The Compounding Strategy in Binary Options is a method where the trader does not withdraw profits from each trade. Instead, they add these profits to the initial capital, allowing the size of future trades to increase.

This approach focuses on optimizing the risk-to-reward ratio and leveraging capital growth through the compounding effect.

The impact of this strategy in High Win Rate Systems is remarkable and exponentially accelerates capital growth; however, if Risk Management is weak, losses will accumulate consecutively and a severe drawdown becomes unavoidable.

What is the Compounding Strategy in Binary Options?

The Compounding Strategy in Binary Options is a method in which, after each successful trade, the trader reinvests the profit earned.

This approach, relying on compound interest, enables exponential account growth without the need for new capital.

Maintaining a winning streak and discipline in executing the trading strategy are among the key factors for applying this method.

For further reading and how to implement this method in binary options, you can use the tutorial article on the Compounding Strategy in Binary Options on cyberfutures.com.

Advantages and disadvantages of the Compounding Strategy in Binary Options

Using a Compounding Strategy in binary options trading, under stable conditions and with discipline, can deliver proper returns; however, if there is no adherence or one enters highly volatile markets, its negative effects emerge quickly.

Advantages and disadvantages of using the Compounding Strategy in Binary Options:

Parameters | Advantages | Disadvantages |

Capital Growth | Exponential capital growth | Exponential and rapid losses |

Capital Management | Defined percentage-based framework | High sensitivity to plan non-compliance |

Profit Efficiency | Additional returns through profit reinvestment | Profits exposed to the risk of subsequent trades |

Flexibility | Can be executed conservatively or aggressively | High complexity in hybrid modeling |

Trader Psychology | Increased confidence during consecutive wins | Psychological pressure during large losses |

Market Fit | Effective in trending markets | Risky in highly volatile markets |

Risk Management | Preserves principal in the net-profit model | Risk of losing capital in aggressive models |

Long-Term Potential | Higher returns over a long-term horizon | Requires experience and strict discipline |

Execution Complexity | Simplicity in the fixed-percentage model | Error-prone in hybrid models |

Psychology and the Role of Mindset in the Compounding Strategy

In implementing compounding, managing emotions and the trader’s mindset is crucial. As position sizes gradually increase, psychological pressure also rises.

Many traders, fearing to give back profits or being greedy to multiply capital quickly, violate their trading plan.

To counter fear or greed, the trader should:

- Have a predefined trading cycle (e.g., 5 to 7 consecutive trades);

- Be able to stop and revert to the initial capital in case of a loss;

- Use techniques such as journaling or daily note-taking to control emotions.

