No Displacement in the ICT trading model and Smart Mony refers to a scenario where the price breaks a key level (such as a short-term high or low) but instead of continuing in the same direction, it quickly retraces back to the previous range.

This behavior typically indicates market weakness in sustaining the current trend and increases the probability of price reversal or a shift in direction.

Characteristics of No Displacement

To identify No Displacement, it is essential to recognize its characteristics, which include:

- Quick retracement to the previous range: After breaking a key level, the candles are not aggressive, and the price quickly moves back into the prior range.

- Small and weak candles: The candles formed after the breakout are usually small and they lack momentum.

- Failure to close beyond the breakout level: In the absence of Displacement, candles typically do not close near the breakout level but rather revert back into the range.

- Failed Breakouts: Unsuccessful breakouts are a clear indication of No Displacement and are often considered as reversal signals.

Why Does No Displacement Occur?

No Displacement happens due to various factors such as:

- Lack of liquidity in Forex

- Counter-orders at the breakout level (e.g., buying pressure at a bearish breakout)

- Market consolidation, where price lacks directional momentum to sustain a breakout

How to Identify No Displacement?

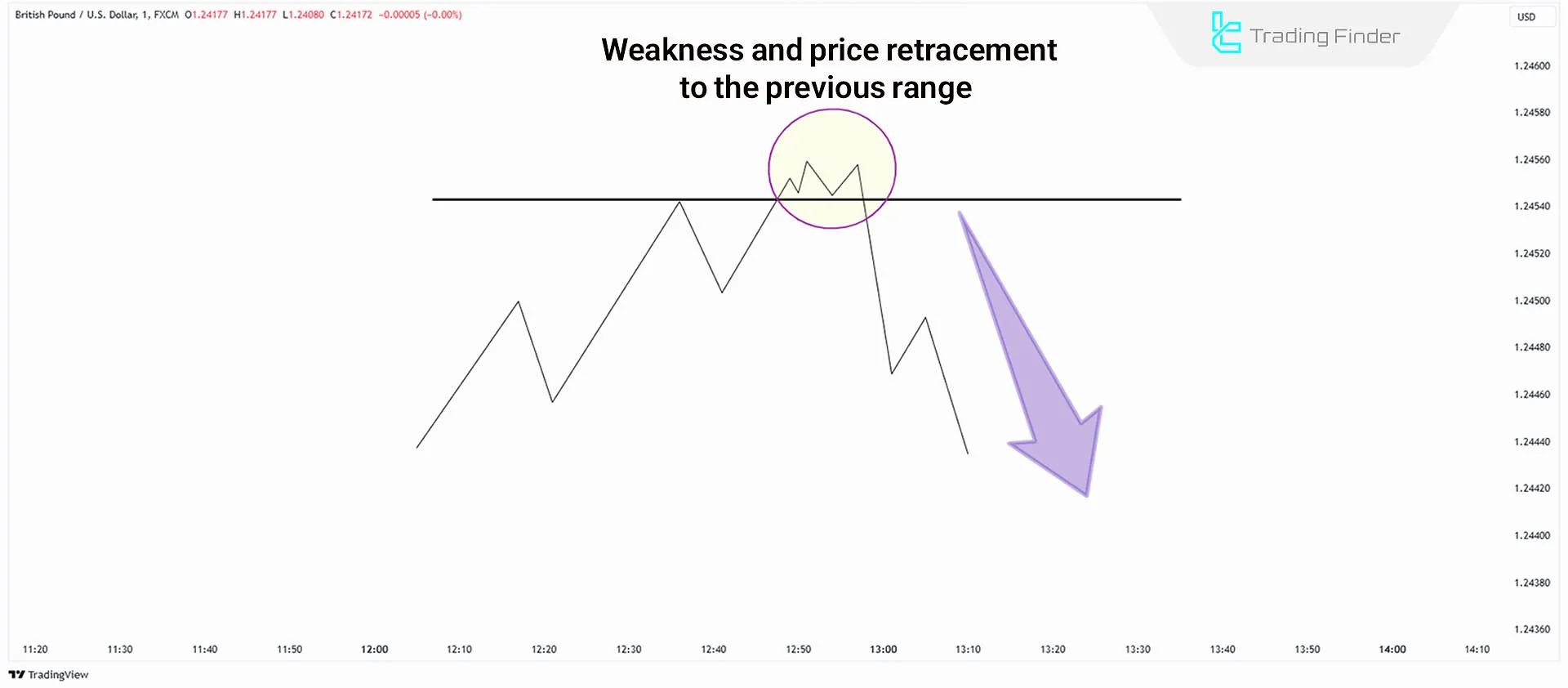

To assess No Displacement, traders must analyze candlestick behavior at key levels. If a breakout occurs with large candles closing near the high or low, it indicates strong Displacement and a high likelihood of continuation.

