Aligning entry points between higher and lower timeframes using concepts such as Order Block and Fair Value Gap (FVG) in ICT Style and Smart Money strategies helps identify precise and optimal entry points. This method can also improve the Risk to Reward Ratio.

Pros and Cons of Increasing Risk to Reward Ratio Using Lower Timeframes

Increasing the risk-to-reward ratio with lower timeframes has multiple advantages and disadvantages:

Pros | Cons |

Optimized entry point and reduced stop-loss | Increased chance of stop-loss being triggered early |

Increased trade accuracy | More frequent stop-loss triggers due to rapid fluctuations |

Better control and utilization of hidden liquidity | Requires deep market analysis knowledge |

How to Increase the Risk to Reward Ratio (RRR)?

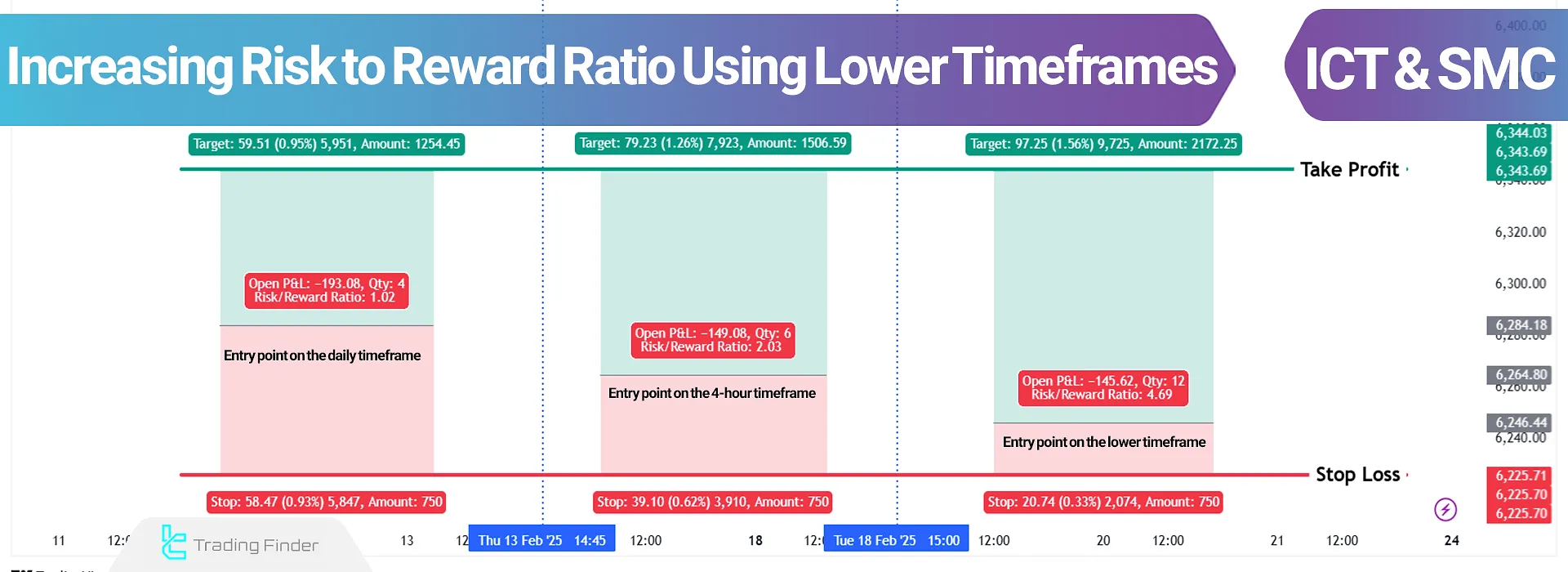

To optimize trade entries and increase the risk-to-reward ratio, you must first analyze the higher timeframe and identify key entry zones such as Order Blocks or Fair Value Gaps (FVG).

Then, by switching to lower timeframes and conducting a more precise analysis, you can refine (narrow) these entry zones. This reduces the stop-loss distance, ultimately improving the risk-to-reward ratio (RRR).

The process of increasing the risk-to-reward ratio using lower timeframes consists of the following steps:

#1 Identifying Key Zones on the Higher Timeframe

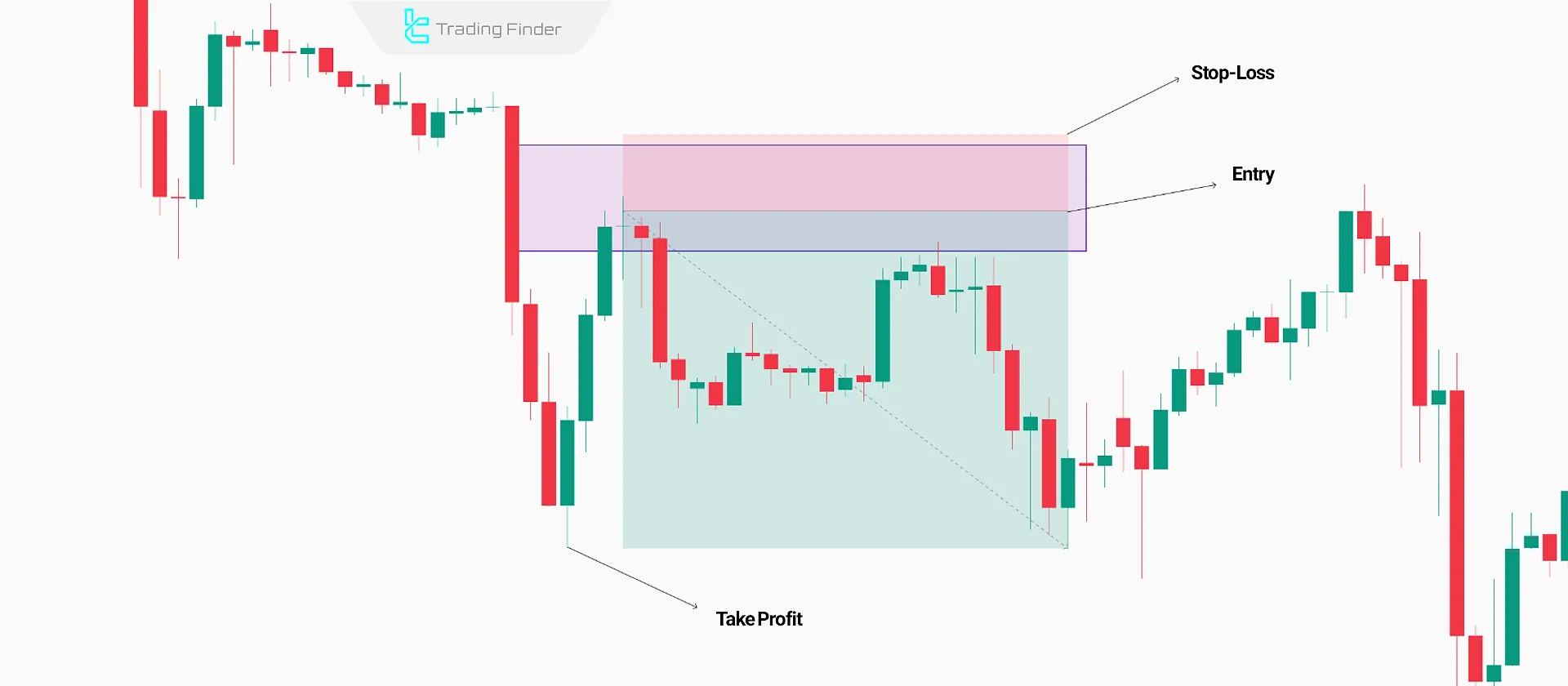

To optimize trade entries and improve the risk-to-reward ratio, the trader must first determine an Order Block, Fair Value Gap (FVG), or liquidity zone on a higher timeframe (e.g., 1-hour or 4-hour).

This zone serves as a potential entry area and acts as a foundation for further analysis.

Based on the FVG strategy and liquidity in Forex, the stop-loss is placed above the candle, creating the FVG, while the take-profit is positioned below the liquidity under the previous low.

#2 Precise Analysis on the 15-Minute Timeframe

Once the entry zone is determined on the higher Timeframe, traders should switch to the 15-minute Timeframe to refine entry points. During this timeframe, analyzing the break of structure (BOS), liquidity and narrowing the entry zones, enhance trade accuracy.

#3 Final Entry Refinement on the 5-Minute Timeframe

At this stage, the trader moves to the 5-minute timeframe to pinpoint the entry area with greater precision. This timeframe can reveal entry points with tighter stop-losses, thus improving the risk-to-reward ratio.

However, reducing the stop-loss on lower timeframes may lead to more frequent stop-loss activations due to the increased market volatility at these levels.

Using lower timeframes gradually narrows the entry zone and stop-loss, while the take-profit target stays fixed based on the higher timeframe. This results in an improved risk-to-reward ratio.

However, while reducing stop-loss distances increases the risk-to-reward ratio, it also raises the likelihood of early stop-loss activations, leading to multiple consecutive stop-outs.

Conclusion

Optimizing the risk-to-reward ratio using lower timeframes involves a precise identification of liquidity zones and filtering low-risk entry points near Order Blocks (OBs) and Fair Value Gaps (FVGs).

This technique allows traders to reduce the stop-loss distance while maintaining the same take-profit target as defined in higher timeframes. Consequently, it enhances the risk-to-reward ratio while also increasing the probability of early stop-loss activations.