Margin Trading is a form of leveraged trading that allows traders to operate with capital exceeding their available balance.

In margin trade activities, both potential profit and risk increase with the amplified capital. Exchanges and brokers offer margin accounts to enable this service for traders.

Margin trading also involves concepts such as Initial Margin, Maintenance Margin, and Margin Call, each of which plays a crucial role in risk control and preventing the liquidation of capital.

What Is Margin Trading?

Margin Trading, or trading by margin, refers to borrowing funds from a broker or exchange and using them to buy and sell cryptocurrencies, stocks, or other tradable assets.

Traders repay the borrowed amount on a specified date, along with the agreed interest.

Difference Between Spot and Margin Trading

In spot trading (Spot Trading), the trader uses only their personal capital and becomes the actual owner of the purchased asset. In this type of trade, the transfer of asset ownership takes place in reality, and the risk is limited only to the amount of the initial capital.

In contrast, in margin trading (Margin Trading), the trader increases the size of their trading position by using borrowed funds from the exchange or other users, without being the full owner of the asset.

This method, due to the use of leverage, allows for the potential of multiplied profits but also proportionally increases the potential for losses.

The main difference between these two structures lies in the level of risk and ownership: in spot trading, the risk is limited and real ownership exists, whereas in margin trading, the risk is higher and ownership is partial.

The table below compares margin and spot trading:

Spot Trading | Margin Trading |

Use of personal capital | Use of personal capital and borrowed funds (leverage) |

Full ownership of the asset | Partial ownership of the asset |

Real and direct transfer of the asset | Holding of the asset in a margin account until settlement |

Risk limited to initial capital | Risk beyond initial capital, possibility of account liquidation |

Profit and loss proportional to price changes | Multiplied profit and loss affected by leverage |

No leverage (1:1) | Multiple leverage (1:3, 1:10, etc.) |

Trading fee | Trading fee plus loan interest |

Suitable for beginner and intermediate traders | Suitable for professional and experienced traders |

No risk of liquidation | Possibility of liquidation due to price fluctuations |

Used for simple trades and long-term holding | Used for short-term trading and advanced strategies |

Difference Between Margin Trading and Futures Trading

At first glance, margin trading and futures trading (Futures Trading) may appear structurally similar, but there are fundamental differences between them in nature and execution.

Understanding these distinctions is especially important for choosing the right strategy and managing risk effectively.

- Margin Trading: The trader borrows assets (Borrowed Assets) from the exchange or other users to buy or sell actual assets;

- Futures Trading: Instead of purchasing a real asset, a contract for future purchase or sale (Future Contract) is made, which is based on the predicted price of the asset.

Margin trades are generally conducted without an expiration date (No Expiration Date), while futures trades have a specific maturity date (Expiration Date).

The level of fees, funding rate (Funding Rate), and risk in the futures market are usually higher than in margin trading.

Comparison table of margin trading vs. futures trading:

Margin Trading | Futures Trading |

Use of borrowed assets (Borrowed Assets) | Trading based on a future contract (Future Contract) |

Buying or selling real assets | Buying or selling a contract based on a predicted price |

Partial ownership of the real underlying asset | No actual ownership of the underlying asset |

No expiration date (No Expiration Date) | Has a specific expiration date (Expiration Date) |

Lower risk compared to futures | Higher risk due to leverage and contract price volatility |

Lower fees and funding rate | Higher fees and funding rate (Funding Rate) |

Used for short-term trading with real assets | Used in futures trading and speculative strategies |

Requires moderate risk management | Requires advanced risk management and continuous monitoring |

Suitable for intermediate to professional traders | Suitable for professional traders and derivatives market participants |

In the educational video on Jake Broe’s YouTube channel, more details about margin trading are discussed, and those interested can use this video to gain further insight.

Comparison of Margin, Futures, and Spot Trading

The table below provides a detailed comparison of the features of margin, futures, and spot trading:

Feature | Margin Trading | Futures Trading | Spot Trading |

Nature of Trade | Real asset trading using broker/exchange loan | Contract trading without physical delivery | Real asset trading |

Leverage | Limited, varies by exchange/broker | Often high (100x or more) | No leverage |

Costs | Interest and trading fees | Usually includes transaction fees | Includes transaction fees |

Expiry Date | No fixed expiry, long-term positions allowed | Perpetual futures often have no expiry | No expiry due to physical settlement |

Asset Ownership | Actual ownership of asset | Ownership of futures contract | Actual ownership of asset |

Liquidity Risk | Quick liquidation if price drops | Rapid liquidation with loss mitigation systems | Liquid if buyers and sellers are available |

Use Case | Capital expansion for asset fluctuation gains | Quick trades exploiting price movements | Asset trading and price fluctuation benefits |

Types of Margin Trades

Margin trades can be executed as long or short positions:

- Long Position: Buying an asset using borrowed funds;

- Short Position: Selling an asset or currency based on an anticipated price drop.

