- TradingFinder

- Education

- Forex Education

- Trading Platforms Education

Trading Platforms Education

Trading platforms provide a structured environment for executing trades, analyzing market data, and implementing trading strategies. Each platform differs based on market structure, asset types, and order execution models. In forex and CFD markets, MetaTrader 4 & 5 (MT4 & MT5) are popular due to their support for algorithmic trading, fast order execution, and customizable indicators. Meanwhile, TradingView is widely used by technical analysts for its comprehensive historical data, advanced charting tools, and Pine Script coding for custom strategies. Choosing the right platform depends on factors such as account type, order execution model (ECN, STP, Market Maker), liquidity availability, and risk management tools. On TradingFinder, custom indicators and Analysis tools are available for MT4, MT5, and TradingView, enabling traders to enhance market Analysis and optimize trade execution.

What is a Forex Journal? Recording Trading Conditions and Trade Volume

One of the most important factors in improving the performance of forex traders is the documentation and analysis of the trading...

What Is NinjaTrader? Installation Guide for NinjaTrader 8 [Free Version]

NinjaTrader is one of the advanced platforms for technical analysis, automated trading, and order execution in financial markets....

Automated Trading; Decision-Making with Predefined Logic in Financial Markets

In the Forex market, speed, accuracy, and emotional control are three factors that directly determine a trader’s profit or loss....

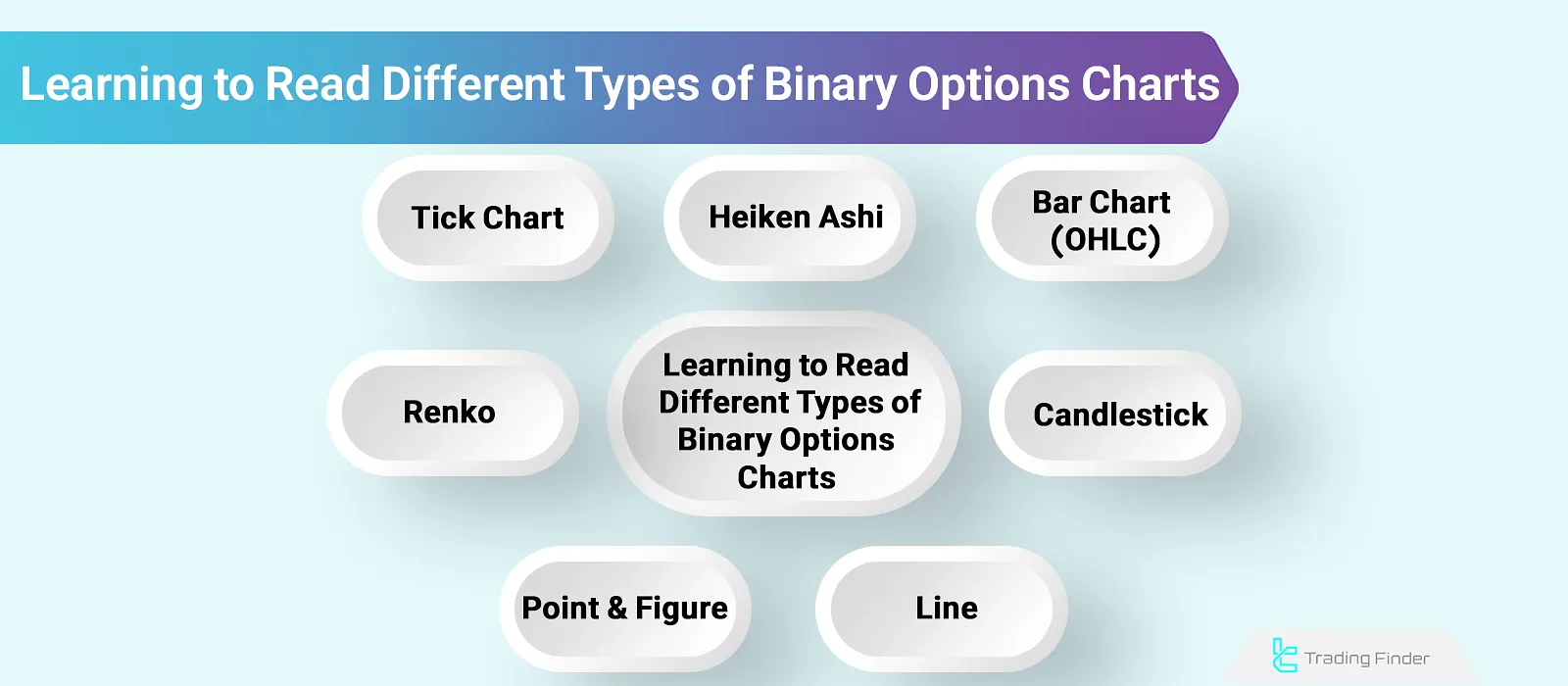

Types of Binary Options Charts (Line, Bar, Heikin Ashi, Tick, and Renko)

In binary options trading, entry and exit timing has a direct impact on profit and loss. Since the trade outcome is simply yes...

