- TradingFinder

- Education

- Forex Education

- ICT (Inner Circle Trader) Education

ICT (Inner Circle Trader) Education

The ICT (Inner Circle Trader) trading style is an advanced approach to price action, focusing on analyzing the behavior of major financial institutions and the role of market makers. In the ICT method, traders aim to identify optimal entry and exit points by analyzing market structure, Break of Structure (BOS), Order Blocks, Liquidity, and Fair Value Gaps (FVG). Trading Finder offers the best ICT-style educational content across four different levels, tailored to the needs of beginner to advanced traders. These courses cover concepts such as the Market Maker Model, Power of Three, and Smart Money Techniques, providing efficient methods for traders.

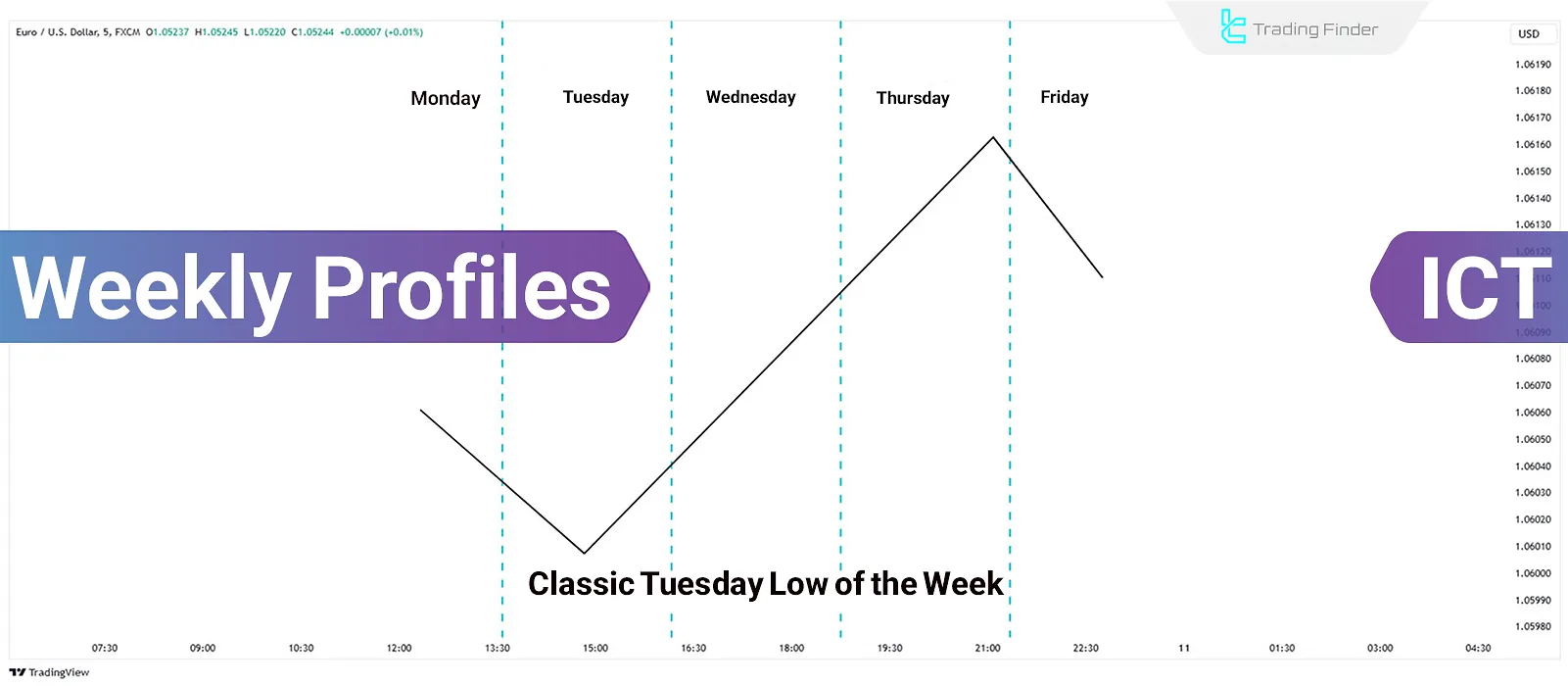

Weekly Profiles on SMC & ICT Concepts

Weekly Profiles are patterns that represent typical price behavior throughout a trading week. These profiles are composed of...

