In the Forex market, speed, accuracy, and emotional control are three factors that directly determine a trader’s profit or loss. Automated trading is an engineered response to these three essential challenges. In this model, human decision-making is replaced by predefined logic, free from fatigue, doubt, fear, or greed.

Professional traders, instead of spending hours watching charts, translate their strategies into machine language so that software can enter trades based on their logic—without emotional interference. This process not only minimizes human errors but also enables backtesting, optimization, and the simultaneous execution of multiple trading strategies.

What is Automated Trading?

Automated trading in Forex refers to the process in which entering and exiting trading positions is carried out based on a set of predefined rules, without real-time human intervention.

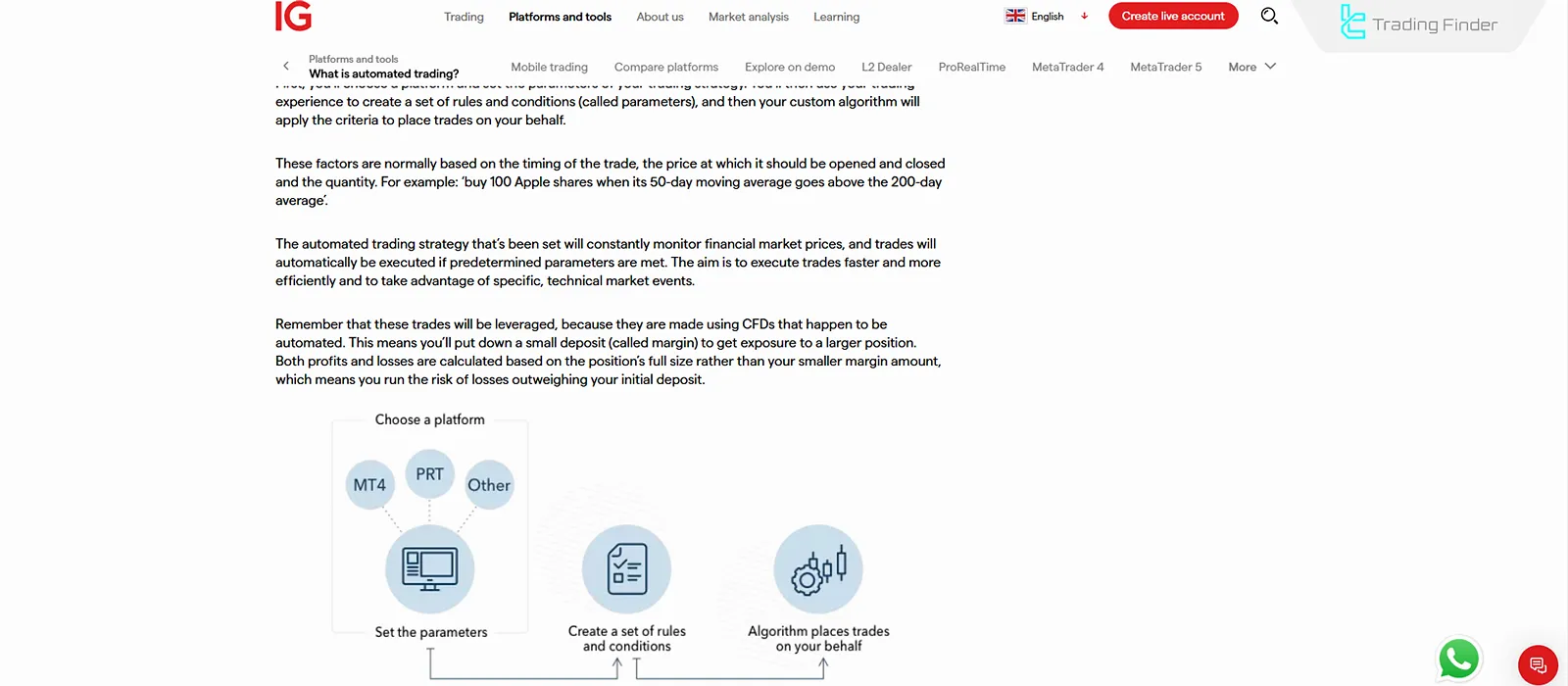

These rules can include technical analysis indicators, volume parameters, or specific market conditions that, once triggered, automatically send trade information and buy or sell orders. Training of automated trading functionality from IG.com:

The importance of this method lies in eliminating human errors, increasing execution speed, and the ability to process multiple markets simultaneously.

