Stop hunting is a process in which the market is designed to trigger the stop losses of retail traders, with these movements ultimately benefiting institutional traders and market makers.

Stop Hunting in the ICT style refers to a scenario where the price triggers astop-loss order with a shadow (wick) and then reverses direction toward thetake-profit level. This phenomenon is also known as “stop-loss hunting.”

Objectives of Stop Hunting

Smart Money executes stop hunting for several reasons:

Liquidity Extraction

Stop-loss levels are known as areas of high order volume. Large market players use these orders to facilitate trades and absorb liquidity.

Narrowing Price Spread

Market makers use stop-hunting to generate sufficient liquidity, enabling them to reduce the cost of entering or exiting large trades.

Creating Volatility

Stop Hunting induces stress among retail traders, leading to impulsive decisions. These actions benefit market makers by creating Volatility in the market.

How Does dose Stop Hunting Works

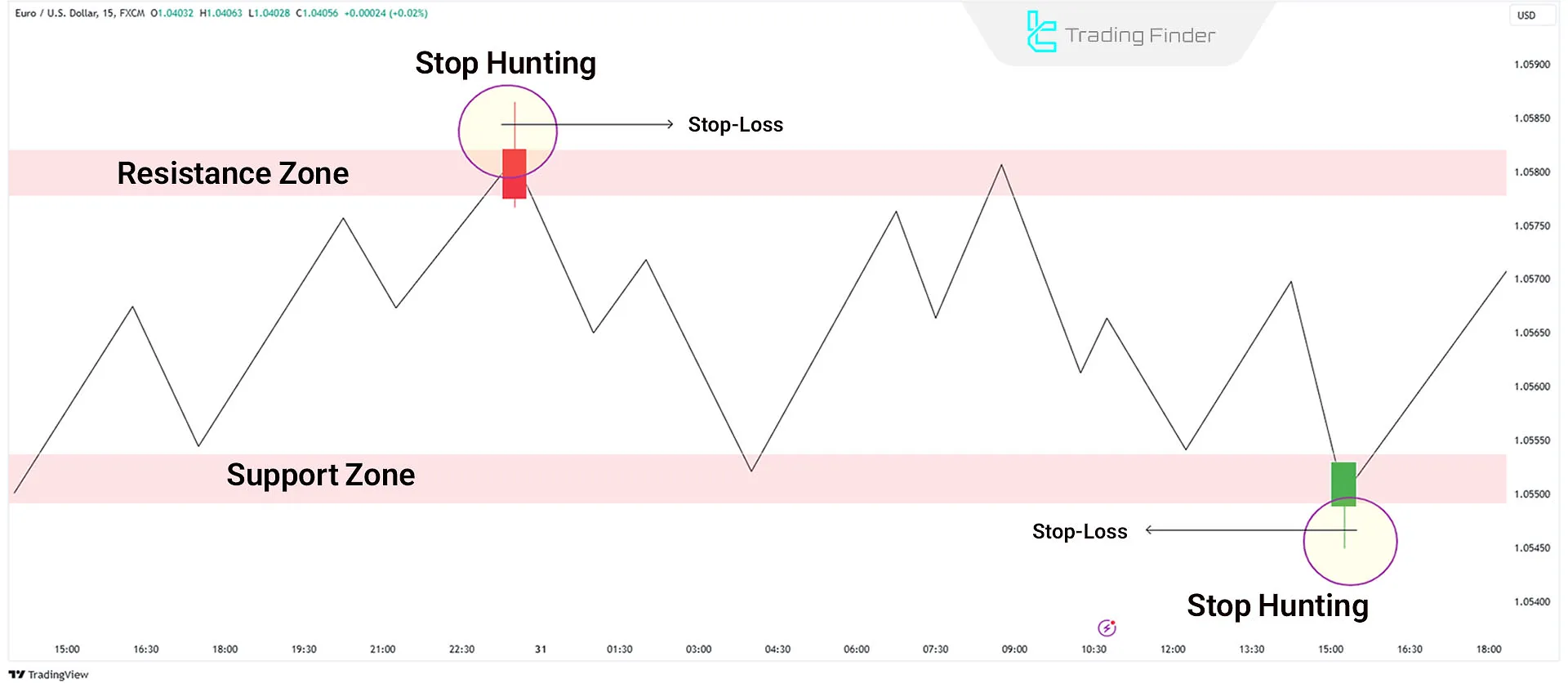

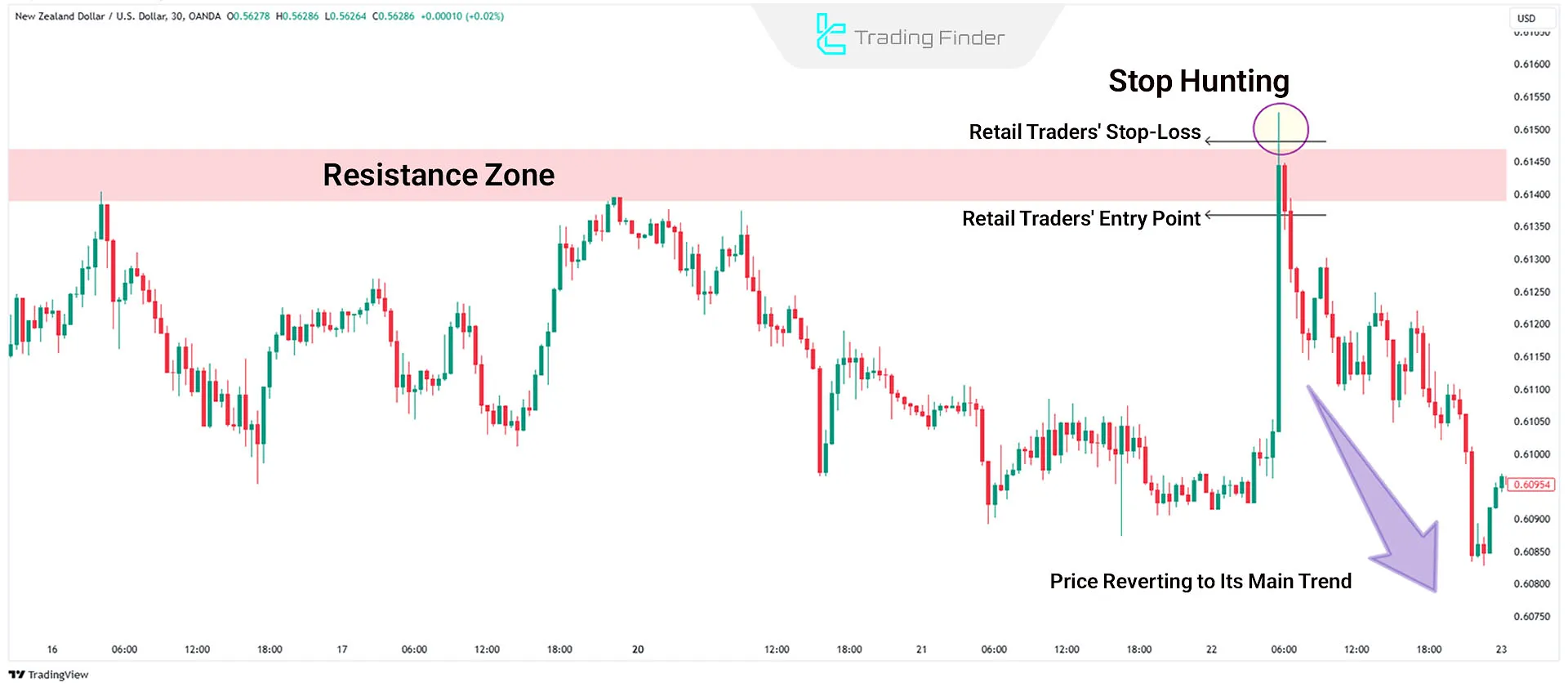

Market makers identify areas where numerous stop-losses are placed, such as below support, above resistance, or near-round numbers.

Then they drive the price toward these areas with significant trade volumes. Once stop-losses are triggered, a large number of orders enter the market to create liquidity in Forex.

This liquidity allows major market makers to execute large trades at more favorable prices. Afterward, the price often returns to its original direction.

How to Identify Stop Hunting? Signs of Stop Hunt

To spot hunting on a chart, watch for these signs:

- Long Wicks: The price touches a specific level and suddenly reverses quickly;

- Temporary Breaks of Key Levels: The price temporarily breaches support or resistance but promptly returns to its previous path;

- Unexpected Volatility: Rapid price movements in one direction, followed by a quick reversal.

Conclusion

Stop Hunting is a common phenomenon in financial markets, used by market makers to absorb liquidity and execute large trades at better prices.

Retail traders can mitigate risks and benefits by understanding and identifying this method.