On the other hand, a quick retracement to the previous range with small candles suggests a lack of Displacement. Evaluating this pattern across multiple timeframes helps in identifying precise trade opportunities.

How to Use No Displacement in Trading?

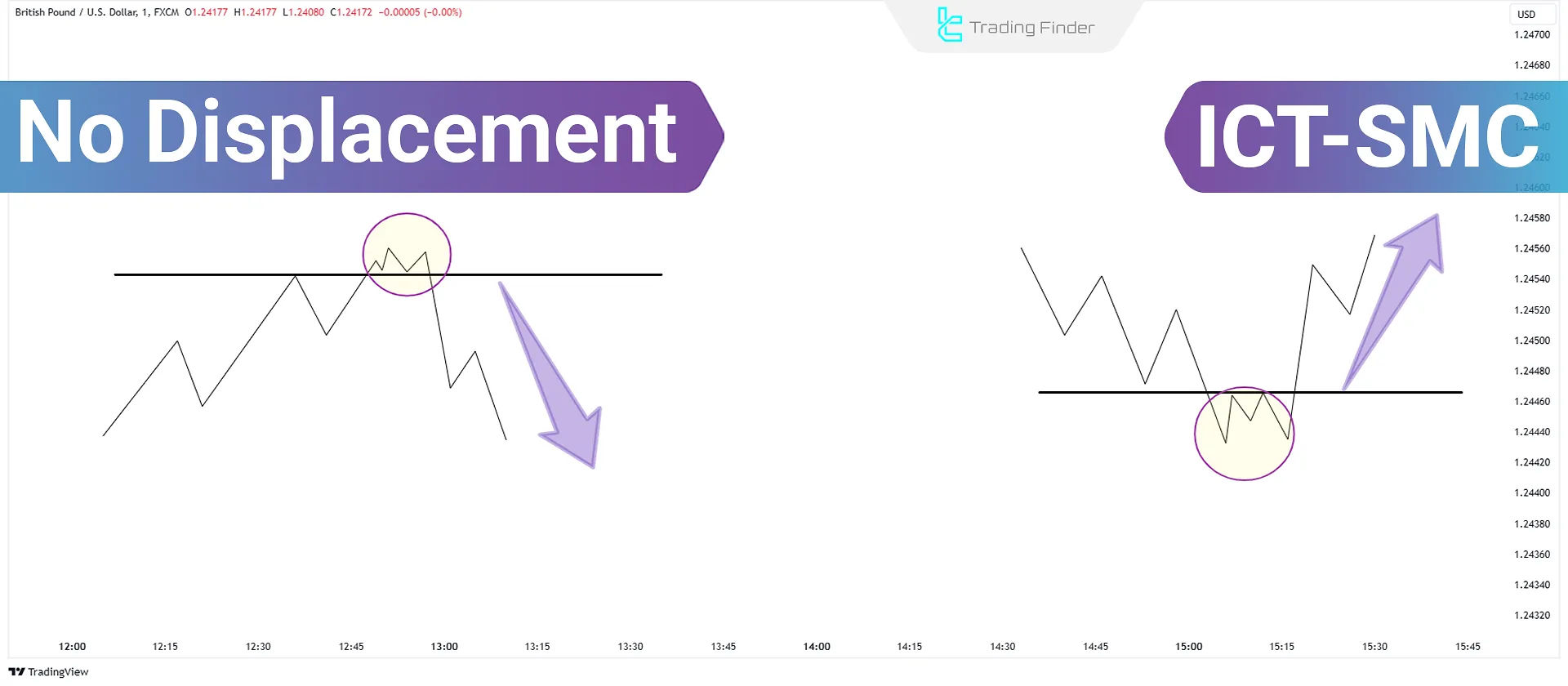

In an uptrend, a breakdown of a low without Displacement suggests weak bearish momentum and a buying opportunity. In a downtrend, a breakout above a high without Displacement indicates weak bullish momentum and presents a selling opportunity.

Failed breakouts are strong reversal signals that can be leveraged for counter-trend trades.

No Displacement Example in Uptrend

To trade with this setup in an uptrend, the following is used:

- Price breaks a short-term low but instead of continuing downward, it quickly retraces.

- Candlesticks are weak and lack bearish strength.

No Displacement Example in Downtrend

To trade with this setup in an Downtrend, the following is used:

- Price breaks a high, but no strong bullish candles

- Price quickly retraces, indicating weak buying pressure

Conclusion

The No Displacement Model in ICT trading highlights market weakness in trend continuation. When price breaks a key level but fails to show strong momentum, the probability of reversal increases.

Failed breakouts under such conditions provide ideal reversal trade opportunities. Combining this pattern with risk management strategies and multi-timeframe analysis enhances trade accuracy.