The factors affecting the price of Ethereum(ETH) the second-largest cryptocurrency in the market are divided into two main categories: fundamental and technical.

Continuous technical upgrades, the expansion of the Ethereum ecosystem, and strategic partnerships with major companies have all contributed to increasing investment in this cryptocurrency.

Ethereum’s price volatility is influenced by a combination of macroeconomic factors, including global interest rates, central bank monetary policies, and the overall condition of the cryptocurrency market.

On the on-chain level, the expansion of the DeFi (Decentralized Finance) ecosystem, the growth of the NFT market, and the increasing use of smart contracts have strengthened the real demand for Ether.

Fluctuations in transaction fees (Gas Fees) and structural upgrades such as Ethereum 2.0 and the complete transition to the Proof of Stake (PoS) mechanism represent key fundamental factors shaping Ethereum’s supply–demand dynamics.

These elements collectively exert a profound influence on the cryptocurrency’s long-term value.

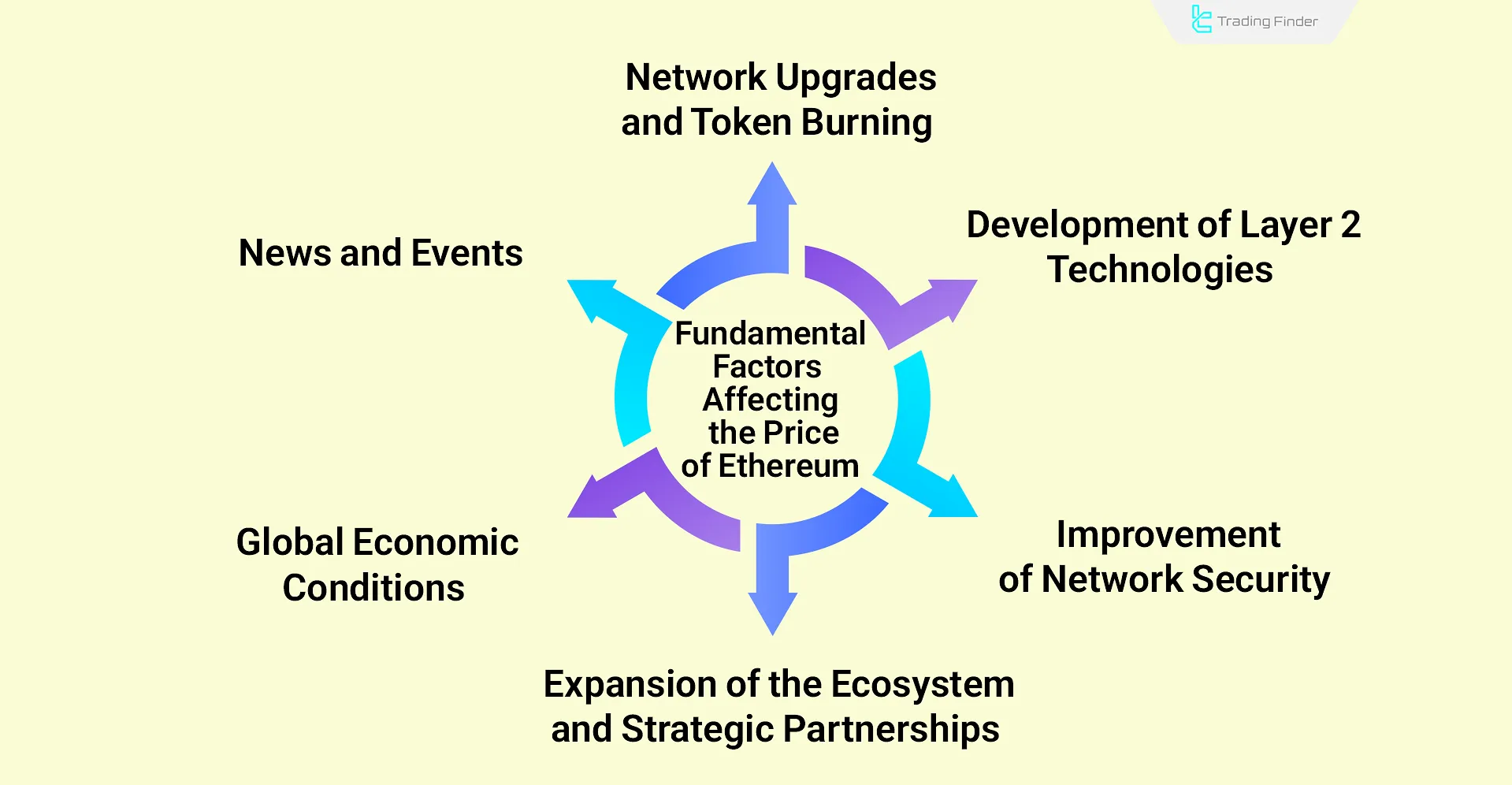

Fundamental Factors Impacting Ethereum Price

Several factors, including the increase in staked Ethereum and external fundamental drivers, influence the price of Ethereum. Fundamental factors affecting the price of Ethereum include:

