The Forex market is a global marketplace for currency trading that operates 24 hours a day, five days a week (Monday to Friday). The market opens at 00:00 GMT-UTC and continues until 22:00 GMT on Friday.

The market's structure is based on four major trading sessions of Sydney, Tokyo, London, and New York.

The overlap between trading sessions particularly London and New York generates the highest trading volume and price volatility, offering significant opportunities for professional traders.

What Are the Forex Market Hours?

The Forex market starts at 22:00 UTC on Sunday and continues until 22:00 on Friday, operating nonstop 24 hours a day.

This continuity results from the rotating activity of the four major global financial centers, each responsible for the market during specific time intervals.

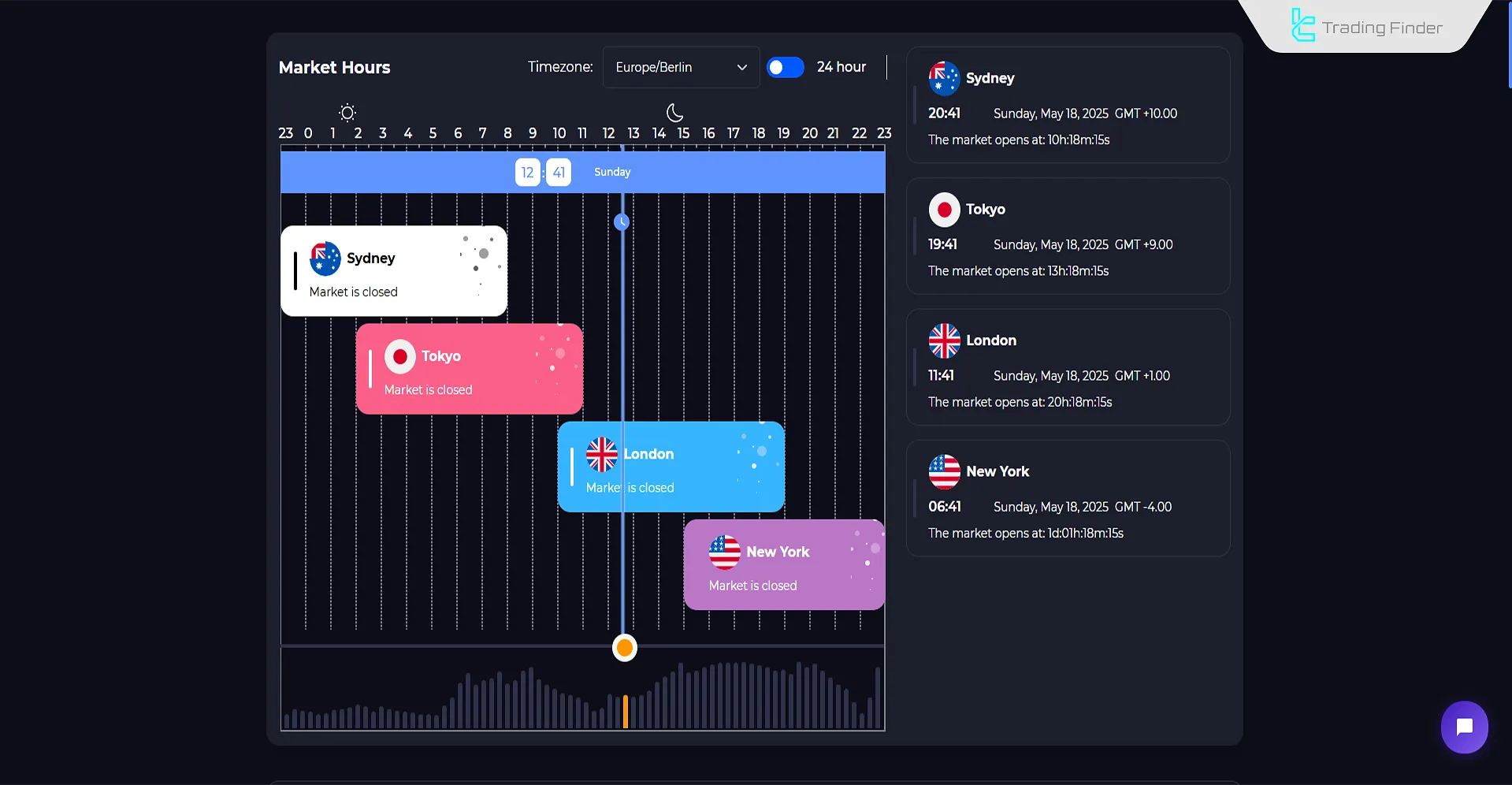

Traders can easily access the Forex market hours across various time zones using the TradingFinder Trading session tools.

