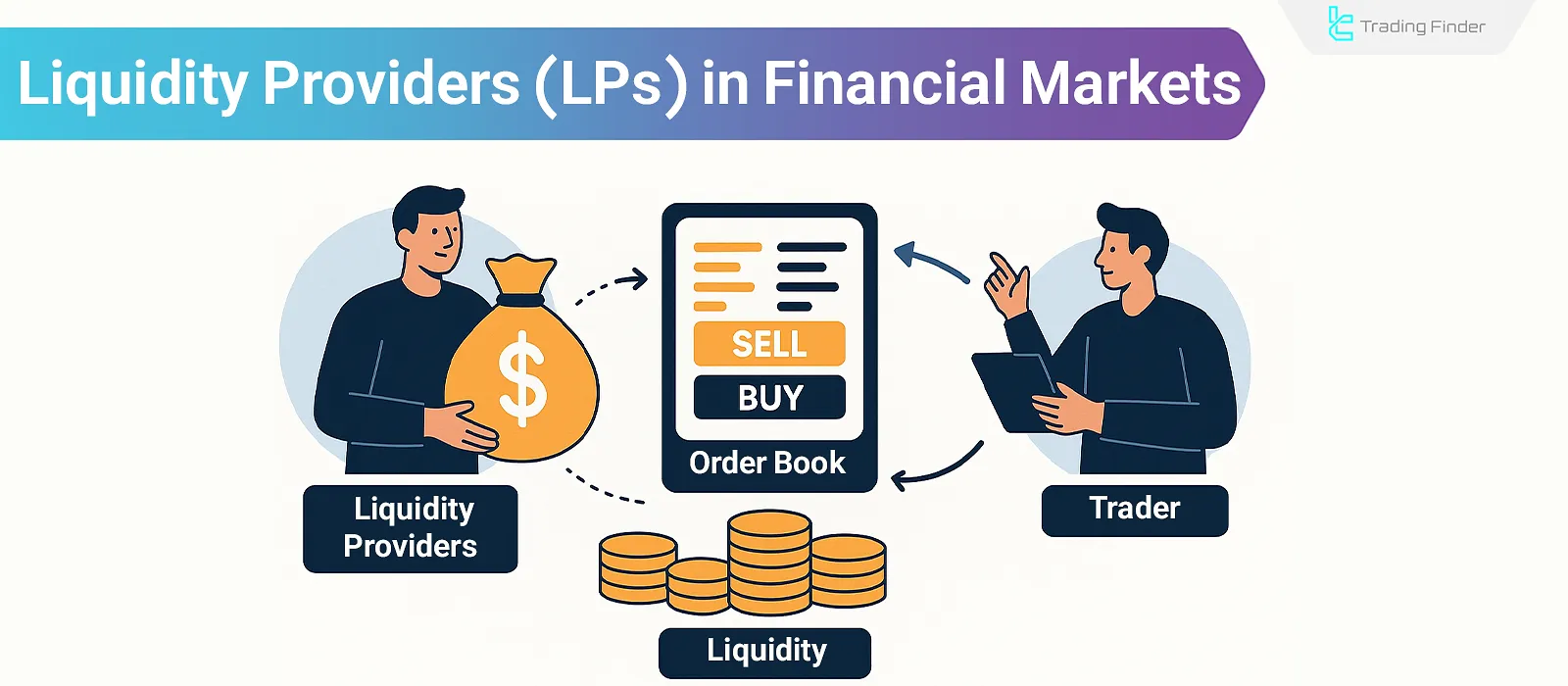

Liquidity Providers supply the required capital for trading in Forex, cryptocurrency, stock markets, and other markets. Liquidity Providers provide bid and ask prices, and the speed of trade execution depends on their presence. In fact, a liquidity provider is an individual or entity that supplies assets to a market or a liquidity pool in order to facilitate smooth trading and, in return, receives fees or rewards.