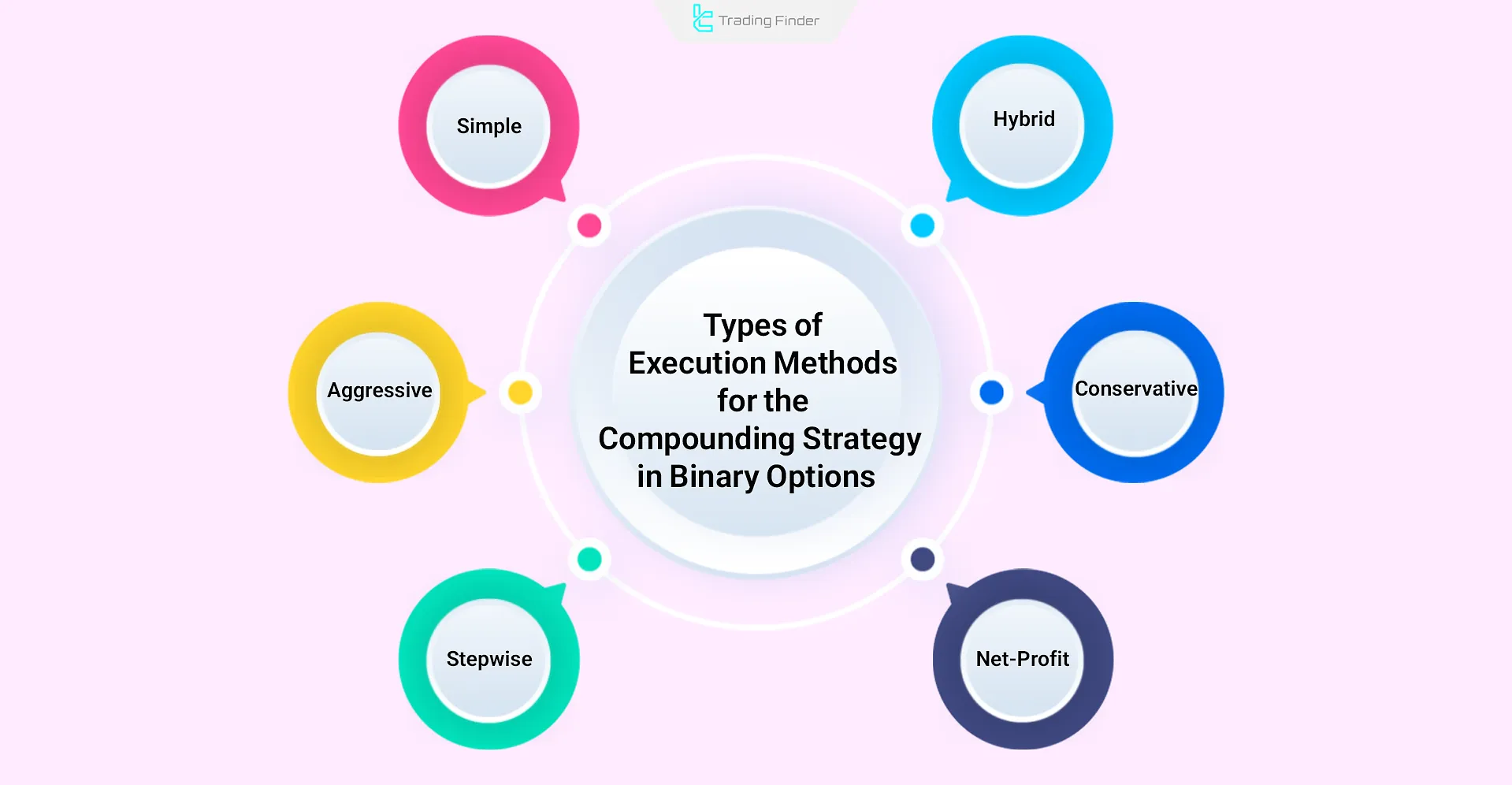

Types of execution methods for the Compounding Strategy in Binary Options

Compounding, built on the compounding effect, has several execution variants, noted below:

- Simple Compounding Strategy (fixed percentage)

- Stepwise Compounding Strategy

- Aggressive Compounding Strategy

- Conservative Compounding Strategy

- Hybrid Compounding Strategy

- Net-Profit Compounding Strategy

Simple Compounding Strategy (Fixed Percentage)

In this structure, the trader always allocates a fixed percentage of total equity (e.g., 5% or 10%) to each trade. After each successful trade, the profit is added to the principal and the next trade’s calculation is based on the new balance.

Example of a Simple Compounding Strategy in binary options trading

In the example below, a sample of the Compounding Strategy in binary options trading with a fixed-percentage method over 10 trades is shown.

In each trade, 10 percent of the total balance after each win is added to the grown capital. In this sample, we observe more than 100% exponential growth in the trading account using this strategy:

Trade No. | Investment Amount | Profit per Trade | New Balance |

1 | 10.00 | 8.00 | 108.00 |

2 | 10.80 | 8.64 | 116.64 |

3 | 11.66 | 9.33 | 125.97 |

4 | 12.60 | 10.08 | 136.05 |

5 | 13.61 | 10.89 | 146.94 |

6 | 14.69 | 11.75 | 158.69 |

7 | 15.87 | 12.70 | 171.39 |

8 | 17.14 | 13.71 | 185.10 |

9 | 18.51 | 14.81 | 199.91 |

10 | 19.99 | 15.99 | 215.90 |

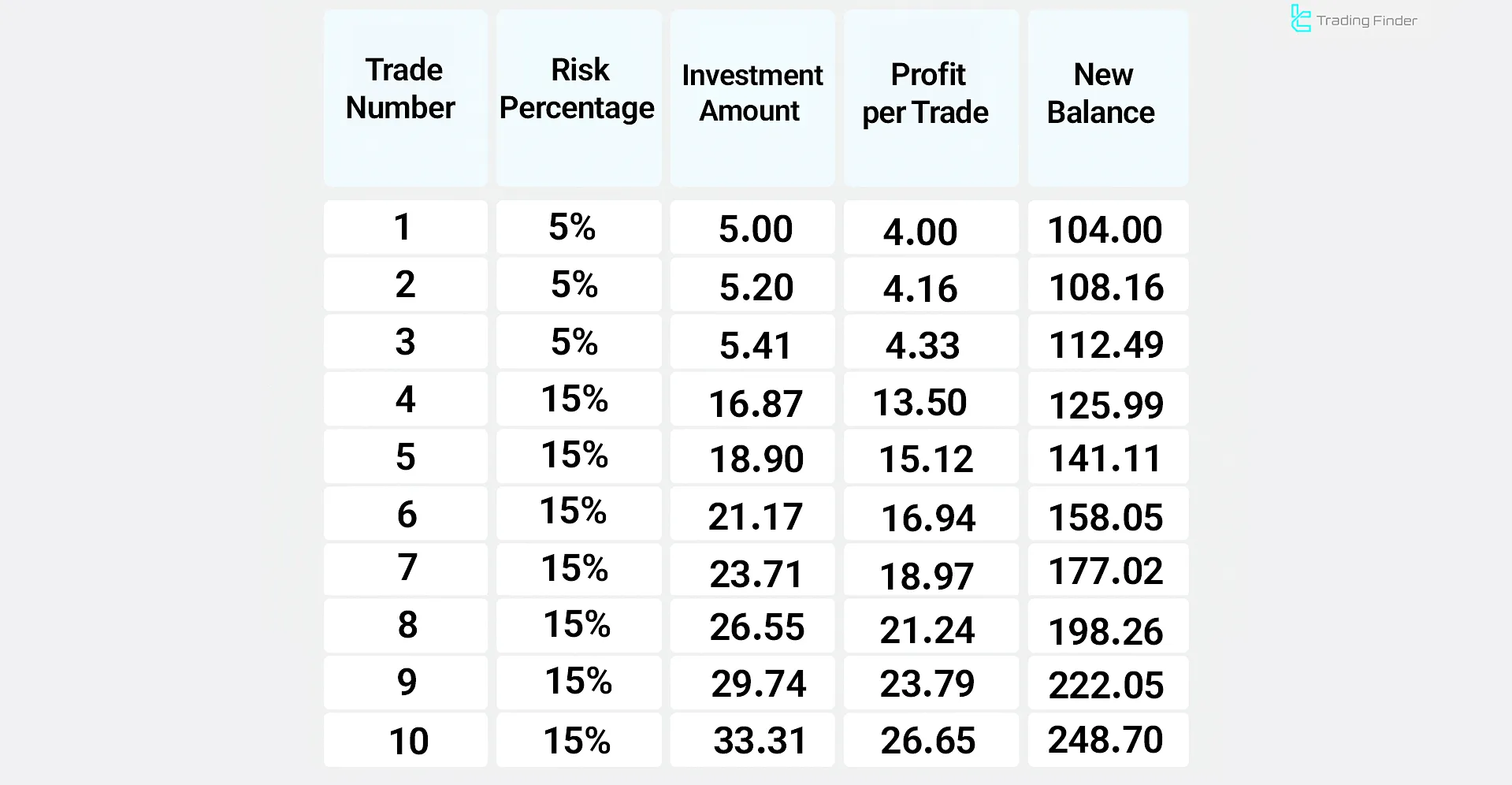

Stepwise Compounding Strategy

In this model, capital allocation increases in steps. For example, the first three trades are done with 5%, and if all succeed, from the fourth trade onward the percentage is raised to 10%.

