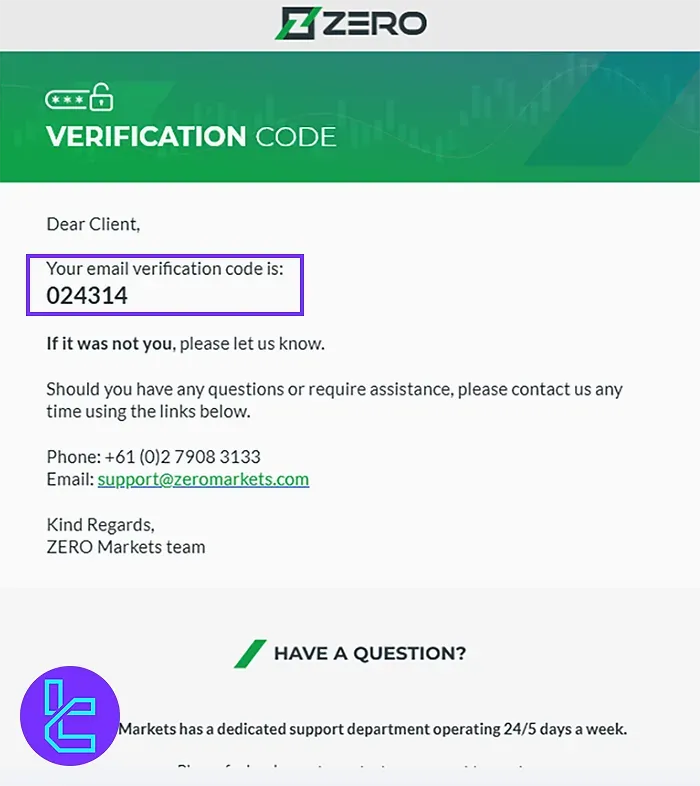

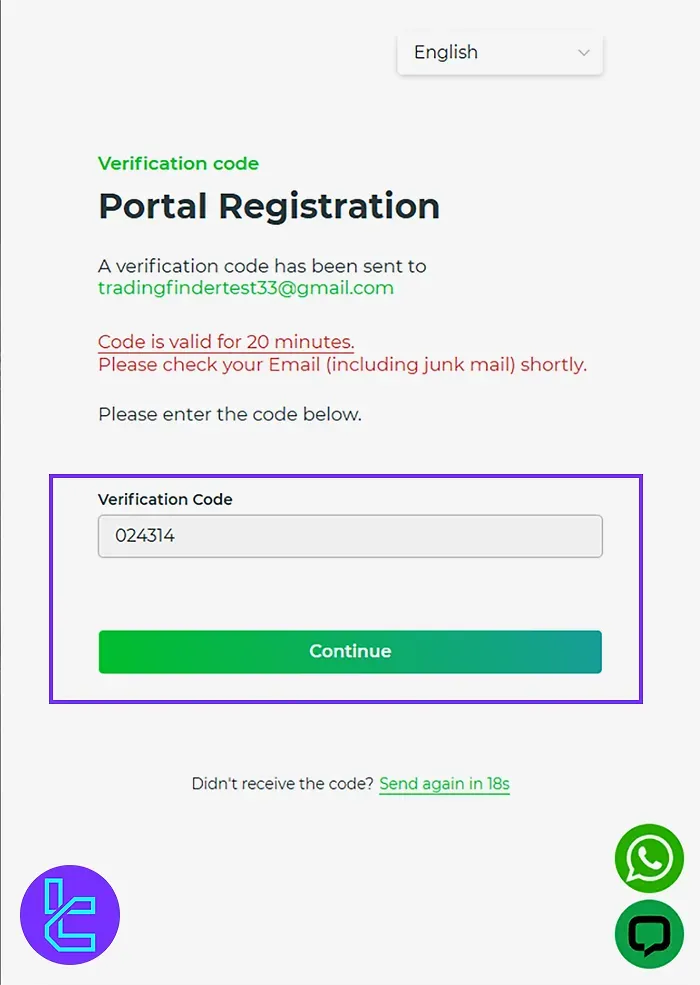

A verification code will be sent to your email and will remain valid for 20 minutes.

Copy the code from your email and paste it into the verification field. Then, click continue to proceed.