Learning to to Market Structure Shift (MSS) and Change of Character (CHoCH) in ICT

In ICT style, Market Structure Shift (MSS) and Change of Character (CHoCH), are two key concepts and powerful tools for...

ICT Unicorn setup; confluence of Breaker Block and FVG in the Unicorn strategy

ICT Unicorn trading style is one of the advanced models in technical analysis. It combines two key concepts of Breaker Blocks...

New Week Opening Gap (NWOG); Trading Strategies with NWOG in ICT

The New Week Opening Gap (NWOG) refers to the price gap between the market's closing price on Friday and its reopening on...

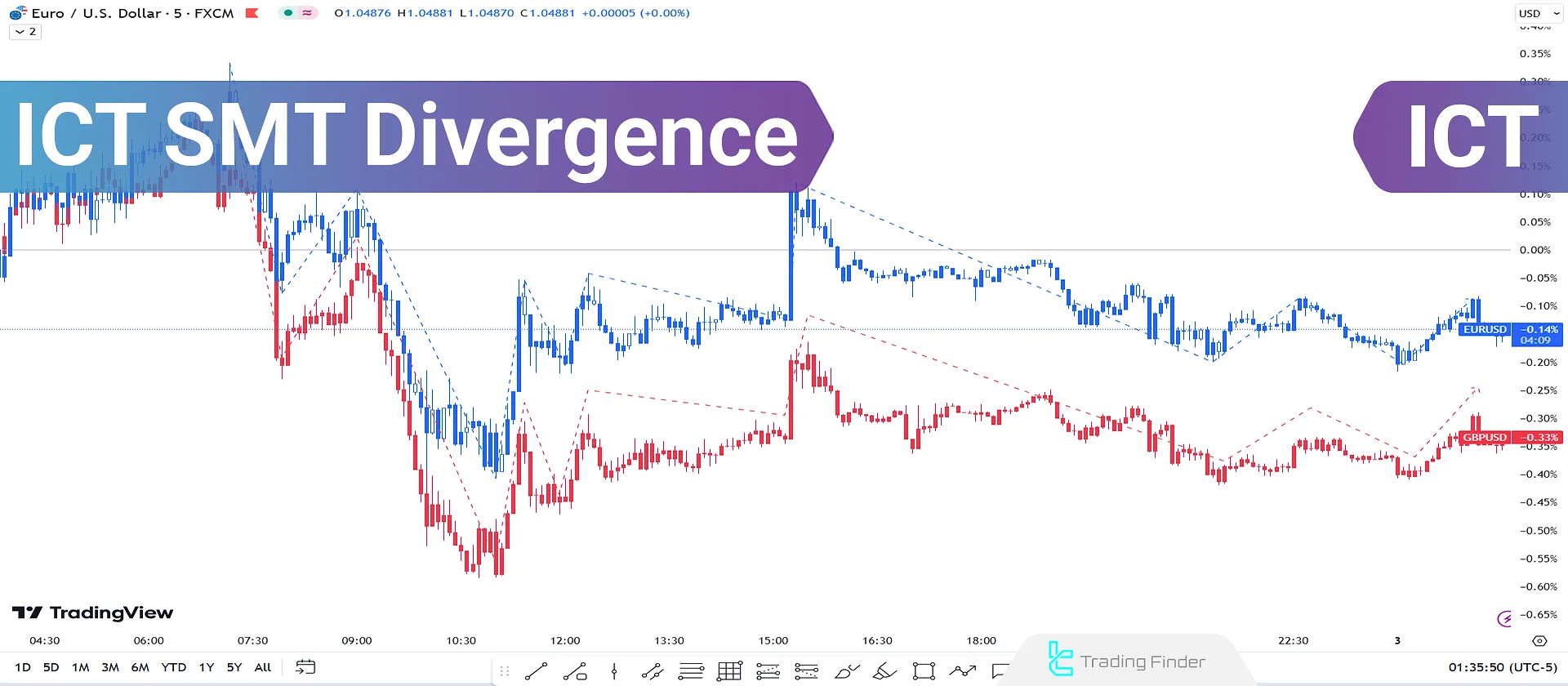

SMT Divergence in ICT: Guide to Identifying SMT Signals & Trading Strategies

ICT SMT Divergence occurs whentwo related and correlated assets show opposite trends [one bullish and the other bearish] on their...

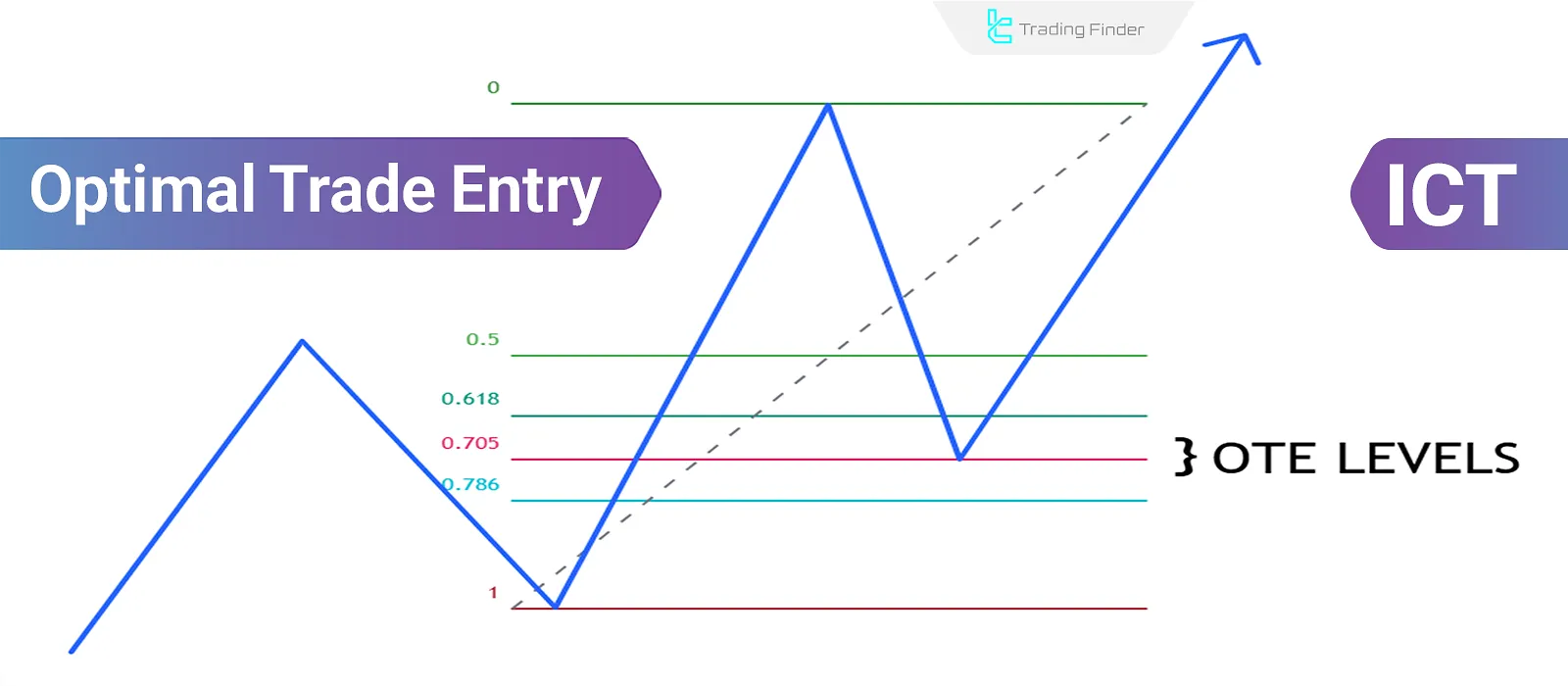

What Is the OTE Strategy? Optimal Trade Entry Using Key Fibonacci Levels in ICT Style

OTE (Optimal Trade Entry) strategy uses multiple Fibonacci levels to identify the optimal time and place to enter a position. In...