In highly volatile markets, quick decision-making unaffected by human emotions becomes a decisive factor in a trader’s performance. From this perspective, automated trading is not only a useful tool but also an operational necessity in the competitive space of financial markets.

Video tutorial on Automated Trading from The Transparent Trader YouTube channel:

Different Levels of Automated Trading

Automated trading can range from simple orders to complex algorithms, and understanding its levels, tools, and risks is essential in trading. The three main levels of automated trading are:

- Basic level: Using simple conditional orders such as Stop Loss and Take Profit;

- Semi-automatic level: Combining manual trader analysis with bots or trading scripts;

- Advanced level: Utilizing complex trading algorithms, AI, and machine learning for decision-making and trade execution.

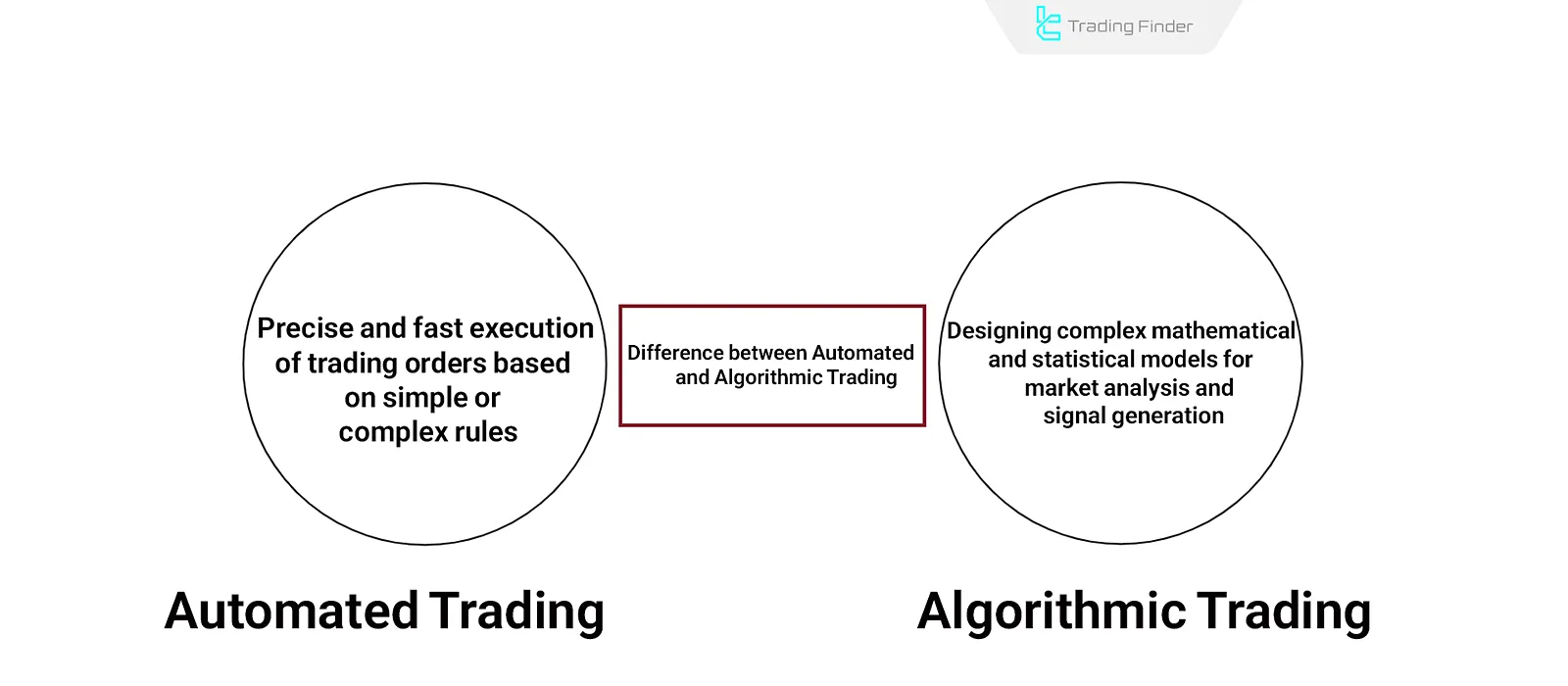

Difference Between Automated and Algorithmic Trading

Although in financial markets these two terms are sometimes used interchangeably, in practice, there is a clear distinction between Automated Trading and Algorithmic Trading.

Automated Trading

This method focuses on the accurate and fast execution of trading orders based on simple or complex rules. It may be designed without deep market analysis and may merely rely on basic technical signals.

Algorithmic Trading

These trades usually involve designing complex mathematical and statistical models for market analysis and signal generation. In this type of trading, automated trade execution is only one component of the process, with the main focus placed on market behavior modeling and trend forecasting.

Simply put: all algorithmic trades can be executed automatically, but not all automated trades are algorithmic. The difference lies in the complexity level and the purpose of the trading system’s design.

Table – Differences between Automated Trading and Algorithmic Trading:

Features | Automated Trading | Algorithmic Trading |

Basis of Decision | Simple technical rules and signals | Complex mathematical & statistical models |

Main Focus | Fast & precise order execution | Analysis, modeling & trend forecasting |

Complexity Level | Low to medium | High and advanced |

Trader’s Role | Designing initial rules | Developing & optimizing models |

Common Application | Order management & reducing human errors | Predictive strategies & macro trading |