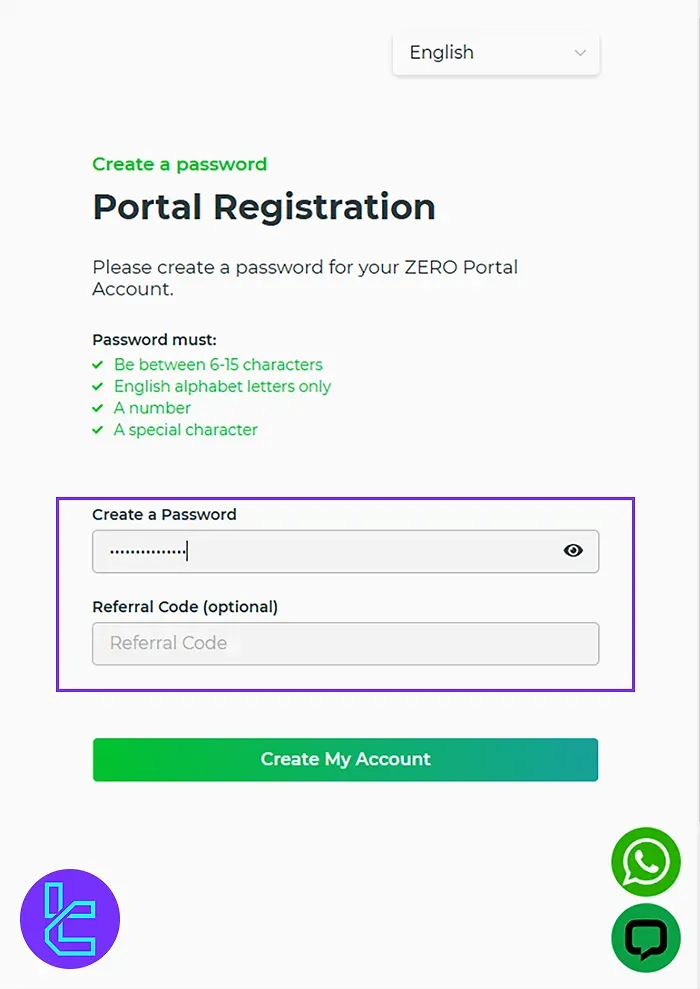

#3 Choose a Strong Password

Set a secure password using a mix of letters, digits, and symbols (6–15 characters). If you have a referral code, this is where it should be entered.

#4 Configure Your Trading Account

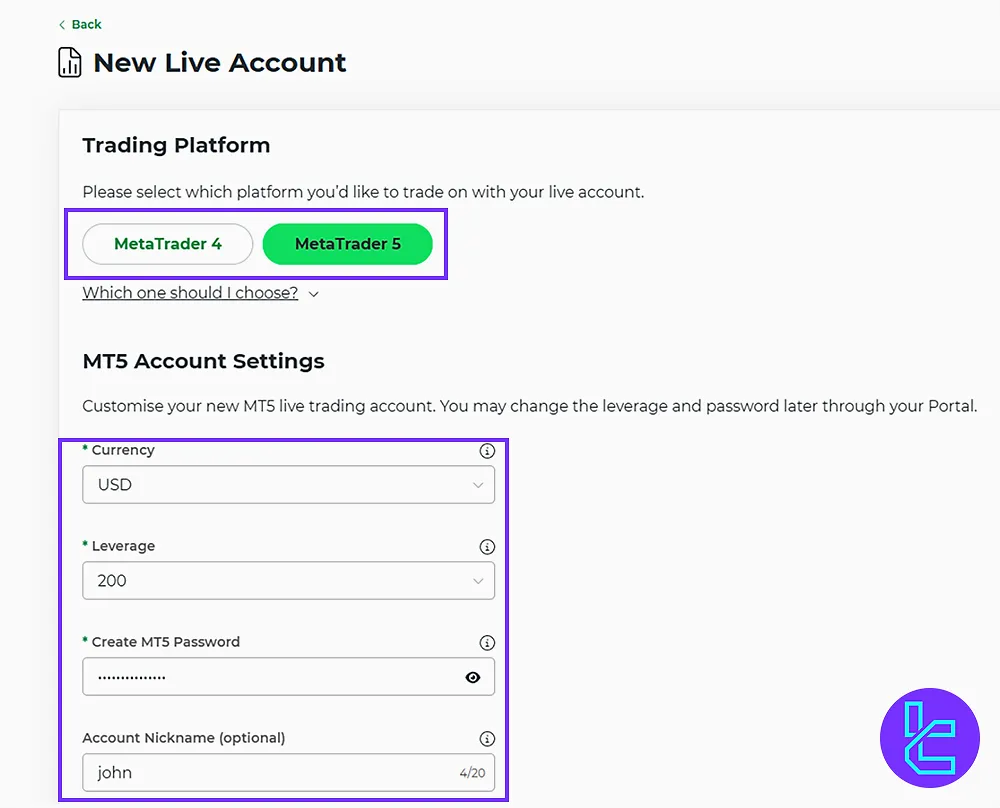

Choose between a Live or Demo setup. Then define:

- Trading platform: MetaTrader 4 or 5

- Preferred base currency

- Desired leverage

- Account type: Standard or Super Zero

- Personal account nickname

Finalize your selections and click “Create My Account” to complete the registration.