Liquidity providers include major banks, financial institutions, hedge funds, and institutional brokerages that, by continuously offering bid and ask quotes, narrow the price spread and enhance market transparency. These entities, through their active participation, improve asset liquidity, reduce price slippage, and ensure order execution in the shortest possible time.

Their role as the core infrastructure of stability and efficiency in electronic markets is vital; the absence of such a structure leads to intensified price volatility and a weakening of traders’ confidence.

Who is a liquidity provider?

Liquidity Providers are individuals or companies in financial markets, especially in Forex, stocks, and cryptocurrencies, that provide the necessary liquidity for transactions.

They enable traders’ orders to be executed quickly and smoothly by offering bid and ask prices to the market.

To gain a better understanding of the role of liquidity providers in financial markets, you can also refer to the educational video from the One Minute Economics channel on YouTube.

Features and role of Liquidity Providers:

- Increase market depth: Offering large buy and sell orders to reduce sharp price fluctuations;

- Spread reduction: Narrowing the gap between bid and ask to lower trading costs;

- Liquidity ensurance: Enable fast buying and selling of assets without significant price impact;

- Act as market makers: Continuously quoting bid and ask prices to keep markets active;

- Improve market performance: Stabilizing prices and preventing unusual volatility;

- Support official and OTC markets: Ensuring smooth operation in all types of markets;

- Utilize advanced technologies: Use algorithms and automated systems for order and risk management.

