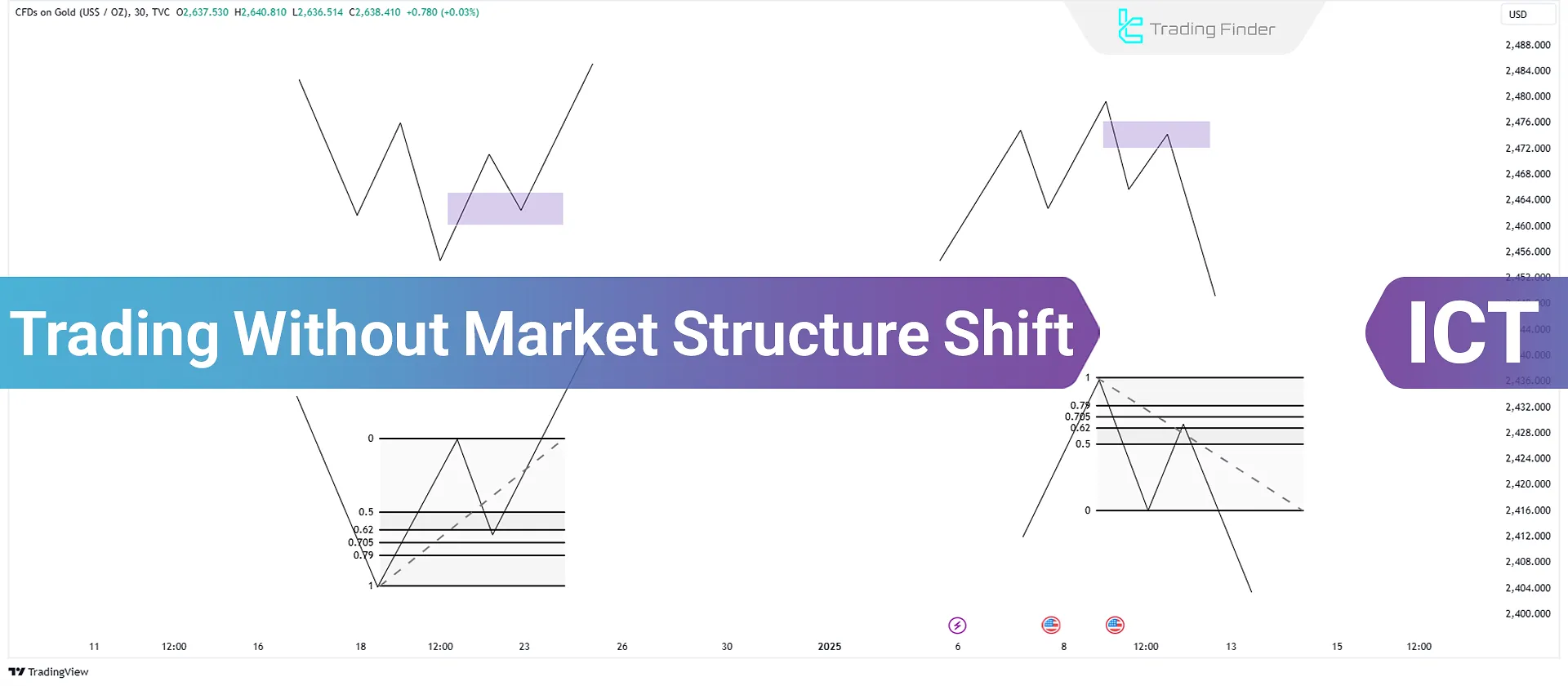

With "Trading Without Market Structure Shift" strategy in the ICT style, traders can execute trades without waiting for a Market Structure Shift (MSS) or Market Structure Break (MSB).

Many traders miss market movements while waiting for these changes and experience FOMO (Fear of Missing Out).

What Is Trading Without MSS/MSB in the ICT Style and Why Is It Important?

In the ICT style, many classic trading models rely on a Market Structure Shift (MSS) or Market Structure Break (MSB) to confirm entries. In this approach, the trader waits for price to break a structural high or low and then enters the trade.

The “trading without MSS/MSB” model discards this assumption and shifts the focus from structure change to liquidity behavior and price reaction at key levels.

In this model, trade entries are executed before an official market structure change occurs. Decision-making is based on the precise combination of higher-timeframe points of interest (HTF POI) , short-term liquidity raids , and aggressive price reactions.

Educational video on trading without market structure shift from the TTrades YouTube channel:

The importance of this approach stems from the fact that in many market conditions especially during active trading sessions the main price move occurs before an MSS or MSB is formed.