#5 Verify Your Identity

- Navigate to the profile section and verify your phone number;

- Provide proof of identity (passport or driving license) and proof of residence (utility bill or bank statement).

Trading Platforms and Apps

The company offers a selection of industry-standard trading platforms, from the robust MetaTrader 4 and MetaTrader 5 to the user-friendly social trading platform Signal Start. It also has a WebTrader in place which requires no downloads.

MetaTrader 4 (MT4)

- MT4 Android

- MT4 iOS

- Desktop

MetaTrader 5 (MT5)

- MT5 Android

- MT5 iOS

- Desktop

Signal Start

Zero Markets Broker Fees Explained

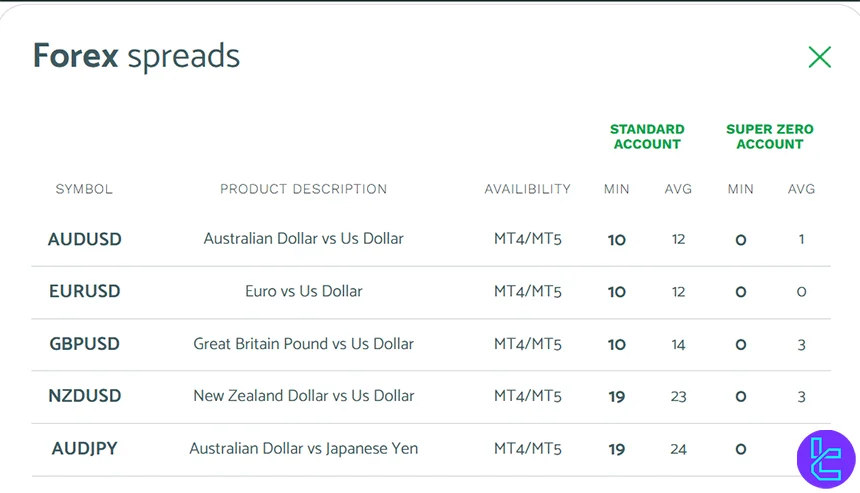

Zero Markets offers a transparent pricing model, involving spreads, commissions, and swap rates, across its account types.

Key features of the company’s fee structure:

- Standard / Islamic Standard Accounts: No commissions and 1.0 pip mark-up on market spreads

- Super Zero / Islamic Raw Accounts: A $2.5 commission per side and market spreads from 0.0 pips

Important Tip: Share / ETF CFDs commissions vary from other instruments and are fixed on all account types.

Market | Commission per Side | Minimum Commission |

HK Stocks | 0.20% | $2 |

US Stocks | 2 Cents/Share | $2 |

ETFs | 3 Cents/Share | $10 |

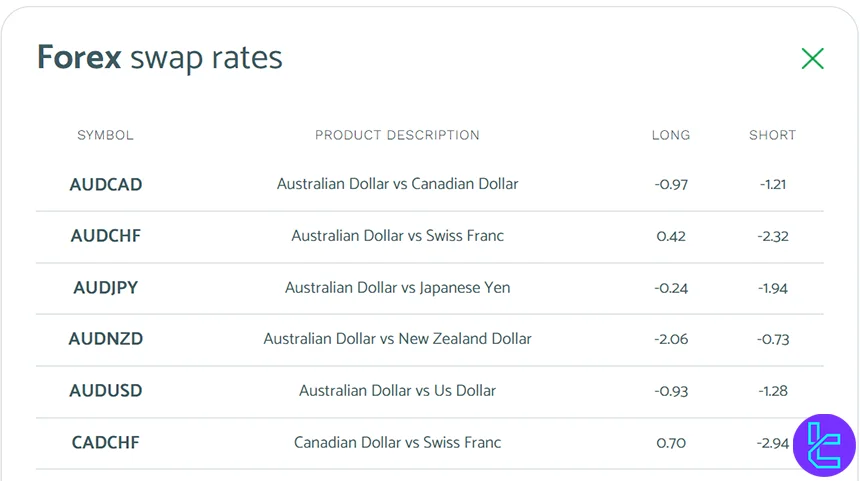

Swap Fee at Zero Markets

Zero Markets charges swap (rollover) fees on overnight Forex and CFD positions; for example, on AUDUSD the official published swap is −0.93 (long) / −1.28 (short) per lot.