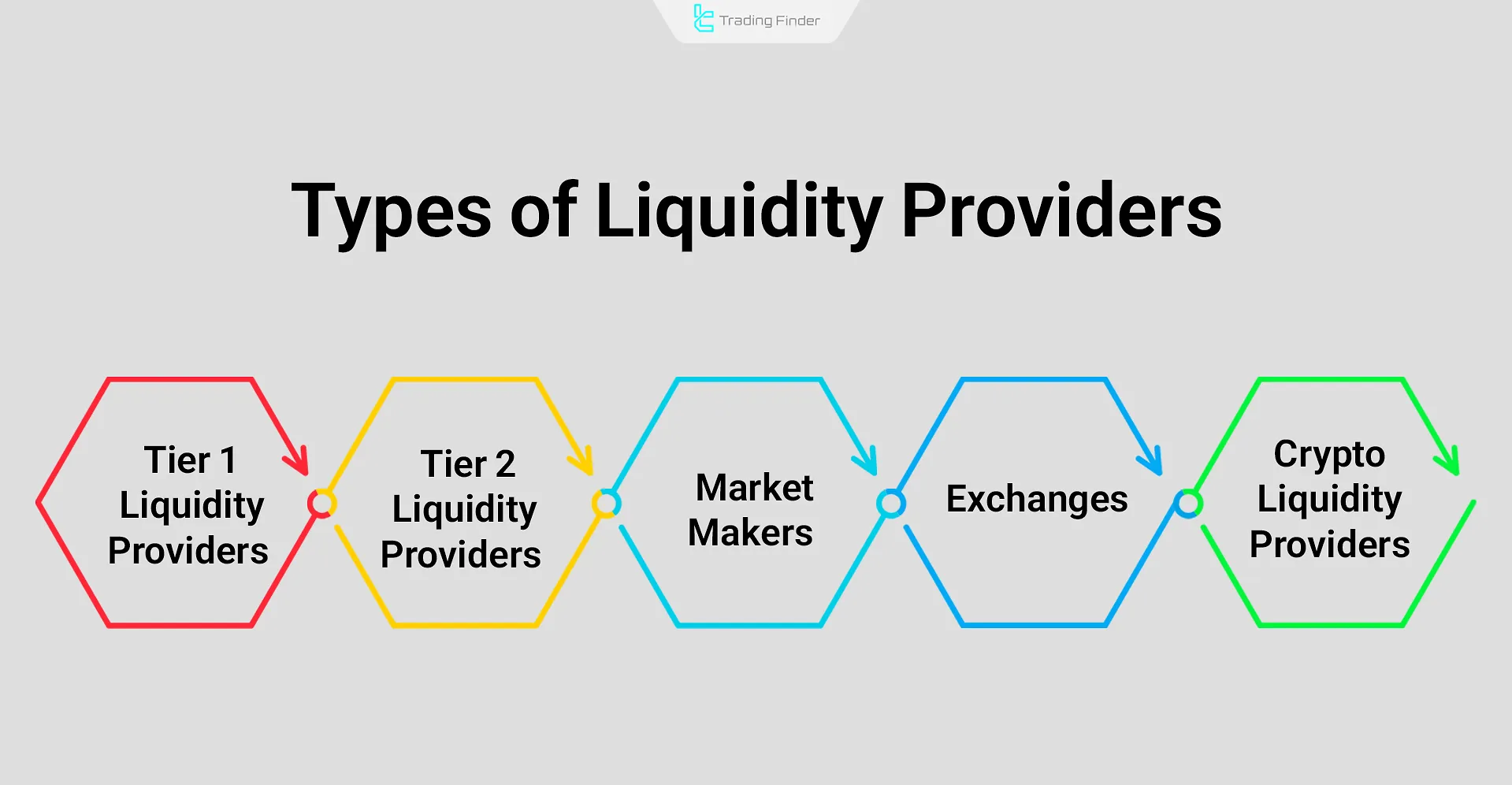

What are the types of liquidity providers?

In financial markets, liquidity providers play a key role in ensuring fast order execution with minimal price discrepancies. Liquidity providers are divided into several main categories:

- Tier 1 Liquidity Providers

- Tier 2 Liquidity Providers

- Market Makers

- Exchanges

- Decentralized Crypto Liquidity Providers in DeFi

Tier 1 Liquidity Providers

Tier 1 Liquidity Providers are the main players and largest sources of liquidity. Most of them are banking, financial, and investment institutions (such as Deutsche Bank, J.P. Morgan, Goldman Sachs, and others).

Some are not banks but, with very high financial strength, play a vital role in providing Forex liquidity.

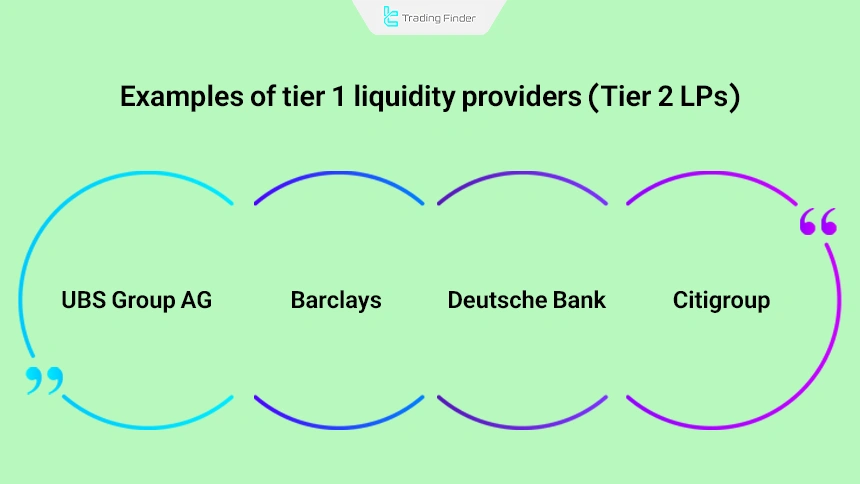

An Example of Tier 1 Liquidity Providers (Tier 1 LPs)

Tier 1 liquidity providers are international financial institutions with direct access to the interbank market, whose massive transaction volumes and liquidity capacity shape the market spread structure.

These entities supply the core infrastructure of global liquidity in the forex market and other asset classes and are considered the primary benchmark for assessing the true depth of the market.

