The Next Day Model (NDM) trading strategy in the Market Maker Buy and Sell (MMXM)ICT style focuses on analyzing and predicting price movements for the following day.

The model identifies trading opportunities by assessing current price behavior, recognizing patterns, and pinpointing key levels across different trading sessions.

What is the Next Day Market Maker Trading Strategy?

The Next Day Model (NDM) in Market Maker trading employs ICT’s key strategies to predict probable scenarios for future price movements.

This model streamlines identifying entry and exit points while helping traders determine market trends.

Traders can utilize the MMXM Trader indicator on TradingView, developed by the Trading Finder team, to enhance their trading analysis.

Advantages of Using the Next Day Market Maker Model

Applying the model aids in trend prediction, risk management, and strategy optimization. The key benefits of MMXM’s Next Day Model include:

- Better Trend Prediction: Traders can analyze potential trading patterns for the following day and evaluate probable price movements;

- Improved Risk Management: The method allows traders to pinpoint optimal entry and exit points, enabling them to effectively use risk management tools like stop-loss and take-profit levels;

- Enhanced Strategy Performance: Integrating the Next Day Model with other MMXM Trader techniques, such as liquidity patterns and order blocks, refines overall strategy execution.

Steps to Trade Using the Next Day Market Maker Model (MMXM)

The Next Day Model in MMXM Trader is executed in four key steps:

#1 Analyzing the Market Structure

Traders first evaluate the market structureand overall trend on higher timeframes such as H4 and Daily to determine whether the market is bullish, bearish, or ranging.