For a better understanding of the types of margin trading, you can also refer to the article “Margin Trading Tutorial” on the website investopedia.com.

Cross Margin vs. Isolated Margin

Exchanges usually offer two types of margin structures for leveraged trading, each providing traders with a different level of risk exposure and capital control:

- Cross Margin: In this mode, the entire account balance serves as collateral for all open positions; if one trade incurs a loss, the available balance is used to prevent liquidation;

- Isolated Margin: In this method, a specific portion of the trader’s capital is allocated to each position, and in the event of a loss, only that portion is affected while the remaining assets remain protected.

The choice between cross and isolated margin depends on the trader’s risk tolerance, trading strategy, and capital management style. Accurate control of leverage and margin in both models is a key factor in avoiding heavy losses and maintaining portfolio balance.

Comparison Table: Cross Margin vs. Isolated Margin

Features/Type of Margin | Cross Margin | Isolated Margin |

Definition | Use of the entire account balance as collateral for all positions | Allocation of a specific amount of capital to each position |

Risk Management | Higher overall account-level risk | Limited and controlled risk at the position level |

Level of Trader Control | Less control over individual positions | Greater control over each position |

Likelihood of Liquidation | Lower likelihood of liquidation | Higher likelihood of liquidation |

Suitable For | Professional and experienced traders | Beginner or conservative traders |

Flexibility | Less flexibility in position management | More flexibility with independent positions |

Profit and Loss Management | Unified calculation of profit and loss across all positions | Separate calculation of profit and loss for each position |

Margin Type Adjustment | Limited to setting before opening a position | Can be changed during an open position (depending on the exchange) |

Usage in Platforms | Default mode in exchanges such as Binance, Bitget, Bybit | Offered as a separate option in most exchanges |