Prominent examples of Tier 1 LPs include:

- UBS Group AG: A leading Swiss bank with a global presence in the forex market and the provision of multi-layered liquidity;

- Deutsche Bank: An institution with direct access to the interbank market and the capability to provide liquidity across various asset classes;

- Barclays: One of the oldest liquidity providers with a focus on currency trading and contracts for difference;

- Citigroup: With coverage of more than 400 currency pairs and an advanced global liquidity structure, one of the main players in the international market.

Tier 2 Liquidity Providers

Tier 2 Liquidity Providers are companies that have access to Tier 1 liquidity and deliver it to clients using technological tools. These companies work with several providers, and the more partners they have, the more liquidity and market depth they can offer.

Some brokers also act as secondary Liquidity Providers; however, not all brokers are Liquidity Providers.

An Example of Tier 2 Liquidity Providers (Tier 2 LPs)

Tier 2 liquidity providers are typically large brokers or liquidity aggregation platforms that collect pricing from multiple tier 1 sources.

By using technologies such as smart order routing and price aggregation, they deliver these rates to retail brokers and smaller institutions.

These entities effectively act as a bridge between the interbank market and the retail market. Well-known examples of tier 2 LPs include:

- CFH Clearing (Saxo Bank Group): Providing aggregated liquidity for FX and CFD with ultra-low latency;

- FXCM Pro: Supplying multi-source liquidity for brokers, hedge funds, and financial institutions;

- Sucden Financial: Offering direct access to multiple tier 1 LPs with customized pricing for institutional clients;

- Finalto: Intelligent multi-asset liquidity aggregation with dynamic pricing algorithms and fast execution;

- Invast Global: Delivering prime-of-prime liquidity with competitive spreads and high-quality execution in the Asia-Pacific region.

Market Makers

Market Makers actively set bid and ask prices and are often the counterparty in trades. Market Makers are individuals or institutions in financial markets that continuously provide buy and sell quotes, thereby supplying liquidity.

By simultaneously offering bid and ask prices for a particular asset, they create the bid-ask spread.

Decentralized Crypto Liquidity Providers in DeFi

In decentralized finance (DeFi), ordinary users can act as LPs by depositing assets into liquidity pools. In other words, Liquidity Providers in DeFi are users who deposit their assets (such as cryptocurrencies) into liquidity pools of decentralized exchanges.

These pools are smart contracts that lock users’ assets to provide the liquidity required for trading.

Revenue and Risk Model of Liquidity Providers in DeFi

In the decentralized finance ecosystem (DeFi), users earn returns by depositing cryptocurrencies into liquidity pools; these returns are usually a portion of transaction fees or the platform’s native token.

Thismodel creates a dynamic mechanism for generating passive income, but it also comes with certain risks:

- Impermanent loss: The price difference of deposited tokens compared to the entry point;

- Smart contract risk: The possibility of bugs or attacks leading to a loss of capital;

- Liquidity pool risk: The potential lack of sufficient liquidity during large-scale user withdrawals.

Interested readers can also use the educational article on the role of liquidity providers in financial markets on the stonex.com website to obtain more information.

This structure creates a combination of passive returns and active risk and is only valuable when the choice of platform, token, and investment amount is made with care.

Difference in Liquidity Between Forex and Cryptocurrency Markets

In the forex market, liquidity is provided by a network of major banks, financial institutions, and tier 1 liquidity providers. This network has a centralized, interbank nature, and prices are determined directly based on interbank supply and demand.

In contrast, in the cryptocurrency market, liquidity is supplied through liquidity pools and automated market makers. This structure is decentralized, and retail users can also assume the role of liquidity providers by depositing digital assets into pools.