In such cases, waiting for a structure change leads to late entries, increased risk, and a reduced risk-to-reward ratio.

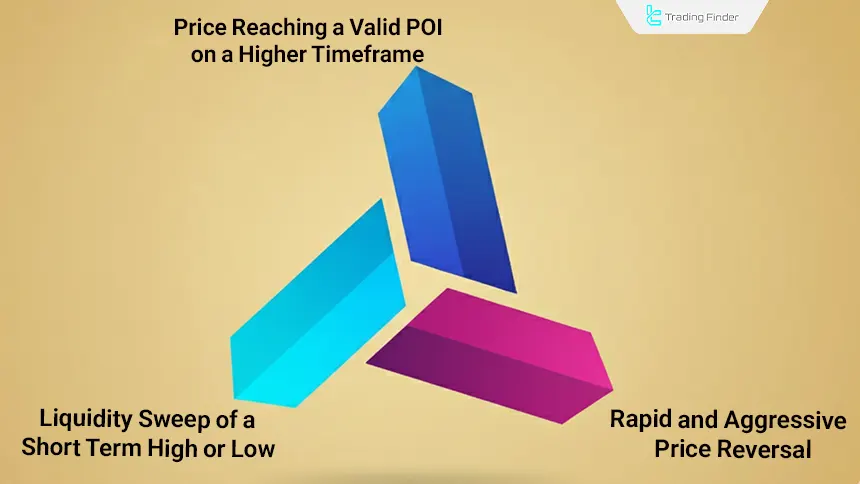

Three key points in trading without MSS and MSB:

- Price reaching a high-value zone on the higher timeframe;

- Liquidity collection of a short-term high or low before entry into that zone;

- A fast, strong, and imbalanced price reversal.

Advantages and Disadvantages of Entry Without Market Structure Shift

Entering trades without waiting for MSS and MSB has its own advantages and limitations. Being aware of them is essential for correct execution of this model.

This approach can lead to faster and more optimal entries, but without sufficient skill, it increases the risk of analytical errors.

Advantages and Disadvantages of Entry Without MSS and MSB:

Advantages of Entry Without MSS/MSB | Disadvantages of Entry Without MSS/MSB |

Early entry into the main market move | High sensitivity to misidentifying liquidity raids |

Improved risk-to-reward ratio (R:R) | Requires high precision in selecting higher-timeframe POIs |

Eliminates delay caused by waiting for MSS/MSB | Not suitable for inexperienced traders |

Strong alignment with fast moves during active sessions | Higher probability of fake moves in low-liquidity markets |

Effective use of FVG without structure break | Strong dependence on price reaction after liquidity |

Applicable in ranging markets and trend pullbacks | Difficulty in defining bias without HTF |

Reduced FOMO during early market moves | Requires precise HTF and LTF alignment |

Flexibility in entry timeframes (1M–15M) | Risk of consecutive losses with poor risk management |

Key Factors in the Strategy

This strategy focuses on identifying zones with the highest probability of price reaction and analyzing price behavior after liquidity has been collected.

The core logic of the model is the use of the higher timeframe and the market’s rapid reaction following short-term breaks. Two key factors in using entry without a market structure shift:

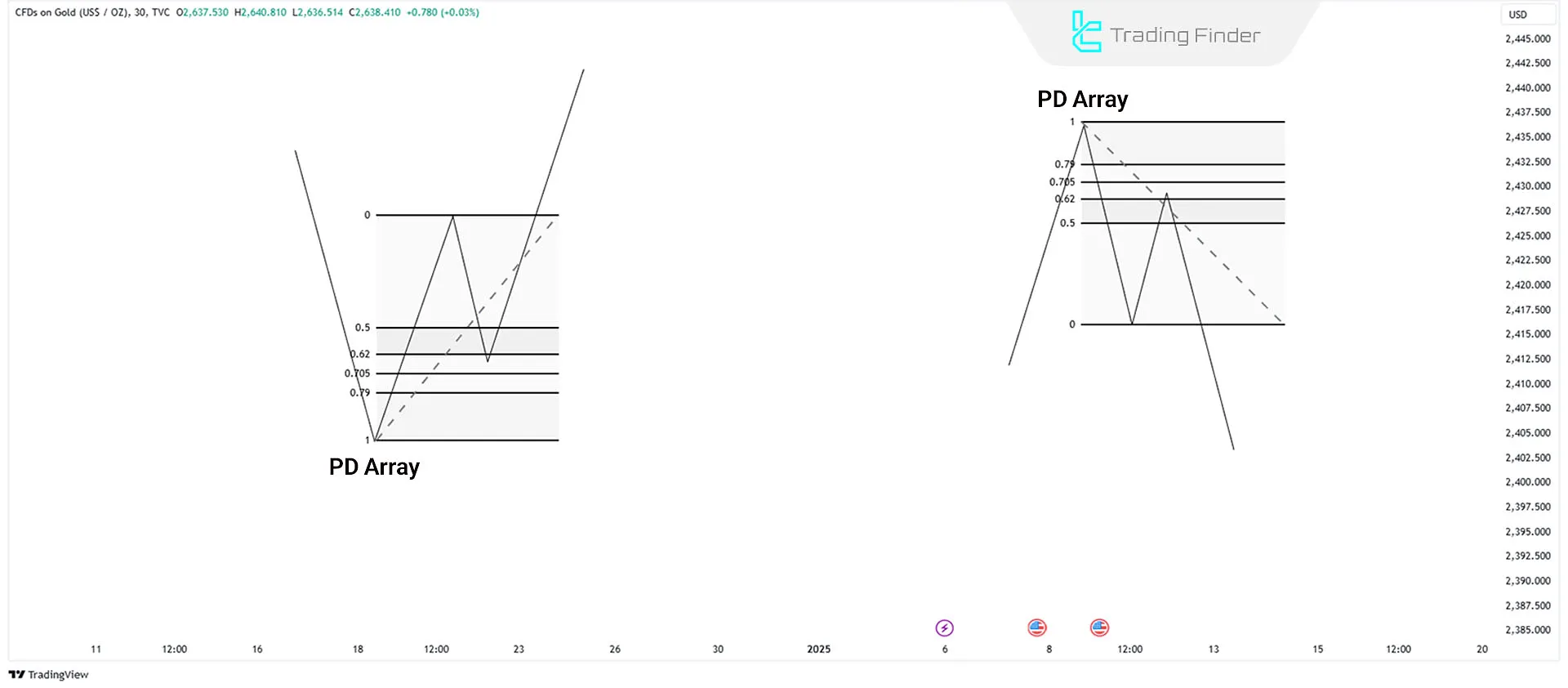

Higher Timeframe Points of Interest (POI)

Points like highs and lows, Fair Value Gaps (FVG), Order Blocks, and other significant liquidity zones are identified on higher timeframes.

These zones act as market decision-making areas, and price reactions within them are usually the origin of aggressive moves or higher-probability reversals.

Strong Moves After Short-Term High or Low Break (Liquidity Raid)

After breaking a short-term high or low, the price must quickly and strongly return to the previous range.

These types of moves usually create trading opportunities in the Balanced Price Range (BPR) or Box setup. OTE levels in ICT style can be used to pinpoint exact entry points.

How to Identify These Opportunities?

Identifying trading opportunities in this model requires a step-by-step and structured process. First, the most important zones on the higher timeframe must be identified, and then price behavior during liquidity collection should be analyzed.

The combination of these two steps forms the basis for identifying precise entries without reliance on a market structure shift or break. Steps for Identifying Trading Opportunities Without MSS and MSB:

#1 Identify Higher Timeframe Points of Interest

To identify these points, consider the following:

- Points of interest could be previous highs or lows on timeframes like 15 minutes or 1 hour;

- When the price reaches these points, consider the potential for a strong upward or downward move.

#2 Liquidity Raid

The important points in hunting for liquidity are as follows:

- A break of a short-term high or low, followed by a quick return to the previous range, usually signals a significant and strong move;

- These moves can create candles with long wicks (Hammer or Shooter) on higher timeframes.

Important Notes for Trading Without Market Structure Shift

This strategy can be used to determine the general market bias. The most critical element of this model is identifying strong price movements that occur after the break of a short-term high or low.

These sharp moves typically indicate strong market reversal points. To pinpoint exact entry points, using various timeframes like 1 minute or 15 minutes is essential, as these timeframes reveal more details about market structure changes.