How to Calculate Margin Trading

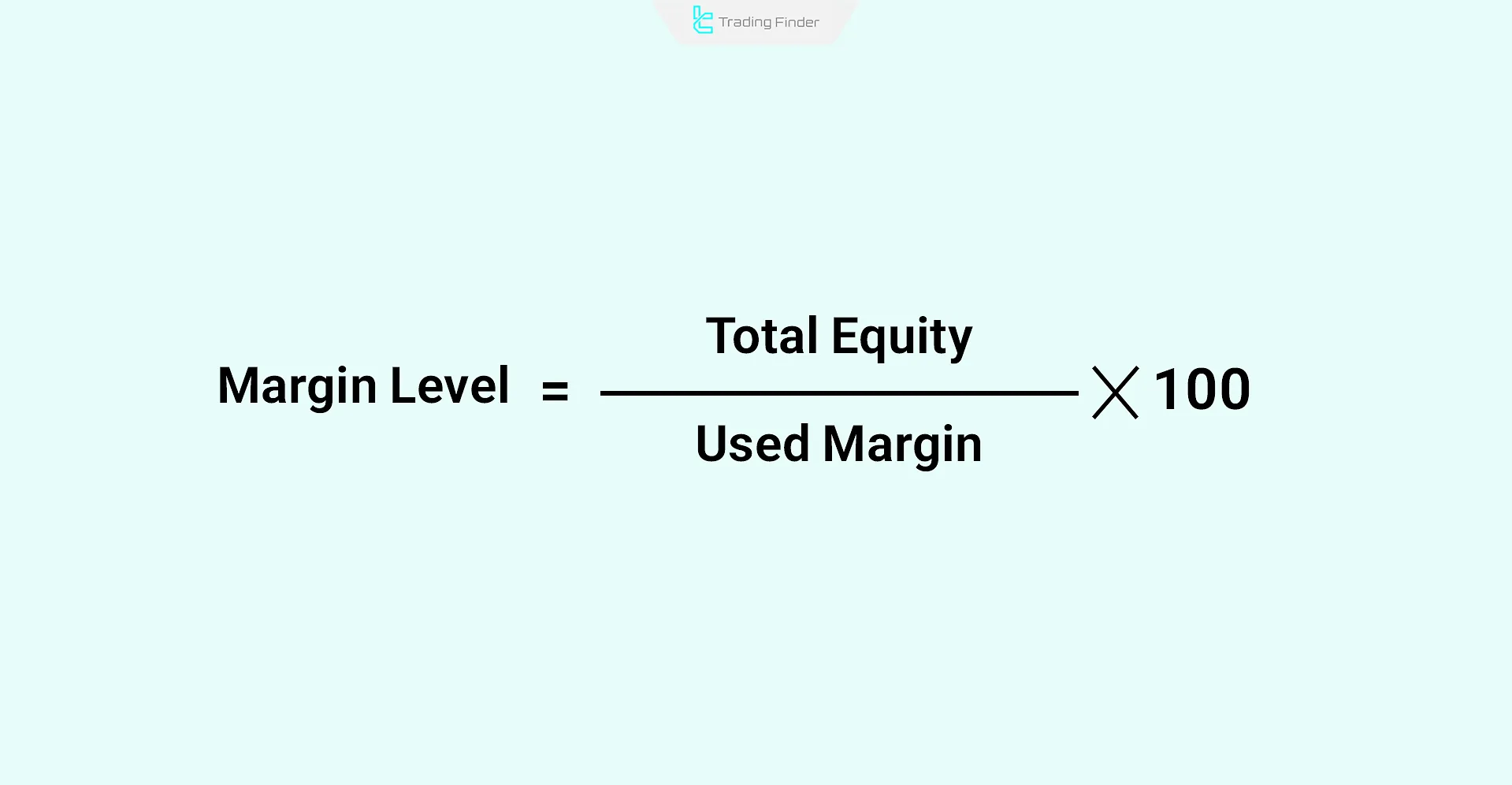

The Margin Level is a key metric used for percentage-based margin calculations. It determines whether a trading account qualifies to receive margin.

Formula for calculating Margin Level:

To enter margin trading, the trader must hold a specific amount of their own capital in the trading account as the initial margin (Initial Margin). This amount serves as collateral to cover the risk associated with leveraged trades.

When the value of the trader’s assets decreases and falls below the minimum level set by the exchange, the account balance reaches the maintenance margin (Maintenance Margin).

If the balance continues to drop below this level, a margin call (Margin Call) is triggered, and the exchange requires the trader to add more funds to the account or close part of their positions to prevent further losses.