Feature | Forex market | Cryptocurrency market |

Liquidity source | Banks and tier 1 and tier 2 liquidity providers | Liquidity pools and automated market makers |

Market nature | Centralized and interbank | Decentralized and blockchain-based |

Main participants | Financial institutions and banks | Retail users and liquidity providers |

Price discovery | Interbank supply and demand | AMM algorithms and asset ratios |

Liquidity depth and volume | Very high, low spreads | Dependent on pool size, sometimes shallow |

Price volatility | Lower and more stable | Higher and more variable |

Transaction transparency | Limited and institutional | Fully on-chain |

Risks | Lower, but dependent on monetary policies | Includes impermanent loss and smart contract risk |

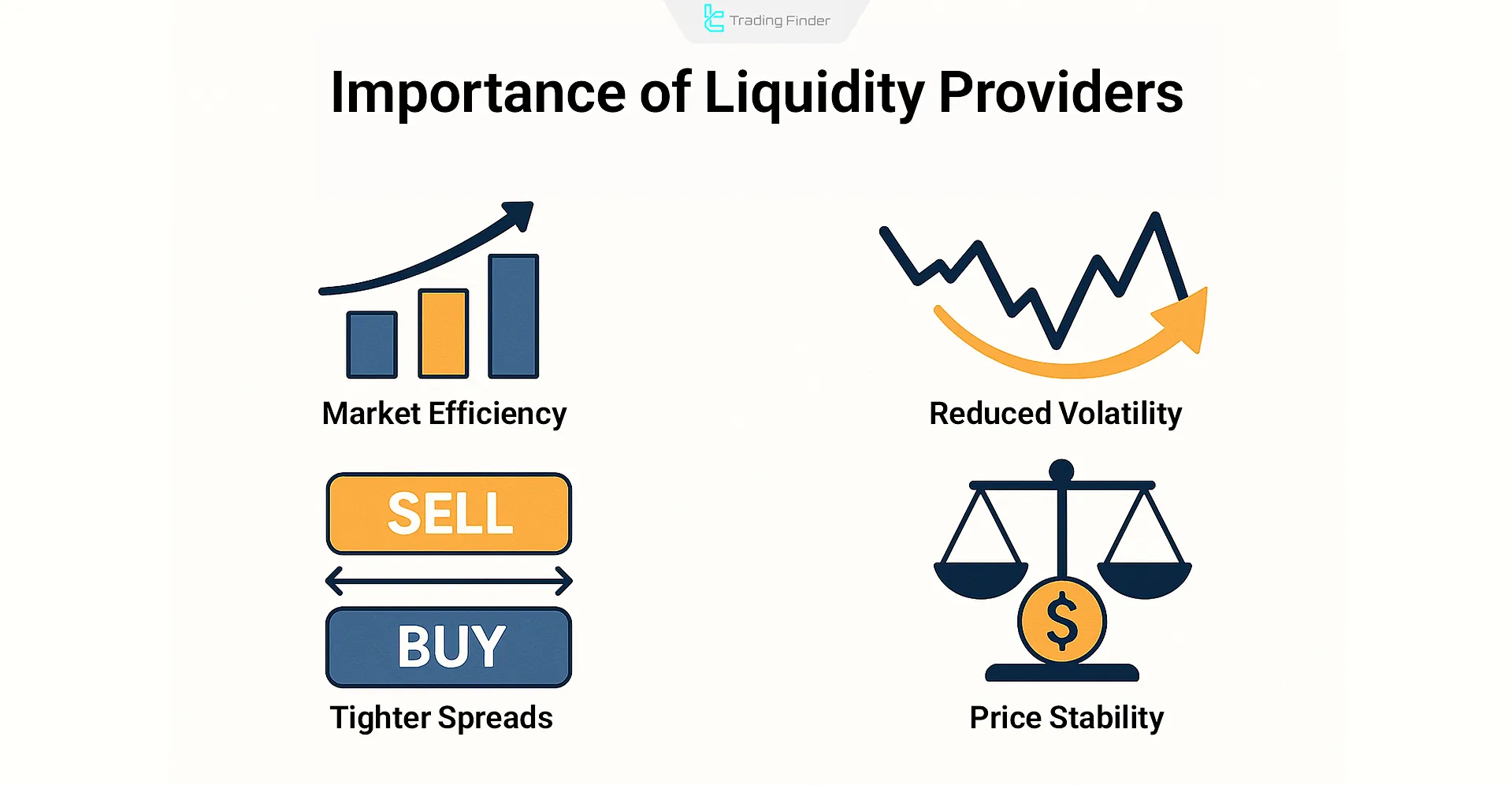

Importance of Liquidity Providers

The importance of Liquidity Providers in financial markets is critical. They guarantee market dynamism, efficiency, and tradability. Without them, many markets would stagnate or face severe volatility. Choosing the right broker heavily depends on its Liquidity Providers and affects order execution quality.