If you keep a position open overnight on a Wednesday (or over a weekend/holiday rollover), the swap is applied at three times the normal daily rate.

Here are some key points you should know:

- On EURUSD, long-positions incur −3.60, short-positions get +0.46 (per lot, per night);

- For closed-or-rolled over futures CFD positions there isno swap; they are settled when the futures contract expires;

- If you convert to an Islamic Account, overnight swap/interest charges are replaced by a fixed administration fee per night.

Non-Trading Fees at Zero Markets

Zero Markets does impose certain non-trading fees under specific conditions (e.g. account maintenance and administrative charges for data-feed services or low-balance/inactivity accounts). These fees are separate from spreads, commissions or swap.

Below are the main official non-trading charges and rules.

- If the balance is under USD 500 with no activity for 6 months, a USD 30 monthly maintenance fee applies;

- Optional data-feed or market-access services carry admin fees ranging roughly from USD 15 to USD 100;

- Withdrawal charges vary by method, with international bank-wire transfers subject to fixed or percentage-based fees;

- Most deposits are free, though banks or payment providers may impose independent processing fees.

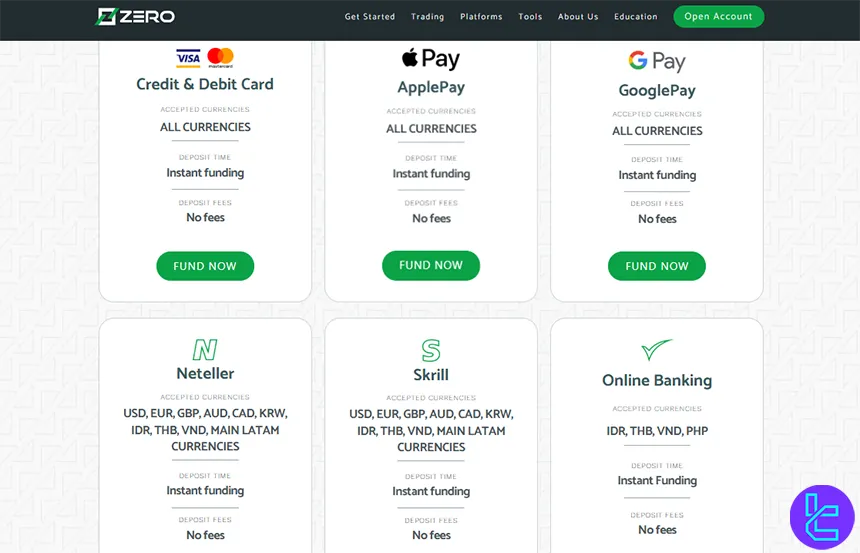

Payment Methods

We must mention the funding and withdrawal options in this Zero Markets review. The company provides a wide array of payment methods to cater to traders from different regions and with varying preferences, including:

- Visa / MasterCard

- Neteller

- Skrill

- EPay

- SticPay

- Apple/Google Pay

- Crypto

- AIRTM

- ZOTAPAY

- Bank Wire

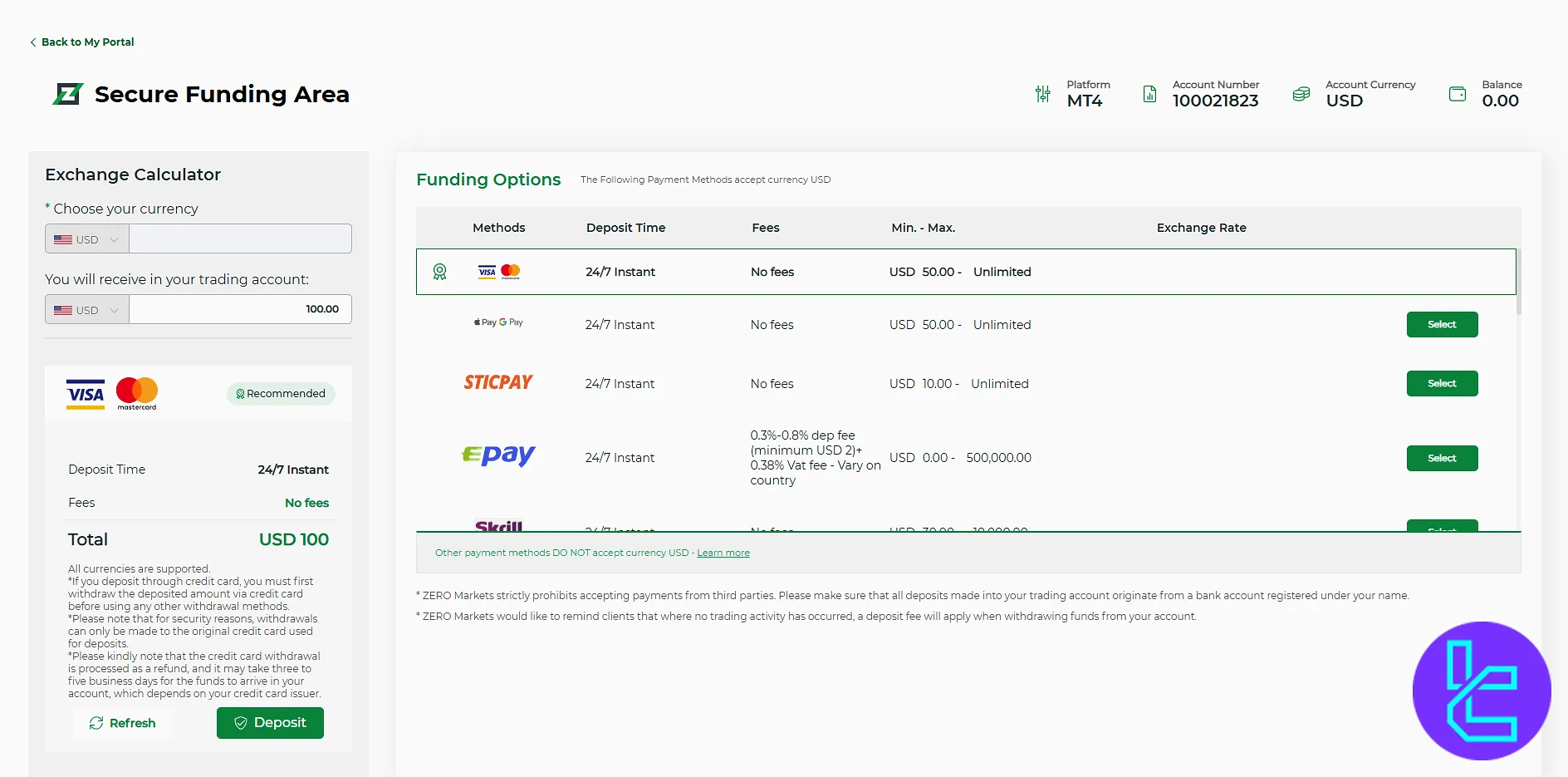

Deposit Methods at Zero Markets

Zero Markets supports a wide variety of deposit methods, allowing traders to fund accounts via cards, e‑wallets, cryptocurrency or bank wires, typically with no deposit fees and fast processing.

For most methods (cards, e‑wallets, crypto) the deposit is credited instantly, while bank wires usually take about one business day. The conditions (currencies accepted, minimal fees, processing time) vary by method.

Below is a table summarizing key deposit‑options:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Deposit Time |

Credit & Debit Card | All currencies | USD 50 | No fees | Instant |

Apple Pay | All currencies | USD 50 | No fees | Instant |

Google Pay | All currencies | USD 50 | No fees | Instant |

Neteller | USD, EUR, GBP, AUD, CAD, KRW, IDR, THB, VND, main LATAM currencies | USD 30 | No fees | Instant |

Skrill | USD, EUR, GBP, AUD, CAD, KRW, IDR, THB, VND, main LATAM currencies | USD 30 | No fees | Instant |

Online Banking | IDR, THB, VND, PHP | USD 50 | No fees | Instant |

Finrax (Crypto) | BTC, ETH, LTC, XRP, BAT, BNT, CVC, ENJ, FUN, LINK, MITH, MTL, OMG, REP, XLM, BCH, USDT | USDT 10 | No fees | Instant |

STICPAY | USD, EUR, GBP, AUD, KRW | USD 30 | No fees | Instant |

Epay | USD, EUR, GBP, AUD, BRL, KRW | N/A | 0.3–0.8% (min USD 2) + 0.38% VAT | Instant |

CryptoPay Plus (USDT) | USDT only (TRC20, ERC20) | USDT 10 | No fees | 24 hours (weekend exclusive) |

Skrill LATAM | USD, EUR, GBP, AUD, CAD, main LATAM currencies | USD 30 | No fees | Instant |

Bank Wire (EUR) SEPA | EUR only | EUR 50 | All bank charges covered by client | 1 business day |