What Is Economic Calendar? Applications + Key Events [NFP,CPI,PMI]

The Forex Economic Calendar provides essential economic information related to various forex market assets, including central bank...

What Is Social Trading? Copy Trading, Mirror Trading, and Signal Trading

Social trading refers to leveraging the experience and skills of other individuals in your trading strategy. Onsocial trading...

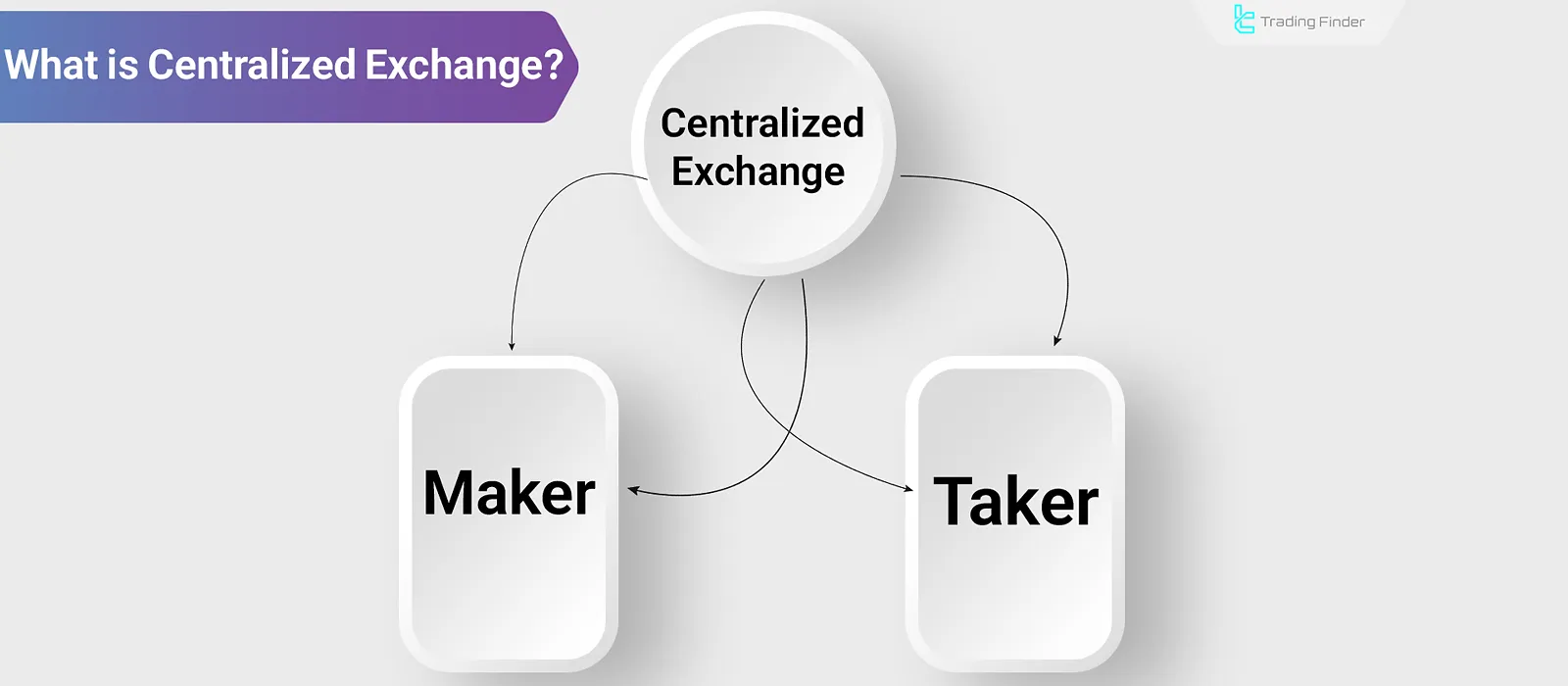

What Is a Centralized Exchange? High Liquidity & Diverse Financial Services

In the cryptocurrency market, exchanges are categorized into two types of centralized (CEX) and decentralized (DEX). Currently,...

What Is Arbitrage? Types of Arbitrages [Triangular, Merger & Spatial]

Arbitrage occurs when the same asset is simultaneously traded at different prices in two separate markets. If this price...