- Network upgrades and token burns

- Staking and locked supply

- Development of Layer 2 technologies

- Improved network security

- Ecosystem expansion and strategic collaborations

- Global economic conditions

- News and events

For a more detailed analysis of the factors influencing Ethereum’s price, it is recommended to watch the analytical video about Ethereum on the Focus Economy News YouTube channel.

Network Upgrades

With new upgrades to the Ethereum network, the transaction fee structure has changed, increasing the appeal for users.

Additionally, by burning a portion of Ethereum during upgrades, the inflation rate of circulating ETH decreases, resulting in a reduced supply and increased price.

In some cases, the amount of ETH burned exceeds its issuance rate, which can drive its price higher in the long term.

Staking and Locked Supply

One of the key factors shaping Ethereum’s price trends is staking.

After transitioning to the Proof of Stake (PoS) algorithm, a significant portion of Ethereum’s supply has been locked on the Beacon Chain.

Currently, more than 26% of all ETH is staked, with approximately 987,000 validators active on the network. This process removes part of the ETH supply from market circulation, reducing selling pressure.

Protocols such as Lido, Rocket Pool, and EtherFi allow users to utilize staked ETH in the form of derivative tokens like stETH, which are actively used within the DeFi ecosystem, influencing secondary demand and overall market dynamics.

The table below summarizes the Ethereum staking process and its impact on the market:

Parameters | Short Description | Market Impact | Examples |

PoS Staking | Locking ETH to secure the network after the Merge | Decreases circulating supply | — |

Percentage Staked | Around 26% of total ETH locked | Reduces liquidity and selling pressure | Beacon Chain |

Validators | Approximately 987,000 active nodes | Enhances network security and decentralization | — |

Liquid Staking | Converts locked ETH into derivative tokens | Maintains capital liquidity | Lido, Rocket Pool, EtherFi |

Derivative Tokens (LSTs) | Represent staked ETH in DeFi | Improves capital efficiency | stETH, rETH, eETH |