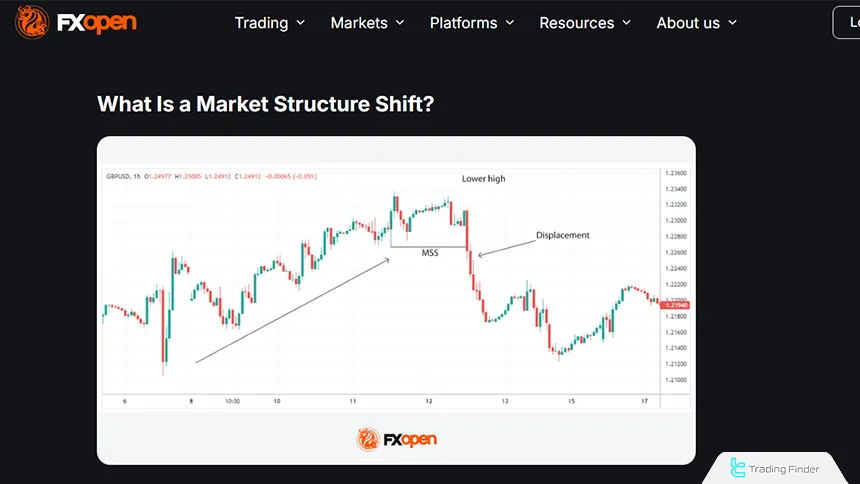

Note: To trade without a market structure shift, you must first be familiar with the concept of MSS or MSB. Market structure shift education from the FXOpen website:

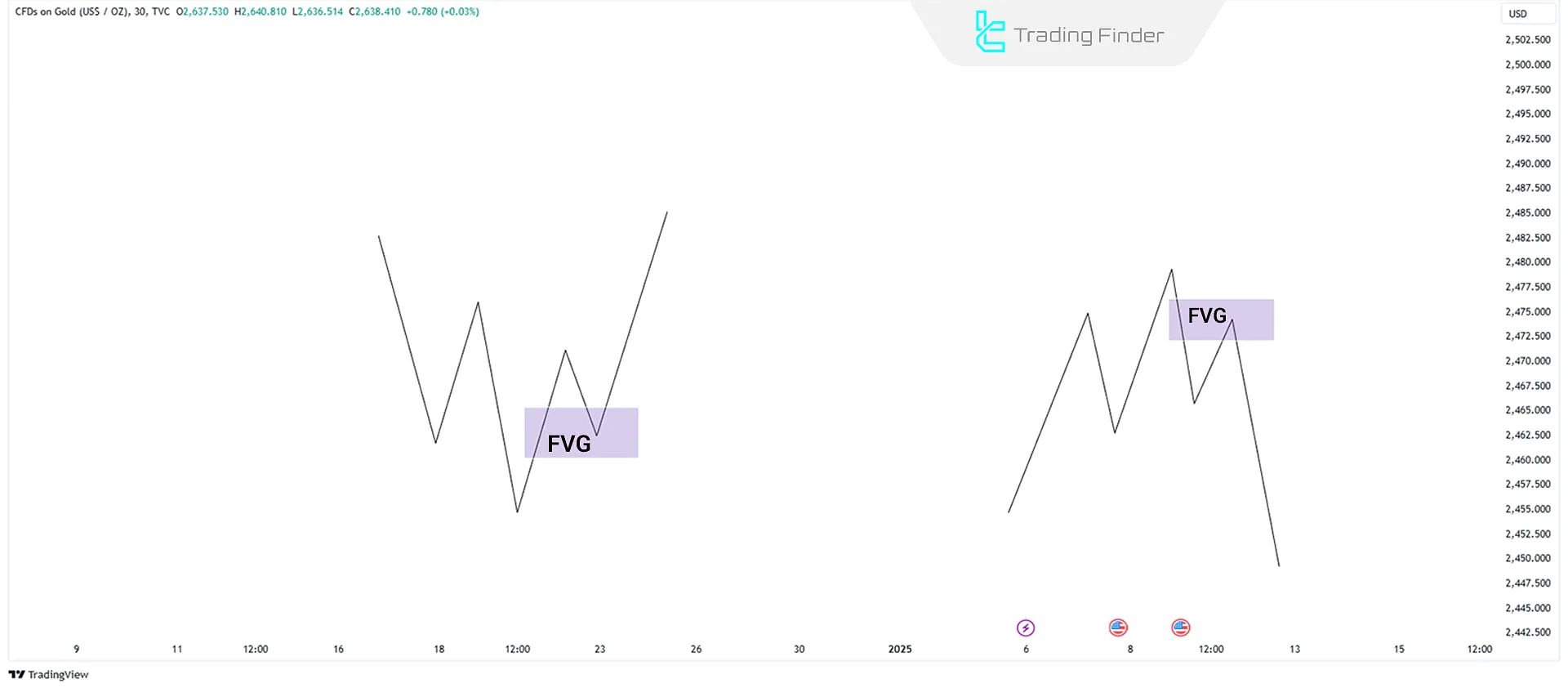

Example of Trading Without Market Structure Shift

In the chart below, the price reaches higher timeframe points of interest, and a reaction to these zones is expected.

