Price action, by directly analyzing price behavior without using lagging indicators, holds a significant position in binary options trading. Traders can identify entry and exit points by studying patterns such as pin bars, inside bars, or breakout levels.

This method has high flexibility in both trending and ranging conditions and clearly reveals the real market structure.

Price Action in Binary Options

Price action is the study and analysis of price changes on the chart without relying on complex indicators. In this method, instead of focusing on computational tools, the trader directly observes candlesticks, support and resistance levels, and price patterns to understand the real market behavior.

In binary options, this is of great importance since decisions must be made within short timeframes and with high accuracy. For example, by spotting a pin bar or a breakout of a resistance level, the trader can forecast the next price direction in the upcoming minutes and determine a buy or sell position accordingly.

The main advantage of price action compared to indicator-based methods is the absence of delays in signaling and its flexibility under different market conditions. Indicators usually issue alerts after price movement has already occurred, while price action allows traders to follow the real market flow in real time.

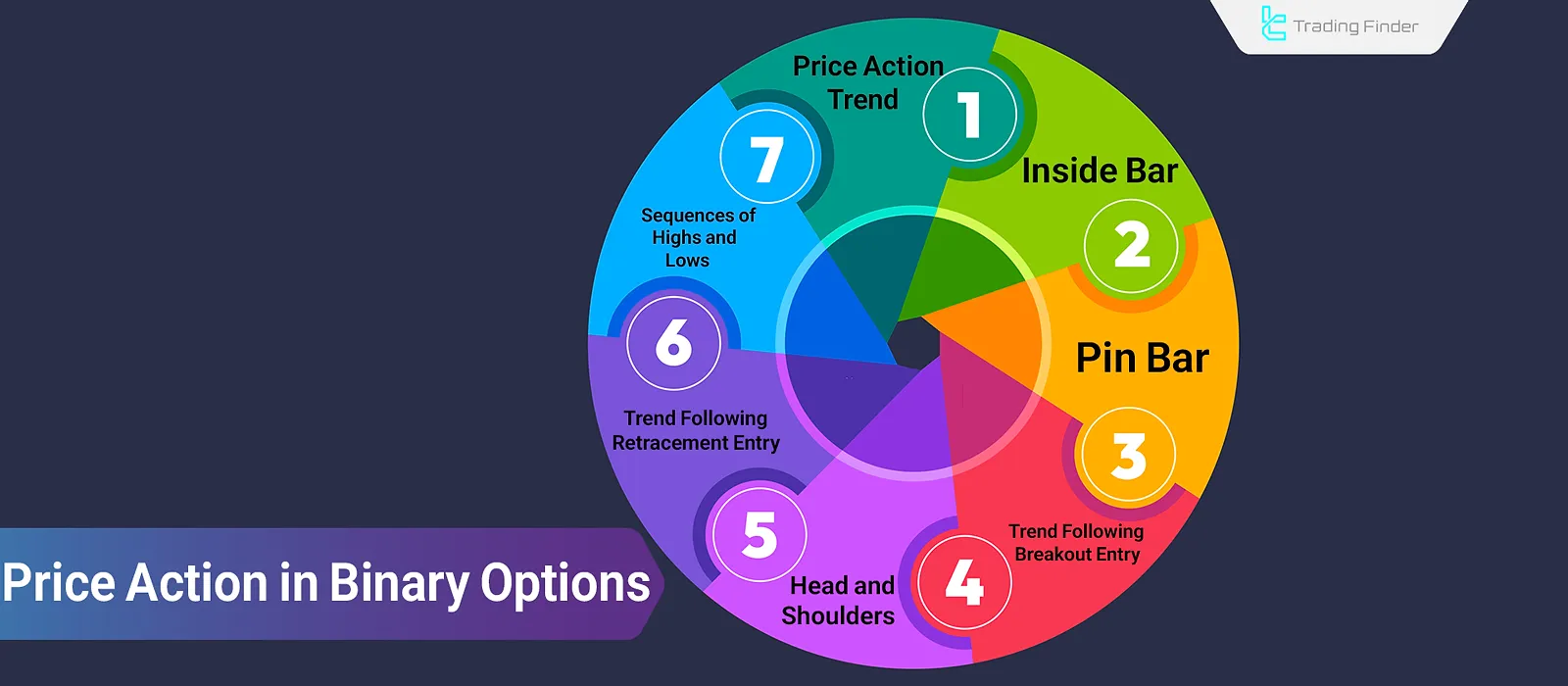

List of the Best Price Action Strategies in Binary Options

Price action strategies, by focusing on raw price movements, provide opportunities for identifying trades in both trending and ranging markets. One of the key advantages of these strategies is their usability across multiple timeframes. The top Price Action strategies in Binary Options include:

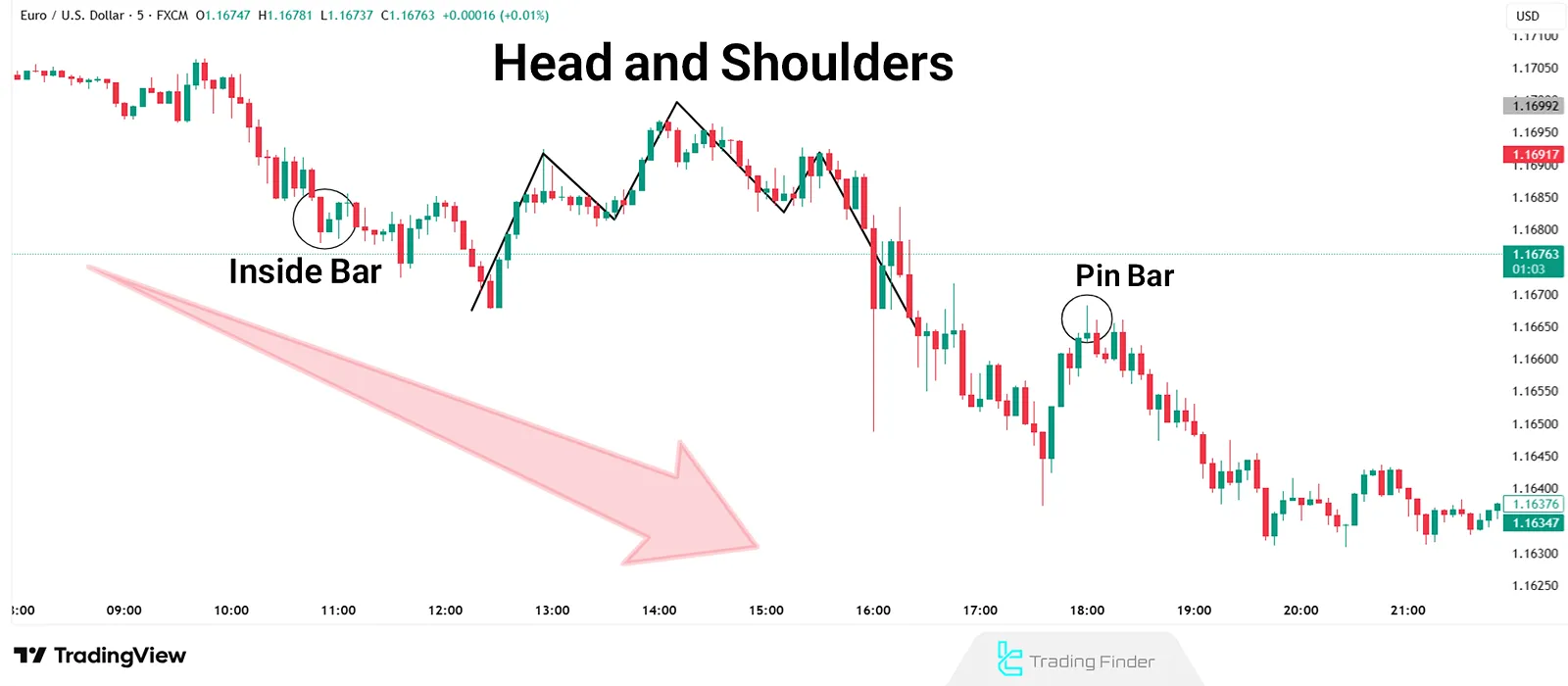

Pin Bar Strategy (Pin Bar)

A pin bar, or reversal signal candlestick, is one of the most recognized price action methods in binary options trading. These candlesticks, with long wicks and small bodies, signal that the market strongly rejected a certain price level. The longer the wick, the greater the rejection and reversal pressure.

