The Asian session sets the initial course of the market with the start of the trading day. Although the volume is lower compared to the London and New York sessions, the initial price structure and key supply and demand zones form during this session.

Volatility is often limited and range-bound, but these movements become the basis for analysis in the following sessions.

The market focus is on currency pairs involving the yen, Australian dollar, and New Zealand dollar. Economic data from East Asia—especially Japan, Australia, and China—have the greatest impact during this period.

For day traders and scalpers, this session provides a suitable environment due to orderly price action and controlled risk.

What Is the Asian Session?

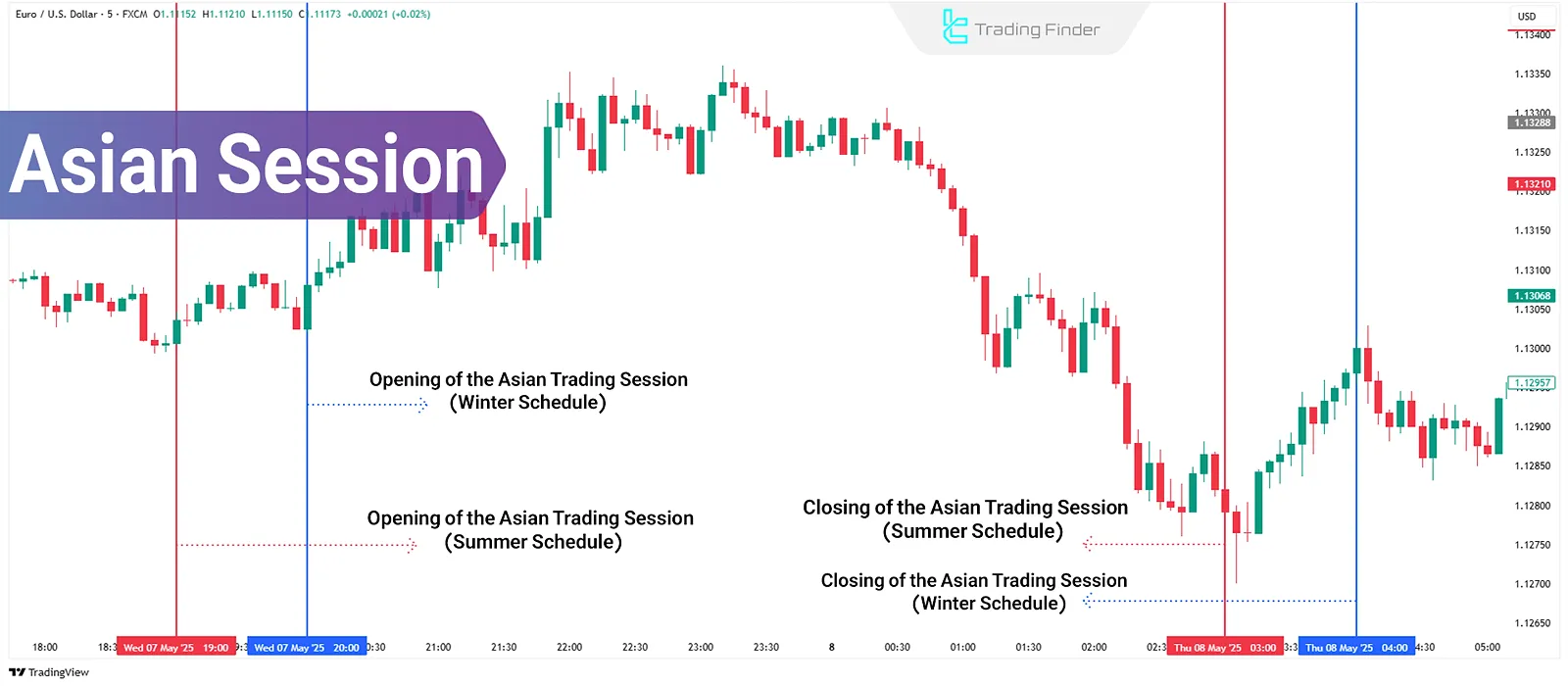

The Asian trading session is the first active phase of the Forex market during the 24-hour day. The unofficial Forex market activity begins when the Sydney market opens at 8:00 PM New York time.

Then, with the official opening of the Tokyo market, the main trading phase starts; This period usually continues until about 4:00 AM New York time.