Leverage Concept in Margin Trading

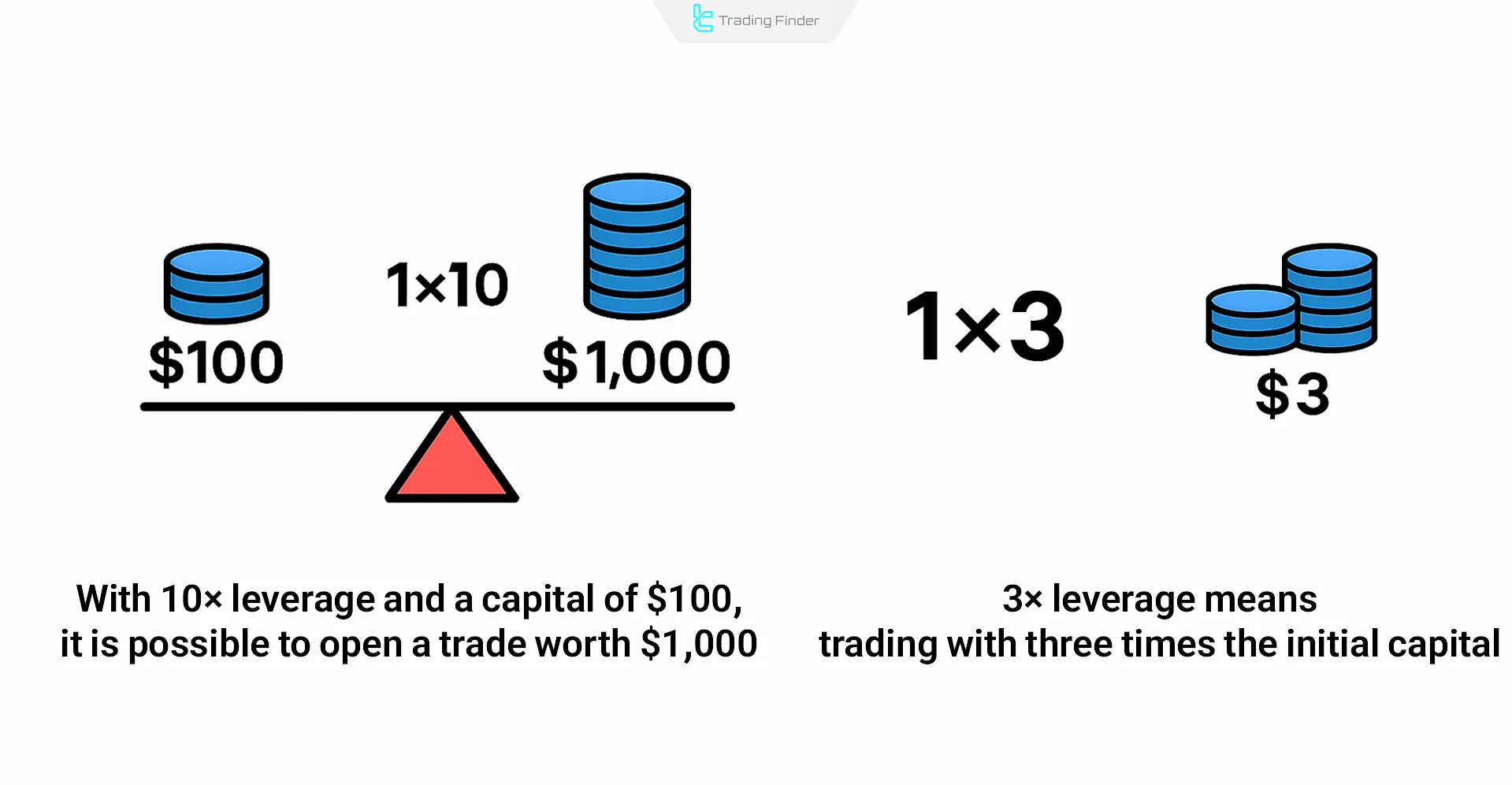

In margin trading, leverage involves depositing a portion of the trade value as collateral this deposit is known as margin.

Margin is the difference between the total investment value and the loaned amount. Leverage refers to the ratio between borrowed funds and the trader’s capital.

Example of Leverage in Margin Trading

Leverage is a tool that allows a trader to enter a position several times larger than their actual capital. For example, with 10× leverage, if a user has $100 in capital, they can open a trade worth $1,000.

In other words, 3× leverage means that for every $1 of capital, the trader can trade with $3.

Although leverage can increase potential profits, it also proportionally increases the risk of losing capital. Choosing the right leverage level should align with the trader’s experience and risk management capability.

How to Choose the Right Leverage for Margin Trading?

Choosing the appropriate leverage according to one’s level of experience, strategy, and investment goals plays a decisive role in risk management. Using high leverage without proper understanding can lead to irreversible losses.

Beginner traders usually use low leverage levels such as 2× to 5× to maintain better control over risk and to assess market behavior more accurately.

In contrast, professional traders may use higher leverage (10× or more) under specific conditions; however, increasing leverage directly raises the probability of liquidation exponentially.

Note: At the beginning of trading activity, it is recommended to select the lowest leverage level so that the trader can understand the impact of price fluctuations and market movements under controlled risk.

What Is Liquidation and How Does It Occur?

Liquidation occurs when the trader’s losses exceed the allowable limit, and the account balance is no longer sufficient to cover the open position.

In this situation, the exchange automatically closes the position (Close Position) to prevent further losses and debt accumulation.

Important Note: Using high leverage greatly reduces loss tolerance and increases the risk of liquidation; hence, managing leverage ratios and setting appropriate stop-loss levels are vital for effective risk management.

Advantages and Disadvantages of Margin Trading

Using margin trading increases capital and thus amplifies both profits and risks. Below are more pros and cons:

Advantages | Disadvantages |

Access to leverage | Interest payments to the broker |

Increased profit potential | Risk of margin calls |

Flexible repayment terms | Higher chance of losses |

Key Tips for Margin Trading

Engaging in margin trading requires awareness of crucial tips to avoid major losses:

- Use trusted exchanges

- Start with small capital

- Begin with demo trading before going live

- Understand different order types

- Withdraw profits incrementally

- Monitor interest and fees

- Combine technical and fundamental analysi

Hidden Risks in Margin Trading

Many traders focus primarily on the potential profit in margin trading, while this type of trading involves a set of hidden risks that can lead to significant losses. Understanding these risks is an integral part of professional capital management.

