The Inner Circle Trader (ICT) trading style is based on precise market structure analysis and the trading behavior of major financial institutions.

This approach helps traders identify Smart Money movements and align their strategies accordingly.

The ICT terminology encompasses a wide range of concepts, including Order Blocks (OB), Fair Value Gaps (FVG), and Market Structure Shifts (MSS).

What is the ICT Trading Style?

Michael Huddleston developed the ICT (Inner Circle Trader) trading style. It revolves around market structure analysis, liquidity concepts, and the trading behavior of large financial institutions such as banks and hedge funds.

The primary objective is to track and align with Smart Money movements. ICT traders use market structure, Break of Structure (BOS), Order Blocks (OB), and Fair Value Gaps (FVG) to identify optimal entry and exit points.

Five Key ICT Terms

This section introduces five essential ICT terms which form the foundation of this trading methodology:

- Fair Value Gap (FVG): Price gap between the first and third candles in a three-candle formation, where the price has not yet been retracted.

Bullish & Bearish Fair Value Gaps (FVG) – A core concept in ICT trading

Bullish & Bearish Fair Value Gaps (FVG) – A core concept in ICT trading

2. Market Structure Shift (MSS): Shift in ICT market structure, indicating a trend change, whether short-term or long-term.

3. Power of Three (PO3): Fundamental ICT concept that describes how price is delivered throughout the day, consisting of Accumulation, Manipulation, and Distribution.

4. Order Block (OB): Smart Money zone where institutional orders are placed for entry or exit.

5. Optimal Trade Entry (OTE): Refined ICT trade entry model based on Fibonacci retracements and market trends.

Market Structure Terminologies in ICT

This section includes terminologies related to market structure, which help traders identify trends and key market shifts.

- Break of Structure (BOS): Key level breakout, signaling a potential trend shift.

- Break of Market Structure (BMS): Market structure change, indicating a trend reversal.

- Market Structure Shift (MSS): Short or long-term directional trend shift.

MSS (Market Structure Shift) identified on the EUR/USD chart

MSS (Market Structure Shift) identified on the EUR/USD chart - Change in State of Delivery (CSID/CSD): Shift in price delivery mechanics dictated by the market algorithm.

- Consequent Encroachment (CE): Price entry into a previously untraded area.

- Change of Character (CHoCH): Sudden shift in market direction, signaling trend weakness or potential reversal.

Liquidity and Imbalance Terminologies in ICT

These terms focus on liquidity imbalances and market inefficiencies, highlighting high-order flow zones and trading opportunities.

- Fair Value Gap (FVG): Three-candle price gap where the price has not yet returned.

- Inversion Fair Value Gap (IFVG): Fast-moving price zone that has not been revisited, moving in the opposite direction.

- Fair Value for Buying (FVFB): Discounted price gap, offering an attractive buy opportunity.

- Fair Value for Selling (FVFS): Premium price gap presenting an optimal selling opportunity.

- Breakaway Gap: Gap formed at a key breakout level, indicating market structure changes.

- Premium & Discount Array (PD Array): This is a price model using Fibonacci retracements, categorizing prices as Premium (above 50%) or Discount (below 50%).

- Equilibrium (EQ): The 50% retracement level, where buying and selling pressures balance.

- Liquidity (LQ): The ease of converting an asset or security into cash without significantly affecting its price.

- Liquidity Void (LV): Chart area where no trades have been executed, creating a price vacuum.

