ICT Kill Zones are critical timeframes in financial markets related to ICT trading and Smart Money Concepts (SMC) when the highest levels of volatility and trading volume occur.

These four intervals (Asia, London, New York Morning, and New York Afternoon) assist traders in identifying optimal market opportunities.

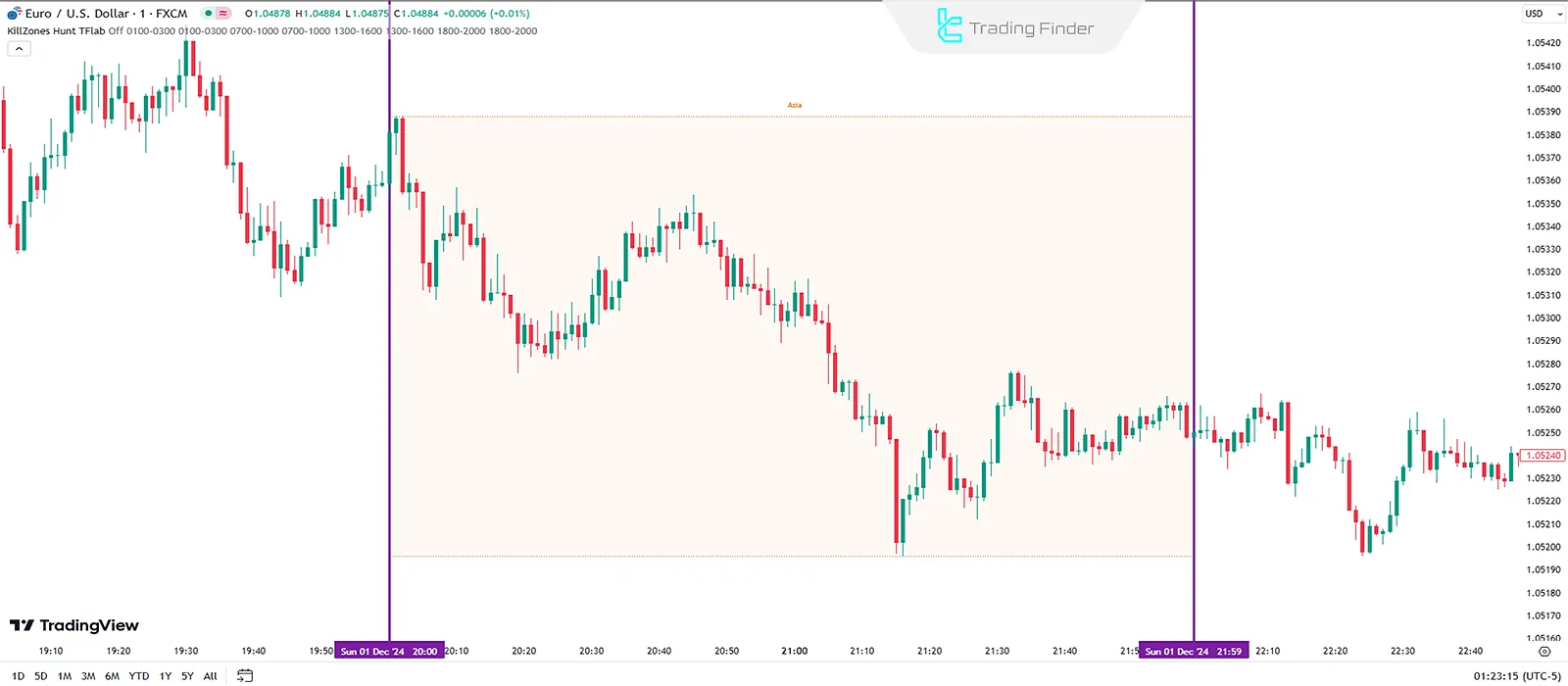

Note: To simplify the identification of KillZones, you can use the indicator developed by the TFlab team:

- TradingView version of the KillZones indicator

- MetaTrader 4 version of the KillZones indicator

- MetaTrader 5 version of the KillZones indicator

What is a Kill Zone?

Kill zones are specific times of the day, marked by significant institutional trading activity, resulting in increased volatility and trading volume.

These periods are divided into four primary categories:

- Asia

- London

- New York AM

- New York PM

Each kill zone aligns with the major forex market sessions (Tokyo, London, and New York) and has unique characteristics.