Note: New York summer time is one hour behind.

Active cities in the Asian session include Tokyo, Sydney, Hong Kong, and Singapore. The highest trading volume occurs between 7:00 PM and 1:00 AM New York time, when the Japanese market is at its peak activity.

Tokyo plays an important role in the Asian session. The Bank of Japan's activity, the release of yen economic data, and the high volume of Asian currency pairs (such as AUD/USD, USD/JPY, and NZD/USD) make this session relatively stable but directional in terms of volatility structure.

This session generally tends to exhibit range or calm corrective moves in the absence of high volume; Many market algorithms use it to determine daily key levels.

Characteristics of the Asian Session

The Asian session is known as the calmest phase of the Forex market. Its structure is usually low-volatility, low-volume, and limited in movement. The most important features of the Asian session:

Low Volatility

Price movement in most currency pairs is limited; the market tends to form a range-bound structure, and strong breakouts are rare.

Relatively Lower Liquidity

Liquidity is noticeably lower than in the London and New York sessions; Most orders come from Japanese, Australian, and Hong Kong markets.

Higher Spreads at Session Start

During the early hours, especially concurrent with the Sydney market opening, spreads are generally high due to lack of sufficient order depth.

Mild and Corrective Price Patterns

The market mostly moves in corrective or neutral phases because strong directional moves usually begin in the London session. The Asian session often acts as an initial preparer phase.

Price Behavior Analysis in the Asian Session

Analyzing price behavior during the Asian session shows that this period is often characterized by limited moves, compressed volatility ranges, and reduced trading volume. Key points of Asian session price behavior:

Range and Price Compression

Price action in the Asian trading session generally lacks strong trends. Most pairs, especially non-Asian pairs, move within narrow ranges (range-bound). These ranges serve as the basis for entries or breakouts during the London session.