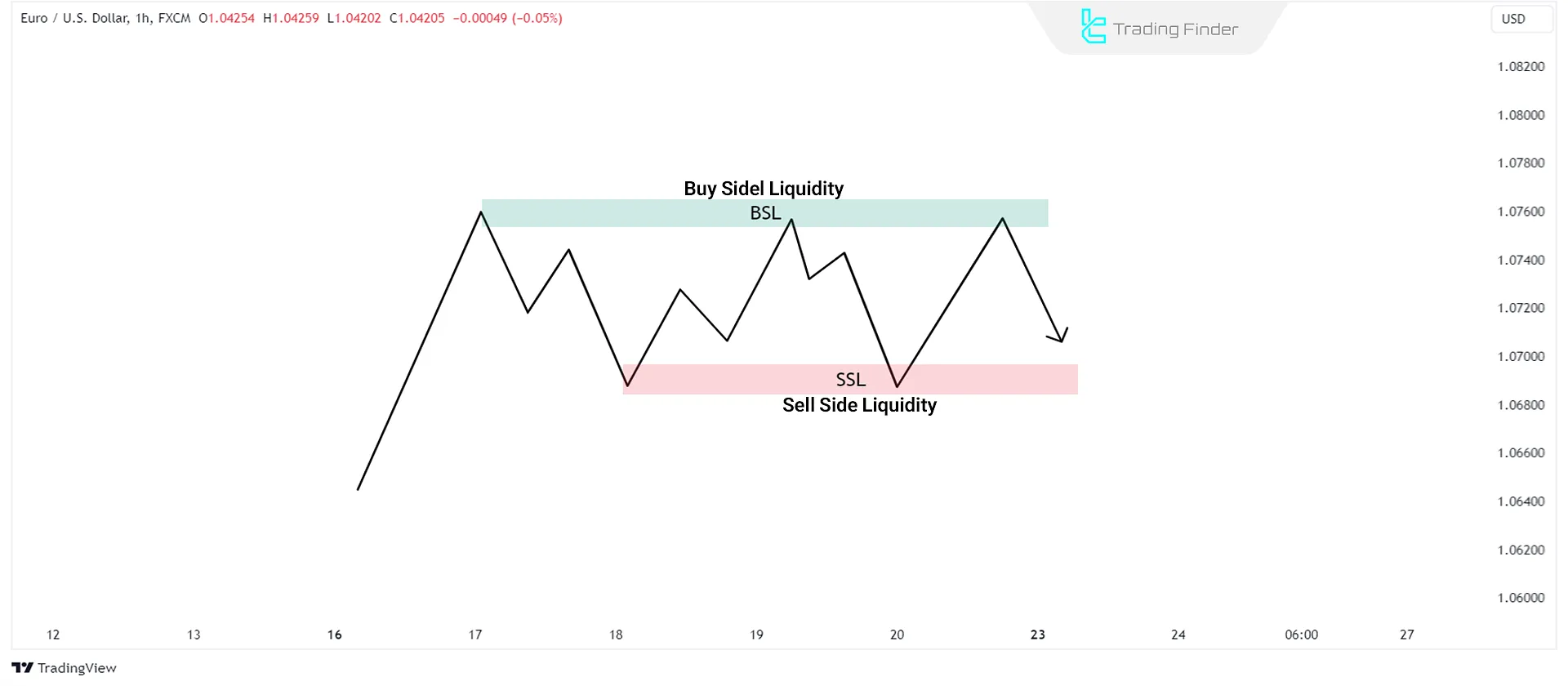

- Buy-Side Liquidity (BSL): Buy orders available in the market.

- Sell-Side Liquidity (SSL): Sell orders available in the market.

Buy-Side Liquidity (BSL) & Sell-Side Liquidity (SSL) in ICT trading

Buy-Side Liquidity (BSL) & Sell-Side Liquidity (SSL) in ICT trading - External Range Liquidity (ERL): Liquidity present outside the current price range.

- Internal Range Liquidity (IRL): Liquidity present within the current price range.

- Liquidity Pool (LP): Zone with a high concentration of buy or sell orders, including stop-loss orders.

- Draw on Liquidity (DOL): Price movement toward high-liquidity zones.

- First Point of Liquidity (FPOL): The first liquidity level reflecting market activity, often used as a potential entry or exit point.

Key ICT Price Zones & Blocks

This section explains critical price zones and order blocks, which traders use to define high-probability trade areas.

- Order Block (OB): A Smart Money zone where large orders are placed.

- Bearish Order Block (OB-): Order block confirming a downtrend.

- Bullish Order Block (OB+): Order block supporting an uptrend.

Bearish & Bullish Order Blocks (OB) in ICT trading

Bearish & Bullish Order Blocks (OB) in ICT trading - Mitigation Block (MB): Risk-reduction block where Smart Money hedges trade.

- Bullish Mitigation Block (MB+): Mitigation block operating in an uptrend.

- Bearish Mitigation Block (MB-): Mitigation block operating in a downtrend.

- Breaker Block (BB): Former order block, now acting as support or resistance.