The market activity starts with the Sydney session and ends with the New York session at the close of the business week. Below is a table of the Forex market opening and closing hours:

Trading Session | Major Financial Centers | Market Opening Time (UTC) | Market Closing Time (UTC) |

Sydney | Australia, New Zealand | 22:00 | 07:00 |

Tokyo | Japan, Singapore, Hong Kong | 00:00 | 09:00 |

London | UK, Germany, France | 08:00 | 17:00 |

New York | USA, Canada | 13:00 | 22:00 |

Summer and Winter Time in Forex Market

Forex market hours are affected by Daylight Saving Time (DST) in regions like the United States and Europe.

This seasonal adjustment temporarily shifts the start and end times of some trading sessions, particularly impacting traders in the Middle East and Asia, who must adjust their schedules accordingly.

Forex session time table:

Trading Session | Summer Time (DST) UTC | Winter Time (Standard) UTC |

Sydney | 21:00 – 06:00 | 22:00 – 07:00 |

Tokyo | 23:00 – 08:00 | 00:00 – 09:00 |

London | 07:00 – 16:00 | 08:00 – 17:00 |

New York | 12:00 – 21:00 | 13:00 – 22:00 |

Overview of Forex Market Trading Sessions

The Sydney, Tokyo, London, and New York sessions each have distinct characteristics regarding trading volume, price volatility, active currency pairs, and response to economic news.

Oceanian Session (Sydney)

The Sydney session kicks off the Forex trading week, starting at 22:00 UTC. Although liquidity is relatively low, this session is suitable for scalping strategies and traders who preferlow-risk approaches.

Asian Session (Tokyo)

The Tokyo session is the second phase in the Forex market time cycle, beginning as the Sydney session ends.

Influenced by Asian economies particularly Japan, China, and Australia this session typically features moderate and steady volatility.

European Session (London)

The London session is the third and most liquid part of the Forex market hours. It accounts for over 35% of daily trading volume, supported by the participation of banks, financial institutions, and professionaltraders.

The overlap with the New York session makes it the peak period for both volatility and liquidity.

American Session (New York)

The New York session is the final segment of the daily Forex cycle and is heavily influenced by U.S. economic data such as NFP, CPI, and interest rate decisions.

The session typically opens with high volatility, especially during its overlap with the London session, which marks the day’s highest trading volume. However, volatility tends to drop in the final hours.

Overlap of Trading Sessions and Increased Market Volatility

In the Forex market time, the simultaneous activity of two sessions creates what’s known as an Overlap.

During this period, liquidity increases, spreads tighten, and price volatility rises, offering excellent opportunities for short-term trades and scalping.

Overlap Session | Time (UTC) | Features |

London – New York | 13:00 – 17:00 | Highest daily volatility, maximum trading volume, reaction to economic news |

Tokyo – London | 08:00 – 09:00 | Moderate volatility, early trend formation |

Sydney – Tokyo | 00:00 – 07:00 | Low volatility, suitable for Asian currency scalping |

Which currency pairs are best to trade in each session?

The forex market operates 24 hours a day; however, liquidity intensity, directional movement, and volatility range differ across sessions.

Understanding each session’s behavior allows you to choose the most suitable currency pairs based on your strategy type (scalping, day trading, or swing trading).

The table below highlights some of the best currency pairs for each trading session:

Session | Top Currency Pairs | Market Characteristics | Key Notes |

Asia (Tokyo) | USD/JPY, EUR/JPY, AUD/JPY, NZD/JPY | Moderate volatility (50–80 pips), clean movements | Focus on JPY crosses; ideal for range and early breakout setups |

London (Europe) | EUR/USD, GBP/USD, EUR/GBP, EUR/JPY | Highest liquidity and volatility (70–120 pips) | The main daily trend forms; suitable for scalpers and day traders |

London–New York Overlap | EUR/USD, GBP/USD, USD/JPY, XAU/USD | Peak liquidity, tight spreads, fast reactions | Major economic releases (NFP, CPI); ideal for news and momentum trading |

New York | USD/CAD, USD/JPY, XAU/USD | Lower liquidity, more directional moves | Influenced by oil and U.S. indices; suitable for position traders |

London–New York Overlap

The London–New York overlap is the most significant and active time frame during Forex market hours.

The simultaneous presence of both European and American institutions greatly enhances liquidity and volatility.

During this period, the highest number of traders, banks, and financial entities are active at the same time.