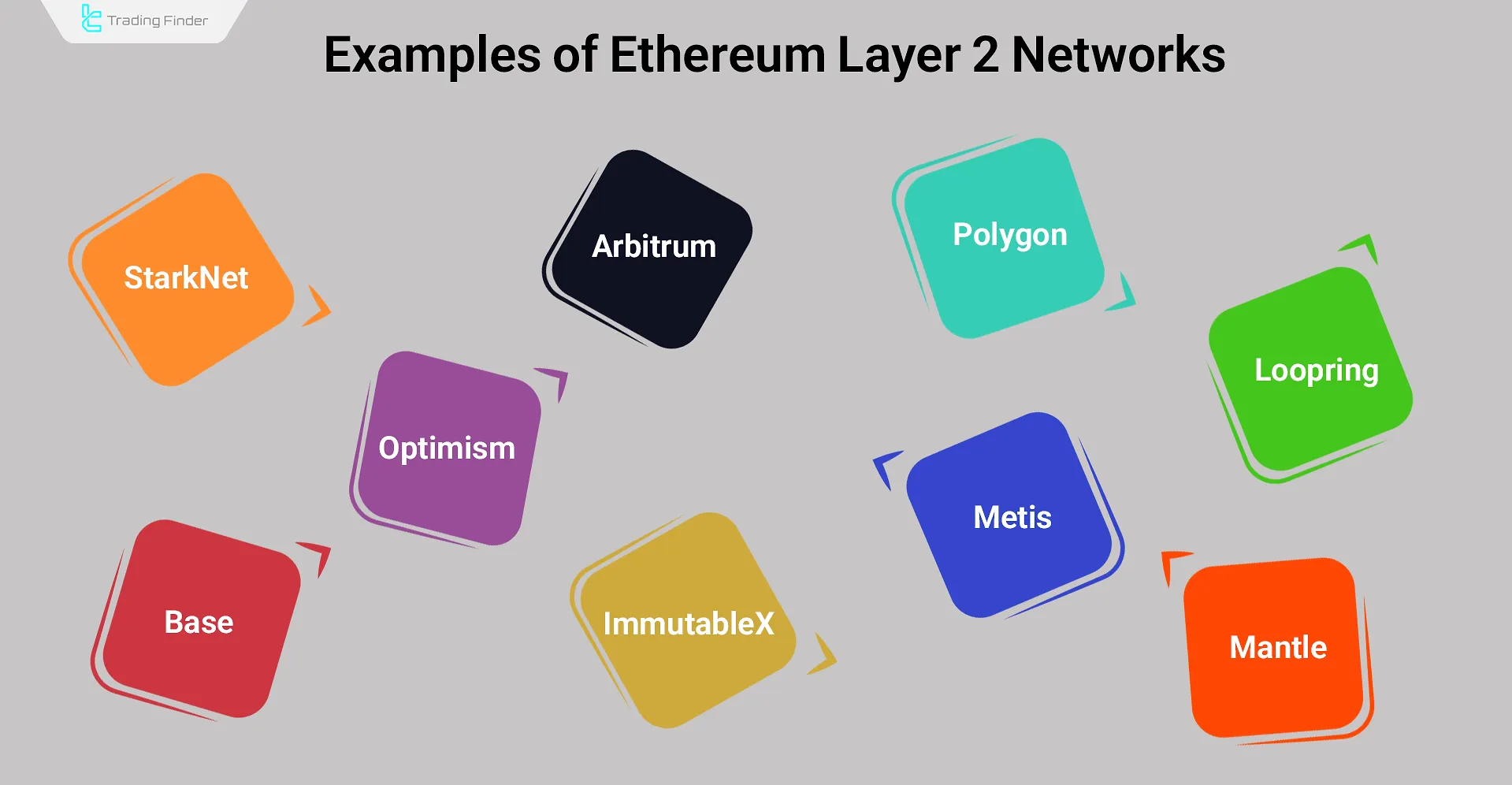

Development of Ethereum Layer 2 Technologies

To improve the scalability of the Ethereum network, Layer 2 solutions such as Arbitrum and Starknet have been developed, enhancing network speed and accelerating growth in decentralized finance (DeFi) and non-fungible tokens (NFTs).

Examples of Ethereum Layer 2 Networks:

Improved Network Security

Regular updates focused on enhancing Ethereum’s security boost user confidence and attract investors. Reducing the risk of hacking and network breaches lowers the price volatility caused by adverse security events.

Ecosystem Expansion and Strategic Collaborations

Ethereum’s partnerships with major companies such as Microsoft and JPMorgan have enhanced its credibility. Additionally, expanding integrations and use cases increase the factors impacting the Ethereum price.

Global Economic Conditions

The state of the global economy is one of the factors influencing Ether's price in the crypto market.

When the global economy is strong, demand for riskier investments tends to increase. In this context, Ethereum is seen as a trustworthy and attractive investment option in the crypto market.

News and Events

Global economic, political, and social events also influence Ethereum’s price.

Additionally, Ethereum-related news, broader cryptocurrency news, and security events, such as network hacks, can significantly affect Ethereum’s price.

For further analysis of the factors influencing Ethereum’s price, you can refer to the educational article on Ethereum’s key factors available on the coinmotion.com website.

On-Chain Metrics and Whale Behavior Analysis in the Ethereum Network

In Ethereum price analysis, examining on-chain data is a crucial tool for understanding the supply and demand dynamics within the network.

These data sets reveal the inflows and outflows of assets to and from exchanges, the accumulation or distribution behavior of large investors (whales), and the activity levels of different wallets offering deep insights into overall market behavior.

Behavioral analysis, based on such data, enables a more precise evaluation of investor sentiment and potential structural shifts in the Ethereum market. Below is a deeper look into investor behavior and liquidity flow:

Ethereum Exchange Reserves

Exchange reserves represent a key metric for assessing investor behavior and the supply flow in the market.

A decline in exchange balances often indicates the transfer of assets to cold wallets or DeFi contracts, reflecting a growing preference for long-term holding (HODL).

This reduction in circulating supply can create conditions for upward price movement.

Conversely, an increase in Ethereum reserves on exchanges is typically interpreted as a sign of higher liquidity demand or selling intent, raising the likelihood of short-term selling pressure. These variations are usually measured through the Exchange Netflow indicator.

Whale Behavior

Whales wallet addresses holding more than 100,000 ETH are among the most influential participants driving Ethereum’s price volatility.

An increase in their accumulation generally signals confidence in a continued bullish trend, whereas the start of distribution phases may act as a warning of correction or reversal.

Furthermore, tracking the number of active addresses and large transaction volumes provides a more detailed view of market sentiment and capital movement within the Ethereum network.