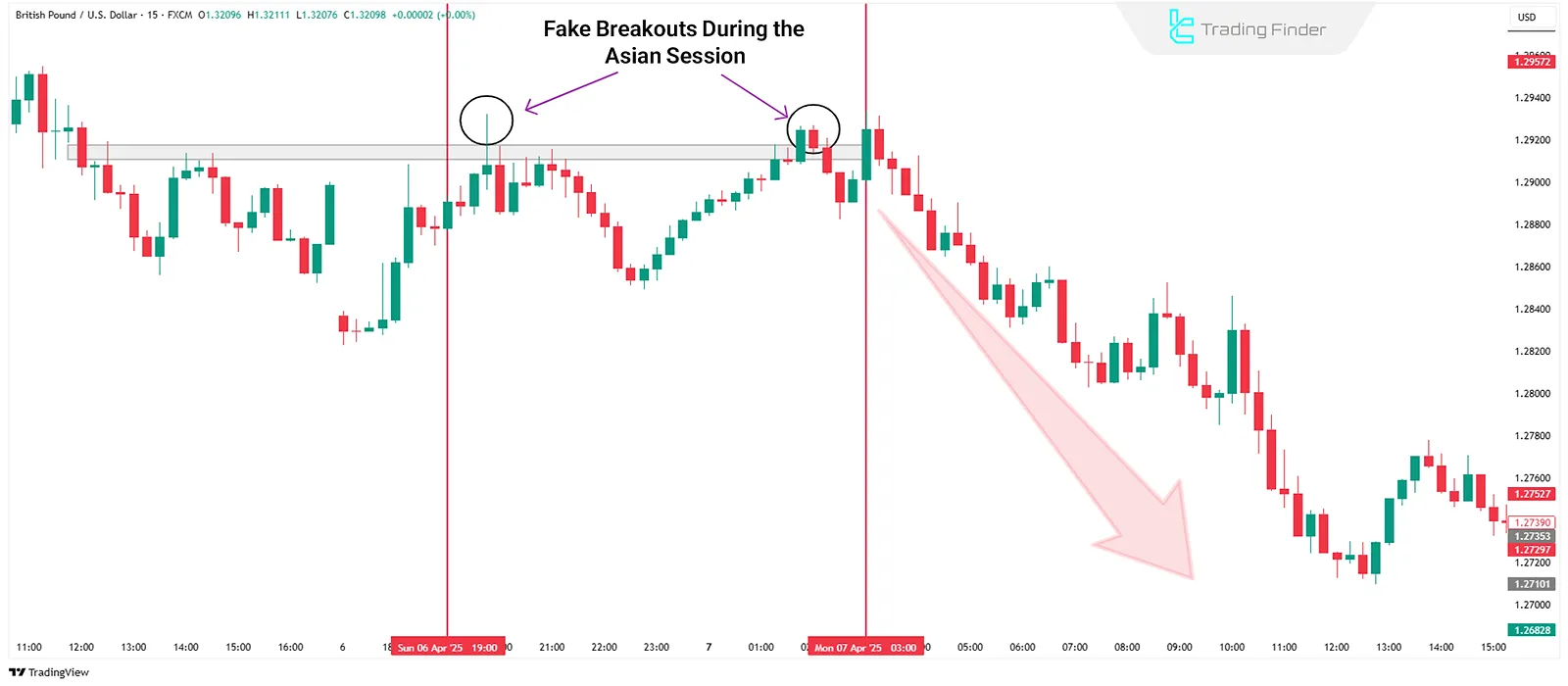

False Breakouts

In a low-liquidity environment, price breakouts often fail to hold. Prices cross the top or bottom of the range but quickly revert. This traps inexperienced traders and provides liquidity for larger players to enter.

Asian Sentiment Analysis and Its Psychological Impact

Although weaker than other sessions, economic data released during the Asian session (such as BOJ interest rates or Japan's CPI) can determine market direction for the rest of the day.

The prevailing sentiment in Asia often influences initial tendencies in the London session, especially when paired with safe-haven assets like the Japanese yen.

Important Tips for Traders in the Asian Session

Due to low liquidity in the Asian session, precise risk management, choosing brokers with appropriate spreads, and adjusting trade size to avoid losses from sudden volatility are critical.

Key tips for trading during the Asian session:

Risk Management in Low Liquidity Conditions

During the early hours of the Asian session (especially before Tokyo opens), the market operates with low order depth. This can lead to irrational price jumps and increased slippage. It is better to avoid high-volume entries or trades without stop losses during this period.

Choosing Brokers with Suitable Spreads

Due to reduced trading volume, spreads increase in pairs other than USD/JPY and AUD/JPY. Brokers offering ECN accounts or fixedspreads have a competitive advantage in such conditions.

Adjusting Trade Volume to Session Volatility

Given the limited volatility, entering with large volumes results in an unfavorable risk/reward ratio. Volume should be set according to average movement ranges (e.g., ATR on M15 or M30 timeframes) to prevent overexposure.

Avoid Early Entries

The opening moments of the Sydney market typically feature high spreads, low liquidity, and falsemoves; entering at these times increases the risk of market deception. It is better to wait for the Tokyo market opening and the stabilization of initial candles.

Correlation of the Asian Session with Subsequent Sessions

Despite limited volatility, the Asian session plays an important role in shaping the daily market structure and forms the basis for liquidity in forex flow decisions in the London and New York sessions. Asian session Correlation:

Price Structure Transfer to London Session

Price behavior during the Asian session, whether range-bound or showing a weak trend, forms the basis for many European traders' decisions.

Levels such as the Asian session's high and low often act as critical breakout or reversalpoints at the London session's start. Valid breakouts of these ranges in the early London hours generally determine the dominant market direction for the rest of the day.

Price Behavior in the Tokyo-London Overlap

The 3:00 to 4:00 AM New York time window coincides with the late Asian session and the London session opening, significantly increasingtradingvolume.

If the Asian market has limited and low-volatility moves, the likelihood of breakouts during this overlap rises. Also, any trend transferred from Asia usually continues or reverses during this overlap.

Asian Impact on Gaps in Other Markets

The performance of the Asian market, especially Tokyo and Chinese indices (like SSE or Hang Seng), can lead to gaps in European and Americanfutures or stock markets.

Important news released in Asia (such as Chinese economic data or Bank of Japan decisions) is often the main cause of these gaps.

Conclusion

The Asian session, with its limited volatility and orderly pricestructure, offers a suitable environment for scalpers and day traders. Although, liquidity is weaker than other sessions, its role in shaping daily key levels and initially setting market direction is significant.

Professional traders analyze the Asian session not as a time for heavy entries but as a preparation phase for decisions in the London and NewYorksessions. Data from this session including price ranges, reactions to Asian economic releases, and volatilitytype are useful in market behavior analysis and setting trading scenarios.