AIRTM | USDC | N/A | No fees | Instant |

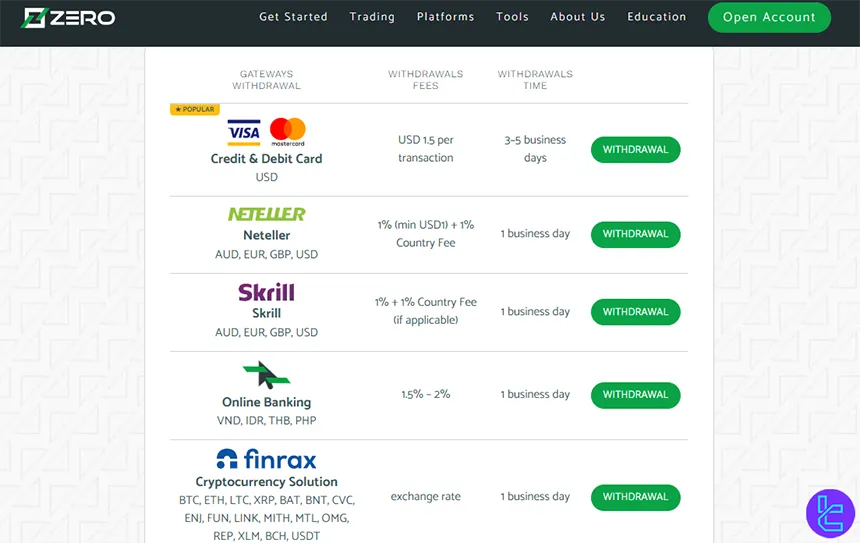

Withdrawal Methods at Zero Markets

ZERO Markets offers a variety of withdrawal channels (bank‑wire, card, e‑wallets, crypto etc.), each with specific fees and processing times.

The fee depends on method and currency; some are free, others carry a percentage or flat charge.

Below is a table summarizing the main withdrawal options:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

World ‑ Pay (Credit & Debit Card) | USD | USD 3 | USD 1.5 per transaction | 3–5 business days |

Neteller | AUD, EUR, GBP, USD | USD 0.01 | 1% (min USD 1) + 1% country fee | 1 business day |

Skrill | AUD, EUR, GBP, USD | USD 0.01 | 1% + 1% country fee (if applicable) | 1 business day |

Online Banking | VND, IDR, THB, PHP | USD 0.01 | 1.5–2% | 1 business day |

Finrax (Crypto) | BTC, ETH, LTC, XRP, BAT, BNT, CVC, ENJ, FUN, LINK, MITH, MTL, OMG, REP, XLM, BCH, USDT | USD 5 | Charged via exchange rate | 1 business day |

Sticpay | AUD, EUR, GBP, USD | N/A | 2.5% + USD 0.3 | 1 business day |

Interac | CAD | N/A | Flat Fee CAD 7.87 | 36 hours |

epay | AUD, EUR, GBP, USD | N/A | No fees to EPay Wallet / USD 4 + 0.38% TAX | 1 business day |

Tether | AUD, EUR, GBP, USD | N/A | Flat Fee USDT 4 | 1 business day |

Skrill LATAM | AUD, EUR, GBP, USD | USD 0.01 | 1% | 1 business day |

Airtm | USDC | N/A | 2.5% | 1 business day |

IBS (Bank Wire SEPA) | EUR only | USD 0.01 | 0.2%, min €8 | 1 business day |

Zero Markets Copy Trading

The broker has embraced the growing demand for social and copy trading, offering several options for traders looking to leverage the expertise of others or those who want to earn more from their winning strategies.

- Social Trading: Available through the Signal Start platform with real-time performance tracking

- Copy Trading: Available on the MT4 platform with a minimum investment requirement of $100

- PAMM/MAM: Provide signals and earn performance fees with a minimum balance requirement of $20K

Zero Markets Broker Trading Instruments

ZERO Markets provides access to over 500 trading instruments with diverse leverage options across asset classes, offering flexibility for different trading strategies.

Here are all you need to know:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Major, minor & exotic currency pairs | 60+ | 40-70 | 1:500 | |

Share CFDs | Global equities | 400+ | 300-1000 | 1:20 |

Indices CFDs | Major & minor stock indices | 16 | 10-20 | 1:100 |

Commodities | Energy commodities | 4 | 5-10 | 1:100 |

Metals | Gold, Silver, other metals | 6 | 2-10 | 1:500 |

ET Fs | Exchange-Traded Funds (CFDs) | 17 | 10-30 | 1:5 |

Major crypto CFDs | 11 | 5-20 | 1:5 |

A broad instrument selection combined with variable leverage enables traders to implement both conservative and high-risk strategies efficiently.