In cryptocurrency markets, decentralized Liquidity Providers (LPs) play a vital role in facilitating trades and boosting the efficiency of decentralized exchanges (DEX).

Liquidity Aggregators

One of the core components of the liquidity infrastructure in modern markets is liquidity aggregators. These systems simultaneously connect to multiple tier 1 and tier 2 liquidity providers and collect the best bid and ask prices, executing trades through smart order routing algorithms.

This process allows traders to access the best real-time market rates, even when liquidity is sourced from multiple providers. Some of the most well-known liquidity aggregators include PrimeXM, OneZero, and FX Bridge.

Difference between Market Makers and Liquidity Providers

The difference between Market Makers and Liquidity Providers lies in their roles, operational structures, and type of market interaction. Below we examine these differences in more detail.

Difference between Market Makers and Liquidity Providers:

Feature | Market Maker | Liquidity Provider |

Definition | An institution that continuously provides bid and ask prices to maintain market liquidity | An institution or individual that provides its capital to execute buy and sell orders |

Role in the Market | Creates prices and executes trades | Executes orders without direct involvement in pricing (especially in STP and ECN models) |

Type of Market | Mostly in Dealing Desk models or brokers’ internal markets | Mostly in interbank markets and ECN/STP brokers |

Counterparty | May directly trade with clients (internal broker) | Usually not the direct counterparty; clients’ orders are passed to them |

Source of Income | Earns from spreads, bid-ask differences, or trading against clients | Earns from interbank spreads, trading volumes, and small markups |

Level of Risk | High; since it may take the opposite side of client trades | Lower; usually operates with hedging or risk management strategies |

Main Objective | Maintains liquidity by continuously quoting bid and ask prices | Provides market depth and increases order execution speed |

Price Control | Sets prices or adjusts them internally | No; prices are usually sourced from interbank or external markets |

Dependence on End User | High; directly interacts with end clients | Low; usually connected through brokers or liquidity networks |

Role of Liquidity Providers in Price Discovery and Risk Management

Liquidity providers, or LPs, in addition to supplying liquidity, play a vital role in price discovery and market risk management. By offering real-time bid and ask quotes, they contribute to price stability and reduce slippage.

They also control sharp market fluctuations and maintain stable liquidity flows by employing methods such as hedging and position coverage.

- Quote dissemination: Facilitating the discovery of true market prices

- Volatility control: Reducing spreads and increasing market depth

- Effective hedging: Preserving liquidity stability under high-volatility conditions