Technical Factors Affecting Ethereum Price

Given the activity of retail traders and market makers in the crypto space, chart patterns and technical analysis concepts also impact Ethereum’s price fluctuations. Key technical factors affecting Ethereum price include:

- Trading volume

- Support and resistance levels

- Chart patterns

Trading Volume

Trading volume indicates the strength of price trends and the number of active traders. An increase in Ethereum’s trading volume contributes to its long-term price growth.

Conversely, a decline in trading volume and trader interest can lead to price corrections and drops.

Support and Resistance Levels

Support and resistance levels are keydecision points for traders to determine when to buy or sell Ethereum. These points help determine entry and exit opportunities in the market.

Example of the Impact of Support and Resistance Levels on Ethereum’s Price

In the example below, a support and resistance zone can be observed where Ethereum has shown multiple reactions on the daily timeframe.

This area previously acted as support and later served as resistance, illustrating the structural importance of this level in determining the direction of subsequent price movements.

Chart Patterns

Price patterns such as flags, Candlestick patterns, divergence formations, and more serve as technical indicators for Ethereum investors.

The Role of the Derivatives Market in Ethereum Price Volatility

The Ethereum derivatives market which includes Futures and Options contracts plays a decisive role in short-term volatility and overall price direction. The key analytical points in this area are as follows:

- Open Interest (OI) Index: A measure of the total capital committed in open positions, serving as an indicator of market depth and active liquidity flow;

- Sudden Increase in OI: A sign of new capital inflow and growing trader participation, often accompanied by the start of strong price movements;

- Periods Leading Up to Events such as Ethereum Spot ETF Launches: Times characterized by noticeable growth in trading volume and OI, resulting in heightened market volatility;

- Funding Rate: A dynamic indicator of market sentiment positive values reflect dominance of long positions (bullish bias), while negative values indicate growing short pressure (bearish sentiment) and downward market tendency.

Ethereum’s Price Correlation with Bitcoin

Ethereum and Bitcoin have a close price correlation. However, this does not mean Ethereum always follows Bitcoin’s movements; it may outperform or underperform at times.

Historical data often reflects this correlation: when Bitcoin has reached price peaks, Ethereum has exhibited similar behavior.

Forex Factory Calendar Indicator for Monitoring Crypto-Related News (Bitcoin, Ethereum, etc.) in MetaTrader

If you are active in financial markets especially in cryptocurrency trading and trade Ethereum, the Factory Calendar (FF Calendar) indicator is one of the most practical tools that can help you clearly understand how economic news impacts Ethereum’s price movements.

This indicator retrieves economic data published on the Forex Factory website via the Web Request function and displays it directly on the MetaTrader chart.

When activated, the indicator allows traders to view the release times of key indicators such as GDP, inflation rate, unemployment rate, and employment statistics in real time, helping them make more precise entry or exit decisions.

- Download Forex Factory Calendar Indicator for MetaTrader 5

- Download Forex Factory Calendar Indicator for MetaTrader 4

To activate it, simply go to the Tools Options menu in MetaTrader, enable the Allow Web Request for listed URL option, and enter the weekly calendar CSV link from the Forex Factory website in the designated field.

After the initial setup, the indicator plots vertical lines on the chart and uses red, orange, and yellow color codes to show the importance level of each news event.

This feature enables traders to manage their positions ahead of major economic announcements.

For example, on an H1 chart, the FF Calendar indicator clearly displays a bullish price reaction following the release of positive economic news, while on an M30 chart, a bearish market reaction during negative news is also visibly evident.

In the indicator’s settings, options such as Alerts (sound alerts), Notifications (push alerts), and Alert Before News allow for a high degree of customization.

Additionally, filters like High Impact, Medium Impact, and Low Impact help distinguish the importance levels of economic events.

Overall, the Forex Factory Calendar is an essential tool for combining fundamental analysis with technical analysis in MetaTrader particularly for crypto traders who monitor global economic news and its volatility impact.

By providing a clear visualization of how events influence price action, this indicator helps traders make more informed and professional trading decisions.

Impact of Ethereum Spot ETF Launch on Price

With the approval of Ethereum spot ETFs by the U.S. Securities and Exchange Commission (SEC), a legal investment channel has opened for large investors such as Grayscale, BlackRock, and other financial institutions.

Following the influx of institutional capital and high liquidity, Ethereum’s price volatility has decreased significantly.