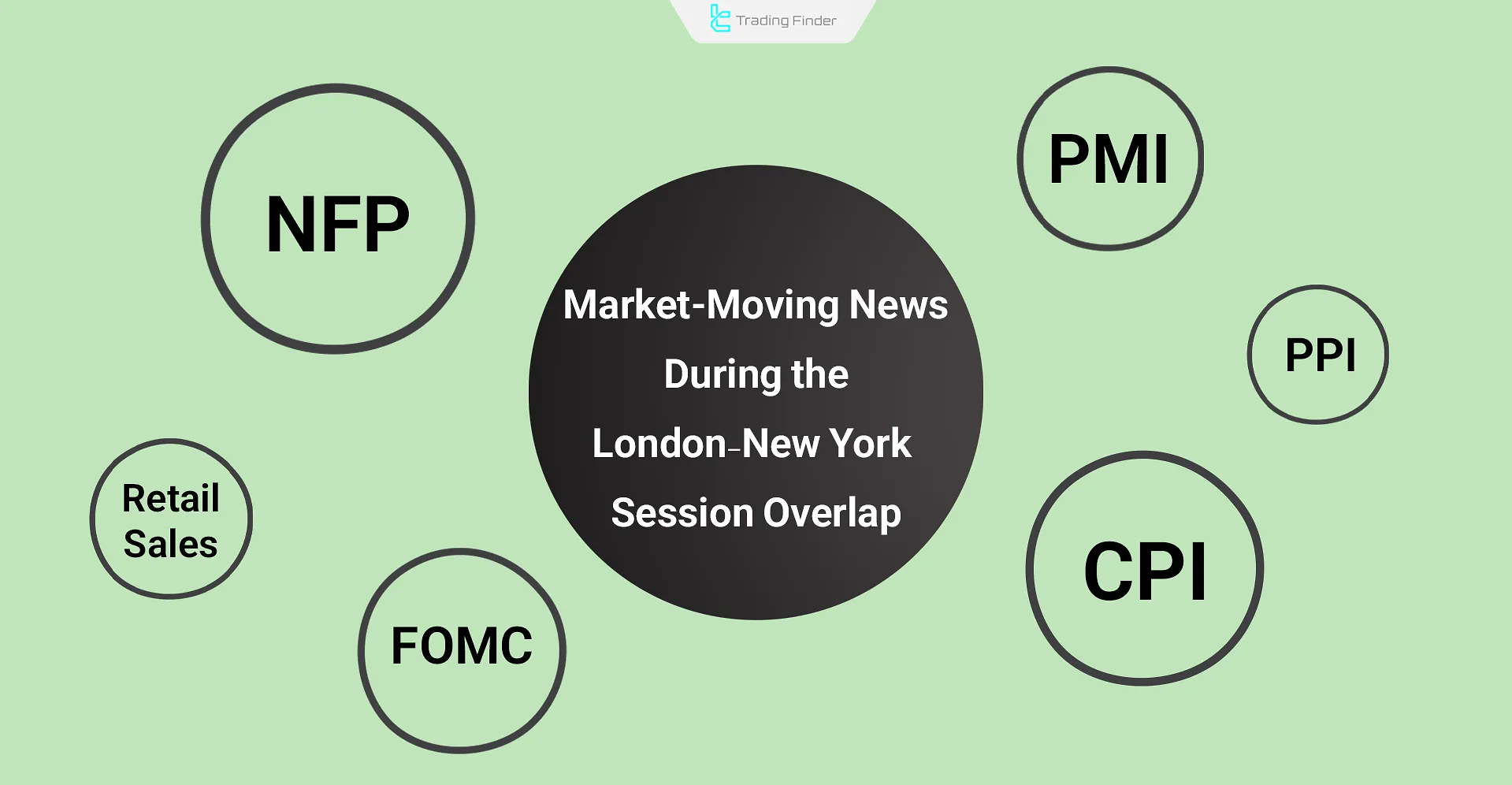

Market-moving news during the London–New York overlap

During the London–New York overlap session, the release of key data such as CPI, NFP, FOMC, PMI, and Retail Sales for the U.S.

dollar (USD), as well as CPI, PMI, and Rate Decision for the euro (EUR) and the pound (GBP), temporarily widens the spread and increases the likelihood of price slippage.

When the trading strategy is not news-driven, it is advisable to reduce position size or completely avoid entering the market 15–20 minutes before and after these data releases.

This helps prevent exposure to unpredictable volatility and maintains stability in trade execution.