- Bullish Breaker Block (BRK+): Breaker block confirming bullish momentum.

- Bearish Breaker Block (BRK-): Breaker block confirming bearish momentum.

- Rejection Block (RB): Failed price zone leading to trend reversals.

- Vacuum Block (VB): Zone with no executed trades, where price moves rapidly.

- Reclaimed Order Block (ROB): Order block that price revisits and reactivates.

- Propulsion Block (PB): Block that drives aggressive price movement in a specific direction.

- Mean Threshold (MT): The midpoint of an order block, acting as a retracement level.

- Return to Order Block (RTO): When the price returns to an order block.

- Return to Breaker (RTB): When the price revisits a breaker block.

- Point of Interest (POI): Key zone where traders focus on potential price reactions.

ICT Timeframe and Session Terminologies

This category includes terms related to different timeframes and trading sessions in ICT methodology, enhancing precision in analysis.

- Higher Time Frame (HTF): Longer-term timeframe used for market analysis.

- Lower Time Frame (LTF): Short-term timeframe for detailed market entries and precision analysis.

- High of Day (HOD): Highest price reached during the current trading session.

- Low of Day (LOD): Lowest price reached during the current trading session.

- Previous Day Low (PDL): Lowest price recorded on the previous trading day.

- Previous Day High (PDH): Highest price recorded on the previous trading day.

- Previous Session High (PSH): Highest price reached in the previous trading session.

- Previous Session Low (PSL): Lowest price reached in the previous trading session.

- Previous Week High (PWH): Highest price recorded during the previous week.

- Previous Week Low (PWL): Lowest price recorded during the previous week.

- Previous Month High (PMH): Highest price recorded in the previous month.

- Previous Month Low (PML): Lowest price recorded in the previous month.

- True Day Close (TDC): The market closing price at 17:00 New York time.

- True Day Open (TDO): The market opening price at 00:00 New York time.

- New Day Opening Gap (NDOG): Price gap formed at the beginning of a new trading day.

- New Week Opening Gap (NWOG): Price gap appears at the start of a new trading week.

ICT Trading Sessions

- Asian Session (Asian Session):Trading hours are from 19:00 to 03:00 New York time.

- Asian Kill Zone (A-KZ): High-liquidity window within the Asian session between 20:00 and 22:00 New York time.

- Asian Range (Asian Range): Price range formed during the Asian session.

- London Open (LO): London trading session opens from 02:00 to 05:00 New York time.

- London Close (LC): London session closes from 08:00 to 11:00 New York time.

- London Open Kill Zone (LO-KZ): High-liquidity period from 02:00 to 05:00 New York time.

- London Close Kill Zone (LC-KZ): High-impact trading period from 09:00 to 11:00 New York time.

- New York Open (NYO): New York session opens from 08:00 to 11:00 New York time.

- New York Open Kill Zone (NYO-KZ): High-liquidity period that occurs from 07:00 to 09:00 New York time.

- ICT Macro Times (ICT Macro Times): Key time-based pivots monitored by the market algorithm for trade execution.

ICT Price Level Terminologies

This section includes key price level terms, helping traders identify crucial support and resistance areas.

- All-Time High (ATH): Asset's highest price ever recorded.

- All-Time Low (ATL): Lowest price ever recorded for an asset.

- Higher Low (HL): Newly formed higher low in an uptrend.

- Higher High (HH): Newly formed higher high in an uptrend.

- Lower Low (LL): Newly formed lower low in a downtrend.

- Lower High (LH): Newly formed lower high in a downtrend.

- Short-Term High (STH): The highest point within a short timeframe.

- Intermediate-Term High (ITH): Highest point within a medium timeframe.

- Long-Term High (LTH): Highest point within a long timeframe.

- Short-Term Low (STL): Lowest point within a short timeframe.

- Intermediate-Term Low (ITL): Lowest point within a medium timeframe.

- Long-Term Low (LTL): Lowest point within a long timeframe.

- Equal Highs (EQH): Price formation where two or more highs align at the same level.

- Equal Lows (EQL): Price formation where two or more lows align at the same level.

- Support & Resistance (S/R): Key price levels where the price tends to reverse or breakthrough.

- Key Support & Resistance Levels: Major price levels prevent further price drops or surges.