Table – Advantages and Disadvantages of Pin Bar in Binary Options:

Advantages | Disadvantages |

Easy to identify on charts | Possibility of fake signals in highly volatile markets |

Usable across multiple timeframes | Dependent on trader interpretation |

Clear entry and exit points | Requires proper understanding of market context |

Trend Strategy (Price Action Trend)

Studying market trends is one of the simplest yet still highly effective trading methods. In this strategy, the trader analyzes successive price changes to decide on entering buy or sell positions. Using technical analysis, the trend strategy aims to identify and confirm trends and then enter trades in the same direction.

Table – Advantages and Disadvantages of the Trend Strategy in Binary Options:

Advantages | Disadvantages |

Identifies strong trends | Risk of missing early stages of a trend |

Applicable in various markets and timeframes | Subjective interpretation and need for strong analytical skills |

Flexibility for both short-term and long-term trades | – |

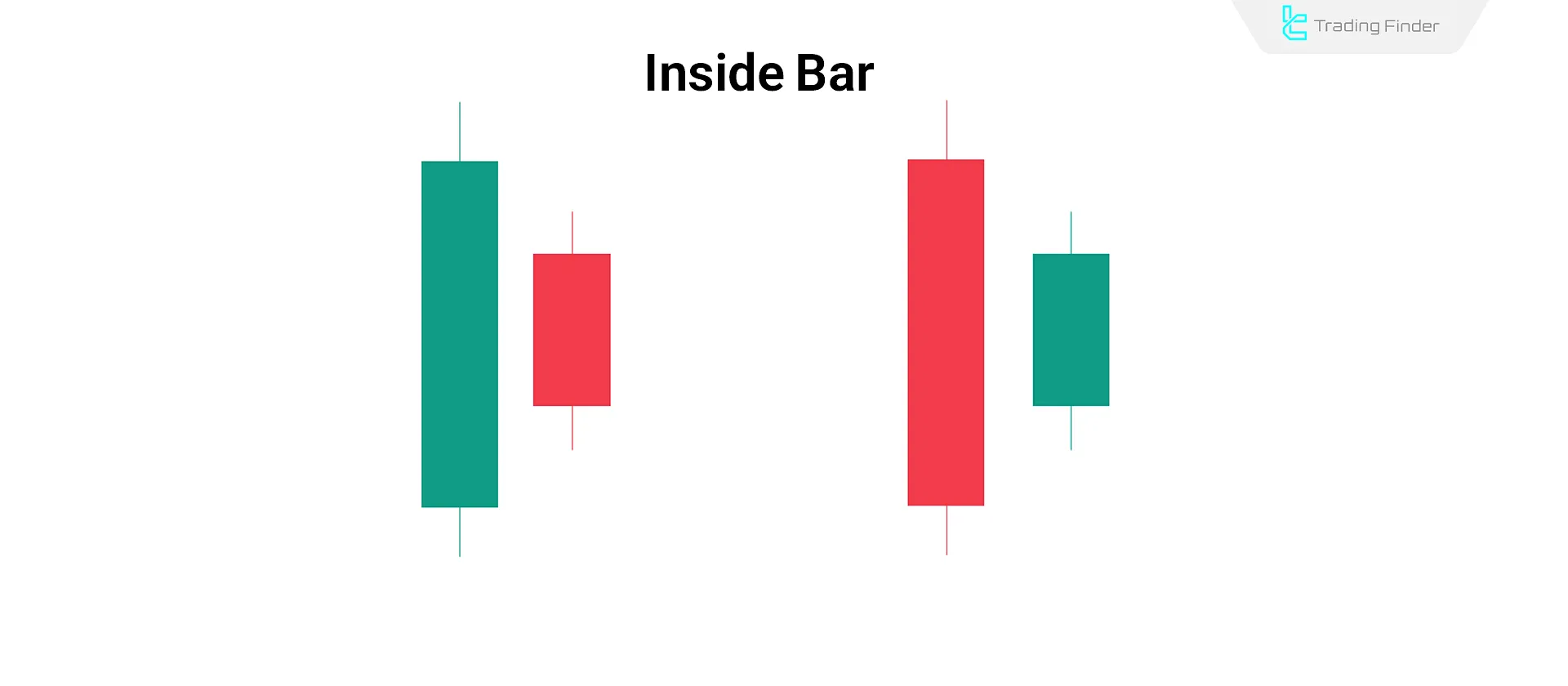

Inside Bar Strategy (Inside Bar)

The inside bar is a pattern where a smaller candlestick forms within the high and low of the previous “mother” candle. This setup indicates a consolidation or decision-making phase in the market and often appears before a strong move.

Table – Advantages and Disadvantages of the Inside Bar Strategy in Binary Options:

Advantages | Disadvantages |

Suitable for identifying trend continuation or reversal | Late signals in fast markets |

Compatible with different market conditions | Difficult to detect in volatile environments |

Can be combined with other technical tools | Risk of false breakouts |

Trend Following Breakout Entry

In this method, traders pay attention to support and resistance levels. When the price breaks through these levels, a breakout occurs, and a strong move is likely. With proper risk management, the trend-following breakout strategy can increase the win rate of trades.

Table – Advantages and Disadvantages of the Trend Breakout Strategy in Binary Options:

Advantages | Disadvantages |

Ability to capture big moves | Requires precise risk management |

Works in various market conditions | Difficulty in distinguishing real breakouts |

Suitable for momentum trades | High importance of entry timing |

Head and Shoulders Reversal Pattern

The head and shoulders pattern is one of the most reliable reversal setups in price action. After forming a shoulder, a strong bullish head, and another shoulder, the market typically shifts direction. Correct identification of this pattern provides clear entry and exit opportunities.

Table – Advantages and Disadvantages of Head and Shoulders in Binary Options:

Advantages | Disadvantages |

Clear entry and exit points | Requires accurate recognition, subject to trader error |

Applicable in both bullish and bearish trends | Late entry after pattern confirmation |

Trend Following Retracement Entry

In this strategy, traders take advantage of price retracements within a trend. For example, in an uptrend, a pullback to a lower level, or in a downtrend, a short-lived upward correction, provides a trading opportunity.

Table – Advantages and Disadvantages of the Trend Retracement Strategy in Binary Options:

Advantages | Disadvantages |

Favorable risk-to-reward ratio | Hard to distinguish between retracement and full reversal |

Can be combined with indicators for confirmation | Performs poorly in ranging markets |

Effective in strong trends | Dependent on market volatility |

Sequences of Highs and Lows

Studying consecutive highs and lows is one of the fundamental price action techniques. If highs and lows consistently move upward, the trend is bullish; conversely, if highs and lows move downward, a bearish trend is confirmed. Trading decisions are based on this simple yet powerful sequence.

Table – Advantages and Disadvantages of Highs and Lows in Binary Options:

Advantages | Disadvantages |

Confirms trend direction and strength | Can be misleading in ranging or volatile markets |

Useful for identifying trend continuation or reversal | Requires context analysis for validation |