Tokyo–London Overlap

The Tokyo–London overlap is short but impactful, occurring from 08:00 to 09:00 UTC. It marks the transition from Asian to European market activity and often features initial movements in major currency pairs.

Session display indicator on the chart (session box)

The Session Box Indicator is one of the practical MetaTrader tools categorized under ICT and trading session indicators, designed to precisely display the opening and closing times of global markets.

This tool, based on the operating hours of central banks, visually highlights the time range of each trading session on the chart.

Once activated, an information panel appears on the chart, showing whether each session (such as London, New York, Asia, or Sydney) is open or closed.

Simultaneously, the colored boxes drawn on the chart mark the high and low prices of each session, enabling traders to analyze price behavior within each time range.

This visual representation helps users identify high-volatility and high-liquidity zones, allowing them to adjust their scalping or day trading strategies accordingly.

A proper understanding of trading sessions plays a crucial role in optimizing entry and exit points.

For instance, on a 15-minute chart of a currency pair, the price reaction to the highs and lows formed during the London session can determine the market’s direction for the New York session.

Similarly, a break below the Sydney session’s low at the beginning of the European session often coincides with bearish movements and the formation of a pullback an idea widely used in ICT analysis.

The Session Box Indicator offers a variety of customization options in its settings, including:

- Previous Candles: defines the number of candles used in calculations;

- Show Panel: enables or disables the information panel;

- UTC/Local Time: allows selection of the time base (UTC or local time).

This indicator includes separate sections for each session (Asia, Sydney, Tokyo, Europe, London, New York), where traders can customize color, box fill style, and start/end times.

Designed for forex, commodities, and index traders, this tool performs best on lower timeframes such as M1 to M30. Thanks to its non-repainting structure, the data it provides is both accurate and reliable.

The Session Box Indicator is one of the key tools for analyzing price behavior across different market sessions.

By combining time visualization and price range mapping, it helps traders better understand session-based volatility and identify higher-quality trading opportunities in MetaTrader.

Best Time to Trade in the Forex Market

The best time to trade Forex is when liquidity is high, and meaningful price fluctuations occur. This ideal condition typically exists during the London–New York overlap, between 13:00 and 17:00 UTC.

During this time, spreads narrow, order execution is more precise, and more trading opportunities emerge.

For a better understanding and to find the best trading times in the forex market, you can also use the educational video from the Twfforex channel on YouTube.

Example of Choosing the best time to trade in the forex market

Suppose you are trading the GBP/USD pair. Between 13:00 and 17:00 UTC during the London–New York overlap the level of liquidity reaches its peak.

For instance, at 14:00 UTC, when major economic data such as CPI or NFP are released, volatility surges sharply, and the spread temporarily widens from the usual 0.5–0.8 pips to around 3–6 pips, making trade execution highly risky.

In such conditions, a professional trader avoids entering the market at the exact time of the release.

Instead, they enter a buy position after the spread narrows back below 0.7 pips and a breakout and pullback confirmation occurs around the 1.2700 level, setting a take-profit target of 20 pips and a stop-loss of 10 pips to control slippage and capitalize on the returning market liquidity.

Best days of the week to trade forex

When viewed from the perspective of weekdays, the rhythm of the forex market hours shows a clear structure:

- Monday: a slow start; the market is just reopening after the weekend, and liquidity flow has not yet formed;

- Tuesday to Thursday: peak liquidity and volatility; a period when trends consolidate and precise opportunities emerge for trend-following, news-driven, and scalping strategies;

- Friday: active and tradable until around London noon; from New York afternoon onward, volatility narrows, and position-closing activity intensifies.

In scalping and news-driven styles, focusing on Tuesday through Thursday offers higher returns, whereas for swing trading, waiting until late Tuesday when directions solidify provides more accurate and lower-risk decision-making.

Key Tips for Managing Time in the Forex Market

Time management in Forex distinguishes between impulsive trading and precise strategies, forming the foundation of a profitable and consistent trading system.

For more accurate information about forex market trading hours across major global financial centers, you can also refer to the educational article on forex market hours available on the forex.com website.

Here are some essential professional tips for effectively managing the Forex market time:

- Understand the four main trading sessions;

- Monitor session overlaps (Overlap);

- Account for Daylight Saving Time (DST) adjustments;

- Avoid low-volatility hours;

- Align trading times with your strategy style;

- Track economic news using an accurate calendar.

Conclusion

With its 24-hour structure, the Forex market enables traders to operate at any time of the day.

By analyzing the global session schedules, factoring in seasonal DST changes, and reviewing overlap periods, one can identify the most optimal trading times.