In this scenario, trades can be executed without requiring a market structure shift or break, utilizing tools like FVG, OTE, Order Blocks, and more. In the example below, the entry point is determined using OTE levels.

In the following example, the entry point is identified via using FVG.

Common Mistakes in Using Trading Without MSS and MSB

Successful execution of the trading-without-MSS/MSB model requires high precision and avoidance of common analytical mistakes.

Many losses in this strategy occur not because of weaknesses in the model itself, but due to improper execution and misinterpretation of key concepts. Common mistakes in trading without MSS and MSB include:

Entry Without Higher-timeframe (HTF) Confirmation

One of the most common mistakes is entering on a lower timeframe without price being located in a key higher-timeframe zone. In such cases, price reactions are usually short-term and unstable. This type of entry often leads to an increase in low-quality trades.

Mistaking every Short-term Break for a Liquidity Raid

Not every break of a high or low represents liquidity hunting and requires confirmation. A valid liquidity raid must be accompanied by a fast and aggressive price reversal. The absence of this characteristic is usually a sign of continuation in the direction of the break.

Ignoring the Strength and Speed of the Price Reversal

In this strategy, the power and speed of the reversal are more important than the visual appearance of patterns. Slow or corrective reversals indicate weak opposing order flow. Such reactions usually reduce the validity of the entry.

Lack of alignment between higher and lower timeframes

Entering without alignment between different timeframes increases noise and analytical errors. This lack of alignment creates conflicting signals. HTF and LTF confluence is one of the core foundations of this model.

Mechanical use of FVG or OTE

Using FVG or OTE without a valid liquidity raid turns the entry into a mechanical decision. These tools alone are not entry signals. Their primary role is to confirm market context.

Premature Entry Without Price Behavior Confirmation

Simply reaching a POI does not justify entry. Price behavior must show imbalance and clear order-flow pressure. Entering before observing these signs increases the risk of trade failure.

Ignoring Market Conditions and Trading Sessions

This model is highly dependent on active liquidity flow. Applying it in low-volume markets or outside major sessions reduces analytical accuracy. The highest effectiveness is usually seen during the London and New York sessions.

Poor Risk Management in Early Entries

Entries without MSS/MSB are inherently more sensitive than delayed entries. Undefined stop-loss placement or improper position sizing amplifies the impact of errors. In this model, risk control is more important than the entry point itself.

Using the Fair Value Gap (FVG) Indicator in Trading Without Market Structure Shift

The Fair Value Gap (FVG) indicator is an analytical tool within the Smart Money and ICT framework, used to identify imbalances between supply and demand.

An FVG forms when the market experiences a fast and aggressive move-one that indicates temporary dominance by buyers or sellers. In such situations, price does not have enough time to fully fill transactions, leaving a gap in the candlestick structure.

FVG indicator tutorial video:

Structurally, an FVG is defined based on a three-candle sequence, where the price distance between the first and third candles forms the fair value gap zone.

This zone typically acts as an area with potential for future price reversals. The reason for this behavior is the market’s tendency to revisit areas where order imbalance previously existed.

In the trading-without-market-structure-shift or break model (without MSS/MSB), FVG plays a key role. In this approach, the trader does not wait for an official market structure change, but instead focuses on price reactions to high-value zones on higher timeframes.

FVG is considered one of the most important of these zones, as it often forms after short-term liquidity raids and can mark the starting point of a reversal move.

Using FVG in this model allows traders to enter positions before an MSS or MSB occurs. When price returns to an FVG zone after a liquidity raid and shows a fast and imbalanced reaction, it can be considered a valid entry signal.

This type of entry is usually associated with a tighter stop-loss and a more optimal risk-to-reward ratio.

However, FVG should not be used in isolation. The validity of these zones increases when they are aligned with higher-timeframe context, overall market direction, and liquidity behavior. Otherwise, price gaps may be purely corrective or ineffective.

Overall, FVG is a powerful complementary tool for ICT-style traders, especially in strategies without market structure shifts, enabling more precise identification of entry and exit points.

A correct understanding of liquidity and supply-and-demand logic is the primary requirement for effective use of this concept.

FVG Indicator Download Links:

Conclusion

Trading without market structure shift strategy is suitable for traders who aim to quickly identify trading opportunities and reduce dependence on market structure changes.

By focusing on higher timeframe points of interest and sharp moves after liquidity raids, trades can be executed without waiting for a Market Structure Shift or Market Structure Break.