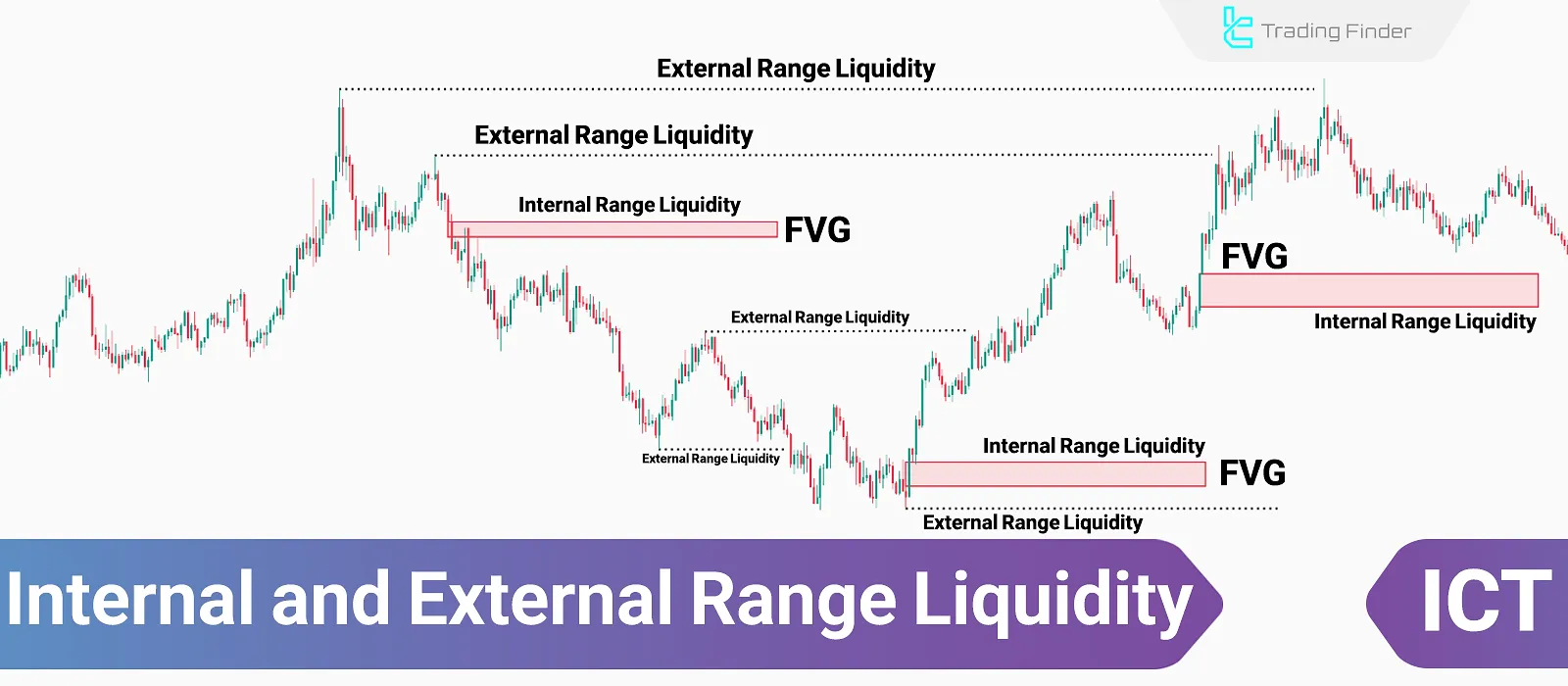

In the ICT Style, price movement in financial markets like Forex market is shaped solely towards liquidity; In this context, liquidity is divided into two categories of Internal Range Liquidity (IRL) and External Range Liquidity (ERL).

Internal Range Liquidity (IRL) refers to Fair Value Gaps (FVGs) within a range, while External Range Liquidity (ERL) refers to Old Highs and Old Lows.

How Does Price Move According to ICT?

According to this style, prices in financial markets move solely to gather liquidity and adjust imbalance zones such as Fair Value Gaps (FVGs).

The creator of the ICT style views the market as moving algorithmically, driven toward areas of liquidity regardless of patterns or analyses from other technical styles.

What is a Dealing Range in ICT?

This concept refers to the space between a Swing High and a Swing Low, forming a price movement step.

Within this range, various levels and areas exist, including Fair Value Gaps (FVGs), Order Blocks, and liquidity levels related to short-term highs and lows.

What Are Internal and External Range Liquidity?

Internal range liquidity represents trapped orders within a swing, while external range liquidity targets breakout traders and stop hunts.

Internal Range Liquidity (IRL)

Internal Range Liquidity (IRL) refers to Fair Value Gaps (FVGs) formed within a price range, where each gap represents an imbalance and a liquidity target that attracts market movement.

External Range Liquidity (ERL)

External Range Liquidity (ERL) refers to the levels above Old Highs and below Old Lows; Retail traders perceive these levels as resistance or support due to the high concentration of stop orders.

This liquidity attracts the market, making these areas prime targets for stop hunts.

How Does Price Move Towards Liquidity?

In ICT analysis, price movement in the market is algorithmically drawn towards liquidity. When the market reaches an Internal Range Liquidity (IRL), it will be drawn towards an External Range Liquidity (ERL). Conversely, after reaching an External Range Liquidity (ERL), the market is drawn back towards an Internal Range Liquidity (IRL). This cycle occurs constantly.

What Are the Applications of Internal (IRL) and External (ERL) Liquidity Concepts?

By applying IRL and ERL effectively, traders can refine their approach to Identifying Daily Bias while ensuring Precise and Optimized Trading, aligning their entries with liquidity cycles and institutional order flow.

Identifying Daily Bias

Traders can determine the overall market direction and daily bias by using internal and external liquidity concepts in higher timeframes such as monthly, weekly, and daily charts.

Precise and Optimized Trading

Applying this concept in timeframes lower than 4 hours helps traders accurately identify optimal areas to enter trades. Additionally, stop loss and take profit levels can be set more precisely using these concepts.

Conclusion

The concepts of Internal Range Liquidity (IRL) and External Range Liquidity (ERL) in ICT style refer to Fair Value Gaps (FVGs) and Old Highs and Lows that act as liquidity-attracting zones.

In this approach, price moves algorithmically to collect liquidity and fill gaps between IRL and ERL. The continuous interaction between these liquidity ranges forms the foundation of this analysis, guiding market direction and enabling precise entry and exit points in trades.