- TradingFinder

- Education

- Forex Education

- Fundamental Analysis Education

Fundamental Analysis Education

Fundamental Analysis examines the influence of economic indicators, central bank policies, and macroeconomic conditions on asset prices. Key fundamental factors include interest rate decisions, gross domestic product (GDP), consumer price index (CPI), and unemployment rate. Different markets rely on different fundamental indicators. In forex, interest rates and trade balance are crucial. In stocks, earnings per share (EPS) and the price-to-earnings ratio (P/E ratio) matter. In cryptocurrencies, institutional adoption and regulatory changes play a significant role. Analyzing economic data helps traders gain a deeper understanding of market direction and its impact on price fluctuations. TradingFinder offers free educational resources on evaluating economic reports, assessing their effects on market prices, and integrating fundamental Analysis with other trading strategies.

Economic Recession [2008 Recession and Government Actions]

Recession is a phase in the economic cycle characterized by rising unemployment rates and weak consumer demand....

The Role of Expectations in Financial Markets: How Expectations Shape Prices

Expectations in financial markets are a key driver of price volatility before the actual data is released. In fact, traders buy...

Currency Correlation in Forex: Correlation Tables & How to Trade Using Them

Some currencies have positive or negative correlations with other assets due to their risk-on or risk-off nature. Currency...

Forex Trading Sessions: The Ultimate Guide to Asian, London & New York Markets

The operational hours of financial markets are broadly categorized into four sessions of Sydney, Tokyo, London, and New...

What is GDP? [The Impact of Demand and Investment on GDP]

Gross Domestic Product (GDP) is the main measure of economic growth, showing whether the economy is in a boom or a recession....

Forex vs Futures Markets [Leverage and Trading Volume]

Forex market and Futures are two attractive financial markets that differ in nature, features, trading...

Futures Trading: How It Works Across Forex and Crypto Markets

Futures contracts are tools for trading and speculation or risk hedging; futures contracts allow retail traders and large companies...

4 Factors Influencing Forex Fundamental Analysis [Economic Reports and GDP]

The most significant factors influencing Forex Fundamental Analysis are economic reports, Gross Domestic Product...

Stocks vs Forex Trading - Which Market Is Better for You?

The stock market and Forex market differ in terms of nature, trading hours, leverage, fees, and fundamental analysis...

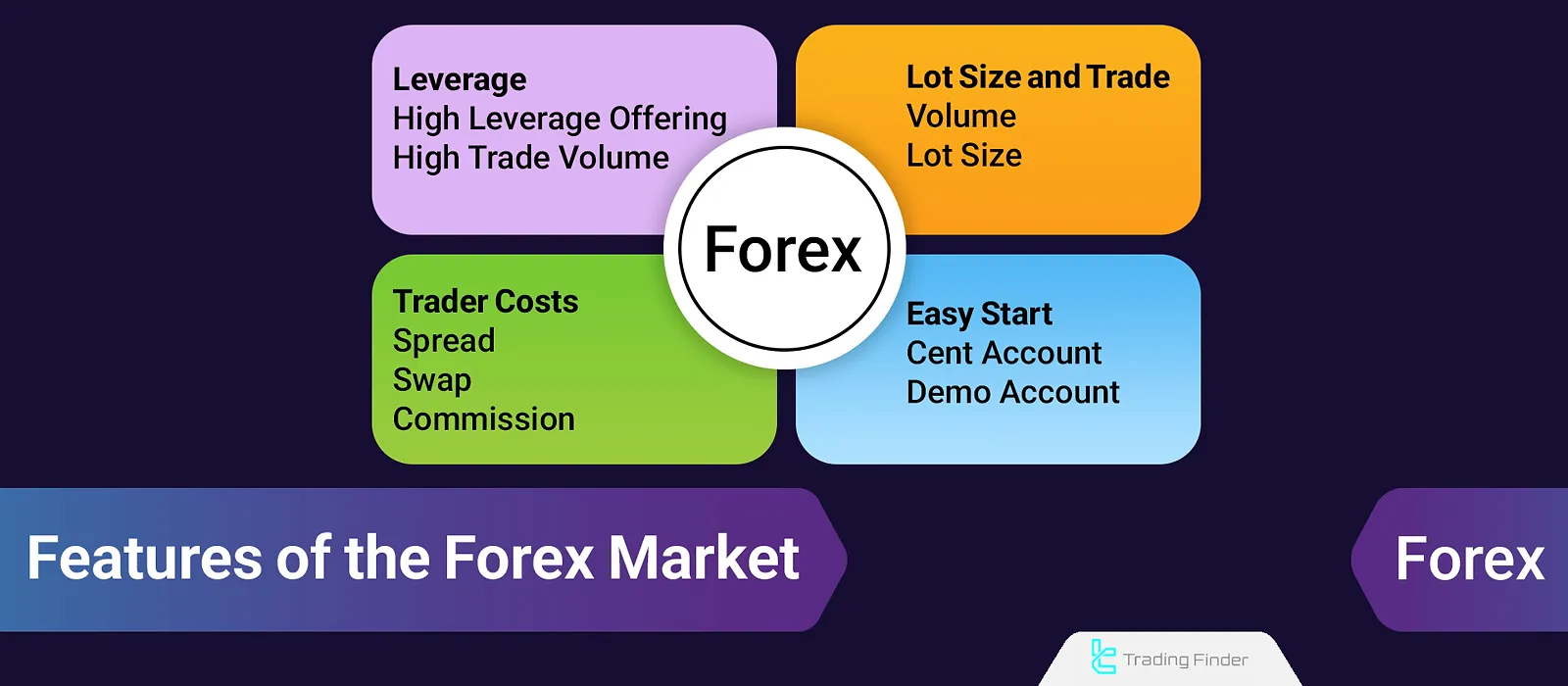

Features of Forex Market: Definition, How It Works & Market Participants

A daily trading volume of around $7 trillion, a 24-hour decentralized market, high leverage, and an easy start witha demo account...

Who is Forex Market Maker? How Does it Work?

Market makers refer to traders or financial entities such as central banks, large commercial companies and banks that significantly...

What is Inflation? [Examining the PPI, CPI, and PCE Indices]

Inflation is an economic concept introduced in the early 20th century by the German economist “Heinrich Von”. It refers to...

![Economic Recession [2008 Recession and Government Actions]](https://cdn.tradingfinder.com/image/351387/16-017-tf-en-what-is-recession-01.webp)

![What is GDP? [The Impact of Demand and Investment on GDP]](https://cdn.tradingfinder.com/image/324039/16-020-tf-en-what-is-gdp-01.webp)

![Forex vs Futures Markets [Leverage and Trading Volume]](https://cdn.tradingfinder.com/image/303684/16-008-tf-en-forex-vs-futures01.webp)

![4 Factors Influencing Forex Fundamental Analysis [Economic Reports and GDP]](https://cdn.tradingfinder.com/image/303741/16-002-tf-en-factors-influencing-forex-fundamental-analysis-01.webp)

![What is Inflation? [Examining the PPI, CPI, and PCE Indices]](https://cdn.tradingfinder.com/image/310401/16-005-tf-en-what-is-inflation-01.webp)