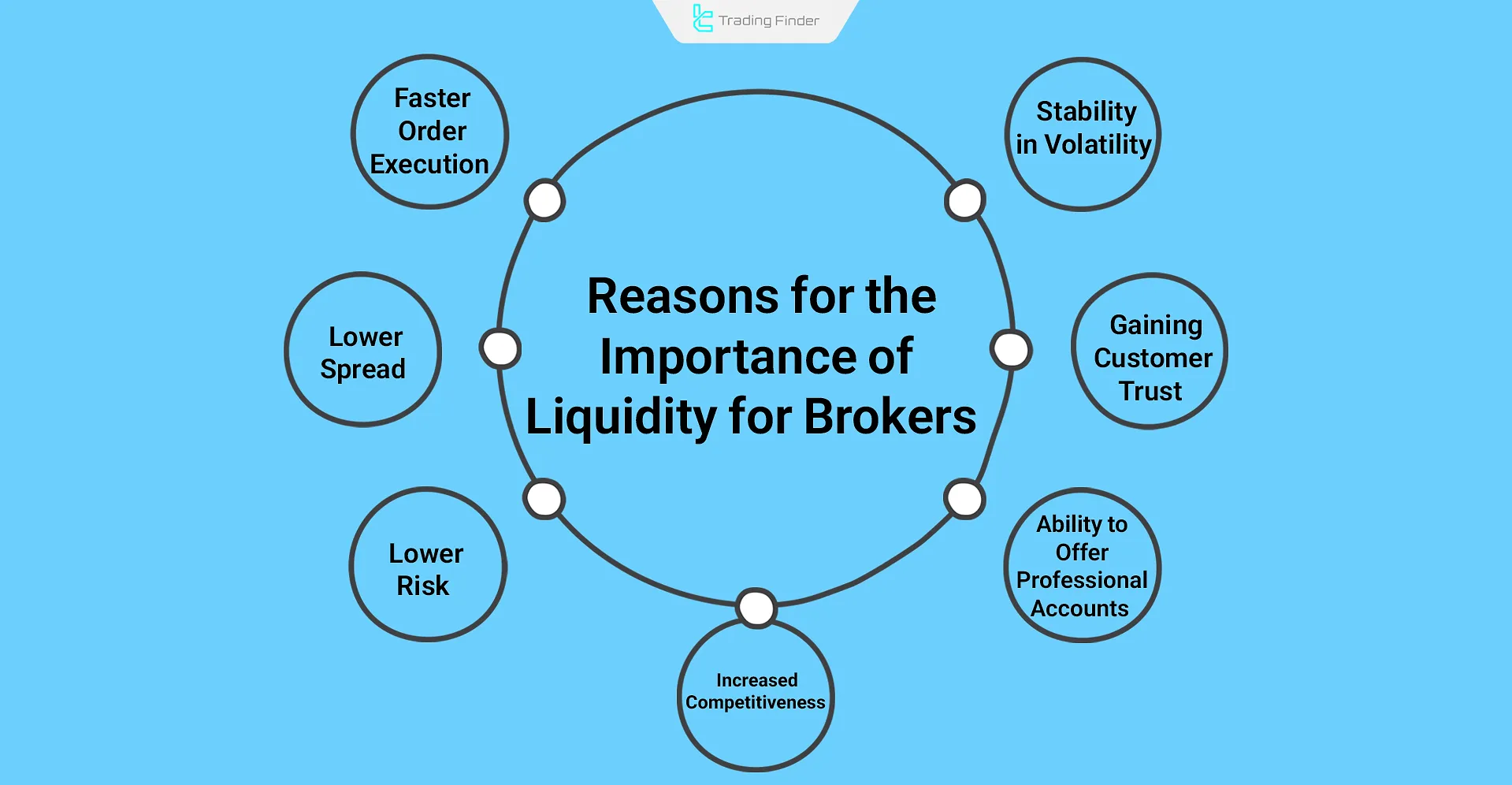

Why is liquidity level important for brokers?

Liquidity levels are critical for brokers because they directly impact service quality, execution speed, trading costs, and client satisfaction. Reasons include:

- Faster execution: Reduced delays and slippage;

- Lower spreads: Reduced trading costs for clients;

- Lower risk: Easier order execution with a Liquidity Providers;

- Stability in volatility: Better price control in volatile markets;

- Client trust: Proof of access to reputable liquidity networks;

- Ability to offer professional accounts: Such as ECN and Raw Spread;

- Competitive advantage: Attracting professional and institutional traders.

Profits and losses of Liquidity Providers

Contrary to common belief, Liquidity Providers do not only earn from spreads; their activity can be both profitable and risky depending on business model, target market, hedging strategy, and trade structure.

