The 20 Pips a Day ICT Strategy is one of the methods based on the ICT style and market structure, aiming to deliver relatively consistent daily profits. This strategy focuses on the New York and Asia trading sessions.

Introduction to the ICT 20 Pips a Day Strategy

The main goal of the 20 Pips a Day strategy is to capture at least 20 pips daily from the market. This method leverages liquidity grabs and market structure shifts (MSS) to take advantage of short-term price moves, especially in lower timeframes.

Unlike predictive strategies, 20 Pips a Day is based on actual price behavior and liquidity dynamics in the market.

Advantages of the ICT 20 Pips a Day Strategy

Despite its simplicity, the 20 Pips ICT scalping strategy has several features that make it practical for many short-term traders:

- Ease of execution: Can be implemented using simple tools like 5-minute and 1-minute charts;

- Daily profitability: When executed correctly, it can yield consistent daily profits;

- Defined risk-to-reward ratio: Typically maintains at least a 1:1 risk/reward, enhancing money management;

- Smart position management: Allows traders to hold a portion of the position to gain additional profit if the trend continues.

How to Use the ICT 20 Pips a Day Strategy?

The strategy is applied during two main sessions: Asia and New York, as described below:

Executing ICT 20 Pips a Day in the Asia Session

The Asia session implementation occurs between 8:00 PM to 12:00 AM (New York time).

Price often moves towards liquidity zones left from the New York session during the window. After tapping these zones, we usually see reactions such as reversals or directional moves.

Buy Scenario – Asia Session

To execute long trades in the Asia session:

- On the 5-minute timeframe, identify short-term lows formed at the end of the New York session;

- Wait for the price to briefly break these lows and grab liquidity (Liquidity Raid);

- On the 1-minute timeframe, look for signs of rejection or a Market Structure Shift (MSS);

- Once confirmed, enter a buy position. Set stop-loss at 20 Pips below entry and take-profit at 20 Pips above;

- If the price moves in your favor, you may leave part of the position open to capture further gains.

Sell Scenario – Asia Session

To execute short trades:

- Similar to the buy setup, but this time focus on short-term highs formed at the end of the New York session;

- If price breaks these highs and grabs liquidity, switch to the 1-minute chart for further confirmation;

- Look for signs of price rejection or MSS;

- Enter a sell trade. Set stop-loss and take-profit at 20 Pips

Executing ICT 20 Pips a Day in the New York Session

The strategy is applied from the New York session open until around 10:00 AM (NY time).

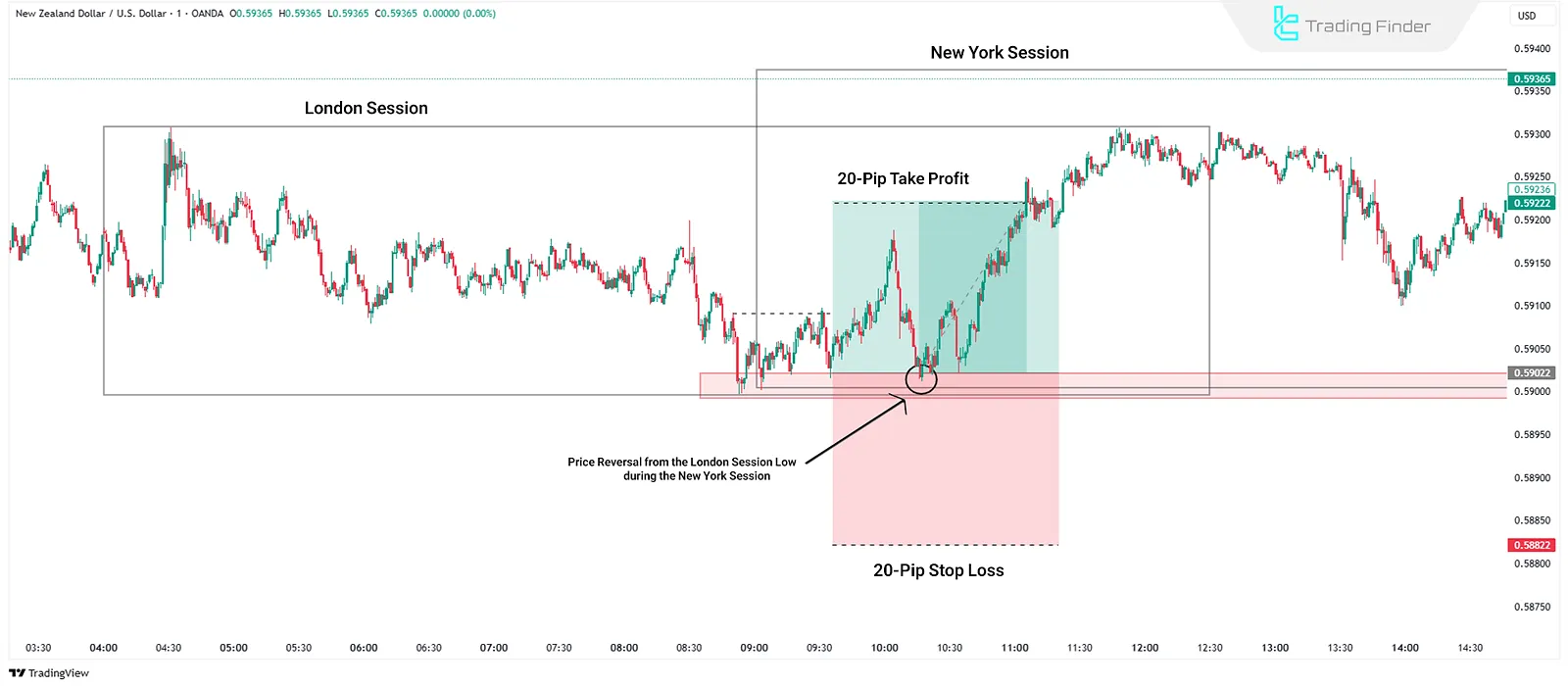

After the London session sets the daily high or low, the New York session usually sees a retracement or reversal, offering a prime scalping opportunity.