This model suits traders who want to benefit from consecutive wins while preserving a framework for psychological control of trades.

Example of a Stepwise Compounding Strategy

Assume initial capital is $100 and the payout rate is 80%. The table below is designed with the first three trades at 5% of capital, and if successful, from the fourth trade onward the investment percentage increases to 10%.

Aggressive Compounding Strategy

In this approach, a high percentage of equity (such as 20% or more) is allocated to each trade. With a few consecutive wins, capital multiplies, but a single mistake is enough to wipe out all or a large portion of the capital.

This method is suitable for professional traders with very high-risk tolerance who can handle heavy psychological pressure.

Example of an Aggressive Compounding Strategy

Below is an example of how to execute an aggressive Compounding Strategy (with high-risk percentage):

Trade No. | Risk % | Investment Amount | Profit per Trade | New Balance |

1 | 20% | 20.00 | 16.00 | 116.00 |

2 | 20% | 23.20 | 18.56 | 134.56 |

3 | 20% | 26.91 | 21.53 | 156.09 |

4 | 20% | 31.22 | 24.98 | 181.07 |

5 | 20% | 36.21 | 28.97 | 210.04 |

6 | 20% | 42.01 | 33.61 | 243.65 |

7 | 20% | 48.73 | 38.98 | 282.63 |

8 | 20% | 56.53 | 45.22 | 327.85 |

9 | 20% | 65.57 | 52.46 | 380.31 |

10 | 20% | 76.06 | 60.85 | 441.16 |

Conservative Compounding Strategy

This model is built on allocating a very small percentage (1 to 2%) of capital to each trade. The speed of profit growth here is slow, but the principal remains more protected against severe losses.

A conservative Compounding Strategy is suitable for those with low risk tolerance whose main focus is preserving capital over the long term.

Hybrid Compounding Strategy

This approach combines conservative and aggressive styles. The trader first enters the market with a limited percentage (e.g., 2%), and if several consecutive wins are achieved, increases the risk level to 8% or 10%; in case of a loss, they revert to the initial level.

A hybrid strategy suits those seeking a balance between risk and return and who do not wish to be confined to a single absolute style.

Example of a Hybrid Compounding Strategy

The hybrid strategy is slightly conservative. The table below provides an example of how to implement it over 10 trades:

Net-Profit Compounding Strategy

In this method, only the profits earned are allocated to subsequent trades and the principal remains untouched. Even if a loss occurs, the base capital is protected and the overall drawdown is minimized.

This model is suitable for risk-averse traders whose main priority is preserving the initial capital and who do not wish to put the principal at risk.

Example of a Net-Profit Compounding Strategy

The table below provides a sample execution of a Compounding Strategy with net profits. In this example, the investment risk amount is fixed, and if a trade is losing, only the accumulated profit is reduced while the principal remains intact.

Trade No. | Principal | Fixed Investment | Profit per Trade | Total Accumulated Profit | Total Balance (Principal + Profit) |

1 | 100 | 10.00 | 8.00 | 8.00 | 108.00 |

2 | 100 | 10.00 | 8.00 | 16.00 | 116.00 |

3 | 100 | 10.00 | 8.00 | 24.00 | 124.00 |

4 | 100 | 10.00 | 8.00 | 32.00 | 132.00 |

5 | 100 | 10.00 | 8.00 | 40.00 | 140.00 |

6 | 100 | 10.00 | 8.00 | 48.00 | 148.00 |

7 | 100 | 10.00 | 8.00 | 56.00 | 156.00 |

8 | 100 | 10.00 | 8.00 | 64.00 | 164.00 |

9 | 100 | 10.00 | 8.00 | 72.00 | 172.00 |

10 | 100 | 10.00 | 8.00 | 80.00 | 180.00 |

Comparison of Hybrid and Simple (Fixed Percentage) Capital Management in Binary Options