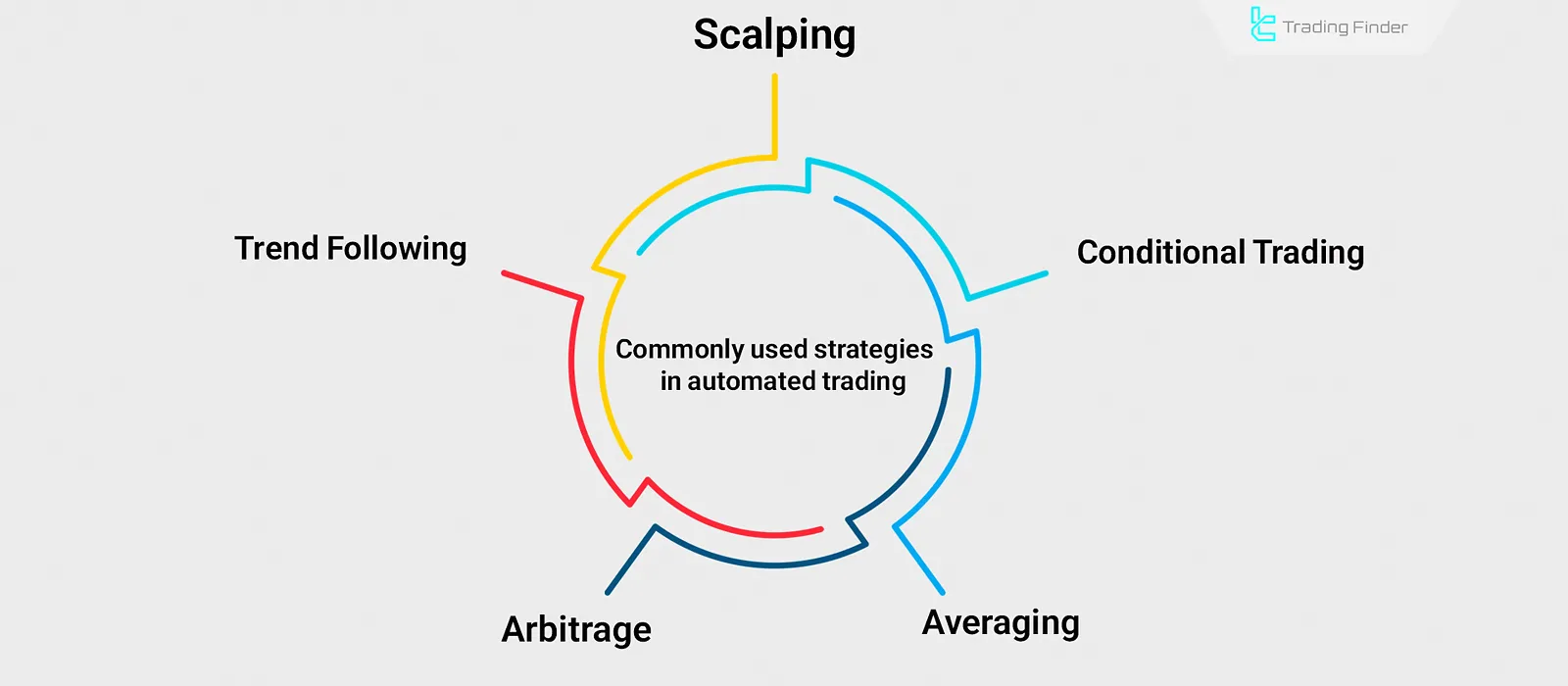

Popular Strategies in Automated Trading

Each automated trading strategy has a unique structure and logic, and choosing the right one can significantly affect system performance. For example, scalping relies heavily on execution speed, while arbitrage requires stable connections and simultaneous monitoring of multiple markets. Common strategies include:

- Scalping: High-volume short-term trades;

- Trend Following: Tracking the direction of market movements;

- Arbitrage: Exploiting price differences between markets;

- Averaging: Gradual entries to manage risk;

- Conditional Trading: Trade activation only under specific market conditions.

Advantages and Disadvantages of Automated Trading

Understanding the pros and cons of automated trading is necessary for proper evaluation and decision-making in financial markets.

Table – Pros and Cons of Automated Trading:

Advantages | Disadvantages |

Fast and uninterrupted execution | Dependence on technical infrastructure |

Emotional control | Lack of adaptability to exceptional markets |

Backtesting and evaluation capability | Risk of using unknown/unverified systems |

24/7 trading without constant human presence | – |

The Role of Trading Psychology in Automated Trading

Eliminating human emotions is one of the key strengths of automated trading, as many trader losses stem from fear, greed, or impatience.

However, it must be noted that the design of a trading system is also influenced by the trader’s mindset. If strategy rules are not correctly defined, the bot will repeat the same mistakes.

Eliminating human emotions is considered one of the major strengths of automated trading.

Tools and Programming Languages in Automated Trading

Selecting the right trading platform and determining the level of technical knowledge required are among the first important decisions in designing or using automated trading.

From ready-made software with strategy execution without coding, to specialized programming languages such as MQL4/MQL5, Python, or Pine Script, traders have access to a wide range of tools—each with unique benefits, limitations, and different levels of complexity.

A careful review of these options forms the foundation of decision-making in automated trading.

Artificial Intelligence and Machine Learning in Automated Trading

The integration of artificial intelligence with automated trading has transformed analysis and trading in financial markets. Market sentiment analysis through Natural Language Processing (NLP) and predictive modeling of price behavior using machine learning algorithms allows for the creation of adaptive, data-driven, real-time systems.