- High Market Volatility: Sudden price movements can quickly trigger the liquidation of open positions;

- System Errors/Exchange Latency: During high volatility, order execution may experience delays or price slippage;

- Trader Emotions: Greed or fear can lead to impulsive decisions and deviation from analytical discipline;

- Hidden Fees: Especially in long-term trades, interest costs or the funding rate can have a significant impact on net profit.

Psychology of Margin Trading

Margin trading is more influenced by emotions than any other type of trading. The financial pressure caused by leverage often leads to emotional decision-making.

A successful trader must distinguish between confidence and reckless risk-taking. Using a written trading plan, setting clear stop-loss levels, and maintaining mental discipline are among the most important factors for success in margin trading.

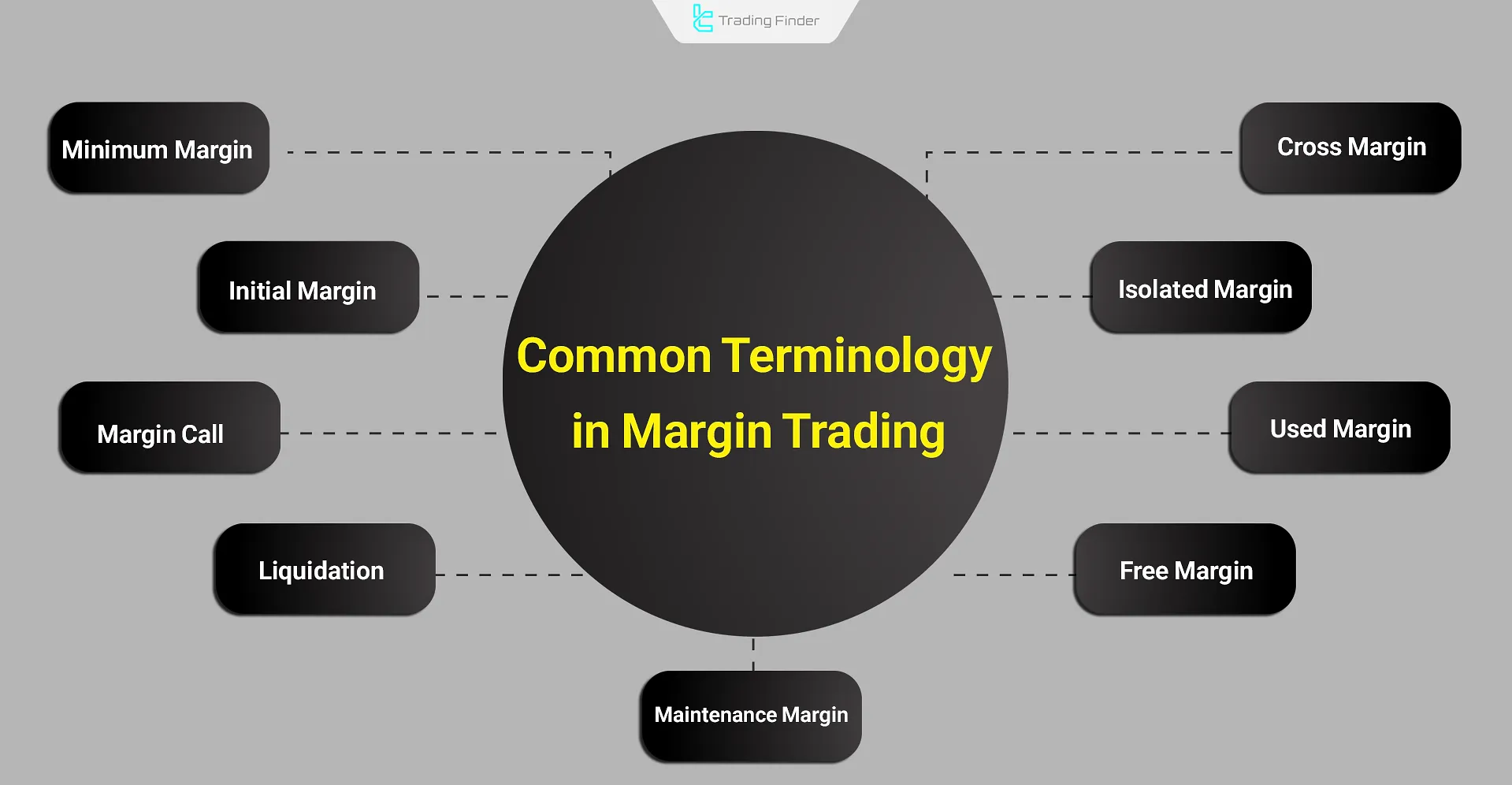

Common and Practical Terms in Margin Trading

Understanding these terms is essential for navigating margin trade platforms:

- Minimum Margin: The deposit needed to open a margin account, varies by exchange/broker;

- Initial Margin: A portion of the asset's purchase price paid in cash when trading;

- Maintenance Margin: The minimum balance required post-trade; falling below this triggers a margin call;

- Margin Call: Triggered when account balance falls below maintenance margin, possibly closing positions;

- Liquidation: Forced closing of positions by the exchange/broker to reclaim the loaned amount;

- Free Margin: The remaining funds in the account available for new trades or withdrawal;

- Used Margin: Already allocated Capital for open trades;

- Isolated Margin: Funds assigned to a specific position only;

- Cross Margin: All positions draw from a shared margin pool.

Common Mistakes in Margin Trading

In leveraged trading, many beginner traders make recurring mistakes due to a lack of sufficient experience or poor risk management, which can result in losing a large portion of their capital.

Recognizing these mistakes is the first step toward preserving capital and achieving consistent performance in the market.

- Using high leverage (High Leverage) without sufficient mastery of analysis and risk management;

- Lacking a clear and defined exit strategy (Exit Strategy) for closing positions;

- Making emotional trading (Emotional Trading) decisions instead of relying on logical and data-driven analysis;

- Ignoring trading fees and the funding rate (Funding Rate), which can significantly reduce profits in long-term trades;

- Opening multiple positions (Multiple Positions) simultaneously without following proper capital management (Capital Management) principles.

Capital Management in Margin Trading

One of the most critical pillars of success in margin trading (Margin Trading) is the precise application of capital management (Capital Management) principles.

No trader, not even the most professional ones, should allocate all their capital to a single trading position, as high market volatility can wipe out any account within moments.