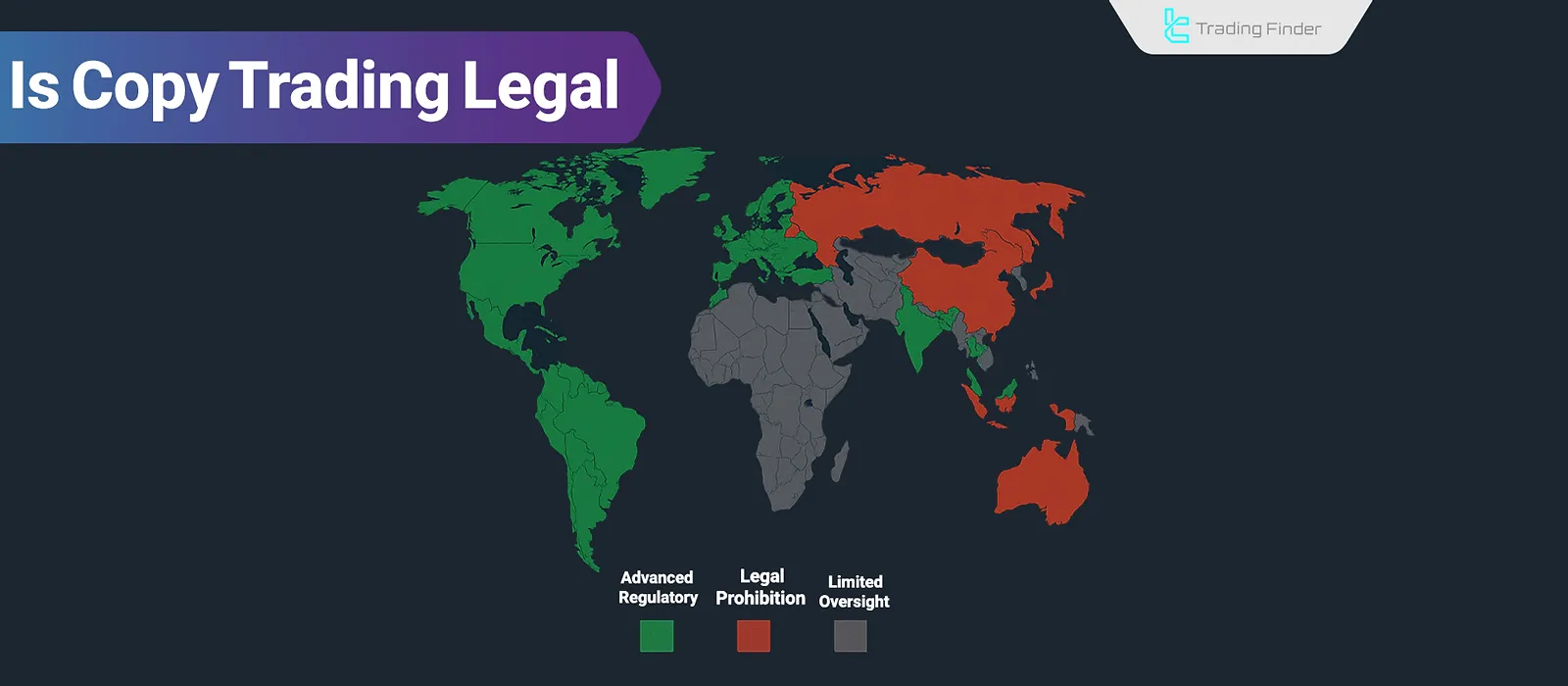

Is Copy Trading Legal? Global Overview of Copy Trading Legal Status

The legal status of copy trading varies from one country to another. For instance, in the United States, copy trading is only...

Choosing a Forex Broker - Step-by-Step to Choose the Best Forex Broker

In financial markets such as Forex market, a broker acts as the intermediary between the trader and the market. To make the...

Margin Call – Methods to Prevent Margin Calls in Different Markets

When the account balance is not sufficient to cover open losses, the broker or exchange issues a call margin alert. This warning...

What is MetaTrader 5? Getting to Know the Features + Pros and Cons of MT5

MetaTrader 5 (MT5) is an advanced trading platform developed and released by the Russian company “MetaQuotes” in 2010. It was...

![What Is NinjaTrader? Installation Guide for NinjaTrader 8 [Free Version]](https://cdn.tradingfinder.com/image/603241/7-168-en-what-is-ninja-trader-01.webp)

![What Is Economic Calendar? Applications + Key Events [NFP,CPI,PMI]](https://cdn.tradingfinder.com/image/478340/03-36-tf-en-forex-economic-calendar-01.webp)

![What Is Arbitrage? Types of Arbitrages [Triangular, Merger & Spatial]](https://cdn.tradingfinder.com/image/431600/03-24-tf-en-what-is-arbitrage-01.webp)