Understanding the practical applications of AI—especially in learning—plays a fundamental role in developing advanced and intelligent strategies in automated trading.

AI-Powered Expert Advisor for Automated Trading

The AI-connected trading expert is a tool that enables instant and automated access to advanced market analysis. This tool is designed by integrating two AI models, ChatGPT and Claude, with the primary goal of providing precise chart analysis, identifying key price levels, interpreting economic news, and executing custom commands.

Educational video on using the AI trading Expert Advisor:

YouTube:

Its functionality is based on sending requests to AI model APIs and receiving analytical responses in text format. Key features include support for trading indicators, machine learning tools, AI-based indicators, and trader assistants.

It can also be used across multiple markets such as Forex, cryptocurrencies, and stocks. The required skill level is low, making it accessible even to beginner traders.

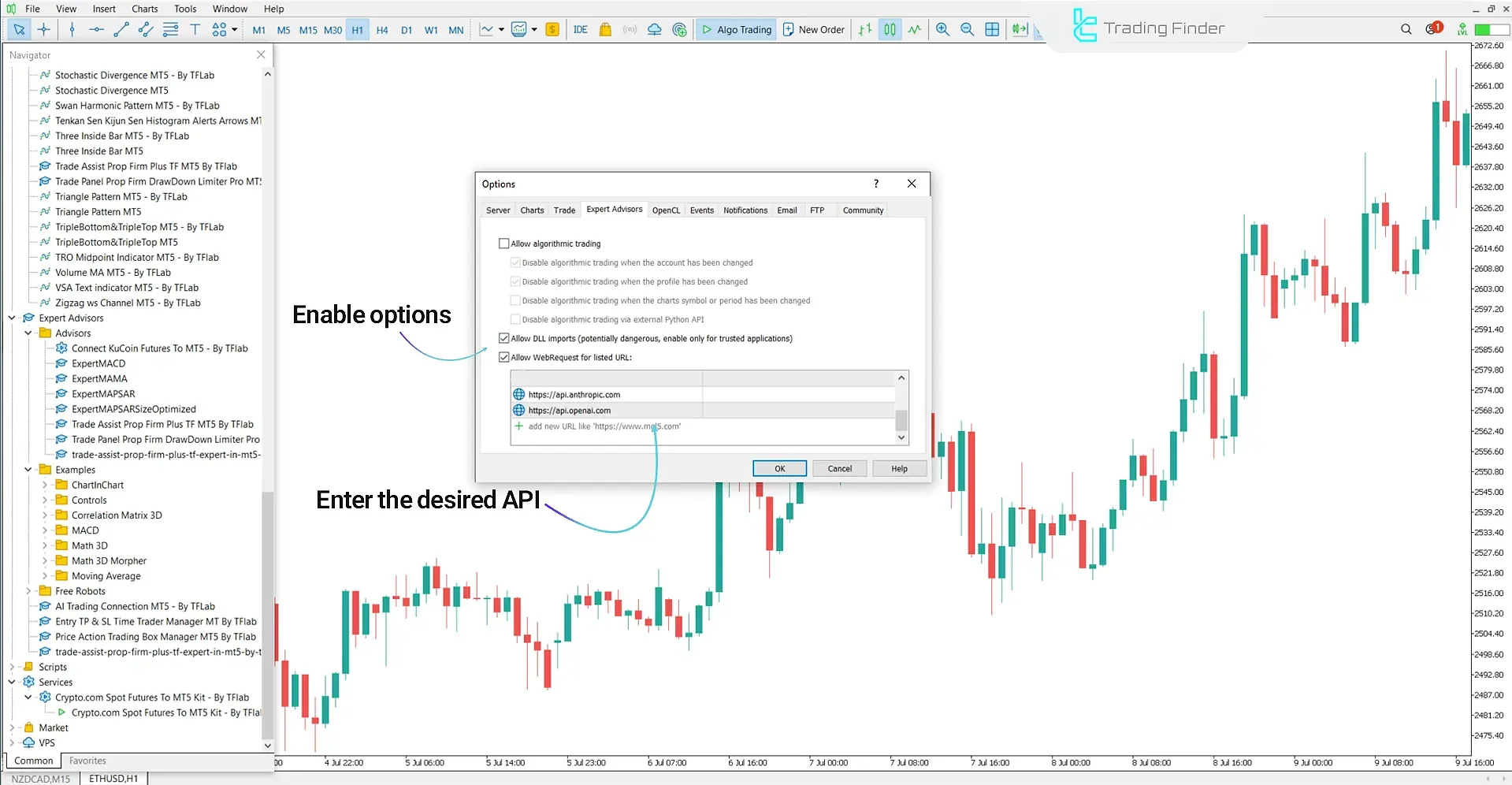

To use it, first enable web connection, then obtain API tokens from the relevant services to connect with AI models. After entering the token in the settings, users can input their own analytical prompts and receive customized text-based responses.

In this process, the chosen model generates analytical outputs based on user input data, which may include technical, fundamental, or a hybrid of both analyses.

Other advantages of this tool include flexibility in choosing AI models and customizable prompts, making it a smart and precise assistant for traders. Ultimately, the AI-connected Expert Advisor offers traders deep text-based analyses as an advanced solution.

Download links for AI Expert Advisor trading tools:

Practical Execution and Trade Management in Automated Trading Systems

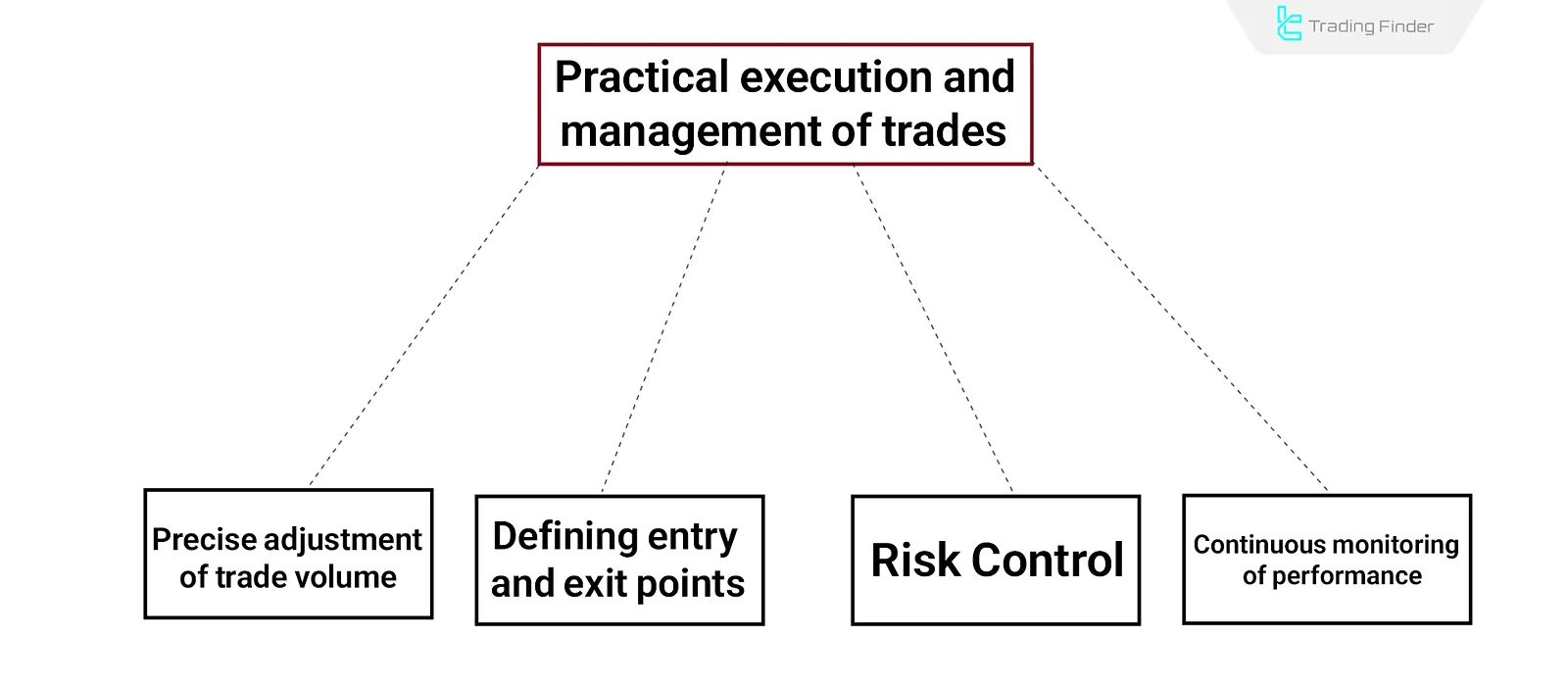

In designing an automated strategy, the main challenge begins when the strategy is executed, managed, and monitored under real market conditions. Live execution of automated trades requires adherence to key principles such as precise trade volume adjustment, defining entry and exit points, risk control, and continuous performance monitoring.

Neglecting these factors can cause even the best strategies to fail. Therefore, careful preparation before live trading and the use of monitoring tools are essential for the successful application of automated systems.

Automated Trading in Special Market Conditions

While automated trading may perform well under normal market conditions, its true efficiency and stability are tested during unexpected situations (such as extreme volatility, sudden news, or events like Flash Crashes).

Unexpected conditions can override predefined analyses and lead to unpredictable behavior. Therefore, designing strategies with the ability to react properly to sudden market changes plays a crucial role in capital preservation and risk reduction in volatile environments.

Cost Reduction in Automated Trading Systems

One of the significant features of using automated trading systems is the reduction of operational costs in trading. These systems eliminate the need for constant human intervention, reduce manual errors, execute trades faster and more precisely, and manage multiple markets simultaneously—saving time, labor, and infrastructure resources.

Moreover, through capabilities such as high-volume trade execution with minimal delay and the use of lower-cost technology structures, automated systems enhance the economic efficiency of financial operations. Evaluating these impacts is essential for understanding the true value of automation on both individual and institutional scales.