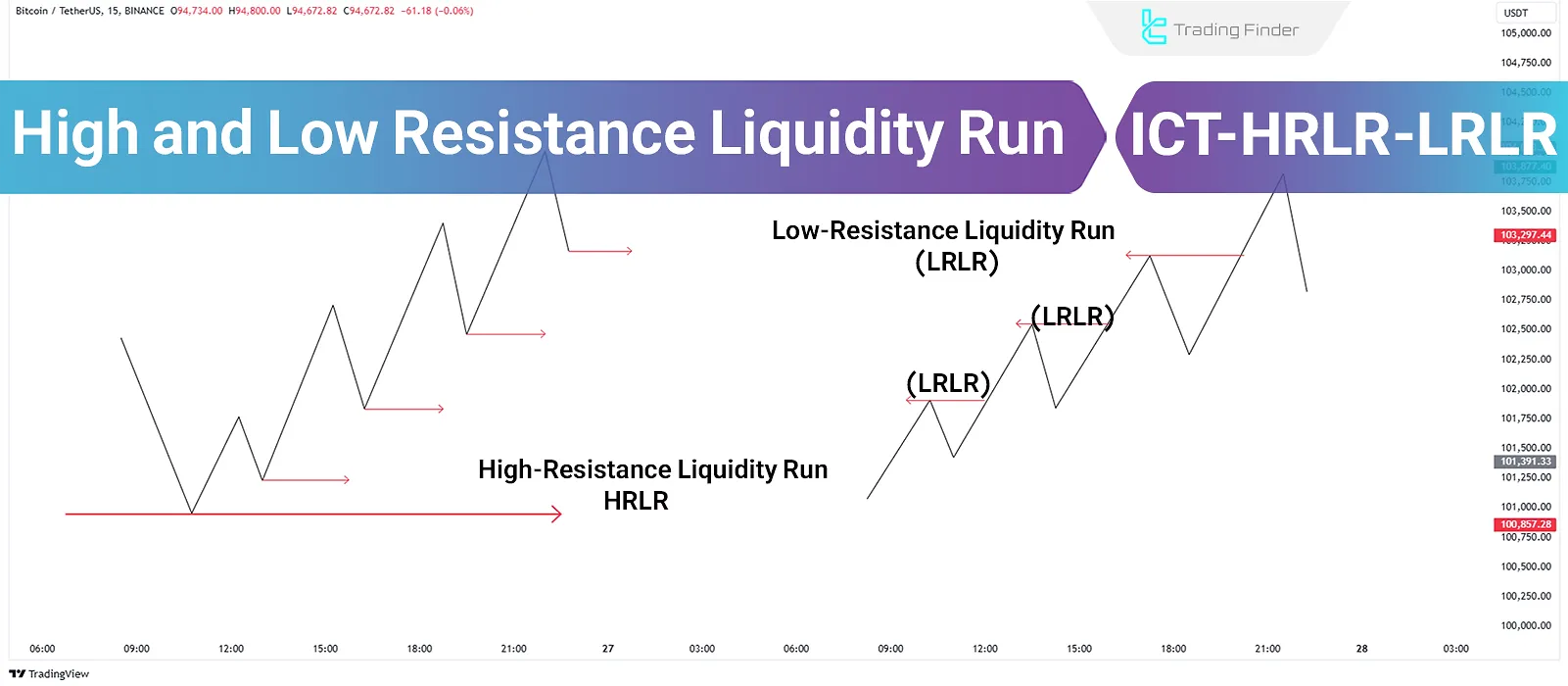

High Resistance Liquidity Run (HRLR) and Low Resistance Liquidity Run (LRLR)

High-resistance liquidity run (HRLR) and low-resistance liquidity run (LRLR) are two technical concepts; These can be used to...