Bonus and Promotions

While the strong regulatory framework prevents the broker from offering traditional promotions like deposit bonuses and welcome gifts, it offers a comprehensive partnership program in 3 models, including:

- IB: Volume-based rebate structure with tight spreads from 0.0 pips

- Affiliate: up to $1,000 commission for referring new clients

- Money Manager: Customized trading solutions and conditions

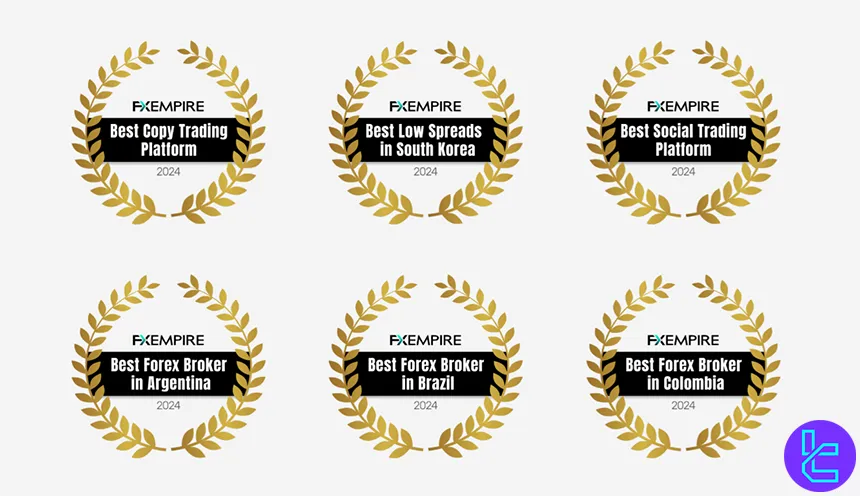

Zero Markets Awards

Zero Markets has earned widespread recognition for its superior trading services, including copy trading, social trading and competitive spreads.

In 2024, the broker received multiple awards from FXEmpire across key global markets, highlighting its industry leadership and client-focused offerings.

Here are all the awards that Zero Markets has achieved:

- Best Copy Trading Platform (2024) - awarded by FXEmpire

- Best Low Spread in South Korea (2024) - awarded by FXEmpire

- Best Social Trading Platform (2024) - awarded by FXEmpire

- Best Forex Broker in Argentina (2024) - awarded by FXEmpire

- Best Forex Broker in Brazil (2024) - awarded by FXEmpire

- Best Forex Broker in Colombia (2024) - awarded by FXEmpire

Zero Markets Customer Support

The company prides itself on providing comprehensive 24/5 support through multiple channels, including:

support@zeromarkets.com | |

Tel | +61 (0)2 7908 3133 |

Live Chat | Available on the official website |

Facebook Messenger | The link is not valid |

Call Back Request | Through the “Support Center” |

Zero Markets Geo-Restrictions

We must discuss the restricted countries in this Zero Markets review. Due to regulatory requirements, the company is prohibited from providing services in certain jurisdictions, including:

- Afghanistan

- Cuba

- Iraq

- Iran

- Liberia

- Libya

- Myanmar

- Palestine

- Russia

- Somalia

- Syria

- Sudan

- Yemen

- Spain

- European Union

- Malaysia

- Indonesia

- Vietnam

- Thailand

- United States

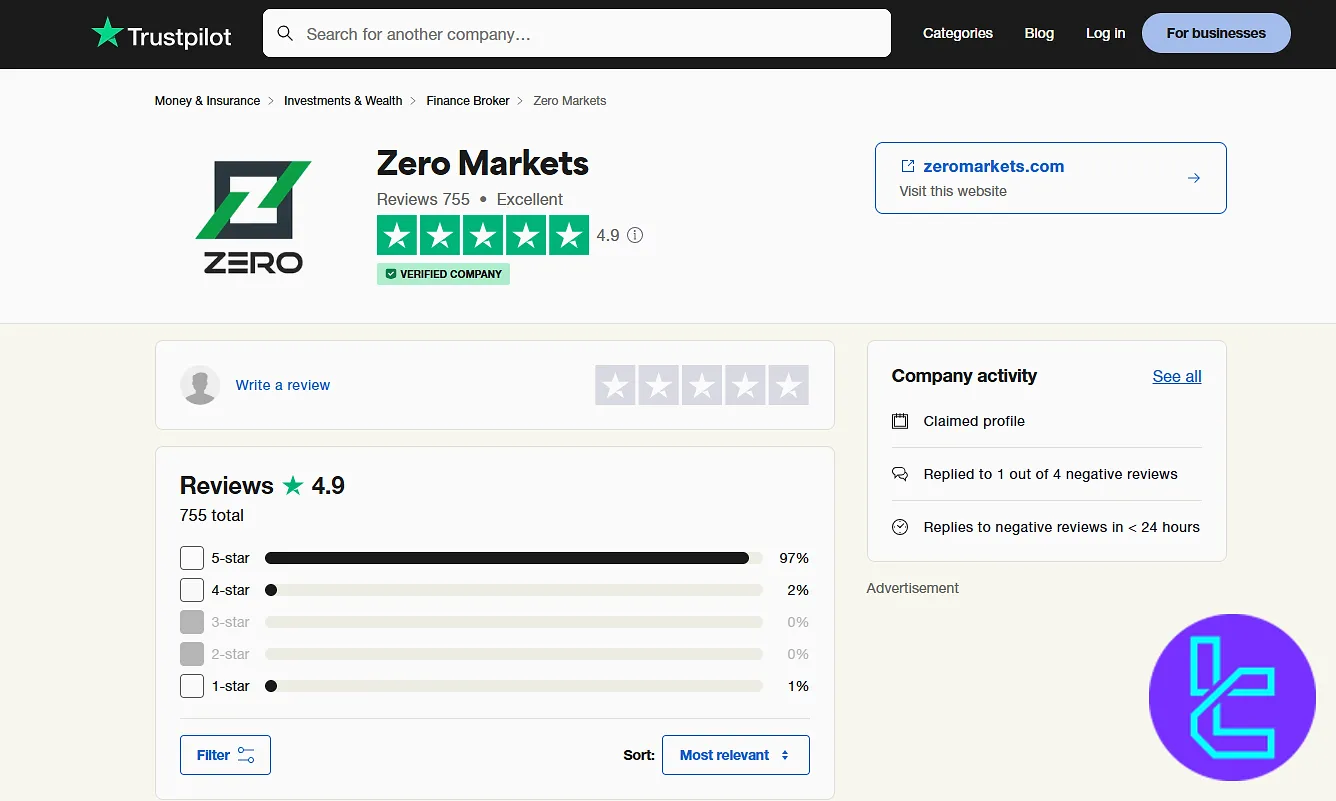

Trust Score and User Satisfaction

The broker has garnered generally positive reviews across various platforms.

4.9/5 based on 755 comments | |

Forex Peace Army | 2.7/5 based on 5 reviews |

Users have mostly praised Zero Markets’ good customer support, fair pricing, and fast executions.

Educational Resources

Zero Markets broker has provided a full suite of video tutorials on how to use MT4/5 platforms, the client dashboard, VPS, E As, and the copy trading service. However, to access the videos you must check the company’s YouTube channel.

The broker also offers a comprehensive blog, covering the following topics:

- Market trends and news

- Forex education

- Daily analysis

Zero Markets Compared to Its Peers

The table below draws a comprehensive, fair comparison between the discussed broker and some of its competitors:

Parameter | Zero Markets Broker | IC Markets Broker | LiteForex Broker | Exness Broker |

Regulation | ASIC, FMA, FSC, FSA | FSA, CySEC, ASIC | CySEC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Minimum Spread | 0.0 pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $0.0 per lot | From $3 | From $0.0 | From $0.2 to USD 3.5 |

Minimum Deposit | 100 AUD | $200 | $50 | $10 |

Maximum Leverage | 1:30 (ASIC, FSC) 1:500 (FSA) | 1:500 | 1:30 | Unlimited |

Trading Platforms | MT4, MT5, WebTrader, Signal Start | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MetaTrader 4, MetaTrader 5, Mobile Proprietary App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Account Types | Standard, Super Zero, Islamic Raw, Islamic Standard | Standard, Raw Spread, Islamic | Classic, ECN, Demo | Standard, Standard Cent, Pro, Raw Spread, Zero |

Islamic Account | Yes | Yes | No | Yes |

Number of Tradable Assets | N/A | 2,250+ | N/A | 200+ |

Trade Execution | Market | Market | Market | Market, Instant |

Conclusion and Final Words

Zero Markets provides access to CFDs across 6 asset classes, including Forex, Crypto, and US/UK stocks. The broker also allows for purchasing ETFs with a commission of 3 Cents per share.

Social trading is available through the Signal Start platform, and money managers can open a MAM/PAMM account on Zero Markets broker with a minimum balance requirement of $20K.

The company has scored an excellent rate of 4.9/5 on TrustPilot.