Limitations and Common Errors in Automated Trading

Automated trading is not flawless. Although it has many benefits, without awareness of the risks, it can result in losses. The most important issues to examine before using automated trading include:

- Backtest error: Past results do not necessarily guarantee future performance;

- Technical issues: Internet disconnection or server failure can cause incomplete order execution;

- Software bugs: Coding errors or unexpected market conditions may lead to significant losses.

Example of Automated Trading in MetaTrader Algorithmic Trading (Algo Trading)

In automated trading via MetaTrader, algorithmic trading is conducted through Expert Advisors (EA). By enabling the Auto Trading button at the top of the platform, the system begins automatically executing the strategy, and orders are placed or closed without manual input.

At any moment, this feature can be turned off with a single click, allowing trades to continue manually. This on/off flexibility provides traders with strong control over automated trades depending on market conditions.

Conclusion

Automated trading addresses three fundamental challenges of professional trading: the need for speed, the elimination of human error, and complete control over strategy execution. These systems, through predefined logic, enable continuous, emotion-free, and highly accurate execution.

Understanding its difference from algorithmic trading, selecting the right tools, evaluating technical requirements, and becoming familiar with AI applications are prerequisites for entering this field. In addition to improving decision quality, these systems reduce operational costs by minimizing human involvement, optimizing resources, and increasing scalability.

Given the complexity of real market conditions, success in automated trading is only possible through continuous monitoring, systematic risk management, and readiness for extreme volatility.