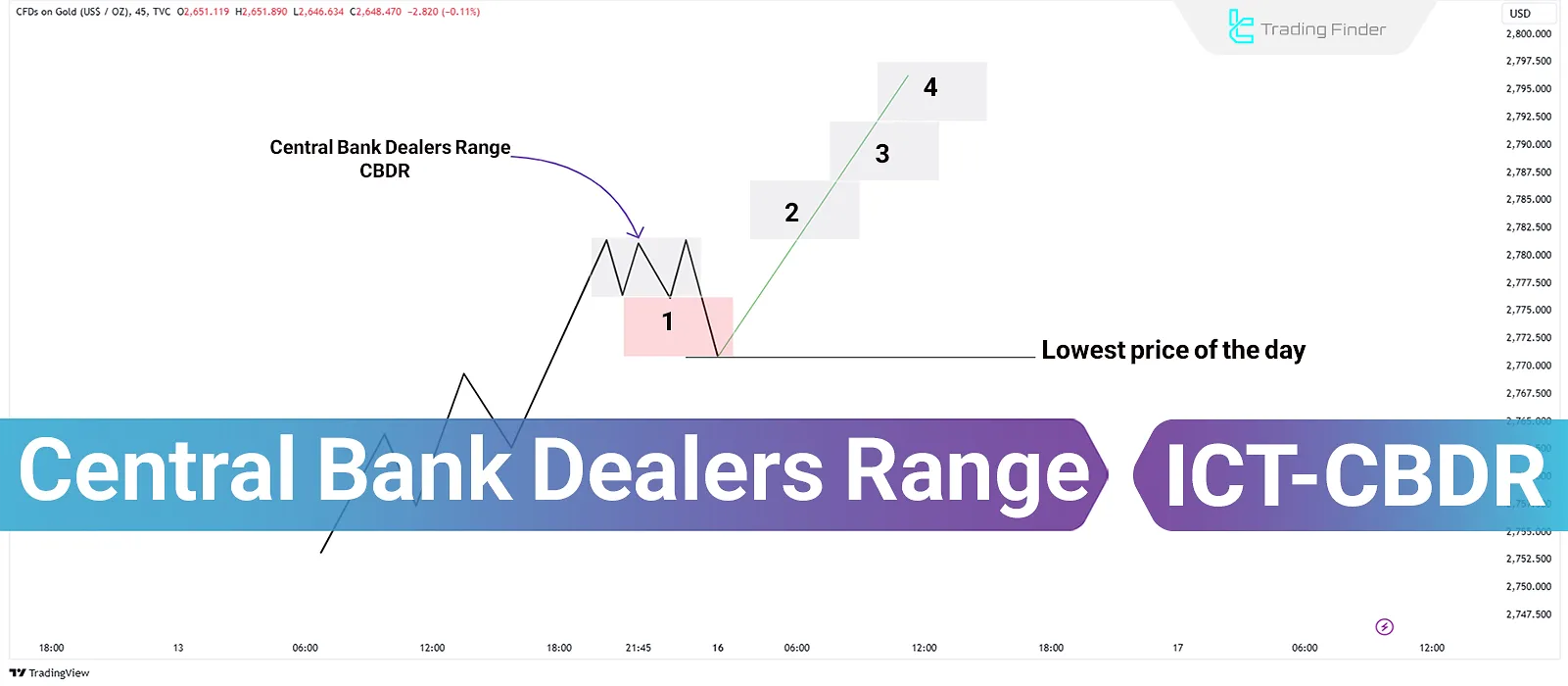

Central Bank Dealers Range (CBDR); Using CBDR in Trading

The Central Bank Dealers Range (CBDR) represents price stabilization before the market’s major moves. Central banks and large...

ICT Macro Times – Best Macro Market Times for ICT Trading Methods

ICT Macro Times refer to short time intervals during which the algorithm seeks liquidity to fill Fair Value Gaps (FVG) and...