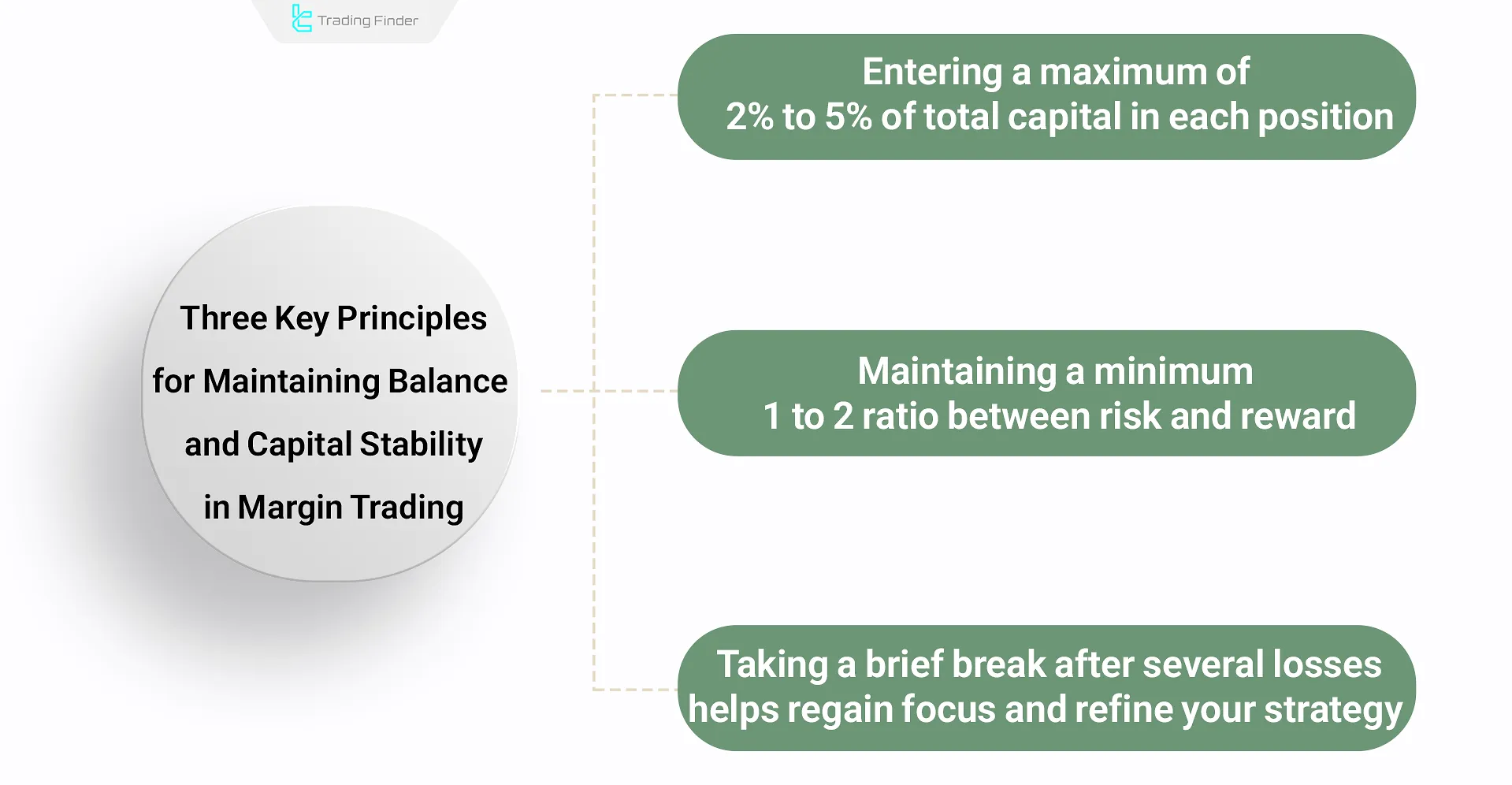

Three key principles for maintaining balance and capital stability in margin trading are as follows:

- Enter a maximum of 2% to 5% of total capital in each position;

- Maintain at least a 1:2 risk-to-reward ratio;

- Take a temporary break from the market after several consecutive losses and review your trading strategy.

Trade Manager Expert Advisor (Trade Manager TF) for Capital Management in MetaTrader

The Trade Manager TF expert advisor is part of the professional TradingFinder toolkit, designed for intelligent trade management on the MetaTrader platform.

The main goal of this expert is to provide complete control over capital, risk, and trade execution with precision and automation.

- Download Trade Manager TF Expert Advisor for MetaTrader 5

- Download Trade Manager TF Expert Advisor for MetaTrader 4

This system consists of two main panels: Trade Manager and Magic Panel. The combination of these two panels provides traders with an advanced suite of trading tools to manage all aspects of trading from entry to exit with precision.

Key features of this tool include:

- Partial Exit: Allows gradual closing of positions;

- BreakEven: Moves the stop loss to the entry point;

- Trailing Stop: Dynamic and intelligent stop-loss adjustment;

- Lot Management: Based on capital percentage or fixed dollar amount;

- Multiple Take Profits: Enables staged profit-taking;

- Quick Execution: Executes Market or Pending orders instantly;

In the BreakEven & Trailing Stop Settings section, users can choose from eight trailing models, including both simple methods and indicator-based algorithms such as ATR, MA, Fractal, Parabolic SAR, Bollinger Bands, and ZigZag.

The second panel, Magic Panel, is designed for rapid command execution, offering options like Close All, 50% exit (C50), and one-click activation of Trailing and BreakEven functions.

This expert advisor also displays key information such as Spread, Time to Close (the remaining time for the current candle), and Open Orders Info, providing high transparency within the MetaTrader environment.

The Trade Manager Expert Advisor is a strategic tool for active traders in the forex, stock, and indices markets.

Combining features such as Partial Close, Multi Take Profit, BreakEven, Trailing Stop, and precise lot control settings, it serves as a comprehensive trading assistant for professional risk management and enhanced trade efficiency.

Best Crypto Exchanges for Margin Trading

Choosing a reliable crypto exchange is crucial for margin trading. Top exchanges include:

Best Brokers for Margin Trading

For stock market traders, selecting the best margin broker is essential. Criteria include security, commissions, spreads, and platform:

- IG Broker

- Interactive Brokers

- Saxo Bank

- CMC Markets

- TD Ameritrade

Conclusion

Margin Trading allows traders to borrow capital from brokers or crypto exchanges to execute larger trades and potentially increase profits.

However, the amplified capital also increases the margin trade risks, making it less suitable for beginners. Understanding the mechanics, tools, terminology, and platforms is vital for success.