Profits and losses of Liquidity Providers (LPs):

LP Profits | LP Losses and Risks |

Income from bid/ask spreads | Risk of sudden market moves (Adverse Selection) |

Commission/Fee Income | Inventory Risk |

Arbitrage and profitable algorithms | Impermanent Loss in DeFi |

Rebates and cash incentives | Low liquidity risk in special conditions |

Profit from market psychology inefficiencies | Price manipulation or Flash Loan Attacks |

Although liquidity provision is a sustainable and profitable model, it requires advanced risk management, fast infrastructure, and automated position hedging; otherwise, it can be loss-making.

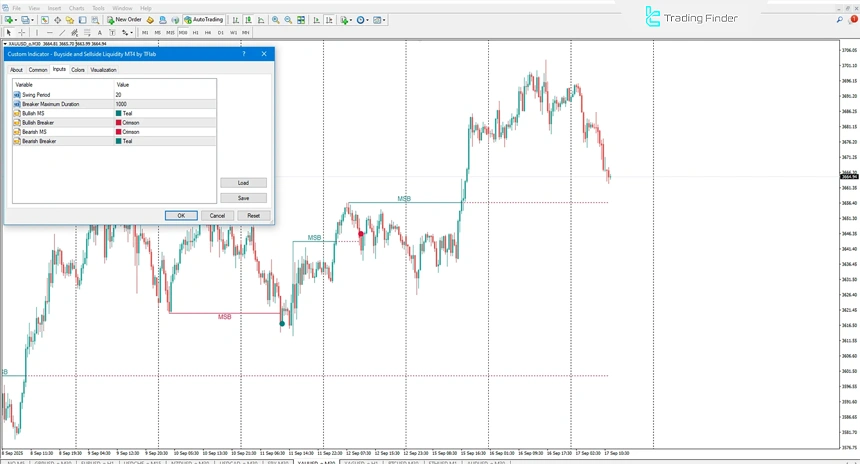

Buyside and Sellside Liquidity Indicator in MetaTrader

The buyside and sellside liquidity indicator is one of the advanced analytical tools on the MetaTrader platform, designed to identify liquidity accumulation zones on both sides of the market.

This indicator analyzes the behavior of pending orders and stop orders to reveal the liquidity structure at key levels and provides a clear view of the balance of power between buyers and sellers.

- The buyside & sellside liquidity indicator for MT5

- The buyside & sellside liquidity indicator for MT4

The core functionality of this tool is based on identifying areas where a large volume of pending orders is concentrated. At the moment a liquidity sweep occurs and price reverses from these zones, the indicator generates a buy or sell signal.

This process allows traders to enter or exit trades at precise points, aligned with changes in liquidity flow. The key features of this indicator include:

- Identification of buyside and sellside liquidity zones;

- Signal generation in response to liquidity absorption and price reversal;

- Support for multiple analytical timeframes, including multi-timeframe analysis;

- Compatibility with scalping, day trading, and short-term trading styles;

- Configuration includes the swing period, breaker maximum duration, and bullish/bearish color settings.

This indicator falls under the category of MetaTrader reversal, breakout, and entry/exit indicators and is suitable for traders with intermediate to advanced skill levels. In real market conditions, the indicator demonstrates multi-functional performance.

For example, on a currency pair in the 30-minute timeframe, sellside liquidity levels are marked with red lines, and after liquidity is collected and price reverses, a buy signal is activated.

Similarly, on another currency pair, the absorption of buyside liquidity followed by a bearish breakout triggers a sell signal. This tool is applicable not only in the forex market but also in cryptocurrencies, indices, stocks, and other financial markets.

Overall, the buyside and sellside liquidity indicator is a precise analytical tool for examining liquidity flow, which, by focusing on price behavior at key zones, enables intelligent decision-making and accurate trade timing.

Conclusion

Liquidity Providers (LPs) are the main players in financial markets responsible for quoting prices and providing large order volumes. These entities, including major banks, financial institutions, Market Makers, and even DeFi users, play a vital role in narrowing spreads, improving order execution speed, and maintaining market stability.

The level of liquidity provided by them directly impacts brokers’ service quality and client satisfaction.