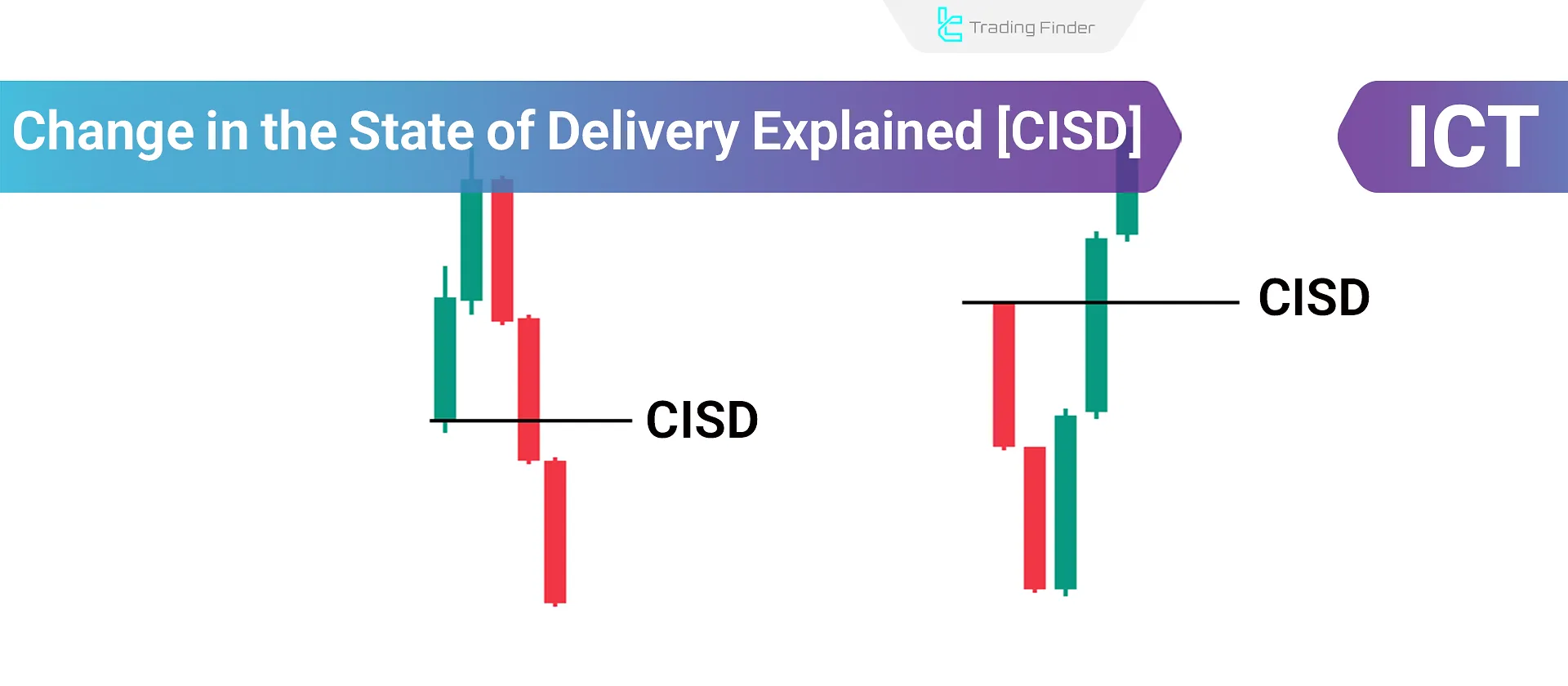

Change in the State of Delivery (CISD); How to Identify CISD on the Chart

The Change in the State of Delivery (CISD) represents a shift in the price trend flow from bullish to bearish or vice versa in...

ICT New Day Opening Gap (NDOG); How to Use NDOG in the ICT Style

The New Day Opening Gap (NDOG) refers to the price difference between the market's closing price and its reopening price in the...

Turtle Soup Strategy; Liquidity Hunt and Market Manipulation in the ICT Style

Turtle Soup is a strategy from the ICT trading style that is most often used after the formation of price range movements, which...