For greater clarity, two capital management methods hybrid Compounding and simple are compared in the table below:

Features | Simple Strategy (fixed percentage) | Hybrid Strategy |

Pattern | Fixed percentage of total capital in each trade | Changing the percentage based on wins or losses |

Risk | Fixed and controlled | Variable (low at start, higher later) |

Capital growth | Steady and gradual | Faster if consecutive wins occur |

Complexity | Simple and executable for everyone | More complex, requires mental discipline |

Suitable for | Beginner traders | Experienced traders with strong risk management |

Main weakness | Slower profit growth | Chance of giving back profits at higher risk levels |

Step-by-step Tutorial for Trading with the Compounding Strategy in Binary Options

Executing the Compounding Strategy in binary options is a precise process that requires a disciplined and structured approach to capital management.

Below are the steps on how to use the compounding strategy in binary options.

#1 Define the amount of trading capital

Before starting any position, defining a fixed amount of capital is essential. This amount acts as the foundation of the Compounding Strategy in Binary Options and creates a clear framework for managing trades.

#2 Set a specific percentage of risk for the capital

Typically, the risk size is kept within 1 to 2 percent of total capital, while in aggressive approaches this amount is between 5 to 10 percent.

Such a structure ensures trading discipline and prevents excessive risk-taking.

#3 Let profits grow and reinvest them

If a trade is successful, the profit is returned to the trading capital. This action activates the Compounding effect and leads to exponential profit growth.

This approach is recognized as a key element in maximizing returns and accelerates capital development.

#4 Accept losses without increasing the trading capital

In loss conditions, strict adherence to the trading plan is essential.

Increasing size to immediately recoup losses creates unreasonable risk and can dismantle the strategy’s structure. Discipline in accepting losses is a pillar of sustainable, long-term success.

#5 Repeat steps 2 to 4 in subsequent trades

Consistency and persistence are the keys to success in the Compounding Strategy in Binary Options.

Continuously repeating the trade cycle while strictly adhering to predefined percentages lays the groundwork for sustainable growth in investing.

Practical Example of a Compounding Cycle

Suppose a trader with $100 initial capital decides to risk 10 percent of total capital on each trade and to use the Compounding Strategy.

Different outcomes after 3 trades are calculated in the table below:

Number of wins and losses | Final capital after 3 trades | % change relative to $100 |

3 consecutive wins | $133.1 | +33% |

2 wins – 1 loss | $108.9 | +9% |

1 win – 2 losses | $89.1 | −11% |

3 consecutive losses | $72.9 | −27% |

According to the example, consecutive wins create exponential growth, and even with two wins and one loss, capital is still profitable; but consecutive losses lead to a rapid decline in capital.