- Range Contraction: Period of low volatility, where price consolidates within a narrow range.

- Range Expansion: Period of high volatility, where price moves powerfully in one direction.

ICT Strategies & Trading Models

This section covers ICT trading strategies and models, which traders use to refine their entry, exit, and market execution techniques.

- Accumulation, Manipulation, Distribution (AMD): Three-phase model Smart Money uses to control price movements.

- Power of Three (PO3): Trading concept describing how price progresses through Accumulation, Manipulation, and Distribution during a session.

- Buy-Side Imbalance Sell-Side Inefficiency (BISI): Market condition where buy orders dominate sell orders, creating an imbalance.

- Sell-Side Imbalance Buy-Side Inefficiency (SIBI): Market condition where sell orders exceed buy orders, leading to inefficiency.

- Balanced Price Range (BPR): Zone where the price reaches equilibrium after an extended move.

- Liquidity Inducement (IDM): When Smart Money deliberately moves prices to trick retail traders into entering poor positions.

- Institutional Order Flow (IOF): Large financial institutions executing major orders that influence liquidity.

- Institutional Order Flow Entry Drill (IOFED): Practice method for trading ICT concepts, focusing on institutional order flow.

- Interbank Price Delivery Algorithm (IPDA): System banks use to manage price movement and liquidity distribution.

- Smart Money Technique (SMT): Methods used by institutions to manipulate price and market flow.

- Smart Money Divergence (SMT Divergence - SMT Div): Divergence pattern created by Smart Money indicates price manipulation.

- Market Maker Profile (MMP): Trading profile tracking market makers' behavior.

- Market Maker Buy Model (MMBM): Model representing Smart Money accumulation before a bullish move.

- Market Maker Sell Model (MMSM): Model showing Smart Money distribution before a bearish move.

- Market Maker Sell/Buy Model (MMXM): Combined strategy of Smart Money accumulation and distribution cycles.

- One Shot One Kill (OSOK): Precision-based trade execution method for high-probability setups.

- Thanks God It's Friday (TGIF) is a Friday-specific trading model that reflects price behaviors unique to weekly closes.

- Judas Swing: Fake price breakout that traps retail traders and hunts stop-losses.

- Turtle Soup (TS): Trading strategy capitalizing on market reversals from key levels.

- Turtle Soup Buy Model (TSBM): Bullish version of the Turtle Soup setup.

- Turtle Soup Sell Model (TSSM): Bearish version of the Turtle Soup setup.

- Silver Bullet: High-probability trade signal or pattern often used for optimal trade entries.

- ICT Unicorn: Rare but highly profitable trading event offering exceptional trade opportunities.

Other General ICT Terminologies

This section contains general terms in ICT trading, encompassing technical and fundamental analysis, risk management, and trade execution.

- Technical Analysis (TA): Study of price movements, chart patterns, and indicators to forecast price action.

- Fundamental Analysis (FA): Examining economic factors, financial reports, and macroeconomic data to assess an asset's value.

- Price Action (PA): Market movement analysis based on price structure without using indicators.

- Stop-loss (SL): Predetermined price level where a trade is automatically exited to limit losses.

- Take Profit (TP): Target price level where a trade is exited to secure profits.

- Breakeven (BE): The price level where gains and losses in a trade are equal, ensuring no net profit or loss.

- Risk-to-Reward Ratio (RR): Comparison of potential loss (risk) to expected gain (reward) in a trade.

- Stop Hunt (SH): Market move designed to trigger stop-loss orders, often used by institutions to accumulate liquidity.

- Drawdown (DD): The percentage decrease in account balance due to consecutive losses.

- Dealing Range (DR): Specific price range where market movement is confined.

- Average Daily Range (ADR): Asset's average price movement range in a single trading day.

- Average True Range (ATR): Measure of market volatility, accounting for price gaps and extreme movements.

- Commitment of Traders Report (COT): Report that details institutional trading positions, offering insights into market sentiment.

Conclusion

Michael Huddleston developed the ICT (Inner Circle Trader) trading methodology based on market structure analysis and Smart Money behavior.

ICT helps traders identify institutional liquidity movements and align their trades accordingly. Key ICT concepts include Order Blocks (OB), Fair Value Gaps (FVG), Market Structure Shifts (MSS), and liquidity patterns.