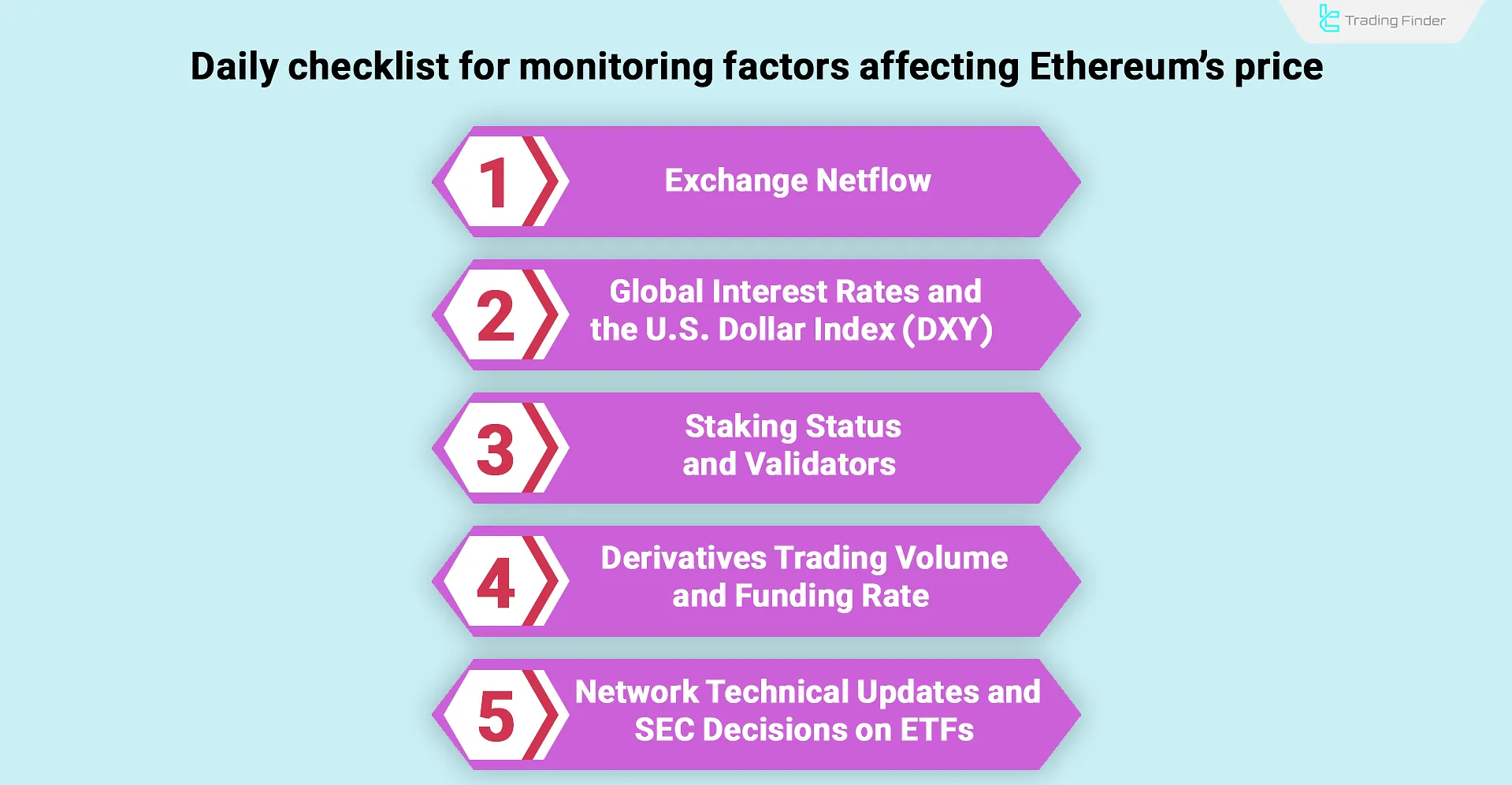

Daily Checklist for Monitoring Factors Affecting Ethereum’s Price

For traders and analysts, regularly tracking Ethereum’s key market indicators is highly important. The most crucial data to review on a daily basis include:

- Exchange Netflow trends

- Changes in global interest rates and the U.S. Dollar Index (DXY)

- Staking status and the number of validators on the network

- Derivatives market volume and Funding Rate

- News related to technical upgrades and SEC decisions regarding ETFs

Simultaneous monitoring of these variables provides a comprehensive and analytical view of the real market condition and the potential direction of price movements.

Conclusion

Short-term and long-term fundamental and technical indicators are among the factors affecting the price of Ethereum.

These factors include the impact of news and events, network upgrades, infrastructure development, chart patterns, and more, which can have both immediate and long-term effects on Ethereum’s price.