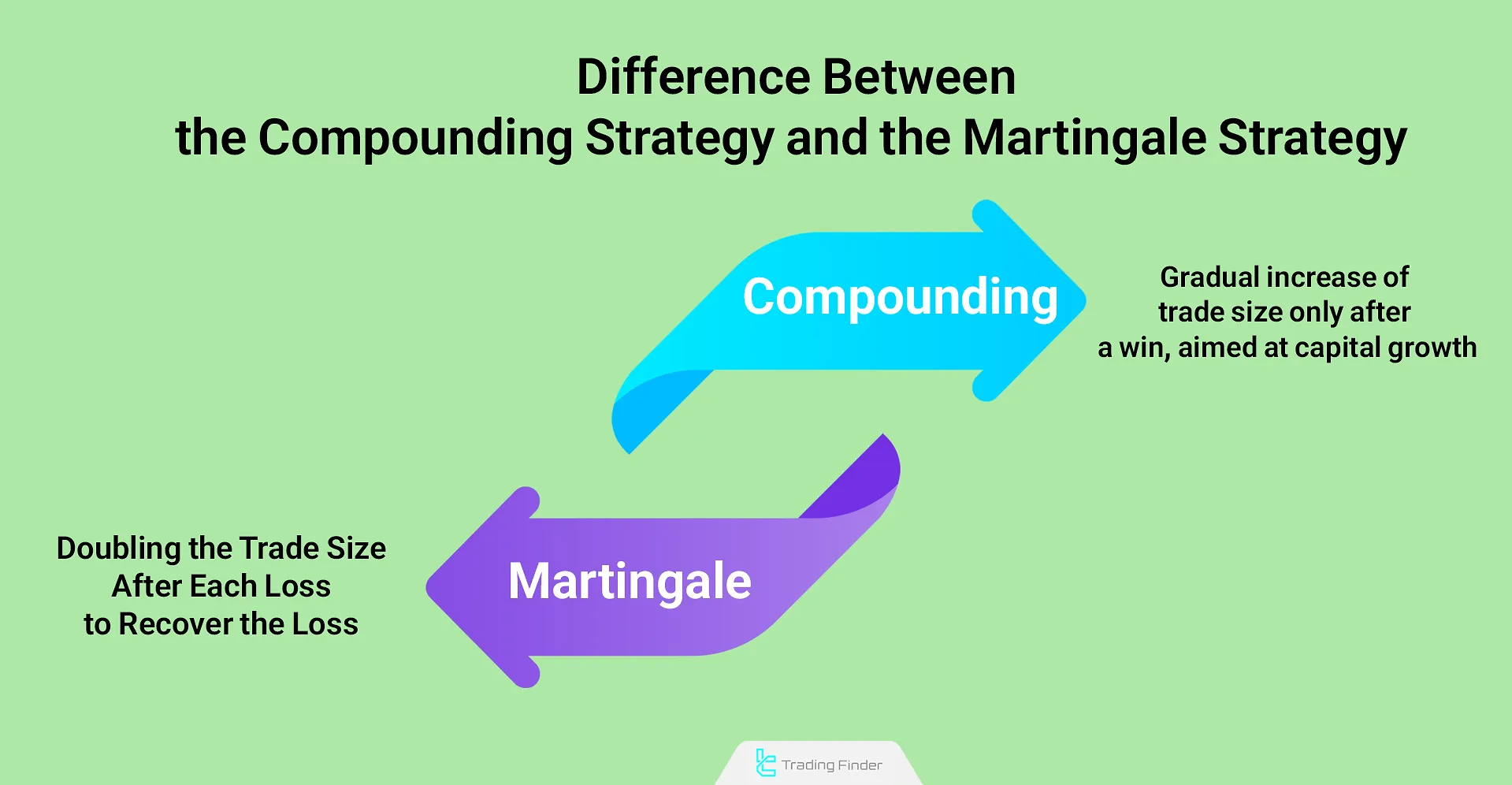

Difference Between Compounding and Martingale

Many novice traders confuse compounding with Martingale. The key differences between compounding and Martingale are listed in the table below:

Parameters | Compounding | Martingale |

Operating logic | Increase size after a win | Increase size after a loss |

Objective | Gradual capital growth | Rapid loss recovery |

Risk | Controlled and low | Very high |

Capital management | Based on compound interest | Based on doubling the size |

Trading approach | Conservative and sustainable | Aggressive and high-risk |

While Martingale bears very high risk and the entire account can be wiped out in a few trades, compounding offers a more conservative approach to capital growth.

Binary Winner Indicator in MetaTrader

The Binary Winner indicator is designed in MetaTrader to identify potential trend reversal zones in binary options trading.

Its structure and operating logic are such that its algorithmic core works based on price structure analysis and candlestick behavior. Optimal entry points are shown directly on the chart:

- Green arrow: CALL signal

- Red arrow: PUT signal

A key feature of this tool is Non-Repaint; that is, after a candle closes, the signal’s validity remains fixed, enabling more confident decision-making.

The Binary Winner indicator can be used across diverse markets, including:

- Forex

- Cryptocurrencies

- Stocks

- Commodities

- Indices

In short timeframes such as M15 or M5, the signaling logic remains consistent. First, the dominant market direction and momentum are assessed, then short-term divergences and the strength or weakness of the rally are evaluated.