The table below outlines the exact timing for each kill zone based on three standard time references (EST, UTC).

Kill Zone | New York Time (EST) | UTC Time |

Asia | 08:00 PM - 10:00 PM | 01:00 - 03:00 |

London | 02:00 AM - 05:00 AM | 07:00 - 10:00 |

New York AM | 08:00 AM - 11:00 AM | 13:00 - 16:00 |

New York PM | 01:00 PM - 03:00 PM | 18:00 - 20:00 |

All of these kill zones are closed on some holidays (new year holidays e.g.); You can be aware of these holidays by using TradingFinder Holiday Calendar.

Characteristics of ICT Kill Zones

Each ICT kill zone (Asia, London, New York Morning, and New York Afternoon) has unique features that are outlined below:

Asia Kill Zone

Time

8:00 PM – 10:00 PM (EST)

Characteristics

- Limited volatility and small price ranges

- Primarily short-term corrective movements with limited trading opportunities

- Typically, it does not set the directional trend for the day

Suitable Assets

- AUD/USD, NZD/USD, and other currencies related to JPY

Trading Tips

- Focus on short-term corrective moves

- Use higher time frame trend analysis to identify trading opportunities

- Avoid high-volume trades due to low volatility

In the Asian Range Hunt Setup, this Kill Zone is crucial for identifying short-term liquidity movements.

London Kill Zone

Time

2:00 AM – 5:00 AM (EST)

Characteristics

- High volatility and the initiation of daily directional moves

- Often breaks the price range of the Asia session

Suitable Assets

- EUR/USD, GBP/USD, and EUR/GBP.

Trading Tips

- Pay attention to liquidity grabs

- Combine fundamental and technical analysis to determine market direction

- This kill zone often sets the primary daily trend

The Silver Bullet Setup frequently utilizes this Kill Zone to capture significant market moves. It is also instrumental in the Power of Three (PO3) concept for identifying price accumulation, manipulation, and distribution phases.

New York AM Kill Zone

Time

8:00 AM – 11:00 AM (EST)

Characteristics

- New York Kill Zone overlaps with the London session and exhibits high volatility

- Includes retracements or continuation of the London session trend;

- High liquidity provides multiple trading opportunities

Suitable Assets

- Any currency pair or index related to the USD

Trading Tips

- Focus on levels established during the London session and price retracements

- Monitor major macroeconomic news releases

- Risk management is crucial due to high volatility

This Kill Zone is often pivotal for confirming the daily trend and finding Optimal Trade Entry (OTE) points. It is highly effective when applying the Power of Three (PO3) strategy for capitalizing on price manipulation and trend continuation.

New York PM Kill Zone

Time

1:00 PM – 3:00 PM (EST)

Characteristics

- Suitable for corrective or end-of-day moves

- Often involves price consolidation or continuation of trends initiated in the morning

- Lower liquidity, but short-term trading opportunities are still available

Suitable Assets

- Any currency pair or index related to the USD, such as NAS100 and S&P500

Trading Tips

- Focus on price movements earlier in the day

- Ideal for short-term trades with smaller targets

- Close open positions to avoid unexpected risks before market closure

This Kill Zone is instrumental for finalizing positions and avoiding overnight risks. It complements the Power of Three (PO3) by helping identify consolidation or distribution phases before market close.

How Does Daylight Saving Time Affect Kill Zones?

Daylight Saving Time (DST) can shift kill zone timings:

- In countries with DST: The timings adjust to EDT (Eastern Daylight Time), but the structure of the kill zones remains the same

- In countries without DST: One-hour time difference may occur

Recommendation: Always use New York local time as reference.

Conclusion

ICT Kill Zones are powerful tools for traders, offering structured intervals to identify opportunities during periods of high volatility and trading volume.

By understanding and applying the specific characteristics of each Kill Zone, traders can enhance their precision and profitability, particularly when executing ICT setups like theSilver Bullet Setup, Asian Range Hunt Setup, and Power of Three (PO3).

Moreover, Kill Zones introduces the broader concept of ICT Macro Times, which explores higher-level institutional trading frameworks. Leveraging these intervals with proper tools, such as the Kill Zones indicators on TradingView and MetaTrader platforms, can further optimize trading strategies and outcomes.