– | Possibility of delayed signals |

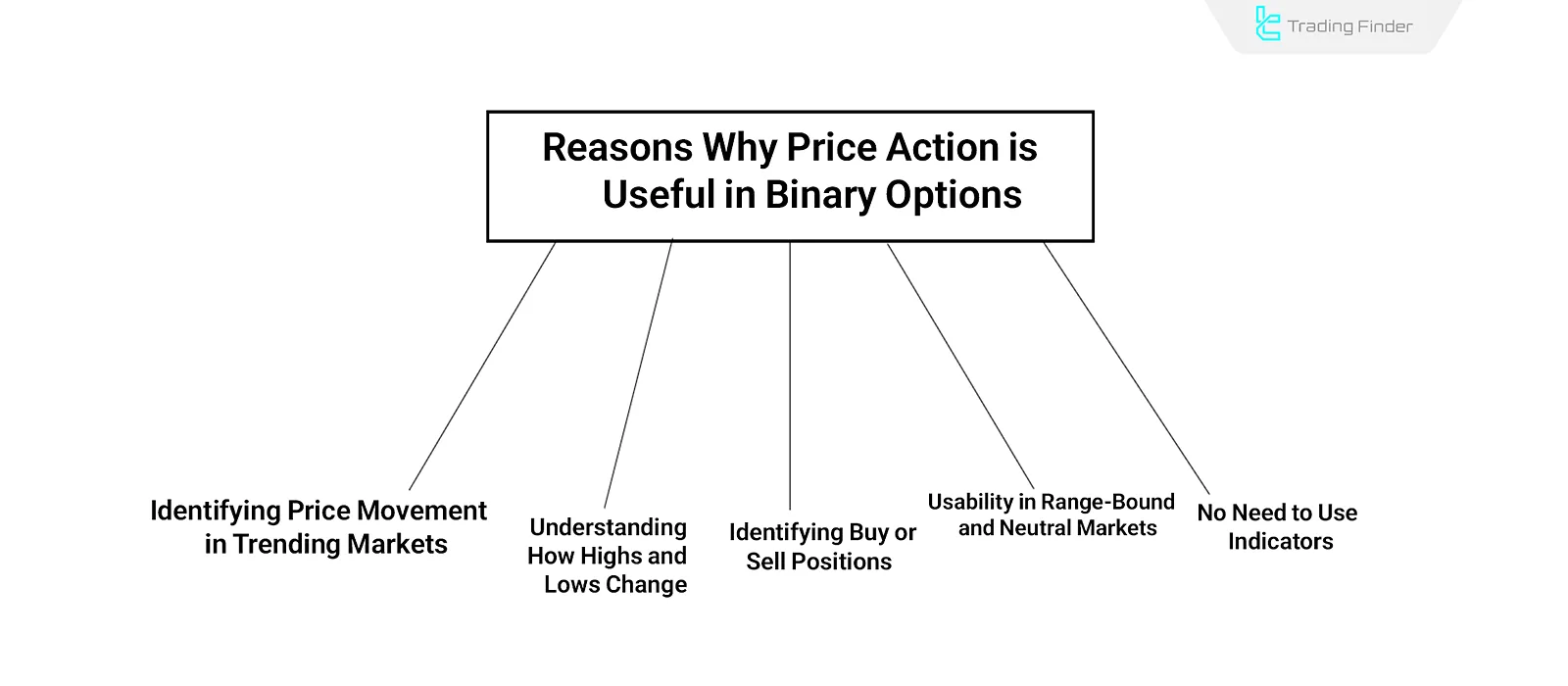

What Is the Use of Price Action in Binary Options?

By applying price action in binary options, traders can identify entry and exit points through direct analysis of price movements without lagging indicators. The uses of price action in binary options include:

- Detecting price movement in trending markets, reducing the risk of sudden unexpected volatility;

- Offering traders a better understanding of how highs and lows evolve;

- Allowing recognition of when to open a long (buy) or short (sell) position simply by tracking highs and lows;

- Even in ranging or neutral markets, price action strategies can provide valid assumptions about potential price direction in binary trades;

- Eliminating the need for indicators, enabling simpler and clearer analysis without complex calculations.

Conclusion

Price Action strategies in binary options, by eliminating indicator delays, allow faster trade entries. Patterns such as pin bar, inside bar, breakouts, or sequences of highs and lows are most effective when combined with proper market structure analysis and risk management.

Price action provides direct insight into market liquidity, enabling traders to gauge the strength of buyers, sellers, and valid binary option breakouts.