Only when conditions overlap does a confirmation arrow appear on the chart. This mechanism reduces signal noise and enhances entry quality for short-term binary trades.

The simple user interface enables quick and easy use for beginners. The MT5 version provides an advanced settings panel that includes:

- Max Bars: sets the range of processed data

- Alert: in-platform alerts

- Email: send signals to the user’s email

- Notification: send push notifications to the mobile phone

- Message Timeout/Subject: manage message timing and content

These capabilities allow coordination of the trading strategy even when monitoring multiple symbols and timeframes. The highest effectiveness of the Binary Winner indicator is achieved when its signals are combined with:

- Capital management rules

- Confirmatory filters

- Support and resistance levels

- Price action patterns

The simple display of arrows helps beginners identify entries, while professional traders can use these signals alongside their own checklists to optimize the ITM win rate.

With non-repaint reversal signals, support for diverse markets, and advanced communication features, the Binary Winner indicator becomes a practical tool for binary options traders as well as participants in Forex, crypto, equities, commodities, and indices.

Auxiliary tools and indicators for executing compounding

To increase precision and avoid random entries, traders employ analytical tools alongside the Compound trading Strategy in binary options.

The most important tools used are:

- Relative Strength Index (RSI) and MACD to identify overbought/oversold zones and confirm trend;

- Price Action and candlestick patterns to detect low-risk entries;

- Moving Averages to identify medium-term trends.

Combining these tools with the compounding plan increases the probability of success and the continuity of profitability.

Advanced Capital Management in Compounding

One advanced capital management method is staggered profit withdrawal. In this technique, the trader periodically withdraws part of the consecutive profits and only allocates a percentage of the remaining profit to the next cycle.

This approach ensures that even if a cycle fails, the principal portion of prior profits is preserved. Also, setting a maximum cap for each cycle (e.g., 30 to 40 percent account growth) prevents excessive risk-taking.