Buy Scenario – New York Session

Steps for a buy setup:

- Ensure that theLondon session has set the daily low;

- On the 5-minute timeframe, identify short-term lows formed after the New York open;

- If price breaks below these lows and grabs liquidity, drop to the 1-minute chart;

- If you see MSS or price rejection, enter a buy trade. Set SL and TP to 20 Pips.

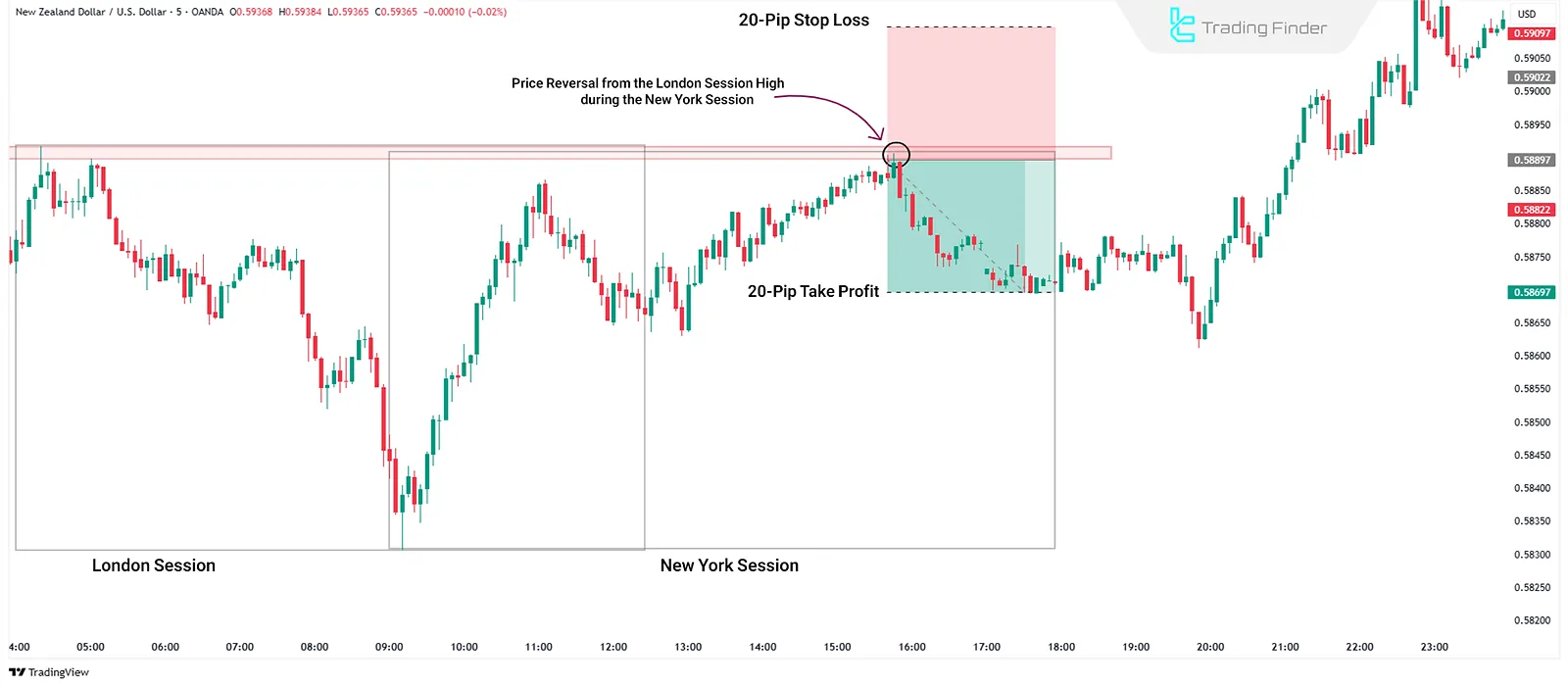

Sell Scenario – New York Session

Steps for a sell setup:

- Confirm that the London session has set the daily high;

- Identify short-term highs formed post-New York open on the 5-minute chart;

- If price breaks these highs and grabs liquidity, analyze the 1-minute chart;

- Upon confirming MSS or rejection, enter a sell position with a 20-pip SL and TP.

Additional Tips for Success with ICT 20 Pips Strategy

Here are a few tips to increase your win rate while using the ICT 20 Pips a Day strategy:

- Assess overall market condition: Don’t rely solely on setups and always consider broader context like market trend, range vs trend phase, and news impact;

- Use higher timeframes: Analyzing H1 or H4 helps validate setups and understand market direction;

- Risk management is critical: Always define your stop-loss and position size to avoid large losses;

- Be disciplined and patient: Only enter when all conditions are met and don’t enter impulsively near key levels without valid signals.

Conclusion

The ICT-style 20 Pips a Day strategy is a structured approach to trading based on price action and liquidity behavior. Traders can identify moments such as Market Structure Shifts (MSS) and Liquidity Raids and enter trades at precise moments.

A key feature of the method is the combination of lower timeframe analysis with higher-level structures like daily highs/lows and key London / New York zones.