#2 Identifying Key Areas

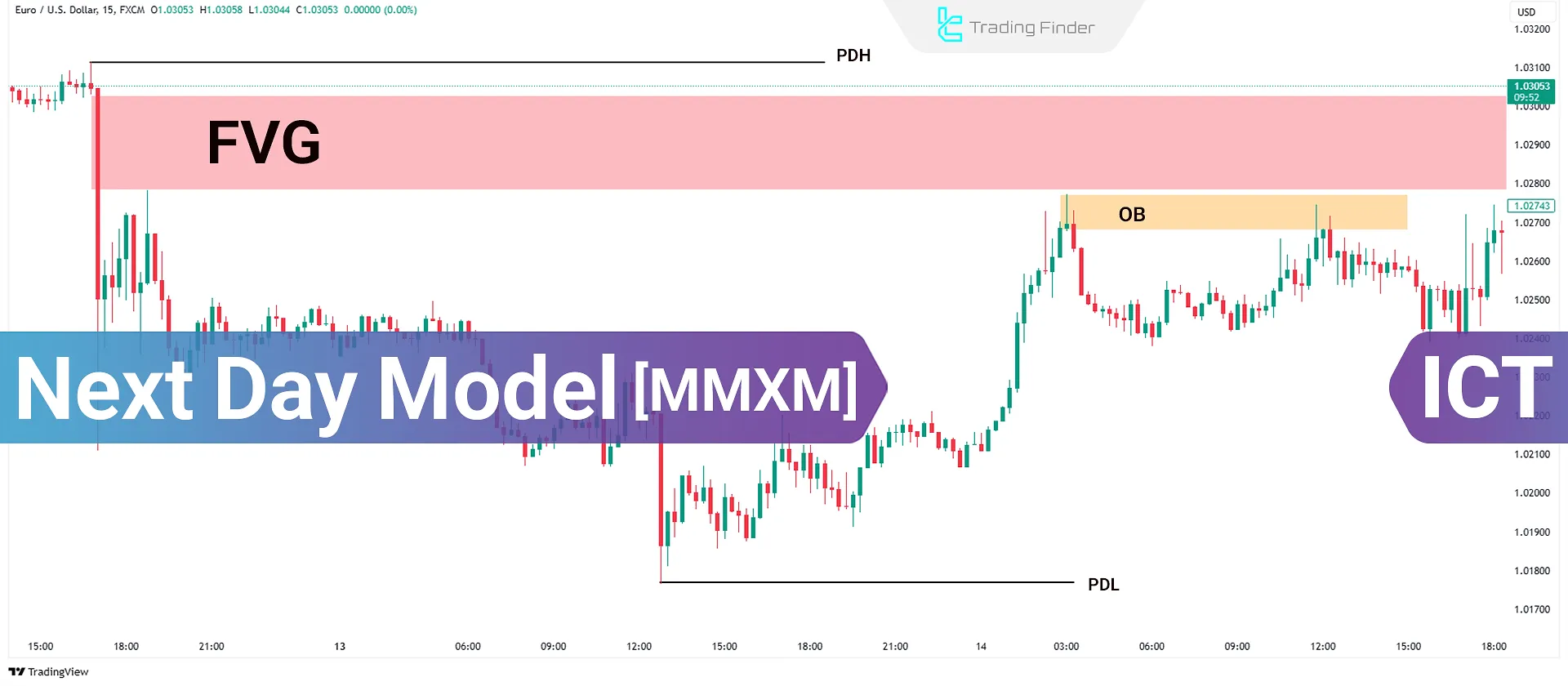

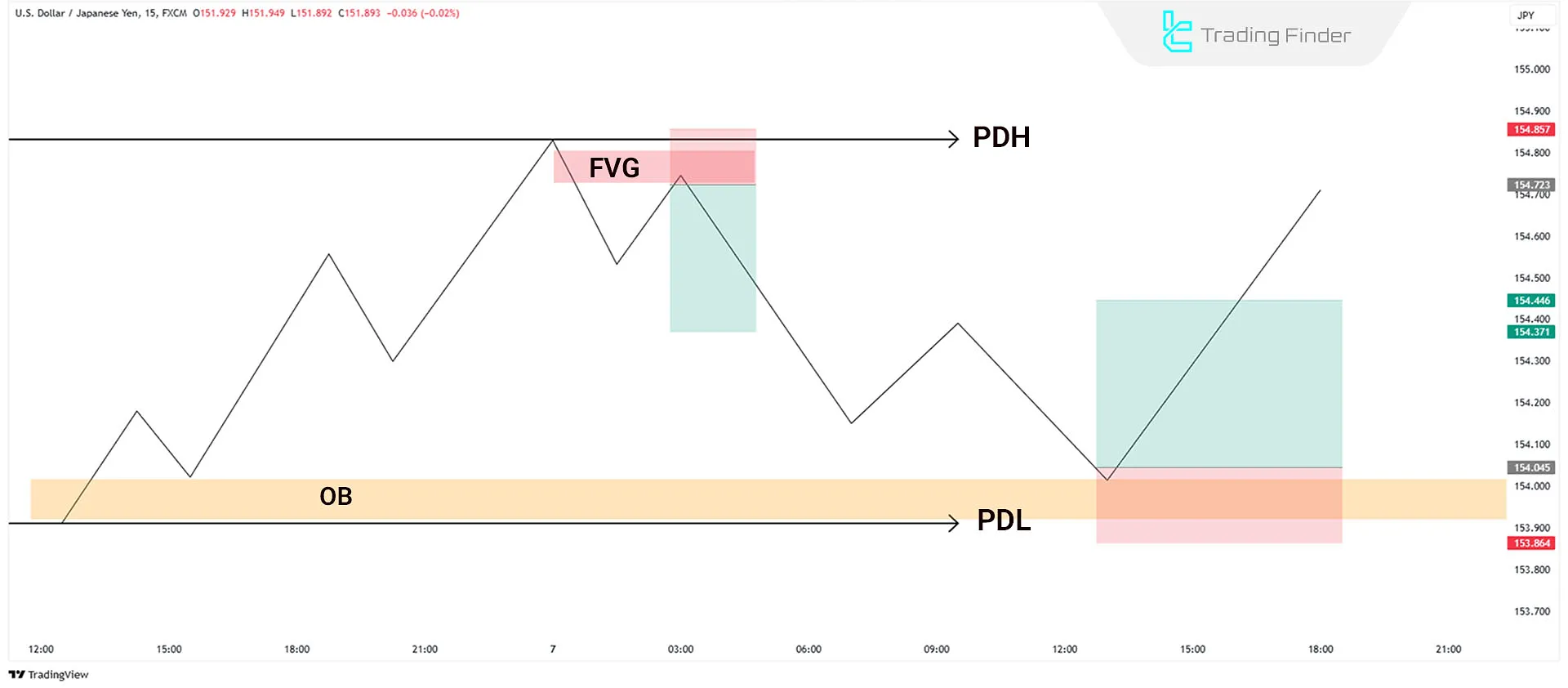

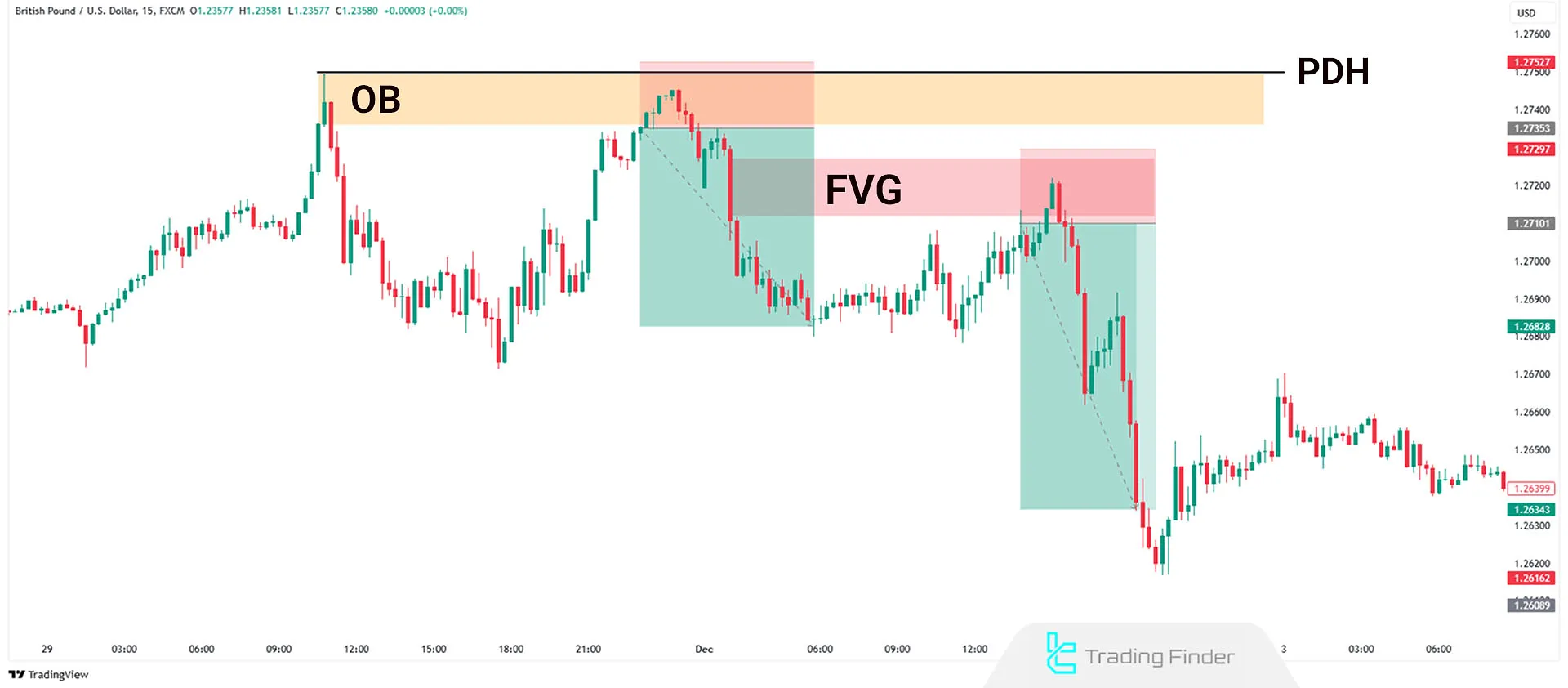

Identifying key liquidity zones involves marking areas like support and resistance levels, order blocks (OBs), and Fair Value Gaps (FVGs). These levels significantly influence price volatility for the next trading day.

#3 Liquidity Analysis

Price stop-hunts typically occur in high-liquidity areas. Therefore, the previous day’s highs and lows are crucial points for liquidity sweeps in financial markets.

#4 Timing Trades Based on Sessions

Trade timing in MMXM Trader’s Next Day Model emphasizes trading session significance (Asian, London, and New York). For instance, a price breakout in the New York session often has a direct impact on price behavior the next day.

Conditions for Using the Next Day Market Maker Model (MMXM)

To implement the Next Day Model, traders must adhere to the following conditions:

- Avoid trading on Mondays due to market instability;

- Focus on the New York trading session;

- Execute trades on the15-minute chart;

- Use aneconomic calendar to factor in macroeconomic events;

- Trade only when the price reaches a key level onhigher timeframes.

Trade Example Using the Next Day Market Maker Model (MMXM)

In the GBP/USD 15-minute chart, the price approaches the previous day’s high (PDH), signaling a potential sell opportunity.

As the price nears this level on higher timeframes, traders can look for entry points using order blocks and FVGs.

Conclusion

The Next Day Model (NDM) is an advanced strategy in ICT trading, leveraging historical data analysis and liquidity structure to anticipate potential trading scenarios for the next day.

By focusing on liquidity zones, structural breaks, and price behavior at key levels, the Market Makers Next Day Buy and Sell Model enhances trading strategies and helps traders capitalize on smart money movements.