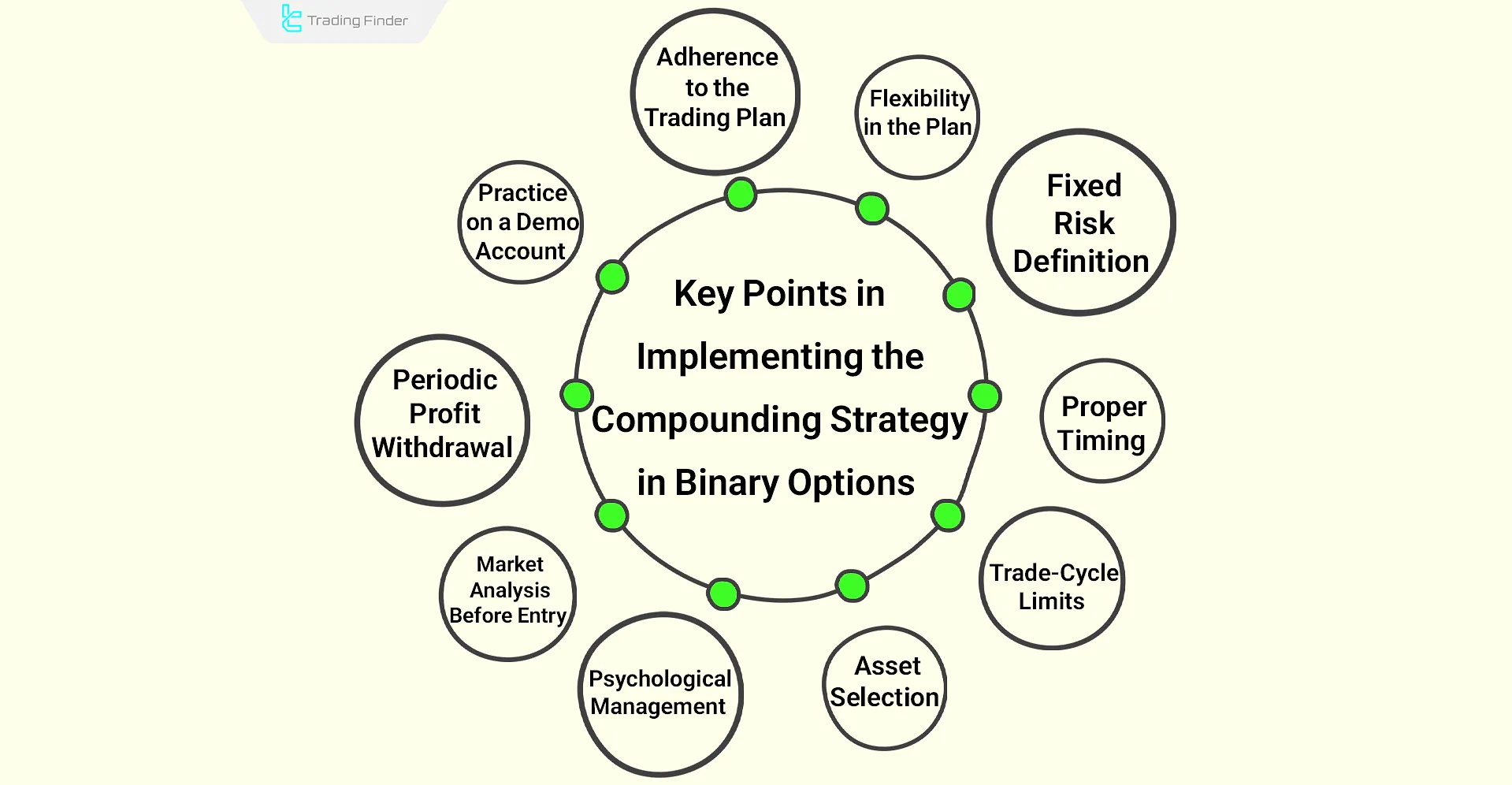

Key Points in Implementing the Compounding Strategy in Binary Options

To successfully implement a Compounding Strategy, follow these:

- Fixed risk definition: allocate 2% to 10% of capital per trade to control risk and avoid heavy losses;

- Adherence to the trading plan: define the number of steps and the profit-taking point and do not deviate from the plan;

- Periodic profit withdrawal: store part of consecutive profits to reduce the risk of losing all accumulated profit;

- Asset selection: focus on major pairs and liquid assets with stable volatility such as EUR/USD or gold;

- Proper timing: use 5- to 15-minute timeframes to reduce noise and avoid ultra-short trades;

- Psychological management: maintain mental discipline and emotional control as size increases at each step and pressure rises;

- Trade-cycle limits: execute 5- to 7-step cycles to balance capital growth and the risk of giving back profits;

- Market analysis before entry: use Price Action, candlestick patterns, and confirmatory indicators (RSI, MACD) instead of random entries;

- Practice on a demo account: test the Compounding plan on a demo account to identify weaknesses before going live;

- Flexibility in the plan: stop the cycle and revert to initial capital to preserve account structure in case of loss.

To watch how to execute the Compounding Strategy in Binary Options, you can also refer to the educational video on the Trading Strategies channel on YouTube.

Common Mistakes Traders Make When Using Compounding in Binary Options

Many beginners make behavioral and computational errors while implementing the Compounding Strategy in Binary Options. Identifying and consciously avoiding these mistakes can significantly improve the strategy’s efficiency and a trader’s long-term success rate.

Common mistakes when using compounding in binary options:

- Starting with high-risk percentages (over 15% per trade) without sufficient experience;

- Trying to quickly recoup losses by suddenly increasing trade size;

- Lacking a defined trading plan and relying on ad-hoc decisions;

- Entering highly volatile markets with increased chance of failure.

Conclusion

The Compounding Strategy in Binary Options is one of the most advanced capital-management methods that operates based on compound interest.

This strategy can deliver exponential capital growth without adding new capital, but it will only succeed if it is accompanied by precise planning, sound risk management, and strong psychological discipline.

Beginners are better off starting with conservative approaches, while professional traders can profit using hybrid or aggressive models.

Success with this method directly depends on sustained adherence to the trading plan and the informed acceptance of risk.